Forecast in flux: 2025 Deloitte Corporate Travel Study

Corporate travel continues to rise, but faces a mixed outlook, with selective pullbacks and pressures from cost and shifting traveler expectations

Eileen Crowley

Kate Ferrara

Matt Josephson

Matt Soderberg

Bryan Terry

Maggie Rauch

The path back to predictable demand for corporate travel appears to face new twists in 2025. After two years of steady movement toward recovery, the corporate travel outlook is now marked by more nuance and caution. In 2024, companies were moving from reactivating travel to redefining its value—experimenting with return on investment metrics, sustainability goals, and strategic alignment. In 2025, while many companies plan to increase travel spending, signs of pullback—especially among larger organizations—complicate the picture.

Deloitte’s Corporate Travel Study, conducted in July 2025, draws on two surveys reaching three key stakeholder groups: travel managers (also referred to as buyers), who set policy, negotiate with suppliers, manage tech implementation, and have an organizationwide perspective; team leaders or budget owners, who allocate travel budgets according to the needs of specific teams; and corporate travelers themselves (see the methodology for more details).

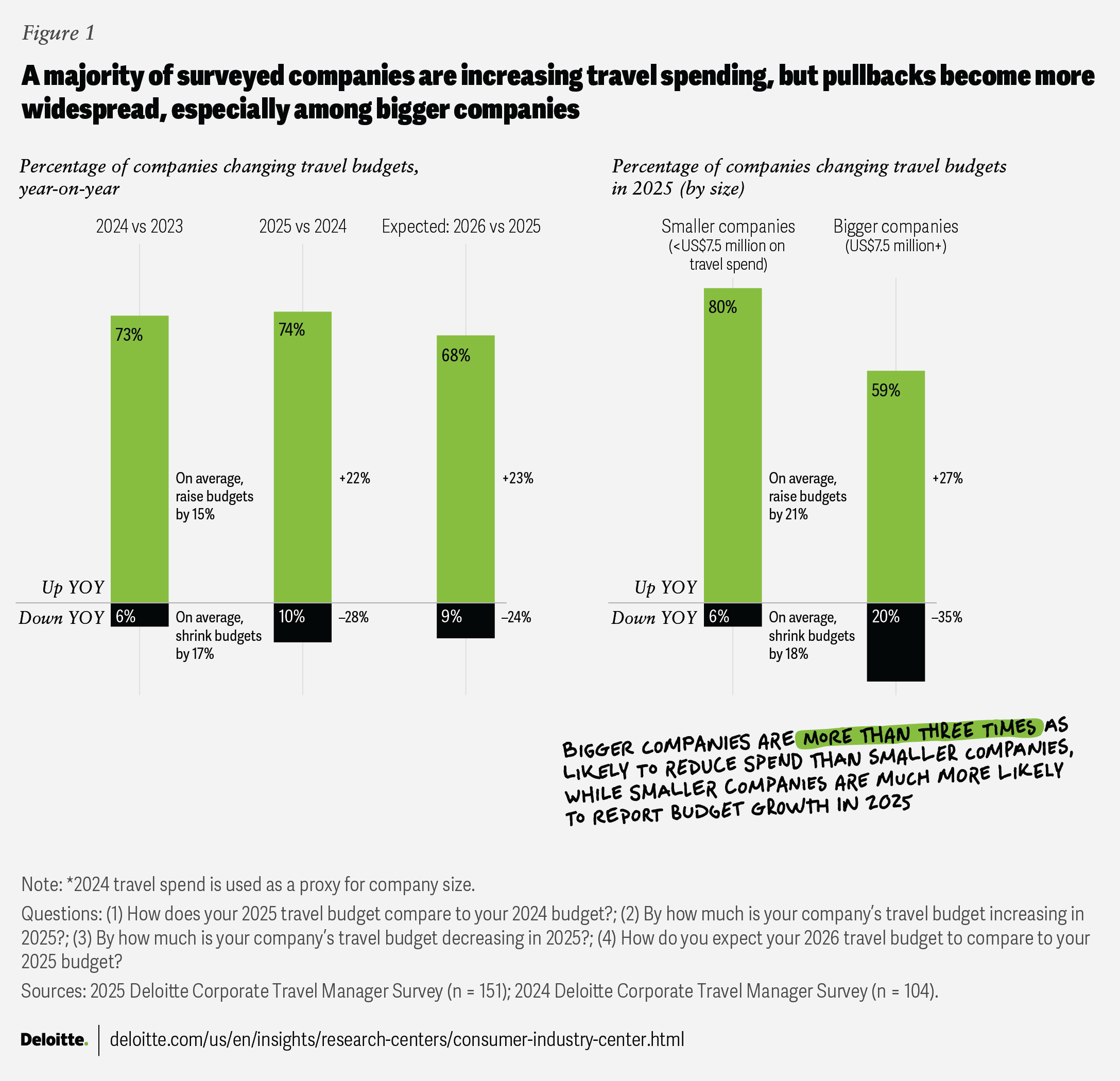

Three in four travel managers responding to Deloitte’s 2025 Corporate Travel Buyer Survey report expanding budgets this year, similar to 2024. However, the share anticipating cuts rose significantly, from 6% to 10% (figure 1). Notably, the scale of both increases and decreases grew, though the average budget decrease widened more.

Although the majority of surveyed big companies reported they expect to increase travel, results from the 2025 Deloitte Corporate Travel Manager Survey indicate that big companies are cutting back more. One in five companies with more than US$7.5 million in 2024 travel spend expect budget declines in 2025, and only 59% expect increases, in sharp contrast to smaller companies (figure 1). These trends by company size run counter to 2024, when larger companies were more likely to expect budget growth.

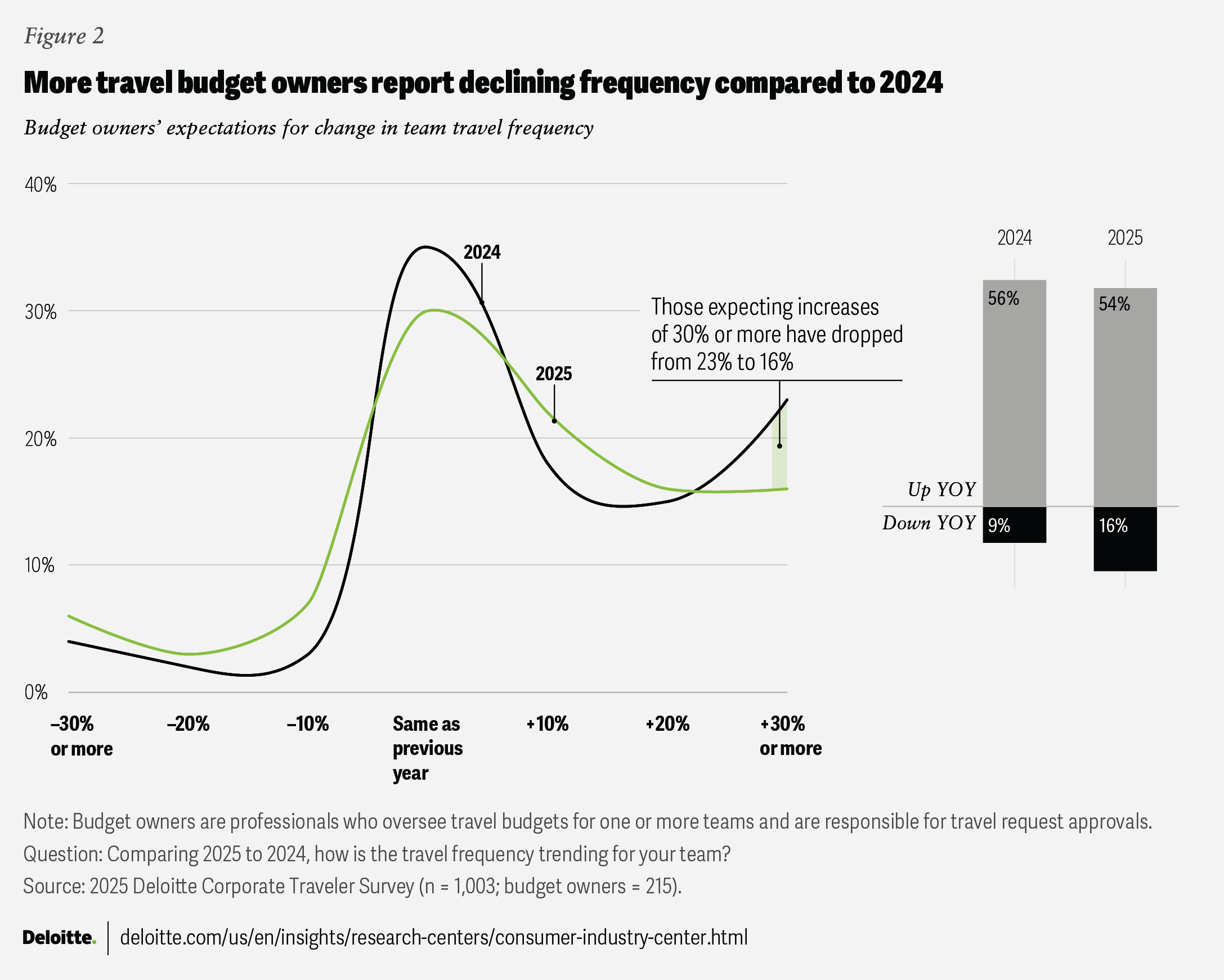

Budget owners, like travel managers, paint a relatively cautious picture: sixteen percent expect their teams to travel less this year, compared to just 9% in 2024, but nearly all of that shift is accounted for by teams reducing travel by about 10%. The share expecting an increase dropped from 23% to 16%, and among those anticipating growth, the scale of expected increases declined (figure 2).

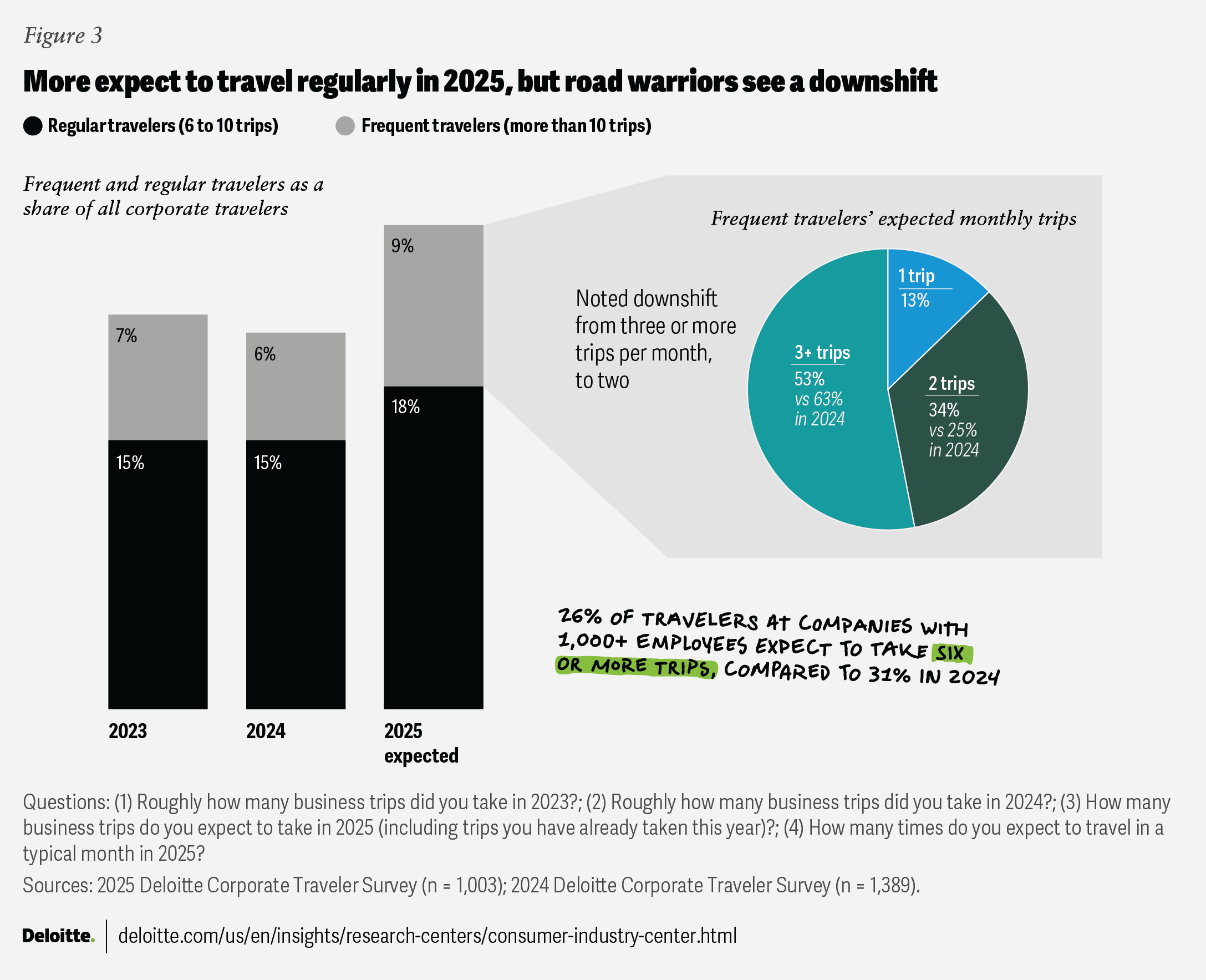

The corporate travel incidence rate—the share of professionals traveling for work—dropped from 36% in 2024 to 31% in 2025. Among those who do travel, trip-frequency expectations present a mixed outlook. Compared to 2024, more travelers expect to travel regularly (6 to 10 trips) or frequently (10 or more trips) (figure 3), but many frequent travelers anticipate a downshift, from three or more trips a month to just two.

The frequent-traveler downshift is especially strong at surveyed companies with 1,000 or more employees, pointing to a key dynamic at play in corporate travel in 2025: Large companies appear to be pulling back more than smaller ones. Travel managers at one in five companies with annual travel budgets of US$7.5 million or more expect to cut spending this year, compared to just 6% of organizations with smaller budgets (figure 1).

These patterns play out against a backdrop of mixed and muted signals, suggesting an uncertain short-term outlook. CoStar cited lagging corporate demand in its recent forecast of a 0.8% decline in US revenue per available room.1 The hotel-performance data provider also noted a 3% drop in group demand for the second quarter of 2025. For the same period, US airlines reported soft corporate-bookings growth.2 Taken together, the data indicate that while travel is growing in 2025, the pace appears modest and is very unlikely to exceed the 9.6% US spend growth forecast by the Global Business Travel Association.3

Unpacking corporate travel spend trends

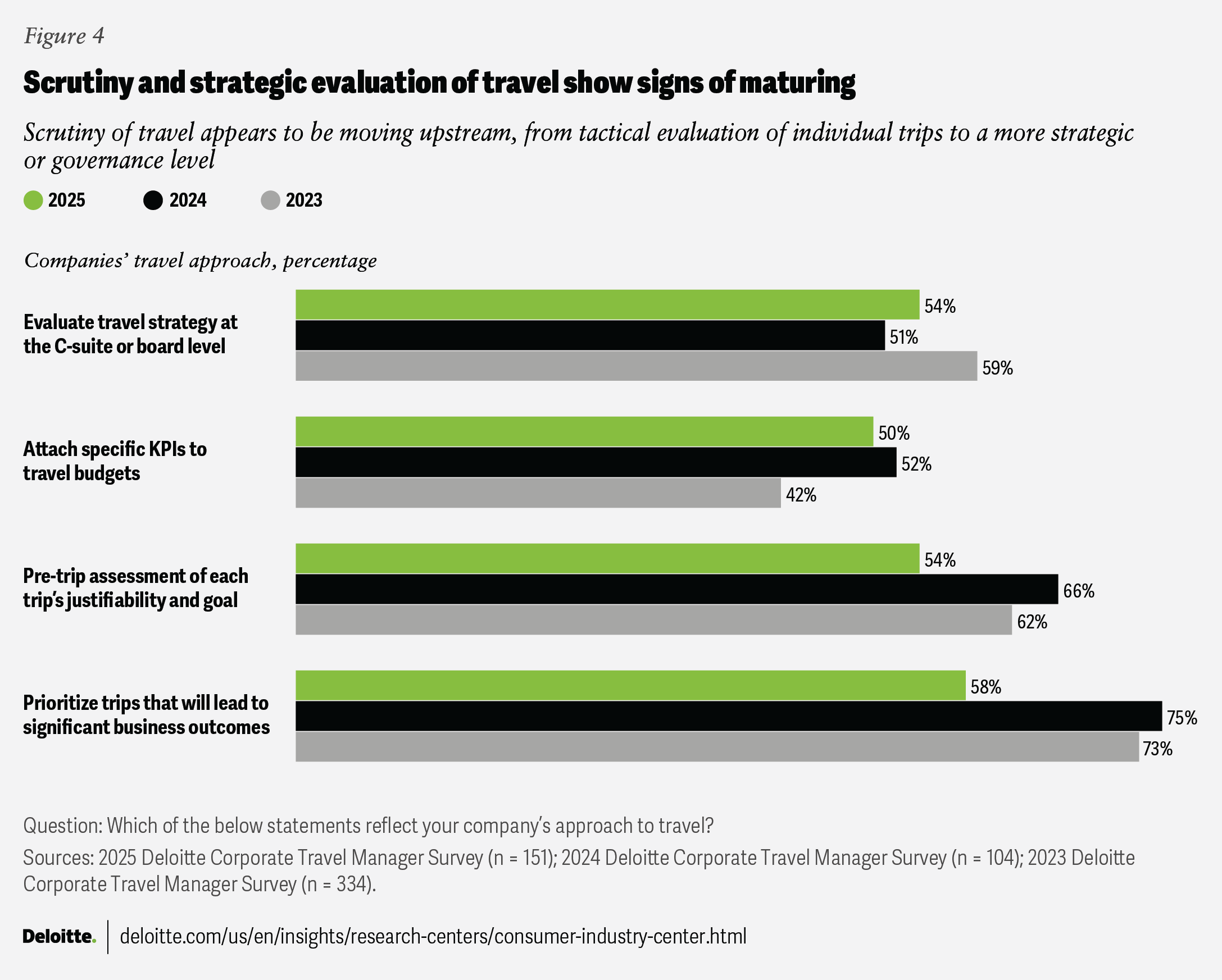

As they steer toward optimal spend levels, organizations also seek to ensure that travel returns the biggest possible benefits. The 2023 and 2024 editions of Deloitte’s Travel Manager Survey suggested that a growing number of companies pursued this aim through closer scrutiny of individual trips (figure 4). This year’s results suggest that some of those efforts may have run their course, indicating that the return on effort for a more granular approach may have been limited.

Most respondents say their companies make pre-trip assessments of each trip’s justifiability and prioritize trips that could lead to specific business outcomes, but these approaches are trending downward. Meanwhile, C-suite attention to travel strategy and the attachment of key performance indicators to travel budgets are at similar levels to 2024. Travel buyers may be moving upstream, away from manual oversight of individual trips and toward a more strategic or governance level.

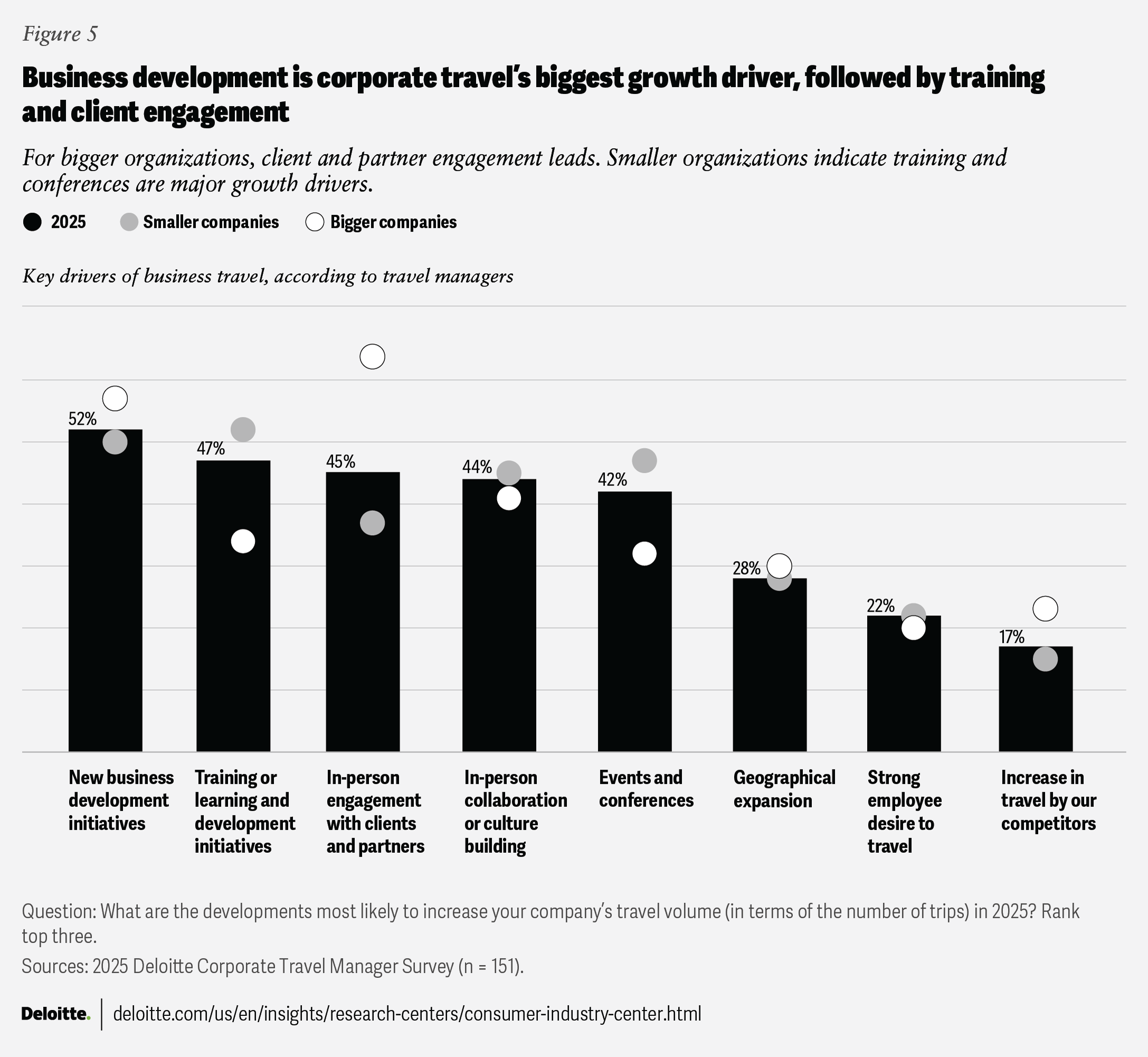

Just as companies have varied approaches to growth and budget discipline, varied trends emerge in the purpose of travel. Corporate travel’s most common purpose is connecting with external stakeholders; new business development initiatives, in-person stakeholder engagement, and conferences all rank among the top four drivers of business-travel growth (figure 5).

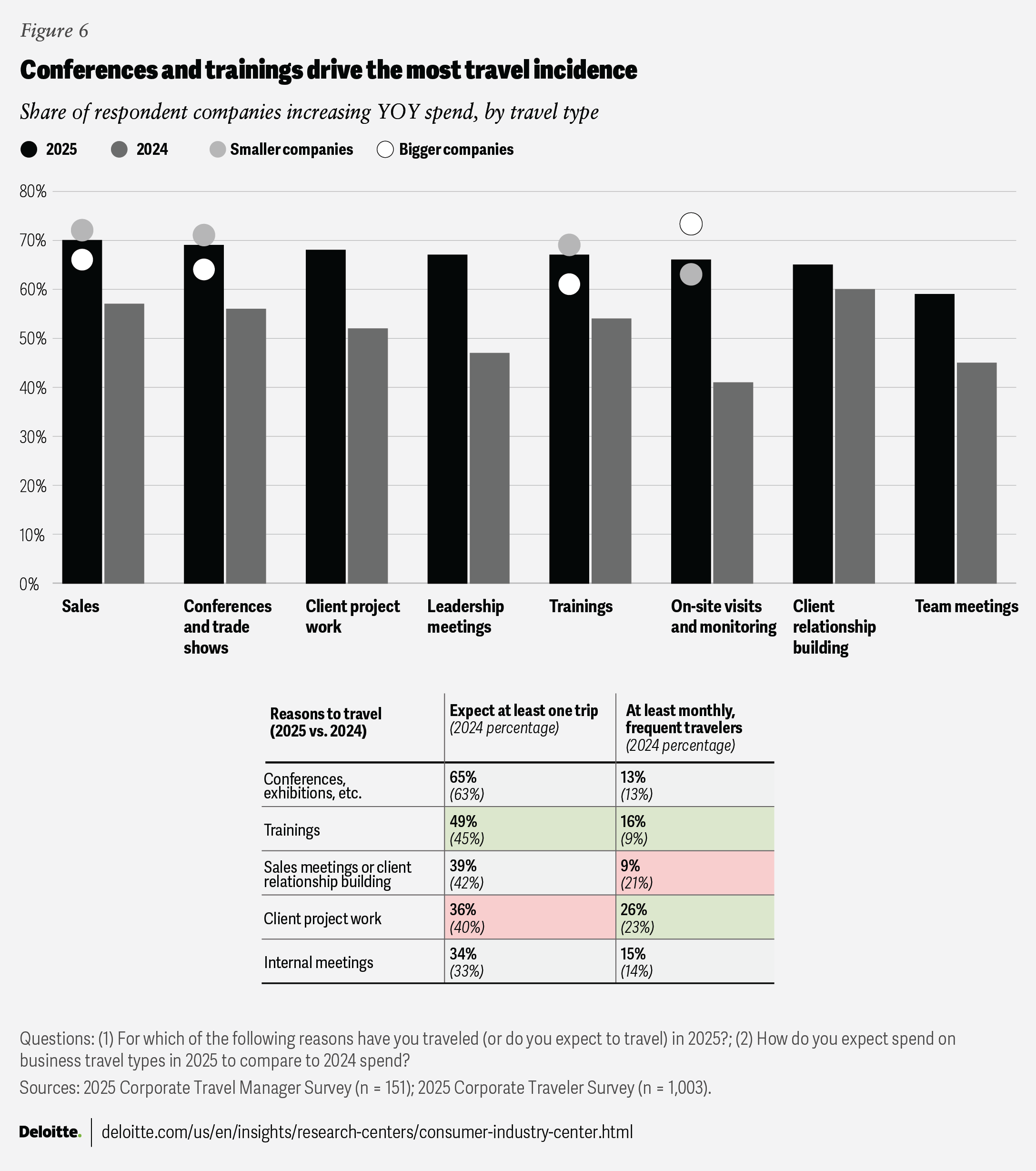

While a higher percentage of bigger companies cite in-person client and partner meetings as a major driver, smaller companies may simply be achieving stakeholder engagement through different means. More respondents from smaller companies select increased event attendance as a driver and report increasing their spend on conference travel (figure 6). For organizations with smaller budgets and fewer employees, live events present efficient opportunities to connect with multiple stakeholders over the course of a few days.

Across respondents, live events remain a major universal driver of travel. Nearly two-thirds of business travelers expect to attend a conference in 2025, making it once again the biggest impetus for travel incidence.

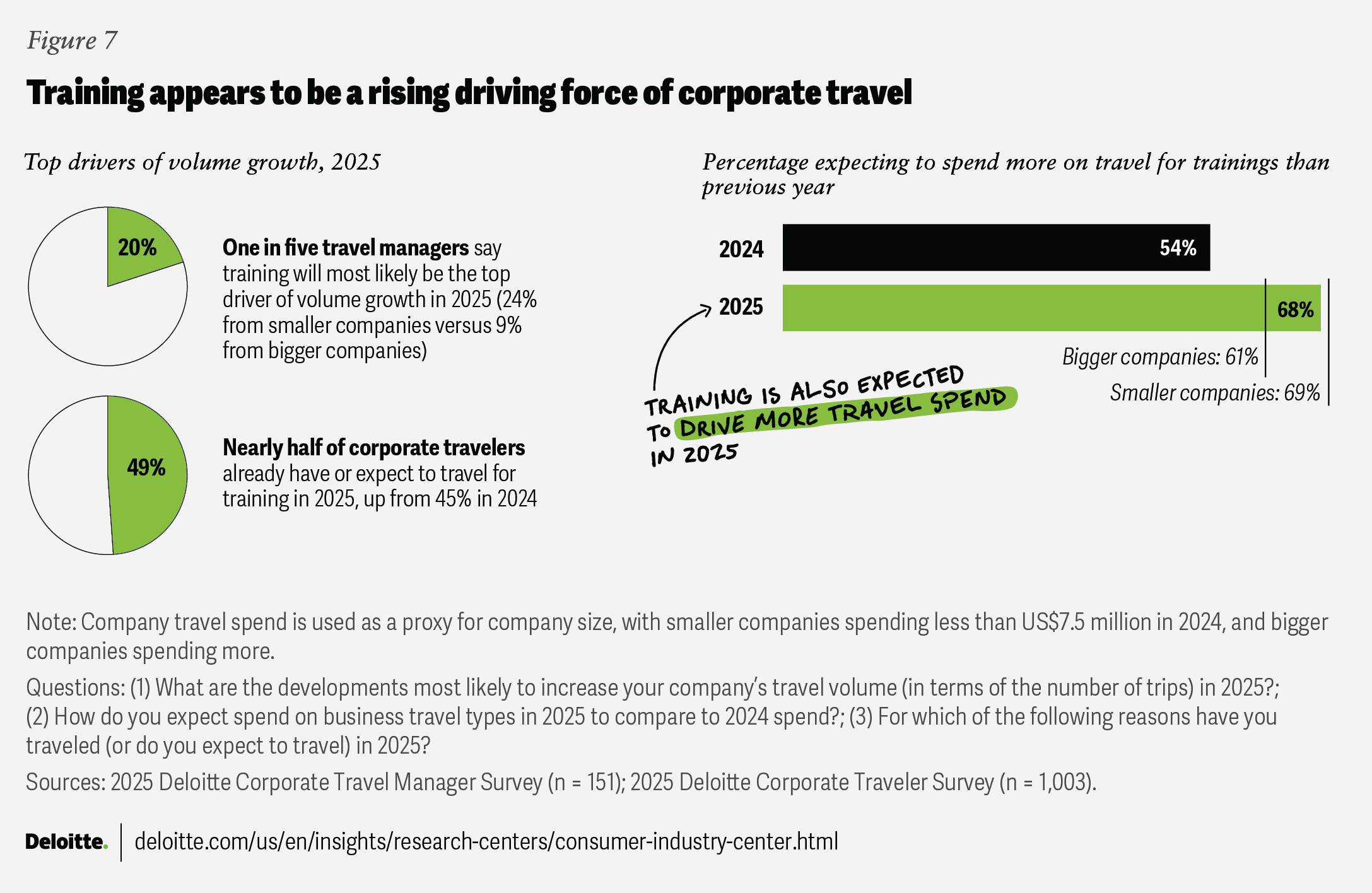

The fastest-growing accelerator is an increased need for training and learning and development initiatives (figure 7). One in five travel managers cite it as their company’s top driver of travel growth in 2025, putting it on par with the increased need for face-to-face engagement with clients, partners, and vendors. Two-thirds say spending in this area is growing, compared to 54% in 2024. According to the World Economic Forum’s “Future of jobs report 2025”, 85% of companies are prioritizing reskilling as they race to adapt to new technology.4 Deloitte’s corporate travel surveys indicate that smaller companies account for much of the surge in training, as more than half placed it in their top three travel-growth drivers. One in four ranked it as number one, dwarfing the 9% of larger companies that did.

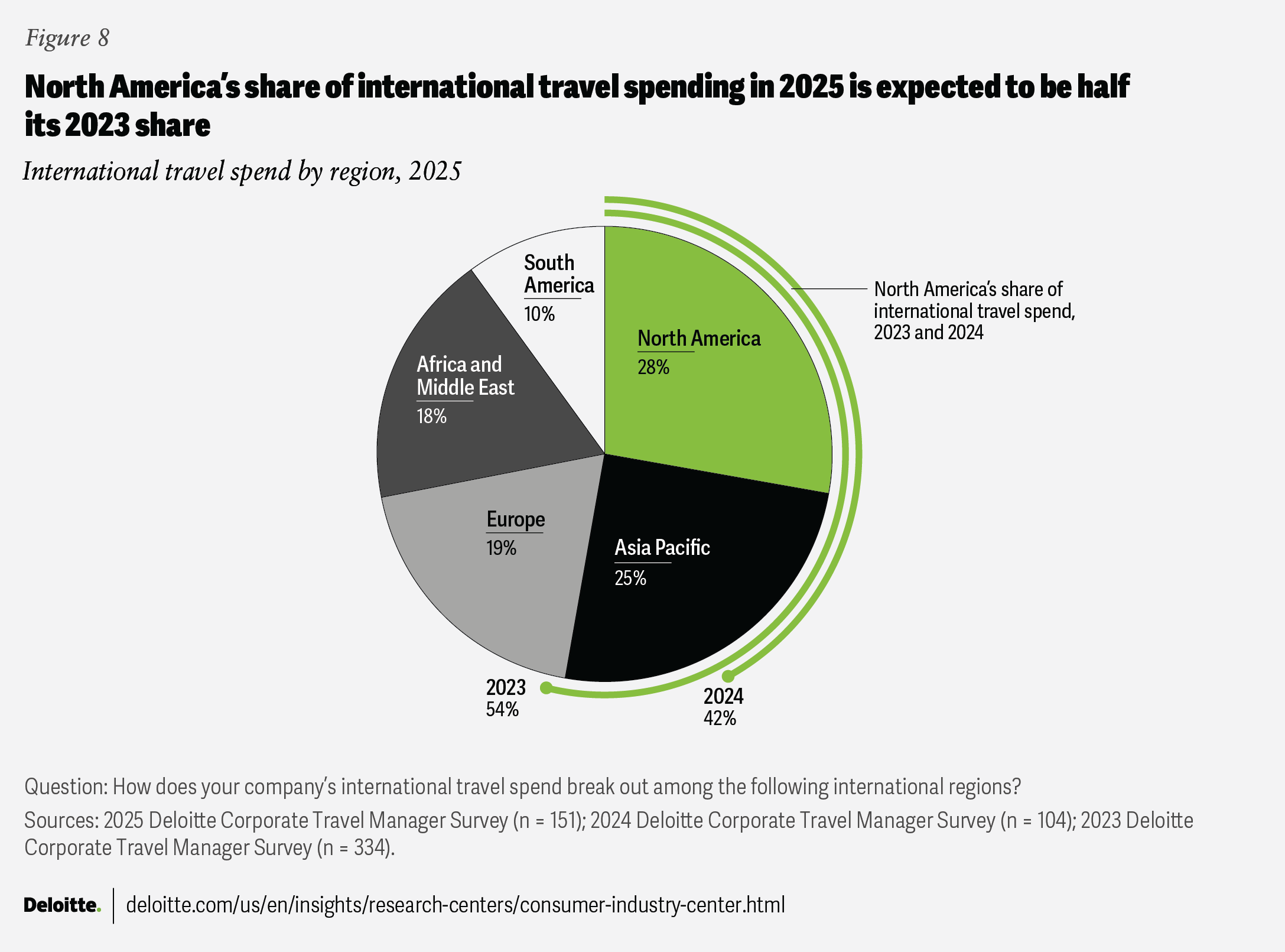

International trips account for about half of respondents’ spending, similar to 2024, but a significant shift in the destination mix continues. North America’s share has trended downward over the past two years, and that trend appears to be accelerating (figure 8). Some of this shift can likely be attributed to farther-flung destinations rising as organizations put pandemic-era restrictions and concerns behind them. But it also coincides with a sharp drop in Canadian and Mexican visitors to the United States in the first half of 2025.5

Decoding travel headwinds

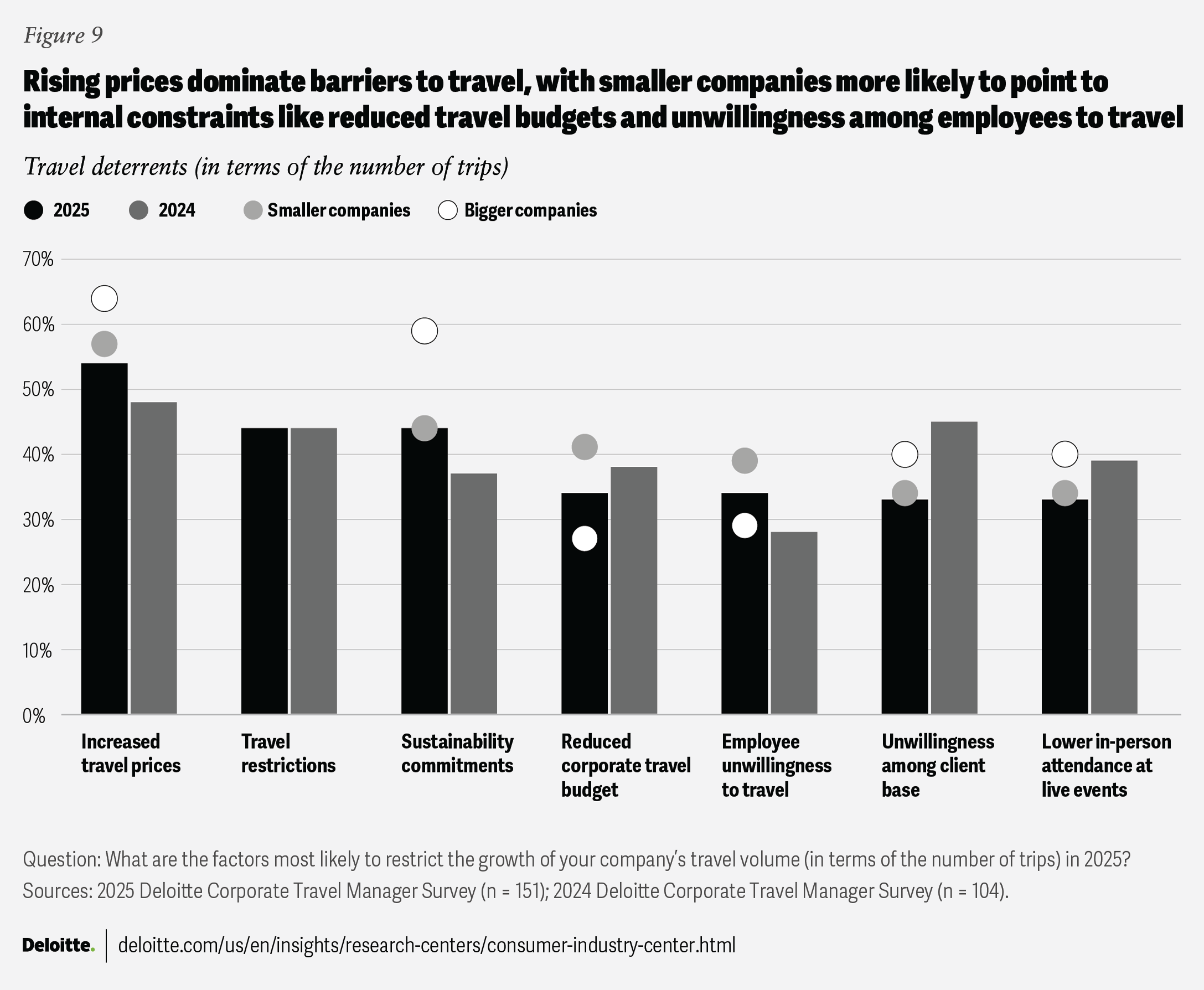

Among travel managers, costs have risen as a drag on travel, pushing most other limiters down. In 2025, 54% of travel managers cite costs among the top three factors restricting travel, compared to 48% in 2024 (figure 9). Budget reductions are a much smaller issue and have receded since 2024. Meanwhile, sustainability commitments are having a bigger impact, with 48% citing them, compared to 38% in 2024.

For bigger companies, drags on spend revolve primarily around two areas: higher prices, which 64% place in their top three, and sustainability commitments, cited by 59%. They are also more likely than smaller companies to point to lower event attendance and lower interest in in-person meetings among their client base.

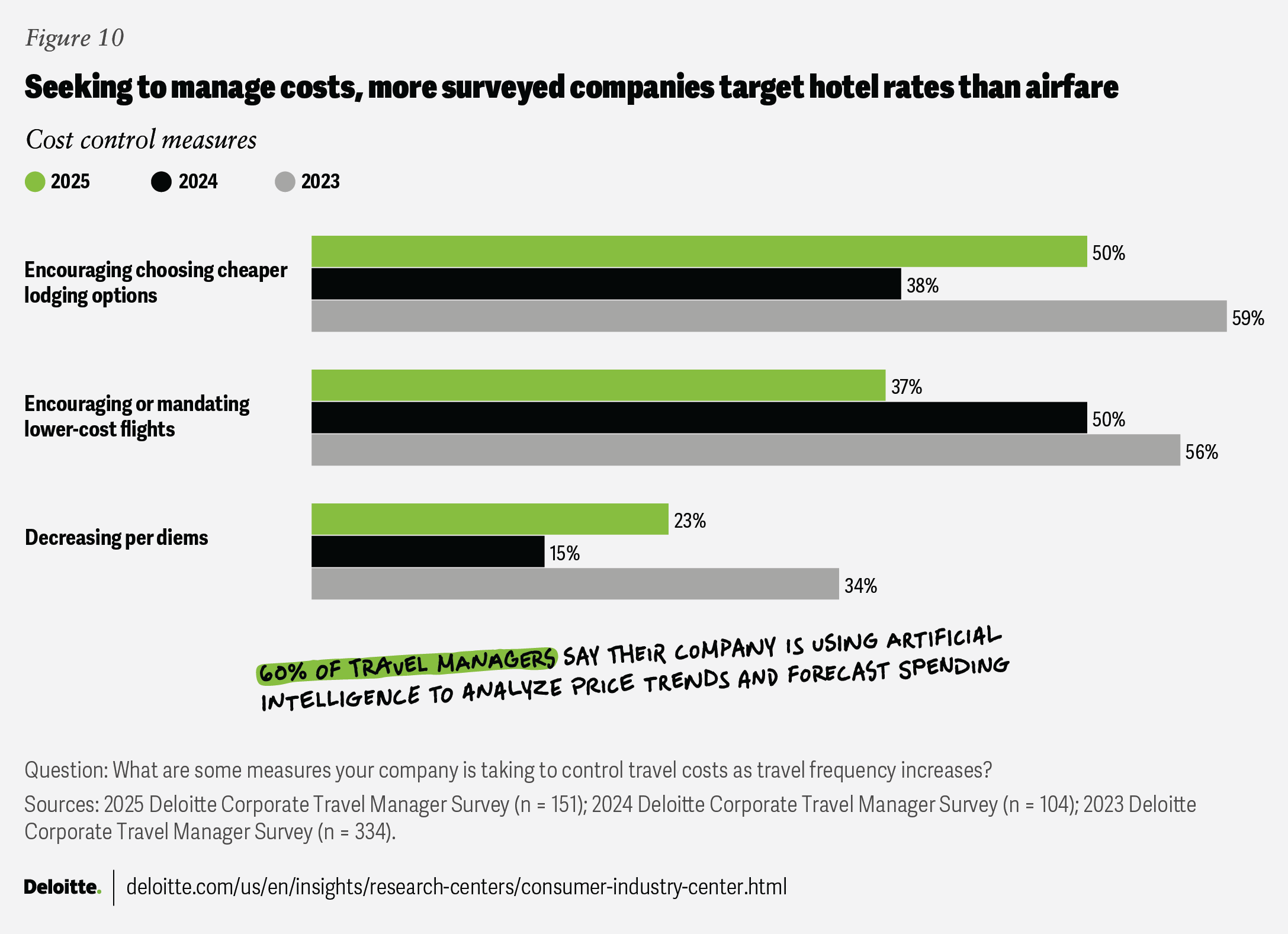

Compared to 2024, cost-control measures have shifted to target lodging and in-destination spending more than flights (figure 10). Companies may be reacting to pricing trends: According to FCM Travel, corporate room rates rose in 2024, while airfare declined.6

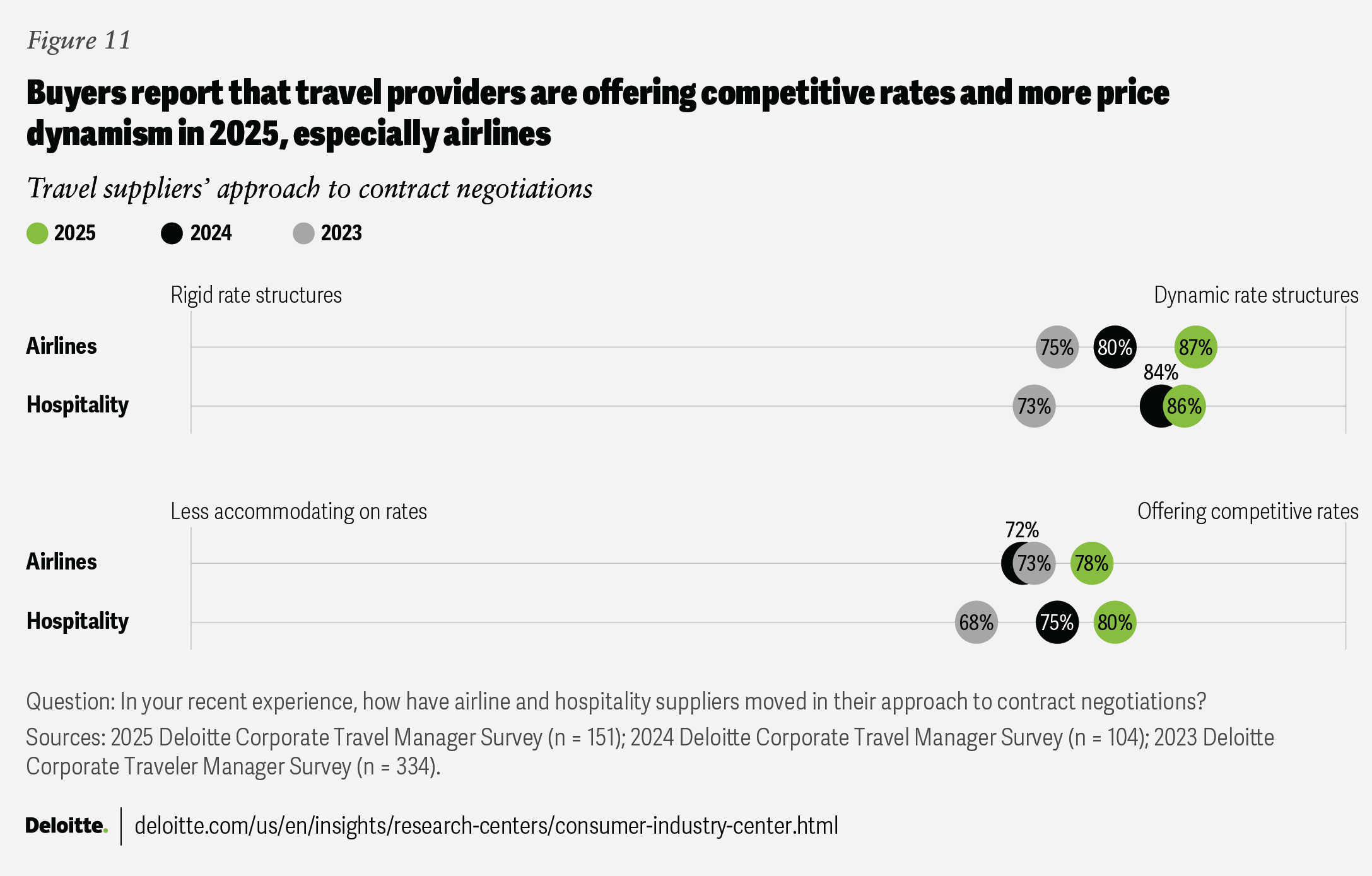

Supplier relations are trending in an overall positive direction, with more travel managers reporting that suppliers have been accommodating and have sought to drive more volume, compared to 2024. More are also continuing to adopt dynamic rate structures (figure 11).

Understanding booking channel behavior

Booking compliance is fundamental to effective corporate-travel management, underpinning both cost efficiency and traveler safety. New patterns in traveler behavior—particularly among frequent travelers and “rogue” bookers who dabble outside of corporate channels—reveal how technology adoption and shifting preferences might be reshaping corporate travel.

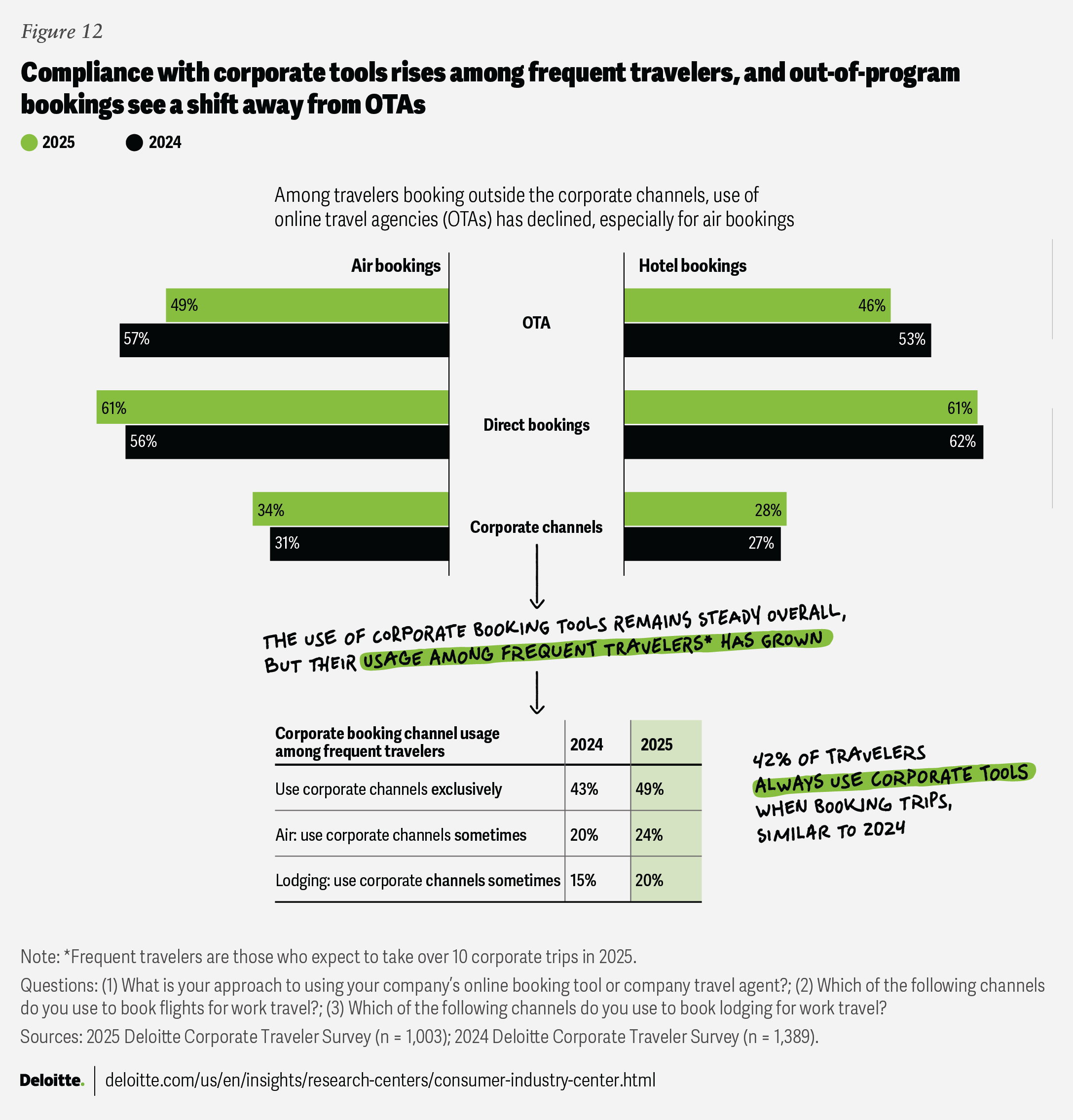

Overall booking compliance remains similar to 2024, but frequent travelers have become more compliant: Forty-nine percent say they always use corporate channels, up from 43% (figure 12). Those who sometimes book off-platform also increased their use of company channels by about 1.7x—from 34% to 58% for air, and from 26% to 44% for hotels.

Among rogue bookers, online travel agency (OTA) usage has declined. This is especially notable among air bookers, where it has gone from 57% in 2024 to 49% in 2025, while both corporate channels and direct bookings with airlines have seen a modest increase. The drop in OTA use is most pronounced among millennials and Generation Z but is observed across age groups.

Responses indicate that user experience gaps between corporate booking tools and OTAs are narrowing. The share of OTA users who say they use the channel due to a superior shopping experience has dropped dramatically, going from 46% of OTA air bookers in 2024 to 27% in 2025. Corporate channels may also be making strides in customer support. The majority of travelers who recently made changes to flights booked through corporate platforms rate their most recent flight change experience as smooth or very smooth—an encouraging sign for program managers focused on compliance and user satisfaction.

Organizations’ tech adoption may also be supporting a move toward direct booking. A growing number of tools exist that enable businesses to connect off-channel bookings to their systems, while airlines and hotels have made a concerted push to attract more direct bookings from corporate travelers.

Focusing on responsible travel, aided by technology

Many organizations are taking a closer look at how they manage corporate travel, identifying opportunities to streamline operations and reduce unnecessary impact. Nearly half (48%) of travel managers surveyed say their companies are optimizing business travel practices to mitigate environmental impact, similar to 2024.

More also conclude that their organizations’ emissions targets call for a significant reduction in travel. The share who say they need to reduce travel by 20% or more nearly doubled to 45% in 2025, compared to 24% in 2024. Bigger companies may be pursuing bigger reductions, as 55% of those with travel spend over US$7.5 million say they need to reduce trip volume by 20% or more (versus 41% of smaller companies).

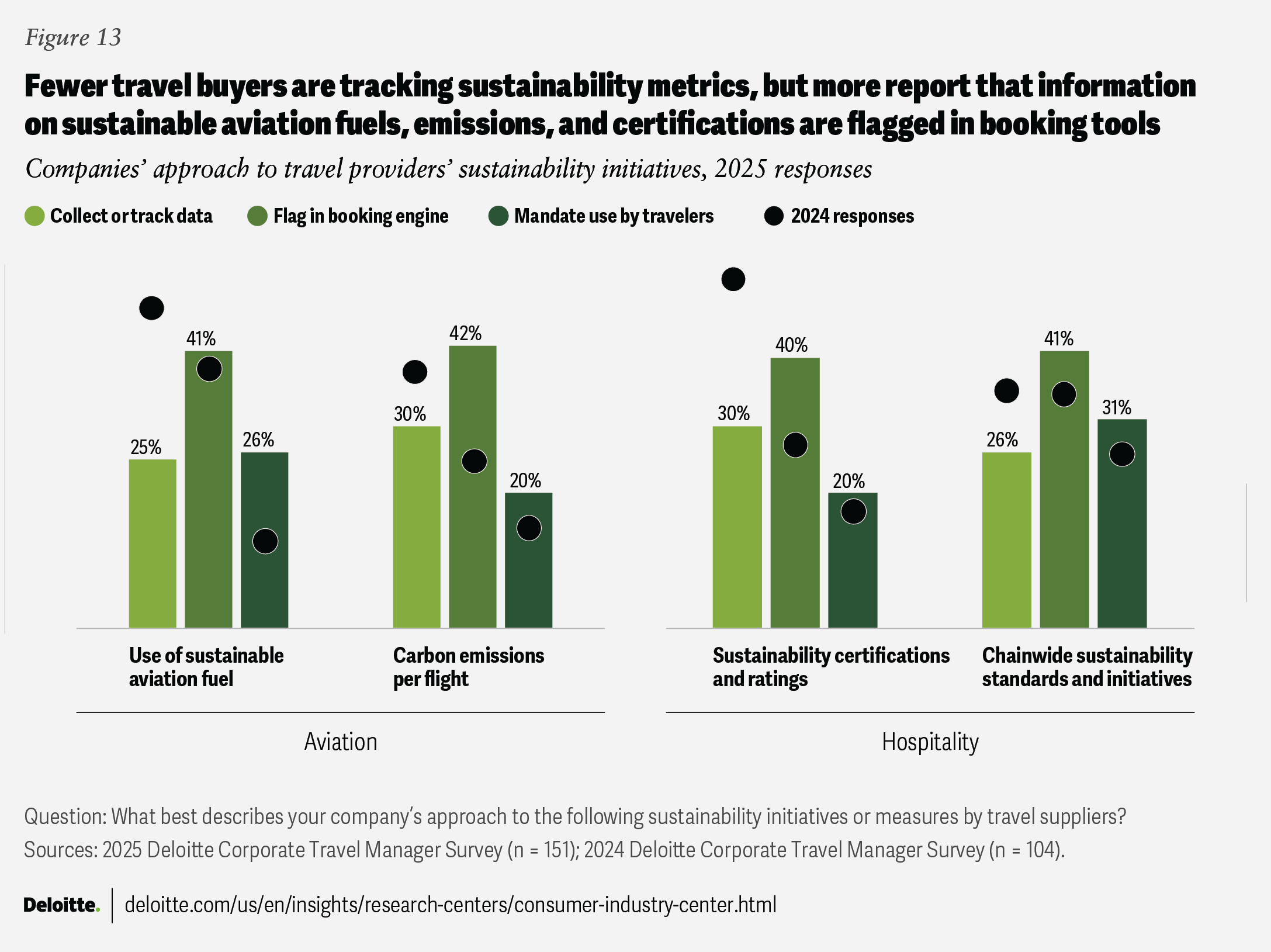

While some travel buyers may look to reduce trips, many also continue to seek ways to reduce the trips’ impact. The share of travel buyers reporting that their companies prioritize airlines that use sustainable aviation fuels (SAFs) jumped to 43% in 2025, up from 33% in 2024. Respondents also report that their approach to various supplier strategies to impact reduction—including the use of SAFs—has shifted more toward action than observation. Across all supplier approaches measured, companies appear to be moving from collecting data to flagging greener options in booking engines or mandating travelers to consider them when possible (figure 13). Fewer travel buyers are tracking sustainability metrics, but more report that information on SAFs, emissions, and certifications is being flagged in booking tools.

Seeking opportunity in uncertainty

Measuring the current moment in corporate travel simply based on growth, or by progress toward a post-pandemic normal, may oversimplify what’s unfolding. The sector appeared to be on a path toward normalization in 2024, but shifting conditions have complicated the trajectory. While spending is still growing in many organizations, it appears to be doing so under selective and strategic conditions, particularly at large organizations, where budget pressure, sustainability goals, and uncertainty about business needs are likely reshaping demand. Companies continue to seek the right balance of managing cost and capacity while pursuing maximum value, impact, and alignment with business goals.

For travel providers, this moment calls for continued agility and collaboration. As buyers refine their strategic approaches, providers that help clients optimize spend, surface clear value, and support unique goals will be best positioned to earn volume. Offering flexibility, transparency, and insight—not just inventory—will help meet the needs of companies navigating a dynamic landscape. The market may be growing modestly overall, but its complexity is growing faster—and that’s where opportunity lies.

Methodology

This report draws on two surveys fielded in July 2025. The 2025 Deloitte Corporate Travel Manager Survey reached more than 150 travel managers, while the 2025 Deloitte Corporate Traveler Survey reached more than 1,000 professionals who took a business trip in 2024 and 2025. Both surveys were US-based.

Travel managers are executives tasked with a variety of company-wide travel initiatives that often include employee-oriented policy, supplier negotiations, duty of care, and the procurement of booking technology. They have a broad perspective on approaches and understand how and why travelers’ options are affected by policy and external forces like market competition, technological innovation, and regulations.

Other key respondent categories are defined as:

- Budget owners: Business travelers who oversee a travel budget and approve travel requests for their team.

- “Bigger” and “smaller” companies: Travel spend is used as a proxy for company size. Smaller companies are those reporting under US$7.5 million in 2024 travel spend. Bigger companies are those reporting US$7.5 million or more in 2024 spend.

- Frequent travelers expect to take more than 10 business trips in 2025. Regular travelers expect to take 6 to 10 trips. Occasional travelers expect to travel five times or fewer.