From frustration to delight: Designing the next generation of AI-powered banking chatbots

Today’s banking chatbots may frustrate some. Tomorrow’s will likely advise, anticipate, and act. To get there, banks should treat chatbots as intelligent, human-centered partners.

Imagine it’s 2030. You’re ready to upgrade to a sleek new electric vehicle. You open your bank’s app and ask, “What’s the best car loan I can get?” Your personalized banking assistant—an intelligent, voice-enabled avatar—replies instantly: “Great idea. Based on your budget, driving habits, and family size, here are the top five EVs for you.” Immersive cards appear—photos, prices, monthly payments, and loan preapprovals—customized to your credit, cash flow, and goals. You tweak filters, compare insurance, or apply on the spot.

Here in 2025, we’re not quite there yet. To better understand how customers interact with banking chatbots, Deloitte surveyed 2,027 customers of US banks in January 2025 (see methodology).

The research shows that while chatbots are nearly ubiquitous in banking, they still struggle to earn customer trust and satisfaction. Most bots handle routine queries, but few inspire confidence when it counts. If banks want to close the gap between convenience and confidence, the next generation of chatbot design should go beyond automation: It should adapt, earn human trust, and address end-to-end customer experience. Too often, chatbots echo the frustration of interactive voice response systems with rigid flows, nested menus, and no clear resolution. Customers may still find themselves asking: “Can’t I just talk to someone?”

Chatbot adoption still has room to grow

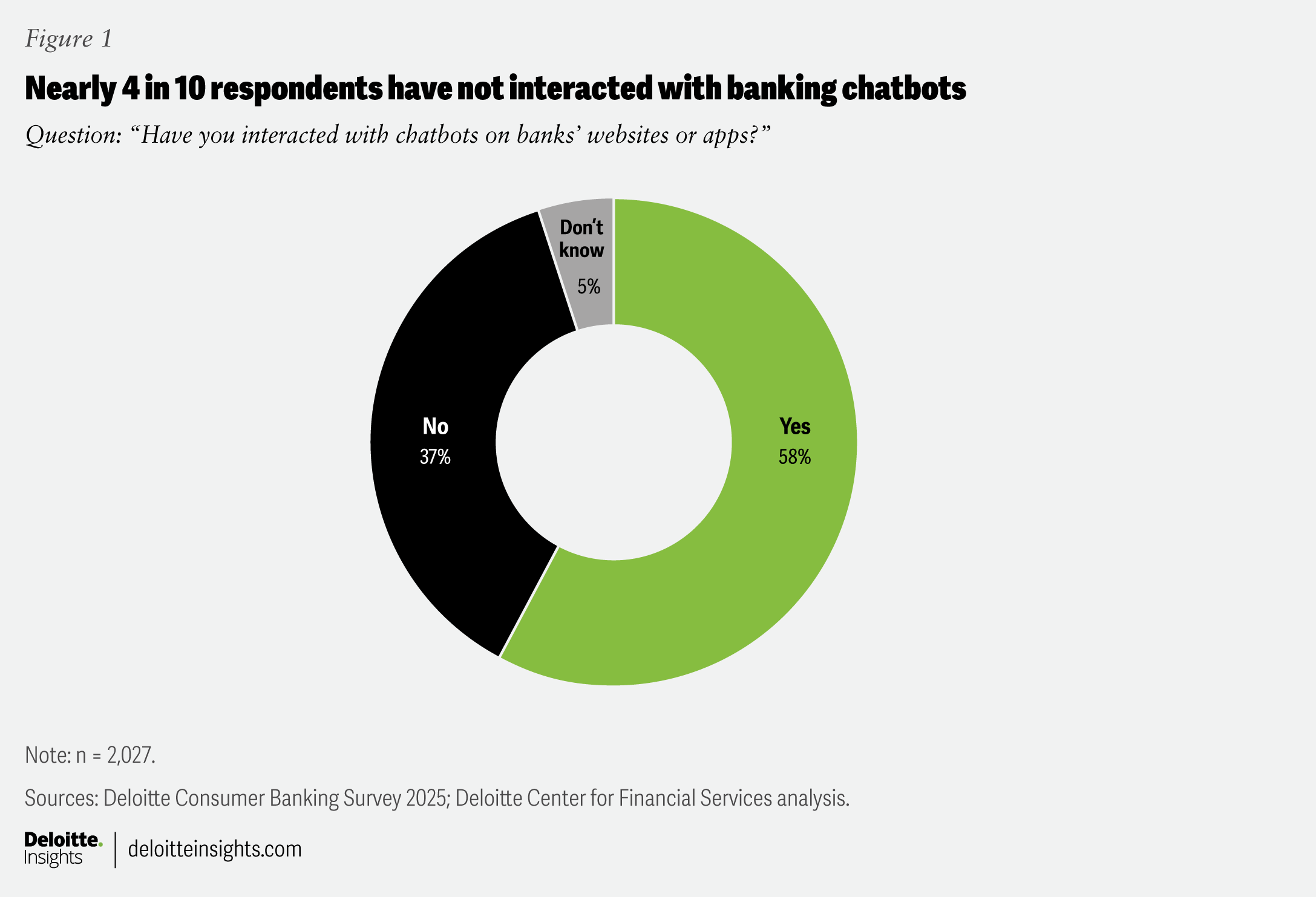

According to Deloitte’s survey, 37% of respondents said they have never interacted with banking chatbots (figure 1). This suggests there is still potential for banks to increase awareness and usage of chatbots, possibly leading to cost savings and improved customer service.1

Chatbot ratings reveal a generational divide

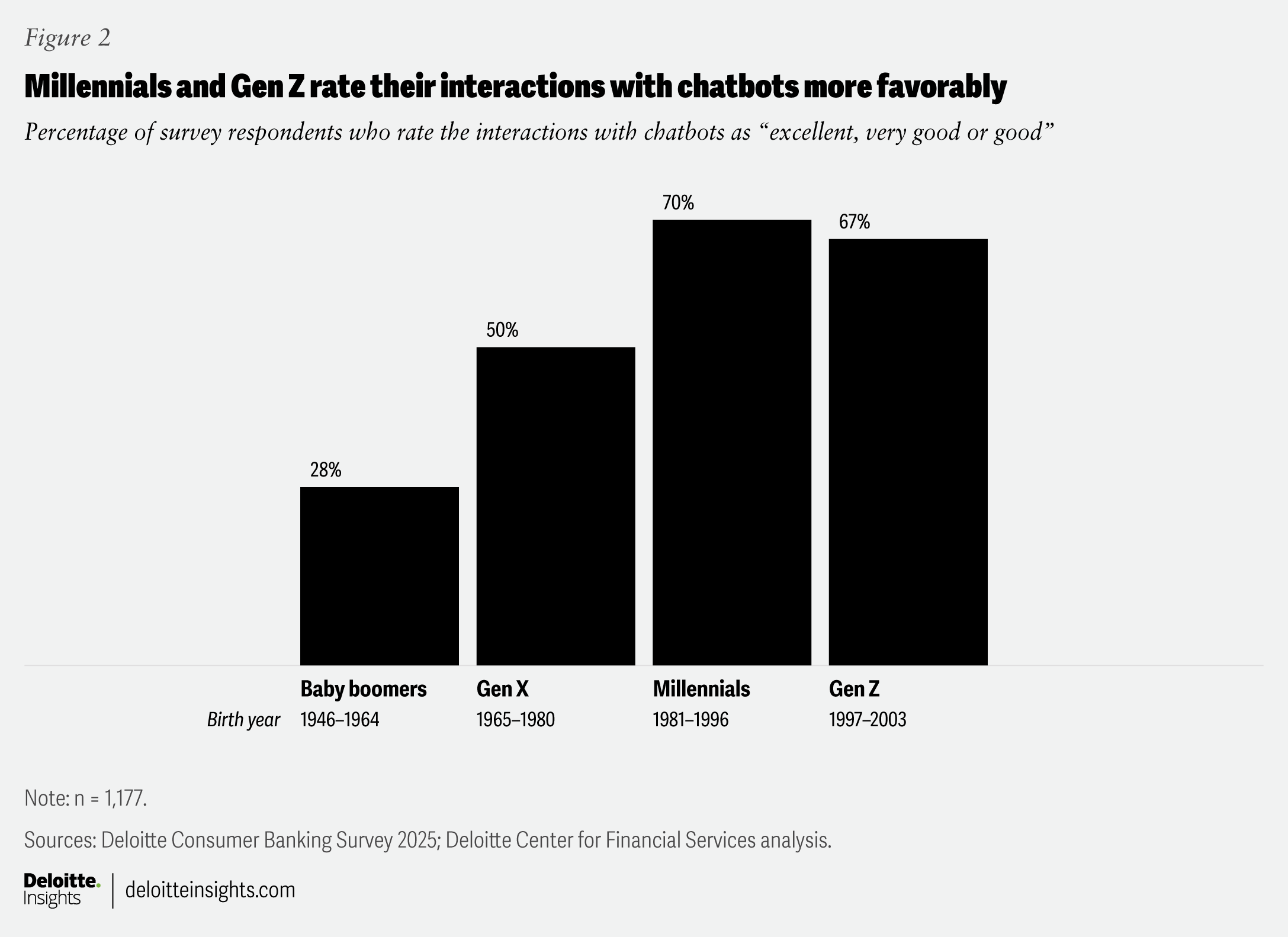

Deloitte’s survey respondents generally rate their experiences with banks’ chatbots positively. Millennials and Gen Zs, raised on digital interfaces, are more likely to report positive interactions, in contrast to baby boomers and Gen Xers, who rate their experiences less favorably. This finding highlights a generational gap (figure 2).

While these positive experiences are encouraging, it’s important to note that they primarily relate to simpler tasks. Deloitte’s survey reveals that users still largely prefer human interaction for routine banking queries.

Chatbots should focus on going beyond simple tasks

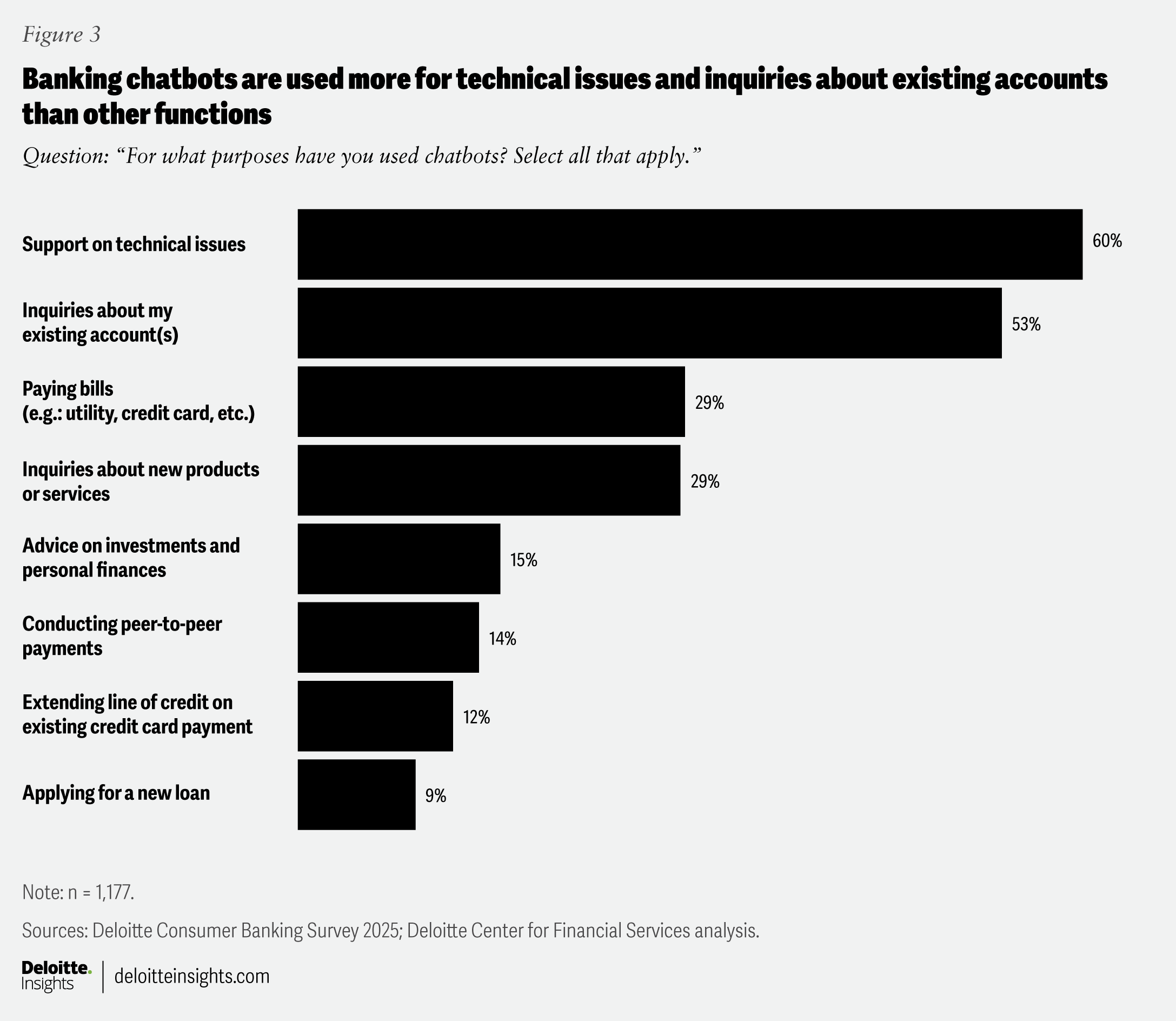

Banking customer respondents use chatbots mainly for technical support (60%) and inquiries about existing accounts (53%), as illustrated in figure 3.

As AI-driven chatbots become more advanced and personalized, banks can aim to expand the use of chatbots to revenue-generating activities such as responding to inquiries about new products and services, processing loan applications, and providing advice on investments and personal finances.2 However, such a transition from primarily informational to transactional activities may be easier said than done.3 A separate study indicates that only a minority (27%) of its respondents trust AI for financial advice.4

The human touch is still important

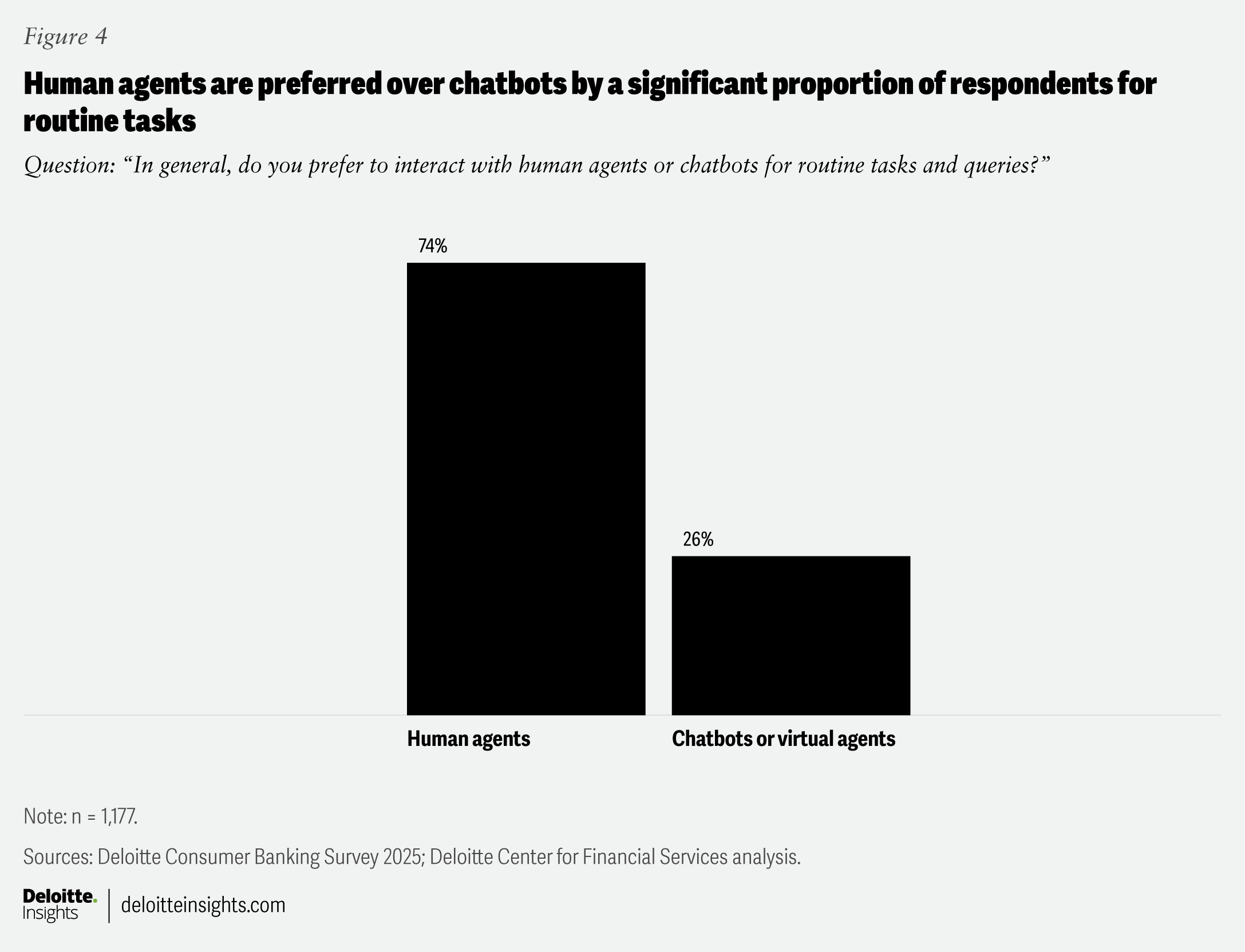

Despite the prevalence of chatbots, most survey respondents still prefer to interact with human customer service representatives for simple, routine queries. According to Deloitte’s survey, 74% of respondents favored human agents over chatbots for these interactions (figure 4). Fewer respondents say they have used chatbots for more complex situations, such as personalized advice or applying for a loan, highlighting ways chatbots could evolve beyond basic functionalities.

Respondents who favored chatbots over human representatives did so primarily for the chatbots’ quick responses (78%) and ability to handle simple queries (69%).

This is consistent with previous research Deloitte conducted in 2021 during the COVID-19 pandemic, when many consumers preferred digital interactions. Among respondents who had used chatbots around the time the survey was conducted, many found them to be less knowledgeable and less empathetic than human agents.5 Of those who used chatbots for product inquiries in the past, 82% said they would not use them for this type of interaction in the future, and 46% indicated they would instead visit a branch. The resulting report considered that “humanizing chatbots … is going to be important in making digital banking behaviors stick.” This seems just as true now.

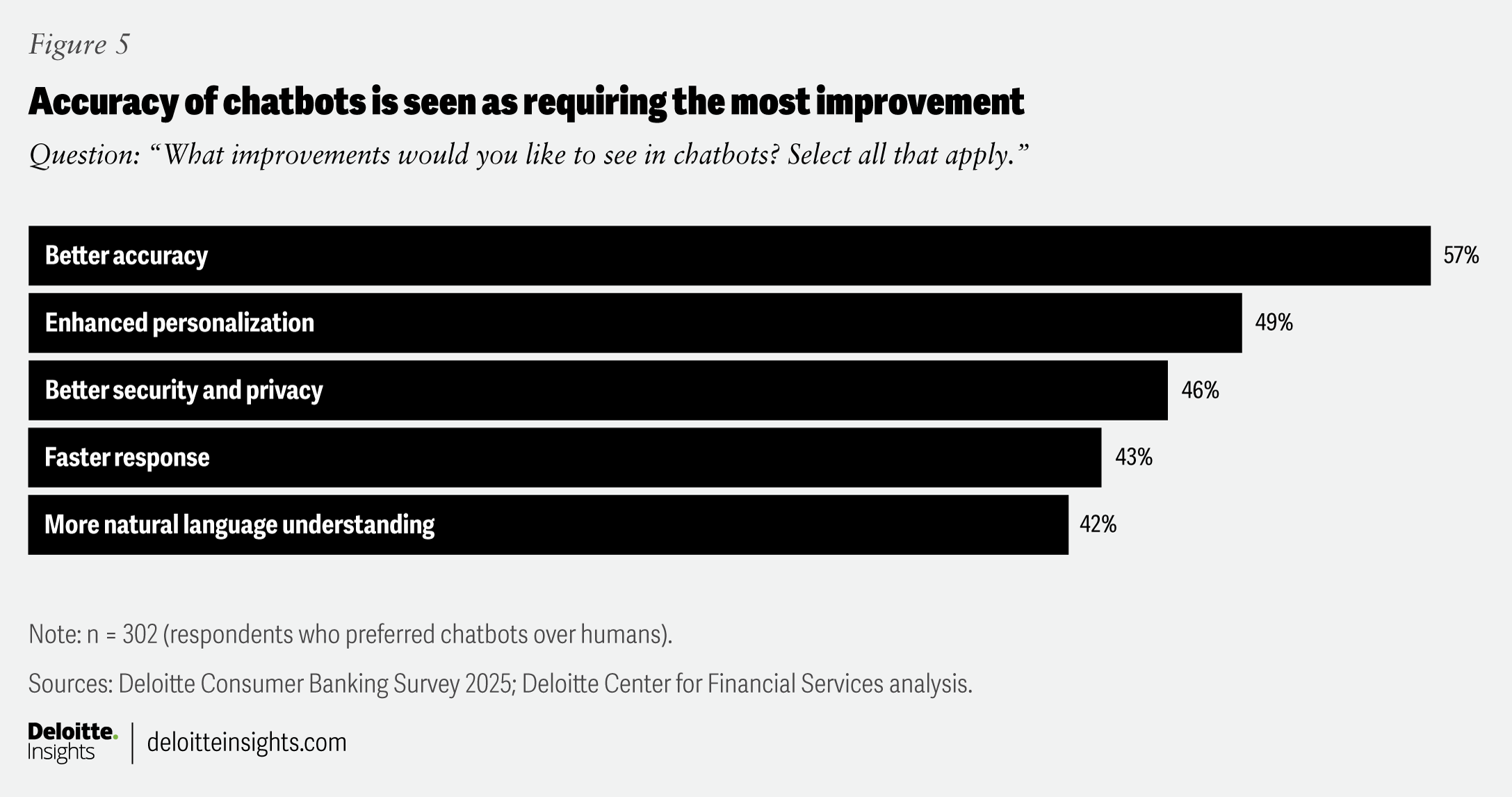

Accuracy tops the list of concerns related to chatbots

Among the respondents who preferred chatbots, 57% said that better accuracy was the improvement they’d like to see. Providing 100% accurate responses by AI chatbots could remain a challenge due to hallucinations, a problem that has been acknowledged for some time.

Also, nearly half of the respondents indicated that chatbots need improvement in areas such as enhanced personalization and stronger security and privacy (figure 5).

Transforming the chatbot experience isn’t simply a matter of adopting the latest technology. Despite rapid advances in AI, banks continue to face challenges, from complex regulatory landscapes and stringent data privacy mandates to the deep-rooted challenge of integrating with legacy systems. Delivering intelligent, secure, and personalized interactions can require more than tech upgrades; it often demands significant investment and hard-to-find talent with deep domain expertise. These realities can help explain why the promise of next-generation chatbots remains just that.

Lessons for the next generation of chatbots

As chatbots evolve into a new generation of sophisticated, agentic AI applications, consider how consumers interact and feel about them now. Addressing challenges—such as improving response accuracy, enhancing personalization, and ensuring greater reliability—will be important. Banks should also improve the precision and contextual relevance of responses and actions, and most importantly, design seamless collaboration between human agents and AI.

Getting from today’s limited, often frustrating chatbot interactions to more seamless, intelligent assistants won’t happen by accident. It should include deliberate investment in trust-building, smarter use cases, and deeply human-centered design. As banks chart this path forward, those that are successful will likely stop treating chatbots as mere cost-cutting tools and start reimagining them as intelligent partners in the customer’s financial journey, one interaction at a time.

Methodology

Deloitte conducted an online survey among 2,027 banking customers in the United States in January 2025. The respondents were drawn from different cohorts, spanning generations, genders, and income levels. Generations were defined using the following ranges as birth years: baby boomers (1946 to 1964); Generation X (1965 to 1980); millennials (1981 to 1996); and Generation Z (1997 to 2003). The study is part of Deloitte’s Consumer Banking Survey 2025.