2026 Consumer Products Industry Global Outlook

Deloitte offers seven provocations for food and beverage, beauty and personal care, and household goods companies

Natalie Martini

Evan Sheehan

Ed Johnson

Oliver Vernon-Harcourt

Justin Cook

Céline Fenech

Although vital, many of the usual topics and trends affecting consumer packaged goods companies are well-trodden. It’s time to start a new conversation.

Why? Companies are navigating significant demographic, political, environmental, technological, and cultural shifts.1 Key drivers, including deglobalization and artificial intelligence, are hitting the industry at speed. Accepted truths, like the imperative for breadth, scale, and optimization, are being challenged by the need for focus, speed, and agility.

So, what should decision-makers put at the top of their agendas for 2026?

Seven provocations for the consumer products industry

Our research (see methodology) spotlights seven executive discussion starters—call them provocations—as catalysts for strategy-setting in the year ahead.

1. Consumers had better see more value

Large groups of consumers no longer feel they are getting good value at fair prices.2 Their perceptions eroded during the peak inflation of 2022 and have not recovered, despite high inflation having abated.

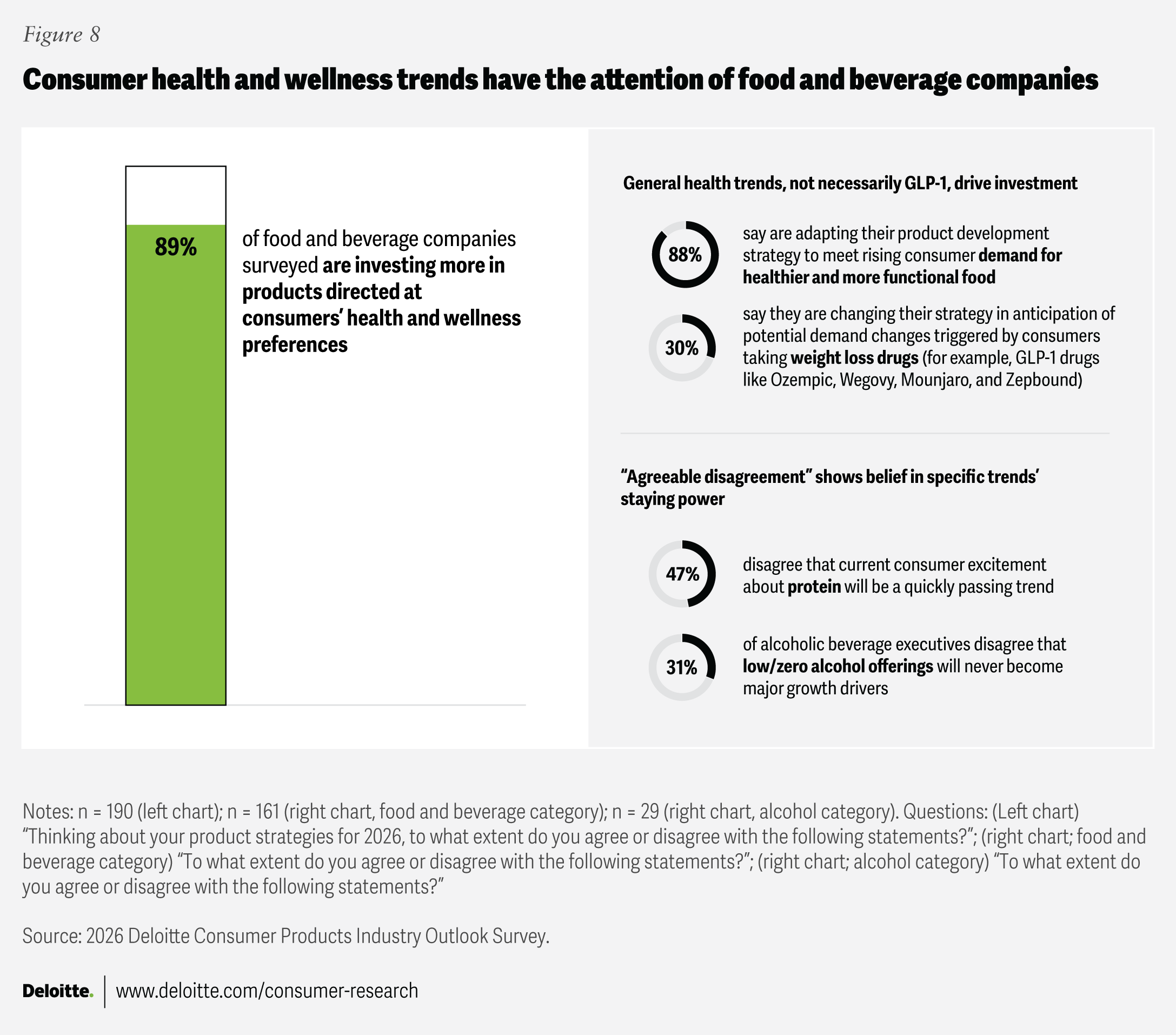

According to Deloitte’s ConsumerSignals survey, almost half of consumers surveyed globally (47%), including 35% of high-income households, are now considered “value seekers”—that is, people who regularly make convenience sacrifices, cost-conscious choices, and deal-driven purchases.3 Executives surveyed view value-seeking as a long-term structural issue, and they consider consumer behavior change more generally as their greatest challenge to volume growth (figure 1).

The good news is that even value seekers are willing to spend when it is “worth it.” Success seems to belong to those brands that deliver more value than expected across all pricing strategies—from low to premium. These “more-value-for-the-price” (MVP) brands have higher purchase intent and are winning household share. According to our research, only about one-third of brands currently achieve that status.4

Two core practices of MVP companies are:

- Value-aware pricing: They don’t over-optimize price for maximum margin. Instead, they manage pricing in ways that create a value surplus for the consumer.

- Cost-aware value: They evaluate their investments against consumer-perceived value created by, for example, using consumer survey data. If their consumers don’t see value, they reallocate their investment.

2. In a less stable world, nimble beats optimal

Many consumer packaged goods (CPG) companies were designed for a more stable and predictable world with expanding globalization. With the shift toward deglobalization, trade policy and international relations have become key pressure points that require more active management.5 Companies over-optimized for scale in the old reality will likely have a harder time competing. Nimbler organizations that can rapidly shift capability and capital will likely have more options when the world moves—and then moves again.

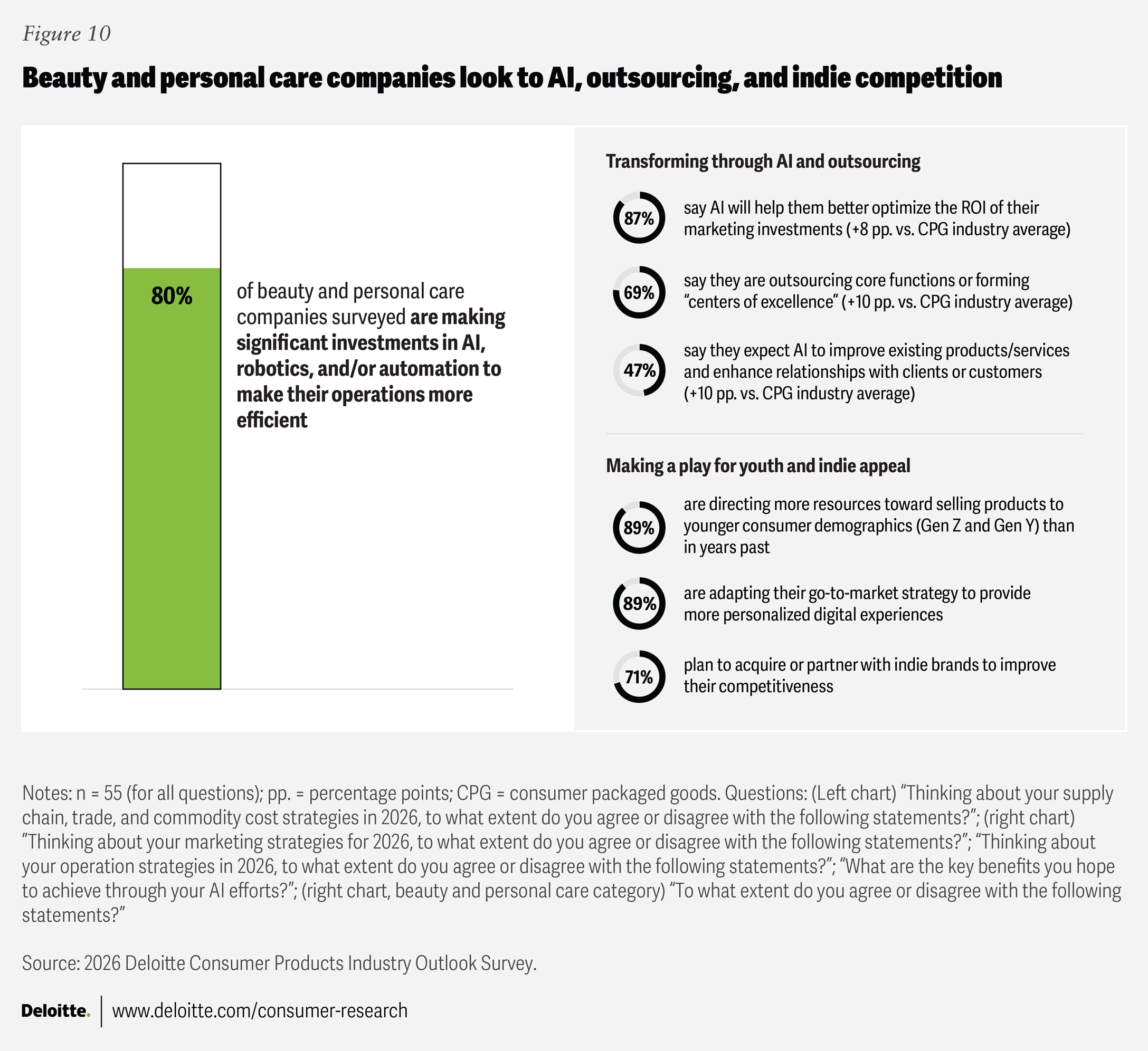

Many companies are already making the shift. All the executives in our survey are taking one or more adaptive actions. The top strategies involve reducing exposure to policy costs, including by increasing domestic production and adjusting their product mix to offer less trade policy–sensitive products (figure 2).

As shown, over half of survey respondents expect they will need to raise their prices due to international trade policies, with very few believing their companies are willing or able to simply absorb new costs. Passing on costs may have a price, as 52% of executives are worried that raising prices due to trade policy could result in lost sales volume and/or market share. Of course, raising prices also makes it harder to boost consumers’ perceptions of value.

If trade policy becomes too challenging for growth in their current markets, some CPG companies will look elsewhere. For 2026, 7 in 10 executives think they will find high-growth opportunities in geographies beyond their traditional markets. The most popular markets are Southeast Asia and India, where they will invest in expanding distribution, as well as digital and e-commerce initiatives.6

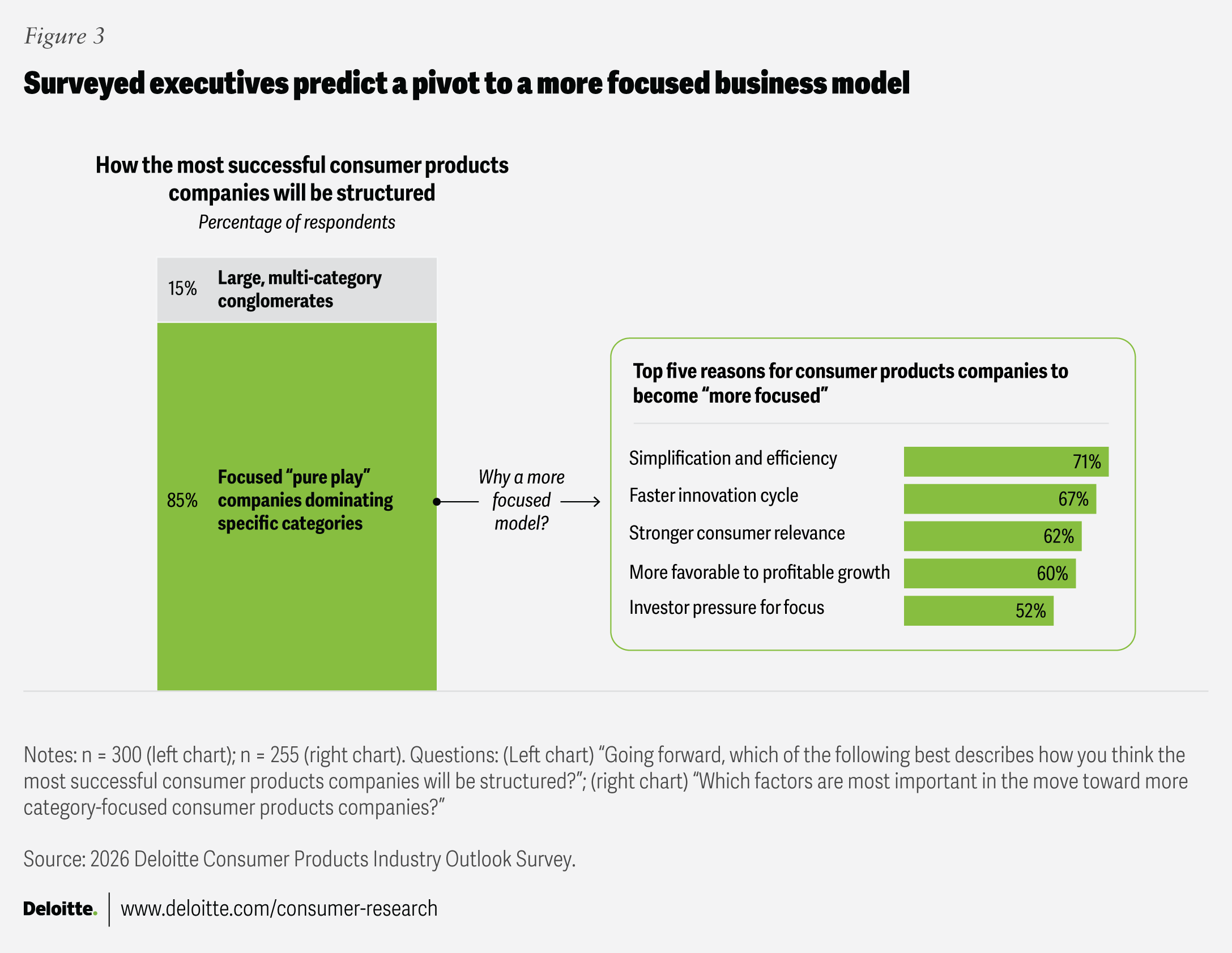

3. Focus looks better than breadth

CPG companies are transitioning away from aisle-spanning conglomerates to more focused, category-killer portfolios (figure 3). As deglobalization and shorter supply chains increase the cost of scope, CPG companies are seeking simplification and efficiency, faster innovation cycles, and the stronger consumer relevance that comes with a more focused model.7 They are transforming their portfolios by divesting from low-growth categories that don’t align with their more focused strategy and acquiring high-growth businesses that do.8

Acquisitions may face more scrutiny. Boards may not want to engage in conglomerate-building that is likely to be reversed. Instead, they may look to joint ventures and partnerships—as indicated by two-thirds of surveyed companies—to explore new territory and gain market excitement without an expensive transaction. Refinement can also occur at a more granular level, as half of the survey respondents plan to rationalize stock-keeping units.

The 2026 global economic outlook for the consumer products industry

In 2025, the global economy was disrupted, in part by significant changes in US trade.9 Countries outside the United States responded by seeking trade liberalization with other countries and implementing fiscal and monetary stimulus meant to boost domestic demand. Additionally, investment in AI has accelerated globally, especially in the United States and China.

Heading into 2026, there is great uncertainty, which could negatively influence business investment.10 Some companies have already postponed supply chain investments.11 The disruption of economic relations between countries also means uncertainty about the direction of currency values and borrowing costs. Overall, a modest slowdown in global economic growth is likely in 2026.

United States

The US economy faces headwinds from trade and immigration policy. Tariffs will likely boost inflation in 2026, thereby reducing consumer purchasing power.12 Immigration policy could mean slower employment growth and labor shortages in key industries. Yet massive investment in AI infrastructure could sustain economic growth. The sharp rise in technology-related equities has boosted wealth and spurred strong spending growth by upper-income households.13 (Meanwhile, low- and middle-income households face increasing financial stress.)14 If the pace of AI-related investment continues, economic growth will likely be moderate. Yet if there is a reversal in AI investments, the US economy could weaken substantially.

China

China’s economy continues to face significant headwinds owing to the collapse of the residential property market.15 This has caused a sharp decline in property investment. In addition, it has resulted in a loss of household wealth, leading consumers to save more and spend less.16 China’s government is utilizing fiscal and monetary stimulus to boost domestic demand. Meanwhile, the country faces a decline in exports to the United States due to tariffs and potential trade restrictions from other countries.17 On the other hand, China has become a leading global player in high technology and renewable energy, which could help fuel its economy and, in turn, drive consumer spending.18

Europe

Governments in Europe are starting to boost investment in defense and infrastructure, funded by debt, in response to geopolitical shifts.19 This is effectively a fiscal stimulus that, combined with lower policy interest rates, should have a modest positive impact on economic growth.20 On the other hand, Europe continues to face challenges, not the least of which are troubled trade relations with the United States and increased competition from China.21 The outlook is for moderate growth with low inflation.

– Ira Kalish, chief economist, Deloitte Global, December 2025

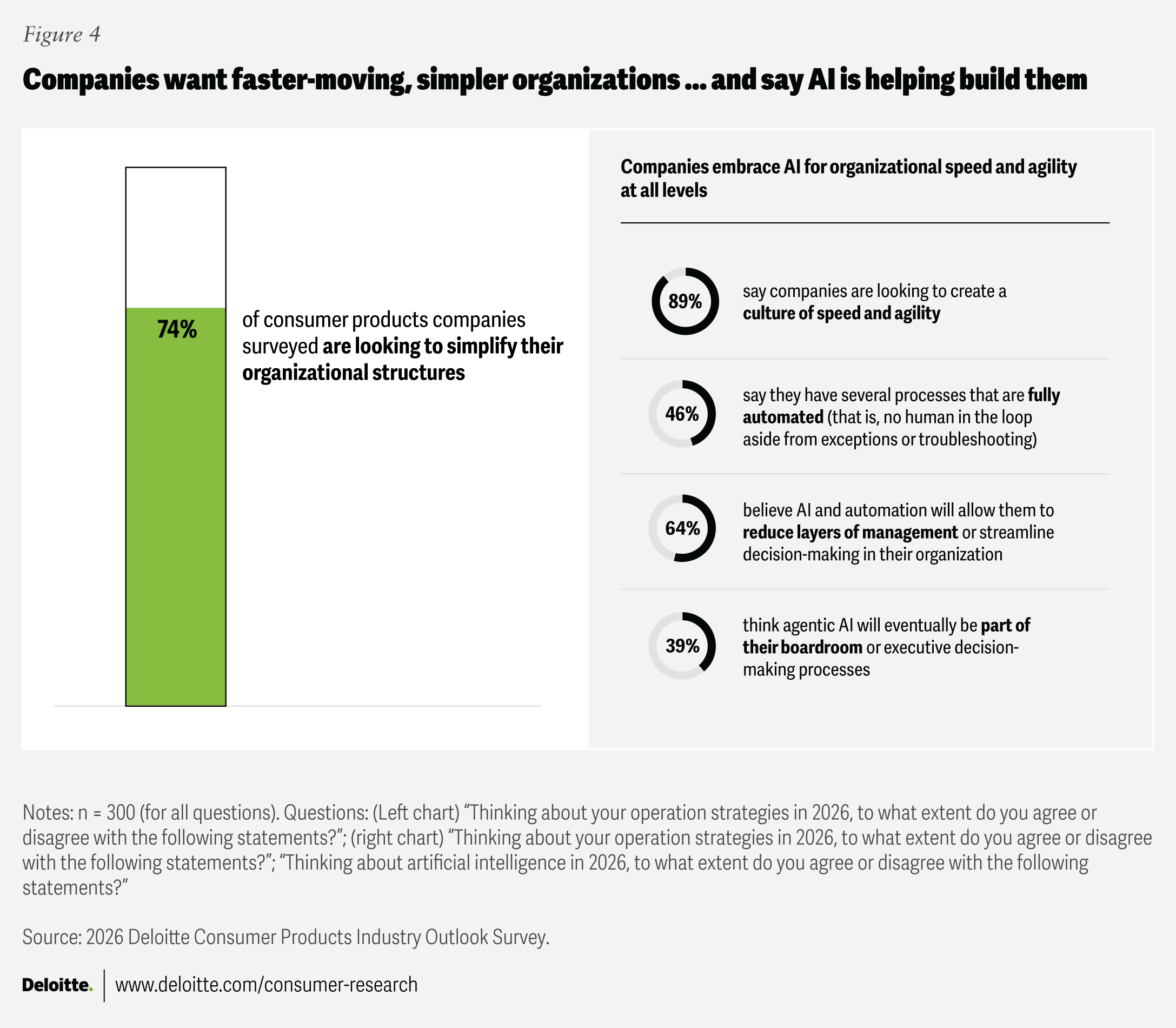

4. Structures will simplify

Today’s organizational silos, whether functional or geographic, create complexity. They also manifest a culture that is relatively comfortable, risk-averse, and consensus-driven.22 Getting more nimble and focused in order to deliver the extra value consumers seek will require something different.

CPG companies are on a quest to simplify their organizational structures to reduce complexity and interdependency (figure 4). They aim to foster cultures of speed and agility that are better adapted to new competitive realities and their more focused portfolios. Simplified structures drive transparency, facilitate task accountability, distinguish essential from legacy data or technology, illuminate cost drivers, minimize opportunities for exceptions, and ultimately facilitate more informed decision-making.23 And to advance these goals, companies are harnessing AI.

Organizational simplicity may also be required for AI to produce maximum value. Flatter structures and end-to-end processes that cross traditional functions bring the data that fuels AI to centralized locations, allowing insights and decisions to flow more smoothly throughout the organization and the market to effectuate action.

Outsourcing can also be a powerful organizational change agent. It can release organizational capacity to focus on growth, support faster incorporation of AI into processes, and facilitate risk-sharing with a third party. Six in 10 executives (59%) in our survey are outsourcing core functions or forming centers of excellence.

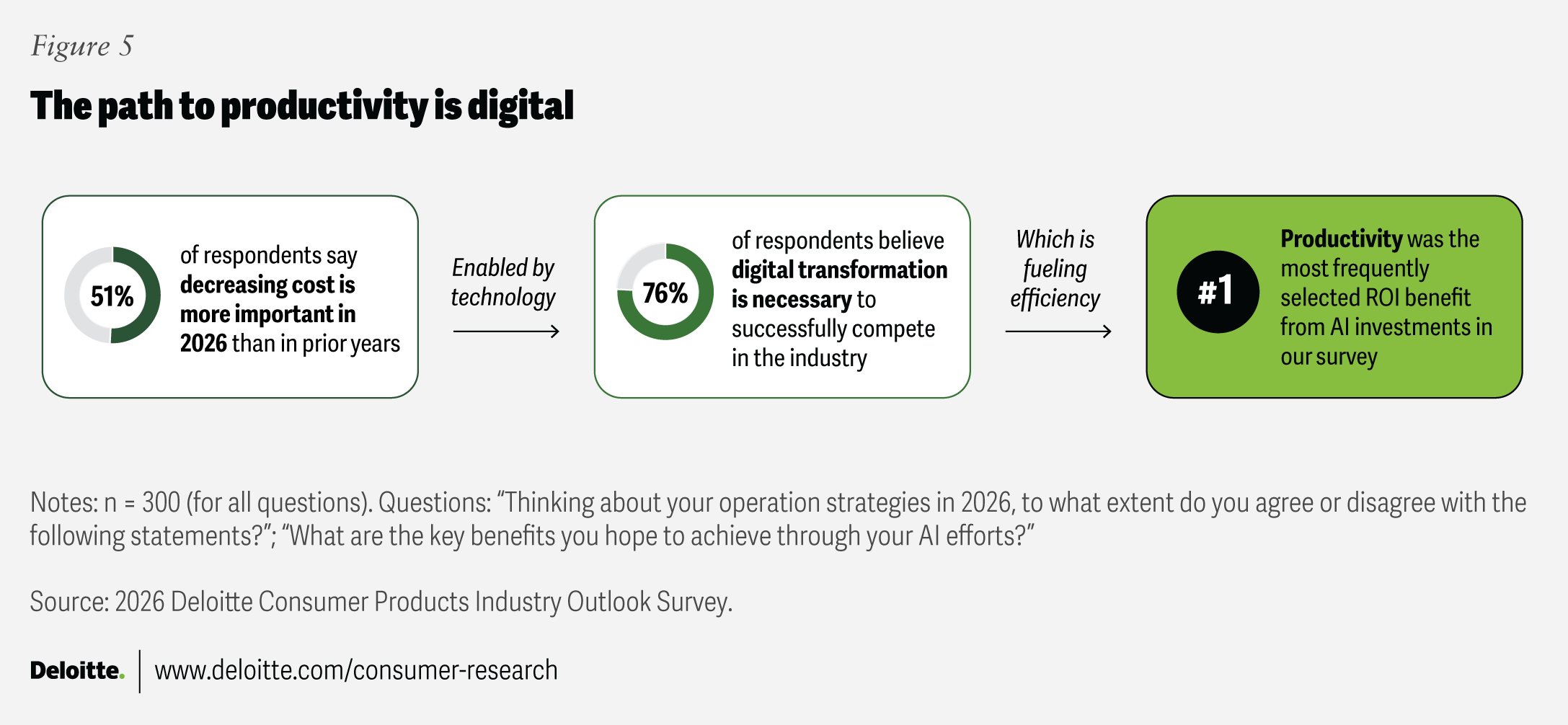

5. Growth is decoupling from hiring

It appears investors no longer take announced layoffs as a sign of trouble or hiring as a sign of growth.24 The message is clear: Investors expect to see radically increased productivity. CPG companies have got the memo, with most surveyed executives agreeing that cost reduction will be even more important in 2026 (figure 5). With labor being one of CPG firms’ top cost areas, it should factor into any new business model productivity discussion.25

Becoming more productive ultimately depends on becoming more digital, including incorporating more AI (figure 5). After all, the cost of computing is decreasing, while labor costs are moving in the opposite direction.26 Productivity is the number one outcome CPG companies expect from their AI investment.

With greater productivity, growth can occur without a commensurate increase in hiring. That doesn’t necessarily mean layoffs. In fact, those surveyed who expect to see the biggest productivity increases are the least likely to expect increased layoffs at their companies.27 Similarly, those who say they are outsourcing in 2026 are more likely to report a high return on investment from their AI investment in the talent domain.28

Paradoxically, AI could lead to a renaissance of more creative, more human roles for the workforce. As AI takes over more technical, repeatable, and bureaucratic tasks, people are freed to become the source of creativity, judgment, and accountable risk-taking in their roles. Product managers, for example, could return to being entrepreneurial, product-obsessed creators and community builders, unloading to AI the technocratic marketing tasks that have consumed their days for the last 10 to 20 years.29

6. Value chains are up for renegotiation

The traditional roles played by retail and CPG companies are being disrupted. In the process, 79% of the executives in our survey think the balance of power is shifting to retailers.

After all, retailers are selling more of their own private-label goods (65% of CPG executives in our survey expect even more private-label competition in the future). The powerful hypermarket and club formats are gaining market share, and retailer alliance buying groups are flexing their muscles in certain geographies.30 Retailers also hold the pole position in capturing consumer data essential to modern commerce, which is giving them new and more profitable businesses, like retail media.31

Yet retailers face their own challenges in a rapidly digitizing and highly competitive landscape. They need to work with CPG companies to find new and better ways of partnering. The good news: Most CPG executives in our survey report success when they do engage their retail partners in deeper collaboration (figure 6).

Examining research on this topic in the United States provides some additional encouragement and nuance.32 The following suggests retailers want collaboration, are engaging to increase it, and are finding commercial success when they do.

- 88% of retailers surveyed desire increased collaboration with CPG partners.33

- 73% of companies (retailers and CPG companies combined) report increased commercial collaboration.34

- 86% of those companies report increased sales as a result of commercial collaboration.35

But barriers exist.

- 56% of retail and 73% of CPG respondents cite goal misalignment as the top barrier to collaboration on joint business planning.36

- 64% of retailers believe they are sharing sufficient data, but only 40% of CPG companies believe they receive sufficient data.37

As the value chain gets renegotiated and barriers overcome, look for opportunities to collaborate on planning, pricing, early-stage product innovation, and cost reduction. Center the joint mission on delivering more value to consumers and explore how AI can open new commercial relationship possibilities.

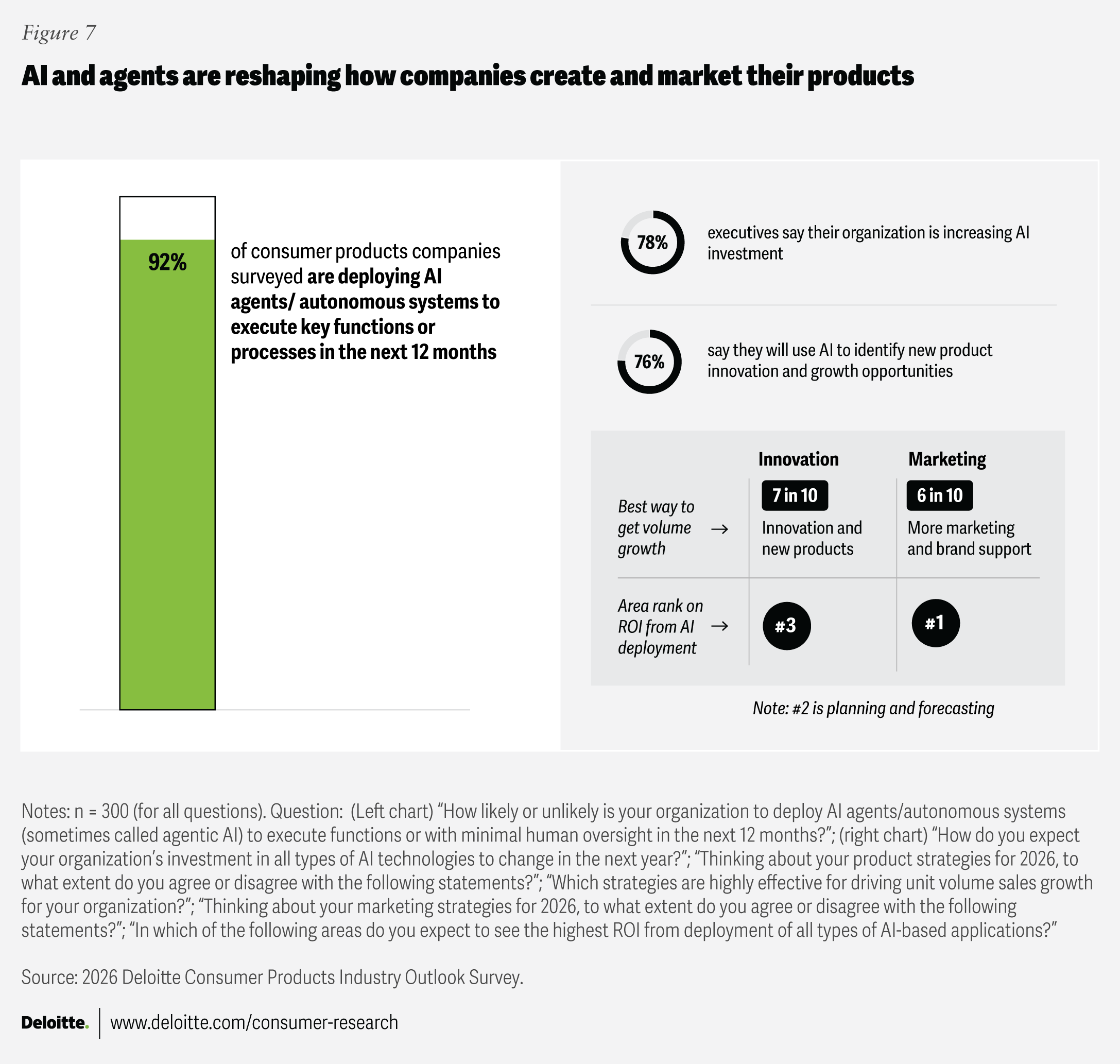

7. Agentic supply will confront agentic demand

For CPG companies, the most promising industry use cases for AI are currently in product innovation and marketing (figure 7). Perhaps not coincidentally, the executives surveyed say these areas are most important to increasing unit volume sales growth. Companies report that AI investments are helping them produce more and better product concepts and personalized content in significantly less time, increasing their ROI.38

However, executives in our survey may not be moving as quickly as they think on the most advanced technologies. Almost two-thirds (64%) think they are ahead of their competition in adopting agentic AI. Surely not everyone can be above average.

As efficient and effective as AI is at helping the supply side of the market, companies aren’t the only ones becoming AI-powered. Consumers are also rapidly adopting AI. Referral traffic from ChatGPT and other AI chats now accounts for 15% to 20% of total referrals for some retailers.39 The industry may still be waking up to this issue: Only 31% of executives surveyed say they are struggling to figure out the best way to reach, influence, or market to consumers who are using generative AI to research or purchase products, while even more don’t yet have an opinion (46%).

Product discovery is different on large language models, as they process content differently than traditional search engines. As a result, companies are engaged in an emerging race to do “GEO” instead of “SEO” (generative versus search engine optimization). Their goal is to make sure products are discovered and available at key retailers, ideally those with instant checkout capabilities accessible through AI. This race will become more important as we transition to agentic commerce, and even more so as we move into a world in which marketing agents interact and transact with retailer and consumer agents without directly involving a human decision-maker.

Executing agentic commerce should be a major pillar in value chain renegotiation with retailers. The value chains with the best shared data on the consumer will likely have an advantage in selecting, pricing, and presenting offerings for agents that best serve their owners’ needs.

Looking ahead

This is a time of discomfort for many CPG companies. Nothing comes easy when the rules of the game, and even the playing fields, change this rapidly.

But all this disruption also creates opportunity. Whether they ultimately agree or disagree with them, organizations that use these provocations to initiate tough conversations—and make the difficult choices they demand—may be better positioned for the year ahead.

Methodology

In October 2025, Deloitte conducted a global survey of 300 senior executives from major consumer products companies across the food and beverage, household goods, and beauty and personal care sectors. The survey sample proportionally approximates the geographic and subsector distribution of the global top 100 consumer products companies by revenue. Survey questions were developed through an analysis of trending topics found in company presentations, earnings call transcripts, and analyst reports, as well as through exploratory surveys and interviews with Deloitte industry leaders.

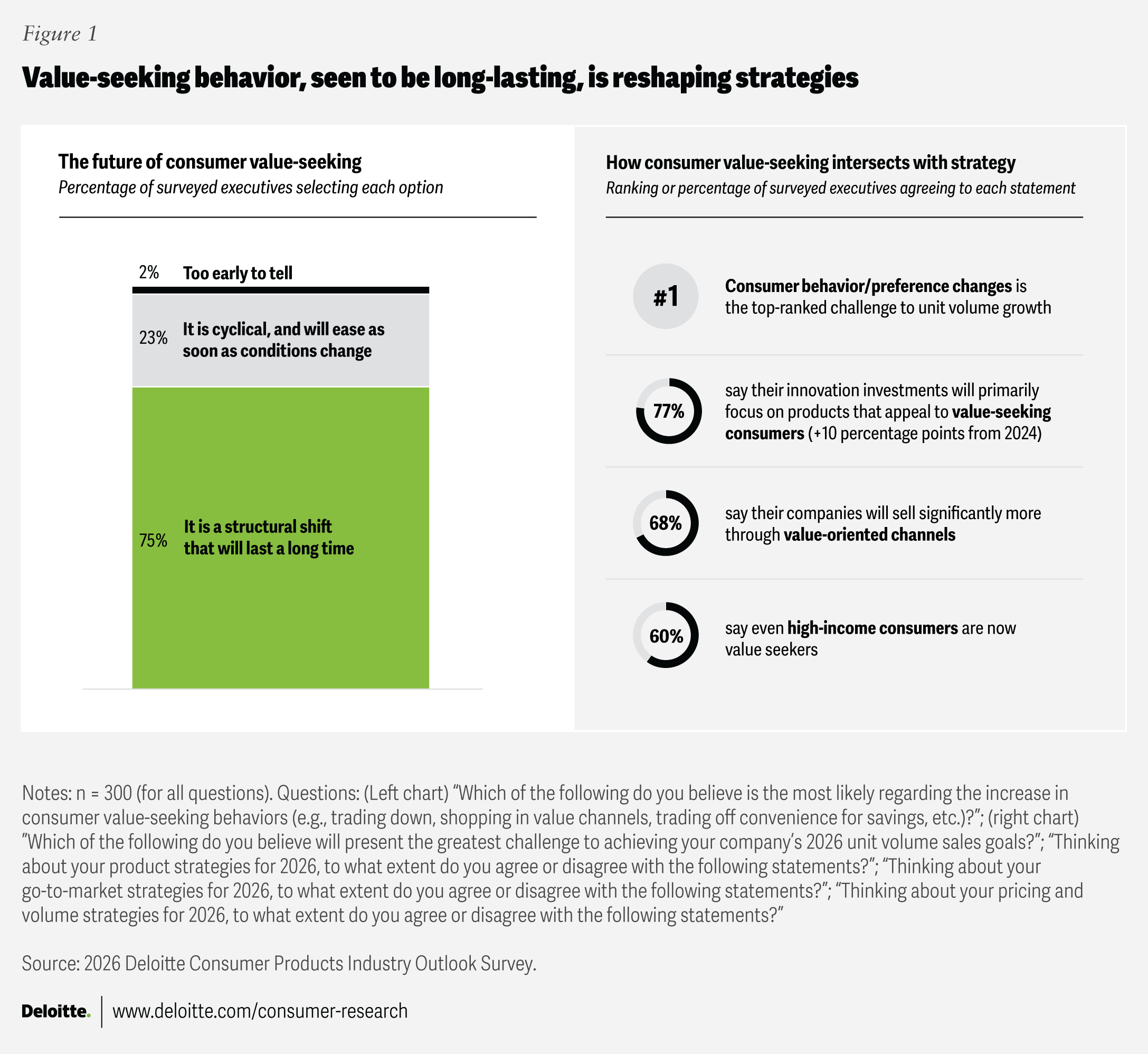

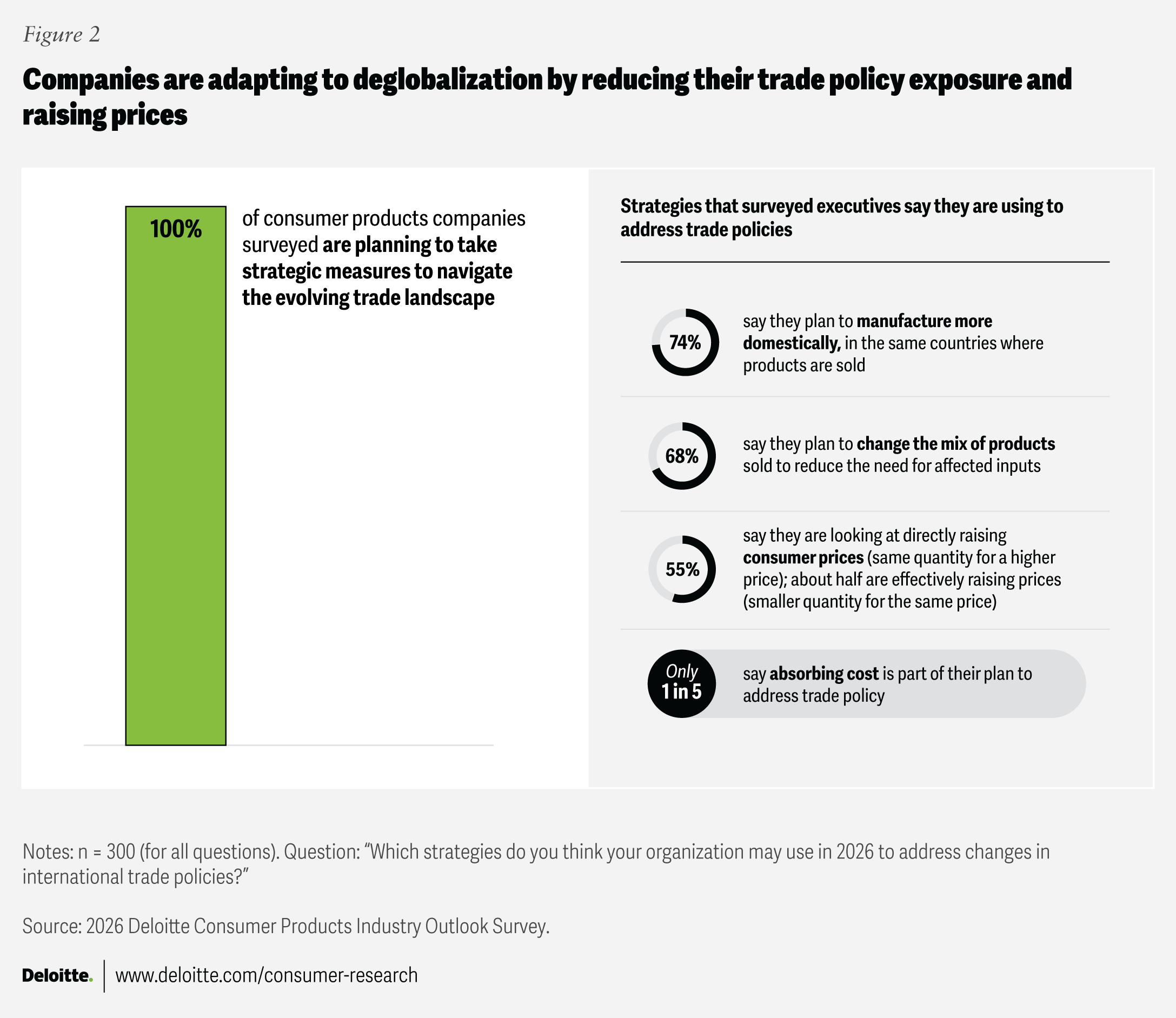

Appendix: Industry sector databank

Although the industry as a whole is experiencing common changes and challenges, each part of it has its own unique factors as well. The following are survey findings of particular relevance to three major sectors: food and beverage (figure 8), household goods (figure 9), and beauty and personal care (figure 10).