Considerations for health systems to help bridge the tech value gap

Broader measurement of enterprise technology can unlock greater benefits for patients, staff, and finances

Christy Lemak

John Hendricks

Michael T. Black

Anwesha Dutta

Maulesh Shukla

Madhushree Wagh

Health systems are investing billions into enterprise technologies,1 yet many cannot confidently quantify the true value of these investments. A new Scottsdale Institute-Deloitte survey of health system executives reveals that while 80% agree that measuring technology value is critical, most still default to traditional metrics like implementation costs and associated savings. What often goes undermeasured are outcomes that matter to consumers, clinicians, and boards of directors. Half or fewer executives report regularly assessing technology’s impact on consumer experience, workforce productivity, or brand reputation—or tracking indirect costs such as opportunity costs. This disconnect between what is measured today and the full spectrum of technology’s value is what we call the “tech value gap.”

As scrutiny of tech spending intensifies2 and advanced technologies like generative AI and agentic AI gain traction, closing this gap may be more important than ever. In fact, 78% of survey respondents say their willingness to invest in transformative technologies would be influenced by how holistically and accurately their value is measured. Health systems that overlook the tech value gap may risk undercutting future growth and innovation.

Building on several years of joint research tracking health system technology implementation, Deloitte and the Scottsdale Institute surveyed 25 technology and finance leaders from medium and large US health systems and academic medical centers from August to September 2025. To identify leading practices for assessing the true value of enterprise technology investments, this article analyzes leaders’ insights and offers three practical strategies to consider for bridging the tech value gap: establishing a clear value taxonomy, embedding value governance with accountable owners, and building a robust value infrastructure. This research builds on Deloitte’s prior reports examining tech transformation, consumer perspectives, and workforce impacts in health systems.

Defining tech value: Health systems look beyond cost to strategic impact

When asked how they define value derived from enterprise technology initiatives, executives indicate a growing recognition that value extends well beyond traditional financial metrics. Historically, organizations have evaluated technology investments primarily through tangible metrics such as return on investment, cost savings, and revenue growth.3 While these remain important, leaders increasingly view them as just one part of a larger equation. Many tech initiatives are now pursued to drive broader priorities like improved clinical quality, a better patient experience, and regulatory compliance.4 As one executive describes, “Primarily we look at ROI, but we also consider intangibles like patient safety, quality, and experience, as well as must-dos like regulatory compliance.”5

Executives now tend to see the true value of technology extending well beyond cost savings. Workflow efficiency and staff productivity have emerged as highly valued outcomes, particularly for reducing clinician burden and improving team member satisfaction. As a regional health system executive explains, “We look at the potential for more efficient operations through consolidating functions, but equally at the improvements to employee and patient experience.”6 Some organizations even tie technology’s value to trust and brand reputation. As one surveyed chief operating officer put it, “At its core, this is the most fundamental way to define the value of enterprise technology: quantify what trust and reputation would look like if the tech was all taken away.” 7 This broader perspective may be reshaping investment priorities.

“We look at the potential for more efficient operations through consolidating functions, but equally at the improvements to employee and patient experience.”

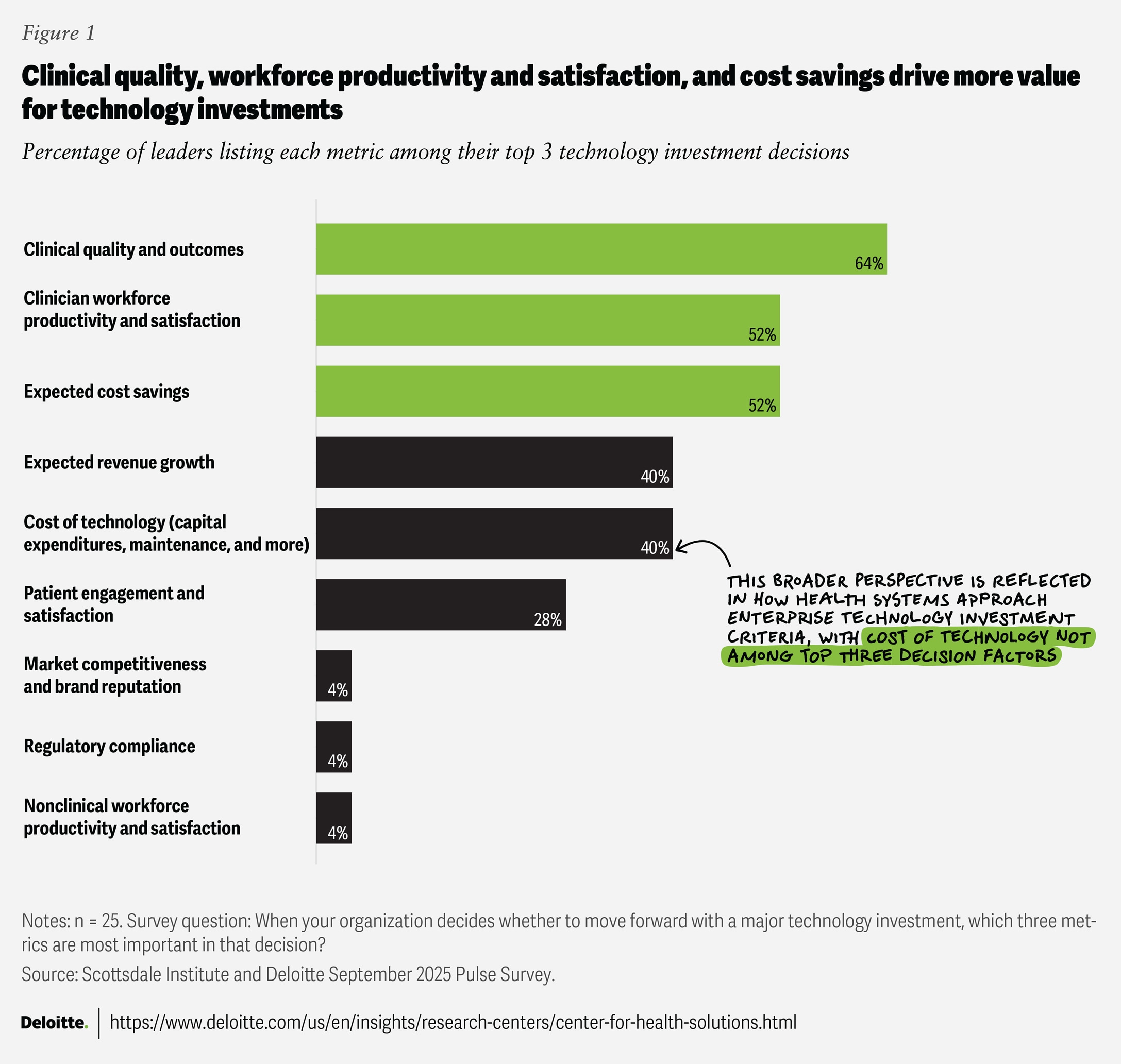

Cost of technology ranks fifth among surveyed executives’ decision-making criteria (figure 1). Instead, clinical quality and outcomes, clinician productivity and satisfaction, and cost efficiencies were the top priorities. Other key considerations include patient engagement, brand reputation, and compliance. By expanding the definition of value, health systems appear to be positioning technology as a driver for strategic goals, improved patient and staff experiences, and organizational reputation.

The tech value gap

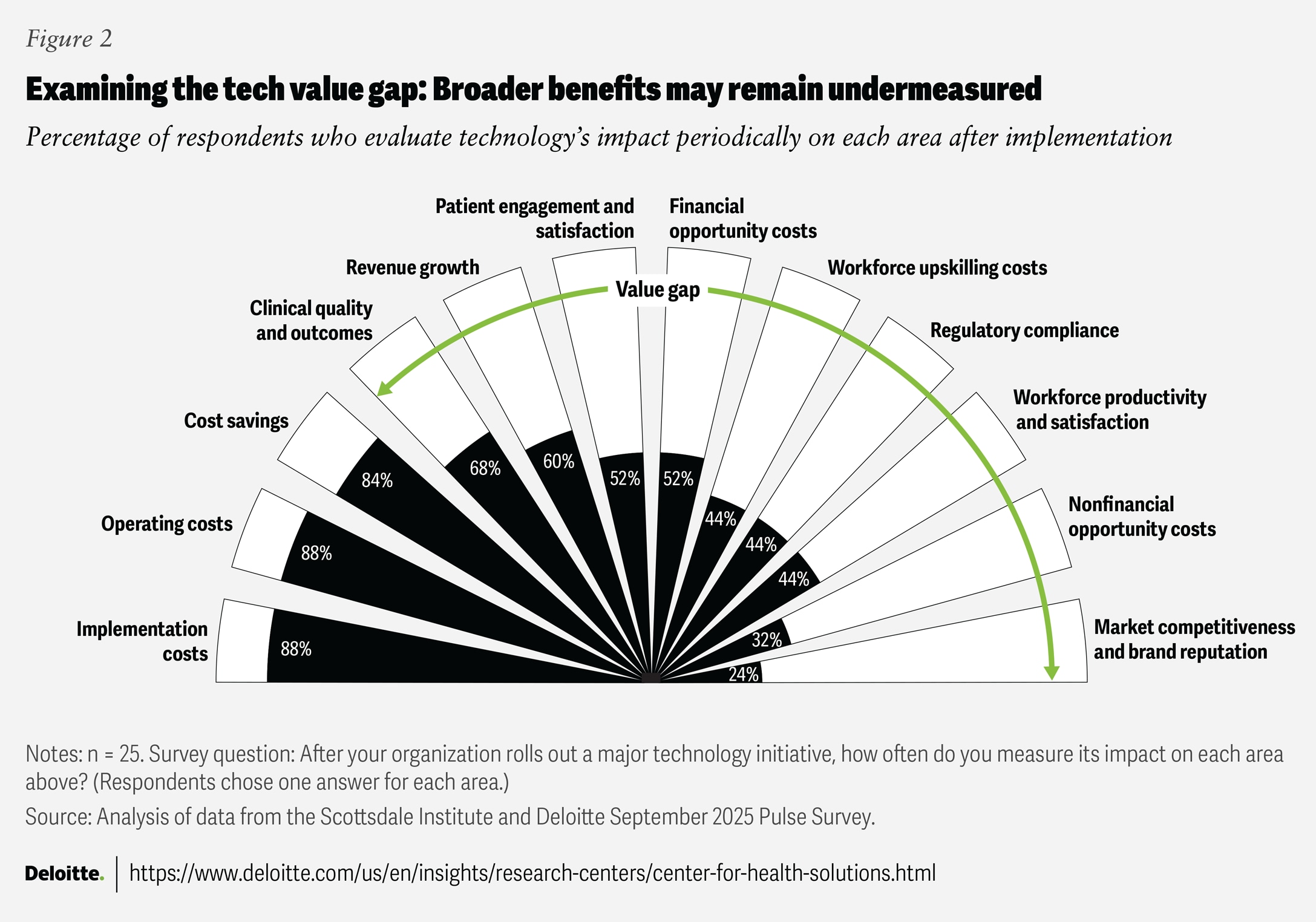

Survey findings show that investment decisions are often made based on value, not just the cost of technology. However, the realization of value may be incomplete without understanding how frequently and comprehensively value is measured today. Our survey helped us understand the value gap (figure 2).

In this research, outcomes from enterprise technology, such as implementation costs (88%), operating costs (88%), and cost savings (84%), are most frequently tracked, highlighting the emphasis on operational efficiency. About two-thirds of respondents (68%) also monitor technology’s impact on clinical quality and outcomes, through initiatives such as clinical decision support or electronic health record improvements. A few recent examples show technology’s role in achieving better clinical outcomes. For instance, AI‑enabled sepsis surveillance led to a 17% relative reduction in in‑hospital mortality at one health system—an outcome impacting human lives and financial metrics such as length of stay and ICU utilization.8 Other digital programs, such as remote patient monitoring and AI-assisted procedures, have also shown benefits in reducing readmissions and improving operational efficiencies.9

While most health system leaders surveyed track direct costs, less than half periodically measure indirect costs, such as opportunity costs and workforce upskilling. Legacy tech systems can create hidden technical debt (like downtime risk or deferred innovation)10; yet many organizations do not consistently track these liabilities,11 even though periodic technical debt assessments can help prioritize modernization efforts (see “Measuring technical debt at health systems”).

Measuring technical debt at health systems

Health systems have historically been prone to accumulating technical debt—costs arising from postponed upgrades, integrations, cybersecurity enhancements, or system decommissioning.12 A recent report found that 96% of hospitals, regardless of size, operated end-of-life systems.13Technical debt drives information technology overspending, especially in provider settings where complex legacy technology environments make resolution more difficult.14 Much of this debt does not appear as a direct expense on budget sheets but instead shows up as slower software release cycles, limited analytics capabilities, and heightened security risks.15

Assessing technical debt with quantifiable metrics like backlog hours, proportion of unsupported operating systems, patch latency, and unplanned downtime frequency can help organizations develop stronger cases for investments in cloud migration and other remediation efforts.16

Comprehensive assessment strategies include:

- Diagnosing the current IT operating model to benchmark and expose inefficiencies

- Rationalizing the application portfolio by retiring outdated and redundant systems

- Modernizing infrastructure by transitioning from on-premises to scalable, cloud-based platforms

- Building a self-funding business case by quantifying savings and reinvesting in transformation initiatives

Regular assessments can help shift technical debt from an intangible liability to a prioritized investment-driven opportunity, allowing health systems to reduce ongoing costs and accelerate meaningful change.

Consumer-facing metrics are only periodically assessed by just over half of respondents (52%), despite clear evidence of technology’s impact. For instance, digital patient portal use reduced no-shows by 21 million visits in 2024 across 1.6 billion outpatient visits,17 and self‑scheduling tools are generating new revenue streams for some health systems.18

Workforce measures are tracked even less, with only 44% of the 25 technology and finance leaders surveyed periodically measuring the impact on workforce productivity and satisfaction. The rest measure these areas ad hoc, if at all, even as the workforce faces talent shortages and burnout.19 Involving both clinical and nonclinical staff in the design and implementation of technology initiatives can help improve adoption and facilitate better measurement.20 Deloitte’s previous research found that health systems prioritizing clinician engagement—actively involving them in the design process, providing upskilling and training, and keeping communication clear and open—are five times more likely to have their tech initiatives rated as effective by frontline clinicians.21 In addition, emerging technologies such as ambient listening and generative AI show the potential to improve workforce productivity and clinicians’ work experience in measurable ways (see “Ambient AI: Transforming clinician productivity and well-being”).

Ambient AI: Transforming clinician productivity and well-being

Emerging technologies like ambient AI are redefining how workforce experience is measured, offering real-world proof beyond traditional metrics. Clinician documentation remains one of the most time-consuming and dissatisfying aspects of medical practice, consuming more than a third of providers’ working time and fueling burnout.22 Ambient AI tools capture clinical conversations and generate structured, electronic health record–ready notes, allowing clinicians to focus on patient care.

Adoption is accelerating, with more than 300 US health systems already using ambient AI-driven scribe technology since the past two years,23 and industry investments doubling to US$800 million in 2024.24 Reported impacts include:

- Efficiency and capacity: A study showed that an academic medical center spent up to 20% less time on note-taking, 30% less after‑hours work, and improved same‑day chart closure.25

- Reduced burnout: Another study showed clinicians meeting burnout criteria fell from 53% to 31% in three months at one health system, and the proportion of clinicians reporting a positive well‑being and joy at work rose from 2% to 32% at another health system.26

- Increased revenue: Using ambient scribing and documentation, a health system realized US$13,049 additional revenue per clinician annually through improved documentation integrity and coding while easing documentation burden.27

- Improved patient experience: A recent report found that 81% of surveyed patients noticed physicians spent less time on computers when ambient scribes were used. Another health system showed an 8-percentage-point improvement in patient experience scores when ambient scribes were used.28

While ambient AI is likely to have a tangible impact, challenges like documentation accuracy, hallucinations, and data privacy concerns remain. However, continuous measurement and feedback can help organizations realize the full benefits.29

Market competitiveness and brand reputation are among the least monitored metrics. Just 24% of the surveyed leaders are assessing them periodically, while 40% do not measure them at all—even as technology increasingly influences consumer choice and organizational growth. This gap is notable because many executives cite growth, market share, and differentiation as strategic aims of technology investments. Some may argue that market competitiveness and brand reputation are often intangible and difficult to assess through the lens of technology. However, with evolving consumer needs, greater choices and price transparency, brand and market effects may not be completely intangible—they may be increasingly observable in today’s environment. Proxy metrics such as digital front door options and workforce engagement rates can provide insight into technology’s broader strategic impact.30

Bridging the gap: Where to start

Health systems that measure technology’s full spectrum of value—financial, clinical, consumer, and workforce—may be well positioned to lead in the digital era. Turning technology investments into real value means treating outcomes as measurable products, assigning clear ownership, and providing continuous oversight. Three actionable approaches to consider in order to enhance technology value tracking and realization include:

- Define a comprehensive value taxonomy. Establish a unified value framework integrating both traditional measures (such as cost savings, revenue growth, and efficiency) and nontraditional measures (such as patient outcomes, workforce experience, health gaps, and access). This can help position organizations to demonstrate resilience and leadership while meeting stakeholder expectations. A systemwide taxonomy, developed with finance, clinical, human resources, and digital leaders, can position organizations to earn future funding confidence, strengthen brand reputation, and set the pace for industry leadership. Notably, 80% of surveyed leaders agree that this approach would significantly improve technology investment outcomes.

- Implement a value-centric governance model and data modernization approach. Sustained value involves ongoing accountability. Establish a governance model with robust benchmarking, a dynamic benefits ledger, clear ownership, regular checkpoints, and periodic during and post-implementation reviews. Half of the surveyed leaders report gaps in accountability for tracking value, and 40% point to insufficient post-implementation audits as a top challenge. By embedding periodic reviews and adapting targets as conditions change, health systems may be more likely to realize the long-term value they expect.

- Invest in a robust value measurement infrastructure. Closing the value gap involves building an analytics backbone that can fully capture, analyze, and report value across clinical, financial, and human-capital domains. Key steps include improving data quality and interoperability between systems, dedicating appropriate resources, and deploying advanced technologies like generative AI and agentic AI to automate data collection and surface actionable insights. By embedding these capabilities into the organization’s analytics backbone, health systems can continuously track both tangible and intangible benefits, offering a more complete and actionable view of technology’s value.

As transformative technologies become more prevalent, measurement is likely to be the ultimate differentiator between innovations that deliver results and innovations that simply add costs. Health systems that can measure technology’s full spectrum of value—financial, clinical, workforce, and reputational—could set the standard for future performance. In contrast, those that cannot may miss opportunities and experience increased innovation fatigue.