2026 US Health Care Outlook

Three critical strategies shaping a more resilient, technology-enabled future

More than two-thirds of US health plan and health system leaders expect their organizations to outperform competitors in 2026, according to Deloitte’s 2026 US Health Care Outlook Survey. Yet the most commonly reported strategies—expanding market share, minimizing patient and revenue loss, and increasing care capacity—may fall short amid mounting industry uncertainty. Today’s health care environment involves escalating financial pressures, persistent consumer challenges, and evolving regulatory requirements.1 Long-term success will likely depend on leaders’ willingness to rethink core business models and drive agile, organizationwide transformation.

Against this backdrop, Deloitte’s annual survey highlights three critical strategies for health care organizations aspiring to build resilience and achieve sustainable growth in 2026 and beyond.

- Empower consumer health with digital experiences and technology

- Scale generative AI and agentic AI2 to modernize operations across all functions

- Join forces with other industries to unlock innovation and impact

Now in its fourth year, Deloitte’s survey of 120 US C-suite health care executives tracks evolving priorities and emerging trends across health systems and health plans (see methodology). Notably, 43% of leaders report feeling “uncertain” or “neutral” about the industry’s near-term outlook, up from 28% last year, largely due to policy and regulatory uncertainty. This year’s outlook explores considerations that may help forward-looking health care organizations manage uncertainty, move beyond incremental change, strengthen their core business, and proactively prepare for transformation in an evolving market.

Table of contents

Three critical strategies for health care leaders in 2026

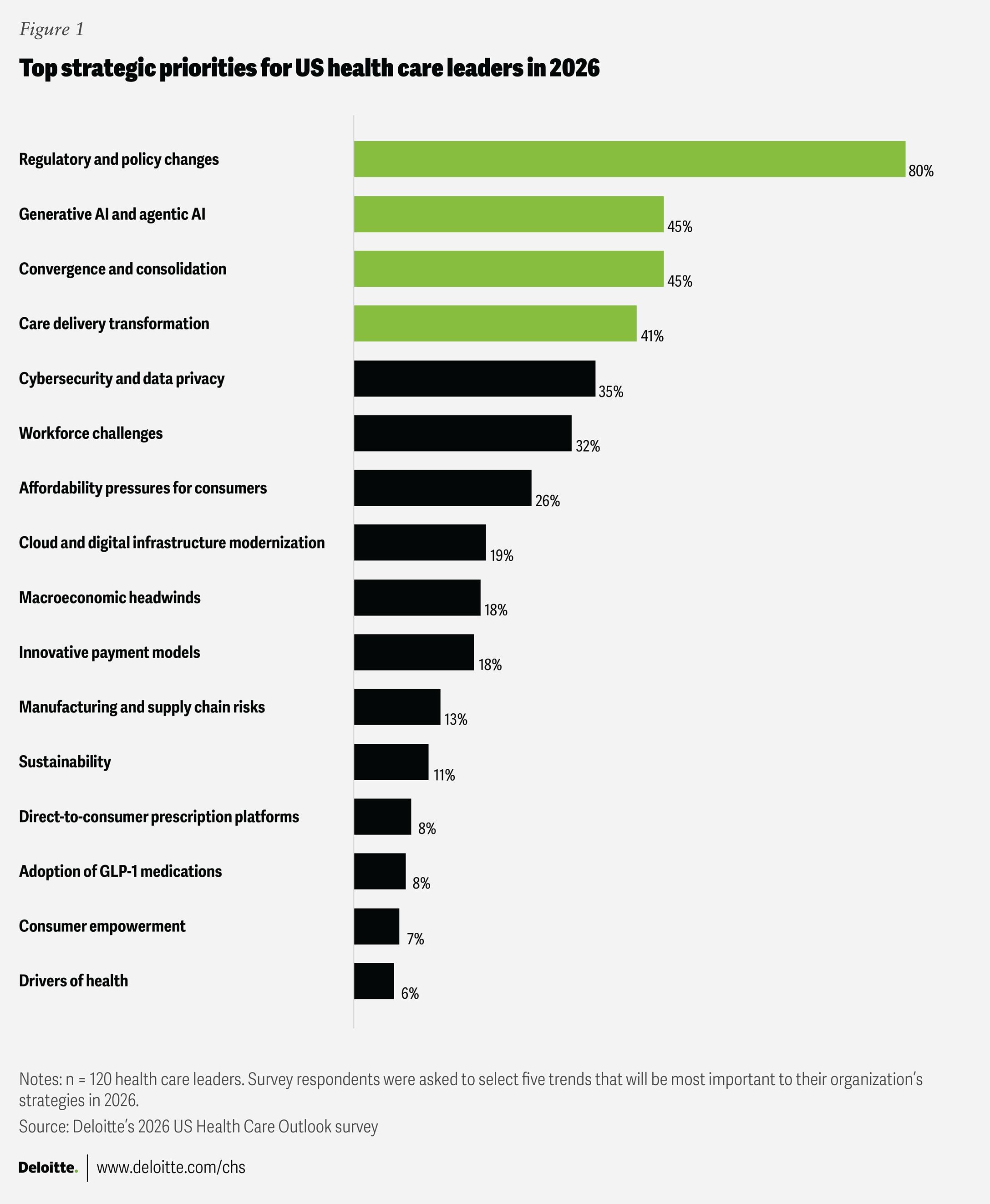

Eighty percent of health care executives said regulatory and policy factors will influence their 2026 strategies. With a growing need to manage uncertainty and drive transformation, surveyed leaders also expect gen AI and agentic AI, convergence and consolidation, and care delivery transformation to have an impact on their strategies for the year ahead (figure 1). These top issues form the basis for the three strategies that could drive long-term resilience, growth, and innovation in the year ahead. While every organization’s journey will differ, these research-backed themes can serve as a lens through which leaders might assess their own strategy and resilience.

Empower consumer health with digital experiences and technology

Only 38% of US health care spending is devoted to prevention, early detection, and overall well-being, according to Deloitte’s actuarial modeling.3 More than 41% of executives who participated in Deloitte’s 2026 US Health Care Outlook Survey said care delivery transformation will impact their organizational strategy in 2026—a signal that traditional models of care are evolving. But enduring challenges remain. In fact, 26% expect the affordability of health care coverage and medical services to persist as a defining trend. Nearly as many (23%) pointed to service gaps, patient experiences, care quality, and outcomes as key issues. Digital and artificial intelligence tools could be essential levers that redefine how care is delivered. A path forward could involve investment in digital platforms and AI tools that have the potential to expand access, enhance affordability, and drive improvements in outcomes and engagement. Key considerations for 2026 include:

Prioritize digital delivery

Consumers continue to seek digital experiences and more convenient services that can reduce the need for in-person doctor visits.4 Virtual and remote care options can also attract individuals who traditionally avoid or delay care.5 According to Deloitte’s 2025 US Health Care Consumer Survey, more than 90% of people who had a virtual health visit would be willing to have another.6 Consumers also show interest in connected care: 37% of consumers report using monitoring devices for health conditions, and another 47% use devices for fitness and health tracking. Investing in virtual health presents opportunities to identify illnesses before symptoms develop, manage costs, and reach people who experience care gaps, like those who live in rural communities with limited access to services and specialists.

Nearly 60% of surveyed health plan and health system executives intend to invest in virtual health services to improve preventive care for their patients, members, and communities. Given this trend, more health care organizations should consider bolstering their focus on virtual and remote options across preventive, acute, and chronic care. If traditional health care organizations don’t innovate to meet the changing demands of the people they serve, new entrants and disruptors are likely to move in. In 2025, health tech startups secured 14% of venture capital investments and are positioned to offer more convenient and consumer-friendly services, potentially taking business away from established incumbents.7

Build integrated digital platforms, not one-off digital tools

More than half of surveyed health plan executives (53%) intend to invest in initiatives that expand the use of digital tools for member engagement and behavior change, and 50% of health system executives plan investments in tech-enabled patient engagement and monitoring tools. Rather than investing in disconnected solutions, however, organizations should consider trying to create or join digital platforms with shared capabilities, data, and governance.8 Digital platforms are intended to serve as central hubs that connect various health care tools like electronic health records, virtual care, health monitoring apps, and online pharmacy and lab portals with the data they generate, such as patient records, lab results, and medication information.

Digital platforms can also help clinicians deliver proactive, coordinated care and improve health outcomes by consolidating information from multiple sources and creating a comprehensive data set. This unified data can enable advanced analytics, such as predictive models to assist with diagnoses and gen AI tools to provide personalized treatment recommendations. The growing adoption of AI is making these capabilities more accessible.9 For example, Johns Hopkins Medicine’s clinical platform aggregates multimodal data from its electronic health records, imaging machines, genomics testing, and wearable devices to generate new clinical evidence through advanced AI and machine learning for research and patient-level precision health.10Some organizations are also creating platform-based ecosystems for broader use and benefits. Mayo Clinic has established a distributed clinical data network platform that partners with health systems, health insurers, medical device companies, and other academic medical centers to enable better ways to diagnose, treat, and prevent diseases.11

Scale gen AI and agentic AI to modernize operations across all functions

AI has the potential to improve health outcomes, strengthen consumer engagement, and streamline operations for health care organizations.12 However, 49% of these organizations are still experimenting with gen AI and agentic AI, while 18% have not adopted these technologies at all. With only one-third of surveyed health care organizations operating AI at scale, incremental pilots in limited functions may no longer suffice. Achieving scale with AI means implementing the technology enterprisewide and realizing measurable financial impact. Health care organizations that deploy AI across multiple functions—rather than isolating it within specific departments—can broadly reduce administrative burdens, accelerate decision-making, and enhance outcomes and consumer experiences. Key actions to consider include:

Focus on impact across functions to build scale

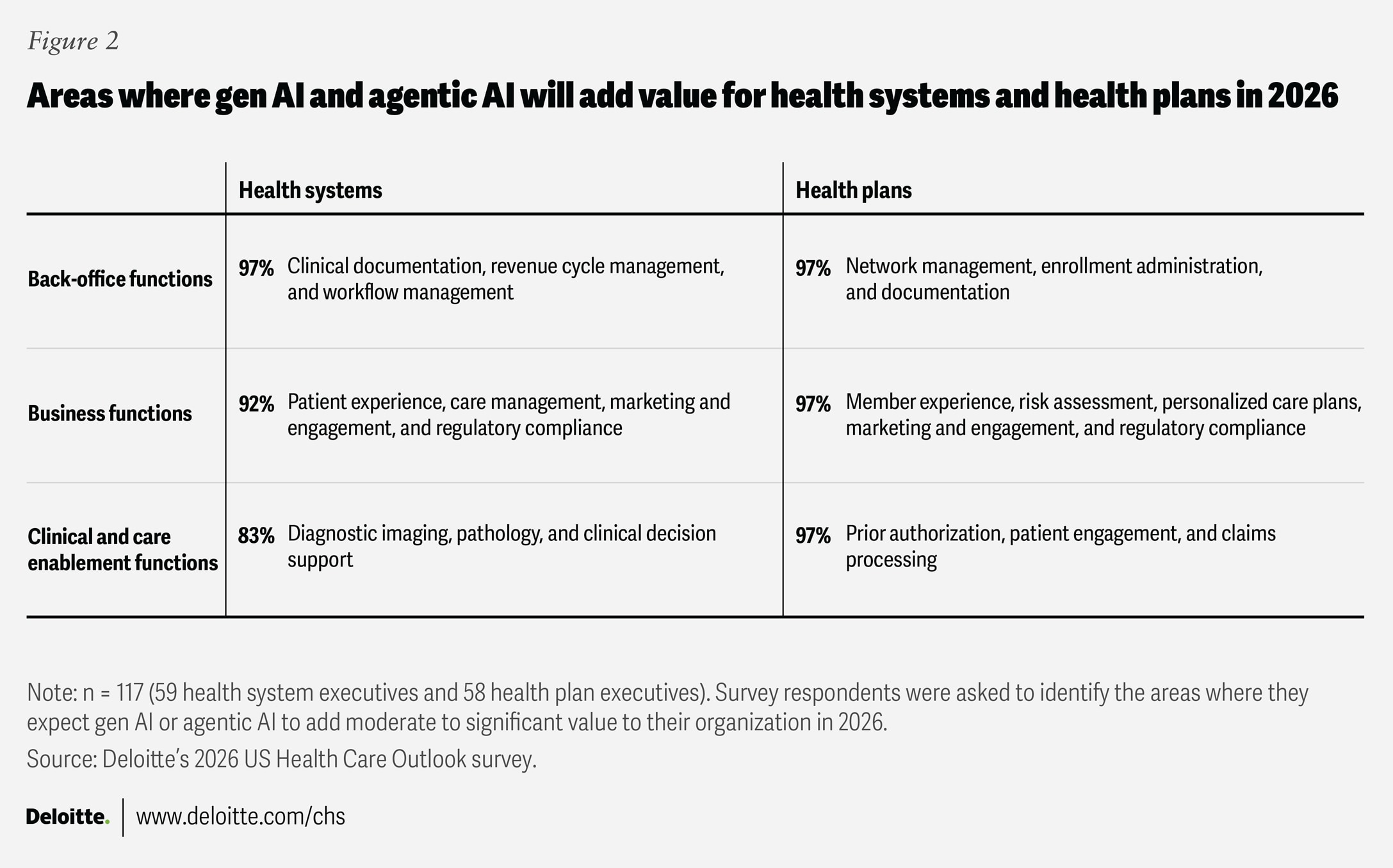

Over 80% of health system and health plan executives agree that gen AI and agentic AI are poised to deliver moderate-to-significant value across a range of functions in 2026, from clinical and business operations to back-office functions (figure 2). This highlights the case for health care organizations to consider approaching gen AI and agentic AI with a broad, enterprisewide strategy.

The prior authorization process can be an administrative burden and operational bottleneck that affects care delivery, patient and member satisfaction, and overall efficiency. New regulations from the Centers for Medicare and Medicaid Services require standard prior authorization decisions to be delivered more quickly (from 14 days to 7 days) starting Jan. 1, 2026. Metrics must be publicly reported beginning March 31, 2026, and information must be shared electronically starting Jan. 1, 2027.13 Gen AI and agentic AI can be a cost-effective and dynamic way to rethink the process. They can also reduce administrative burden, improve accuracy, ensure compliance, and remove friction for consumers by mining clinical information, monitoring rule sets, and supporting decision-making. For example, prior authorization approvals require specific clinical criteria for medical necessity to be met, and AI could automate the assessment. Human oversight is needed for denials, as a lack of clinical evidence identified by AI may not be a valid reason for denial, though AI can still accelerate the process.

Some health plans are already adopting gen AI and agentic AI for this purpose. For example, Highmark Health has deployed an AI agent with ambient listening capabilities to assemble the necessary clinical rationale and submit prior authorization requests in real time. As a result, processes that once took weeks can now be completed in minutes.14 Improvements like this can also enhance member access and overall experience.

Health care organizations might consider investing in gen AI and agentic AI across the enterprise to:

- Enable clinical care. Nearly all surveyed health plan executives (97%) and 83% of health system executives expect gen AI and agentic AI to add value to clinical functions in 2026. The expected benefits span areas such as diagnostic imaging, digital pathology, clinical decision support, and care delivery enablement. AI can also support clinicians in diagnosis and treatment planning, helping ensure the right care is delivered at the right time. For instance, Northwestern Medicine’s in-house gen AI system drafts radiology reports in real time that are about 95% complete and automatically flag life-threatening findings. This helps radiologists deliver faster, more consistent reporting and enables earlier detection and triage in emergency settings, with no impact on clinical accuracy.15

- Reduce administrative burden and improve operations. Gen AI and agentic AI can also improve efficiency for staff across clinical, business, and back-office operations. For instance, a research study by the Perelman School of Medicine at Penn Medicine found that clinicians using ambient technology to create pre-visit patient histories, transcribe clinical notes, and review treatment plans saved 20% of their documentation time.16 St. Luke’s Health System also implemented gen AI and reported an increase in reimbursement of about $13,000 per clinician, driven by revenue cycle coding improvements resulting from AI-based documentation review.17

- Enhance consumer and workforce experiences. Patient, member, and workforce experiences are also being improved through AI-powered assistants and workflow tools. For example, Sutter Health is using AI agents to provide patients with a faster, more unified experience across chat, voice, and SMS channels, resulting in an 85% reduction in interaction abandonment rates. With over 13 million patient visits annually, this allows the workforce to focus on more complex interactions with patients.18

Using a disciplined approach

Successful AI deployment is as much about people and processes as it is about technology. The emphasis should shift from automating isolated tasks to systematically remapping entire workflows to integrate human and AI workforces. To scale gen AI and agentic AI, health care organizations should consider a disciplined approach that develops a true enterprise strategy. This involves defining the challenge to solve, quantifying the value (for example, cost and experience), determining the governance, and assigning accountable owners. Health care leaders should decide the reference architecture through standardized data access, model choices, security, observability, and interoperability. Creating a dynamic investment pipeline that balances showcasing a few successful use cases (as proof points) with a prioritized backlog by function can also be useful. Success may be bolstered by codesigning solutions with the workforce, including retraining employees and developing new career paths as AI agents take on routine tasks. Additionally, operationalizing trust will involve cross-functional governance to address bias, explainability, model life cycle management, privacy, and security.19

Join forces with other industries to unlock innovation and greater impact

The traditional health care system—one grounded in episodic, reactive care— may no longer be sustainable.20 Achieving proactive, preventive, and wellness-focused care involves addressing consumer needs and broader drivers of health, often beyond the reach of health care organizations alone. To spur meaningful innovation and deliver greater impact, health care leaders should try to look outside their sector for new ideas and expertise. In fact, 45% of executives say market convergence and consolidation will be important to their organizational strategies in 2026, while about 80% indicate that collaborations with other industries are a priority for their organizations’ C-suites and boards.

Working with partners from fields such as technology, retail, and consumer industries, where necessary skills and technologies often reside, can offer faster, lower-risk paths to new capabilities and innovation. Sixty-three percent of surveyed executives expect strategic partnerships and joint ventures to become a higher priority in 2026. As the boundaries between health care and other industries blur, cross-sector collaborations are likely to become essential. Collaborations that prioritize holistic and sustainable care approaches are important for achieving better outcomes and longer health spans.

To help them turn this vision into reality, health care organizations should look for opportunities to join forces with other industries based on needed capabilities and risk assessments. Leaders may consider approaches such as:

Partner with technology and digital companies to improve health

Technology solutions such as predictive AI and consumer-facing digital tools are compelling options for addressing the industry’s challenges with access and outcomes. About 70% of surveyed health care executives plan to pursue alliances with technology or digital companies in 2026. To improve access, ride-sharing companies frequently partner with local health systems to provide transportation for nonemergency doctor visits and treatment appointments.21 UMass Memorial Health and Google Cloud are building AI models to help identify patients with cardiac disease who may be candidates for advanced therapies. These predictive analytic models review vast data sets to identify potential patients and generate personalized care plans, ultimately improving health outcomes and cost-effectiveness.22 Best Buy’s collaboration with Atrium Health is another example of efforts to address access and outcomes. This joint initiative scales hospital-at-home operations by leveraging the retailer’s technology resources to set up connected care monitoring for patients.23

Join forces with community-based organizations to address social and economic needs

Gaps in health outcomes highlight the importance of addressing social and economic drivers of health. That is why 53% of health system executives intend to look for ways to collaborate with community-based organizations. For example, multiple hospitals in the Chicago area invested in creating a laundry service in a West Side neighborhood, which brought new jobs to the community.24 As household incomes increase, community members have more opportunities to afford stable housing and healthy food, ultimately leading to improved health.25

Work with retailers and grocers to support access to healthy food

Thirty-seven percent of health plan executives say they are likely to explore opportunities with grocers. These partnerships can increase consumer engagement and loyalty while driving better health outcomes. Digital tools and data analytics can aid these initiatives by delivering customized prompts and education about healthy food choices. For example, Select Health—an insurance subsidiary of Intermountain Health—and Kroger launched cobranded Medicare Advantage plans that provide members with savings on groceries and prescriptions, as well as access to programs and services designed to improve health and wellness.26Meanwhile, Instacart Health connects food payment programs with digital recipes and personalized advice from dietitians to guide purchases.27

Positioning health care organizations for long-term growth and resilience

Given how quickly the health care landscape is changing, leaders from both health plans and health systems should consider how they can seize this moment to move beyond traditional strategies and champion bold, transformative change. By using technology and digital tools to empower consumers, scaling AI across the organization, and forging cross-industry collaborations, leaders have an opportunity to transform their organizations and the broader health care landscape. Those who take decisive action now and are first to embrace whole-system change are likely not only to withstand industry disruption but also to help define a new era of health care.

Methodology

The Deloitte Center for Health Solutions surveyed 120 C-suite executives (including senior vice presidents and vice presidents) from large US health systems and health plans between August and September 2025. The organizations represented include multihospital systems, independent hospitals, academic medical centers, public health authorities, and a range of health plans (national, provider-sponsored, and regional or Blue Cross and Blue Shield–affiliated), each with annual revenues over US$500 million. The survey aimed to identify the key trends executives expect will shape their organizations’ strategies in 2026 and to learn what actions they plan to take in response.