2026 Travel Industry Outlook

The momentum that defined post-pandemic travel could slow, as financial caution and economic uncertainty reach high-spending groups

Kate Ferrara

Eileen Crowley

Matt Josephson

Matt Soderberg

Stephen Rogers

Maggie Rauch

After years of resilience that defied broader economic uncertainty, travel demand may be showing signs of strain. Over the 2025 to 2026 holiday season, more than half of Americans planned to travel—the highest since the onset of the COVID-19 pandemic. But many have shifted toward a conservative approach, with cuts to trip frequency and length, distance traveled, accommodation class, and in-destination activities.

Financial pessimism, reaching up to higher income levels compared to recent years, appears to be the biggest cause of this frugal trip planning. And on the corporate side, economic uncertainty may be at the root of more cautious budgeting.

Signs do not point toward a major slowdown or decline in travel demand. But if this conservative posture takes root among enough consumers and businesses, the year ahead could see many travel metrics plateau. If financial anxiety spreads or deepens, especially among very high-income Americans, it could be an even slower grind. But travel remains a priority among Americans of all ages and income levels, and if consumer confidence improves, the industry should continue its strong post-pandemic run.

Premium and luxury categories and upsells have performed well for the past few years. Airlines and hotels have pursued this strategic opportunity by dedicating more of the plane to premium seats and developing more upscale properties. Demand for these may be more challenging to tap into in 2026.

Regardless of how traveler behaviors flow, demographic, technological, and political forces continue to reshape the travel industry. Deloitte’s 2026 Travel Industry Outlook, based on multiple surveys conducted between March and October 2025 (see methodology), highlights four major trends to watch for as the year unfolds:

- Bifurcation of premium and luxury: Intense competition for the high-spending traveler

- Generational shift: Gen Z and millennials now dominate US travel demand

- A new engine gains steam: Generative AI use rises in travel shopping, even as commerce and content are not fully connected

- Policy watchlist: International travel, tech oversight, and climate regulation

Bifurcation of premium and luxury: Intense competition for the high-spending traveler

The front of the plane, the destination resort, the upper-class urban hotel: These premium offerings have led the post-pandemic recovery, as many travel providers have enjoyed some lift from relatively high spenders. But shifts in financial perceptions and corporate confidence could begin to challenge this dynamic.

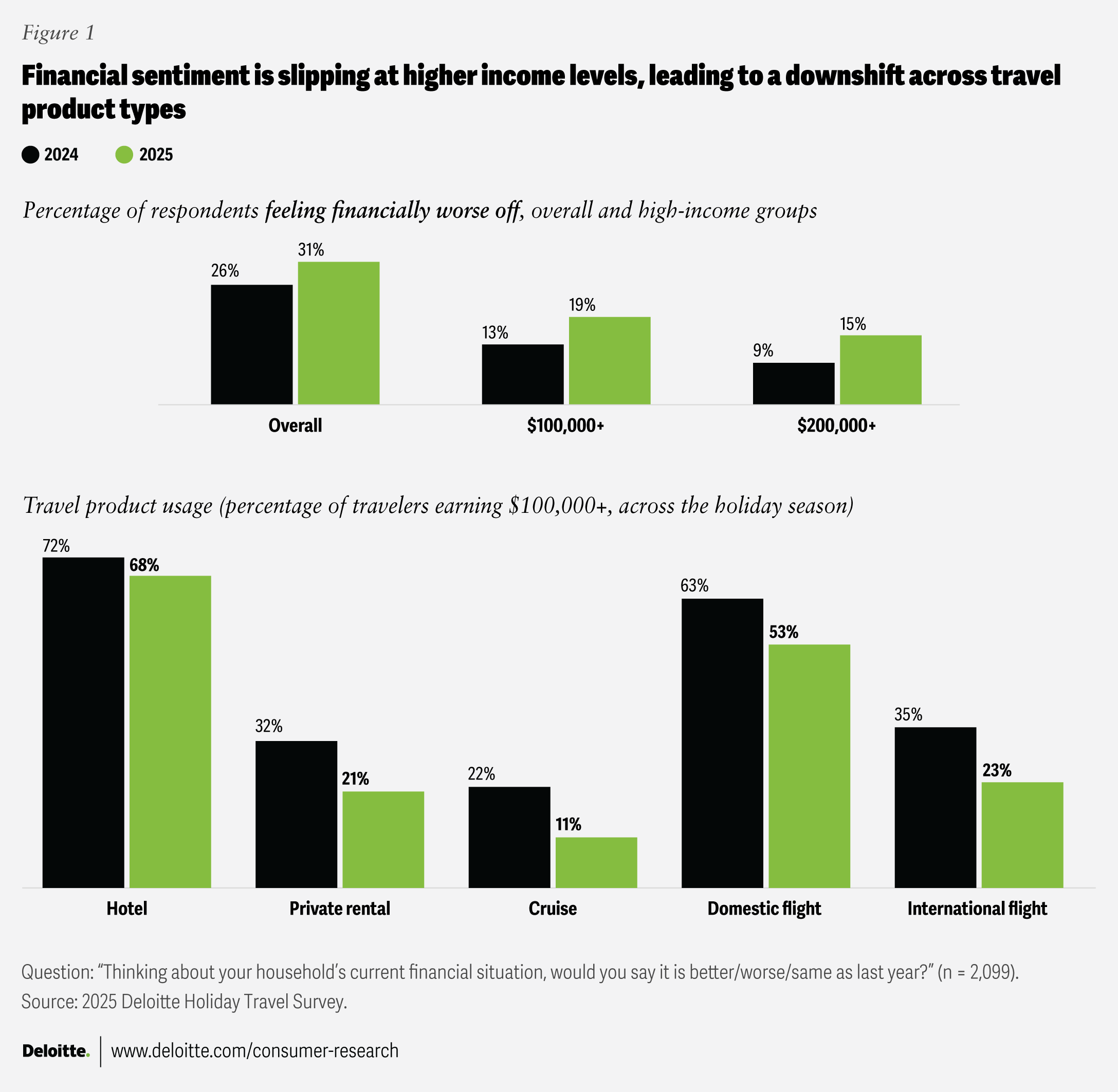

Among leisure travelers, the cause of concern is the “cautious class”—high-income Americans with negative financial sentiment. Affluent Americans were more affected than others as financial concern grew across income groups in 2025 (figure 1). The share of higher-income travelers (US$200,000 and above) indicating negative financial sentiment jumped to 15% in 2025 from 9% in 2024.

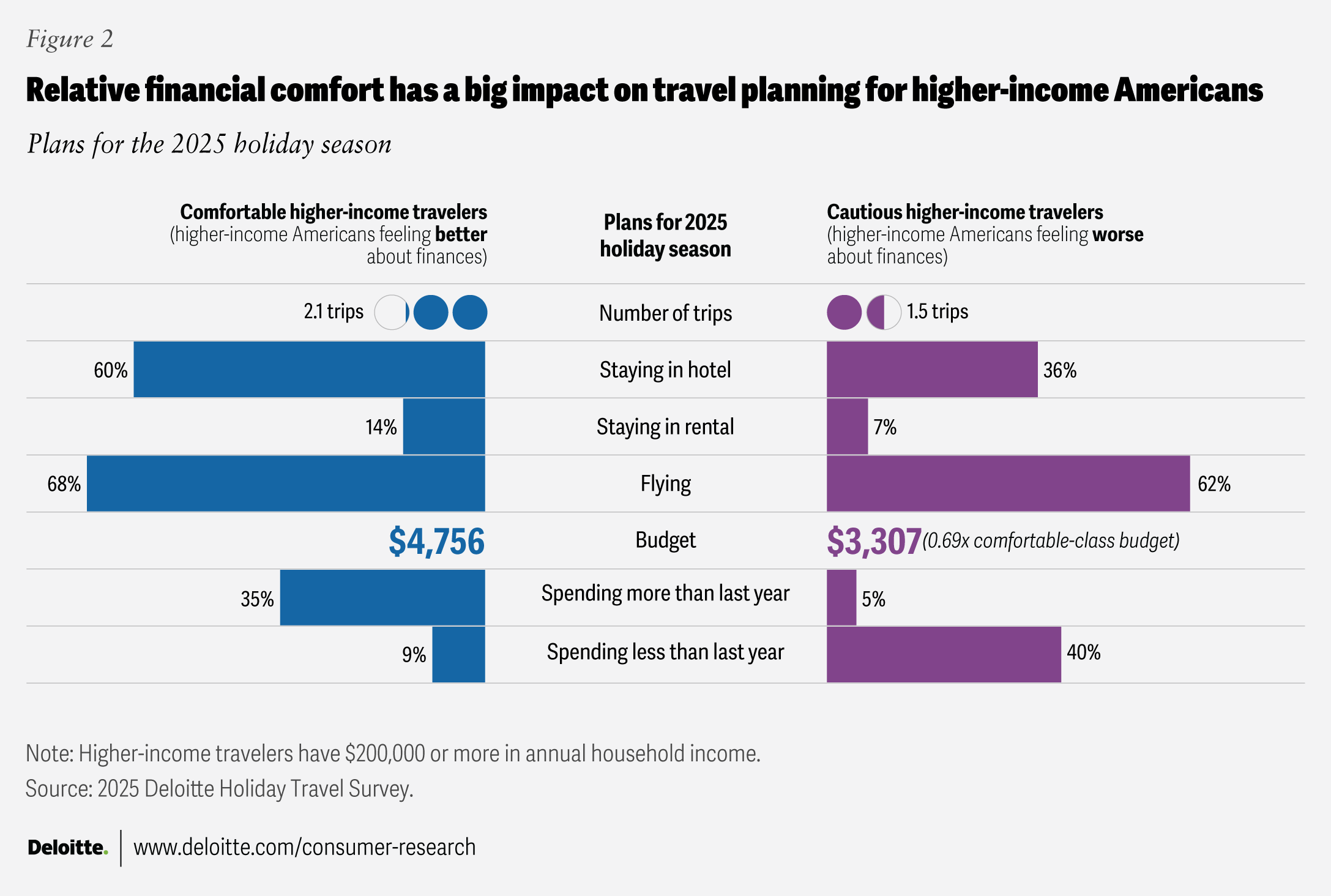

Higher-income Americans are more likely to travel, and more likely to indulge in high-end properties, upgraded flights with convenient itineraries, and in-destination activities. But relative financial comfort is also a predictor of travel behavior, and it has bifurcated trip planning among higher-income Americans over the 2025 holiday season, with cautious higher-income households planning fewer and more conservative trips than their comfortable peers (figure 2).

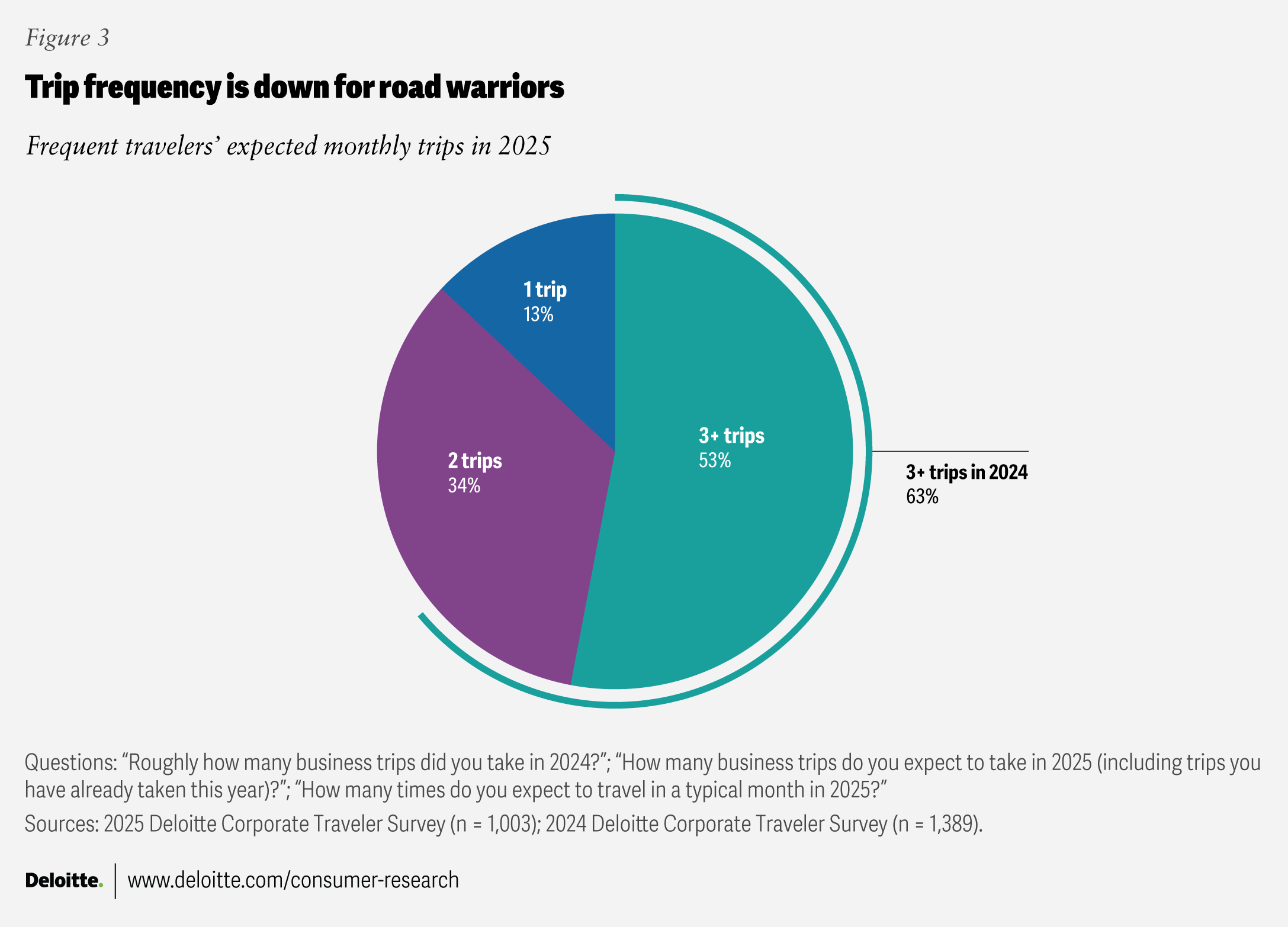

At the same time, corporate travel may be slowing down among highly desirable road warriors. Among respondents to Deloitte’s 2025 Corporate Traveler Survey, 53% of frequent corporate travelers (10 or more trips per year) said they expected to travel three or more times in a typical month, down from 63% in 2024 (figure 3). Like their higher-income counterparts, frequent corporate travelers are more likely to book premium options when they travel.

If higher-income travelers and frequent corporate travelers pull back their spending in 2026, categories that benefited most from post-pandemic growth in upgrading may be particularly exposed. Upgrading to premium cabins, which has been hugely important to airlines in the past few years, could soften or plateau in the year ahead, increasing the importance of reaching the right flyer with the right offer at the right time. Mid-scale and upscale destination resorts and city hotels could see erosion of occupancy or rates as higher-income travelers become more deal-sensitive or shorten their stays, and business travelers take fewer trips.

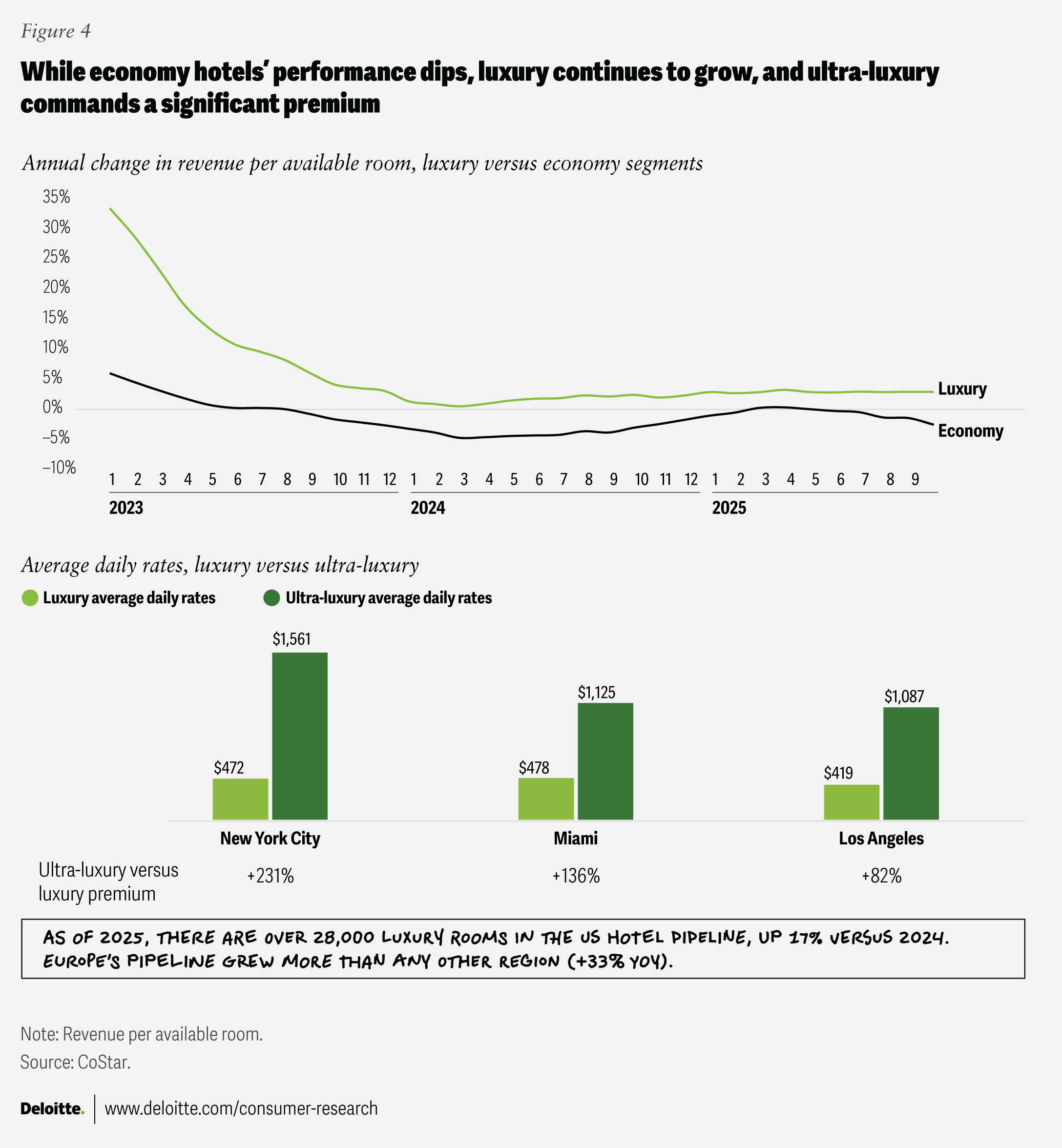

There is less concern, however, about the ultra-luxury space, where average daily rates (ADRs) have grown without challenging occupancy (figure 4). The more mass-market luxury space, with ADRs under US$500 in most markets, is the segment that may show some softness in 2026, while the ultra-luxury segment appears insulated from economic concern and uncertainty.

Many in the industry are betting on continued strength in high-end travel, and many will likely continue to benefit from it. Ultra-luxury travel products, such as long-haul business class airfare and hotel rooms with four-figure ADRs, may not be affected soon. But there are some potential challenges ahead for premium travel products that depend on high-earning (if not ultra-wealthy) Americans.

Generational shift: Gen Z and millennials now dominate US travel demand

As of the 2025 holiday season, Gen Z and millennials combined now account for half of all travelers. Gen Z in particular is gaining share quickly, jumping from 8% of Americans planning to travel over the 2024 holidays to 14% in 2025. Given their relatively lower earning power, they are overrepresented in the traveling public.

As their behaviors and preferences steadily become more influential, the two youngest adult generations stand apart from older generations in important ways.

Together, Gen Z and millennials are:

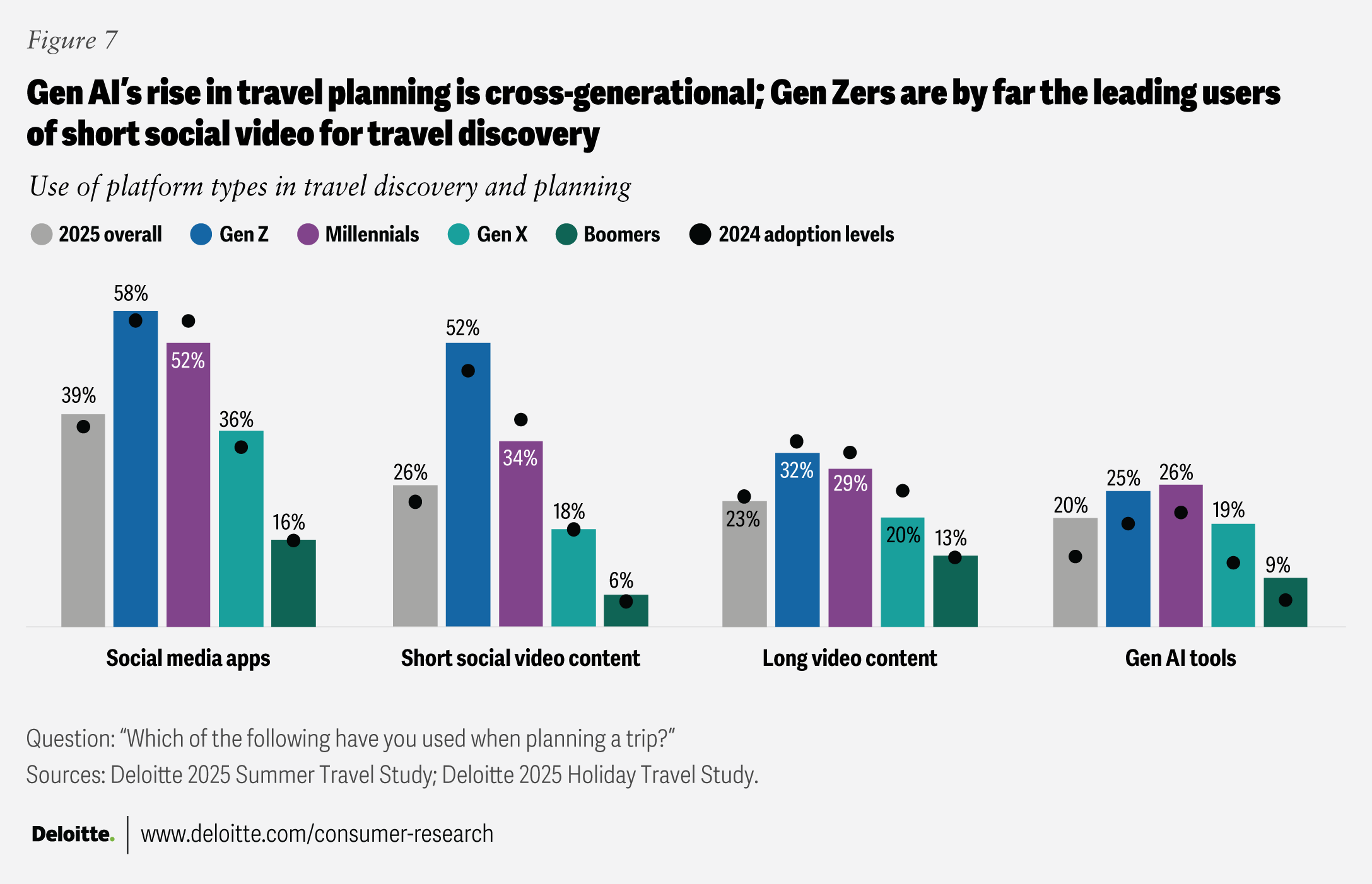

- Reshaping how travel is planned and booked: Younger generations remain the biggest users of social media platforms by a wide margin. More than half of both millennials and Gen Z say they use social platforms in their trip planning, compared to about 1 in 3 Gen Xers and 1 in 7 baby boomers.

- Leading growing demand for sustainable options: Thirty-eight percent of millennials and 42% of Gen Z travelers say they take some kind of sustainability-related action in travel planning, such as purchasing flight carbon offsets or filtering hotel searches for sustainability certifications. These rates are about double those of boomers, and 10 percentage points more than Gen Xers.

- Value-driven but still travel (and spend) at high rates: Even in the softer 2025 holiday season—when overall trip frequency and budgets were down—Gen Z and millennials planned more trips than older generations.

Although the two youngest adult generations share some common ground, there are some major distinctions between the two.

Millennials’ trending travel habits:

- They lead gen AI adoption for trip planning: Gen AI’s use in trip planning tripled from 2023 to 2025, led by millennials. They are the generation most likely to use gen AI tools for building itineraries, choosing hotels, finding things to do at the destination, and more. As they use gen AI more, millennials report less usage of all other research sources. If this trend continues, it will have major implications for travel marketing and distribution.

- Millennials’ view of “luxury” is family- and food-centric: In 2025 survey results, among travelers who meet Deloitte’s “luxury traveler” threshold, millennial luxury travelers (who travel with children more than other generations) are especially likely to associate luxury with on-property dining, in contrast to Gen Z (who places more emphasis on spa and pool amenities) and boomers (who prioritize brand and location).

- They bring cost awareness alongside high enthusiasm: Across the 2023 to 2025 surveys, millennials repeatedly emerge as enthusiastic trip-takers but are often cost-conscious. In some seasons, they are the biggest spenders, while at other times, they rank behind older generations. They adjust their trips as broader financial pressures require.

Gen Z’s trending travel habits:

- Social video is their primary planning channel: More than half of Gen Z respondents use short-form social video for travel research, versus 34% of millennials and 14% of Gen X and boomers combined.

- Gen Z is especially likely to act on sustainability: Among all American travelers, roughly one-third say they will take some action to travel more sustainably (for example, choosing hotels with higher sustainability ratings). About 42% of Gen Z travelers say they will take some sustainability-related action, leading efforts among generations to minimize the climate impact of their travel.

- Room comfort and amenities drive their perception of luxury lodging: Among luxury travelers, Gen Z is most likely to define luxury in terms of room comfort and amenities like a spa or fitness center, rather than brand cachet or fine dining.

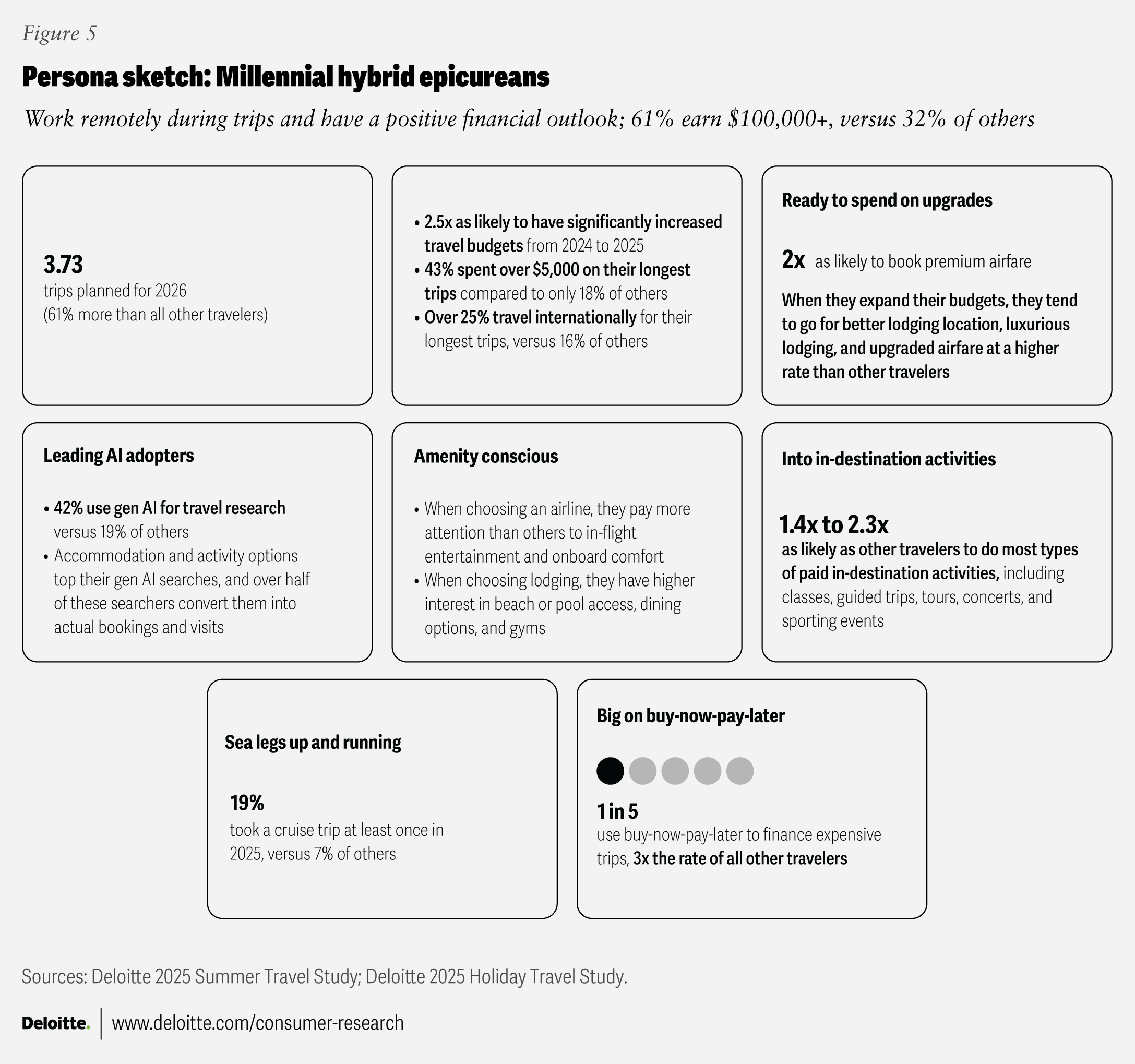

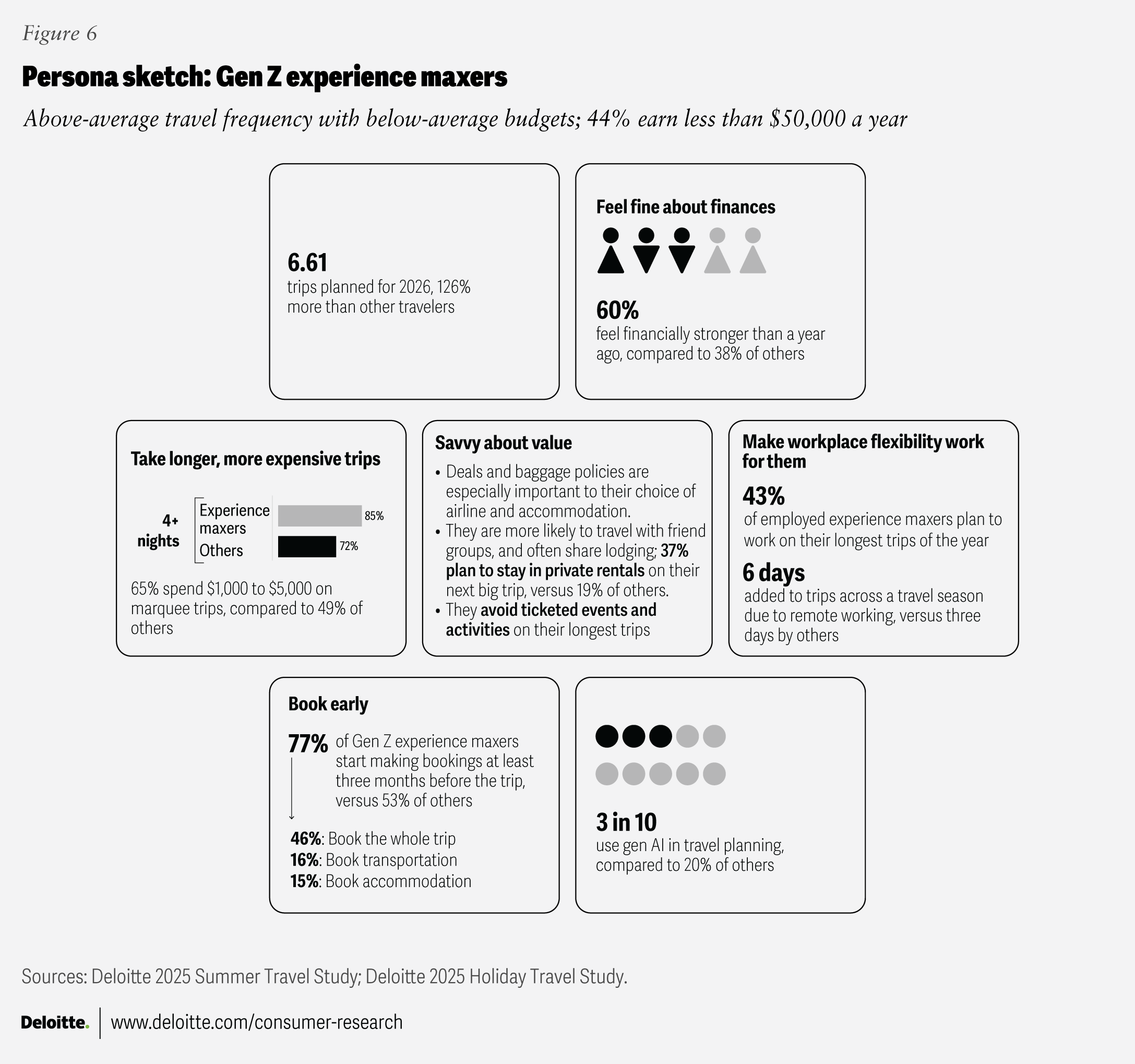

In addition to overall generational trends, some distinct personas emerge in each of these generations (figures 5 and 6). Understanding these (and other groups) could be competitive differentiators in the next few years.

A new engine gains steam: Gen AI use rises in travel shopping, even as commerce and content are not fully connected

Not since smartphones started appearing in everyone’s pockets—and arguably for even longer—has a new technology inspired as much experimentation, investment, and speculation in travel as generative AI. Travel providers have already begun applying it to customer service and operational efficiency functions. The technology also has the potential to completely transform how travelers discover and purchase their trips.

Adoption has already accelerated dramatically: Nearly a quarter of travelers report using gen AI tools for trip planning in late 2025—thrice as many as in 2022 (figure 7). This growth is occurring even before fully integrated discovery and booking experiences—combining visuals, reviews, and seamless transactions—are widely available. As these capabilities mature, adoption likely has significant upside. Unlike previous waves of travel technology, adoption is not strictly generational. Older travelers are also embracing these tools.

For travelers, gen AI introduces the possibility of greater personalization, automation, and control. Agentic capabilities may allow users to define preferences and delegate shopping and booking tasks entirely, reshaping how decisions are made and reducing traditional brand touchpoints during the consideration phase. For suppliers, gen AI offers new ways to personalize offers in real time, from tailored add-ons to dynamic pricing and merchandising based on context, timing, and traveler behavior.

While the near-term booking experience may not change dramatically, travel companies should prepare for more than incremental shifts. Gen AI is likely to inspire the reintroduction of past industry experiments, such as unbundling, dynamic pricing, and flexible labor models. Some may succeed while others fail. As competitive dynamics evolve, consolidation, strategic pivots, and a renewed focus on discovery and visibility will become increasingly important. Continuous evaluation of how travelers search, decide, and transact—and how brands remain discoverable within those journeys—should become a standing priority in travel leadership discussions.

Policy watchlist: International travel, tech oversight, and climate regulation

Regulatory and policy developments can be critical factors for the industry’s growth and resilience, as well as travel providers’ profitability. Policy shifts can shape who travels, how trips are booked and priced, and the cost of delivering travel experiences at scale. From border processing and visa access to digital consumer protections and climate-driven mandates, several government oversight actions could influence the industry in 2026.

Visa, immigration, and travel policy

In early 2025, the US Travel Association was advocating for streamlined visa processing and entry procedures to support international tourism demand. As the year went on, new and proposed regulations advanced that could impact visa processing and travel into the United States. The US Department of State has narrowed the requirements for waivers of in-person visa interviews,1 introduced a new US$250 “visa integrity fee,” and now requires some visitors to put up several thousand dollars’ worth of bonds.2 Most recently, Customs and Border Protection has proposed requiring some visitors to provide five years of social media history to enter the country.3

These developments come as the United States tries to reverse its 2025 inbound visitation decline4 and prepares to host the FIFA World Cup, for which Tourism Economics has forecast a 10% increase in inbound visitors in June.5

Evolving travel tech oversight, consumer protection, and data privacy regulation

The entire travel life cycle is increasingly digital, from inspiration and bookings to in-destination experiences and loyalty programs. Intertwined as it is with an evolving consumer tech ecosystem, travel is also subject to the complex scaffolding of data privacy, consumer protection, and online distribution platform regulation.

For several years, the European Union’s General Data Protection Regulation (GDPR) has been the most comprehensive consumer data privacy regulation affecting online travel platforms. As travel companies deploy gen AI to power personalized offers and dynamic pricing, GDPR’s rules on consent, profiling, transparency, and automated decision-making are becoming central requirements for how traveler data can be used, raising compliance risk and shaping how far personalization and price optimization can go.

In the United States, new state regulations effective in the second half of 2025 through early 2026 further complicate consent, data-sharing, and targeted advertising practices for travel brands. The rules of engagement continue to evolve state by state.6 Additionally, scrutiny of all-in pricing and “junk fees” has resulted in state-level enforcement against travel platforms.7

The growing use of gen AI could bring heightened oversight of both data privacy and pricing practices. Travel companies should continue to ensure their data governance is up to date and monitor user consent and disclosure frameworks. In 2026, major travel providers can expect a patchwork of requirements across international markets, and also within the United States.

Climate regulation pressure eases as regulations soften and deadlines recede

The push toward sustainability that pressed the travel industry to adapt in recent years will likely be gentler in 2026. Major geographies like the United States and the European Union have postponed disclosure deadlines and may alter requirements.8 In the meantime, some US states are moving forward with their own reporting requirements, compelling travel providers to monitor developments at that level.

Travel suppliers should not assume climate and emissions reporting requirements are going away completely. And because travel is, by definition, global and fragmented, there’s complexity: Different jurisdictions may impose different rules affecting one subsector or the other, leading to harmonization challenges and compliance burdens.

2026: A year of turbulence and transformation

The trajectory of demand may be shifting in ways that could strain some segments of the travel industry. Some sectors and pockets that anticipated a full bounce-back from pandemic-related challenges, such as corporate and inbound international travel, could continue to struggle. And areas that have benefited the most over the past few years, such as destination resorts and upper-midscale products, could face new challenges.

There remains cause for optimism, especially for companies that make the right investments. Understanding the needs of younger travelers will only become more important over the next several years. These generations include a range of traveler types—from deep-pocketed millennials leveraging remote work to make family memories, to Gen Z seizing the opportunity to explore the world on tighter budgets. And gen AI can offer lucrative new pathways to identify high-value demand signals and translate them into better-targeted offers across channels. For travel companies, this represents a meaningful opportunity to rethink how demand is captured, priced, and converted.

Methodology

The 2026 Travel Industry Outlook is US-focused and based on synthesized findings from three primary research efforts conducted in 2025—2025 Deloitte Summer Travel Survey, 2025 Deloitte Holiday Travel Survey, and 2025 Deloitte Corporate Travel Study. Primary findings are supplemented with secondary research, industry expert insights, and Deloitte’s economic analysis to provide a forward-looking perspective.

The leisure travel samples are representative of the US population, and results are analyzed both at the “season” level and at the level of respondents’ longest trips to capture trends across trip types, travel product preferences, and spend levels.

The corporate travel insights draw on a survey of corporate travel managers, as well as a survey of professionals taking at least one business trip in 2025.