Thanksgiving 2025: Grateful for good value

Deloitte’s Thanksgiving index reflects price changes closer to historical norms, but consumer value-seeking is now part of the holiday tradition

Natalie Martini

Justin Cook

Nimisha Mohanan

Lupine Skelly

It is no surprise that Thanksgiving remains a prominent fixture in American life. Seventy-four percent of consumers in Deloitte’s 2025 Black Friday Cyber Monday Survey plan to host or attend a holiday gathering with friends and family.1 It is not just another big meal, especially for the hosts, as 78% of them say it is an important part of their culture and traditions.2 The holiday meal is so important that very few (20%) are worried about not being “fully present” for their friends and family or about letting Black Friday Cyber Monday promotions distract them from celebrating.3

However, even Thanksgiving isn’t completely immune to pocketbook realities and shifts in consumer shopping behavior. Our analysis (see methodology) suggests some relief from rising food costs; however, this relief is unlikely to knock consumers out of their value-seeking mindsets.

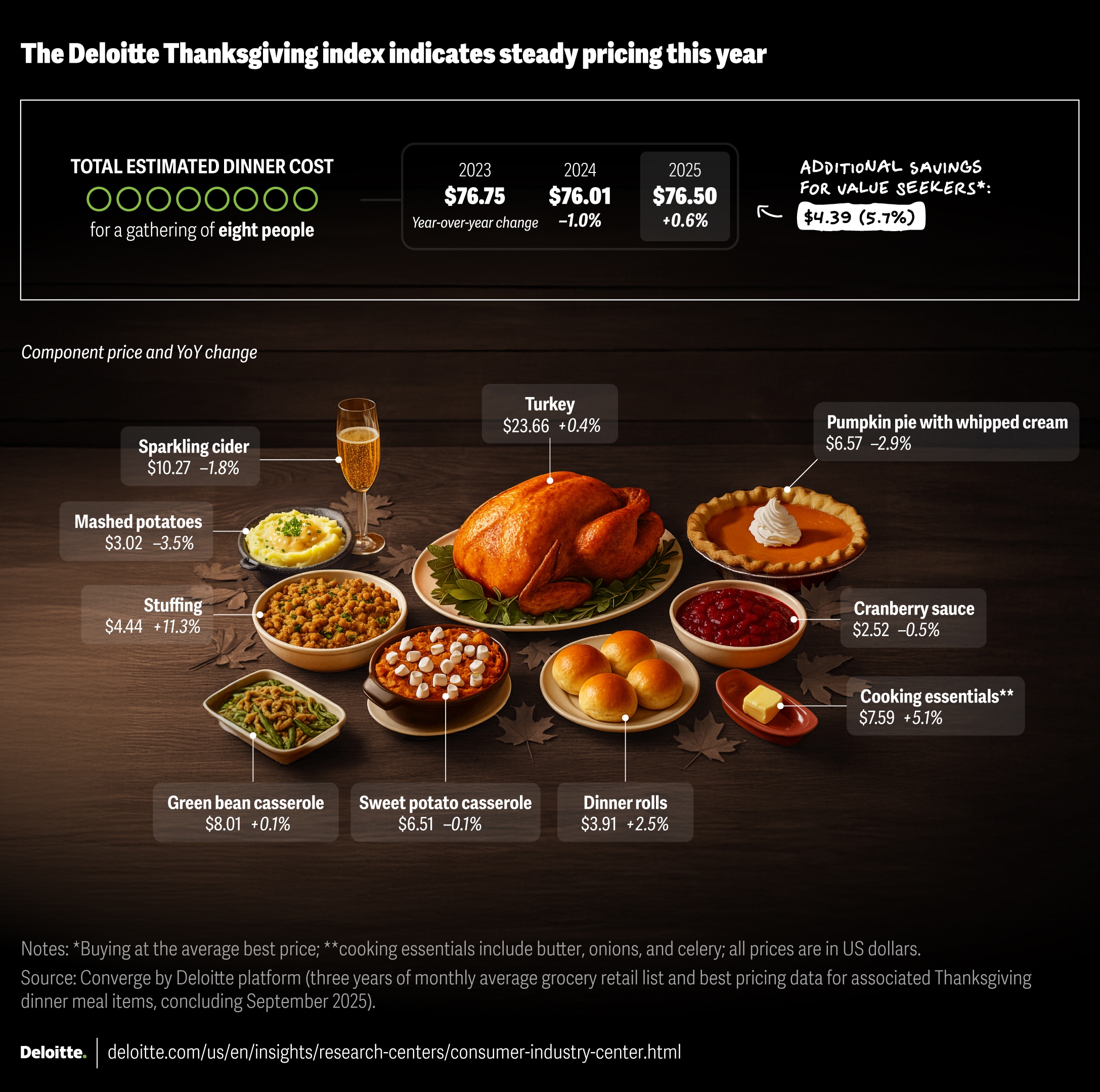

A softer season for prices

Although many families are grappling with the price of groceries, the cost of the Thanksgiving meal may be less of a distraction from the celebration now than it was a few years ago. Costs have not decreased, like they did last year, but have instead risen at a more normal historical rate, according to our Deloitte Thanksgiving index. For 2025, the combined cost of turkey, sides, and sparkling cider for a gathering of eight amounts to US$76.50, up only 0.6% from 2024 and somewhat below the food-at-home inflation rate, as of the last consumer price index release in October.4 (Note that dramatically higher prices have not yet shown up in our retail data, although many organizations are forecasting a substantial turkey price spike, in part due to avian influenza, which still could emerge.5)

Sharing remains a hallmark of the holiday, including when it comes to the expenses. Forty-eight percent of hosts surveyed say they plan to ask guests to bring something to help offset costs,6 and approximately 4 in 10 surveyed consumers overall consider these expense-saving offerings even more important this year.7 Yet, on their part, the average expected contribution from guests remains unchanged at approximately US$47 in food and drinks for their hosts.8

To better evaluate how far these guest dollars may go, our index also tracked the cost of multiple regional favorite side dishes. Prices for these dishes have risen by about 2%, but costs can vary depending on the items you bring.

If your traditional dishes are from the Midwest, homemade macaroni and cheese averages US$16.20. If your family leans toward flavors of the Southwest, tamales for eight cost about US$12.69. An East Coast favorite, succotash, costs around US$15.19. The ingredients for making a West Coast quinoa salad ring up to about US$17.73. Other sides, such as collard greens and roasted Brussels sprouts, remain more budget-friendly at around US$9.00 for eight servings. And don’t forget the wine. The price of a bottle can vary dramatically, but the grocery store–quality chardonnays we track average US$12.62.

Value-seeking comes to Thanksgiving dinner

Steadier prices haven’t reversed the behavioral shifts of recent years. Across many parts of the consumer economy, large groups of consumers no longer feel they are getting good value at fair prices.9 Their perceptions, which eroded during the peak inflation of 2022, have not recovered even though high inflation has abated. Four in 10 Americans surveyed, including 23% of households earning more than US$200,000 per year, are now considered “value seekers,” based on making convenience sacrifices, cost-conscious choices, and deal-driven purchases.10

These same value-seeking behaviors will likely be on display during the Thanksgiving holiday.

- Convenience sacrifices: The number of surveyed consumers who say they are willing to pay extra for products or services that make hosting easier dropped 23 percentage points from 2024. Just 36% of hosts plan to buy prepared sides or desserts, and only 31% are considering ordering all or part of their meal from a restaurant or similar retailer.

- Cost-conscious choices: While less prominent than convenience sacrifices this year, some consumers surveyed indicate cost is guiding their meal decisions. One-third plan to buy more private-label products. About the same number expect to serve or eat a less fancy meal this year, featuring lower-cost dishes. Finally, about 3 in 10 are inviting fewer guests, downsizing Thanksgiving itself.

- Deal-driven purchases: Value-seekers may want them, but meaningful Thanksgiving discounts could be hard to come by outside of special package deals.11 Based on our index, a diligent shopper who managed to buy everything in their Thanksgiving meal at the average best offered price instead of the typical list price would save less than 6% on the meal, on average. The biggest opportunities for deals are in packaged and processed items, where average best versus list discounts can run 8% to 11%, while the potential for saving on fresh produce remains more limited.

Value should not be a synonym for cheap

Even value seekers are willing to spend when it is “worth it.” Seven in 10 consumers say getting the best value for their money matters more than finding the cheapest option.12 About 6 in 10 (59%) expect to purchase some premium or specialty items for their Thanksgiving meal this year.13 Forty-three percent even plan to serve a “second protein” (for example, fish, brisket, ribs, chicken, duck, or vegan substitutes) in addition to their traditional main dish.14

Another thing that more hosts are finding to be “worth it” is spending on health and wellness. About 6 in 10 (61%) plan to balance indulgent foods with some healthier options for their guests.15 However, grandma isn’t letting GLP-1 type diet drugs spoil the party—3 in 4 consumers surveyed say they are not planning to cut back on what they serve to accommodate the lower appetites of GLP-1 users who may be in attendance.16

Providing more value for the price

Grocers and food brands need to win over value-seeking consumers if they want their Thanksgiving spending. Better pricing is, of course, an important factor—in grocery, it can explain almost 90% of consumer value perceptions.17 But it isn’t everything.

In fact, success seems to belong to those brands that deliver more value than expected across all pricing strategies—from low to premium.18 These “more-value-for-the-price” brands (MVP brands) have higher purchase intent and are winning household share.19 According to our research, only about one-third of brands currently achieve that status.

Brands that aspire to become MVPs should look at common traits. MVP brands, in general, tend to rate better in terms of superior quality, a winning attitude, and higher trust. Grocery-brand MVPs in particular score well for their produce selection, cleanliness of the aisles and surroundings, and speed at the checkout.20

Brands that find their own path to becoming MVPs may get a seat saved for them at the Thanksgiving table and extra money in the cash register.

Methodology

The Deloitte Thanksgiving index was derived from three years of Converge by Deloitte monthly average grocery retail list and best price data through September 2025. Multiple national and store-brand options with broad geographic distribution were selected for each dinner element and then averaged to derive that element’s price contribution to a given dinner item’s overall cost. Serving size and recipes were used as guides to allocate the amount of each item that would be used in a typical dish to feed eight people.

The 2025 Deloitte Holiday Retail Survey polled a sample of 4,270 US consumers and has a margin of error of plus or minus two percentage points for the entire sample. It was developed by Deloitte and conducted online by independent research companies from Aug. 27 to Sept. 5, 2025.

The 2025 Deloitte Black Friday Cyber Monday Survey polled a sample of 1,200 US consumers and has a margin of error of plus or minus three percentage points for the entire sample. It was developed by Deloitte and conducted online by independent research companies from Oct. 15 to 21, 2025.