The year ahead: North American CFOs reveal their top 6 expectations for 2026

Surveyed finance chiefs plan to lean heavily on advanced technologies to help drive transformation—and stay focused on customer retention and M&A opportunities

A year ago, chief financial officer respondents ended 2024 on a high note. Their confidence score in the fourth quarter of 2024 jumped to 5.8, the highest reading since late 2021.

Respondents now appear to be in a similar mindset. Following six months of dwindling optimism, CFO sentiment improved substantially in the most recent quarter. Indeed, the CFO confidence score soared to 6.6 in the fourth quarter of 2025, equaling the level of late 2024.

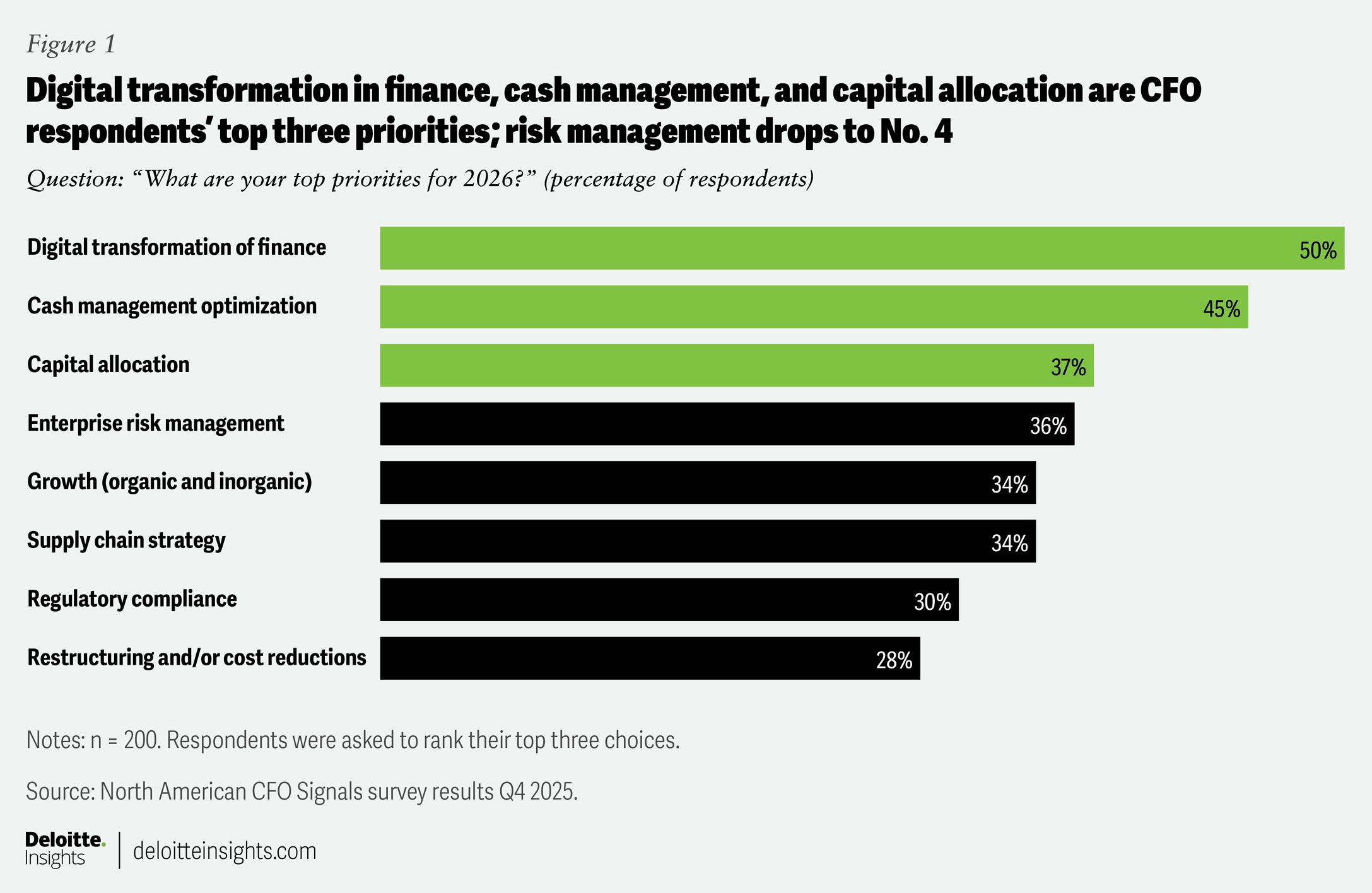

Respondents’ priorities and expectations for the coming year differ somewhat from last year’s, however. Enterprise risk management was the No. 1 priority heading into 2025. Now, tech transformation has taken center stage.

Based on our latest CFO Signals quarterly survey, which polls 200 CFOs at North American companies with at least US$1 billion in revenue, here are the top six priorities respondents expect to focus on most in 2026:

1. Leveraging digital to transform how finance operates. Efficiency and productivity are near the top of respondents’ most worrisome internal risks. The sentiment ran through much of the survey, with CFOs repeatedly citing automation as a key priority in 2026. Fifty percent of the respondents, for example, indicate that digital transformation of finance is their top priority in the coming year—the No. 1 response (figure 1). This was followed by cash management optimization, which typically involves the use of sophisticated technologies such as advanced data analytics.

Moreover, when asked to name their top priorities for finance talent in 2026, nearly half (49%) of CFOs cite automating processes to free employees to do higher-value work. It was the most popular response. This result dovetails with findings from Deloitte’s Finance Trends 2026 survey of nearly 1,500 global finance leaders, in which respondents chose artificial intelligence and automation skills as their top finance skills development priority in FY 2025 and FY 2026.1

2. Going all in on artificial intelligence. AI has truly arrived in finance: In this quarter’s CFO Signals survey, 87% of CFOs predict that AI will be extremely important or very important to their finance department’s operations in 2026.

Across industries, 84% of surveyed CFOs in the energy, resources, and industrials sector believe AI will be extremely important or very important to their finance operations this year. In the financial services industry, 88% say the same, as do 80% in the technology, media, and telecommunications sector. It seems unlikely this uptake will slow anytime soon, particularly as new AI applications gain traction in finance departments.

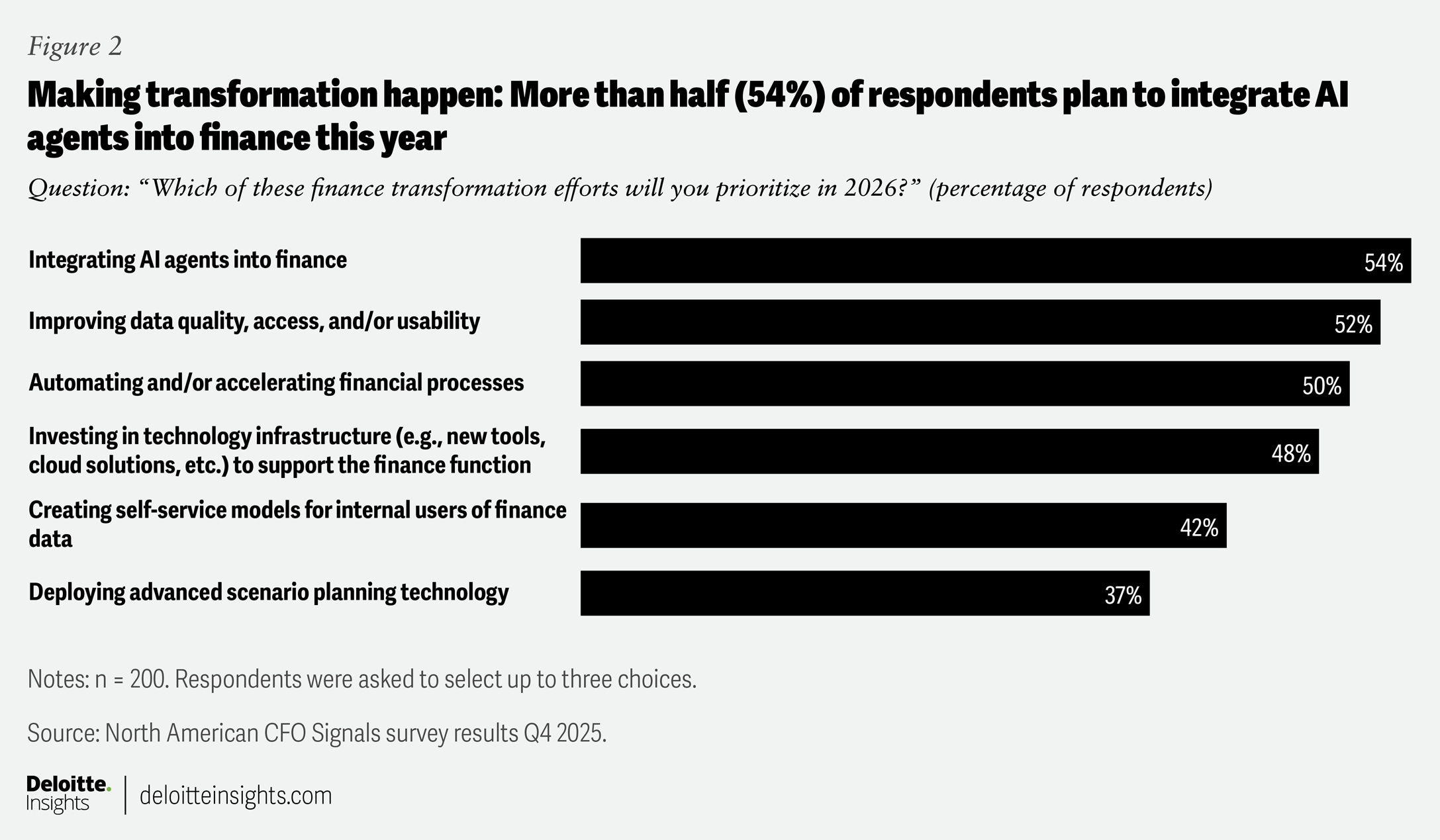

3. Embedding AI agents into finance to make transformation happen. More than half (54%) of CFOs say integrating AI agents into finance will be one of their top finance transformation priorities in 2026 (figure 2). This was their top response, ahead of efforts such as improving data quality, access, and usability (52%).

This mirrors the results of the Finance Trends 2026 survey. Forty-eight percent of surveyed respondents who said they play a leading strategy role at their businesses indicated that they have already deployed specific AI agents within finance.2

4. Staying focused on changes in buyer behavior. C-suite executives will no doubt grapple with several complicated challenges in the coming year: supply chain disruptions, rising benefits costs, and cybersecurity. But CFOs in the fourth-quarter survey also point to a more elemental challenge their companies will confront in 2026: shifts in customer behavior.

When asked to name factors (excluding the economy) that will exert the biggest impact on their companies’ performance this year, 48% cite changes in customer behavior or demographics. This places it second. Not surprisingly, pressure from competitors (51%) tops the list.

Shifts in purchasing patterns or consumer preferences may lead some businesses to rethink how they serve or attract customers. A recent CFO Signals article, for example, revealed that more organizations are starting to accept cryptocurrency for payments as a way to attract new customers.3

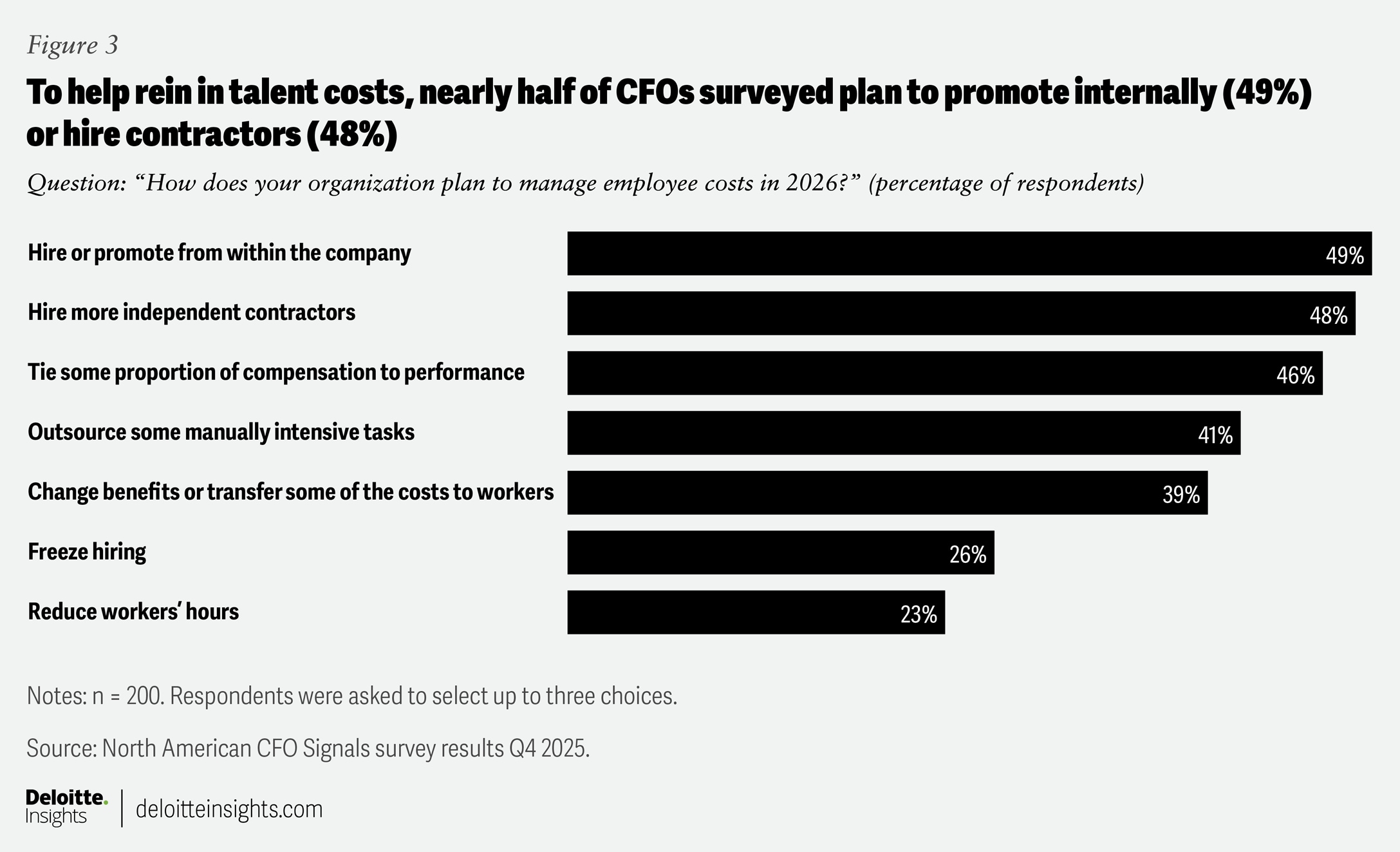

5. Dipping into the internal talent pool to help manage costs. Given that nearly half (49%) of CFOs say cost management is their biggest internal concern in this quarter’s survey, it’s understandable that finance chiefs are exploring several avenues to manage employee costs. The most popular option? Staffing from within. In fact, about one in two (49%) respondents say their organizations will hire or promote internally to help keep worker costs in line in 2026 (figure 3).

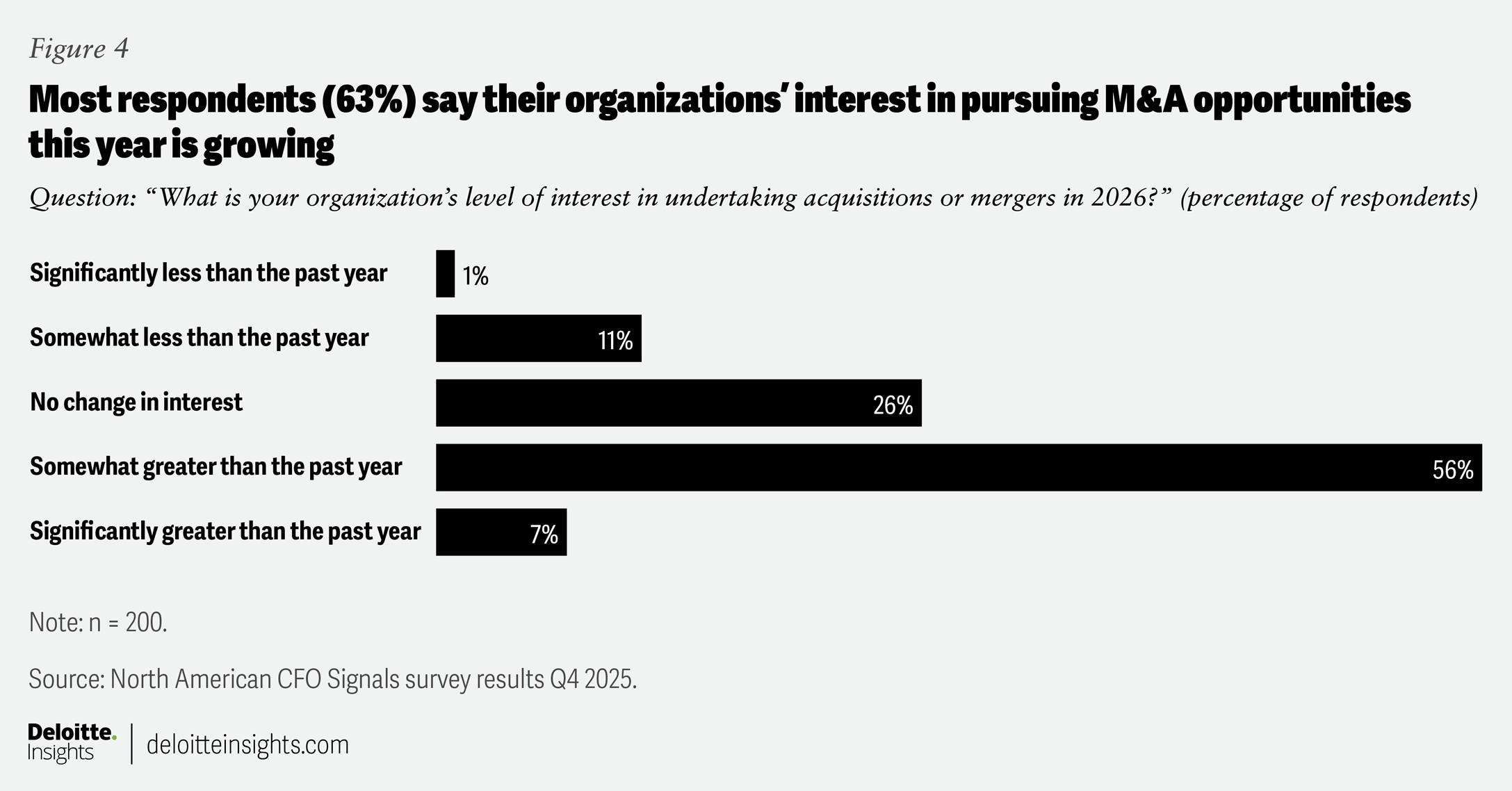

6. Exploring more dealmaking opportunities. In last year’s fourth-quarter CFO Signals survey, 55% of CFOs said their organizations’ level of interest in undertaking acquisitions or mergers was significantly greater or somewhat greater than in the prior year. Apparently, interest in deals has not waned. In this year’s survey, 63% say their level of interest is significantly or somewhat greater than it was a year ago (figure 4).

Of note, Deloitte’s 2026 M&A Trends survey found that 90% of dealmakers at private equity firms and 80% at corporations expect the average number of deals they close in the coming 12 months to increase.4 The appeal of deals makes sense. Borrowing costs have gone down and stock prices have gone up—which could make dealmaking more attractive for buyers and sellers.