2025 Deloitte Holiday Travel Survey

Holiday travel intent is at its highest in recent years, but more high-income Americans plan to make cuts that could be felt across travel supplier categories

Eileen Crowley

Kate Ferrara

Matt Soderberg

Matt Josephson

Maggie Rauch

Upasana Naik

Travel continues to hold a treasured place in holiday plans, but many Americans are holding their wallets a little closer this year. Our 2025 Deloitte Holiday Travel Survey finds that financial concerns appear to lie at the root of several indicators of a softer season, despite the continued enthusiasm for travel.

For the first time in at least five years, more than half of surveyed Americans plan to take trips between Thanksgiving and early January. But most of that increase comes from people staying with friends and family rather than in paid accommodations. The signs of softness don’t stop there. Planned trip length and frequency, as well as travel budgets, are all down compared with last year. With fewer trips and more conservative spending, travel providers could see a weak winter in metrics such as airline load factors, hotel revenue per available room, and activity bookings. By most measures, 2025 appears likely to be a little less busy than 2024.

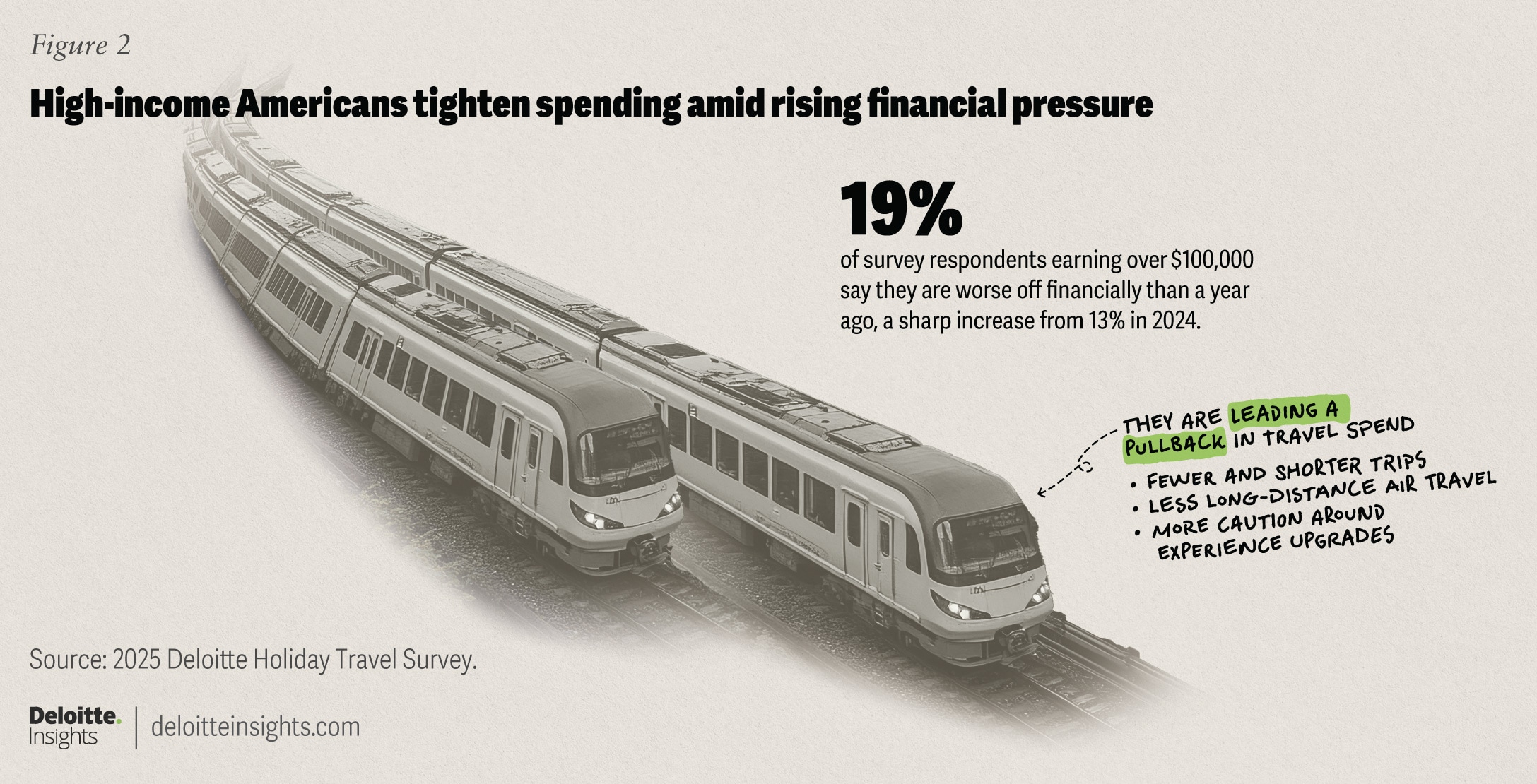

Underlying the tighter travel budgets is a more muted money mood: Nearly one in three Americans say their financial situation is worse compared to a year ago, up from one in four in 2024. High-income Americans1 are leading that shift: 19% with annual household incomes of $100,000 or more feel worse off, compared to 13% in 2024. This concentration of caution among high earners, who tend to take more trips and spend more on them, could have an outsized impact on travel spending.

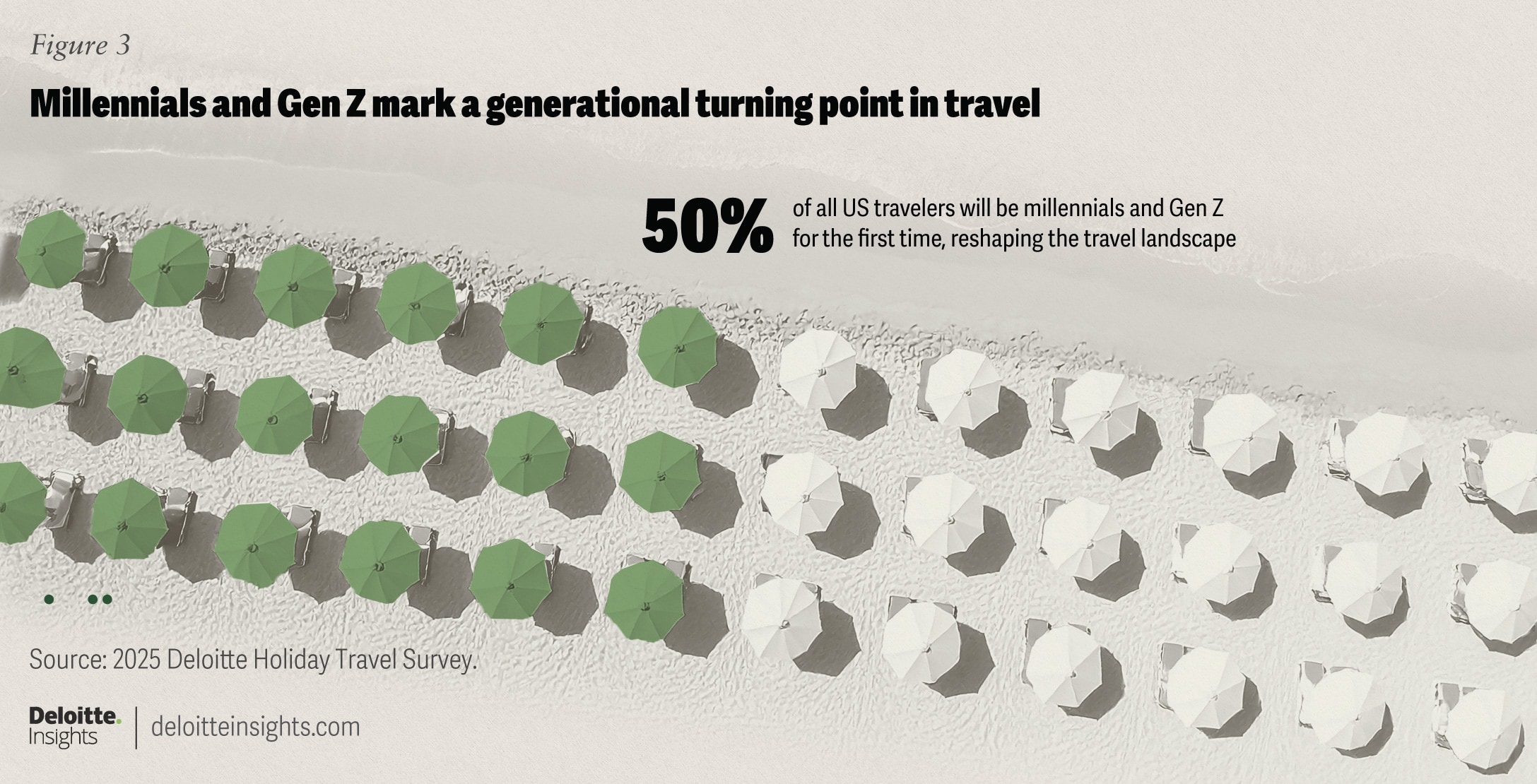

A relatively brighter financial outlook among young Americans may also be contributing to the arrival of a notable milestone: For the first time, Generation Z and millennials are expected to make up half of the traveling public this holiday season. These younger generations plan to take more trips than older generations. And about one in three travelers this holiday season are expected to come from the highest-spending generation—millennials, who have an average holiday travel budget of $2,602.

The growing influence of younger travelers is accelerating the growth of newer tech platforms in travel research. Among respondents, millennials are leading generative AI adoption, which has grown by 1.5x since 2024. More than half of Gen Zs say they use short social video platforms for travel research.

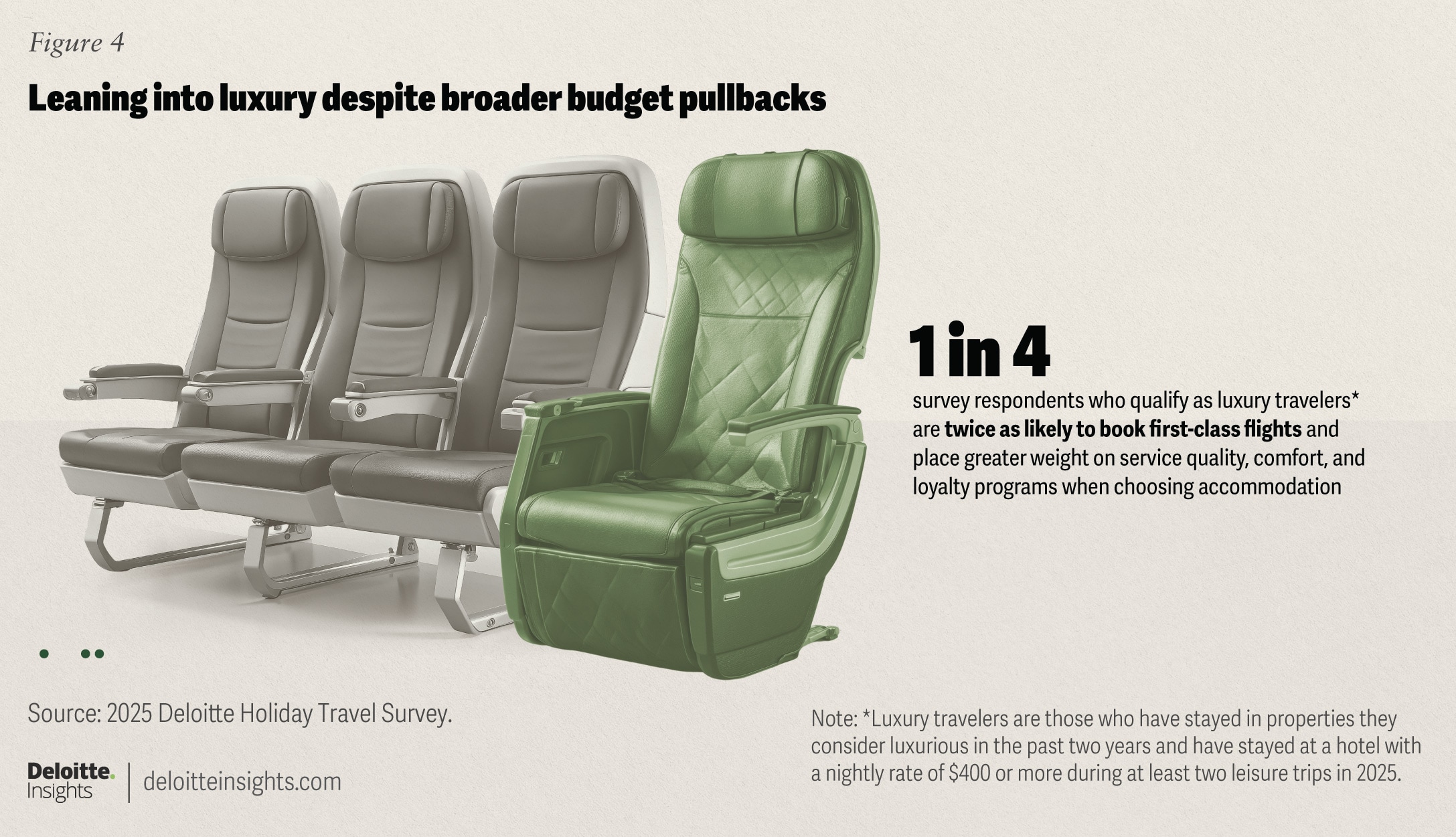

Even in a season marked by softer spending, many plan to continue to shell out for the comfiest seats and the finest rooms. One in four respondents to the survey meet Deloitte’s threshold for luxury travelers.2 They are twice as likely to book first-class air tickets, and when choosing a hotel, they give much greater weight to customer service and loyalty memberships. As suppliers pursue frequent and luxury travelers, they are well advised to balance programmatic loyalty with delivering on high expectations of customer experience and personalization. If pockets of travel demand continue to face pressure, winning their engagement will bring a much-needed lift in the holiday season and the year ahead.

Read on for key takeaways and download the full survey findings.

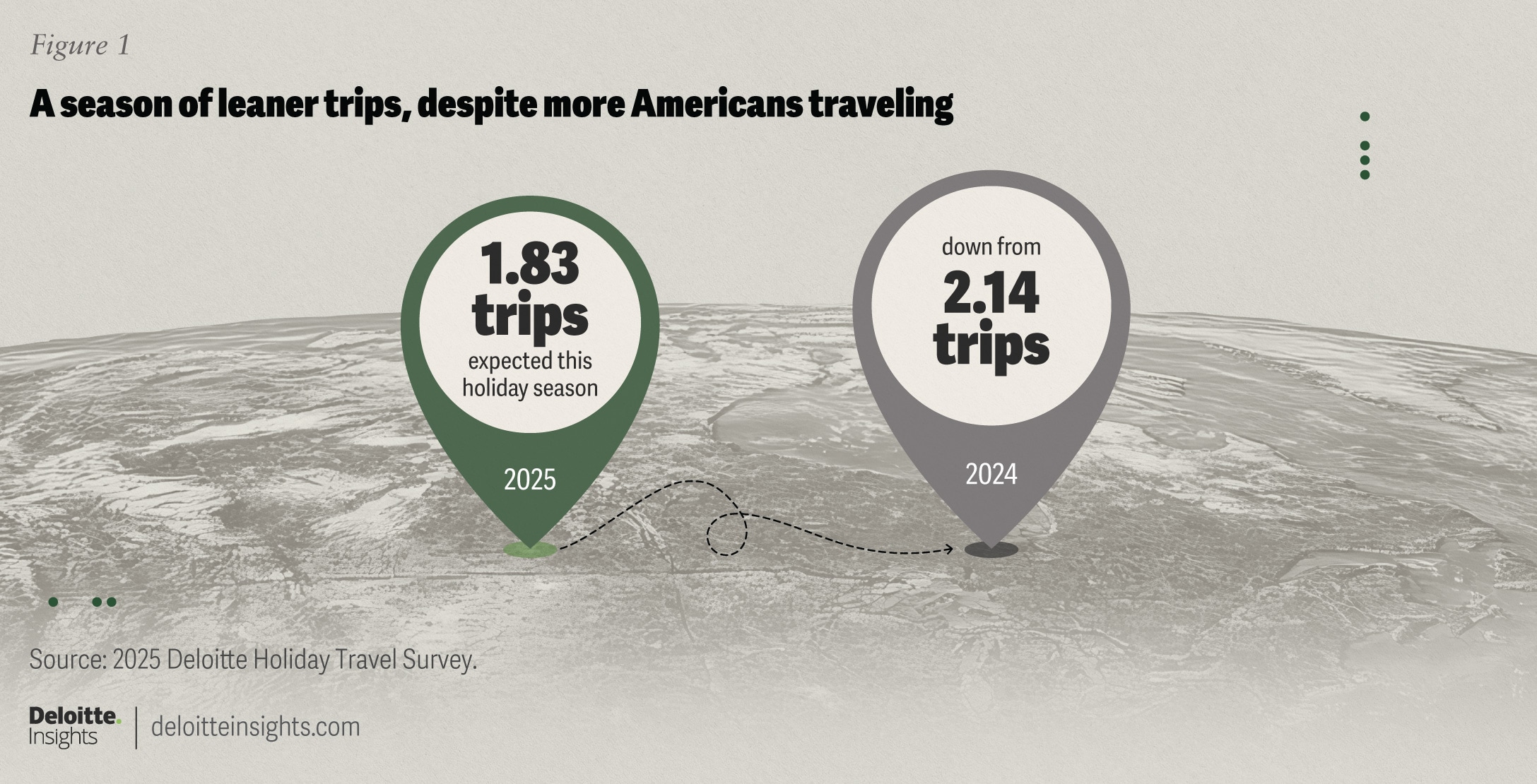

More Americans plan to travel, but trips are likely to look leaner in every way

Most Americans plan to travel, but this strong incidence masks a season of leaner trips. The average number of planned holiday trips has dropped to 1.83, down from 2.14 last year, and average planned trip budgets are down 18% to $2,334. These more cautious travel decisions are driven by sliding financial sentiment. Nearly one in three respondents (31%) say their financial situation is worse than a year ago, up from 26% in 2024. Even high earners are trading down, opting for shorter stays, fewer flights, and less luxurious lodging.

With 57% of travelers citing cost savings as a motivation for driving instead of flying, this frugality appears to be reshaping demand trends across every travel category. It seems enthusiasm for travel remains strong, but it is being expressed through thriftier choices and fewer splurges.

High-income Americans feel financial pressure and take a step back

High-income households—usually responsible for an outsized share of travel spending—plan to tighten their belts this season. Despite their income levels, financial sentiment outweighs raw spending power this year, with high earners leading reductions in both trip length and budgets. One in five survey respondents (19%) earning over $100,000 say they are worse off financially than a year ago, a sharp increase from 13% in 2024. Among this “cautious class,” 80% say they plan to make adjustments to travel more cheaply, compared with 58% of their more financially comfortable peers.

Expected cuts are showing up in airfare, lodging, and in-destination activities. The caution among high-income travelers—who typically spend more and travel farther—could ripple across airlines, hotels, and destinations reliant on premium spend.

Influence inflection: Youngest two generations combine for half of travel

For the first time, Gen Z and millennials are expected to make up half of all US holiday travelers, marking a generational turning point in travel demand. These generations are increasingly shaping not only how much Americans travel but also how they plan and book their trips. Millennials remain the highest-spending generation, with an average planned holiday travel budget of $2,602, while Gen Z continues to expand its travel participation.

Their growing influence extends beyond volume—these travelers are driving new patterns in discovery and decision-making. More than half of Gen Z respondents use short-form social video for travel inspiration, and gen AI adoption for trip planning has jumped 1.5x since 2024, led by millennials. The convergence of digital fluency and strong intent among these generations is reshaping the competitive landscape for travel brands.

Even in leaner times, some still lean into luxury

Even amid broad budget pullbacks, a slice of travelers still have appetites to seek out the finest experiences they can find. One in four surveyed travelers meets Deloitte’s criteria for “luxury travelers”—those who have stayed at a property they consider luxurious in the past two years and have stayed at a hotel with a nightly rate of $400 or more during at least two leisure trips in 2025.

These travelers are twice as likely to book first-class flights and place greater weight on service quality, comfort, and loyalty programs when selecting accommodations. In a more frugal holiday travel season, luxury travelers appear to represent an opportunity to sustain premium demand through exceptional experiences, world-class service, and smart execution of programmatic loyalty.