Finance Trends 2026: Navigating the expanded scope of finance

A Deloitte survey shows finance leaders influencing enterprise strategy, cost optimization, and digital transformation—and building tech-fueled teams to power their organizations

Steve Gallucci

Ed Hardy

Justin Silber

Dave Turk

Timothy Murphy

Compared to the recent past, today’s leading chief financial officers are thinking differently, operating differently, and hiring differently. They’re helping navigate new markets, preparing for acquisitions and divestures, and building future-ready teams. But they’re contending with a complex growth environment.

How are finance leaders preparing their teams to proactively address these complexities, and build for the future?

To help leaders gain a better understanding of what’s likely to come next and inform this inaugural Finance Trends report, we surveyed 1,326 global finance leaders around the world and across industries. Respondents to our survey are CFOs or next-in-line to be CFOs at some of the world’s largest companies (with annual revenues exceeding US$1 billion). We also conducted one-on-one interviews with nine finance executives from global organizations to learn how these trends are playing out in their role and across the finance function (see methodology).

Based on this research, we identified five trends likely to have the most direct impact on finance leaders, the finance function, and, by extension, the rest of the organization, through 2026. Collectively, these trends illustrate the integral—and increasingly more prominent—role finance leaders are often playing in helping their organizations optimize costs, catalyze innovation, and orchestrate a strategic agenda that fuels enterprisewide growth and value. Here are the top five trends impacting finance:

Trend 1: The speed priority—Advanced scenario planning and agile governance for navigating uncertainty

Finance chiefs often walk a razor’s edge between two unrelenting demands: managing cost efficiency while identifying opportunities to invest in business growth. From a cost-optimization perspective, it can be hard to ignore one of the biggest contributors to volatility—supply chain disruptions. Localized pressures, such as labor shortages, combined with cross-border challenges, are among the business factors contributing to higher costs, and can throw global sourcing into disarray.1

Table of Contents

- Trend 1: Boosting agility and scenario planning

- Trend 2: CFOs lean into tech to influence strategy

- Trend 3: How finance-led cost management can drive value

- Trend 4: Embracing AI, on the journey to agentic

- Trend 5: Infusing tech talent and data into finance

- Top takeaways from the 2026 Finance Trends interviews

In tandem, it may be increasingly difficult for finance leaders to keep pace and identify the most important investments to help fuel growth and innovation. Three-quarters of the leaders we surveyed say their organization requires either a moderate amount or “a lot more” resources to maximize investment opportunities across the business.

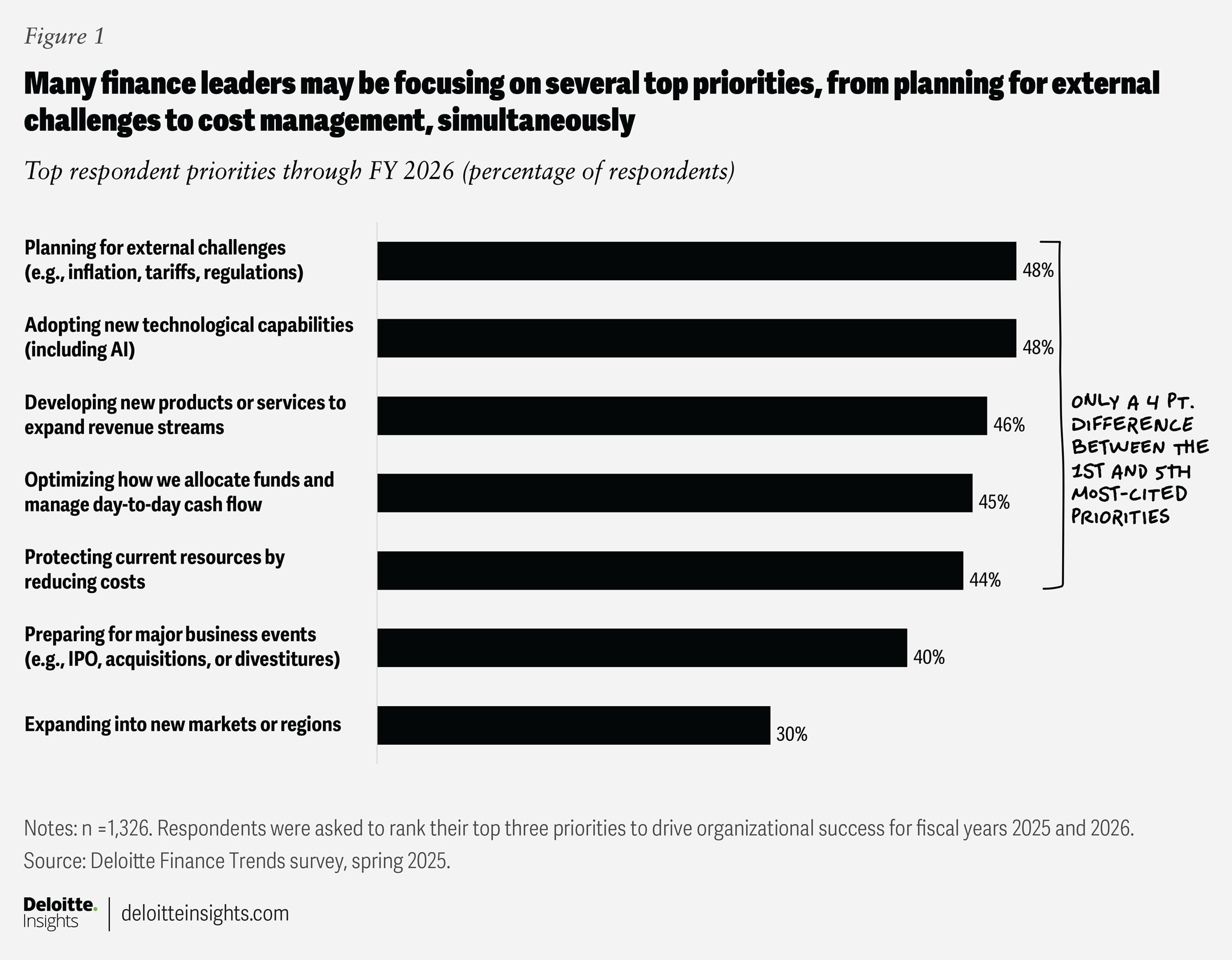

Our survey corroborates a high level of uncertainty and complexity in the current environment. Asked to rank their top three priorities, there was little consensus (figure 1). Planning for external challenges and adopting new technological capabilities tied for highest priorities among respondents. But there was only a 4-percentage-point difference between these responses and the fifth most-cited priority, protecting resources by reducing costs (44%). Overall, this lack of consensus suggests that, when it comes to which priorities should receive the lion’s share of respondents’ attention, it may be a case of “everything, everywhere, all at once”—Many finance leaders are likely juggling several top priorities at the same time.

Respondents’ views on external challenges around perceived risks also help illustrate a challenging landscape. Asked to choose their top two risks, economic uncertainty ranked highest (26%). But this was closely followed by financial reporting and disclosure requirements (25%), data privacy regulations (24%), and tax regulations (22%). Meanwhile, geopolitical tensions and supply chain disruptions—tied for sixth place at 21%—are only 6 percentage points away from the top choice. These findings may suggest that many finance leaders are navigating a number of high-priority risks simultaneously.

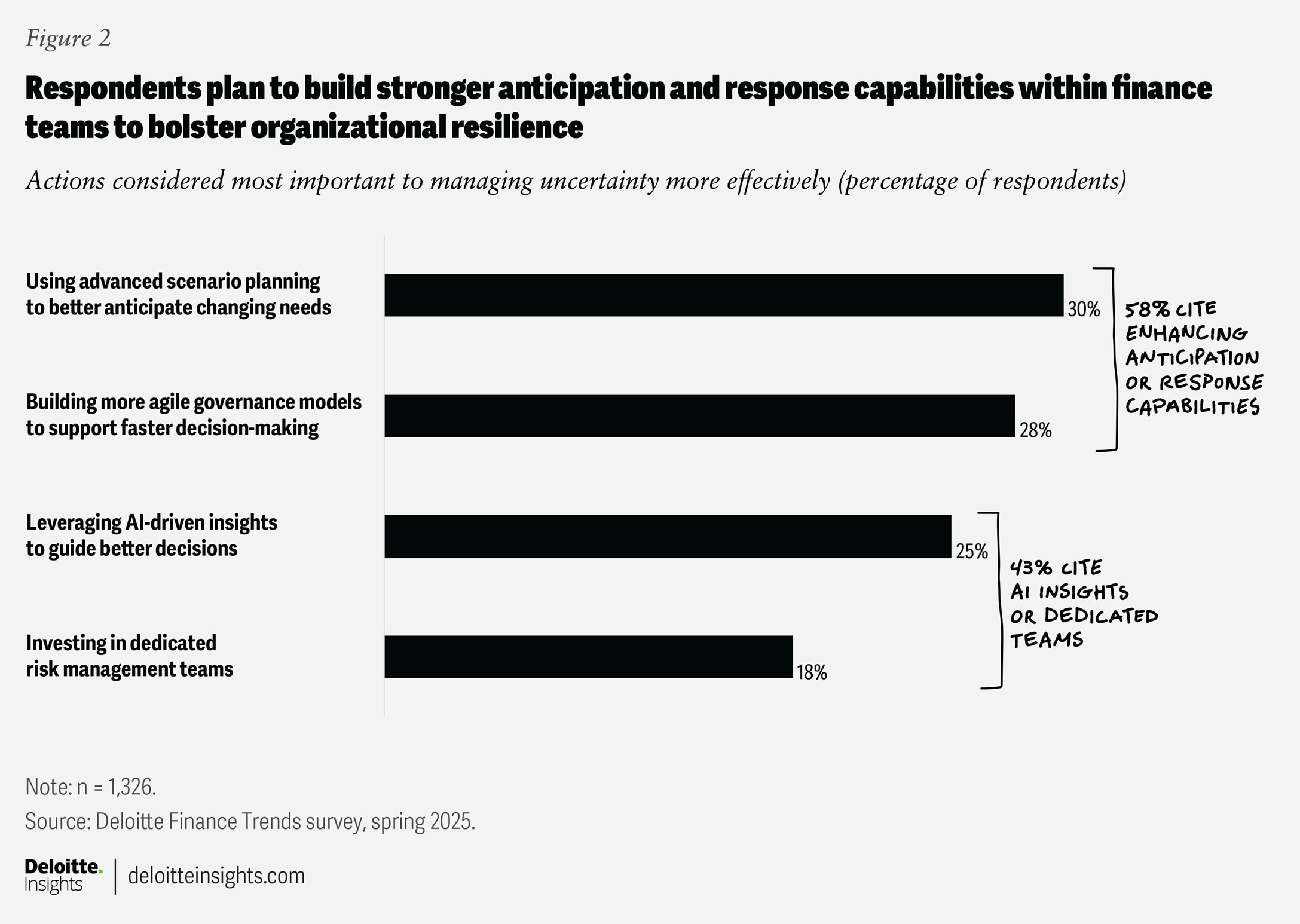

How leaders maintain focus amid competing priorities can influence a company’s agility and resilience. Our research shows that many finance leaders are taking steps to bolster scenario planning and governance structures to better anticipate and respond to their changing environments. Asked to identify their plans to help manage uncertainty (figure 2), respondents cite the need to bolster advanced scenario-planning capabilities (30%) and build more agile governance models to support faster decision-making (28%). Among other top strategies, 25% of respondents plan to leverage AI-driven insights to guide better decisions and 18% expect to invest in dedicated risk management teams. Similarly, advanced scenario planning and agile models lead the list of capabilities respondents say they need to make more informed capital-allocation decisions.

Trends in action: A faster, smarter scenario-planning capability, paired with emerging centers of excellence

Elevating the frequency and sophistication of scenario-planning techniques is becoming critical for many leaders. “Scenario planning is something we’ve always done, but the current environment has caused us to really accelerate the way we do it,” says Walmart’s Corporate Controller and Chief Accounting Officer David Chojnowski. “In the past, we may have run scenarios monthly; now, we’ve been running models and doing analysis almost daily.” He explains that AI has made these models far more sophisticated; they now combine data related to pricing, inventory levels, supplier dynamics, and customer trends. “We’re able to use AI to understand market trends and correlate those trends and other competitors’ decisions with ours in a way that we haven’t been able to in the past.”

Some finance leaders are also establishing new governance structures to help empower teams to respond to their environments more quickly. Embraer, the Brazilian multinational aerospace corporation, has built centers of excellence to provide frameworks, guidance, and specialized talent to help infuse specific capabilities, like intelligent automation, across the enterprise.

This approach can help improve efficiency by providing standardization and oversight with the unique requirements each business line needs. “We want to motivate and encourage our departments to build their own solutions without creating a second or third IT structure,” Antonio Carlos Garcia, executive vice president and CFO of Embraer, explains. “We need to enable the business to address their customer, market, and product needs, which are different from commercial aviation to executive jets to defense and security.” Over the past five years, synergies identified across several initiatives helped reduce IT spend—while simultaneously increasing the speed of implementation, according to Garcia.

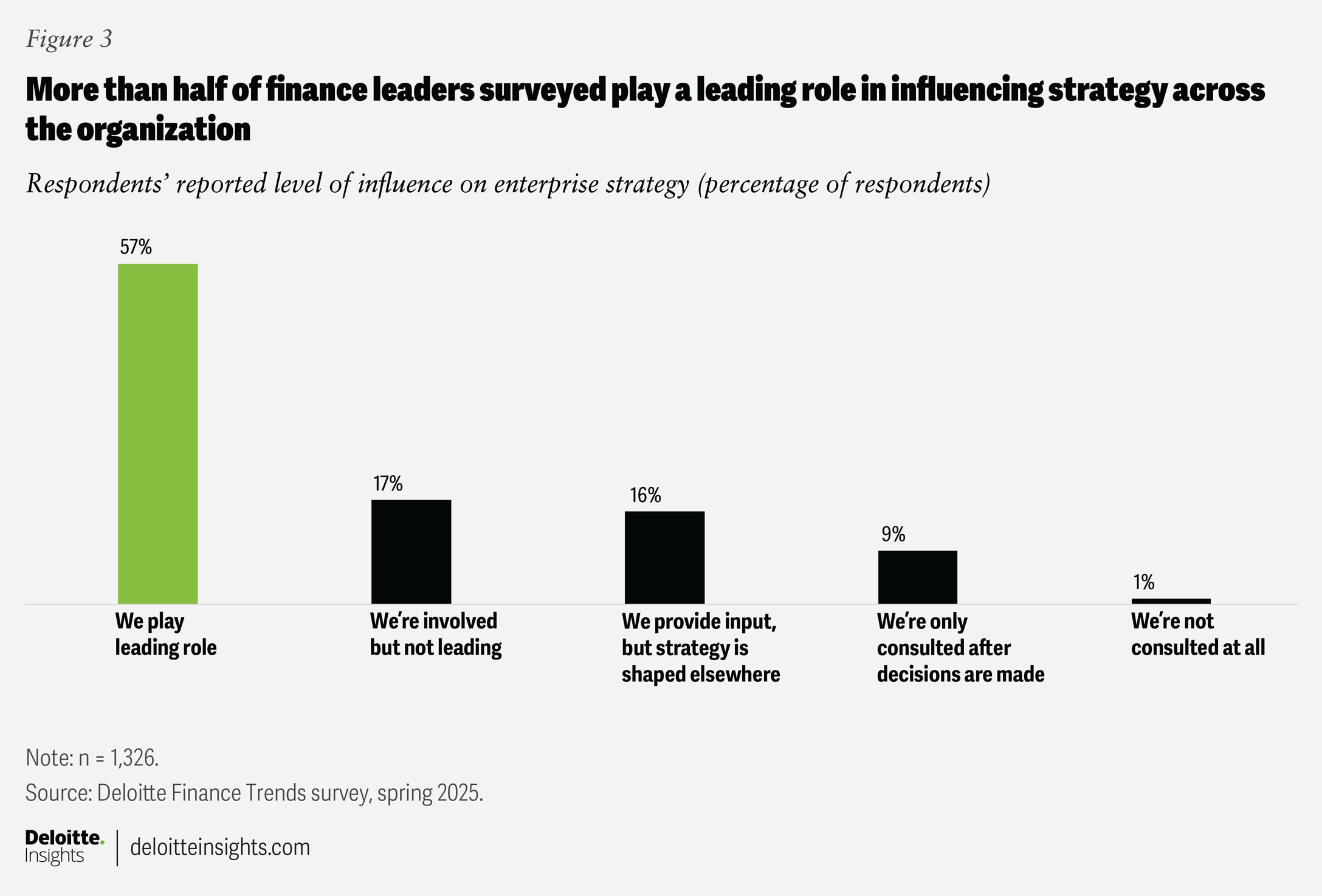

More than half of survey respondents (57%) say they are now among the top leaders influencing strategy development across the organization.

Trend 2: Finance leaders are stepping up as strategy leaders—especially when they embrace advanced AI and cloud

For many, gone are the days when influential finance leaders spent most of their time on the core foundations of financial management. A 2024 Deloitte analysis of CFO job postings revealed the number of skills CFO applicants were asked to bring to the table increased 19% over a five-year period. At the same time, the share of CFOs expected to have a strong grip on risk management more than doubled, according to the same analysis.2

As the scope of finance leadership expands, their influence on strategy across the organization seems to grow in step. Overall, we found that many finance leaders are holding greater accountability for driving business outcomes where they can orchestrate collaboration and drive transformative growth.

More than half of survey respondents (57%) say they are now among the top leaders influencing strategy development across the organization (figure 3). Notably, we found these strategy-influencing leaders also handle a broader scope of responsibilities: Across nine categories, they average 20% more responsibilities than other respondents.3

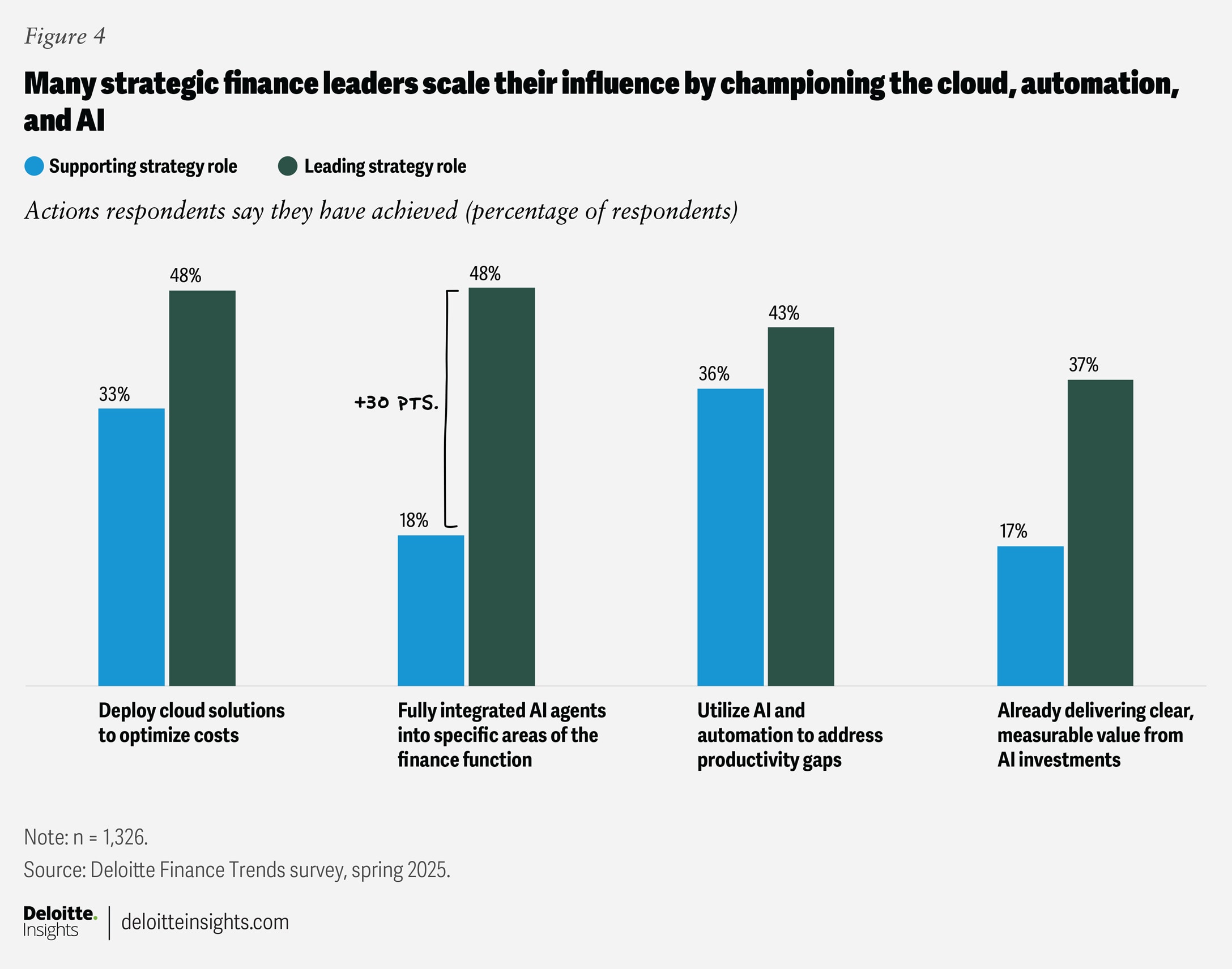

Interestingly, strategy-influencing leaders appear to be scaling their impact quite differently from their (relatively) less influential peers. By systematically applying technological and AI-driven solutions to help manage their broader scope of responsibilities, some of these leaders are helping redefine the finance function as a proactive partner in the business that is aligned with the organization’s most critical goals. Among these respondents, for instance, nearly half (48%) say they’re deploying cloud-based solutions to help optimize costs across their organizations, versus 33% of finance leaders who are in strategy-supporting roles (figure 4).

Strategy-influencing respondents also seem further along in their AI journeys. They’re more likely to use AI to help address current shortfalls in productivity compared to respondents operating in a strategy-supporting role (43% versus 36%). More than one-third say they’re already delivering clear, measurable value from their AI investments compared to those in a strategy-supporting role (37% versus 17%), and nearly half (48%) say they have fully integrated AI agents into specific areas of the finance function, compared to 18% of supporting respondents.4

Similarly, AI is helping enhance the strategic impact of the finance function at Hewlett Packard Enterprise. Marie Myers, the executive vice president and CFO, says, “Our finance organization’s journey over the past 18 months has been transformative. We are using AI to empower our teams to become strategic partners, leveraging data and technology to drive enterprisewide value.” Myers further emphasizes, “We’ve reimagined the role of finance, moving from traditional stewardship to proactive leadership enabled by digital transformation.”

Trends in action: Unlocking value through automation and scaled solutions

While managing a seemingly ever-expanding scope of responsibilities may seem daunting, leveraging automation technologies can help finance leaders clear a path to accomplish more strategic—and rewarding—work across the finance function.

Reflecting on the impact of his team’s multiyear journey to standardize, centralize, and automate a large portion of their day-to-day work (such as processing claims or pulling together routine reports), Walmart’s Chojnowski says, “It’s empowered our team to focus on more value-added work, more forward-looking work, including engaging more with regulators and customers to influence outcomes.” Chojnowski says this transformation has also freed up his team to provide more robust support across functions by equipping business partners “with financial and accounting insights to help them make optimal business decisions.”

Trend 3: Focus. Precision. Discipline—How finance-led cost management helps drive measurable value

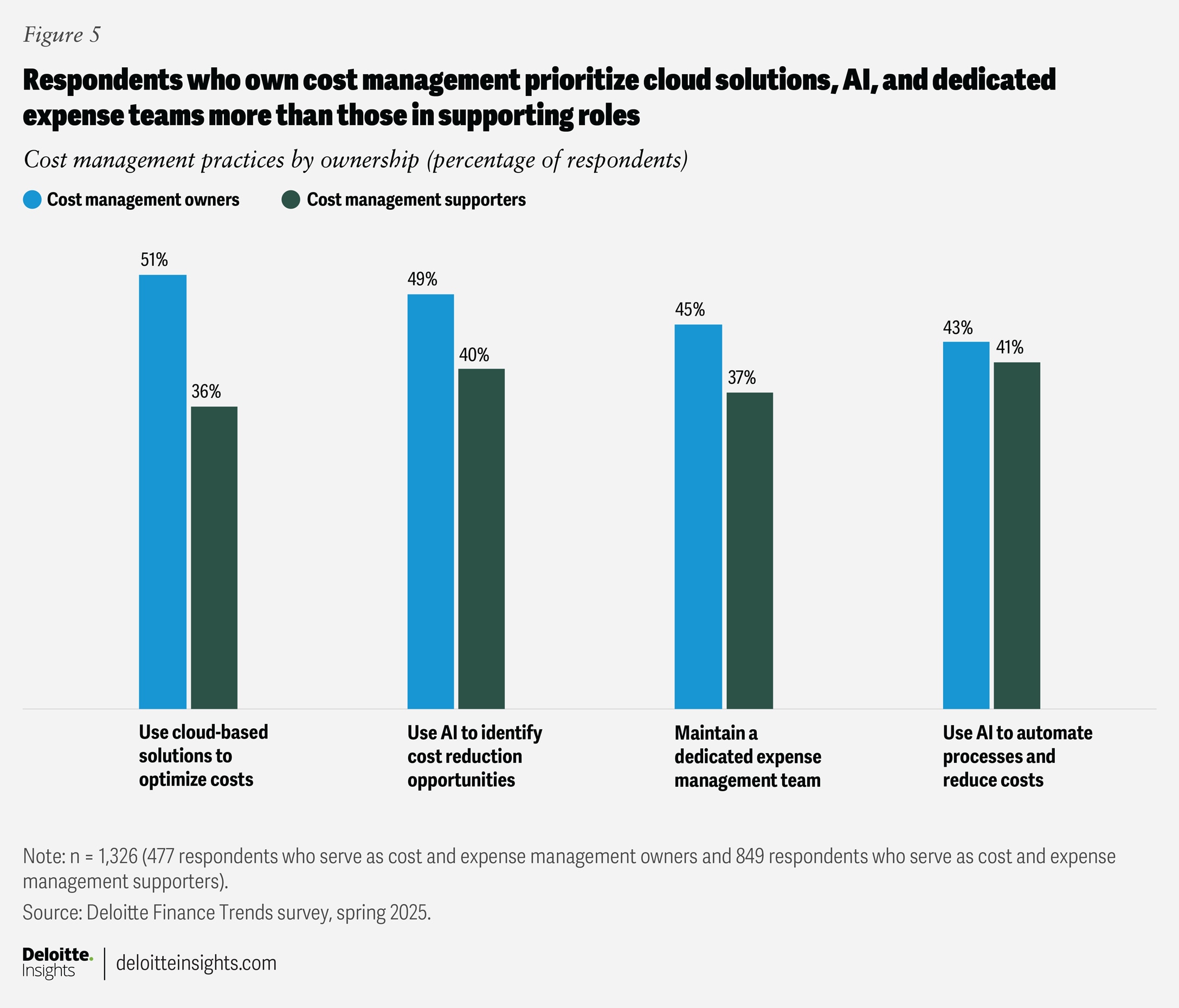

When finance leaders own cost and expense management, what can set them apart are the tools they bring to cost discipline along with a focus on accountability. Just over a third (36%) of finance leaders surveyed (and 42% of CFOs surveyed) are primarily responsible for cost and expense management for their organizations. Yet these leaders are more likely to consistently meet—or exceed—their cost-savings goals compared to respondents who say they play a supporting role in enterprise cost management (47% versus 39%).

Trends in action: Leveraging the cloud, AI, and dedicated expense teams

Respondents who are taking greater ownership of cost management often bring together cloud infrastructure, intelligent automation, and specialized in-house expertise to help strike a balance between growth and cost control.

Finding flexibility in the cloud

Cloud investments appear to be the preferred cost-management method among respondents who own expense oversight. While 51% of respondents who own cost management are deploying cloud solutions to optimize costs, just 36% of their counterparts in supporting roles are doing so (figure 5).

This may also be because some organizations require greater flexibility in their digital structures. For instance, in Deloitte’s 2025 MarginPlus survey, the top two internal barriers to organizational success are the “inability to enable digital infrastructure to meet new external business conditions and scale” (49%) and a “lack of flexibility in existing assets and infrastructure to respond to external demand” (45%).

At its core, the cloud can offer financial and operational flexibility; companies can scale resources up or down without necessarily locking in fixed infrastructure costs. Cloud-based solutions can minimize up-front expenditures for hardware and provide more scalable infrastructure to conduct analysis for identifying cost-saving opportunities.5

While the cloud can create efficiencies, it can also lead to unintended complexity and costs if cloud usage isn’t closely monitored and deployed. For this reason, some companies are also establishing “FinOps” teams (teams that combine finance and DevOps expertise, practices, and strategies) to help assess—and optimize—cloud spending and efficiency.6

Leveraging AI to improve efficiency

Many companies are turning to AI to help cut operational expenses while increasing speed and accuracy. Among respondents owning cost optimization at their organizations, AI ranks second, just behind cloud-based solutions, as the most effective way to achieve cost savings. For these cost and expense owners, 49% say they are likely to use AI to identify cost-reduction opportunities, compared with 40% of finance leaders in a supporting role.

In this capacity, finance leaders can use AI to streamline certain repetitive processes or eliminate manual verification in certain transactions. For example, a few of our interviewees say they are using AI to scan their accounts receivables and proactively analyze transactions to identify potential errors and identify which accounts have a higher potential for delinquency.

Other Deloitte Global research also highlights how AI can be especially helpful in the realm of tax. Specifically, some tax leaders are using AI to help identify efficiencies in transfer-pricing documentation and corporate income tax returns and payments.7

Using dedicated teams to take a disciplined, proactive approach

Another way many finance leaders excel at cost management is by treating it as a continuous, strategic discipline—not a one-off initiative. They invest in dedicated expense management teams, which help find opportunities through cross-functional collaboration and process improvement. Among respondents who serve in a cost-ownership and expense-ownership role, 45% cite the use of a dedicated expense management team as part of their cost-management practices.

Timo Ihamuotila, the global CFO for global electrification and automation manufacturer ABB Group, explains how this dedicated team resides within the financial planning and analysis team. Specifically, they look for opportunities to find efficiency and profitability across ABB’s network. For example, he says, “The team designed a gross profit productivity metric (the amount of gross profit generated per unit of head count) and this metric has been an extremely powerful way for us to drive the right quality of revenue and and profit behaviors across our network.” He emphasizes that establishing rigor around cost metrics makes productivity and efficiency central to ABB’s culture.

Trend 4: The journey to agentic insights—Many finance teams embrace AI, but ROI and agentic implementations often lag

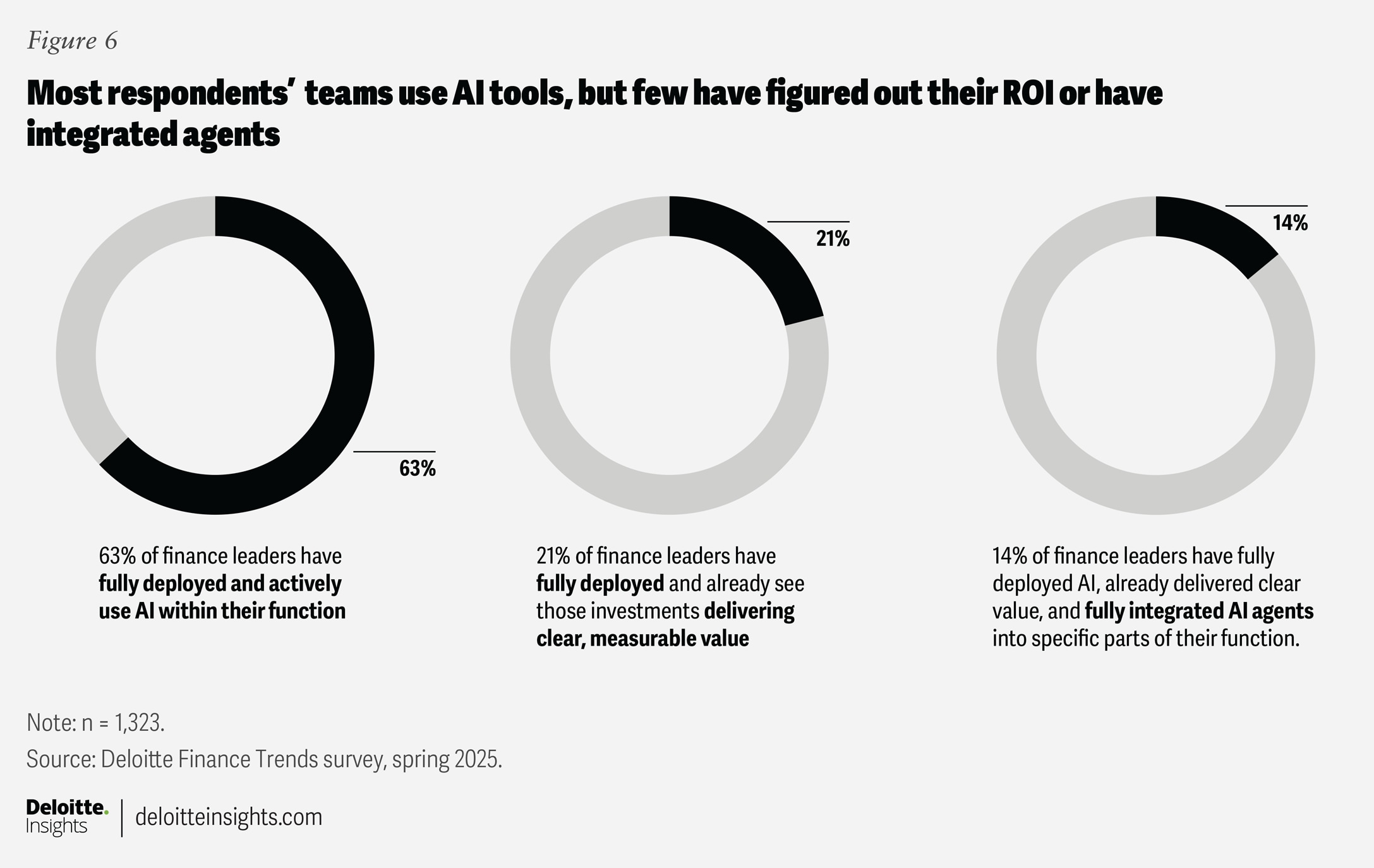

Our survey shows that nearly every finance department is at least experimenting with AI use cases: Impressively, 63% of respondents say they have already fully deployed and are actively using AI solutions in their finance function. Yet, for many, there is still runway to amplify the reach and measurable impact of their AI investments. For instance, among respondents actively using AI solutions, only 21% believe those AI investments have already delivered clear, measurable value; and only 14% have reached the additional milestone of fully integrating AI agents directly into the finance function (figure 6).

This likely reflects a broader challenge of moving from pilot projects to embedding AI in everyday finance operations. It also reflects where many industries and functions are in their march toward enabling AI agents to manage specific tasks—and it is still a relatively new frontier.8

Trends in action: Challenges and opportunities along the AI journey

Our survey analysis suggests that progress in deploying AI depends on where finance leaders are on their AI journey. Here’s what we learned about the challenges and opportunities respondent finance teams are facing.

Early challenges: Legacy technology and unclear return on investment

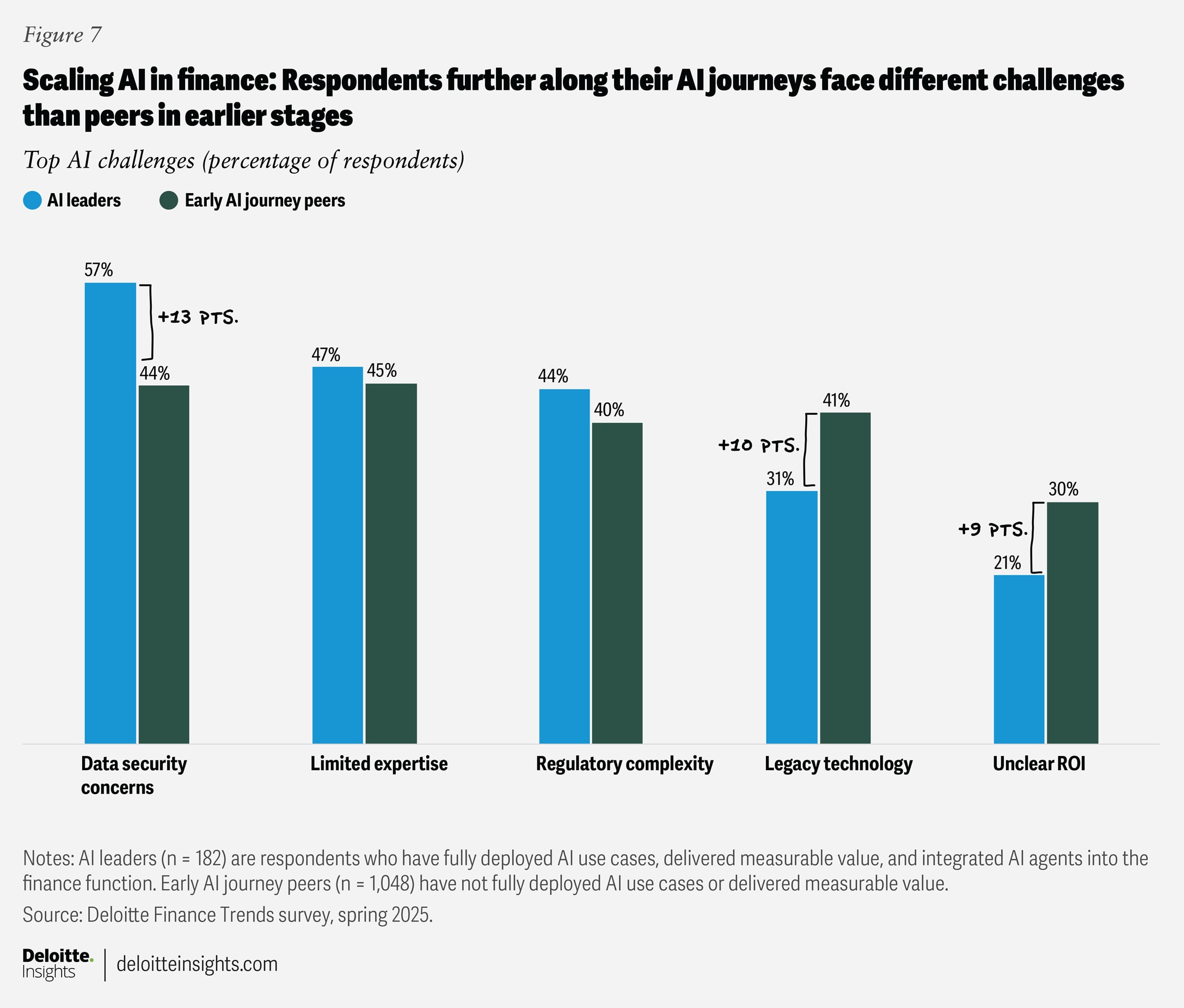

Using AI to transform the finance function remains an elusive goal for many respondents. Respondents from organizations in the early phases of AI adoption (those who have only reached the AI deployment stage) say they are grappling with the weight of legacy infrastructure.

In our survey, 41% of early-stage teams report legacy technology as a barrier to AI adoption, compared with 31% of “AI leaders”—respondents who have deployed AI solutions, delivered measurable value from those solutions, and have already integrated AI agents into the finance function (figure 7). Notably, several of the finance leaders we interviewed say they are actively going through a digital transformation to their enterprise resource planning (ERP) systems to provide greater flexibility and access to insights. But they also acknowledged that this is a multiyear journey.

In addition, some respondents report that with AI adoption, proving a return on investment is challenging within the finance function. Our survey found that 30% of finance leaders in the early stages of AI adoption struggle with justifying ROI, compared with 21% of those further along the AI journey, or AI leaders.

ROI can be a major tipping point across functions, not just finance. According to Deloitte’s State of gen AI in the enterprise January 2025 report, 70% of those struggling with ROI need at least a year to properly resolve those challenges9—showing how transformation can slip through the cracks if finance leaders lack a strong business case and leadership buy-in. Prior Deloitte Global research suggests finance leaders should adopt a more holistic view of AI’s return on investment—measuring sentiment like organizational trust along with traditional financial metrics.10

Recently, electrical supplies distributor Graybar undertook a technology-enabled business transformation. Senior Vice President and CFO David Meyer emphasizes how enhanced AI, and analytics capabilities, can help optimize working cashflow and profitability for their financial planning and analysis function. “We’ve already seen benefits to working capital and are expanding our use of data analytics, machine learning, and AI to enhance forecasting, optimize inventory, and increase cash flow,” he says. “On top of that, we will be applying scenario planning and predictive analytics capabilities to support analyzing acquisition and growth targets.”11

Ensuring data privacy in finance is a top concern

Data security concerns reign near the top of respondents’ list of AI implementation challenges. This appears especially true for respondents who are AI leaders: Fifty-seven percent cite data privacy as a top challenge versus 44% for those earlier on their AI journey.

Several of our interviewees stressed that data privacy is particularly relevant in finance, where teams handle some of the organization’s most sensitive data. Ensuring that AI tools are secure and compliant will be critical as finance teams expand their AI capabilities across sensitive workflows and decision-making processes.

To help manage these sensitivities, Johnson & Johnson, the healthcare company, is creating more nuanced governance models to ensure proper usage and deployment of their potential AI solutions. Bridgette Link, senior vice president, Finance Solutions and Technology at Johnson & Johnson, explains that as they are implementing a new ERP system, they are examining the entire life cycle of the financial process to ensure each relevant facet has a data steward responsible for protecting and considering proper data usage. “For example, our accounts receivable, accounts payables, and supply chain teams all have a data steward assigned with more specialized teams supporting them in assessing each of our data use cases.”

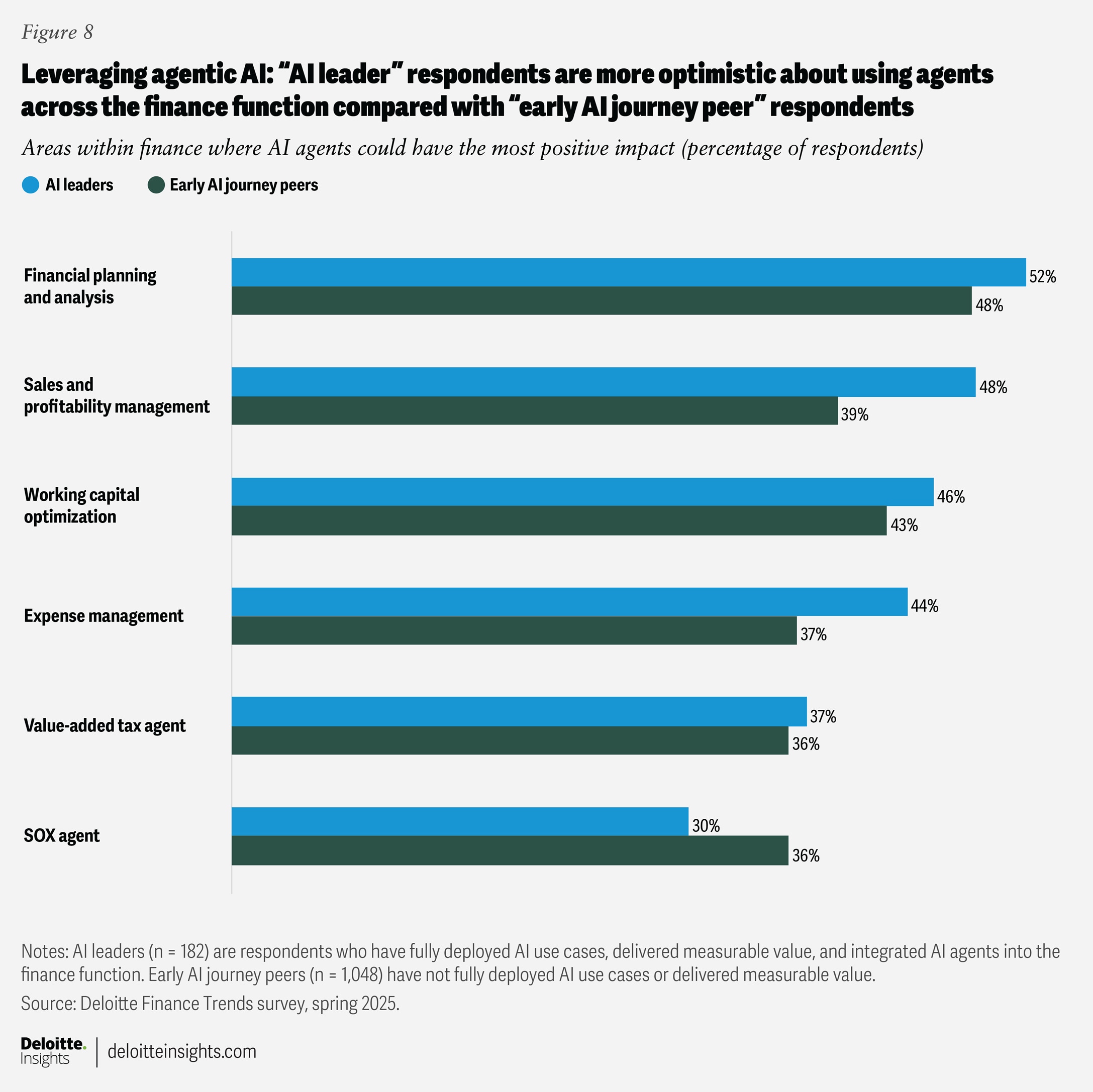

Where “AI leaders” see the next frontier of agentic AI

The area where some finance leaders see some of the greatest potential is in agentic AI. This technology appears to be attracting serious interest as a tool for financial planning and analysis, which can play a crucial role in helping navigate uncertainty and guide capital allocation.

Agentic systems can help finance leaders under pressure move more efficiently on critical tasks. Our survey shows three assistive areas where respondents see the greatest opportunity: sales and profitability management (48%); working capital optimization (46%); and expense management (44%) (figure 8).

Some of these plans are already in motion. Hewlett Packard Enterprises’ CFO Marie Myers is prioritizing agentic solutions across the finance function. “Democratizing AI means making advanced tools accessible and actionable for everyone. We’ve made agentic AI solutions available to our finance colleagues, to automate routine processes and tasks,” says Myers. “We are also building AI solutions that will provide predictive analytics, insights, and decision support. These innovations free our teams to focus on higher-value work—partnering with business leaders, shaping strategy, and driving growth.”

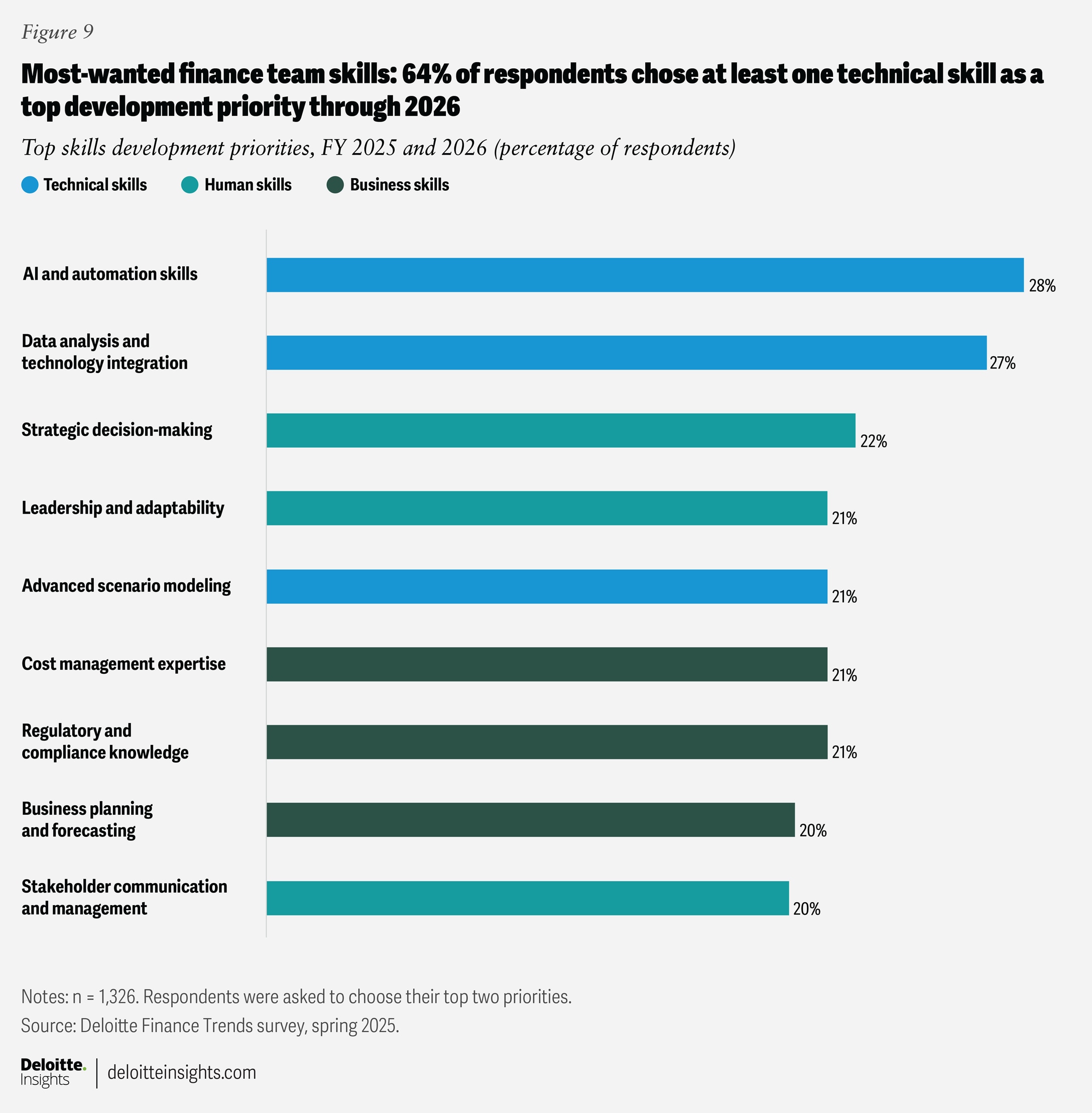

Almost two-thirds of respondents (64%) say they plan to infuse more technical skills and capabilities within their function over fiscal years 2025 and 2026.

Within the finance function of Algar Telecom, a Brazilian telecommunications company, an AI agent named “Billy” was introduced in 2024—and it is already making an impact. Algar CFO Gustavo Matsumoto explains that in their industry, most billing errors appear on the first invoice they issue to new customers, so they’ve charged Billy with reviewing these invoices. “Billy tries to cross-check the contract with the information inputted into the CRM system and corresponding invoice,” he says. So far, in the first nine months of 2025, Billy reviewed 25% of all first invoices issued and has captured an additional US$1.5 million in profit.

Trend 5: Infusing tech talent in finance—Where data scientists and accountants meet

Building organizational agility requires more than finding the appropriate technology infrastructure to help enable it. In our survey, almost two-thirds of respondents (64%) say they plan to infuse more technical skills and capabilities within their function over fiscal years 2025 and 2026. This finding jibes with Deloitte’s Q1 2025 CFO Signals™ survey, in which surveyed finance chiefs listed lack of skilled talent, along with employee engagement, staff resistance to using new technology, and work overload, as the biggest workforce challenges in meeting C-suite expectations for their finance departments.

But finance functions appear to be getting squeezed at both ends of the labor pool: The number of CPA exam candidates has fallen by 27% over the past decade, and the number of accounting graduates continues to slide as well.12 Meanwhile, three-quarters of accounting professionals are within 15 years of retirement, according to the Association of International Certified Professional Accountants.13

As AI increasingly gets integrated into finance, the work and capabilities of the function may shift in-step. How finance leaders meet their pressing talent needs will likely have major implications for their departments going forward. It may even alter what a finance professional—or department—looks like in the future.

Top tech skills respondents need

Topping the list of the skills many surveyed finance leaders are prioritizing for the next fiscal year are AI and automation, along with data analysis and technology integration (figure 9). More specifically, in other research specific to tax professionals, many leaders see AI skills as essential for today’s tax workforce.14

Finding the right blend of technology and talent appears to be top of mind in many finance departments, with technology emerging as a potential solution when talent is scarce. The top action respondents are taking to meet their talent acquisition and retention challenges is “utilizing AI and automation to address productivity gaps.” This aligns with the CFO Signals survey, which showed that many finance chiefs believe it is likely or very likely they will use generative AI in the coming 24 months to help bridge skills gaps in their finance department.15

Core business and finance skills, such as strategic decision-making, cost-management expertise, regulatory and legal compliance, and business planning and forecasting, appear lower on the priority list for development. Leadership and adaptability and advanced scenario modeling garner similar response rates as these more traditional finance capabilities, indicating how much emphasis some finance leaders may be placing on making their organizations more agile and responsive to rapid change.

Trends in action: Balancing tech skills with financial acumen

Many finance leaders are leaving no stone unturned in their hunt to lure or nurture high-priority skills. After utilizing AI and automation to attempt to address productivity gaps (40%), respondents say they are employing an array of internal and external initiatives to train current professionals, source new talent directly into finance, and structure teams to most effectively capitalize on the combined talents of data science and traditional finance professionals.

Overall, it seems clear that many finance leaders aim to strike a balance between their department’s legacy accounting and financial acumen with the tools and skills required to successfully integrate AI into the function. In discussing the technical capabilities he wants to bring to his team, Garcia says, “Curiosity, for me is everything. Adopting new technologies requires a curious workforce, willing to engage with the tools and explore their possible applications.”

How will these new and emerging skills reshape the finance function?

From bottom-up to top-down: Supercharging accountants with new skills

In their attempts to find the right skills within their organizations, 39% of respondents say they are providing specialized training to upskill the workforce. At Walmart, for instance, Chojnowski shares that much of their AI and automation training has focused on a “bottom-up” approach: “Starting with simple tasks, like using gen AI for presentations or emails, to building agents to execute certain types of contract analysis.” Walmart has also conducted “jam sessions to identify other opportunities for embedding AI” into their work, he says.

At ABB, CFO Ihamuotila stresses that the most impactful internal training starts with senior leadership administering a training firsthand to their respective teams: “We run a senior leadership program where we bring between 50 and 60 of the most senior finance leaders to ensure our professionals are developing skills in step with the current talent market.” Then these leaders take these learnings and can become trainers, themselves. “We call this the 'train the trainer' program. The leaders can then act as trainers for their own teams, or on behalf of a specific subject matter, like new tools emerging in the finance transformation program.”

Blending data science and finance with better governance

Some finance leaders are looking beyond their own walls to find talent: Thirty-five percent of respondents say they are considering candidates from nontraditional backgrounds, and another 28% are “insourcing” talent from other departments. This last option was a top response among CFO Signals’ respondents over the first quarter of 2025, when identifying the ways their workforce strategy is evolving due to talent pipeline concerns.

When Perry Beberman joined Bread Financial, a tech-forward financial services company, as CFO, he prioritized introducing new skill sets and upskilling within existing finance talent. “We’re investing in more statistician and data scientist competencies so our team can better conduct complex analyses. It’s not only about hiring these skill sets; it’s also about advancing the skills within the organization”

Beberman believes that focusing on these skills has helped transform their finance organization from a support function to a strategic enabler of growth across the company. By prioritizing strong data, their finance organization can “hang tools on top of it to become more strategic and efficient.”

Similarly, Johnson & Johnson is infusing new data science and engineering talent within their finance organization, “To create better predictive models that the finance teams can deploy, we’re pairing some of our best accountants with our data scientists on a shared reporting and analytics team within finance,” Link explains. “We’re seeing a convergence of the accounting profession with the engineering profession to solve some of the organizations biggest challenges.”

Leading finance into the future: Top takeaways from our interviews

Levitating above each of these trends is a constantly changing environment. Throughout our interviews, leaders continually acknowledged that the sliding doors of opportunity seem to open and close at a breakneck pace. Still, we found the following recommendations continued to rise to the surface:

- Create a connected data infrastructure to build your base. Whether it’s to optimize costs or lay the groundwork for embedding AI, finance leaders constantly referenced a need to bring together previously disconnected data under a single roof.

- Expand your value as a leader beyond the traditional finance function. As the scope of finance expands, new skills and mindsets will need to be brought to the table. This means blending the skills of finance, business acumen, technology, and maybe most importantly, the more human-orientated skills of curiosity and critical thinking. As several interviewees stressed, the world will continue to change, but the need to think critically and bring a sense of curiosity to problem solving will remain constant.

- Foster agility by prioritizing efficient governance and scenario planning. Even with the right infrastructure and skills and capabilities, activating the enhanced capabilities of finance will require agile decision-making. Leaders shared how they have redesigned their teams to help ensure they have the right balance of autonomy and support to lead finance into the future.

The speed of change will likely continue to accelerate. Finance leaders who proactively reimagine their traditional responsibilities to create new value for their organizations can better position themselves to help impact strategy and spur enterprisewide growth.

Methodology

Deloitte’s 2026 Finance Trends survey polled 1,326 finance leaders from across the globe in spring 2025. The respondents included both CFOs and senior professionals in finance one level below the CFO. All respondents work at companies with annual revenues of US$1 billion or more. Leaders represent a cross-section of industries and sectors in 23 countries.

To better understand how each of these trends are unfolding, we conducted in-depth interviews with nine finance executives from a variety of global organizations.