2026 banking and capital markets outlook

The year ahead will likely demand bold choices as banks balance macro headwinds, AI ambition, and the potential disruptive entrance of stablecoins

How could the macroeconomic realities in 2026 impact the banking and capital markets industry’s revenues and profitability?

What does the disruptive entrance of stablecoins mean for banks and payment firms?

What should banks do in 2026 to industrialize AI at scale?

Will some banks’ AI ambitions be thwarted by their brittle and fragmented data infrastructure?

Can banks’ defenses keep up with the increasing speed and sophistication of financial crime?

2026 appears to be shaping up as a defining year for US banks. Macroeconomic uncertainty, diverging consumer sentiment, and persistent inflation could test banks’ revenues and profitability, even as strong capital positions provide resilience. Banks could be forced to defend margins, diversify fee income, and prepare for increased competition from nonbank entities.

The payments landscape also seems to be at a crossroads. Stablecoins, backed by the new Guiding and Establishing National Innovation for US Stablecoins Act legislation, could impact deposit flows and challenge traditional payment rails. Banks should decide whether to issue, custody, process, or partner—and do so quickly, as tokenized deposits and programmable money reshape customer expectations.

Meanwhile, AI is at an inflection point. Many banks are under pressure to scale and move beyond pilots, but 2026 will likely demand robust, enterprise-level strategies, governance, and a disciplined approach to return on investment. Agentic AI offers breakthrough potential, but only if supported by AI-ready data—accurate, timely, broad, and securely governed. Without this data foundation, even the most ambitious models could stall.

Separately, financial crime risks are escalating, fueled by AI-enabled fraud, sanctions complexity, and rising costs. Integrated, tech-driven defenses are imperative.

This report offers potential prescriptions for banks in the above areas. The leaders who act decisively in 2026 may shape the future of banking.

Sustaining growth while balancing optimism and caution in 2026

The range of possible scenarios for the US economy in 2026 remains wide, with possibly yet another year of surprises for the US banking industry. Banks will likely be watching carefully for the impact of tariffs and the strength of the labor market. At this point, there are at least three possible scenarios for how the US economy might evolve in 2026.

In the downside scenario, the impact of tariffs on inflation and economic growth could be apparent as the year unfolds, with the potential for higher inflation and a more stressed labor market. GDP growth could stall or even turn slightly negative for a quarter. The US dollar could also continue to lose ground.

Conversely, in the upside scenario, these risks could remain dormant and keep the economy humming without any major hiccups.

A third, more probable, baseline scenario is the middle path. In this scenario, the economy is predicted to stumble briefly in 2026, but the setback is short, and recovery follows with GDP growth reaching about 1.4% in 2026, down from 1.8% in 2025.1

Looking ahead to 2026, consumer sentiment could be further tested, dampening spending in a meaningful way. Household debt, as of the second quarter of 2025, reached a peak of $18.4 trillion. Consumer confidence has also declined recently,2 but there is a bifurcation in sentiment: The affluent continue to spend and feel more confident, while the middle class is feeling “squeezed.”3 The year-over-year spending growth for lower income households was 0.3%, compared with 2.2% for higher-income households in August 2025.4 This disparity may well continue into 2026. According to Deloitte’s economic forecast, aggregate real consumer spending could grow by 1.4% in 2026 in the baseline scenario.5

Business spending, on the other hand, seems to face a mixed outlook. While AI-related projects, particularly data centers, could boost business investments,6 uncertainty around tariffs may restrain business confidence. Deloitte forecasts business investment to grow by about 3% in 2026, slightly lower than 3.6% in 2025.

The job market also began to show weakness, with a perceptible decline in job openings and higher unemployment among younger workers.7 In 2026, wage growth may moderate, and the unemployment rate could rise from 4.2% in 2025 to 4.5%, as per Deloitte’s economic forecast.8

The inflation picture remains tentative. After modest gains in 2025, the Consumer Price Index may hover at roughly 3.2% in 2026. But with a weakening job market, the Federal Reserve may drop interest rates to 3.125% by the end of 2026.9

Deloitte forecasts that the yield curve should steepen, as long-term yields may remain high due to higher inflation expectations, concerns about the federal debt, and the strength of the US dollar.10 Short-term yields could decline due to a lower rate environment in 2026.

How the macroeconomic environment could impact the banking industry

Banks are likely to enter 2026 on a relatively strong footing, following resilient earnings in the first three quarters of 2025. However, they may face some headwinds in net interest income in 2026, driven largely by lower rates and a slowing economy.

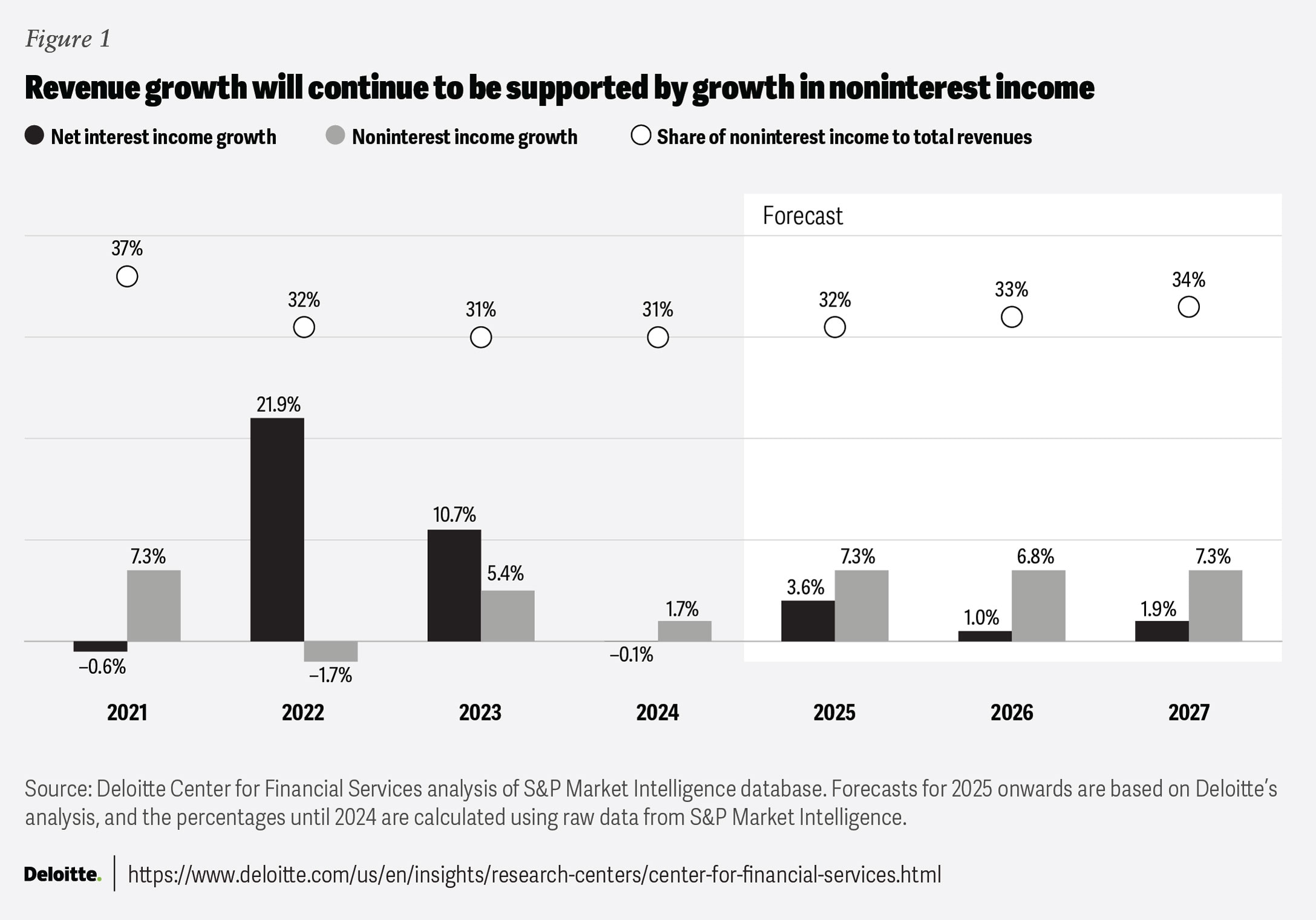

Net interest income improved by 4% in the first half of 2025 after a decline in 2024.11 However, net interest income growth in 2026 could be modest (figure 1), likely driven by lower loan yields. Deposit costs, however, should continue to drop. The average cost of interest-bearing deposits had already declined to 2.5% in the first six months of 2025.12 But deposit betas may remain relatively low, particularly for regional banks, as the competition for deposits remains high.13

Meanwhile, loan growth could pick up as rates fall. Corporate borrowers could enjoy lower rates, reversing the 5.6% drop in the volume of commercial and industrial loans in the first half of the year.14 Spending on AI and data centers would likely keep demand for debt relatively high, even from the most cash-rich companies. Yet, the competition from nonbanks and private credit firms should continue, especially in the middle-market segment.

The commercial real estate market has seemingly turned the corner, with property sales activity continuing the recovery from last year.15 Commercial real estate loans have also seen some stabilization, but banks may remain selective with both existing and new borrowers.

Growth in credit card loans is expected to stabilize in 2026, following a 2.8% decline in the first half of 2025.16 According to the July 2025 Senior Loan Officer Opinion Survey, demand has weakened for credit card lending, and banks have tightened lending standards.17

Credit losses should remain manageable, as per the banks’ guidance.18 Higher unemployment could push provisions for loan losses a bit higher, but there should not be a dramatic spike. Student loan delinquencies may rise.19 Nevertheless, many banks appear to have sufficient reserves and adequate capital to manage adverse macroeconomic turmoil.

Strong, diversified noninterest income should continue to be a key revenue driver for banks in 2026, with fee-based growth continuing to increase next year (figure 1). Investment banking and capital markets are likely set for growth due to demand for dealmaking and lower capital costs, leading to higher equity and debt issuances. Wealth-management fees should also climb in 2026 with banks expanding advisory offerings for the affluent.20At the same time, growth in payments could be affected adversely by decreased consumer spending. Large banks, in particular, should benefit from new sources of fee income from stablecoins, data monetization services, and embedded finance.

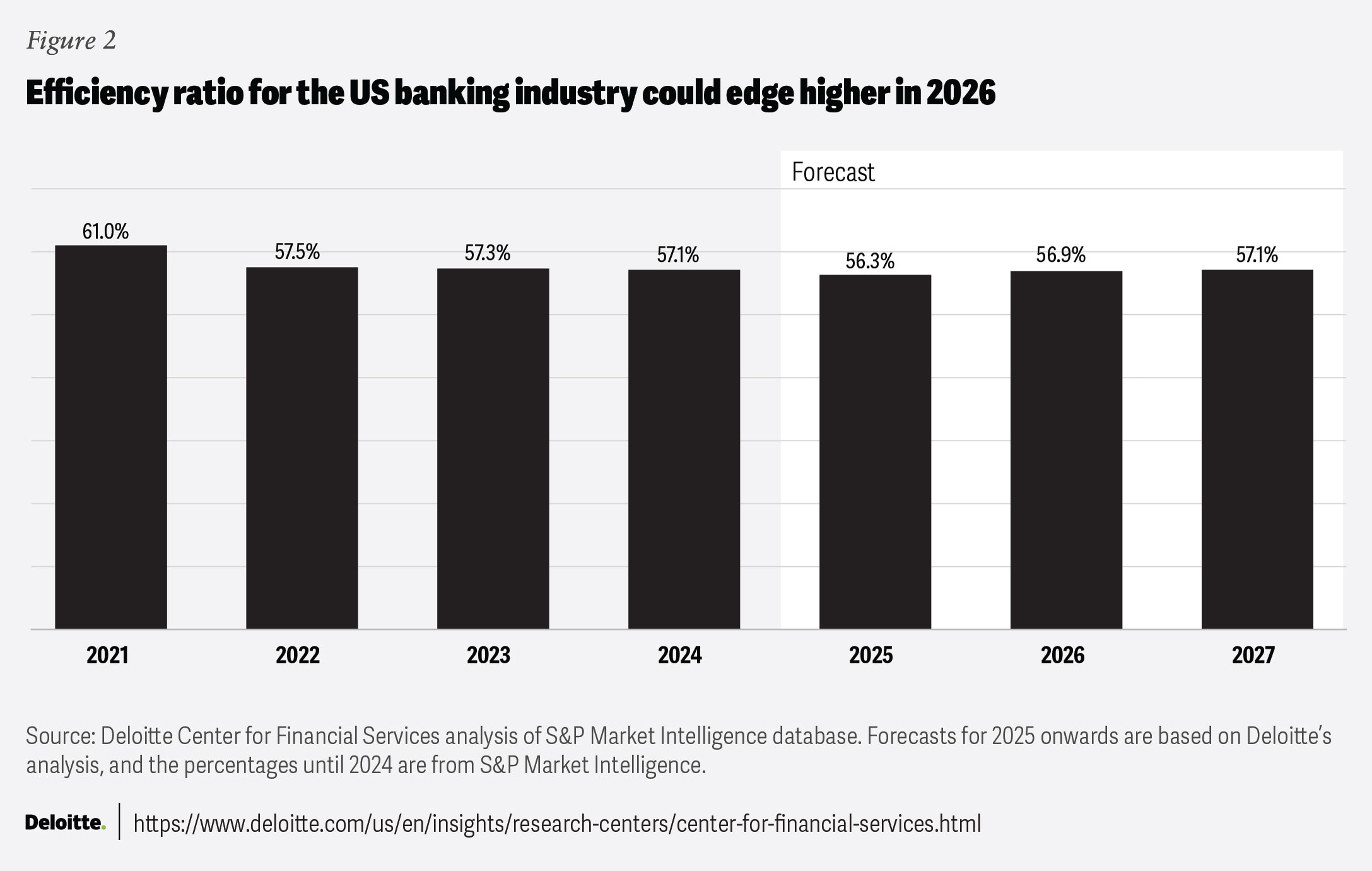

Amid modest revenue growth predicted in 2026, banks will likely remain laser-focused on costs. Compensation costs and high technology spending may slightly pressure efficiency ratios (figure 2). Nevertheless, AI’s positive effect on productivity, at least for some banks,21 is expected to continue in 2026.

On the capital front, US banks remain well capitalized—the average common equity tier 1 ratio has remained above 14% over the last five years.22 In addition, the proposed regulations to modify the enhanced Supplementary Leverage Ratio could benefit large banks by reducing the aggregate capital requirements to a range of 3.5% to 4.5%, down from the current range of 5% to 6%.23

There was excess capital of over $250 billion among the top 20 US banks through the first half of 2025.24 As a result, banks may continue returning capital through dividends and share repurchases and use some of the proceeds to fund growth and AI ambitions.

Rate trajectories around the world

Many European banks are exhibiting a strong comeback. They have outperformed many of their global peers—with a 45% year-to-date increase in share-price returns through August 202525—even with current global macroeconomic tensions.26 Looking forward, they may see a pickup in loan growth amid falling rates and continued support from noninterest income. There could be mild deterioration because of trade tariffs, but it would largely remain under control. After many years of stagnation, European banks may enjoy improved economic growth—either organically or through consolidation—in the coming years.27

Meanwhile, Asia-Pacific banks are likely to show strong growth in emerging markets, though challenges persist in certain economies, especially those with exposure to US trade tariffs.28 Capital market activities recorded a slump in July, with banks in the region raising $6.6 billion, one of the lowest totals in the past year.29

Banks brace for potential deposit disruption while assessing stablecoin opportunities

Stablecoins could herald a new era of money, presenting both challenges and opportunities for banks and payment companies. 2026 could be a pivotal year to develop strategies and address the risks related to stablecoins. In response, banks will likely need to bolster their infrastructure and capabilities as alternatives to deposits and payment rails emerge.

The July 2025 Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act created a legislative framework for payment stablecoins (PSCs) in the United States, providing regulatory clarity and opening the door for traditional banks to be involved in tokenized digital assets. The bill is part of a larger effort designed to help the United States become the “crypto capital of the world.”30 This and other potential legislation should spur further digital asset adoption by corporates and consumers alike.31Institutional demand is already evident: Nearly one in four chief financial officers surveyed expect to use cryptocurrencies within the next two years as a payment method or corporate investment, according to Deloitte’s second quarter 2025 North American CFO Signals survey.32

Due to their unique attributes, PSCs could play a more formidable role in financial services. They can offer faster and cheaper payments and settlements than traditional financial infrastructure. Unlike other types of digital assets, PSCs are backed by reserves of fiat-currency assets, like US treasuries, to maintain a one-to-one peg ratio.

Tokenized deposits: An alternative to payment stablecoins?

As some banks consider their options with stablecoins, an alternative solution has also emerged: tokenized deposits. Like PSCs, they also provide instant settlement, lower transaction costs, and programmability for customers of the same bank. Uniquely, tokenized deposits have the advantages of native cash settlement and the ability to pay interest, and they may also be used as payments for other digital assets and as on-chain collateral.33 Unlike PSCs, they remain within the existing regulatory framework of a bank: These deposits remain liabilities of banks, subject to the same capital management and regulatory oversight.

Notably, tokenized deposits could be a counterstrategy for banks that are cautious about the impact of PSCs on deposit funding. Some banks, including J.P. Morgan and Citibank, are already offering tokenized deposits to clients alongside their efforts with PSCs.34

Drivers of PSC growth and threats to deposits and fees

The primary appeal of stablecoins has typically been tied to their role in crypto trading. As price-stable assets, PSCs have often become the preferred medium for moving between more volatile crypto tokens and for serving as a tool for efficient settlement, arbitrage, and collateral. Moreover, their deep liquidity and predictable value have made PSCs the default choice for on- and off-ramp conversions, establishing them as a bridge between traditional finance and the crypto economy.35

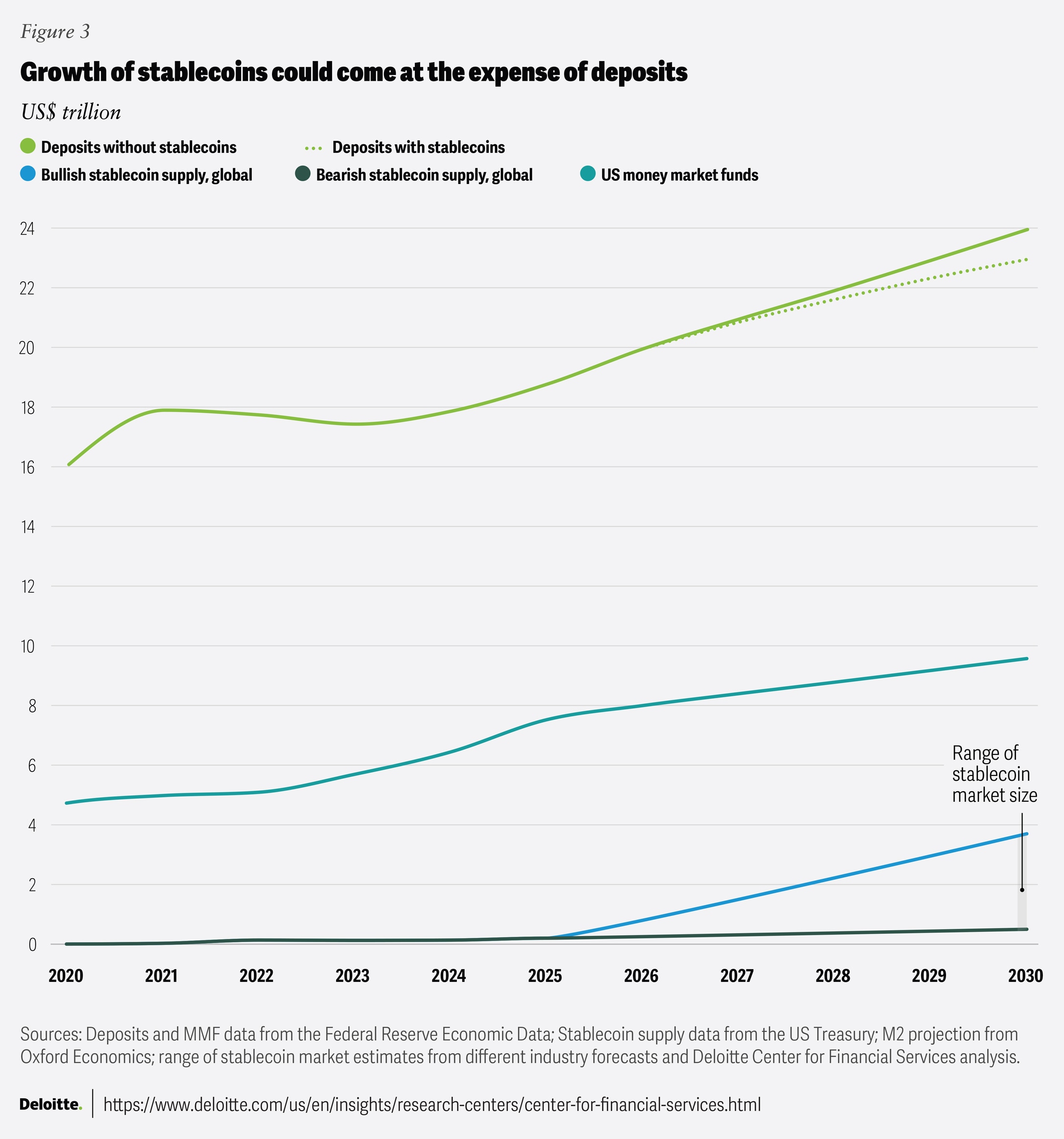

While the current market for PSCs is relatively small, various industry forecasts suggest potential growth from $250 billion to a bullish estimate of $3.7 trillion, or a bearish estimate of around $500 billion by 2030.36 The growth of PSCs could pose a threat to bank deposits, with more than $1 trillion potentially at risk (figure 3).

Flows are anticipated to come from three buckets: corporate working capital held in low-yield transaction accounts; retail transaction balances for 24/7 peer-to-peer and commerce use; and cross-border settlement float currently trapped in nostro or vostro networks. While the GENIUS Act prohibits stablecoin issuers from paying interest, non-issuers can offer “rewards,” potentially spurring demand.37 Given the significant potential impact of PSCs on deposit flows, banks could face tighter liquidity and reduced lending capacity.

Different roles banks and payment companies can play

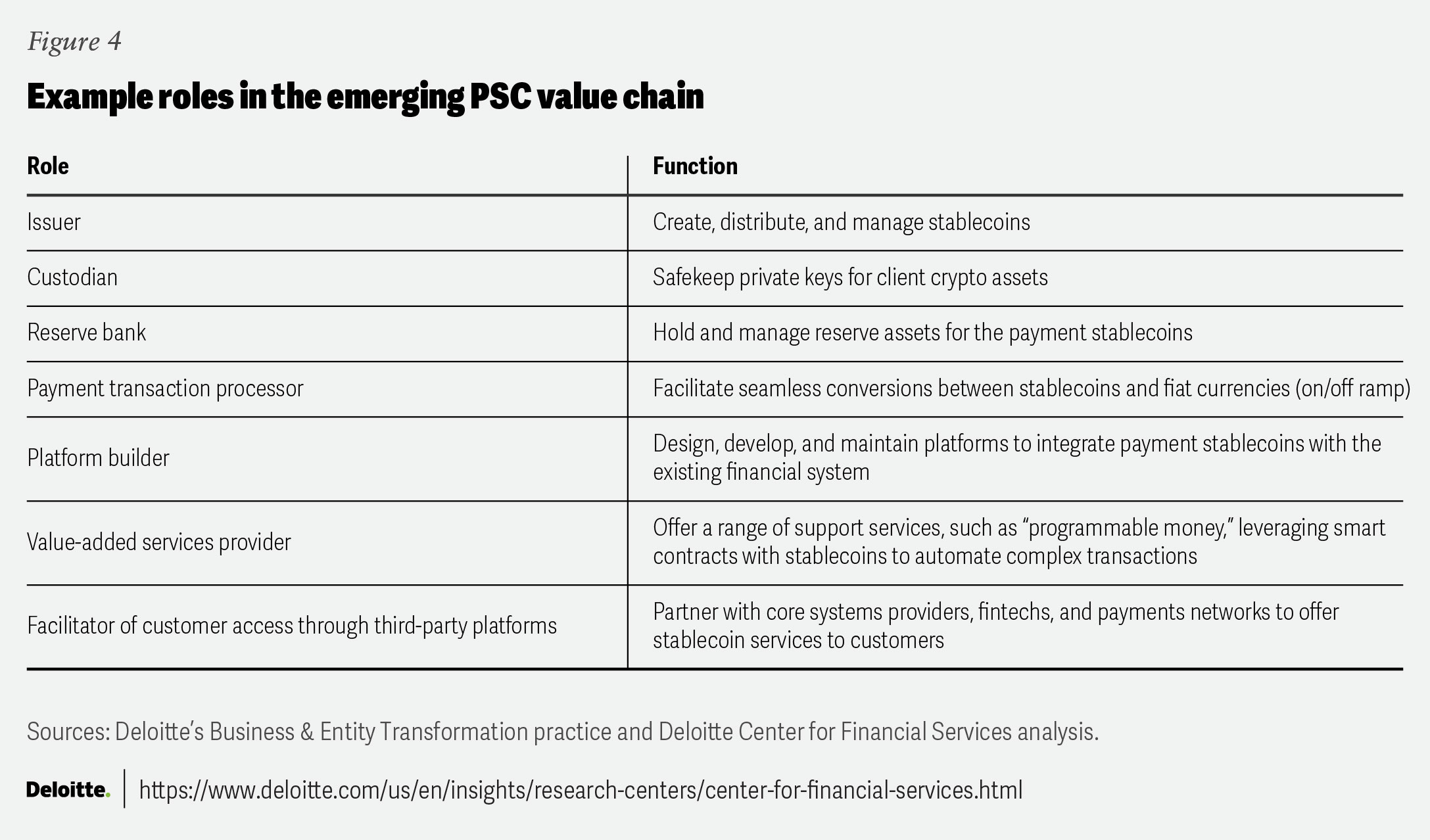

Some banks and payment firms are already preparing for the PSC market, with a range of potential roles—and there may be others—outlined in figure 4.38

By July 2026, federal banking regulators will likely establish the regulations and guidance required under the GENIUS Act. In advance of that date—and ahead of the rules taking effect in January 2027—banks should be proactive in choosing their strategy and delivering on it.39

Accounting for new regulatory and risk considerations

Financial institutions will need to address capital and liquidity rules designed to ensure that issuers maintain a one-to-one peg ratio. They should also hold adequate US asset reserves for foreign entities in the United States to meet liquidity demands from US PSC holders.

Market participants should also await clarity on rules related to tax treatment, accounting standards, know your customer (KYC) and anti-money laundering (AML) obligations, and other aspects of market functioning that will likely shape how PSCs are integrated into financial systems. Regulators are also likely to weigh in on issues related to scalability, fees, fraud, irrevocability, and identities of validators. This guidance could be critical since PSCs could challenge oversight and adoption by functioning like traditional currencies without being classified as money or securities.

While many firms develop new systems and operations, they should also consider how PSCs could alter existing procedures and processes. For example, tokenization attributes could embed KYC and AML compliance requirements, triggering the need to freeze or block transfers to prohibited persons or entities. Furthermore, given the public nature of source code, AML investigators can easily track, source, and stop stablecoin transfers and identify wallet recipients, which can be both a remedy and a customer-privacy risk. Joining consortia can help firms share resources and scale faster.40 Some regional and community banks may turn to “PSC-as-a-service” solutions like Fiserv’s FIUSD, launched in partnership with Circle for its 3,000 bank clients.41

Embracing the future of stablecoins

A regulated PSC market is poised to accelerate digital asset adoption, fostering innovations such as crypto-backed loans.42 Several crypto firms like Circle, Ripple, and Paxos have already applied for bank charters in the United States, suggesting increased convergence between traditional banking and the digital asset world.43

Looking ahead, as rules are finalized, the continued growth of stablecoins is likely to accelerate innovations such as programmable payments, near-real-time trading, and on-chain treasury management.44 If banks and payment companies have not already done so, they should plan their own pilots and applications now or risk potential disruption, since stablecoins are likely to be the gateway to a tokenized economy.

Five steps banks should consider to move beyond isolated AI projects

The year 2026 could be pivotal for banks as they aspire to become fully AI-powered. Currently, AI implementation within banks is often throttled by brittle and fragmented data foundations, mounting compliance demands, outdated legacy systems, and internal resistance to change. Many AI initiatives are stuck in isolated proofs of concept, marked by weak governance, duplication, and uneven impact.

Many bank executives also seem to be grappling with unrealistic productivity expectations and facing increasing pressure to demonstrate tangible results. Despite large and growing AI budgets over the past two years, most US banks have only achieved sporadic tactical wins rather than true strategic transformation.45 Our review of the top 40 US banks reveals predominantly “reactive,” siloed efforts that yield inconsistent value.46

Reframe a clearer and more unified AI vision and strategy

Until now, most banks have generally taken a federated and patchy approach to AI, especially generative AI. While many have experimented, adoption often lacked an overarching vision. Is the primary aim to drive efficiency, accelerate innovation, or strengthen risk management and resilience? Without a unified vision, banks may struggle to identify scalable AI opportunities and measure progress against key performance goals.

To date, only a handful of institutions have articulated a cohesive, firmwide AI strategy where every piece fits together and operates in unison. To succeed, the vision should spell out concrete outcomes; recognize risks, costs, and human implications; align with the bank’s broader mission; be communicated consistently across all stakeholder groups; and be underpinned by disciplined funding.47 Done well, this could prevent the sprawl of disconnected pilots and channel resources toward initiatives with the greatest strategic impact.

Establish clearer ownership and governance for AI

Banks should have clear ownership across the AI life cycle, yet accountability is often fragmented or absent.48 Approaches also vary in how employees can access and use AI tools, making it important to define which responsibilities sit with a central team and which reside within business units.

For most banks, a hub-and-spoke model could be an optimal choice. This model can help ensure that the needs of different business lines are adequately managed, anchored by a central unit like an AI center of excellence.

This central entity can help drive quality across the enterprise and uphold AI governance standards while serving as the operational hub for AI adoption—maintaining a living roadmap for execution across the enterprise. In addition to developing the AI strategy, it could also be responsible for reference architecture, standards, shared assets, and MLOps or LLMOps49 services to help ensure interoperability. Beyond governance, the center of excellence could focus on training, playbooks, and knowledge sharing, and help support delivery by operating core AI platforms.

Reassess the “build vs. buy” calculus

The build vs. buy choice is another recurring dilemma but takes on a different flavor with AI. Many banks have adopted a hybrid model for traditional AI, like machine learning—building proprietary models while buying point solutions and platforms for less differentiated needs.50 For gen AI, some banks have shifted the focus toward an assembly approach in which they buy the foundation model layer but build custom proprietary layers around it with data connectors, guardrails, and third-party solutions.

Beyond leveraging third-party expertise, this approach can help reduce time to market and experimentation costs. The “buy” option can also shift the risk of potential cost increases to third parties.51 Smaller banks, in particular, often have no choice but to adopt a hybrid approach because of tighter budgets, scarce talent, and lower risk tolerance.52

However, the assembly approach is not without challenges. For instance, proprietary layers should be well integrated with the foundational model(s). Also, if every bank uses the same models—or the models from third parties happen to be similar—the only differentiation lies in the proprietary, bank-specific layers.

To help build their competitive differentiation with gen AI, banks should lean heavily on proprietary data. They should also be creative in where and how these models are applied: narrow, high-impact workflows could outperform sprawling moonshots. Finally, banks should invest in specialized talent like prompt or retrieval-augmented generation (RAG) engineers, evaluators, and designers who can turn models into robust systems. This is where true differentiation might lie.

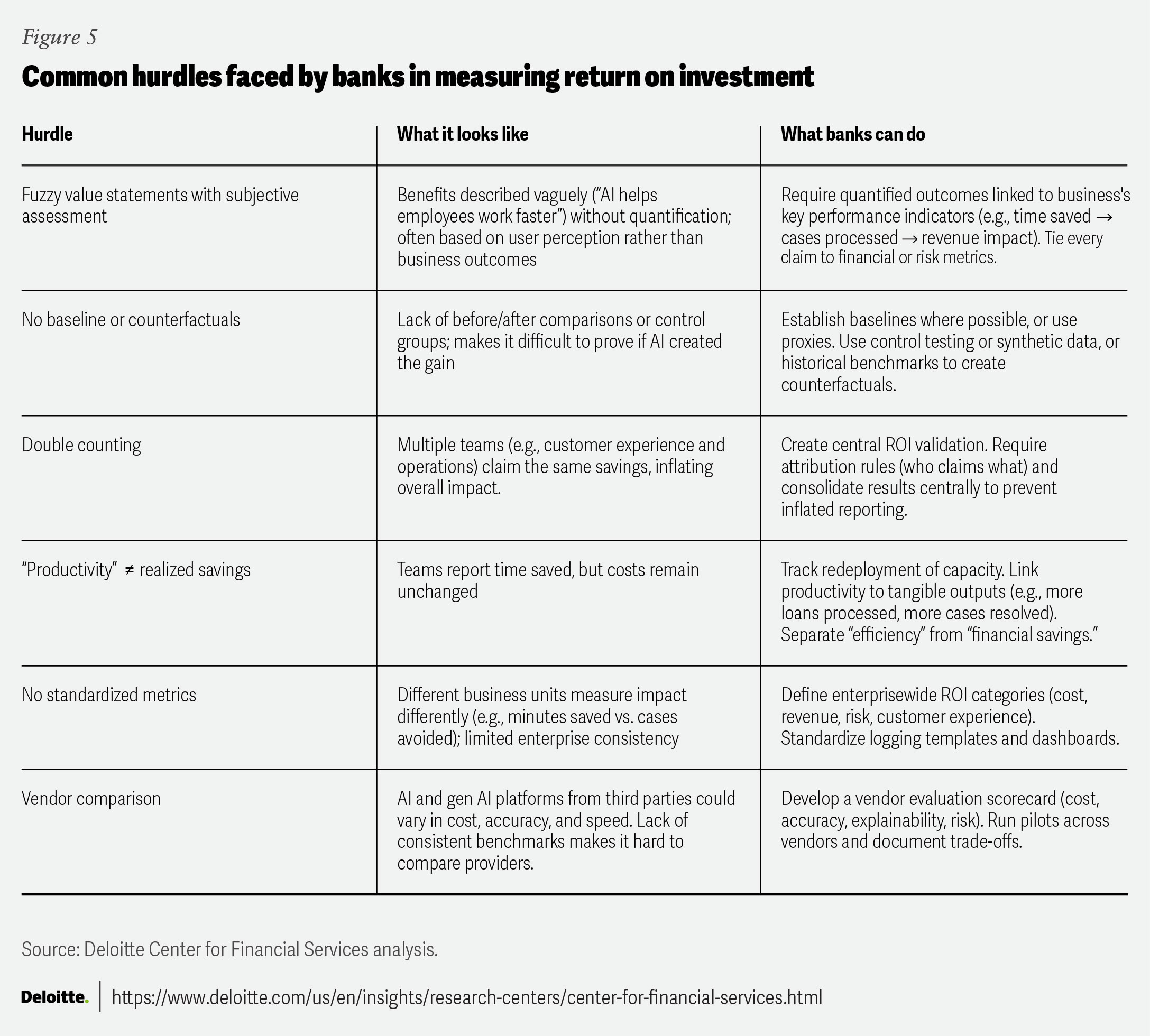

Measure and track ROI with discipline

As AI scales, measuring impact can become critical, yet some senior executives find it hard to assess value beyond anecdotal or subjective metrics like hours saved or calls shortened.53 Software developer productivity is perhaps one area where ROI measurement is most advanced.54

Without standard baselines, counterfactuals, or consistent key performance indicators, benefits often rest on user claims rather than measurable financial outcomes. This can create a credibility gap, making it hard to link soft benefits to tangible cost savings or revenue gains. Many gains can also be second order: for example, shorter customer service calls may improve customer satisfaction, helping drive cross-sales—yet these effects remain hard to quantify. Gen AI can complicate the issue with claims of productivity not connected to actual costs.55 Only 4 out of 50 banks analyzed by Evident in 2025 reported realized ROI from AI use cases.56

Preparing for new industry-specific models and agentic AI

General large language models are powerful but often limited in addressing the complexity of banking operations. The real step change can come from models trained on bank-specific data and workflows. For example, Claude for Financial Services emphasizes governed research, modeling, and compliance workflows with auditable data use.57 Open-source models like FinLlama Instruct have also been shown to outperform certain LLMs in algorithmic trading.58 Meanwhile, small language models are gaining traction—cheaper, faster, and easier to deploy on in-house systems. Tailored to industry data, these models can promise more practical ROI, reducing reactive spend while enabling more focused and trustworthy AI adoption.59

Possibly, the most critical frontier today is agentic AI—autonomous agents that have the ability to take initiative and execute actions.60 Banks should start to embed compliance into the agents themselves, including permissions, auditability, and human checkpoints. They should also prepare the foundations for scale: cloud-based infrastructure, orchestration for multi-agent systems, and strong data governance with quality, lineage, and accessibility protocols. Banks should also shift from a human-at-the-center model to an AI agent-at-the-center approach, with humans in the loop for consequential decisions and oversight, supported by purposeful change management and, where needed, organizational redesign.61

As adoption grows, some banks are rethinking their infrastructure. Many turn to third-party providers for speed, but unsustainable compute costs demand a hybrid AI infrastructure—combining on-premise systems with public, private, and specialized clouds—to help scale flexibly, safeguard sensitive data, and meet regulatory demands.

AI won’t deliver without the right foundations

Success with AI implementations will likely be limited unless banks address other challenges, including modernizing core infrastructure, migration to the cloud, and bolstering data architecture and governance. Banks should also not shy away from a cultural reset where humans and AI collaborate seamlessly, boosting productivity while preserving accountability, trust, and compliance across the enterprise. But a key is to set the vision at the top, back it with investment, and drive alignment so that each AI initiative, no matter how small, can ladder up to a bigger strategic story.

Redoubling the commitment to a modern, AI-ready infrastructure

Many banks have made sizable progress in modernizing their data infrastructure. In particular, moving core data to the cloud62 has helped strengthen their data management practices. However, without an AI-grade data infrastructure, models may underperform, gen AI pilots could stall63 or fall short of regulatory standards and customer expectations, and future agentic AI initiatives may fail to launch. As AI moves from pilots to enterprise scale, building a more resilient and future-proof data architecture could be critically urgent.

What have banks done to become AI-ready?

Our analysis indicates that data readiness for AI among US banks is highly uneven—both across banks and within the same institutions.64 While cloud migration should streamline and organize data better,65 “bad” data may have been migrated, or data may still exist in silos within the cloud.

Additionally, US banks that prepared their data for regulatory compliance should have helped with AI-readiness66 with cleaner, more traceable, and better-governed data. For example, capital and liquidity rules have forced some banks to consolidate risk data and establish lineage; stress-testing regimes such as the Comprehensive Capital Analysis and Review (CCAR) and the Dodd-Frank Act Stress Test (DFAST) have driven more timely, auditable data sets; and AML and sanctions reporting have required standardized customer and transaction data.67 But, these investments often remain siloed, serving only their original compliance mandate rather than being scaled into a foundation that could power AI across the enterprise.

US banks with previous experience in robotic process automation (RPA) and AI should have established data catalogs, clear lineage, quality metadata, new controls, and continuous quality monitoring to improve the accuracy, calibration, and stability of AI models. For instance, banks like BNY are using external sources such as the National Institute of Standards and Technology’s AI risk management framework to align their use of data across the AI life cycle.68

Others are treating data as a product. J.P. Morgan’s Fusion, for example, offers standardized, aggregated private-markets data sets to institutional investors.69 This data-as-a-product approach can help enable consistency, discoverability, ownership, and reusability of data in both internal and external environments. It can also create licensed, high-quality training and RAG-ready retrieval sets.

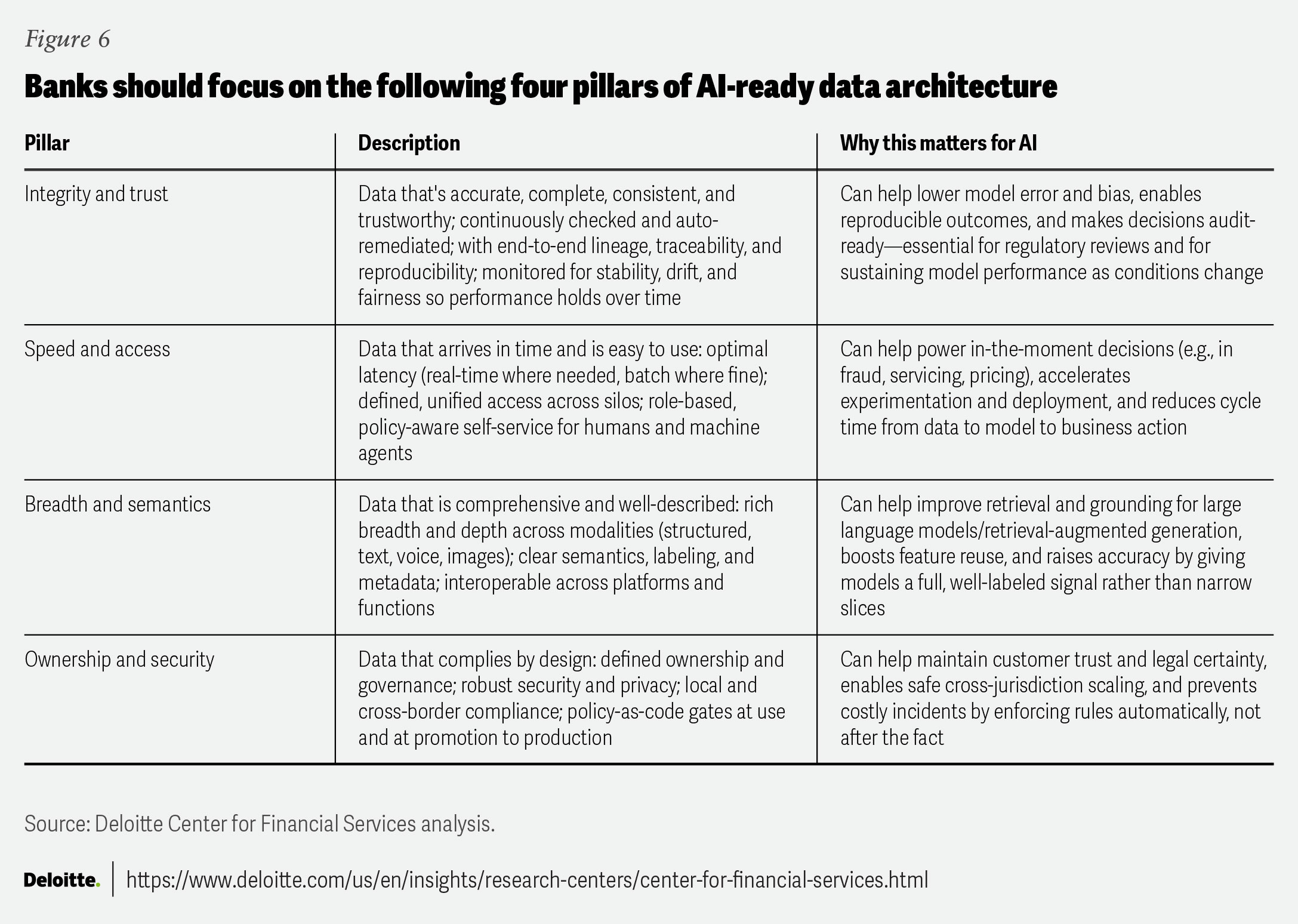

What it means to have AI-ready data

AI is redefining what “good data” means in banking. Figure 6 summarizes some of the key pillars of an AI-ready data architecture.

Banks’ AI readiness is often slowed by the data foundations that models depend on. Poor infrastructure can result in data sprawl, vulnerability, and limited data-led innovation, limiting model efficacy. In addition, data silos often leave training sets incomplete and biased. The impact is evident. In Deloitte’s 2024 Banking & Capital Markets Data and Analytics Market Survey,70 more than 90% of data users in banks reported that the data they need is often unavailable or takes too long to retrieve. Data quality also ranked high, with 81% of respondents citing it as a top challenge.71

AI-ready data should be reliable enough that errors and drift do not erode model performance, timely enough to match the cadence of decisions, broad enough to capture signals across different formats, and governed tightly enough to meet compliance and security demands.

These data attributes are mutually reinforcing. For instance, latency without trust can deliver bad data faster; breadth without context can add noise rather than insight; and governance without usability can starve innovation. Strengthening one dimension often exposes weaknesses in the others. The challenge for banks is often not picking which aspect to optimize but advancing all four in concert so the data foundation keeps pace with the scale, speed, and sophistication of modern AI. In our analysis, nearly two in three of the top 40 banks have publicly announced such programs.72

2026 priorities for data strategies to help succeed in the AI age

Data readiness is likely a multi-year journey. Banks that align executive sponsorship, budgets, and realistic timelines to make data ready for AI are more likely to realize its full potential.

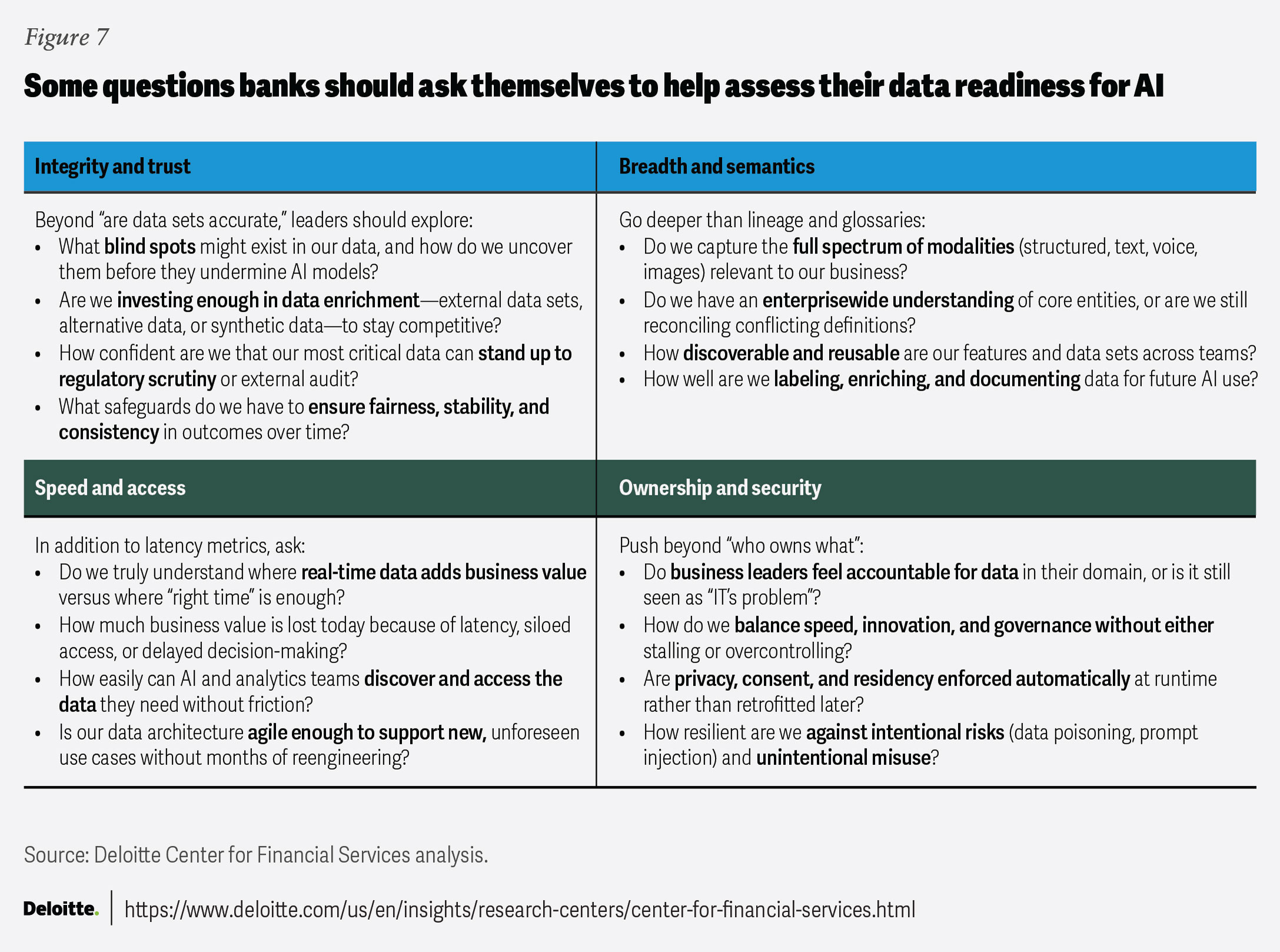

Assess data readiness for AI against the four pillars

Banks should conduct an enterprisewide data readiness review to help pinpoint, across domains and use cases, the specific fixes needed to unlock AI value (figure 7).

Banks may also develop a scorecard with minimum thresholds to help assess AI use cases. For instance, no AI project may advance without identifying the relevant data sets and features, evidencing current scores, and committing to refining where the data falls below the threshold. This should help yield higher model performance and stability, faster deployments, easier audits, and greater repeatability across teams.

Solve for the persistent challenge related to ownership

For some banks, the biggest hurdle is the absence of a single accountable owner for critical data and a lack of clear responsibility when errors arise.73 The roles and responsibilities of chief information officers, chief data officers, and AI centers of excellence often overlap, complicating governance. While there is no optimal approach, a hybrid ownership model could work in many cases. In this scenario, centralized units can supervise standards for data and platforms and manage compliance, potentially under CDO leadership. For example, HSBC’s principles for the ethical use of data and AI provide a bank-level policy anchor for accountability, access, and responsible use.74 At the same time, business lines may hold accountability for data by treating it as a product and maintaining quality.

Use AI to make data better

Today’s AI capabilities can significantly help monitor, repair, and enrich data at scale. For instance, banks can employ supervised anomaly detection models that can be trained on historical error patterns and placed at ingestion points to flag data anomalies within seconds. State Street is using AI to enhance data quality.75 Data owners can also use AI models for lineage and documentation. LLMs can also parse tools such as SQL, then auto‑generate lineage graphs and data‑dictionaries. This can help keep metadata current even as code evolves.

The result is a feedback loop in which AI makes the data fitter for AI: quality improves, lineage stays current, privacy is enforced, and new training material appears safely on demand. Banks that deploy these “AI for data” agents could report faster model cycles, lower operational costs, and smoother regulatory interactions—bringing them closer to an AI‑ready state.

Other considerations

In addition to the above priorities, here are several other considerations.

- Meet internal compliance requirements. Banks may be required to document the origin of every training record, how it was processed, whether it contains sensitive attributes, and how it influences model behavior.76

- Appoint CDO and chief risk officer (CRO) as joint data stewards. CDOs operationalize lineage, metadata, and enforcement, while CROs align thresholds with risk appetite and regulatory expectations and escalate breaches with funded remediation.

- Recognize that agentic AI demands organized data. Autonomous agents cannot thrive on siloed or disorganized data. Otherwise, agents could become unreliable, intensify ownership gaps, and risk making misinformed or even non-compliant decisions.

- Modernize data architecture with concepts such as the data mesh and data fabric. The aim should be to recognize the benefits of such approaches and rebuild the foundation for an AI-ready bank—scalable, flexible, and faster to adapt.

Unleashing the full power of AI

Some banks have already shown they can strategically invest, migrate, and modernize data practices. The next step should be to scale these investments into a steady cadence of improvement along multiple dimensions highlighted in this report. Embracing a bank’s cultural need and redoubling on the commitment to a more modern, AI-ready data infrastructure can help realize the full promise of an AI-powered bank.

Banks should embrace a more dynamic and tech-enabled approach to fighting financial crime

Financial crime is escalating in scale, speed, and sophistication, driving up compliance costs and operational strain on banks. In fiscal year 2024, US financial regulators issued significantly more enforcement actions for Bank Secrecy Act (BSA) and AML violations than in the previous year.77 Banks also submitted a record 2.6 million suspicious activity reports (SARs)—an average of 7,100 filings per day.78

Looking ahead, banks face greater complexities from several new sources of risk. While financial institutions must comply with statutory requirements under the BSA, the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) is coordinating with various law enforcement agencies to focus its supervision of that law on new government priorities, such as cracking down on trade-based money laundering, controlled-substance trafficking, and cartel-related transactional activities.79 These heightened regulatory expectations should place greater pressure on banks to monitor transaction flows for “red flag” indicators of opioid financing and other illicit activities conducted by transnational criminal organizations.80

Furthermore, in response to recently issued executive orders, supervisory BSA and AML examinations may incorporate reviews of bank policies and procedures for “debanking” purposes, reflecting the government’s broader push for open access to banking services.81 Banking regulators may also enforce sanctions violations more aggressively, particularly if geopolitical and trade tensions drive additional sanctions designations against key adversaries.

Recent crypto developments may add another layer of complexity to the current regulatory outlook. Policymakers have reiterated the importance of effective AML, countering the financing of terrorism, and sanctions programs to help target illicit conduct on blockchain networks,82 with stablecoin issuers facing probes into their processes for verification, SAR filing, and asset-freezing processes (see “Managing novel risks in digital and financial innovation”).83

Banks are also likely to face a surge in bad actors exploiting AI, especially gen AI. Malicious AI agents can be used to generate fraudulent, human-like behavior, learn to evade detection, and anonymize user identity.84

Elevated financial crime threat levels present a critical call to action for banks to pivot to a more dynamic and intelligence-led model for managing associated risks. The industry cannot rely on siloed data and legacy systems to deliver meaningful outcomes against external attacks, geopolitical events, and regulatory scrutiny. As a result, banks that fail to build a more tech-driven financial crime framework may grow increasingly susceptible to financial losses and criminal attacks.

Managing novel risks in digital assets and financial innovation

Banks should anticipate risks that may emerge from offering new services and pursuing digital innovation. For stablecoins, banks should take stock of AML and KYC risks that are unique to blockchain-based transactions. Since stablecoins can be transferred into digital wallets that are not associated with personal information, banks may need to develop new processes to verify the source of funds, validate wallet owners, pre-approve senders and recipients, and trace transfers through a blockchain network.

For asset tokenization, they should build monitoring systems that bridge on-chain and off-chain activity, develop platforms that can ingest metadata governing token issuance and smart contract rules, and train AI models to detect risks such as illicit minting and rapid transfers of ownership.

The strategic importance of AI and tech innovation in mitigating risks

Embed AI and tech innovation to help mitigate risks

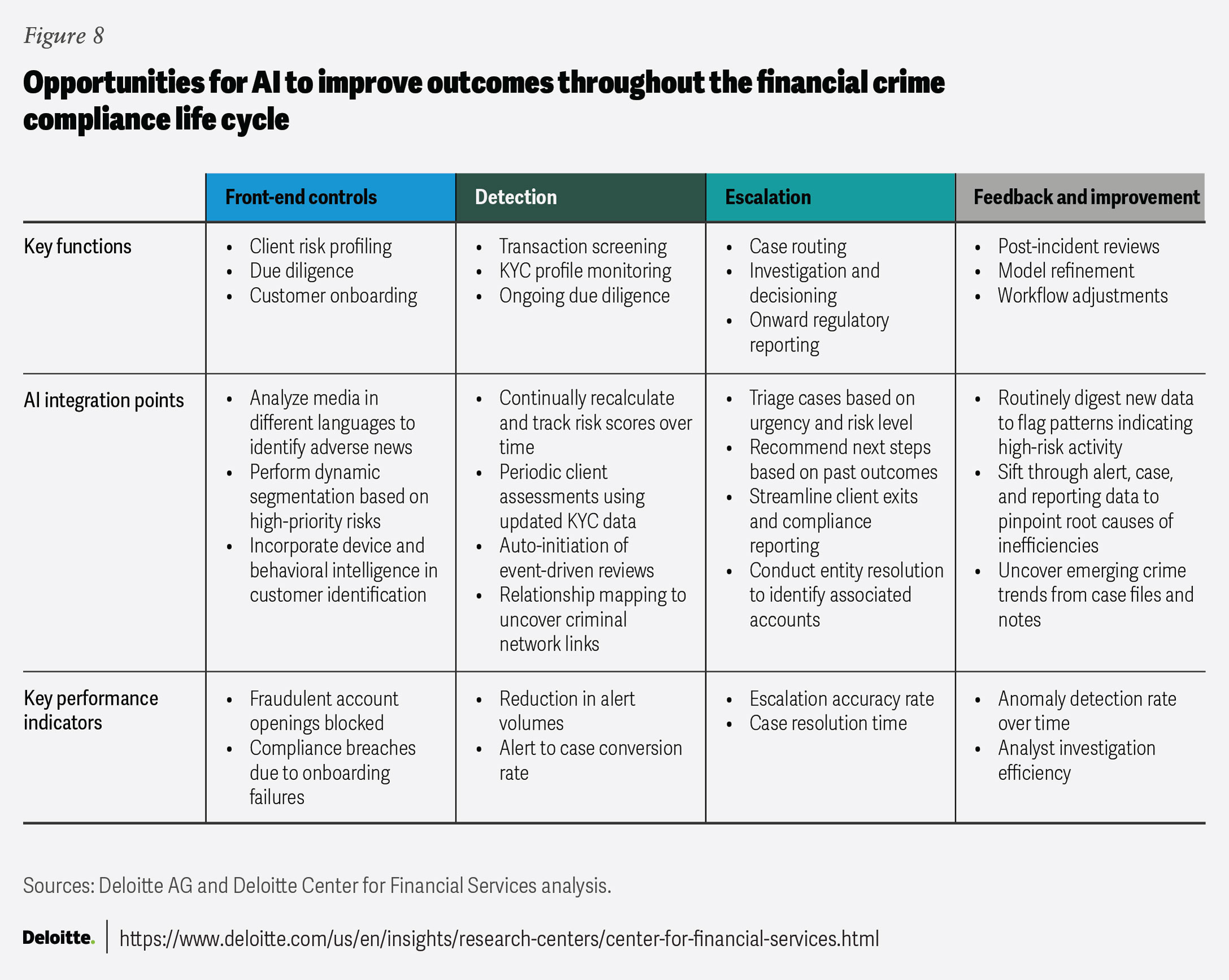

Many banks already use RPA and basic machine learning in financial crime compliance but haven’t adopted more advanced AI for deeper analysis and pattern detection.

Banks should focus AI pilots on practical wins, like summarizing customer risk, scoring alerts, and drafting case summaries. Over time, they can enable one-click decisions for simple cases and use AI to help auto-clear low-risk alerts while sending complex ones to analysts with ready-to-review summaries.

Financial crime teams should also consider the longer term, deploying AI throughout each stage of the financial crime compliance life cycle (figure 8). These integrations can help enhance customer due diligence at the onset of new relationships, strengthen perpetual KYC processes, improve behavioral monitoring of customers and their connections, and reduce the volume of low-quality alerts.85

While traditional and novel forms of AI can aid financial crime mitigation, banks should ensure human experts handle ambiguous or high-risk scenarios and embed explainability into AI-driven decision-making to promote transparency in model reasoning and retain the confidence of regulators.

Strengthening data platforms for a more reliable AML engine

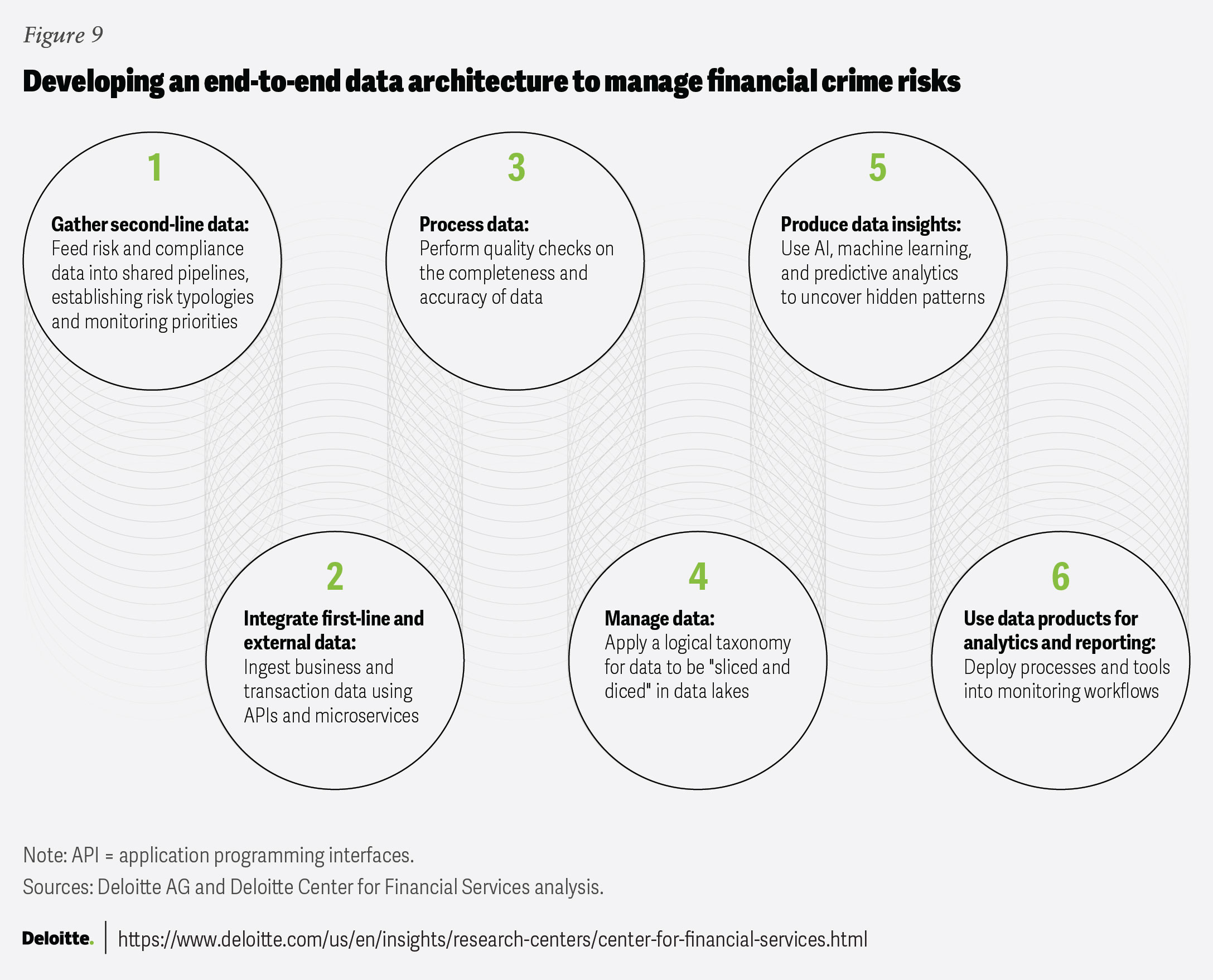

Managing large volumes of data for AI-derived intelligence will likely require consolidated data pipelines that serve as a single source of truth for risk indicators and investigative workflows (figure 9). This data foundation can not only provide a broader view of customers but can also shed light on their corporate structures, counterparties, and evolving risk profiles. In addition, by supplementing external sources like sanctions watchlists, trade and customs feeds, and search engine interfaces, banks can more effectively track risk scores over time.86

Recent enforcement actions have stressed the need for timely, accurate, and complete data, as well as more robust technology systems that can support programs addressing financial crimes. Regulators expect banks’ data and systems to be central to AML programs, not a back-office function. They have also called for more rigorous oversight, including a board-level committee, to track and remediate data defects.87Going forward, banks may be expected to maintain an up-to-date inventory of financial crime compliance systems, as well as dictionaries defining critical data elements, documentation on data lineage, and central libraries explaining how risks are cataloged and managed.

Regulators advocate for new approaches to combat financial crime

Federal regulators, recognizing the challenge of balancing compliance with strategic initiatives, may ease some supervisory burdens to promote more agile approaches to risk management. The Department of the Treasury, for example, aims to reduce reporting requirements and encourage banks to focus on higher-risk activities.88 It recently joined four other regulatory agencies to clarify that banks do not need to submit a SAR if a transaction or series of transactions exceeds $10,000 unless they know, suspect, or have reason to suspect the customer might be attempting to evade reporting requirements.89

An increased focus on the most serious threats in bank supervision could already be taking shape, as some examiners have reportedly started scaling back investigations into areas like reputational risk, sustainability risk, and inclusion.90 New rulemaking and guidance under the Anti-Money Laundering Act of 202091 may also provide banks with more flexibility to divert resources away from lower-impact controls and replace more rigid rules-based systems with AI and advanced analytics backed by model governance and data lineage.

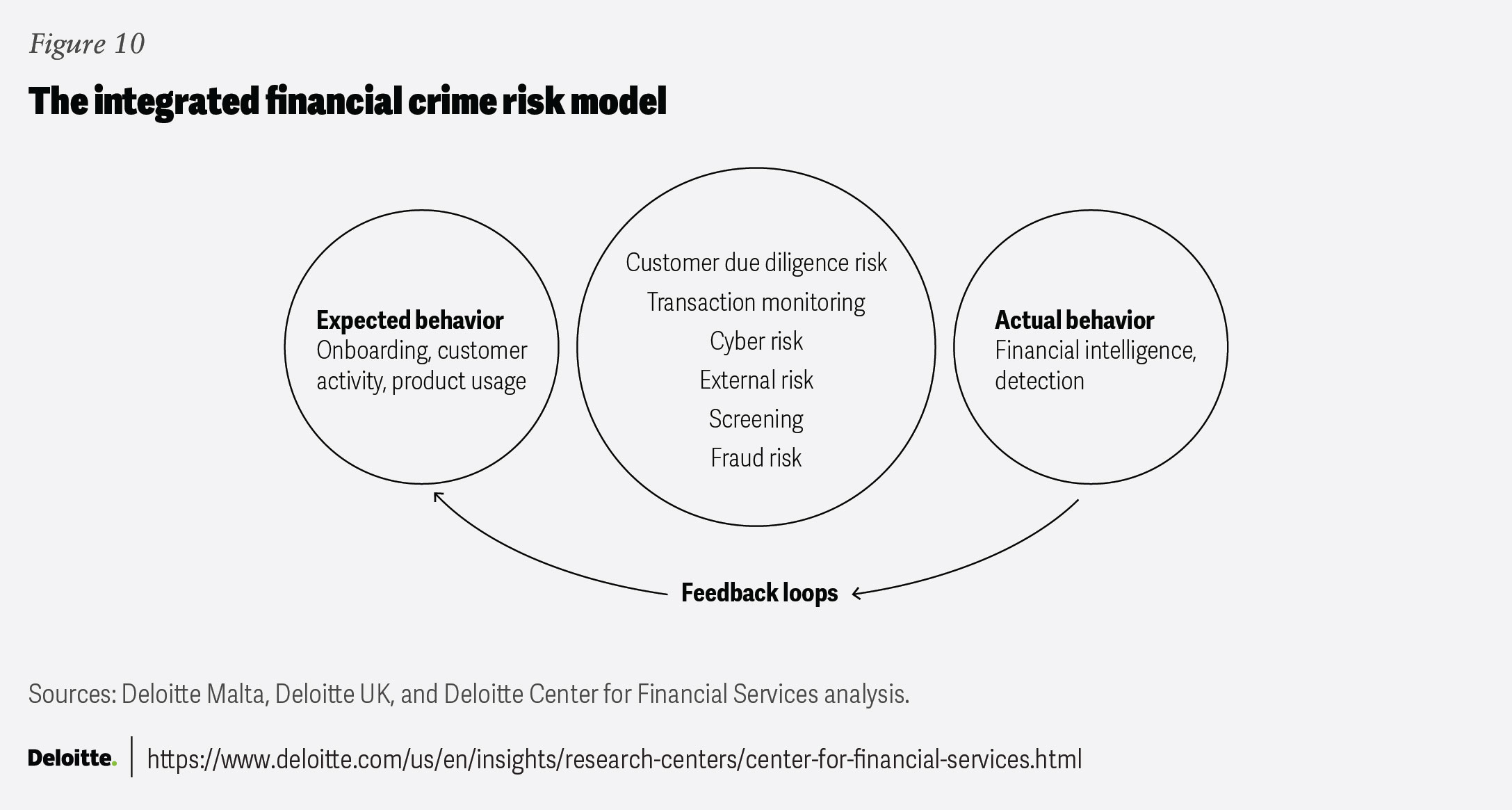

These reforms could also enable banks to be more strategic in designing their financial crime programs to more effectively address future challenges. For example, they could adopt an integrated risk model that enables cybersecurity, AML, and fraud analysts to monitor a broad set of risk indicators, converge on high-priority alerts, and coordinate investigative efforts faster (figure 10).92 This framework can assist teams in spotting malicious parties that test different methods of bypassing controls. Moreover, by feeding insights from successful outcomes back into early risk assessments and frontline controls, financial crime compliance units can continuously redirect their efforts to the most urgent and pressing threats.

Turning regulatory reform and technology into a strategic edge against financial crime

Taken together, these shifts may signal a new era of financial intelligence. With regulatory support and continuous technology improvement, banks may have an opportunity to strengthen their financial crime-fighting capabilities. Leaders who embed advanced analytics and AI while securing their data infrastructure may be better positioned to anticipate and counter an increasingly pernicious threat landscape. But they should act quickly, because rapid adaptation will likely set the standard for resilience and trust.