Crypto is gaining currency with North American CFOs

Nearly 1 in 4 surveyed chief financial officers say their finance functions will be using digital currency within two years. Is crypto set to take off in the corporate world?

If you need further proof that cryptocurrency is steadily edging its way into the mainstream, consider these recent developments. In March, President Trump issued an executive order creating a strategic bitcoin reserve and US digital asset stockpile.1 Meanwhile, in June, the US Senate passed legislation governing stablecoins,2 a cryptocurrency that is typically backed by reserve assets and tied to a traditional currency like the US dollar.

Corporate acceptance has come somewhat slower. Many CFOs appear concerned about investing in non-stable cryptocurrency (bitcoin, ether, etc.) due to price fluctuations. Nevertheless, in the second quarter 2025 North American CFO Signals survey, which polled 200 North American finance chiefs working at companies with at least US$1 billion in revenues, only 1% of responding CFOs said they did not envision using cryptocurrency for business functions in the long term. And 23% said their treasury departments will utilize crypto for either investments or payments within the next two years. That percentage is closer to 40% for CFOs at organizations with US$10 billion in revenues and up.

The responses raise a clear question: Is this a tipping point for corporate adoption of cryptocurrency? If so, what does that mean for CFOs and their finance departments?

Appreciation of tokens

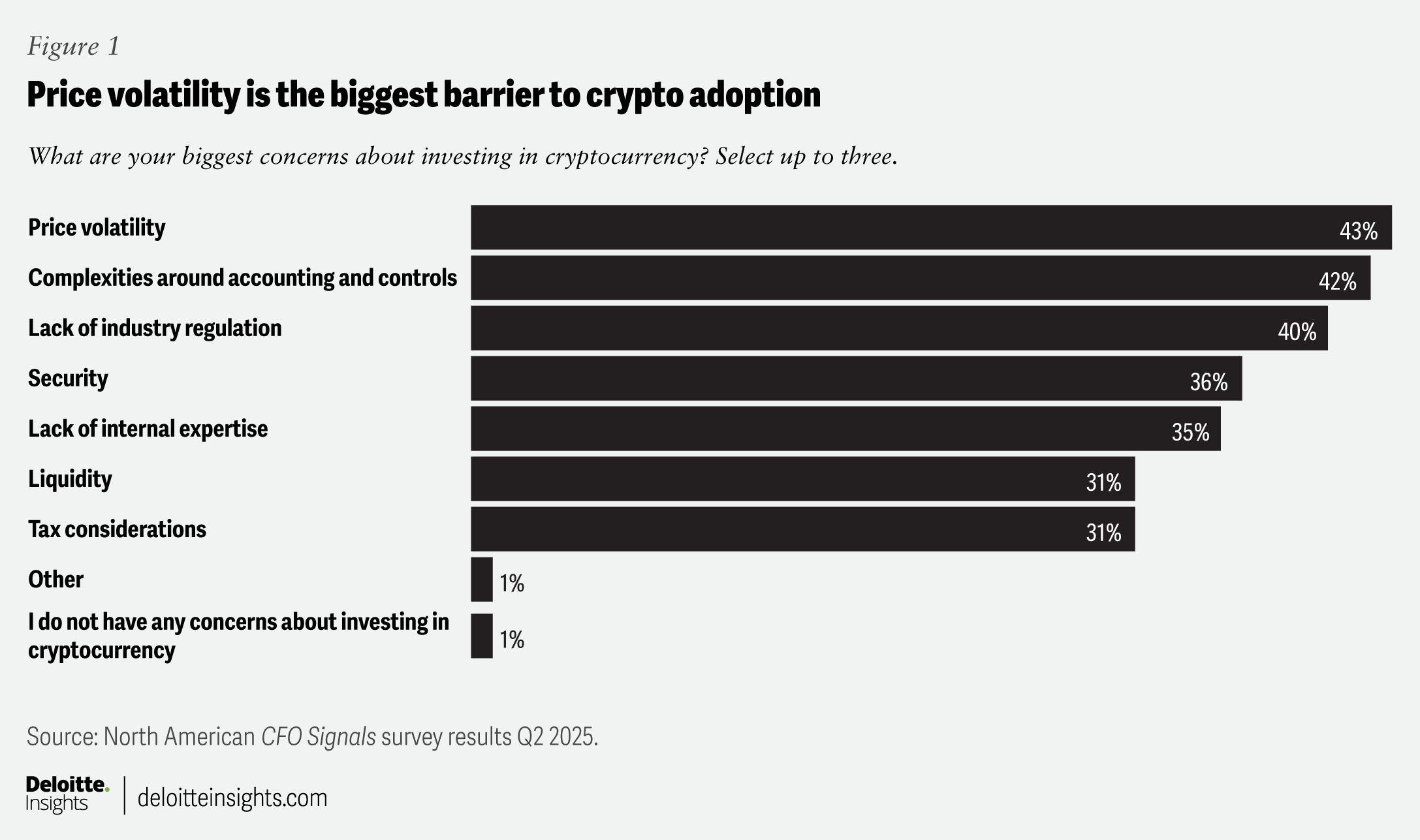

To be sure, respondents to the survey—conducted from June 4 to June 18—expressed concerns about utilizing digital assets. When asked about their biggest worries related to investing in cryptocurrency, 43% of CFOs cited price volatility (figure 1). That’s not particularly surprising, given that the value of non-stable cryptocurrencies such as bitcoin has seen considerable price fluctuations in the past. Earlier this year, for instance, the value of bitcoin dropped 28% in a 10-week span.3

Respondents cited other worries as well. Complexities in accounting and controls (42%) were next on the list, followed by lack of industry regulation (40%). Recent events may have contributed to these concerns. In late January, the Securities and Exchange Commission launched a crypto task force. Two days later, the task force rescinded an earlier staff guidance governing the accounting treatment of crypto assets.4 That, in turn, led the Financial Accounting Standards Board to amend its guidance on accounting for crypto in March.5

Despite these concerns, some survey respondents revealed a willingness to move forward. Fifteen percent of surveyed CFOs believe their treasury departments will likely purchase non-stable cryptocurrencies as part of their investment strategies over the next 24 months. Respondents at organizations with revenues of US$10 billion and up were even more likely to tick the box. Nearly 1 in 4 (24%) said their finance departments will likely invest in non-stable cryptocurrencies over the next two years.

Bitcoin, ether, and other non-stable cryptocurrencies can provide certain advantages for treasurers. Such currencies can help diversify an organization’s investment portfolio. What’s more, despite price fluctuations, non-stable crypto investments offer the possibility of substantial price appreciation—gains that can far outweigh returns on assets like Treasurys.

CFOs see a range of gains from crypto adoption

Cryptocurrency appears to be gaining traction with surveyed CFOs on another front. Fifteen percent of surveyed finance chiefs say that, within two years, their organizations will likely accept stablecoin as payment. That percentage is higher (24%) for organizations with at least US$10 billion in revenues.

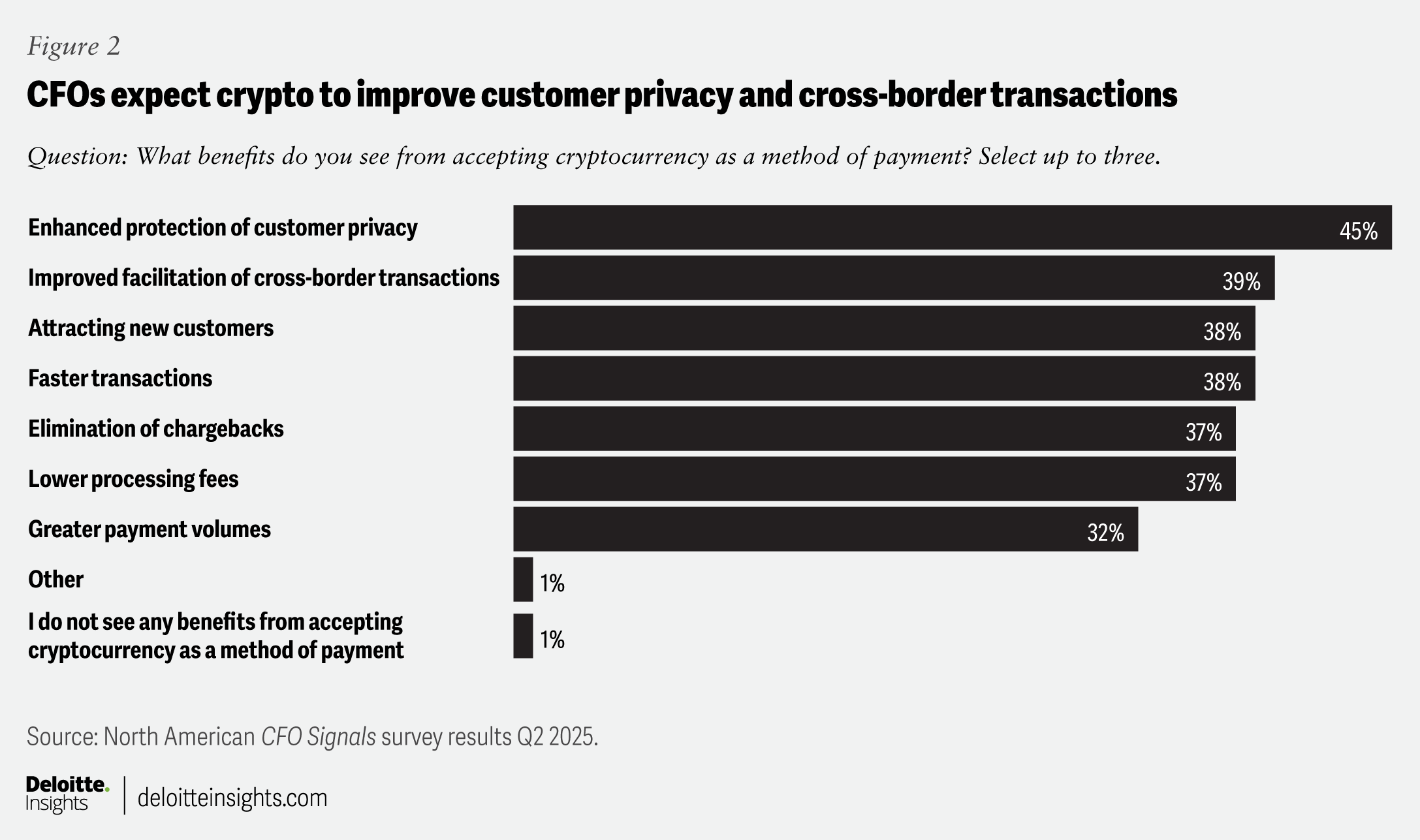

The survey offers some insight into the appeal of conducting transactions with stablecoin. Forty-five percent of CFOs cited enhanced protection of customer privacy as the top response (figure 2). Improved facilitation of cross-border transactions followed at 39%.

The interest in cross-border payments makes sense for organizations conducting business internationally. Transactions conducted in crypto do not require intermediaries like banks, thus reducing costs and speeding up settlement. What’s more, stablecoins tied to the US dollar can—in some cases—serve as a hedge against changes in foreign exchange rates.

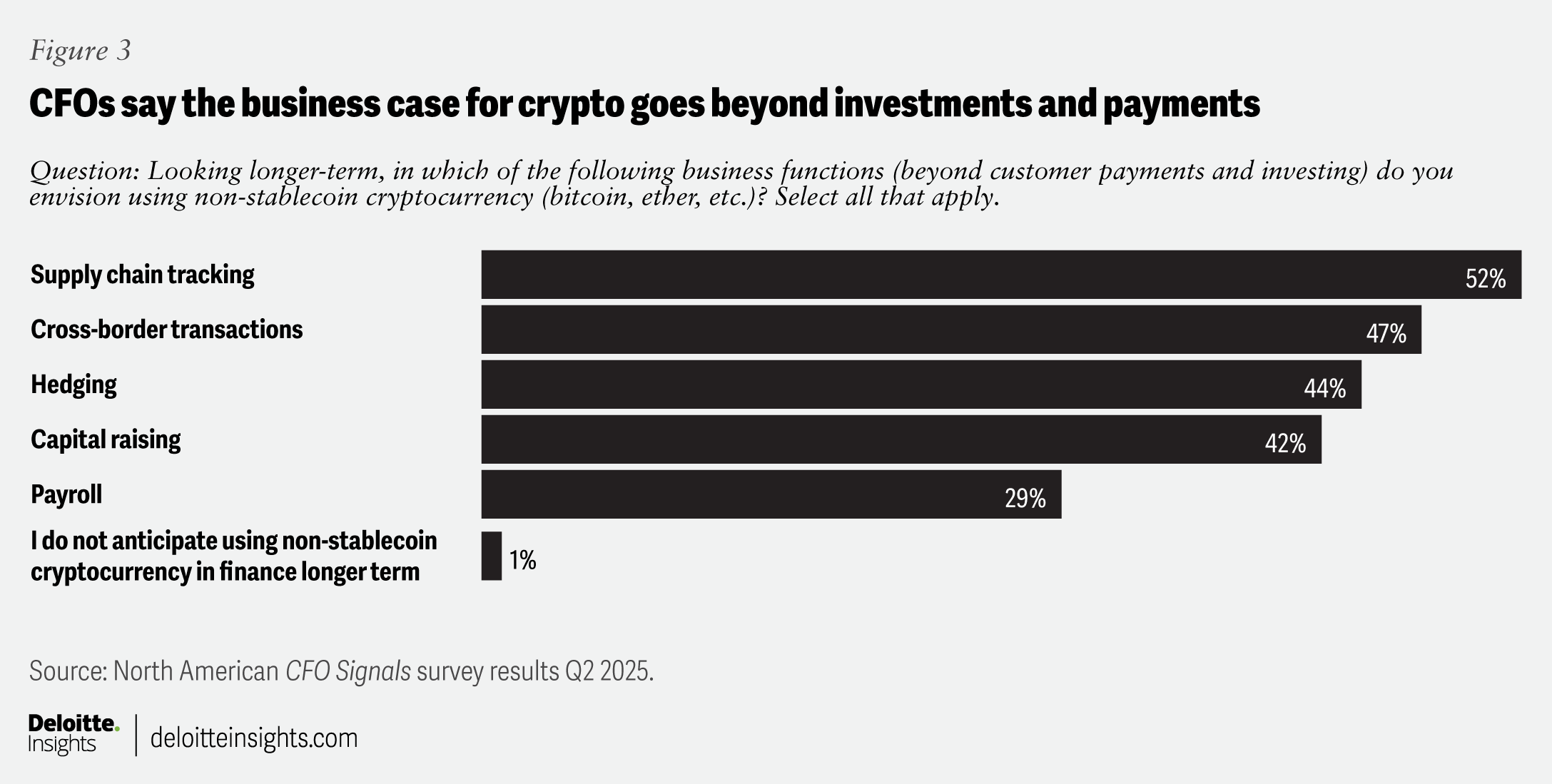

Looking longer term, surveyed CFOs envision a raft of potential business uses for non-stable and stable cryptocurrencies—uses beyond investments and payments. Supply chain management and tracking topped the list. More than half (52%) of respondents indicated they anticipate using non-stable cryptocurrency for supply chain tracking (figure 3). A slightly smaller percentage (48%) said the same for stablecoin.

Payment in crypto transactions can greatly reduce the need to reconcile payment information between buyer and seller that doesn’t match. Equally beneficial, crypto transactions are conducted and recorded quickly on the blockchain—a digital public ledger that serves as the foundation for cryptocurrency. For complex supply chains—ones that involve numerous third parties and various payment points—crypto transactions enable organizations to more easily track the progress of goods.

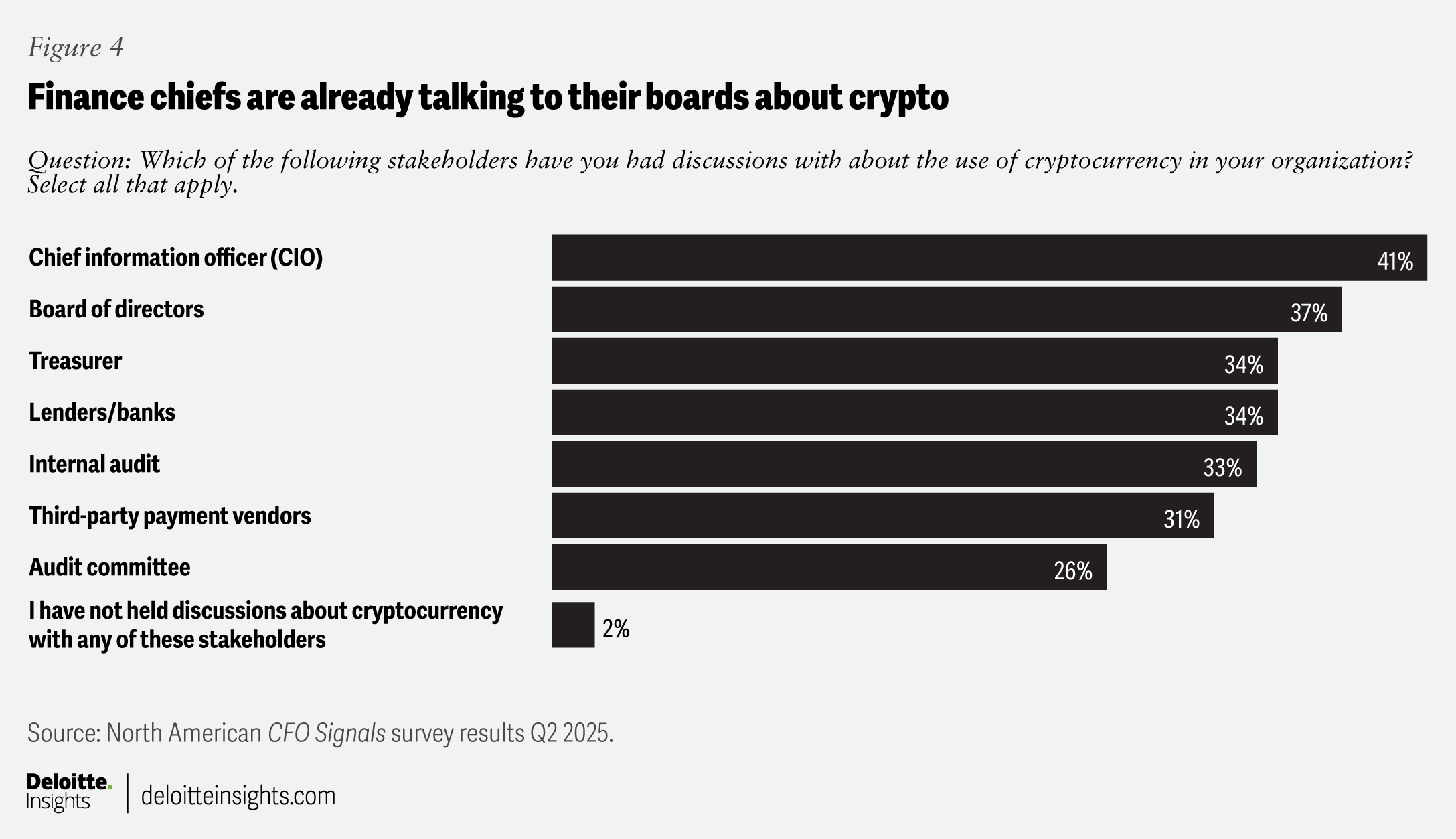

Tracking the adoption of crypto in the corporate world may not be as straightforward. More than a third (37%) of respondents said they have already had discussions with their boards about the use of cryptocurrencies in their organizations. Forty-one percent indicated they’d spoken to their chief information officers about it, and 34% said they’d discussed crypto with their banks or lenders. Perhaps more telling, only 2% of respondents said they have not had any conversations about cryptocurrency with key stakeholders (figure 4).

This may not constitute a tipping point. But it suggests that one may not be far off.