How health care CFOs can adapt to emerging industry conditions

A Deloitte survey shows health care finance leaders are concerned about slowing growth due to multiple external factors

Tina Wheeler

Bill Laughlin

Omosede Ogiamien

Heather Hagan

Maulesh Shukla

Madhushree Wagh

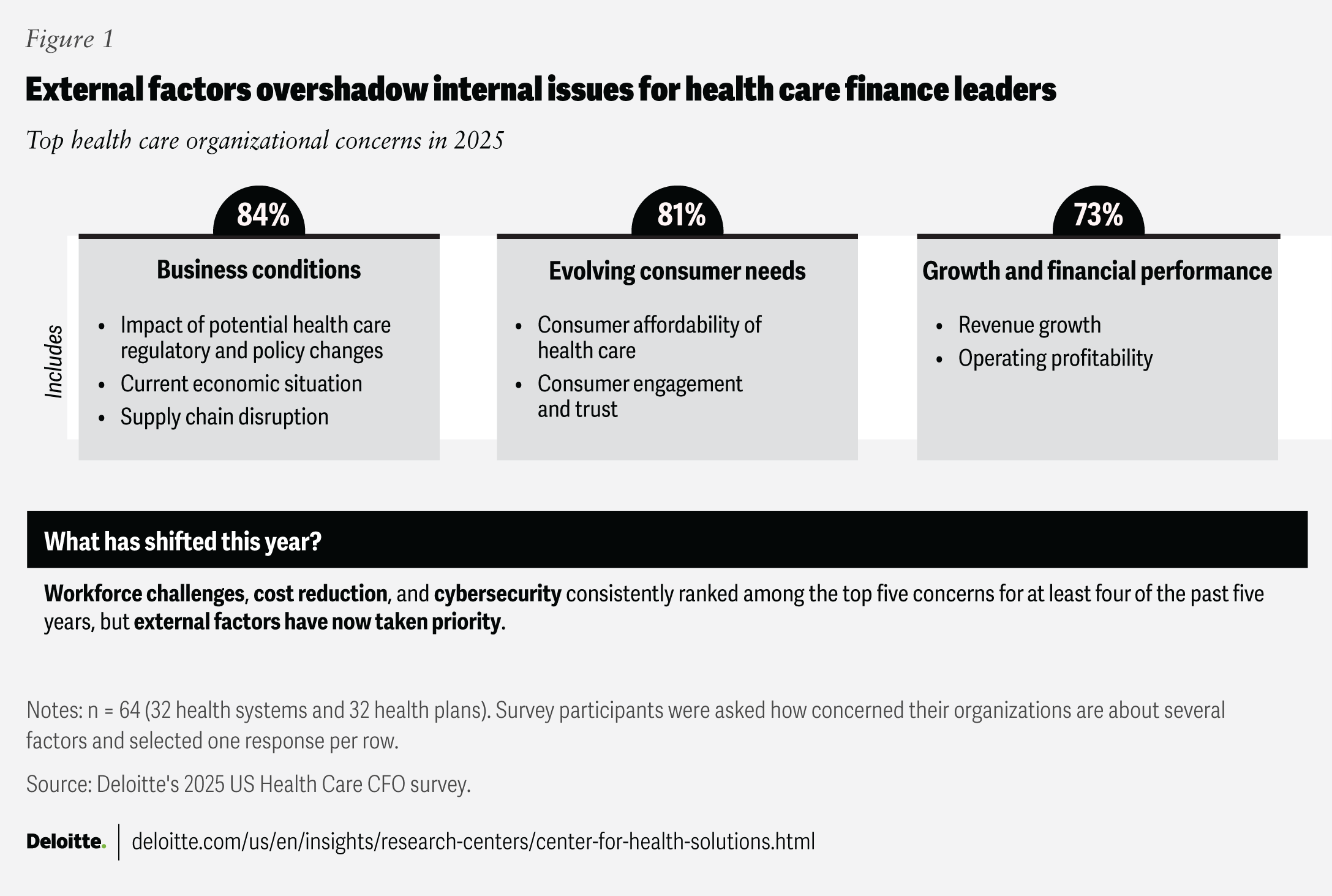

A recent Deloitte Center for Health Solutions survey of health care finance leaders revealed that 84% are concerned about business conditions stemming from potential regulatory and policy changes, macroeconomic uncertainty, and disruptions related to tariffs and supply chains. Notably, 73% of respondents reported concerns about revenue growth and operating profitability (figure 1). This marks a change from Deloitte’s earlier outlook for 2025, where health care leaders reported that they expected a year of growth.

The Deloitte Center for Health Solutions conducted its sixth annual US Health Care CFO Survey in the spring of 2025. We surveyed 64 US health care finance leaders, including 32 from health systems and 32 from health plans, to identify their top issues and priorities.

The surveyed health care finance leaders expressed concerns about consumer affordability, increasing health care costs, and the potential impact on their organizations’ financial performance. For instance, some health insurers noted that the Medicare Advantage medical loss ratio in early 2025 was the highest it has been in several years, due to a significant uptick in members’ use of health care services. This trend may continue throughout the rest of the year.1

Internal concerns like workforce challenges, cost reduction, and cybersecurity—once top priorities for health care CFOs in our previous surveys—seem to have become less urgent amid rising external factors, according to survey respondents.

Although workforce attrition and shortages appear to have stabilized, issues like clinician burnout and low employee trust in health care leadership remain.2 Cost concerns have also waned, with finance leaders now focusing more on growth than on cutting expenses, though monitoring costs can be important given ongoing policy and technology changes.3 Similarly, cybersecurity has dropped in priority, even as cyber threats continue to rise.4 However, overlooking these internal issues could become a blind spot, especially as health care organizations pursue innovation and growth in an increasingly complex environment.

Finance leaders prepare for multiple potential and upcoming regulatory changes

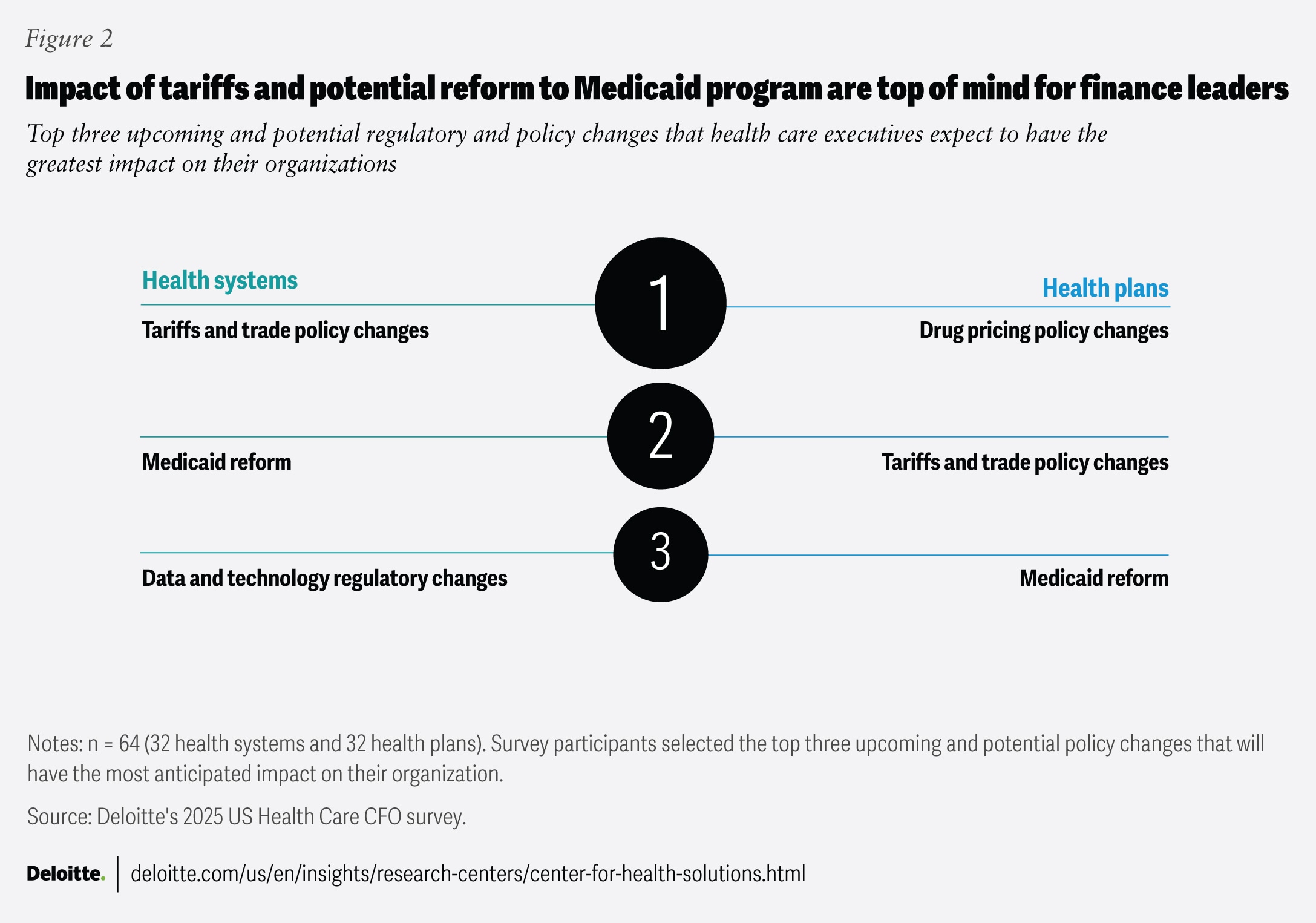

We also explored which upcoming or potential policy changes health care finance leaders believe will have the most impact on their organizations (figure 2). We found that tariffs and trade policy shifts topped the list. Prescription drugs, medical equipment, and other medical supplies account for about 20% of the average US hospital’s expenses5—and a large share of these items are imported. Potential new tariffs on these imports could increase hospital costs by 15% or more, as they disrupt procurement processes and complicate supplier negotiations.6

On the other hand, health plan finance leaders identified changes to drug-pricing policies—such as modifications to the Inflation Reduction Act (IRA)—as the regulatory changes most likely to impact their organizations. Key IRA provisions for Medicare include capping annual out-of-pocket drug costs at US$2000, eliminating the coverage gap phase (also known as the “donut hole”), and shifting a greater share of catastrophic drug costs from the government to health plans.7

Both health system and health plan finance leaders ranked potential Medicaid reform as the second most impactful regulatory change. For health systems, concerns include not only lower reimbursement rates, but also potential uncompensated care if eligibility reductions or budget caps lead to more uninsured patients.8

Health care finance leaders report they are driving actions, but many actions may be falling short of impact

The findings from Deloitte’s 2024 US Health Care CFO Survey emphasized that health care finance leaders may benefit from adopting a holistic approach to margin improvement. This involves focusing collectively on levers across strategic growth and revenue improvement, cost reduction, and efficient capital deployment, rather than addressing these separately. Our analysis found that some levers, often considered lower priority by CFOs, could actually offer better opportunities for financial transformation. We refer to these as high-impact levers.9

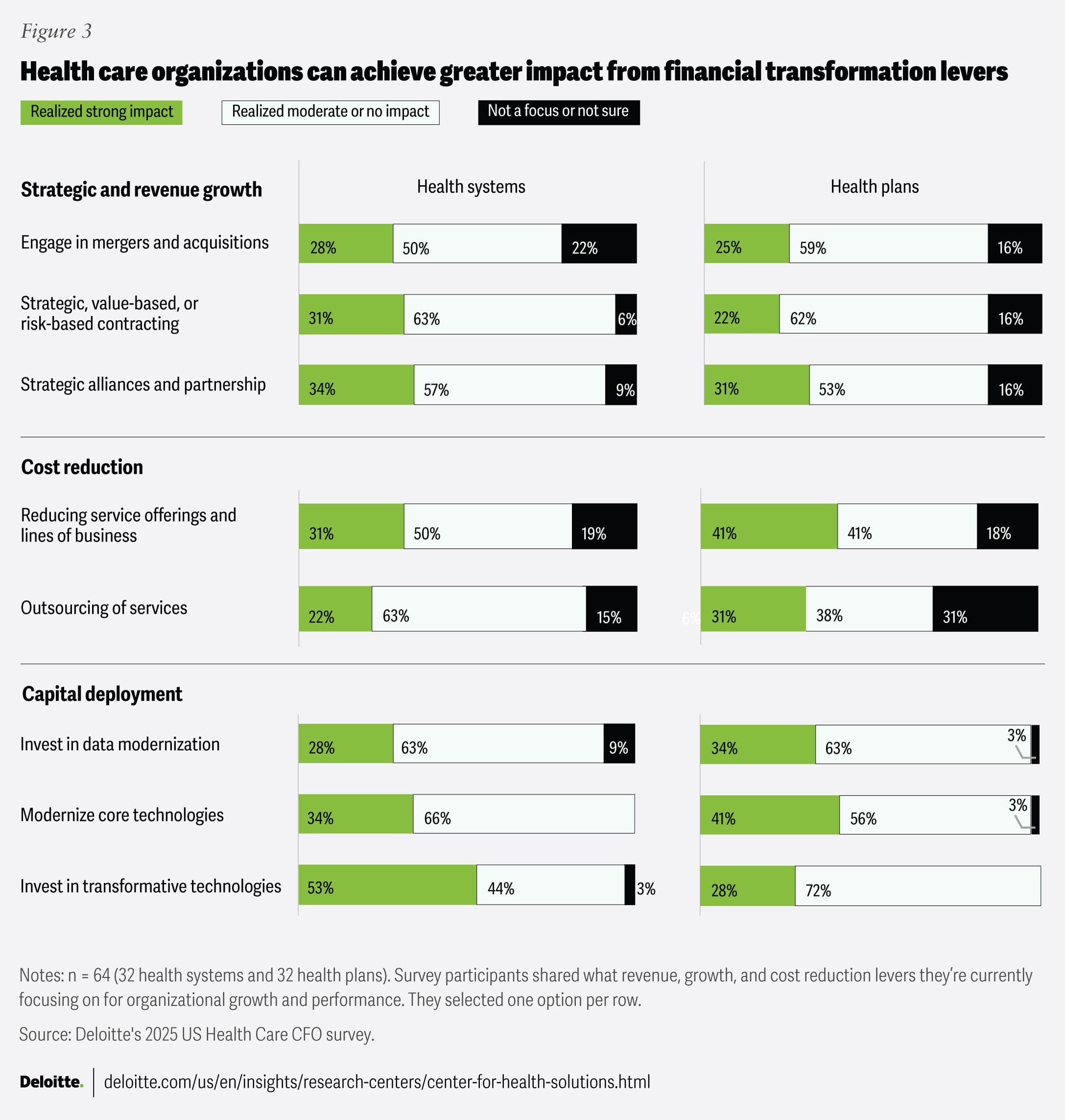

This year, many finance leaders seem to have increased their focus on these high-impact levers, but most have not yet derived impact from them (figure 3). In today’s dynamic business and economic environment, these levers can help enhance the financial performance of health care organizations.

Driving growth via strategic M&As, alliances, and risk-based contracts

Mergers and acquisitions have historically been one of the primary levers for growth among health care organizations.10 When done well, health care M&As can boost market share, productivity, and margins.11 Yet, only 28% of health system respondents and 25% of health plan respondents reported that their M&A efforts have had a strong impact.

Beyond M&As, strategic alliances and partnerships are becoming increasingly popular as opportunities for rapid asset-light growth and protecting competitive position.12 While more than 90% of the respondents said they are focused on these growth levers, only one-third of them have seen a strong impact. Alliances and partnerships can allow health care organizations to gain access to new markets without full-scale integration challenges.13

Almost all respondents reported that their organizations are undertaking value-based contracts (VBCs) for strategic growth, but most said they haven’t seen a strong impact. Health care organizations have cited payment challenges, data capability gaps, and insufficient change management as hurdles.14 Recent regulatory announcements for participants in government VBC programs to take on greater downside risk may act as a catalyst for health care organizations to enhance their data and advanced tech capabilities, such as artificial intelligence. Regulators are encouraging health care organizations to use AI for early diagnosis and prevention.15

Strategic cost reduction through service optimization and rethinking the operating model

Many service offerings for health systems and lines of business for health plans can be loss-making. For instance, half of health plans reported underwriting losses in at least one major line of business consistently over the past three years.16 This can happen due to multiple factors like pricing strategies, high costs, limited scalability, or unexpectedly high utilization among the member or patient demographics served.17 According to our survey, 31% of health systems and 41% of health plans report that they have realized strong impact from their optimization efforts. To help maximize the impact of these efforts, organizations should consider analyzing their service areas and lines of business and divesting or reducing non-beneficial services. However, as organizations evaluate their portfolios, they may want to consider the value of continuing to invest in areas that may not directly generate revenue but are important for enhancing customer experience, retention, and loyalty.

Optimizing operating models is another high-impact lever. Health care organizations can achieve cost savings of up to 28% by outsourcing noncore services, depending on the type of service.18 Despite this potential, 25% of surveyed health plan finance leaders and 16% of health system finance leaders aren’t prioritizing outsourcing this year. Among those that are currently outsourcing, 22% of health systems and 31% of health plans have seen a strong impact. Outsourcing can reduce costs by lowering operational expenses, offering scalability, minimizing infrastructure spending, and enhancing efficiency. However, to help them achieve an impact, organizations should consider strategically assessing and addressing potential risks such as quality concerns, workforce engagement, regulatory compliance, data security, and ongoing costs or vendor lock-in.

Smart capital deployment in data modernization and transformative technologies

To help them navigate a dynamic economic and regulatory environment, health plan and health system respondents report that they are prioritizing investments in technologies to improve data quality, reporting capabilities, and scenario planning.

However, only one-third of respondents from health plans and health systems reported that their efforts to modernize core technologies such as electronic health records, enterprise resource planning systems, and data modernization efforts have led to a strong impact. Data modernization—transforming data infrastructure to improve data accessibility and security—is a fundamental aspect of modernizing and integrating core and transformative technologies. There appears to be an opportunity for finance leaders to invest in data modernization efforts, with a focus on improving care delivery, streamlining operations, and achieving greater returns on investments.19

Furthermore, 53% of health systems reported strong impacts from transformative technologies like generative AI and cloud, while 72% of health plans reported only moderate to no impact. As organizations consider adopting these technologies, especially gen AI, it is important to take a holistic, institutional approach and address data, consumer, and workforce considerations to realize meaningful impact.20

Navigating dynamic times with a multidimensional growth strategy

Responding to headwinds: The COVID-19 pandemic likely taught health care finance leaders the importance of agility and building tech-enabled financial-planning capabilities. In today’s changing macroeconomic environment, these leaders can apply those lessons by:

- Adopting real-time, adaptive planning cycles: Moving beyond static half-yearly or annual budgets to enable quicker, more responsive decision-making.

- Implementing real-time scenario planning: Use automated, continuously updated models based on key drivers of change to better understand and navigate uncertainty.

- Creating a single source of truth: Leverage self-service dashboards and visualization tools to provide clear, consistent information to stakeholders, including board members and C-suite executives.

Preparing for growth: Looking beyond near-term priorities, health care finance leaders can serve as strategists for organizational leadership and potentially drive long-term growth by:

- Creating avenues for strategic organizational growth: Identify and pursue both asset-heavy opportunities (such as M&As) and asset-light opportunities (such as alliances and partnerships).

- Redesigning product and service portfolios: Scale back or reengineer offerings and critical processes to enhance cost efficiency.

- Deploying new technology capabilities: Implement solutions such as gen AI, agentic AI, and cloud computing to help achieve competitive differentiation in a secure and trustworthy way.

As stewards and operators of both stability and agility, strong financial leadership from health care CFOs is important for remaining responsive in today’s environment. Their leadership is important not only for maintaining financial health, but also for driving long-term growth. By driving strategic investments, optimizing cost structures, and enabling data-driven decisions, finance leaders can help build resilient, future-ready health care organizations. In a rapidly evolving market, CFOs can be well positioned to steward stability and transformation in ways that ultimately can benefit patients, members, communities, the health care workforce, and the health care industry, at large.