2026 Global Software Industry Outlook

In 2026, financial pressure, agentic AI adoption and a shift to AI-first products is expected to intensify competition, transform operations, and force new approaches for software companies

Ayo Odusote

Steve Fineberg

Girija Krishnamurthy

David Jarvis

Sayantani Mazumder

In 2026, what it means to be a software company in the agentic artificial intelligence era could start to become clearer.1 Creating software is faster and cheaper than ever, and major players are expected to continue to move from simply adding AI features and functions to their products to AI-first engineering and product design. Competition will heat up as AI-native challengers begin to chip away at market leaders across business processes and create new market segments that were previously unaddressed by software. Software development teams will feel strong pressure to transform, with new organizing principles and skills needed for developers, engineers, designers, and product managers. As software companies increasingly turn their growing agentic AI proficiencies inward, they could use their new capabilities to improve cybersecurity in the face of emerging autonomous AI-powered cyber attacks.

State of the market

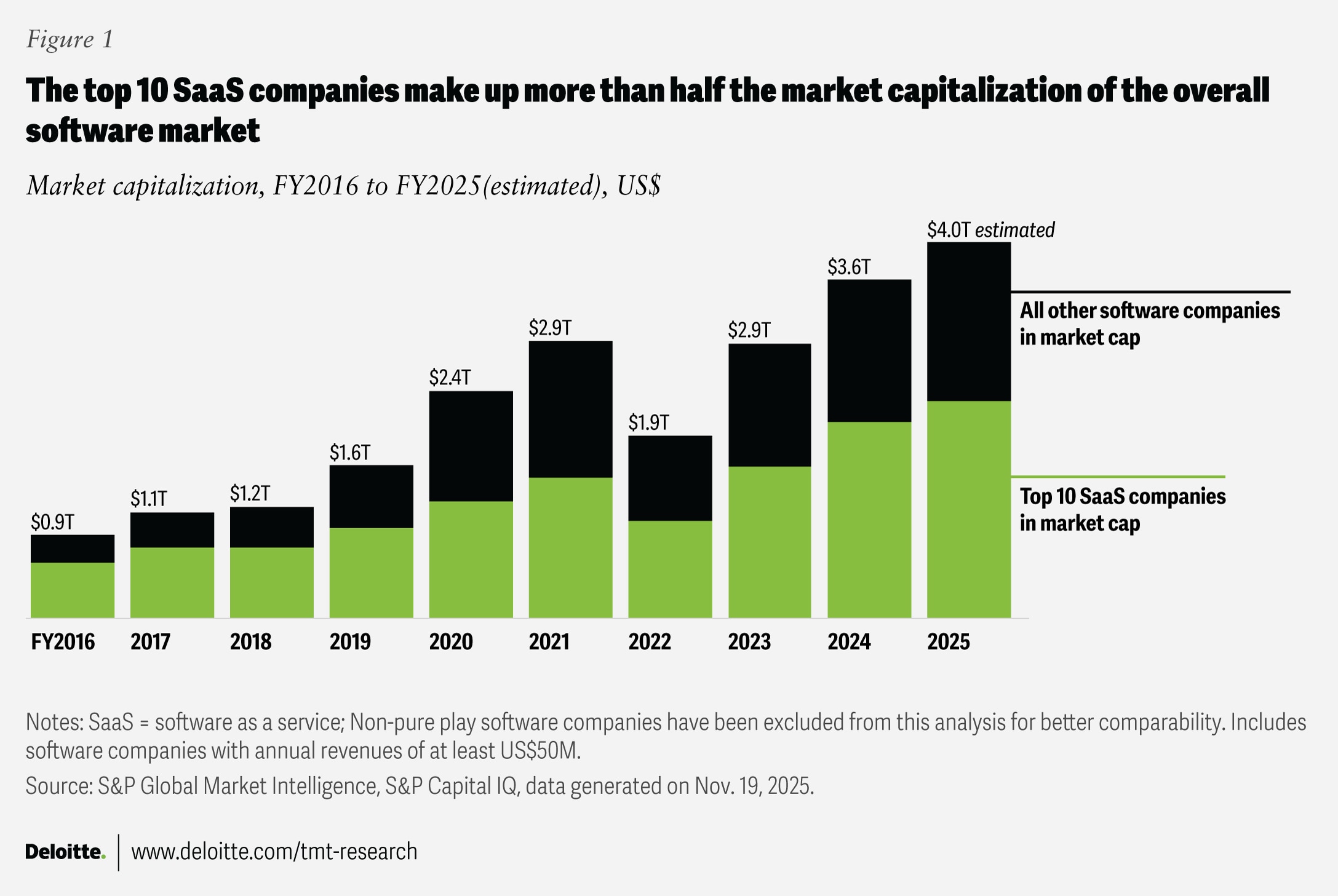

Although investor worries persist, the enterprise software market still grows, generates strong cash flows, and benefits from large install bases2 (figure 1). Questions about future growth are arising due in part to the costs of AI, the value generated from AI implementations, and shifts in pricing power. The additional costs from using large language models (LLMs), investments in new agentic products, and hybrid pricing could pressure future revenues and margins.3 In addition, new entrants are rapidly growing and disrupting the market with leaner operating models.

One hope is that AI agents can drive substantial new growth for established players. Gartner® predicts that, “forty percent of enterprise applications will be integrated with task-specific AI agents by the end of 2026, up from less than 5% today” (2025).4 Because of value captured from the productivity gains from AI agents, it’s projected that the application software market could potentially grow to US$780 billion by 2030 (a 13% compound annual growth rate).5 A few major software providers have started reporting revenues from their agentic offerings to help boost investor confidence.6 Whether these solutions provide the same margins as traditional software products remains to be seen (margins for the top software as a service providers have been around 70% the past few years).7 If margins decrease significantly, investments in research and development, sales and go-to-market activities could potentially suffer.

To get to these expected levels of growth, companies will need to focus on building better customer success strategies. Deeper partnerships, education and support, interoperability and integration, and helping control and predict costs will be important. Since the economics of AI are quite different and more complex than cloud migration, outcomes and return on investment need as much focus as possible—value cannot just be incremental. Additionally, enterprises may expect AI‑embedded software to have costs similar to their traditional products, which can complicate nascent hybrid pricing models.

This raises some questions for software companies in 2026. How are they bringing AI to customers? How are they driving adoption and value, when customers can build their own AI agents? How do they best monetize new capabilities? We see three major themes growing in importance over the coming year: intensifying competition, AI-first development models, and agentic cybersecurity.

Intensifying competition between AI-natives and incumbents

By 2030, it’s estimated that AI agent-powered solutions could represent 60% of the total addressable software market—setting up a race between AI-native companies and incumbents.8 While the “software is dead” narrative is premature, the dominance of traditional incumbents is under some threat. However, it’s not necessarily a zero-sum game. Some AI-native companies are gaining market share in areas that demand agility and they’re creating entirely new market segments. Organizational functions that demand high reliability and tight integration are still very dependent on incumbents.9

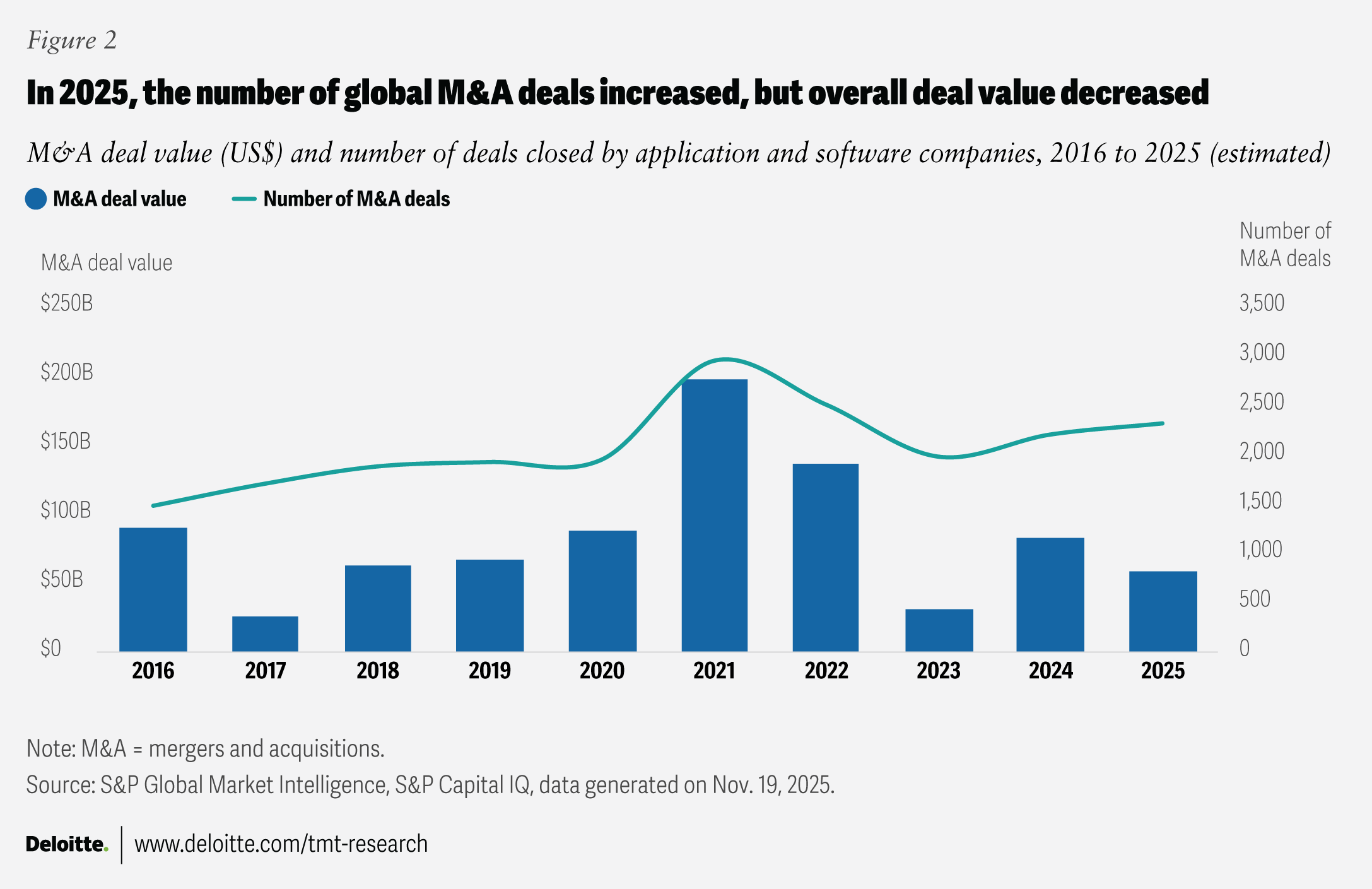

In 2026, established software players are expected to focus on becoming full-stack, end-to-end agentic platforms—helping to build, run, orchestrate and govern agents across functions in their bid to strengthen customer confidence and boost revenue. Some are heavily investing in cloud, infrastructure, and data platforms, signaling this strategic pivot.10 Established players are accelerating mergers and acquisitions to add AI-powered capabilities.11 In 2025, US software companies spent more on acquiring AI companies compared with the previous three years combined12 (figure 2).

AI-native software companies are bringing highly specialized, industry-specific AI and agentic capabilities to the table. Their AI-first mindset, product focus, and new pricing models can help them to be more agile and responsive than incumbents.13 These factors combined with more flexible cost structures position them to secure the attention of enterprise customers. They’re starting with simpler and neglected workflows today but will likely shift to turning more complex workflows into outcome-driven, intelligent, and adaptive systems.

The path to scale is not expected to be easy. Traditional performance benchmarks may be overridden by frameworks that consider new metrics as well as efficiency, quality of growth and fiscal prudence.14 The cost of powering LLM-driven products remains high—driving startups to burn large amounts of capital amid uncertain margins. They too will likely have to make a choice: rapidly scale or be acquired. However, some AI-native startups that may be confident in their ability to thrive on their own could aim for a longer runway supported by strong valuations and ample venture capital.15 If acquisitions do happen, they will likely be based on core products rather than “acquihires”.

In 2026, we will likely see a coevolution of established and AI-native players—with each capitalizing on their core strengths. While incumbents benefit from trust and familiarity with their customers, low switching costs could push them toward AI-native providers as they seek innovation and higher levels of value. In this scenario, businesses will weigh core AI platforms against purpose-built AI applications. Some leading enterprise software firms have already started creating integrated “agentic enterprise” platforms via partnerships.16 AI-native software companies are also teaming with cloud providers, data platforms, and software incumbents to widen their customer base with enterprise-grade infrastructure and governance—capabilities that they may not have on their own.17

In the end, businesses will likely take a hybrid approach. For mission-critical and cross-functional workflows at scale—agentic platforms built through acquisitions and partnerships may win. However, for targeted and high-impact applications, independent AI-native tools may remain compelling.

Strategic questions to consider:

- For software incumbents, what is the best mix of adding AI features to existing software products and launching brand new AI-native products? What’s the best approach to building, buying, or partnering when it comes to AI-native capabilities?

- For AI-native firms, which business model and path to scale ensure long-term viability?

- Which pricing approach and go-to-market strategies will work best in an AI-native software world?

Redesigning AI-first development teams

Development teams are expected to continue to be remade throughout 2026.18 Gartner predicts that, “80% of organizations will evolve large software engineering teams into smaller, AI-augmented teams by 2030”.19 Those that leverage agentic AI capabilities in an integrated way across the full software development life cycle (SDLC)—including coding, requirements development, deployment, monitoring, and testing—may be able to unlock more value. Deloitte expects that AI could potentially drive productivity gains of 30% to 35% across the SDLC.20 To maximize this value and help AI tools and agents improve outcomes, rather than introduce new risks, development teams should revamp their strategies.

Several AI-centric challenges should be addressed as part of this shift. Cultural resistance, trust issues and ambiguity about expectations could throw strategies off track. In addition, skill erosion is a possibility in the long-term, which could hinder innovation and adaptability.21

What does this mean for individual developers and teams? For mid- and senior-level developers, the demand for intangible skills related to customer experience, cross-functional engineering, systems thinking and cross-product management is expected to grow. With respect to the future of entry-level developers, opinion is far from consensus among those we interviewed.22 Some expect such roles to maintain their status quo, others anticipate a significant change of focus.

Teams can expect changes to structure and composition as organizations retool to optimize collaboration between humans and AI systems. Conventional team structures will likely shift with fewer entry-level developers and more mid-level and specialized professionals, with a broader supervisory span for managers. New roles may be added as well, like AI governance specialists, prompt engineers and context designers, and AI-augmented user experience designers. In addition, functional teams are beginning to add AI-native, domain-specialized engineers who can quickly build capabilities without help from IT.

To get the productivity gains from an AI-empowered SDLC, some tech companies interviewed are implementing more AI-first training programs and upskilling initiatives. A senior vice-president at an enterprise applications company highlights this shift, “We brought in 500 interns this year globally… It’s an AI-first internship class where we’re training them to focus on AI capabilities for the first time in our history.”23

Mentorship should also get more attention in 2026. Responses to a recent internal survey of coders showed concerns that AI tools are driving fewer mentoring and collaboration opportunities with AI tools taking the place of interaction with colleagues.24 AI might be causing challenges, but it can also provide talent-related solutions. In a recent Deloitte survey, 60% of respondents said that AI can help experienced workers share their knowledge and skills.25

Finally, conventional models of performance evaluation and incentives might not be enough for software companies going forward. Individual objectives and key results and team key performance indicators may need to shift to reinforce AI adoption and innovation. Addressing these shifts and challenges could help software companies get the AI integration and gains they seek. Those who create effective and sustainable AI-first development teams will likely be the ones who win in the long run.

Strategic questions to consider:

- What should our AI-enabled SDLC operating model ultimately look like? How will we leverage our own agentic capabilities for internal operations?

- How will we redesign our talent pipeline and team structures for both human and digital workers across entry, mid and senior levels? How will we restructure training and mentorship?

- How can we better measure and incentivize performance in an AI-augmented environment to drive outcomes?

Agentifying cybersecurity operations

Long standing fears of autonomous, AI-powered cyberattacks became real in late 2025. A threat actor used a jailbroken version of Anthropic’s Claude Code tool to attack about 30 different organizations, automatically identifying high-value databases and writing exploit code to exfiltrate data.26 Anthropic estimated that about 80% to 90% of the “agentic” attack was conducted without any human involvement. Was this attack simply an advanced science experiment, or does it herald a proliferation of autonomous attacks in 2026?

AI has already reshaped the threat landscape through shadow AI, vulnerabilities in AI-generated code, highly personalized phishing, and social engineering attacks and AI-powered malware. Between March 2024 and February 2025 an estimated 16% of data breaches involved attackers using AI (mostly AI-generated phishing and deepfakes).27 This share is expected to increase, and in 2026 organizations should expect attacks that are faster, more persistent, and adaptive as attackers increasingly use customized LLMs and autonomous AI agents.

Adoption of AI to defend against these attacks is accelerating. Some security leaders are working to use AI-first cyber blueprints to improve their overall capabilities, protect their organization’s AI initiatives, and help ensure that their AI-powered products are secure and resilient. According to Deloitte Global’s most recent Global Future of Cyber Survey, 39% of respondents (on average) report using AI capabilities “to a large extent” for automating security processes and responses, and providing continuous monitoring.28

In 2026, software companies will likely explore how to agentify their cyber operations and will face greater complexity as they add to their existing stable of security vendors and panoply of tools.29 The adoption of AI agents is expected to necessitate an expansion of cyber capabilities across identity, governance, risk management, and compliance.

Organizations can make shifts that could help. Major security players are continuing to build next generation security platforms by consolidating capabilities to better manage the evolving threat landscape.30 Integrated security platforms can help accelerate the move to agentic AI, as fragmented tools and complex architectures make it harder for AI agents to operate. Security leaders should ask themselves how these platforms could potentially provide continuous innovation, operational simplicity and reduced costs, and what the integration challenges could be.31

Another shift is that, in the past, organizations typically managed security issues with a solution-first approach. For example: “We need identity and access management, so we evaluate vendors and acquire a solution based on their capabilities.” In the agentic era, it becomes more complicated. Leaders should consider adopting an AI-first mindset and analyze their security tasks, workflows, and decision-making and then decide what work needs human involvement, what AI agents can automate, and where there are gaps. Then they can procure the capabilities they need.

Strategic questions to consider:

- Are we ready for more persistent, adaptive, and autonomous AI-powered attacks? How will our security operations need to change for “machine speed”? What will an AI-enhanced security operations center look like?

- How can we simplify and consolidate our security tools and operations to be better prepared for AI agents? Where will humans remain essential?

- How will we transform our governance, talent models, and risk frameworks in response to AI agents?

Additional AI, cost, and market uncertainties for 2026

In addition to the growth of AI-native competitors, the continuing transformation of software development teams and emerging cybersecurity threats, consider these additional trends and uncertainties as well:

- The impact of AI on internal operations: Many software companies continue to act as “customer zero” (or even “customer minus one”) for their products. Some are using their own AI-powered platforms and tools to improve internal operations, uncover proprietary insights with their data, and build confidence with customers. Software providers are reporting that AI is involved with a rapidly growing share of their work.32 The next 12 to 18 months will likely determine who can turn this into differentiation.

- The growth of AI as interface: Over the next few years, AI-powered systems are expected to increasingly act as the primary interface across multiple software applications. As traditional applications evolve into collections of autonomous, task-oriented AI agents, AI orchestration platforms will likely become critical for monitoring and governing agents.33 Fierce competition among software companies to be the primary interface layer is expected—to keep customers within their platforms and give providers access to agent telemetry.

- Managing the growing cost of compute: Generative AI is increasing IT budgets for some organizations.34 With the uncertain economics of AI workloads and the potential for growing infrastructure costs, this could squeeze margins for software companies in 2026. For those companies with their own cloud infrastructure, there may be revisions to plans and delays in the construction of data centers. For those using public cloud providers, spending and cloud costs as a percentage of revenue may be considered.

- M&A as a waiting game or musical chairs: Look for major SaaS providers to pursue promising agentic startups throughout 2026. Will acquisitions target specific products, or will there be broader moves to enhance platform and orchestration capabilities? Many acquisition targets may ask for a premium, so deal values will be a good indicator of whether companies are willing to do anything to “win” the AI race.