Charting the next wave of growth and innovation in advanced therapies

Can industry leaders scale advanced therapies from niche launches to mainstream, sustainable patient care?

Hussain Mooraj

Amit Agarwal

Leena Gupta

Darshan Gosalia

When we last connected with leaders in advanced therapies in 2020, the environment was one of investment and optimism, with potential solutions on the horizon for previously intractable diseases. At the same time, leaders highlighted persistent challenges—chief among them, the need to design and deliver highly personalized products within processes built for mass-market pharmaceuticals.

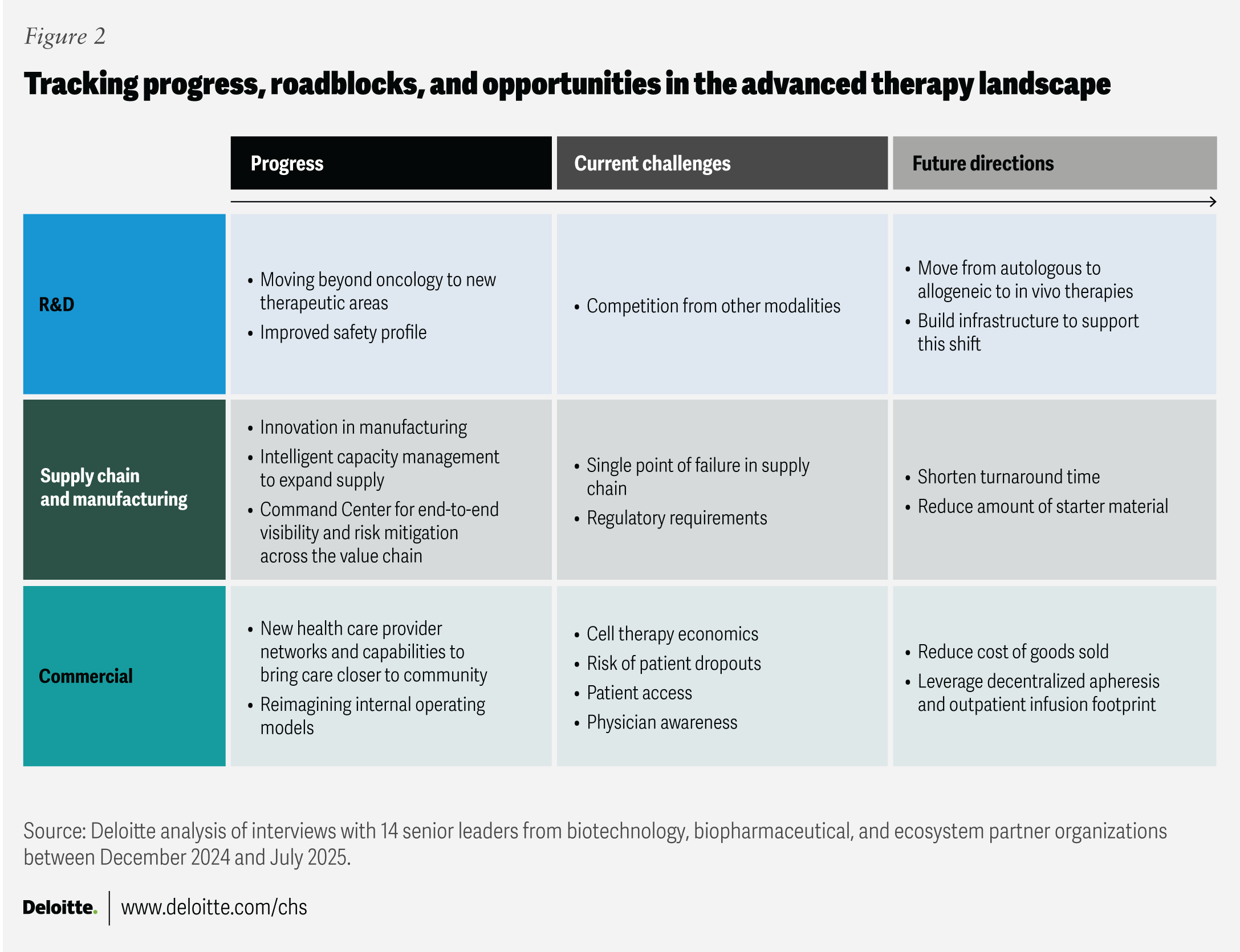

Fast forward to today, and the sector’s horizon has noticeably expanded. Manufacturers are extending advanced therapy offerings into new therapeutic areas, including autoimmune diseases, type 1 diabetes, and complex neurological conditions, while also making critical advances in manufacturing, digital integration, and product safety.1 To provide a fresh perspective on current strategies and challenges in cell, gene, and RNA-based therapies, the Deloitte Center for Health Solutions interviewed 14 senior leaders from biotechnology, biopharmaceutical, and ecosystem partner organizations between December 2024 and July 2025 (see methodology). Their insights indicate a potential evolution of advanced therapies, supported by improved cost structures and production.

Despite this progress, challenges persist: Business models and supporting infrastructure are still catching up with scientific innovation, and a challenging investment climate has heightened the need for clear, scalable strategies and value propositions to secure funding. As we noted in previous research, digitally integrated, end-to-end models are important for breaking down silos and enabling agility and scale. Maturing the sector will also likely involve investment in advanced research and development, supply chain and manufacturing, and commercialization capabilities. This article summarizes some industry leaders’ perspectives on key opportunities and pressing challenges for the next wave.

Understanding the advanced therapy model

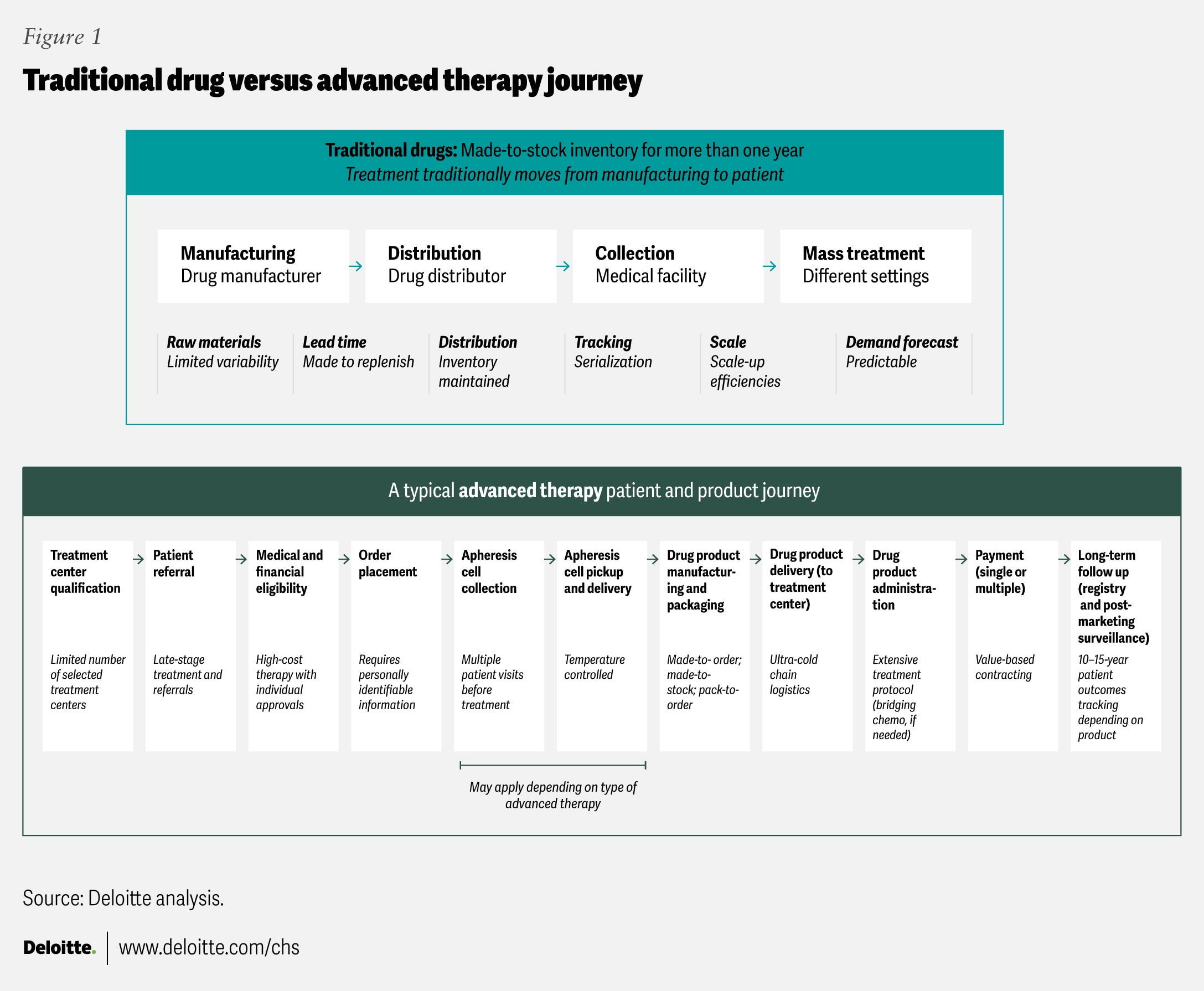

Advanced therapies differ fundamentally from traditional pharmaceutical products (figure 1). While conventional drugs are generally mass-produced, shelf-stable, and widely distributed, many advanced therapies are personalized with patient-specific cellular material and require immediate use due to instability.2 Autologous therapies can also involve complex vein-to-vein processes that typically require cold-chain transport, strict chain of identity and custody systems, and near-real-time delivery. Costs can reach US$400,000 to more than US$2 million per patient, often with uncertain long-term outcomes, making access and reimbursement perennial concerns.3 To help them succeed, the sector should consider integrated, cross-functional business models designed for individualized yet scalable care.

Key progress areas for mainstreaming advanced therapies

As the advanced therapy sector moves from niche to potential mainstream impact, industry leaders share lessons and report progress in three areas: R&D, manufacturing, and commercial strategy. The following sections highlight how leading organizations are charting progress and positioning for sustainable, scalable growth.

R&D progress: Beyond oncology and toward safer treatments

Advanced therapies are expanding beyond rare and often life-threatening diseases to include more common and prevalent conditions. One executive described the expansion of CAR-T therapies outside hematology and oncology as “among the most innovative areas in CGT today.” Data from the American Society of Gene + Cell Therapy second-quarter report shows that 76% of current cell therapy clinical trials now target non-oncology indications, including osteoarthritis, type 1 diabetes, and Parkinson’s disease.8 Companies like Kyverna Therapeutics, Cabaletta Bio, and Cartesian Therapeutics are focusing on developing advanced therapies for autoimmune disorders such as lupus, myasthenia gravis, and multiple sclerosis, ushering in a new era of disease-modifying possibilities.9

The safety profiles of cell therapies also show some measurable improvements. Interviewed leaders note that the incidence of cytokine release syndrome (CRS) or “cytokine storm”—an acute, potentially dangerous immune response to CAR-Ts—has dropped markedly compared to six years ago. Researchers now understand early CRS biomarkers and are developing strategies to mitigate side effects while preserving therapeutic benefits.10 By monitoring a patient’s body temperature, for example, companies can predict the onset of CRS and triage at-risk patients before they enter the symptomatic stage.11 Such advances in biomarker detection and preventive protocols enable earlier intervention and can reduce reliance on acute care facilities for CAR-T administration and accelerate safe treatment timelines.

Other categories of advanced therapies are also emerging, creating competition in this space. Bispecific monoclonal antibodies, for example, which primarily target two antigens, may be a formidable new modality. One interviewee notes that bispecific monoclonal antibodies pose a real challenge to CGTs in oncology because they are an off-the-shelf solution, are easier to deliver, and are therefore more accessible, especially in earlier treatment lines. While bispecifics may not rival CAR-Ts’ curative potential in the near term, leaders tend to see these approaches as complementary. Bispecifics can expand access, while CGTs may be reserved for patients requiring durable, one-time treatments.

Manufacturing progress: Automation, scale, and reliability

Manufacturing seems to have experienced the most dramatic transformation over the past six years. The shift from labor-intensive, error-prone processes to automated, scalable, and reliable systems appears to be underway.

Companies like Cellares have created closed, automated systems such as the Cell Shuttle®, which can produce up to 10 times as many cell therapy doses annually as traditional cleanrooms.12 This reduces vein-to-vein turnaround, a key cost driver, to about a week, and has the potential to lower manual labor requirements, mitigate human error, and improve consistency. Robotics-driven approaches from Multiply Labs and Cellular Origins, and digital modular platforms from Ori Biotech, enable companies to enhance reliability and lower costs.13 A European-based biotechnology company demonstrates the potential of decentralized manufacturing with a small, push-button, automated platform that can be located close to the point of care, also reducing median vein-to-vein time to seven days.14

Despite this progress, several interviewees express some caution about validating the consistency and comparability of products from new manufacturing platforms. Taking into account the increased safety of advanced therapies, however, these technologies could play a central role in moving therapy administration away from academic medical centers into community settings, an important step for expanding patient access. Some of the leaders we interviewed say that maintaining some flexibility between centralized and decentralized manufacturing models allows companies to make choices based on their capabilities and needs. This includes leveraging existing infrastructure and excess capacity from larger players to support smaller players, and hybrid models, where internal manufacturing is combined with contract manufacturing organizations to help satisfy market demand. As one interviewee aptly put it, “There is room for everyone.”

There are other manufacturing concerns—beyond those that new platforms address—to consider. For example, some interviewees note that quality control and release testing still represent a significant share of manufacturing cost and time, often extending the overall vein-to-vein timeline by several weeks, even when the actual therapy production could be completed in a matter of days. AI has shown potential in decreasing batch release cycle time,15 but supply chains remain vulnerable to single points of failure, such as shortages in viral vectors or cryogenic materials, which can halt production entirely. Global tariffs could further increase costs and create logistical uncertainty.16 As a result, companies might need to build redundancies into their supply chains, potentially increasing costs and causing additional delays.

Commercial progress: Sustainable innovation for more patients

The first wave of advanced therapy launches, such as Novartis’s Zolgensma and Kymriah, helped show that highly complex products could successfully reach patients but also exposed challenges with the commercial model. Several interviewees told us that some early rollouts were hampered by slow site onboarding, limited treatment capacity at academic medical centers, and steep learning curves for providers, payers, and manufacturers alike. Manufacturing delays and quality issues sometimes led to reputational risk, while unclear reimbursement pathways left hospitals uncertain about their financial exposure. Companies often underestimate the need for dedicated site support and community education, leading to gaps in physician awareness and patient access. These experiences underscore that scientific innovation does not necessarily guarantee commercial success.

The commercial model likely needs to evolve to keep pace with scientific advances. The next generation of advanced therapies could address these shortcomings by focusing on earlier payer engagement, enhanced provider education, streamlined site operations, innovative patient support programs, and broader delivery networks to make therapies accessible to their intended populations. Three areas will likely require attention and new collaboration models with payers, providers, and large pharma companies.

- Address access and affordability. With prices exceeding US$400,000 for autologous cell therapies and US$2 million for gene therapies, most health care systems cannot sustainably cover these costs.17 Creative payment models, such as outcomes-based agreements, staged payments, and risk-sharing frameworks like the US Center for Medicare & Medicaid Innovation’s Cell and Gene Therapy Payment Model show some potential but will likely need to be scaled and standardized.18 Without new payment approaches that consider the economics for payers, providers, and advanced therapy companies, even the most transformative therapies may not reach eligible patients.

- Expand distribution and care delivery infrastructure. Most interviewees emphasize that while advances in manufacturing automation and improved safety could allow advanced therapies to be administered in community settings, the current ecosystem is ill-prepared to support this transition. We heard from some interviewed leaders that community providers tend to not be equipped yet to treat patients with advanced therapies and require a full suite of capabilities, including clinical training, workflow tools, and facilities adapted for this type of care. There appears to be an opportunity for therapy developers to facilitate partnerships with each other, experienced academic medical centers, and community providers to make this shift possible. Commercial models should consider incorporating training networks, “hub-and-spoke” delivery structures, and digital platforms that can reduce the administrative burden on treatment sites. For example:

- Site onboarding and clinical operations should be simple and standardized so more hospitals and clinics can deliver advanced therapy treatments to more patients, working alongside standard-setting organizations. While 100% standardization is not possible given the personalized nature of these therapies and their unique product characteristics, some interviewees suggest applying an 80-20 principle is realistic. Existing standards already address key elements like cold-chain logistics and the Food and Drug Administration’s Risk Evaluation and Mitigation Strategy requirements.19

- Additionally, specialists outside hematology-oncology should become educated and comfortable with prescribing, administering, and managing new therapies.20 These advanced therapies are likely to call for clinical protocols and workflows that are different from current clinical practices, and will rely heavily on clinical practices from oncology and transplant medicine (figure 1). Some interviewees say the democratization of advanced therapy clinical practice is more likely to be driven by academic medicine than by biopharmaceutical companies. They also note that existing partnership models between academic medical centers and referring provider organizations can serve as a foundation for training community clinicians and disseminating clinical practice guidelines.

3. Evolve portfolio and partnership strategies. Smaller biotechs rarely have the resources to build global commercial infrastructures, making partnerships with large pharma or integration into broader therapeutic area portfolios essential.21 For large companies, a challenge may be moving beyond siloed, product-by-product commercialization in favor of integrated portfolio approaches that support shared resources, unified contracting strategies, and cross-disease customer engagement. As one interviewee notes, from their perspective, future success in advanced therapies will depend not only on the success of individual product launches, but also on how effectively the entire portfolio is positioned to meet payer and provider needs.

Working toward a scalable future for advanced therapies

The advanced therapies leaders we interviewed unanimously agree that scientific innovation will continue, that new categories of advanced therapies will be developed, and that product safety and efficacy will continue to improve—a progression they view as inevitable. However, they also acknowledge uncertainty about how the advanced therapies ecosystem will evolve from bespoke operational models to models that are scalable and produce products that are affordable and widely accessible. Achieving this transition will involve changes in reimbursement policies, delivery infrastructure, and portfolio management approaches. Without these shifts, advanced therapies may remain limited to niche indications. But with them, the sector has the potential to move from a specialty area of oncology and rare diseases into the mainstream of medical practice.

Methodology

The Deloitte Center for Health Solutions interviewed 14 advanced therapy executives from biotechnology, biopharmaceutical, and ecosystem partners from December 2024 to July 2025. The research explored current industry dynamics, organizational strategies, and ongoing versus resolved challenges.

For this paper, advanced therapies include cell therapies (non-genetically modified cell therapies such as stem cell or tumor-infiltrating lymphocyte therapies), gene therapies (genetically modified cell therapies like CAR-T, CAR-NK, CAR-M delivered ex vivo or in vivo), and RNA-based therapies (such as mRNA, RNAi, antisense therapy), often designed to deliver sustained disease modification or cure.

Deloitte’s analysis of the advanced therapies market was focused on the five-year share price performance of about 40 pure-play advanced therapy companies, each publicly traded for at least two years. The research resulted in a proprietary index, a tool to evaluate impacts of key events announced during a typical therapy or product development cycle, such as the completion of clinical research trials and early- and late-stage data readouts.