Amid tariff uncertainty, North American CFOs place a premium on pricing strategies

86% of finance chiefs surveyed say pricing will become more important to their organizations over the next year. Most have already started to recalibrate their strategies.

It would be hard to blame chief financial officers if they’re feeling a little confused by recent events on the trade front. While the United States has reached framework agreements on tariffs with the European Union and other major trading partners,1 import duties on some goods have been modified or postponed.2 And in a decision in August, a federal appeals court struck down many of the government’s tariffs.3 The Supreme Court has agreed to take up an appeal to that ruling.4

The uncertainty will likely test organizations’ ability to quickly adjust prices for their products. And given the specter of higher costs for imported goods and supplies, senior executives could face some tough decisions: Hike prices and you may lose customers. Cut margins and you could cut into profits.

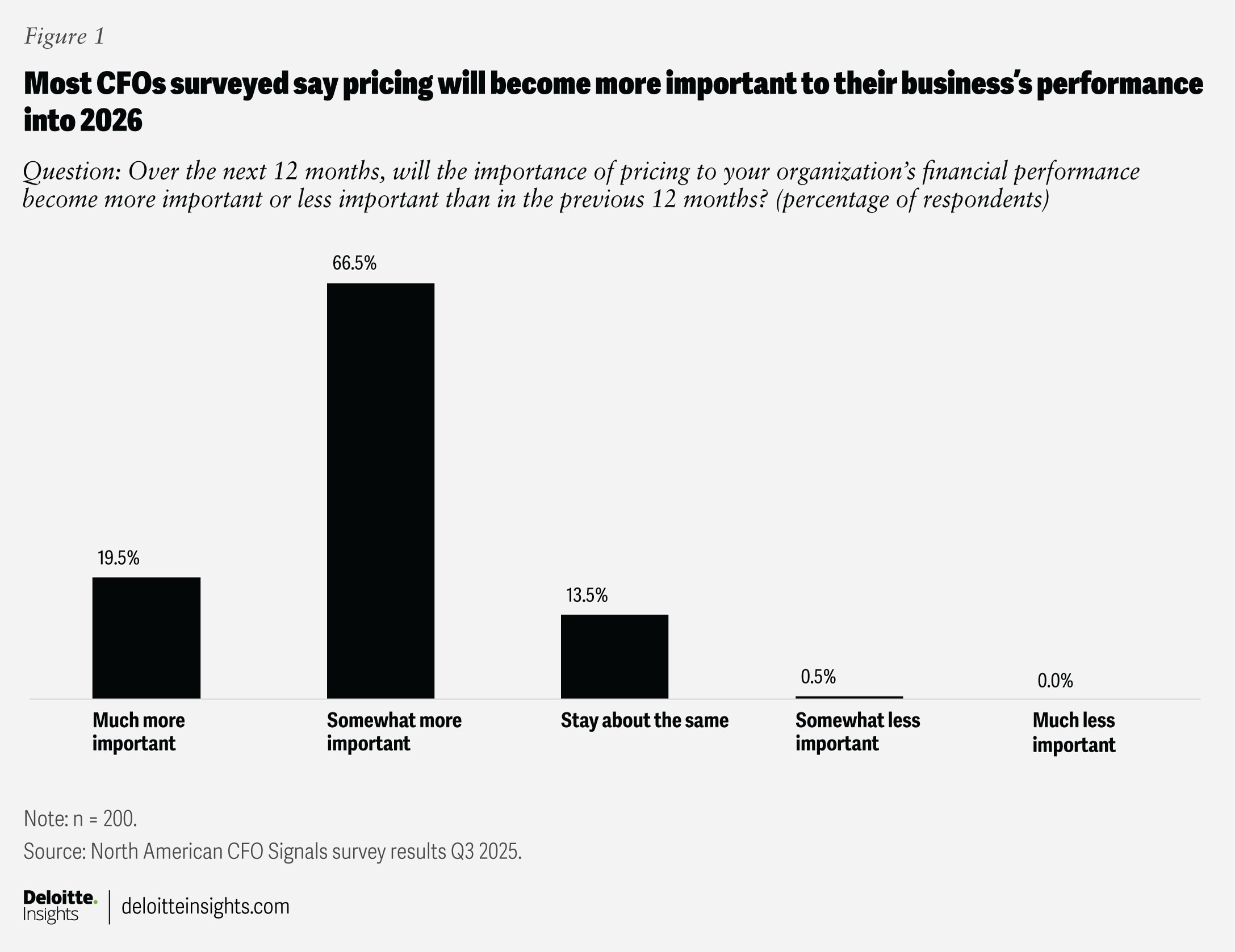

According to the latest North American CFO Signals survey, conducted Sept. 3 to 17, 2025, finance chiefs seem to understand the stakes. Among the 200 CFO respondents from businesses in North America with at least US$1 billion in revenue, 86% say pricing will become much more important or somewhat more important to their organization’s financial performance over the next 12 months (figure 1).

This is hardly surprising. The overall US average effective tariff rate, which measures the amount of tariff revenue collected by a country as a percentage of the total value of imports, currently stands at 18.3%.5 That’s the highest it’s been since 1934.6 Managing materially higher costs for imported goods and products will, no doubt, prove challenging for some organizations. But there’s a more basic, ground-level issue here for CFOs: How do you price goods when the cost of supplies and materials seems to be a moving target?

But there’s a more basic, ground-level issue here for CFOs: How do you price goods when the cost of supplies and materials seems to be a moving target?

Jumping into defray? CFOs look for ways to offset higher import duties

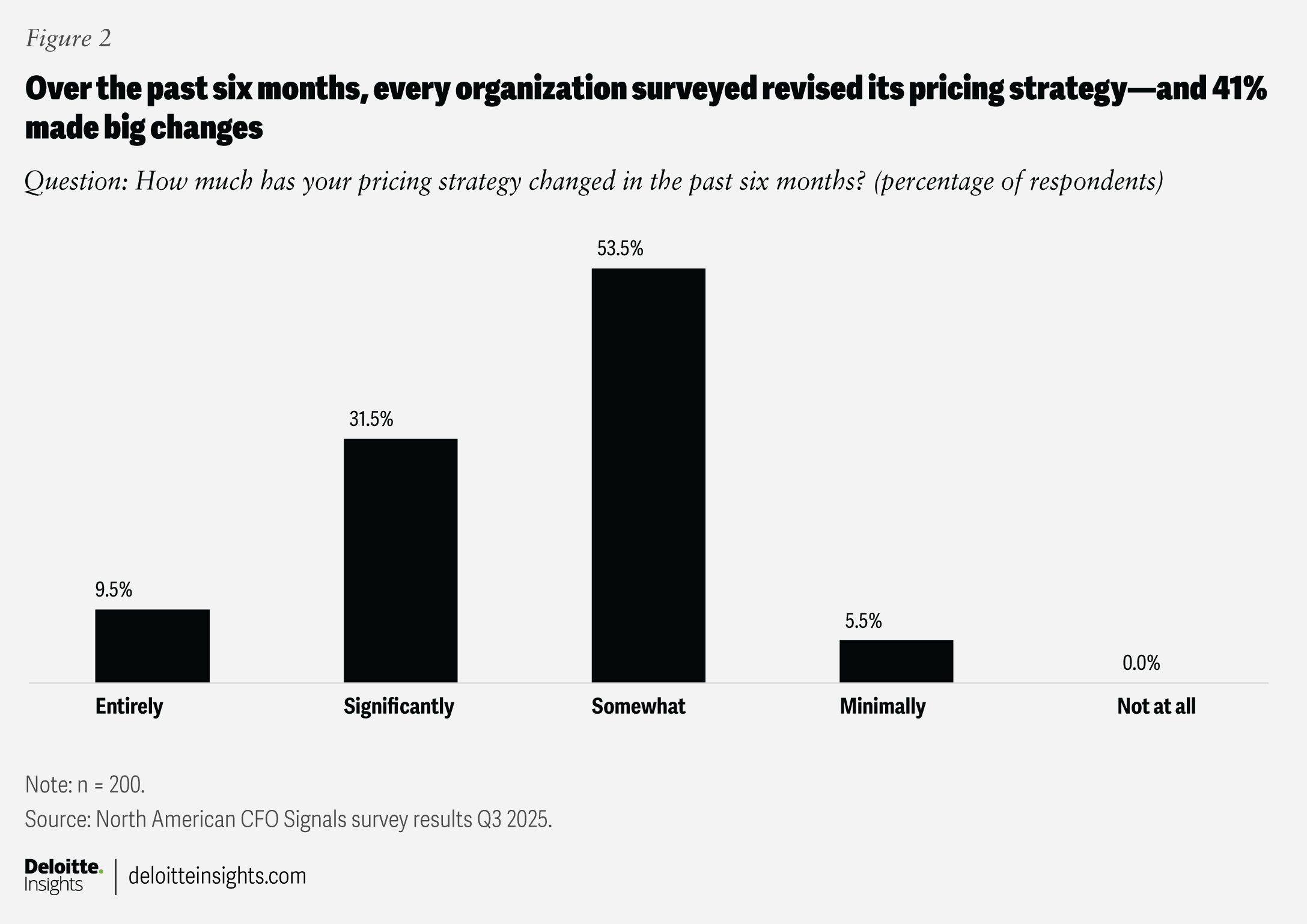

Hitting the mark will likely involve, among other things, a recalibration of a business’s pricing strategies. Many organizations already appear to be headed in that direction. A whopping 95% of respondents say their pricing strategies have changed entirely, significantly, or somewhat over the past six months—a time frame that roughly dates to when the reciprocal tariffs were first announced (figure 2).7

Of course, trade policy is only one element currently shaping organizations’ pricing strategies. In the survey, about one in three (34%) CFOs cite trade policy as the factor impacting their pricing the most. But the top response is competitive pressure, cited by 50% of respondents. Bear in mind, however, that 43% name supply chain disruptions. Such disruptions can, in some cases, be triggered by trade policy: Businesses facing higher tariffs may look to overhaul sourcing networks.

Case in point: When asked the ways that uncertainty over trade policy has changed their organizations’ supply chain strategies, 43% of respondents indicate they have diversified their current network by expanding into other geographies (not including near-shoring)—the No. 1 answer. Notably, increasing the use of domestic suppliers (36%) was down the list. And building or upgrading facilities in their home countries was near the bottom.

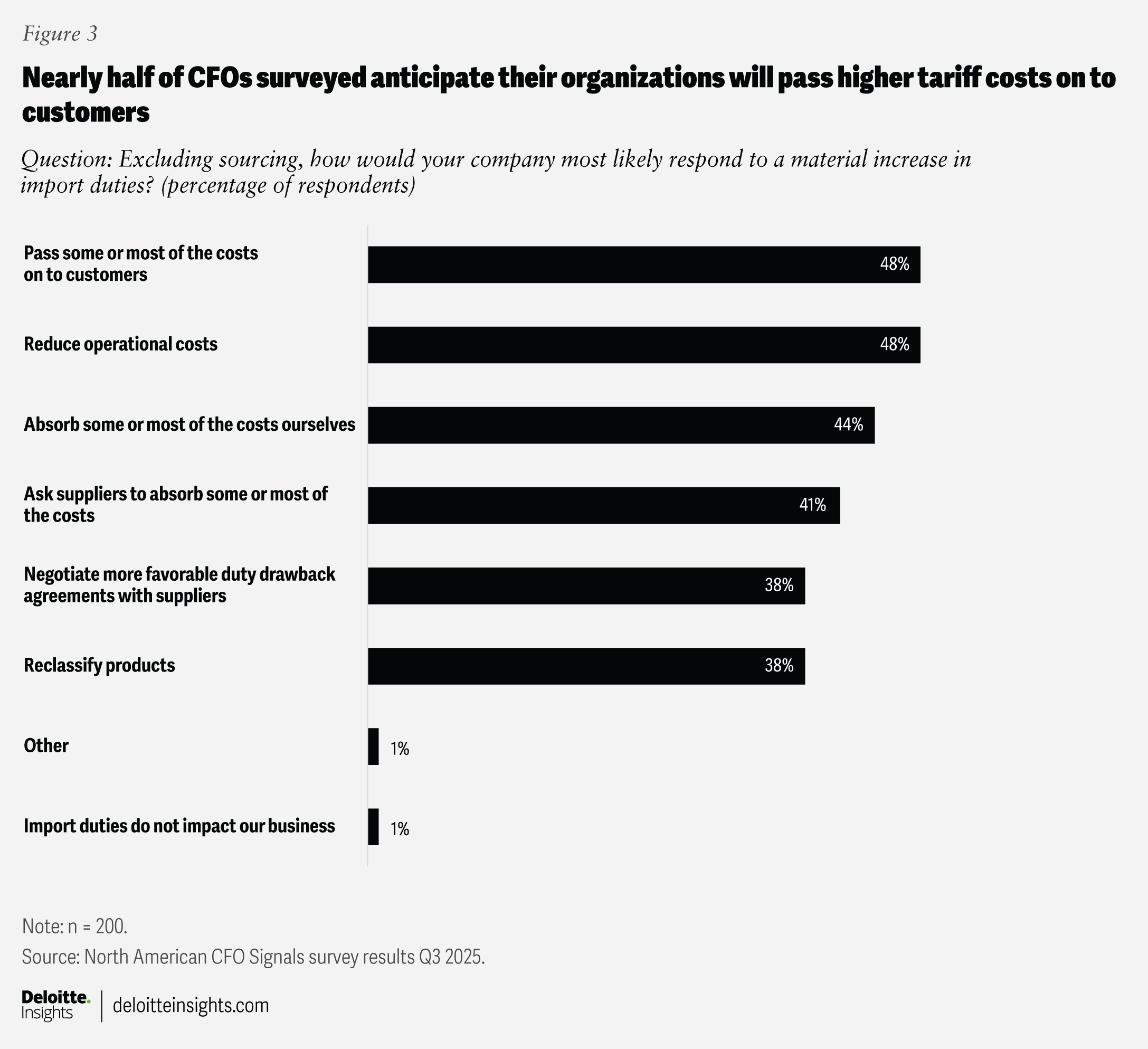

Organizations have several ways to defray the costs of higher customs levies—but few seem particularly good. Forty-four percent of respondents say their organizations would most likely respond to a material increase in import duties by absorbing some or most of the cost increases, placing it third on the list (figure 3). Forty-one percent indicate they’d ask suppliers to absorb all or most of the costs, the fourth most popular response. Both strategies seem more likely to be potential short-term solutions, however. About half of CFOs (48%) say their organizations would pass some or most of the costs on to customers—the most-cited response. The approach seems more sustainable but it risks possible customer defections.

Organizations also turn to less visible responses than price increases. Some of these non-pricing levers involve rejiggering products or service level agreements. In fact, more than half (52%) of the finance chiefs surveyed say their companies are making changes to service levels to address cost challenges and customer negotiations. That was the most popular answer, followed by offering different warrantee terms (47%).

Non-pricing levers do have advantages. Modifying a service level or warrantee is less visible than raising the price of goods, a move that could trigger customer defections. On a more practical level, adjusting prices may involve updating things like signage, a process that can slow the time it takes to implement price changes.

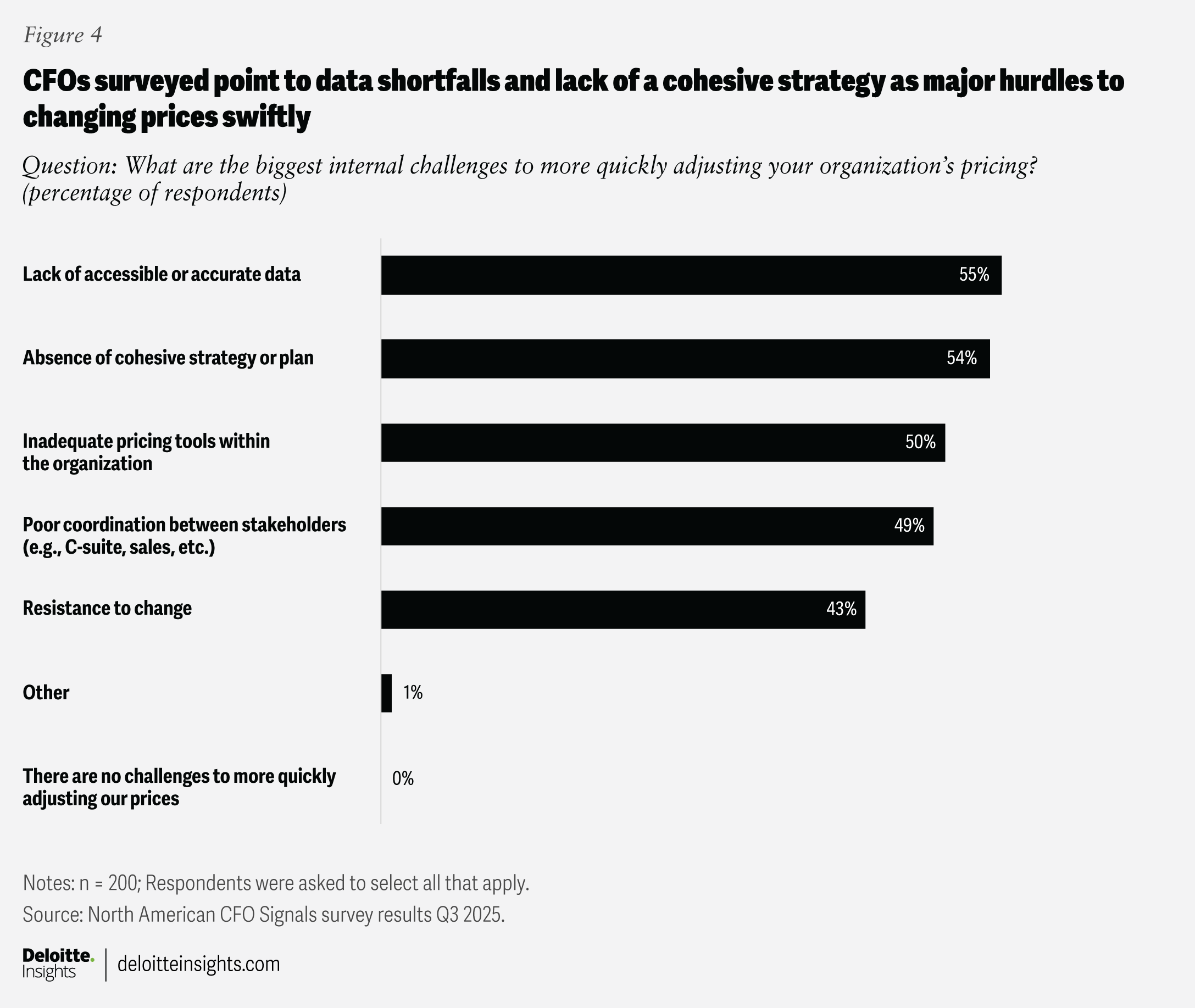

And speed can be critical when setting new prices. Fast action can help companies respond to market changes and potentially steal a march on competitors. But organizations may face sizable challenges when attempting to quickly adjust their pricing. Many respondents point to technology-related challenges, such as lack of accessible data (55%) and inadequate pricing tools (50%), which rank first and third, respectively (figure 4).

The second biggest problem, however, points to a more foundational—and perhaps thornier—problem. Fifty-four percent of CFOs say the biggest challenge to quickly adjusting prices is that their organizations lack a cohesive strategy or plan.

Fifty-four percent of CFOs say the biggest challenge to quickly adjusting prices is that their organizations lack a cohesive strategy or plan.

Despite these obstacles, CFOs surveyed express confidence in their organizations’ pricing strategies. More than eight in 10 (81%) describe their organization’s pricing process as very mature or mature. A mere 1% say it’s not very mature.

Their confidence may be tested in the coming months. The US Supreme Court has agreed to hold oral arguments on the tariff appeal on an expedited basis. A decision could come as soon as the end of the year. Or it could come sometime early in 2026. Or possibly June.8

More uncertainty.