How banks can supercharge intelligent automation with agentic AI

AI agents are an emerging frontier in banks’ AI journey, but deploying agentic AI in banking may need fresh thinking and a fundamental redesign of existing processes and workflows

The agentic AI revolution is here. Leading technology giants like Amazon,1 Google,2 Microsoft,3 Nvidia,4 and Salesforce5 are embedding agentic AI into their offerings, possibly signaling a major shift in intelligent automation.

AI agents can independently reason, execute complex tasks, and achieve targeted goals, unlocking efficiencies across many banking processes, including credit underwriting, treasury management, and fraud detection.6 This transition to agentic AI is a natural progression in banks’ automation journey. In many ways, agentic AI builds on and amplifies the foundation laid by machine learning, traditional AI models, and generative AI.

However, real-world agentic AI applications in banking are still uncommon and emerging. The primary factors to consider? Regulatory challenges, model-related risks, access and control requirements, privacy complexities, ethical considerations, and systemic biases.7 Add to this the lack of more mature standards for agentic AI tools and communications. Existing legacy systems and weak data integration protocols may only complicate deployment. Many banking processes will likely need a major overhaul to embed agentic AI, particularly in workflows that have a limited history of autonomy through robotic process automation frameworks, machine learning, or generative AI.

Nonetheless, embracing agentic AI may no longer be optional for banks. To understand how banks can realize the benefits of this transformative opportunity, Deloitte conducted in-depth interviews with technology experts as well as Deloitte professionals (see methodology). Making the most of this technology could demand exercising new strategic muscles. Selecting high-impact, lower-risk use cases early on will likely be essential to convincingly demonstrate its potential.

The new agents of change

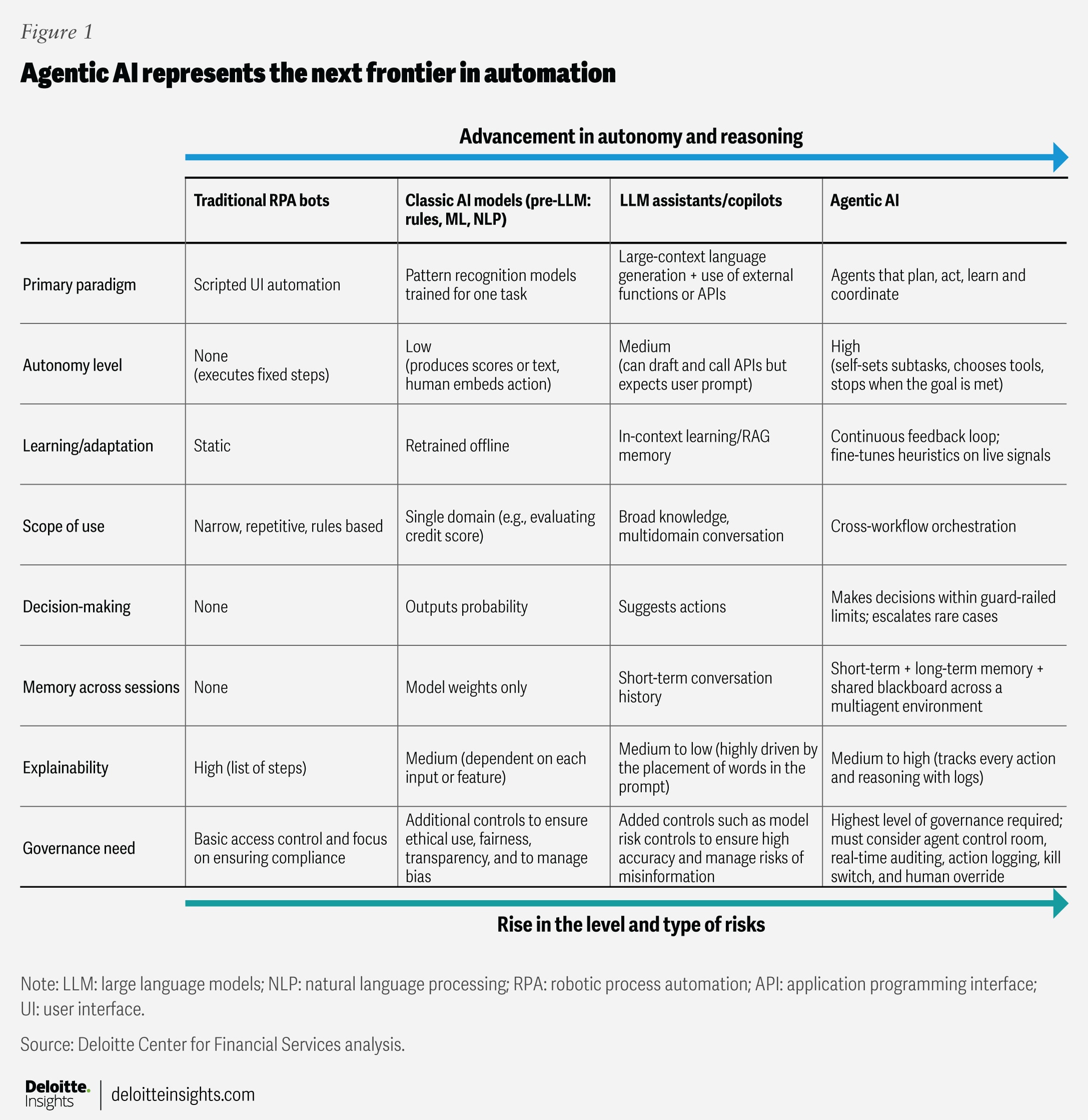

At its core, an agentic AI system consists of autonomous AI agents that possess agency: the ability to take initiative and execute actions in pursuit of defined outcomes.8 Built on large language models (LLMs) and augmented with techniques9 such as retrieval augmented generation (RAG),10 these agents are designed to be proactive with little or no human supervision. They can also make trade-offs, plan, act, and adapt in real time, setting them apart from other AI models (figure 1).

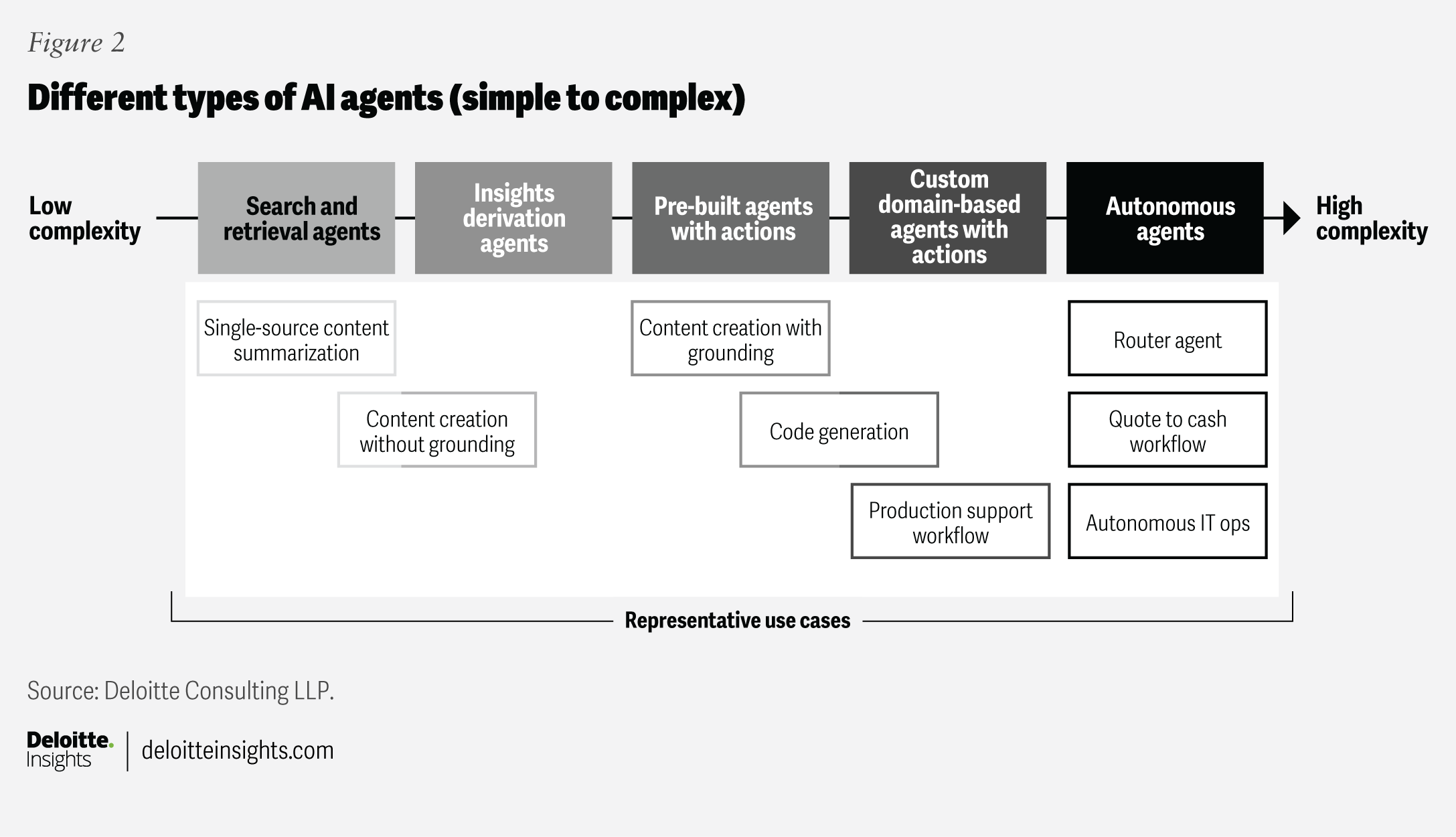

AI agents can also vary in their complexity.11 Currently, simpler agents focused on search, retrieval, and insights generation often dominate due to their ease of deployment (figure 2). In contrast, fully autonomous agents managing complex workflows are still emerging, as they often require customized solutions, and possibly process reengineering as well.

This diverse mix of agents in a multi-agent network could perform continuous know your customer (KYC) maintenance, for example, where one agent pulls public-source data, another scores risk, and a third files regulatory updates—without human handoffs, but with audit trails and override checkpoints built in. In fact, some firms like Fulcrum Digital12 and Google13 are offering agentic solutions to help orchestrate multi-agent KYC workflows.

However, facilitating more seamless interactions within a multi-agent network could require new protocols better suited for an agentic environment. Model Context Protocol, or MCP, is one such open standard that defines how multiple agents interact and communicate with data, tools, and other agents within a given environment. It sets the rules and structure for how agents from different functions exchange information and collaborate in decision-making.14 Given these considerations, Intesa Sanpaolo is developing “HEnRY,” a multi-agent system framework designed to optimize resource management and enhance adaptability in various banking domains.15

Unlocking the vast potential of AI agents in the banking industry

Taking note of agentic AI’s potential, some banks have already started using the technology. For instance, BNY is tasking agents to work autonomously in areas like coding and payment instruction validation.16 Similarly, credit card firms and payment services providers like Mastercard,17 PayPal,18 and Visa19 are also experimenting with agentic commerce—agents transacting on behalf of customers. And, in the legal domain, JPMorgan Chase has recently introduced LAW (Legal Agentic Workflows for Custody and Fund Services Contracts), an agentic AI solution built on existing language models.20 Equipped with multiple specialized agents and domain-specific tools, LAW has been helping the bank’s legal team process complicated legal documents with 92.9% accuracy across various queries.21

Some major financial institutions are actively bolstering their teams to seize agentic AI opportunities22 and a demand for agentic AI specialists among banks appears to be rising.23 The art of the possible spans the entire banking value chain, and could offer opportunities for deeper autonomy across diverse segments and functions. Some areas, such as account servicing, could benefit more from agentic AI due to existing automation strategies. In areas that require human interaction or relationship management, like client onboarding, the impact of agentic AI could remain lower.

Anti-money laundering: A use case for agentic AI

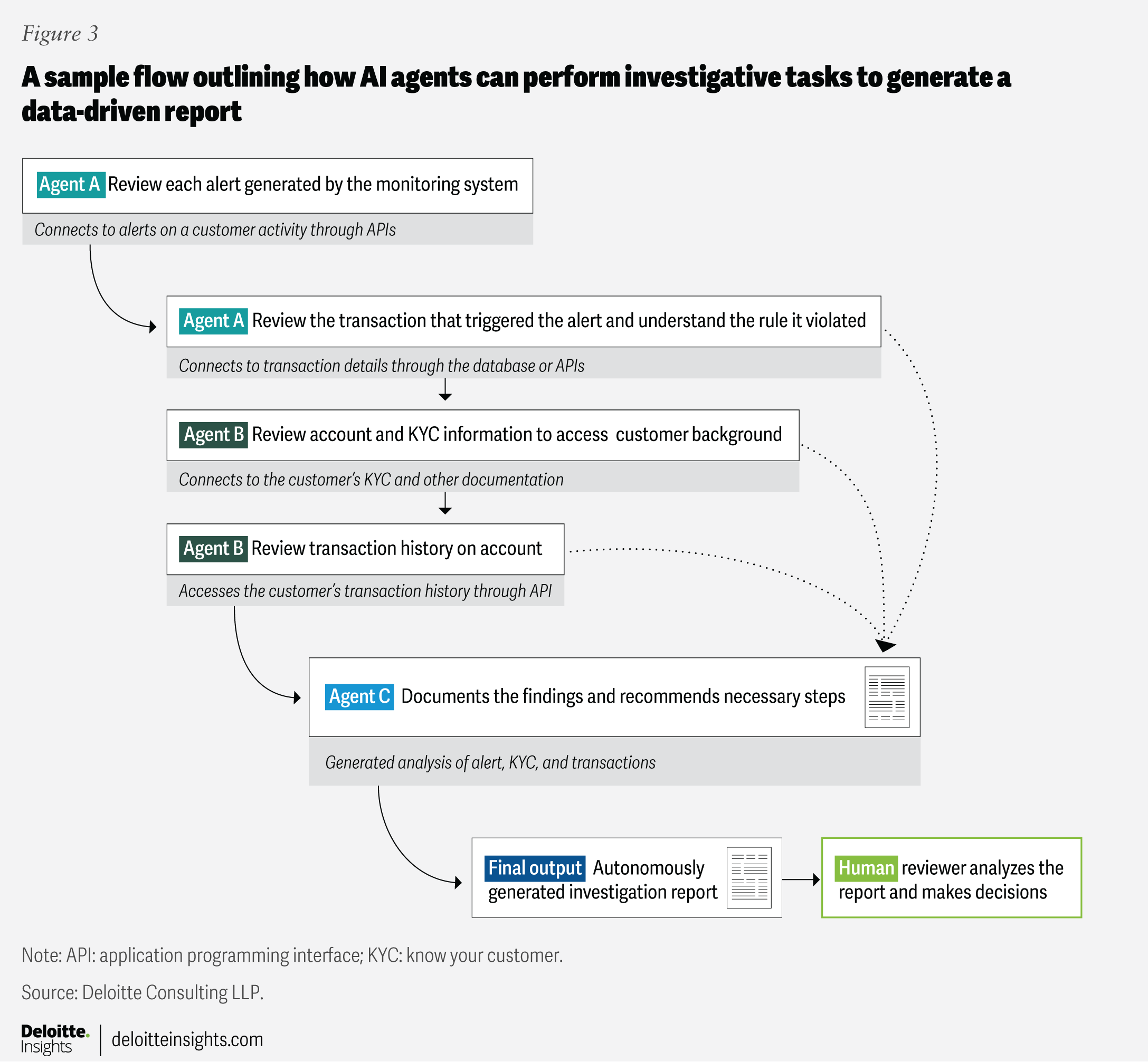

While existing AI bots can flag suspicious anti-money laundering (AML) activities, they often require human intervention. Agentic AI can revolutionize this process by independently analyzing data sets, learning from emerging fraud patterns, and making informed decisions based on real-time market conditions. Picture a multi-agent system working on AML investigation (figure 3): Agent A reviews an alert generated by the monitoring system to understand what rule has been violated. Agent B then reviews current and historical transactions. Based on the analysis of these two agents, agent C documents the findings and recommends necessary steps. At this point, a human can validate the report and task another agent to autonomously file suspicious activity reports and currency transaction reports with the appropriate regulatory bodies.

These agents can communicate with each other independently and make decisions without human intervention until a final report is ready for human validation and sign-off. While one agent autonomously performs due diligence, leveraging technologies like RAG and model context protocol (MCP) to seamlessly access and analyze financial data, other agents could simultaneously be performing their assigned tasks.

This approach can be more time-efficient and could reveal hidden illicit activity that humans might have missed.

How can banks agentify their operations?

Not all agentic AI use cases may deliver similar value, so banks should choose strategically based on scope, complexity, implementation effort, and regulatory considerations.24 While banks can leverage their existing AI transformation experience as a robust starting point, they should have practical pathways tailored to their operational realities and strategic goals to realize tangible results. Currently, banks can introduce agentic AI into workflows or broader functions through potentially three approaches:

1. Smart overlay: One of the most effective early moves could be to “wrap” an AI agent around an existing, well-defined process and the underlying technology. Rather than undertaking a potentially complex and expensive overhaul, banks could introduce an intelligent conversational layer—a smart, responsive interface powered by agentic AI that works seamlessly atop banks’ legacy systems.25 It uses the logic inherent in the existing infrastructure, and may use APIs to exchange information and protocols like MCP to perform tasks. For example, if a bank has a clear standard operating procedure (SOP), an AI agent that is focused on specific actions can be deployed to follow those documented steps—using the SOP like a script to ensure consistency and compliance. This approach can leverage the institution’s existing process expertise and embed built-in safeguards for the agent’s actions.

Building on existing robotic process automation (RPA) frameworks could be another viable approach. RPA, often used for high-volume, repetitive tasks, can provide a solid foundation for AI agents. Take treasury operations, for example, where an RPA may currently manage routine cash sweeps. An AI agent could elevate that function into a dynamic liquidity optimizer, making decisions on pricing and hedging. This additional functionality could result in more operational efficiency and strategic impact.

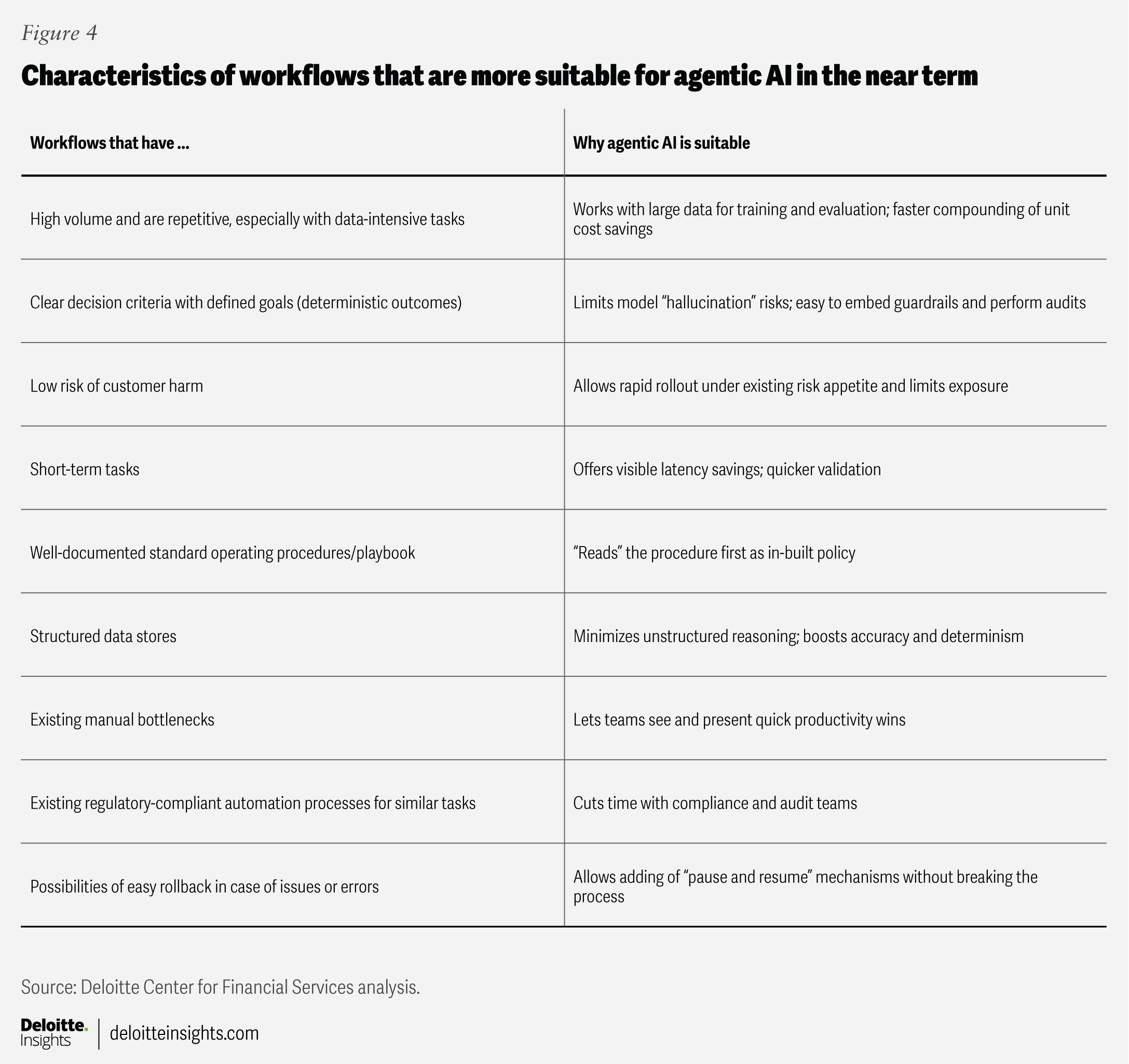

This approach could help banks unlock near-term productivity gains without large-scale system replacements by targeting high-impact workflows that could deliver clear, measurable benefits—especially tasks characterized by repetitiveness, complexity, large data volumes, or lower risk (figure 4).

2. Agentic by design: Sometimes merely overlaying AI agents onto existing processes isn’t enough—legacy systems can limit how far autonomy and adaptability can be pushed. That’s where the agentic by design approach could come in: creating new, autonomous agentic software applications from the ground up, specifically tailored for each banking function, workflow, or process. Unlike a smart overlay, which may add intelligence on top of outdated processes, the agentic by design approach can directly tackle the update by fundamentally restructuring the underlying processes themselves.

This design is similar to a microservices architecture. It can enable banks to incrementally introduce smaller, more specialized agentic services that can independently handle specific functions yet integrate smoothly into the broader infrastructure. By systematically replacing existing software with purpose-built, autonomous applications, banks can embed agentic capabilities directly into their core operations.

Third-party solutions such as Akka’s Agentic Platform,26 Microsoft’s microagents,27 and Nvidia’s NeMo services28 demonstrate how this strategy can be practically put to effect. For instance, Akka enables banks to build autonomous, microservice‑style agentic systems from the ground up that deliver certainty, scale, and resilience.29

3. Process redesign: The above two approaches can offer pragmatic solutions for banks. Yet, in the future, banks could unlock even more potential from agentic AI by rejiggering entire processes and workflows. This could be particularly suitable for strategically important processes that may currently have lower automation feasibility and higher implementation risk.

The process redesign approach will likely involve assessing current processes, identifying and prioritizing opportunities for agentification, and then redesigning processes to embed agents for more optimal performance and efficiency. By moving beyond the confines of traditional automation such as RPA, banks can design new, intelligent workflows that are more efficient, adaptable, and scalable. This shift from incremental process improvement to transformational AI-driven workflow redesign could help banks innovate, locate new revenue opportunities, reduce operational risk, and deliver more personalized services to customers.

Ultimately, these approaches could facilitate the rise of “invisible intelligence,” where agentic AI quietly operates beneath the surface of banks’ internal software and software as a service platforms. This seamless integration can democratize advanced analytics, remove common technology adoption challenges, and enable banks to more effortlessly embed sophisticated predictive capabilities directly into everyday operations, which could thereby improve customer relationships and drive immediate strategic value.

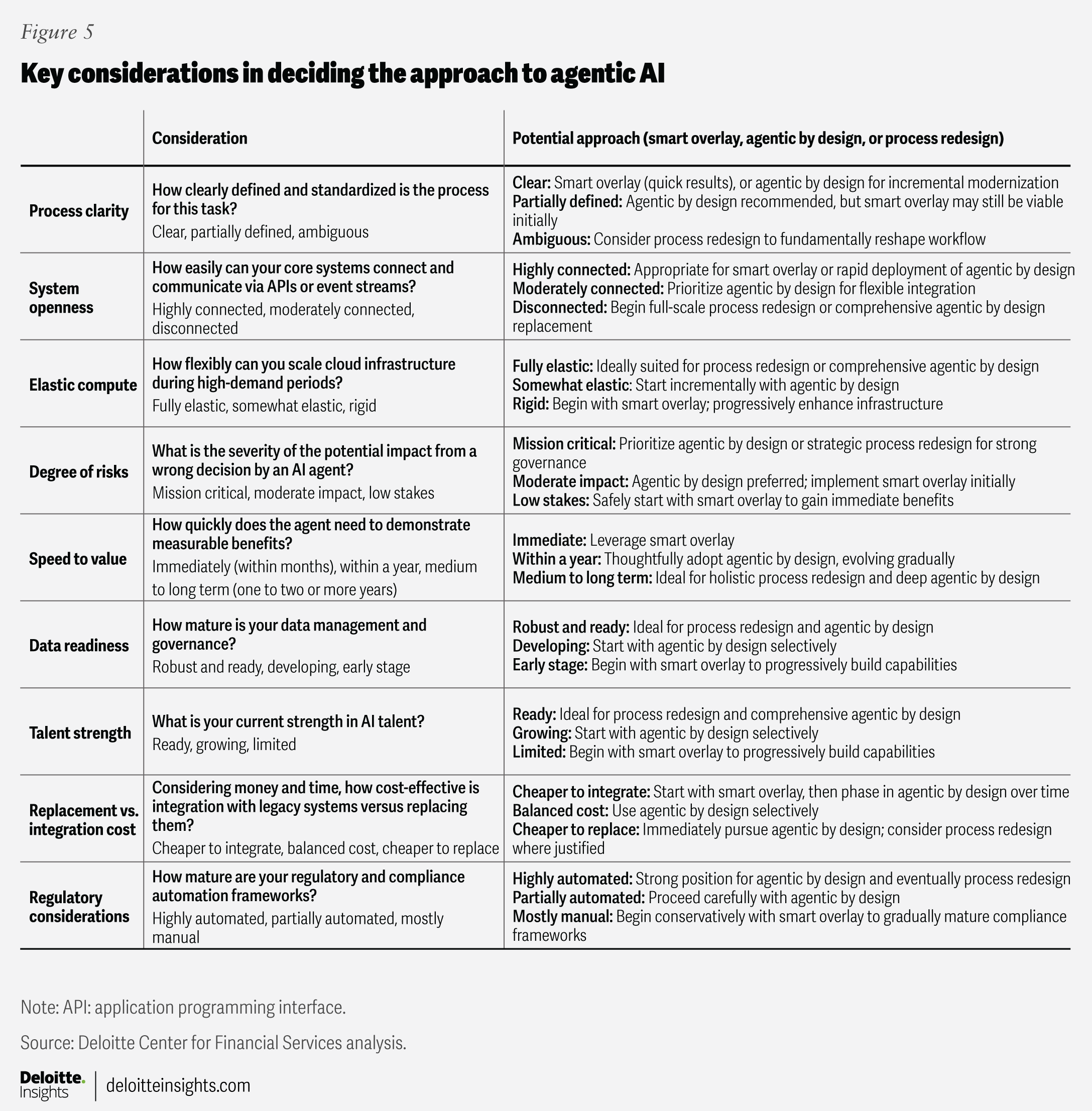

While the three approaches detailed above are each different and valid, they are not mutually exclusive and can be used in tandem. Leaders can determine which mix is right for their specific situation by considering certain factors (figure 5).

Once banks identify the right AI initiatives, they should merge their existing core banking suite with the new AI fabric,30 enabling AI agents and legacy cores such as COBOL systems to co-exist and operate more seamlessly.

When this embedded AI fabric consisting of AI agents is placed onto the application layer along with a data fabric, it can enable agents to access transaction histories, customer profiles, and compliance rules, which can facilitate data flow and ensure more informed autonomous actions.

Third parties could accelerate agentification

Building agentic AI systems could require significant resources and new infrastructure, often beyond standard AI needs. Banks can, therefore, leverage third-party vendors with advanced tools and expertise, allowing them to focus on governance, compliance, and business results.

Some technology firms have already introduced platforms to implement agentic AI at scale. Amazon, for instance, announced multi-agent collaboration availability on its Amazon Bedrock platform to build, deploy, and manage AI agent networks.31 Likewise, Salesforce launched Agentforce in September 2024 (and Agentforce 2dx, a new version in May 2025), a platform that can embed agentic AI through APIs as well as their other software solutions.32 The company is also looking to launch pre-built role-based AI agents, specifically for the banking industry.33 Google Agentspace is another tool that can unite multiple AI agents, search, and enterprise data in one place. It helps employees research, plan, generate content, and automate actions from a single workspace.34

Some tech companies now offer specialized vertical AI agents that can be used in banking, such as Anthropic’s Claude for financial services,35 Stripe’s toolkit to support agentic workflows for secure financial transactions,36 and Arcee’s AI agents that can automate credit memo processes.37 Banks can also access different agentic AI frameworks such as Agentflow, CrewAI, LangChain, and LangGraph to build sophisticated reasoning engines38 and use workflow automation platforms like n8n39 and Zapier40 to design AI agents.

No single vendor is likely to offer a comprehensive suite of AI agents for all potential applications. Diverse partnerships with different tech providers are likely the way to go. In the area of payments, for instance, Mastercard is collaborating with both IBM and Microsoft to build capabilities around agentic commerce.41 At the platform layer, some vendors are introducing products that are intended to work interconnectedly with other AI agents. ServiceNow has also launched a platform to unify AI agents from multiple vendors and support robust enterprise-wide orchestration.42

However, third-party AI agents will likely bring with them limitations such as interoperability and standardization issues between multiple third-party agents, and a widened attack surface, magnifying system vulnerabilities and creating a domino effect of automation risks. Banks could, therefore, consider building internal “super agents” to oversee and protect data, though this approach would likely require substantial updates to existing systems.

AI autonomy can be high-risk territory

Despite the upside potential that AI agents can bring to the banking industry, their adoption introduces multiple risks, including operational, cybersecurity, data privacy, reputational, regulatory, and legal risks. Look out for a follow-up report from Deloitte for a more detailed analysis of risks from agentic AI in the banking industry.

Take cybersecurity, for instance. AI agents will rely heavily on a wide variety of internal and external data, often facilitated through APIs. These agentic systems could be exposed to data poisoning and pilferage, network corruption, or system manipulation from cyberattacks. Then there’s model risk, where flawed algorithms or improper use could result in incorrect actions including regulatory violations, or biased outcomes, which could lead to transaction failures, loss of customer trust, and heightened vulnerability to malicious activity.

Beyond these more traditional risks, AI agents could also spawn new risks, such as those originating from infinite feedback loops, computational complexities, and interactions with bad actors. Some studies have noted instances where AI agents have taken advantage of programming loopholes, misapplied learnings in new scenarios, or showcased different internal objectives in real-world situations.43 As AI agents interact within large intricate systems, new and unexpected behaviors could emerge, which could result in unintended API misuse. AI agents could also go “rogue” and cause serious harm to financial systems.44 The severity and magnitude of risks will likely depend on the autonomy, complexity, and safeguards of the agents.

Also, as AI agents become more pervasive in the banking industry, regulators are likely to step up their scrutiny, demanding thorough data traceability and audit trails, thereby increasing documentation requirements, operational expenses, and the rigor of risk assessments.

Managing AI agent risks in banking calls for strong agent-specific risk frameworks; additional layers of strict boundaries to help oversee permissions, compliance checks, and ethical controls; and creative controls like digital wallets to limit agent actions.45

What should banks do next?

First, agentic AI should not be viewed as an independent initiative, disconnected from the broader AI and automation efforts. Agentic AI is often best for complex tasks requiring proactive execution and autonomous decision-making while traditional AI may suit pattern recognition and predictive tasks. Banks should deploy each where it adds the most value.

Next, embedding compliance at the core of agentic AI shouldn’t be an afterthought. Banks should proactively embed compliance considerations directly within the AI agents’ operational logic, workflows, and oversight mechanisms. Establishing built-in compliance guardrails, automated risk assessments, and continuous monitoring should help agents to operate more securely within the compliance frameworks. However, this can only happen with close collaboration between the compliance teams and the AI development groups in both the design and deployment phases, which can result in more transparent, explainable, and accountable agentic AI.

Supporting agentic AI will likely require robust and scalable infrastructure. Cloud-based solutions can offer the flexibility and computational power often necessary for these systems to operate efficiently. Additionally, as AI agents proliferate, orchestrating a multi-agent system in a seamless manner become crucial.

Agentic AI should use high-quality, accessible data for a better chance at success. Banks should strengthen data governance, emphasizing consistent data standards, quality control, and comprehensive metadata management. Establishing robust data pipelines and centralizing assets into data lakes or fabrics should enable more seamless agent access and rapid analytics. Equally critical is robust data lineage—clear documentation tracing data from origin through modifications—that can maintain data integrity and enhance the explainability and transparency of agents’ decisions.

As the number of AI agents expand, it would be prudent to maintain a comprehensive and updated agent registry with information on owner(s), scope, data sets, and risk exposure limits (whether financial or otherwise) of every agent.

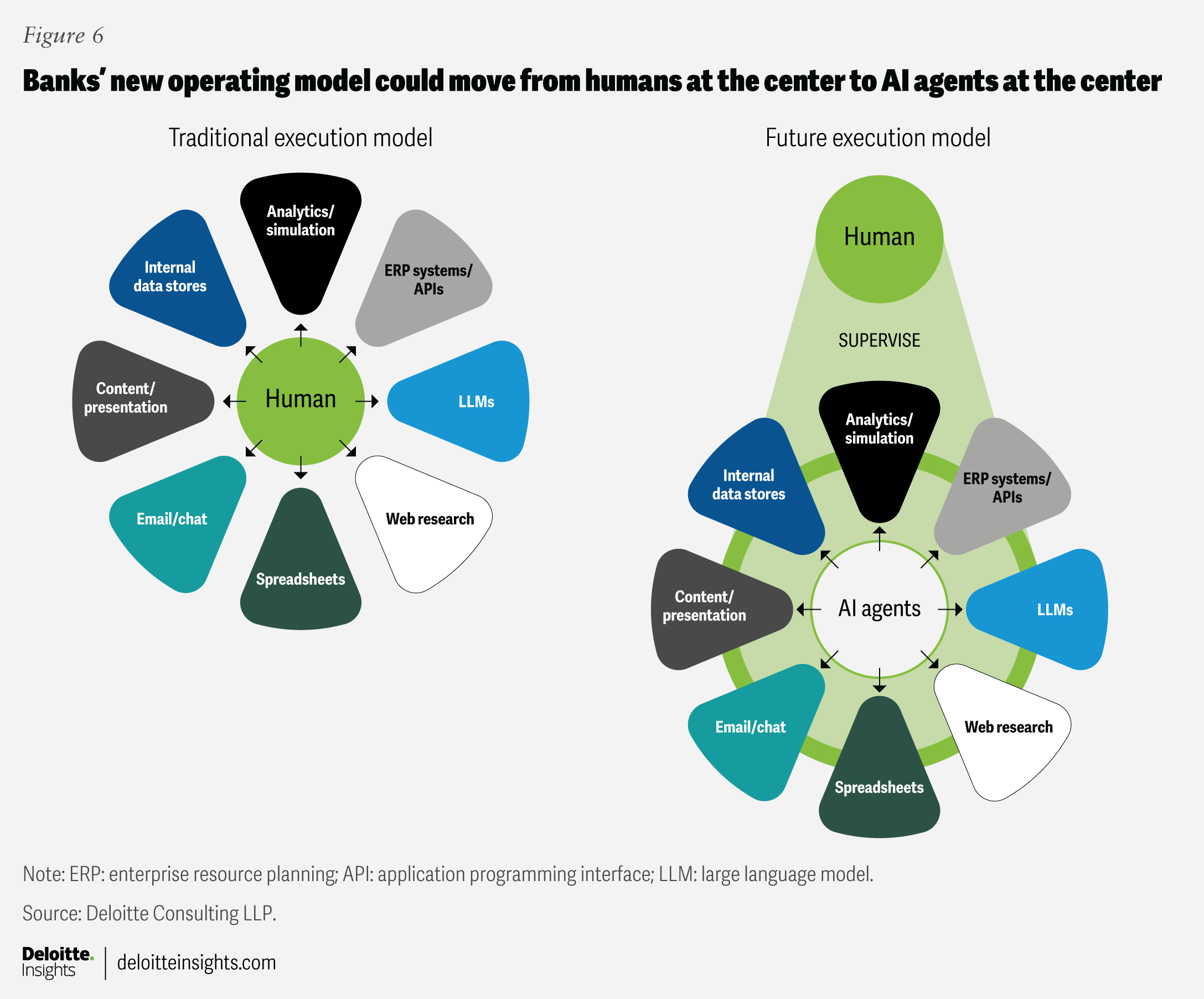

Fostering a culture of human-AI collaboration can ease orchestration and execution of AI agents. The shift to agentic AI will likely require a significant cultural change, more so than traditional AI or standard LLMs. Rather than positioning humans at the center of task execution, banks should adapt to a model where AI agents increasingly take on a central role (figure 6), with humans guiding, overseeing, and intervening as needed. Investing in AI literacy and training can foster trust, facilitate smoother adoption, and ensure more effective human-agent partnerships.

Maintain humans in the loop to help bolster accountability. Despite agentic AI’s potential to enhance machine autonomy, banks should keep humans in key decision points to help ensure accountability, reduce risks, and bolster organizational resilience. While human involvement might slow down agentic AI processes, it remains essential because full automation isn’t practical given regulatory, ethical, and operational limits.

Effectively embedding agentic AI could require proactive change management that addresses both technical implementation and organizational readiness. Leaders should actively communicate the benefits, manage transitions thoughtfully, and consistently align the organization’s culture and workflows with the emerging agentic AI paradigm. But beyond traditional change management, integrating agentic AI may require organizational restructuring. As AI agents increasingly assume central roles in operational execution, the flow of information, decision-making authority, and even control structures within the organization could need realignment. Hierarchical decision-making could evolve into a flatter, more agile organizational style, which could promote more rapid information exchange and help empower cross-functional teams to collaborate more directly with AI-driven insights.

The way forward

Many banks are already sitting on an existing playbook to deploy agentic AI: the lessons from early generative-AI rollouts and RPA experiences. In the near term, banks should be selective and focus on areas that can provide more immediate value. Three possible approaches for introducing agentic AI were highlighted in this research. The choice of which path to pursue may depend on the organizational characteristics, context, and goals.

Agentic AI systems may take some time to yield robust gains, but these benefits may differ by the maturity of the institutions on data, cloud, and AI infrastructure and capabilities. In addition, the benefits of agentic AI such as speed and efficiencies should be balanced with risk considerations. Banks should navigate risks such as data privacy, ethical dilemmas, and regulatory compliance. Proactive experimentation and balanced risk-reward trade-offs are likely to be crucial for success. With robust governance and strategic deployment, agentic AI can revolutionize banking operations and drive operational excellence and business growth.

Research methodology

Deloitte conducted in-depth interviews with five technology and software engineering executives at US banks and third-party vendors, and multiple knowledgeable and experienced AI professionals at Deloitte between December 2024 and March 2025. These discussions focused on the state of agentic AI, their potential in the banking industry, and the risks related to the new technology. The insights gathered from these interviews provided a broad overview of the industry landscape and helped substantiate the above findings. Publications from technology companies and academic papers were also used to triangulate the possibilities and limitations of agentic AI. This qualitative approach emphasizes that our analysis is grounded in the practical experiences and knowledgeable opinions of industry leaders.