2026 Retail Industry Global Outlook

Five dynamics are expected to reshape the retail industry in 2026, demanding agility, intelligence, and discipline in an increasingly AI-led marketplace

Evan Sheehan

Natalie Martini

Brian McCarthy

Lupine Skelly

Dr. Bryn Walton

Oliver Vernon-Harcourt

Over the years, retailers have been able to anchor their strategies around a set of fundamentals, including unwavering customer centricity, rigorous financial prudence, operational excellence, data-driven insights, and continuous adaptability to help ensure resilience and sustained success.

And while those fundamentals still ring true, our recent survey of 330 global retail executives (see methodology) indicates that 2026 could prove to be a watershed moment, forcing retailers to flex their “adaptability” muscles in new and challenging ways. The industry faces significant shifts in commerce, customer engagement, and operational discipline, with artificial intelligence at the core of these disruptions. So, how is the retail world set to respond? Our 2026 outlook explores five dynamics that could shape the year ahead:

1. Value-seeking consumers: A lasting, foundational shift

2. AI in commerce: From experimentation to execution

3. Marketing and customer experience: Reimagined in the age of AI

4. Supply chain transformation: Building resilience amid unreliability

5. Financial fortitude: Margin management and cost discipline

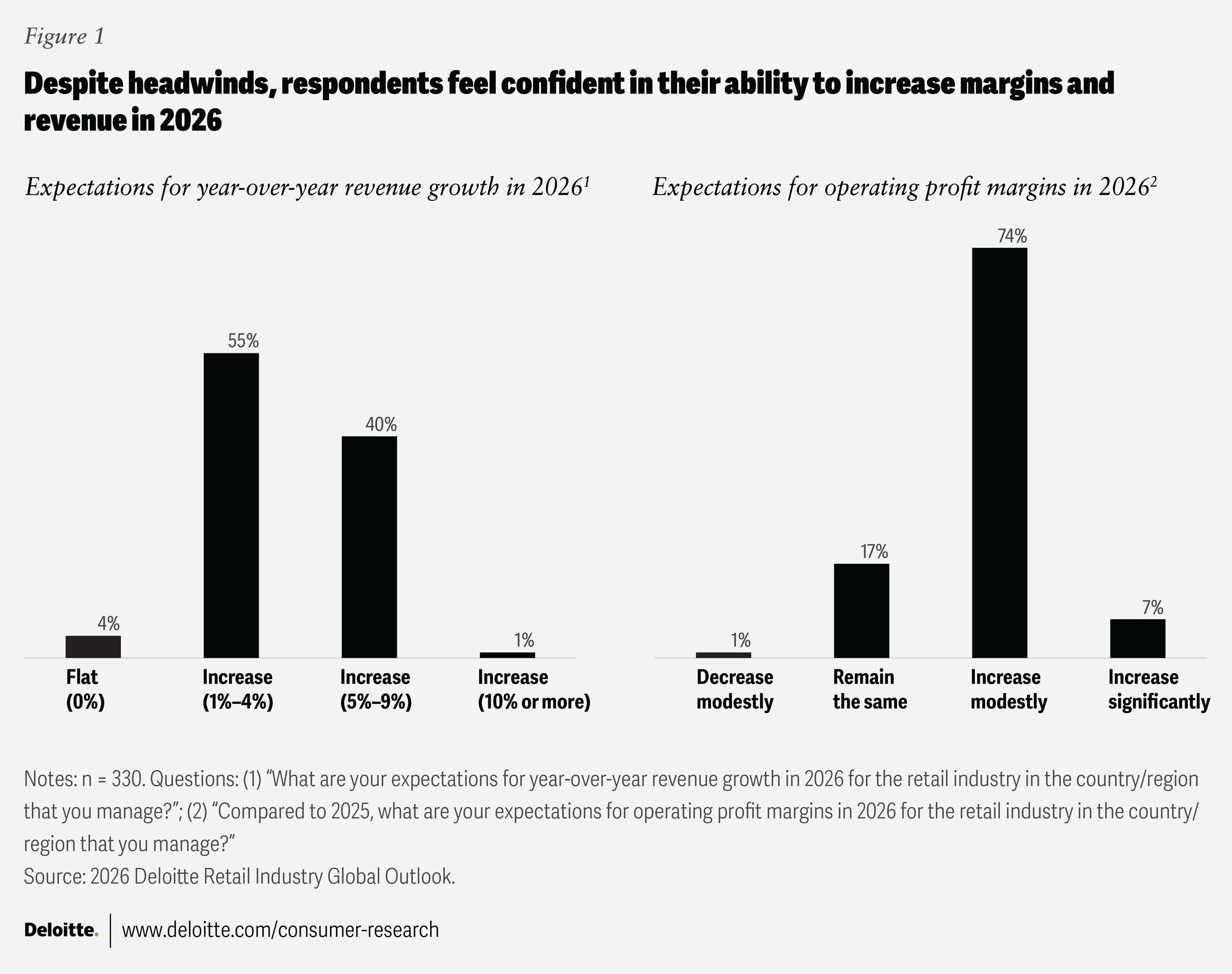

Despite expectations of a modest slowdown in economic growth and the prospect of a further squeeze in consumer spending power in some regions (see “The 2026 global economic forecast for the retail industry”), 96% of global retail executives surveyed expect industry revenues to grow, while 81% foresee margin expansion in the year ahead (figure 1).

The 2026 global economic forecast for the retail industry

– Ira Kalish, chief global economist at Deloitte, December 2025

In 2025, the global economy was disrupted in part by significant changes in US trade.1 Countries outside the United States responded by seeking trade liberalization with other countries and implementing fiscal and monetary stimulus meant to boost domestic demand. Additionally, investment in AI accelerated globally, especially in the United States and China.

Heading into 2026, there is great uncertainty, which could negatively influence business investment.2 Some companies have already postponed supply chain investments.3 The disruption of economic relations between countries also means uncertainty about the direction of currency values and borrowing costs. Overall, a modest slowdown in global economic growth is likely in 2026.

United States

The US economy faces headwinds from trade and immigration policy. Tariffs will likely boost inflation in 2026, thereby reducing consumer purchasing power.4 Immigration policy could mean slower employment growth and labor shortages in key industries. Yet massive investment in AI infrastructure could sustain economic growth. The sharp rise in technology-related equities has boosted wealth and spurred strong spending growth by upper-income households.5 Meanwhile, low- and middle-income households face increasing financial stress.6 If the pace of AI-related investment continues, economic growth will likely be moderate. Yet if there is a reversal in AI investments, the US economy could weaken substantially.

China

China’s economy continues to face significant headwinds owing to the collapse of the residential property market.7 This has caused a sharp decline in property investment and resulted in a loss of household wealth, leading consumers to save more and spend less.8 China’s government is utilizing fiscal and monetary stimulus to boost domestic demand. Meanwhile, the country faces a decline in exports to the United States due to tariffs and potential trade restrictions from other countries.9 On the other hand, China has become a leading global player in high technology and renewable energy, which could help fuel its economy and, in turn, drive consumer spending.10

Europe

Governments in Europe are starting to boost investment in defense and infrastructure, funded by debt, in response to geopolitical shifts.11 This is effectively a fiscal stimulus which, combined with lower policy interest rates, should have a modest positive impact on economic growth.12 On the other hand, Europe continues to face challenges, not the least of which are troubled trade relations with the United States and increased competition from China.13 The outlook is for moderate growth with low inflation.

The foundation for this optimism is a belief that the industry will see tangible benefits from cost savings, efficiency programs, and productivity initiatives.

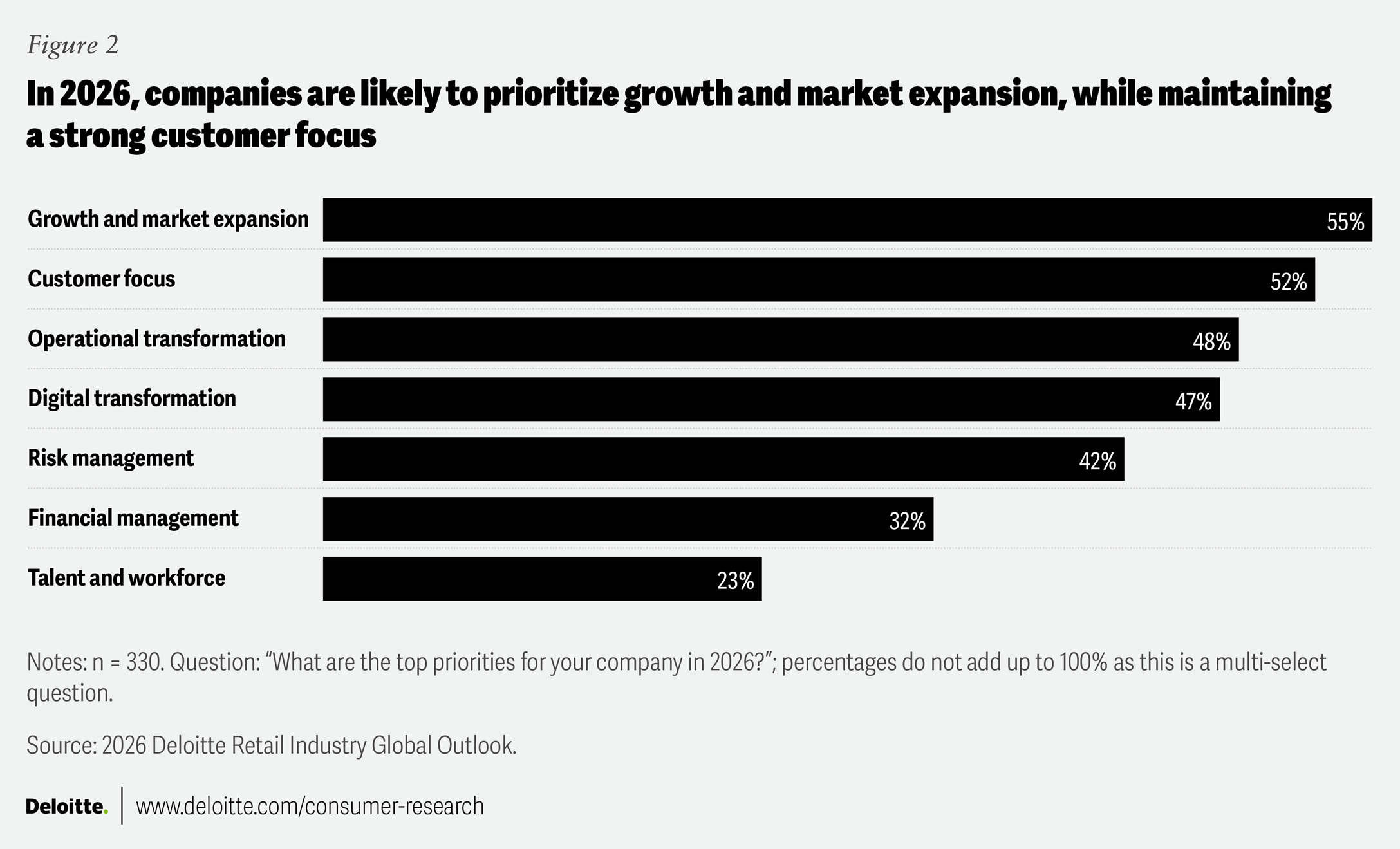

At the same time, retailers surveyed are prioritizing growth, the customer, and investment in operational and digital transformation (figure 2).

These priorities show a clear understanding of the importance of meeting consumers where their priorities are shifting. As spending power tightens and value rises to the top of the decision set, retailers’ plans for efficiency and innovation are increasingly aimed at delivering more for a value-seeking consumer.

1. Value-seeking consumers: A lasting, foundational shift

In 2026, retailers may face a structural shift toward value-seeking behaviors as consumers contemplate what constitutes a fair price. Our value-seeking consumer research finds that four in 10 Americans now demonstrate deal-driven or cost-conscious habits, and even higher-income households are reassessing what “value” means.14 Nearly seven in 10 retail executives surveyed agree that behaviors such as trading down, shopping value channels, or swapping convenience for savings represent a structural change, not a temporary response to inflation.15

But retailers will have to focus on more than just affordability to win over customers in this environment. Our research shows that as much as 40% of consumer perceptions of a brand’s value stems from factors other than price.16 Depending on the subsector, factors such as quality, customer service, ease of checkout, loyalty programs, and even employee attitudes can sway consumers. Understanding those factors and crafting a complementary value proposition may allow retailers to command a competitive advantage, even with today’s value-seeking consumer.

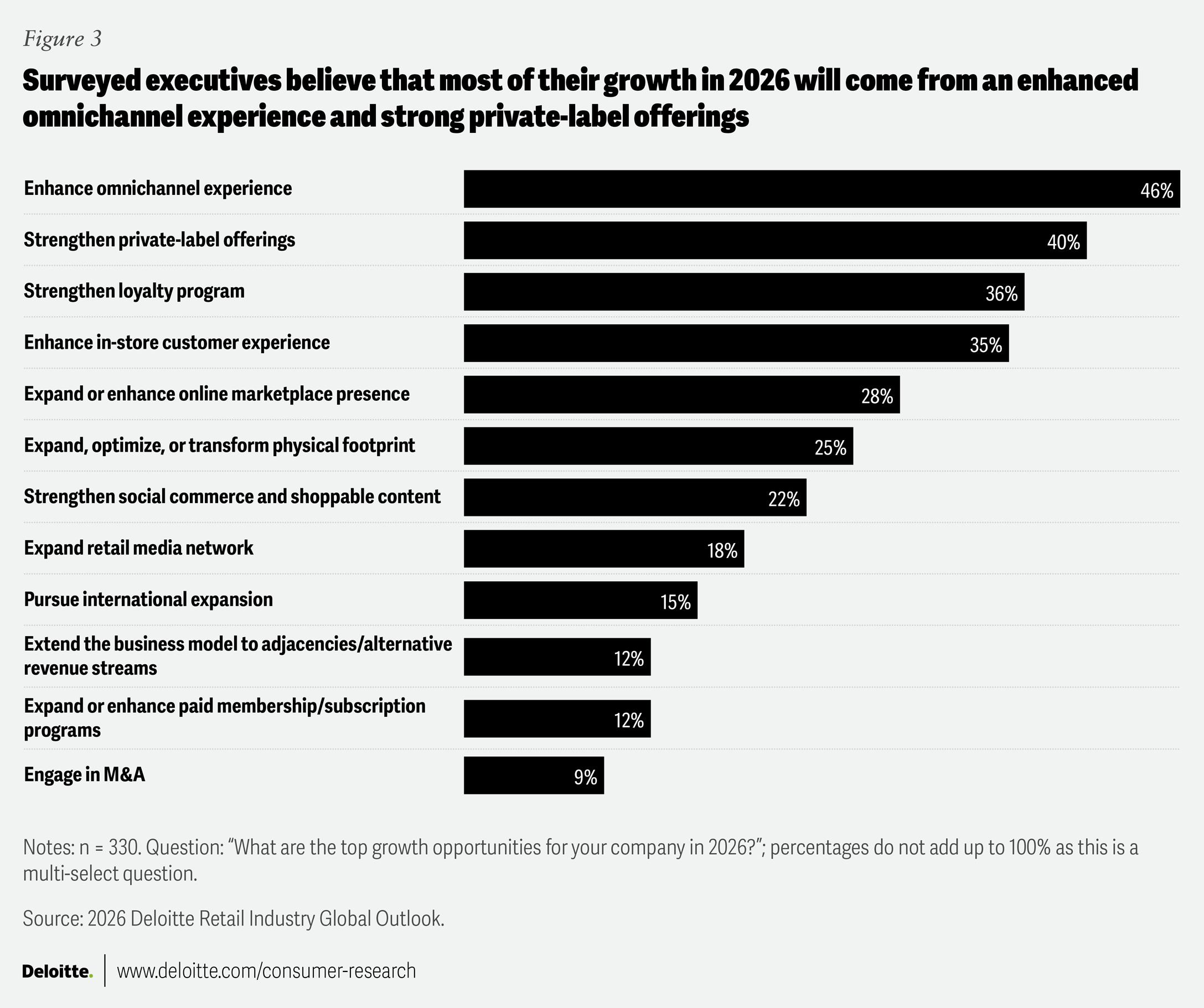

From insight to action: The retail response

Competing in a value-seeking environment involves reimagining the entire consumer proposition, including price, quality, experience, and trust as an integrated value ecosystem. Retailers are taking note: Seventy percent of respondents plan to expand value-priced assortments. Strengthening private-label products was the second-highest cited growth opportunity. Retailers are also focused on enhancing omnichannel experiences (46%) and strengthening loyalty programs (36%) (figure 3), both of which allow them to add value through personalization. A quarter (26%) of industry executives have already homed in on personalization through AI capabilities, while an additional one-third (35%) expect to have personalized AI recommendations in the next year. The winners in this new era will likely be those investing in technology-enabled capabilities that can empower brands to improve quality, attitude, and trust, and create personalized experiences that feel worth the price.

2. AI in commerce: From experimentation to execution

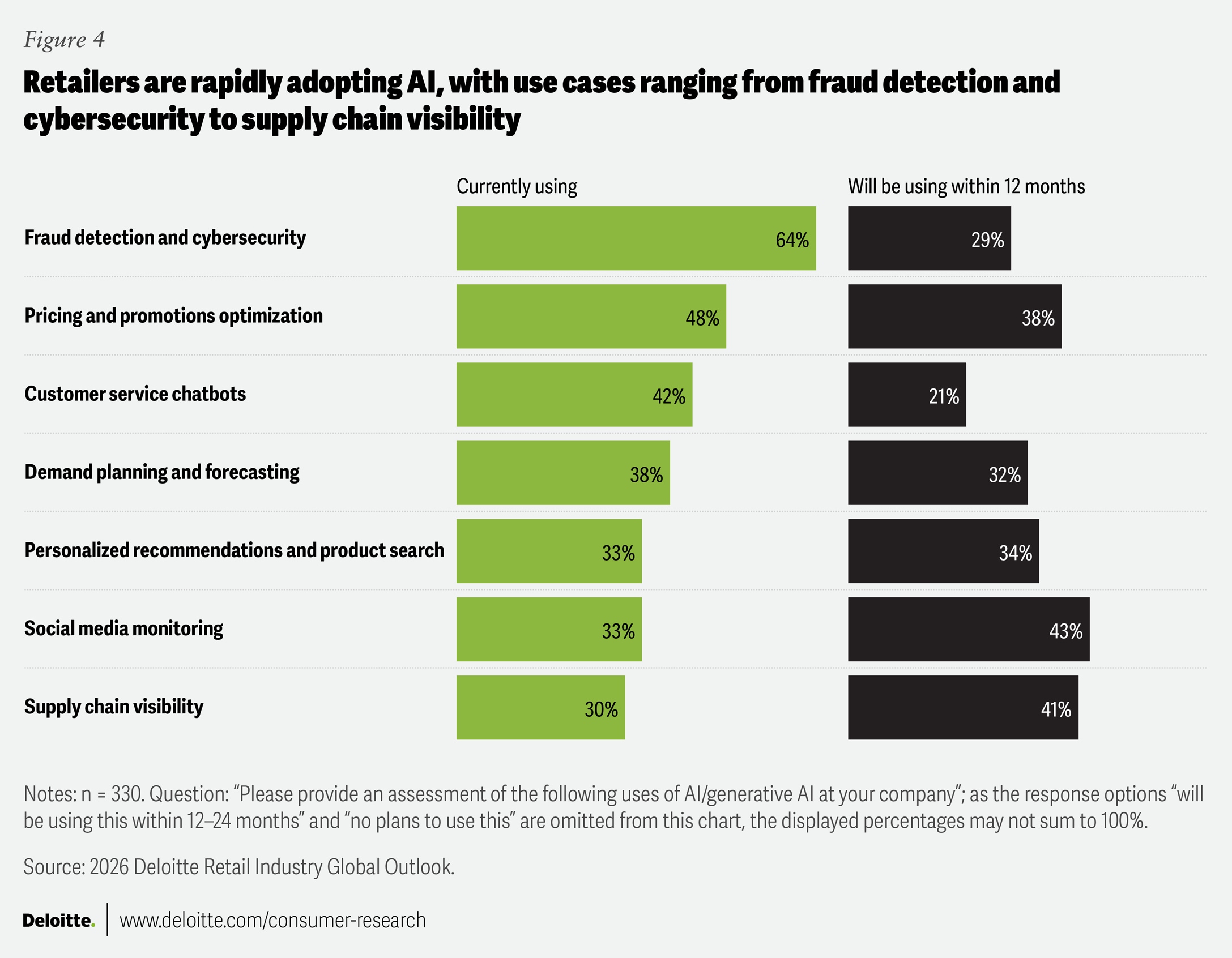

AI’s journey from pilot initiative to the heart of retail operations is accelerating, with an overwhelming majority of retailers either already using, or set to use, AI in the next 12 months for core operational capabilities (figure 4).

Retailers are also planning for the next evolution of AI, with nearly 68% of respondents expecting to deploy agentic AI for key operational and enterprise activities within 12 to 24 months.

In many ways, agentic shopping is already here. In the world of e-commerce, discovery, decision-making, and checkout are quickly shifting from retailer-owned channels to AI intermediaries, with referral traffic from ChatGPT and other AI chats now accounting for 15% to 20% of total referrals for some retailers.17 By 2030, some industry analysts estimate that AI agents could handle as much as 25% of global e-commerce sales.18

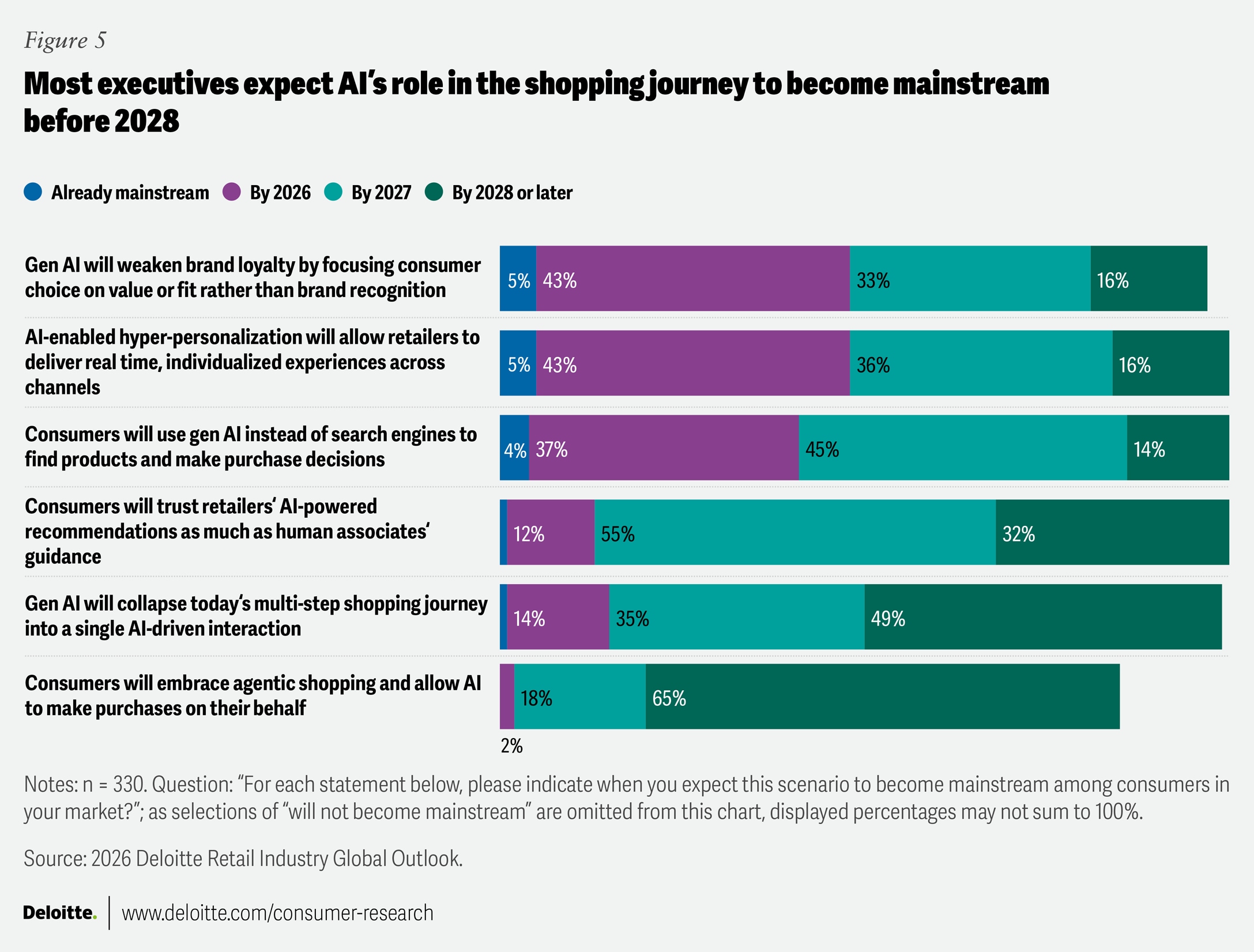

Retail executives are cognizant of the potential disruption—nine in 10 expect AI to be increasingly used over search engines by 2026, while half expect the collapse of today’s multi-step shopping journey by 2027 as shopping moves into a single AI-driven interaction (figure 5).

From insight to action: The retail response

These fundamental shifts in the way consumers discover and ultimately purchase items online can have significant implications for retailers. For example, 81% of retail executives surveyed believe that generative AI will weaken brand loyalty by 2027, as the technology focuses on factors like value or fit over brand recognition. If this expectation becomes reality, retailers should adopt certain AI hygiene factors, including ensuring that their product and pricing data are accurate, accessible, and optimized for AI readability so their products do not become invisible to consumers.

The winners will likely be those who industrialize AI and integrate it into core business functions, deploying and orchestrating multiple AI agents across the organization. Currently, 44% of respondents say that their company’s legacy systems are slowing down innovation, showing a real need to invest in clean, connected data architectures. In addition, training will likely need to be established for commercial teams to work alongside AI tools in real time. Those who adapt early will likely gain a significant advantage if AI agents become the primary interface for consumer transactions online.

3. Marketing and customer experience: Reimagined in the age of AI

In 2026, retailers should be able to lean on an increasingly AI-enabled toolkit to optimize marketing decisions and execute at scale. This toolkit will likely need to span hyper-personalization, creative automation, audience intelligence, content generation, and decision support, all of which allow marketing teams to move faster with targeted precision. Marketing leaders are already taking notice of the transformative potential, as 67% of retail executives surveyed expect to have AI-driven personalization capabilities within the next year, unlocking tailored experiences, targeted campaigns, and loyalty programs that adapt dynamically to each customer.

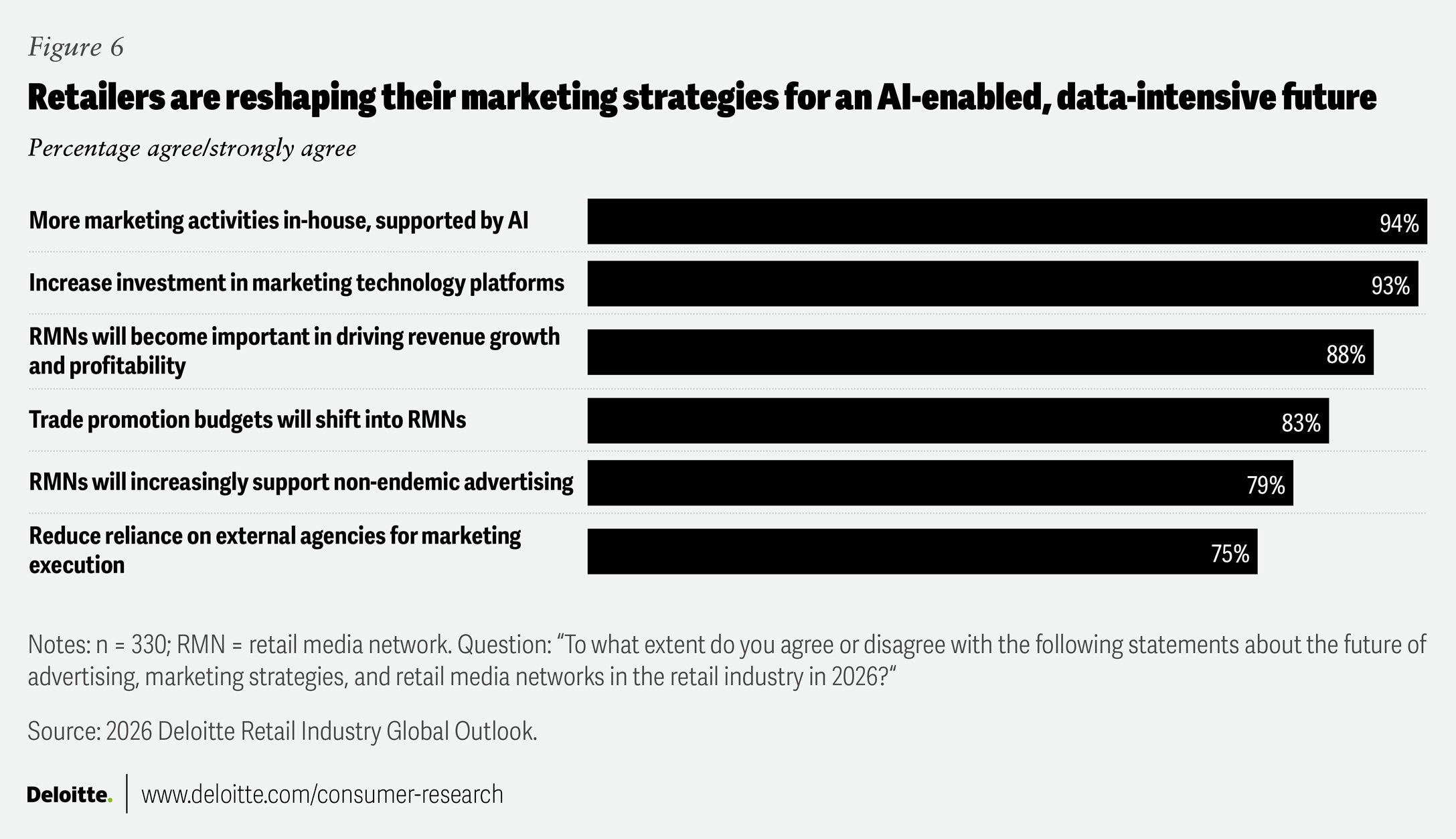

Retail executives are so confident in these AI tools that 94% expect to bring more marketing activities in-house (figure 6). For retailers operating retail media networks (RMNs), in-housing offers an even larger upside. Eighty-eight percent believe their RMN will be crucial for revenue and profitability in the year ahead, and 79% expect expansion into non-endemic advertising, enabling them to monetize audiences with highly targeted ads beyond their own product catalog. For instance, a grocery retailer’s site could advertise services or products not sold by that retailer, like insurance, based on the retailer’s ability to provide non-endemic brands with shopper-based audience targeting. The flip side? Eighty-three percent of executives surveyed expect trade spend to be diverted to RMNs.

From insight to action: The retail response

With three-quarters of retail executives surveyed planning to reduce reliance on external agencies, the move to in-house, AI-enabled marketing will require retailers to develop the capabilities needed to unlock the full value of their data, boost marketing agility, and personalize the customer journey at scale. As gen AI makes creative technologies more accessible, differentiation will likely depend on how effectively retailers blend creativity, data, and AI-driven insights to deliver distinctive brand experiences in an increasingly crowded market.

4. Supply chain transformation: Building resilience amid unreliability

Supply chain transformation has emerged as a critical lever for resilience and competitiveness. With 95% of retail executives surveyed anticipating rising costs due to global trade policies, the focus appears to be shifting toward reimagining supply chains to manage cost pressures and operational complexities.

The urgency for transformation is underscored by the 66% of respondents who plan to restructure their supply chains through measures such as onshoring, nearshoring, and diversifying their supplier base if input costs rise in 2026. Nearshoring, in particular, offers the opportunity to respond faster and better to demand signals, improving inventory management and reducing lead times.

From insight to action: The retail response

Technology is playing a pivotal role in driving supply chain transformation as retailers seek to mitigate escalating fulfillment and logistics costs. Currently, 30% of retailers surveyed leverage AI for supply chain visibility, and this figure is expected to climb to 41% within the next year. Further, 59% of executives surveyed anticipate a positive return on investment from AI-driven supply chain initiatives within the next 12 months. By prioritizing these tech investments, retailers should be able to navigate expected challenges in the year ahead and position themselves for sustained growth and innovation in an increasingly complex and unreliable environment.

5. Financial fortitude: Margin management and cost discipline

In a year where growth is a priority, demonstrating financial fortitude will be essential to help profitability align with ambitious targets. Nearly all executives surveyed anticipate higher costs in 2026 due to changes in global trade policies (6% foresee a significant increase, 55% a moderate increase, and 34% a slight increase). Despite these challenges, retail executives remain positive, with 82% forecasting margin increases in 2026.

Retailers are planning a range of tactics to offset these rising costs. For example, 67% foresee an increase in the threshold for free shipping, 72% plan to shift their product mix toward higher-margin or value-added items, and 73% intend to gradually adjust retail prices upward. But rising costs will also push retailers to adopt a financial approach that impacts the core of their business. Of the 95% of executives anticipating an increase in costs, 76% say their company is likely to adjust investment priorities, and 82% expect their organizations to shift capital allocation toward more profitable ventures.

From insight to action: The retail response

Margin leadership will be as much about precision as it is about restraint. Three-quarters of retail executives surveyed agree that their company is focused on what they can control and not spending resources on factors in the macro environment. Those that do this well are already seeing results, with 71% reporting that they are gaining a competitive edge through stronger cost control. To protect profitability, retailers should embed cost discipline across product mix, sourcing, and pricing, using tactics like dynamic pricing, data-led promotions, and targeted assortment shifts without eroding consumer trust. At the same time, diversifying revenue through higher-margin private labels and loyalty ecosystems, along with pursuing productivity gains and automation at scale, may be necessary for keeping costs in check and supporting sustainable growth.

A new mandate for 2026

In the year ahead, the fundamentals that have long anchored retail, such as customer centricity, financial discipline, operational excellence, and data-driven insight, will remain vital, but this year will test retailers’ adaptability in new ways. Value-oriented consumers, AI-driven commerce, reimagined marketing, resilient supply chains, and smarter margin management are converging to reshape how the industry competes and grows. The retailers that lead will likely be those that treat adaptability not as a defensive posture, but as a strategic capability. For retail leaders, the mandate is clear: Focus on what is in your control, double down on the fundamentals, elevate them with AI and insight, and meet consumers with value. Those who do should shape not just the year ahead, but the next era of retail.

Methodology

The 2026 Retail Industry Outlook survey was developed by Deloitte and conducted online by an independent research company from Oct. 13 to Nov. 19, 2025. The survey polled 330 executives, with 86% employed at retailers generating at least US$1 billion in annual revenue and 41% at companies with annual revenues of US$10 billion or more. The respondents included C-suite and senior executives who were directly responsible for, or exerted significant influence on, their organizations’ major strategic initiatives.