How the right mix of C-suite leadership can drive outsized AI returns

Deloitte’s predictive modeling reveals that when top executives share tech investment decisions, organizations could see stronger results—a case for a new kind of leadership

Tim Smith

Garima Dhasmana

Diana Kearns-Manolatos

Iram Parveen

David Levin

Why does artificial intelligence drive bigger returns in some organizations than in others?

The secret might not always be in the technology itself. Sure, that’s important, but often, there’s another key ingredient: Which C-suite leaders are steering the agenda, and how well do they actually work together?

To explore this question, Deloitte ran a predictive analysis using our proprietary Tech Value data. In a survey of 550 business and technology leaders conducted in April and May 2025, we sought to understand how the degree to which a given C-suite leader owns IT decision-making corresponds with positive AI outcomes. Rather than take a surface-level view, we traced exactly which C-suite roles hold sway over AI investment decisions—zooming in on the degree of participation from chief technology officers, chief financial officers, chief strategy officers, and others. Then, we measured results using a robust set of indicators: perceived improvements in return on investment from technology, movement across 46 operational and financial key performance indicators, and reported earnings before interest, taxes, depreciation, and amortization (EBITDA) gains over the past year.

The findings: It’s not just about technologists at the helm; it’s a partnership game. When the right leaders—think the chief technology officer, chief financial officer, and chief strategy officer—own certain and share other aspects of technology investment decisions, organizations could be far more likely to see outsized results, including above-average EBITDA, greater progress on KPIs, and advances in tech capabilities. Each executive brings a unique value lens: technical capability, financial discipline, strategic alignment, or risk management. When these perspectives combine, they can drive smarter bets and bigger impact.

Who’s at the table—and why it matters

Deloitte’s 2025 Tech Value Survey found that chief information officers and chief technology officers are still the driving force behind most technology decisions, according to 60% to 80% of respondents, with the two generally co-owning legacy modernization, information automation and business support, and other decisions. This can help organizations build strong technical capabilities, but it also raises a big question: When should other leaders—the chief financial officer, chief strategy officer, and even the chief human resources officer—get more deeply involved in AI investment, given its potential impacts on everything from talent to operations and the bottom line?

Different roles, different paths to drive value

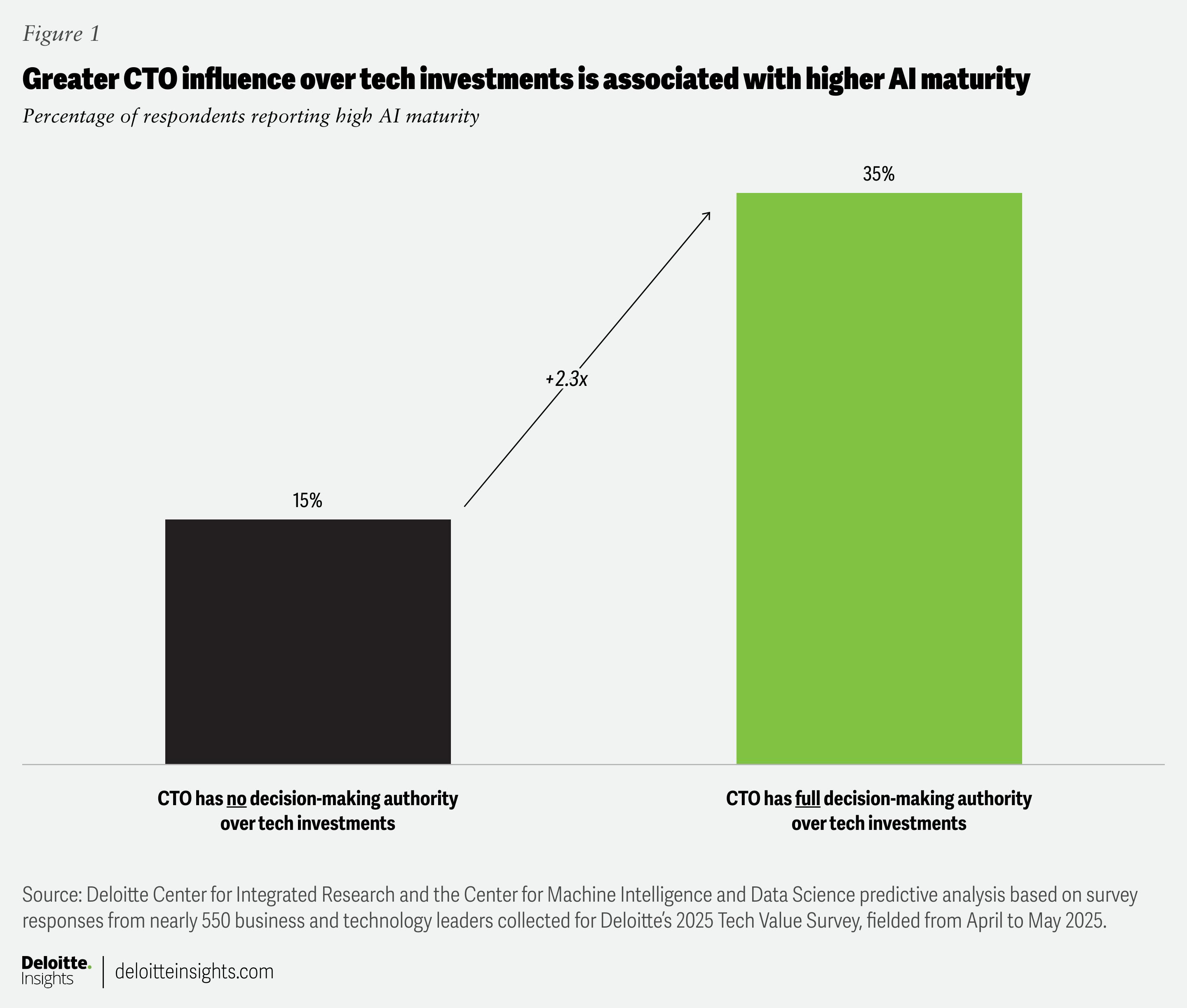

- Chief technology officers: In our analysis, when CTOs shift from having no control over tech investment decisions to full control, organizations could be more than twice as likely to achieve “advanced” AI automation maturity (figure 1). Overall, organizations with higher AI maturity also tend to pursue a wider range of data monetization strategies in an effort to gain more return on the same initial investment.

However, when CTOs are the primary decision-makers, these companies often invest less aggressively in new data monetization initiatives. This pattern could reflect several factors: CTOs may be operating under more constrained budgets, focusing on maximizing ROI from current assets rather than expanding into new projects, or prioritizing cost savings over growth-oriented investments.

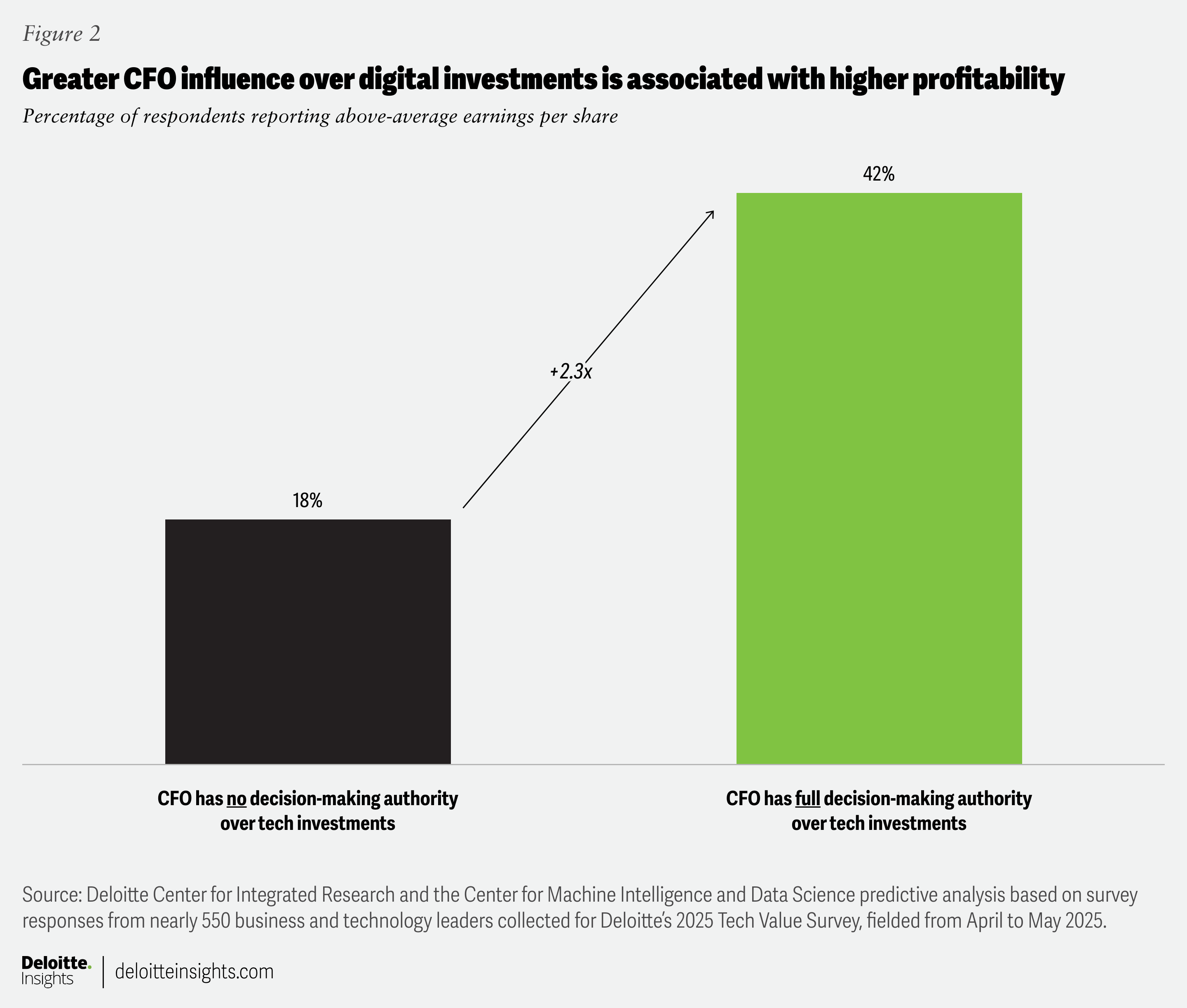

- Chief financial officers: In our analysis, greater CFO involvement in digital investment decisions appears to be directly linked to stronger financial results. Among surveyed organizations in which the CFO had no decision-making authority, only 18% achieved above-average profitability. But when the CFO had full decision-making authority, that figure jumped to 42%—meaning these companies were more than two times as likely to outperform on profitability (figure 2).

What’s also notable is that CFOs in our survey tend to take a more cautious approach when forecasting AI-driven ROI out for three years, but when they’re hands-on in the process, their confidence in meeting automation program milestones grows. These dynamics seem to highlight the potential benefit of a close partnership between the CTO and CFO for achieving both technical progress and financial discipline.

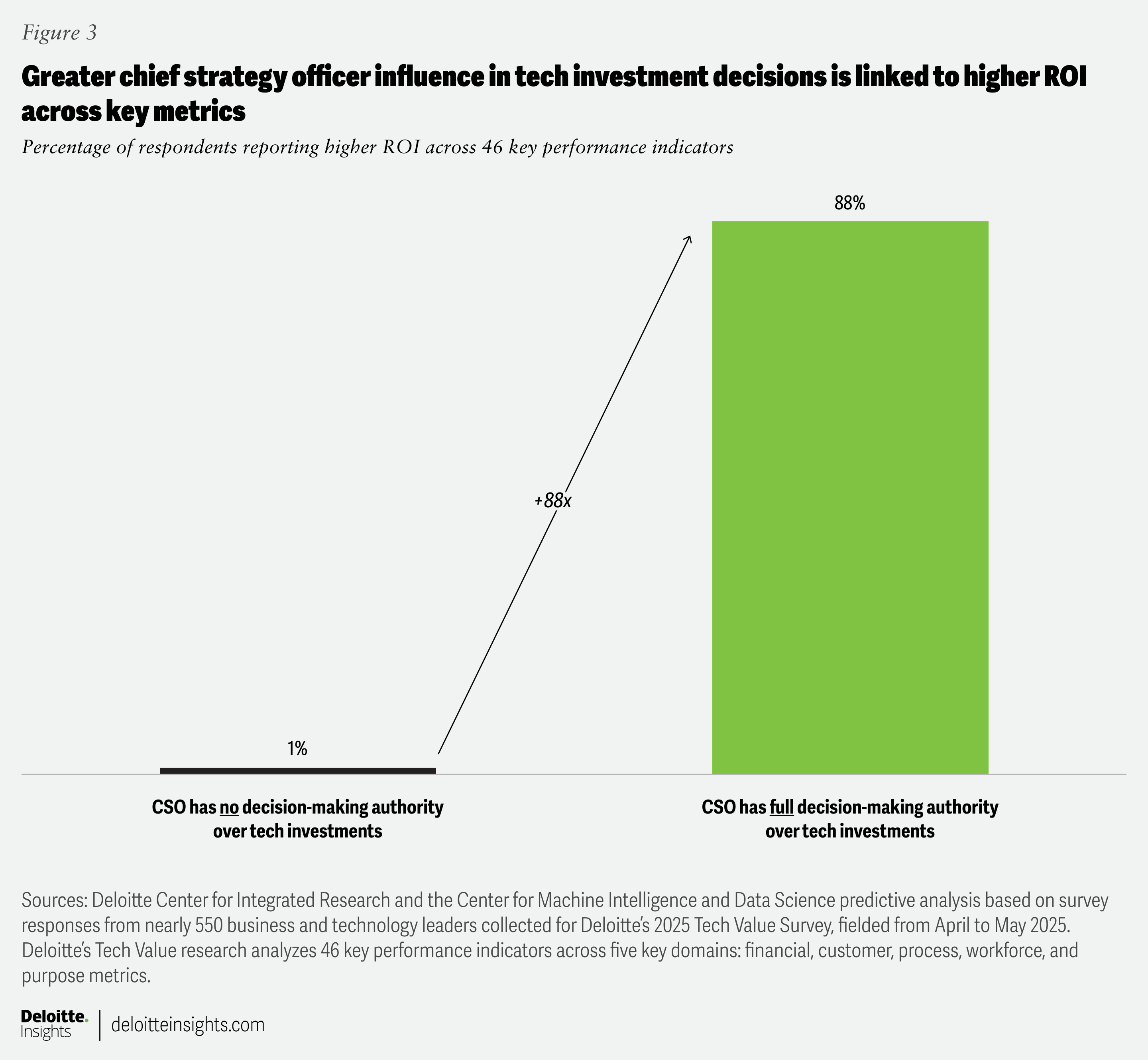

- Chief strategy officers: When organizations bring the CSO into major tech investment decisions, the benefits appear to ripple across the business. Our predictive analysis shows that companies with limited CSO involvement rarely excel across their KPIs. But when CSOs are given substantial authority in our model, organizations could be up to 88 times more likely to achieve high ROI across financial, customer, operational, workforce, and purpose-driven metrics (figure 3).

In practice, this could mean that CSOs are called on either to refocus technology investments that have plateaued or to help clarify and maximize the broader strategic value of digital transformation initiatives.

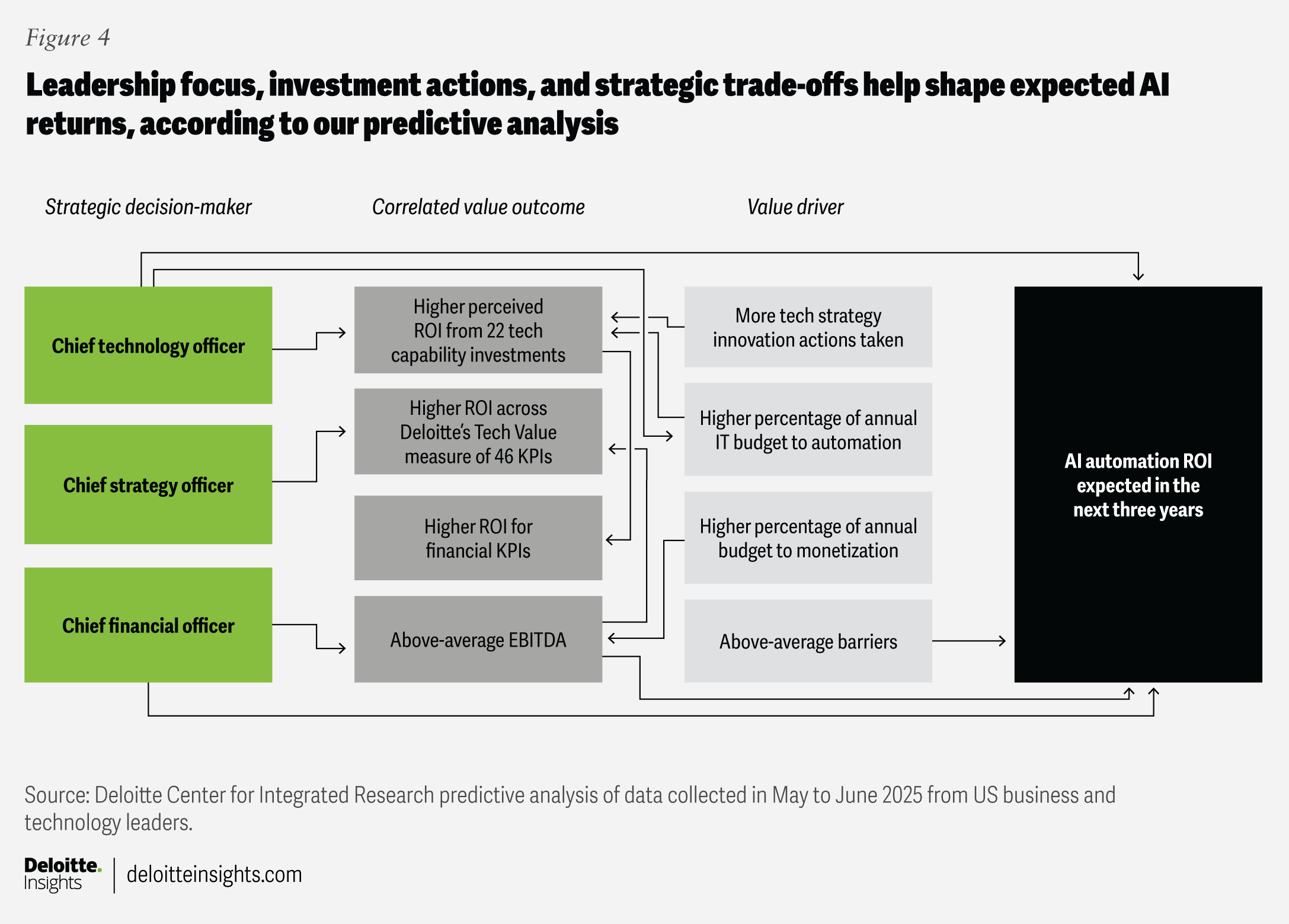

These findings appear to indicate that who owns technology investment decisions has real business implications across the system of ownership and directly relates to AI automation ROI expectations over the next three years (figure 4).

The predictive analysis, as a system of value drivers and outcomes, suggests:

- No single role can drive strategic KPI alignment, technical capability growth, and profitability on its own. All three roles—CIO (or CTO), CFO, and CSO—are needed to drive the full set of value outcomes that most organizations are seeking.

- Three important and predictive value drivers include tech strategy innovation maturity, automation budget, and monetization strategy investment. A strategy for innovation and dedicated spending can help drive higher tech capability returns, while a higher budget for automation can help drive greater profitability.

- CTOs and CFOs are more likely to expect that AI automation returns will come in the next three years, based on our predictive modeling. And when a respondent holds that expectation, they’re more likely to achieve key indicators at above-average levels.

Taken together, these patterns suggest that AI-driven business outcomes peak when decision rights are distributed among complementary leaders.

The case for a new kind of leadership

AI adoption should be a cross-functional effort. Siloed leadership is unlikely to deliver the versatility, agility, or strategic focus needed to achieve enterprisewide value. Instead, organizations are exploring several new approaches:

- Evolving models of C-suite collaboration: Deloitte’s research on digital operating models suggests that a direct line to the CEO can help organizations capture more value from their digital initiatives. The idea here is that digital ambitions—including AI—can be most successful when they reinforce the mission of the organization. It’s easy for a CIO or CTO to get bogged down in the weeds of technical functionality or in building a business case for the CFO to ask for investments. An integrated C-suite is one that understands the enterprise strategy and contextualizes business capability building and technology investments through that lens.

AI is creating new markets that call for both depth and breadth of expertise. Collaboration among the CTO or CIO, CFO, and CSO is emerging as a leading practice, balancing technical capability, financial discipline, and strategic alignment. While enterprise strategy can be a guide, as markets and organizations are transforming, leaders should also consider looking across market-sector peers to pulse-check what’s changing and how to forge new paths. A triumvirate of three executive roles has started to emerge as a successful model: the executive tech leader CIO (or CTO, depending on the organizational context), the CFO, and the CSO. Our predictive analysis shows that each of these leaders brings their own unique perspectives and capabilities to balancing the value equation. Success could hinge on these leaders working together on the investment strategy and partnering with transformation, operational, procurement, and human capital leaders to bring the organization forward together.

- Look to transform the function as a natural output of this collaboration: As C-suite leaders practice shared leadership, one natural evolution could be roles that embed shared functional responsibilities. For example, some organizations are doing away with traditional roles and exploring hybrid roles that bring together functions by tasking a single leader with “double-hatting” across domains. For example, one life sciences organization announced in early 2025 that it would join the CIO and CHRO functions into a new role—chief people and technology officer—responsible for the critical process of rethinking how humans and AI work together in new operating models.1 While there are successful past examples of separate functions coming together into a new function as world contexts change (for example, a chief information officer and chief security officer merging into the chief information security officer), it remains to be seen which intersectional domains and skills will lead organizations into the future. One potential merger may be that of the chief financial operations officer and chief technology officer, given the growing frequency of large tech investments that cut across capital and operating expenditures, driving organizational transformation, as well as the cost implications embedded within tech vendor decisions and tech modernization efforts.

What’s next for C-suite AI leadership?

The path forward is unlikely to look like the past. New roles and responsibilities are emerging. C-suite leaders are being asked to strengthen their “nexus skills,” blending technical fluency, financial literacy, and market awareness. This may call for a willingness to break old models and build new ones, sometimes even merging leadership roles or creating new centers of excellence. It also involves considering industry variation in how leadership mix impacts AI returns. It can further benefit from a shared vision with shared execution.

In short, achieving continuous AI value isn’t just about investing in the right tools; it may also be about ensuring the right mix of C-suite leaders are making decisions together, assessing value holistically, and adapting fast.