Reshaping loyalty programs in an era of value seeking

As consumers seek more value for the price paid, loyalty programs could prove to be the differentiator. How can brands transform these programs to deepen customer engagement?

Ramya Murali

Deirdre O’Connell

Jenny Spiel

Stephen Rogers

Lupine Skelly

Consumers today are redefining what “value” means, and brands are feeling the pressure. Deloitte’s research on the value-seeking consumer shows that 4 in 10 Americans now exhibit deal-driven, cost-conscious, or trade-down behaviors across industries, from groceries to travel. Even high-income households are reassessing what value means and are seeking brands that feel fair in price and generous in return.1

This shift is prompting brands to intensify price-based competition, and many find themselves in a race to the bottom. Yet there is a more strategic way to deliver value than perpetual price cuts. Our research shows that perceptions of a brand’s value stem from factors other than price for as many as 40% of surveyed consumers.2 Depending on the industry, factors such as customer service, quality, ease of checkout, and loyalty programs can help attract consumers versus price alone. For example, in the restaurant and hotel industries, employee friendliness is seen as a top customer service value driver, whereas in the apparel industry, helpfulness and effectiveness are top drivers. Our analysis shows that consumers demonstrate higher future purchase intent toward brands that add value beyond price, creating a meaningful opportunity to differentiate without competing on price alone.3

Among the non-price factors that customers seem to value, loyalty programs emerge as a clear differentiator. In fact, the 2025 Deloitte Consumer Loyalty Program Survey (see methodology) finds that while price, value, and quality remain the top drivers of brand loyalty across all age and income groups, loyalty programs follow close behind. This creates an opportunity for brands to expand how they deliver value, not only through competitive pricing and strong products, but also through loyalty programs that deepen engagement and reward ongoing participation. Put simply, loyalty programs have moved from a “nice-to-have” to a strategic lever that drives continual business over time.

Loyalty enrollment is high, but engagement is selective

The survey results clearly show that effective loyalty programs fundamentally reshape consumer behavior. Most consumers (72%) say loyalty programs make them more likely to spend with their preferred brand, while over half (56%) increase their spending because of the program.4 Perceived value also increases, with 80% of consumers noting they get more from the brand because of the loyalty program.5

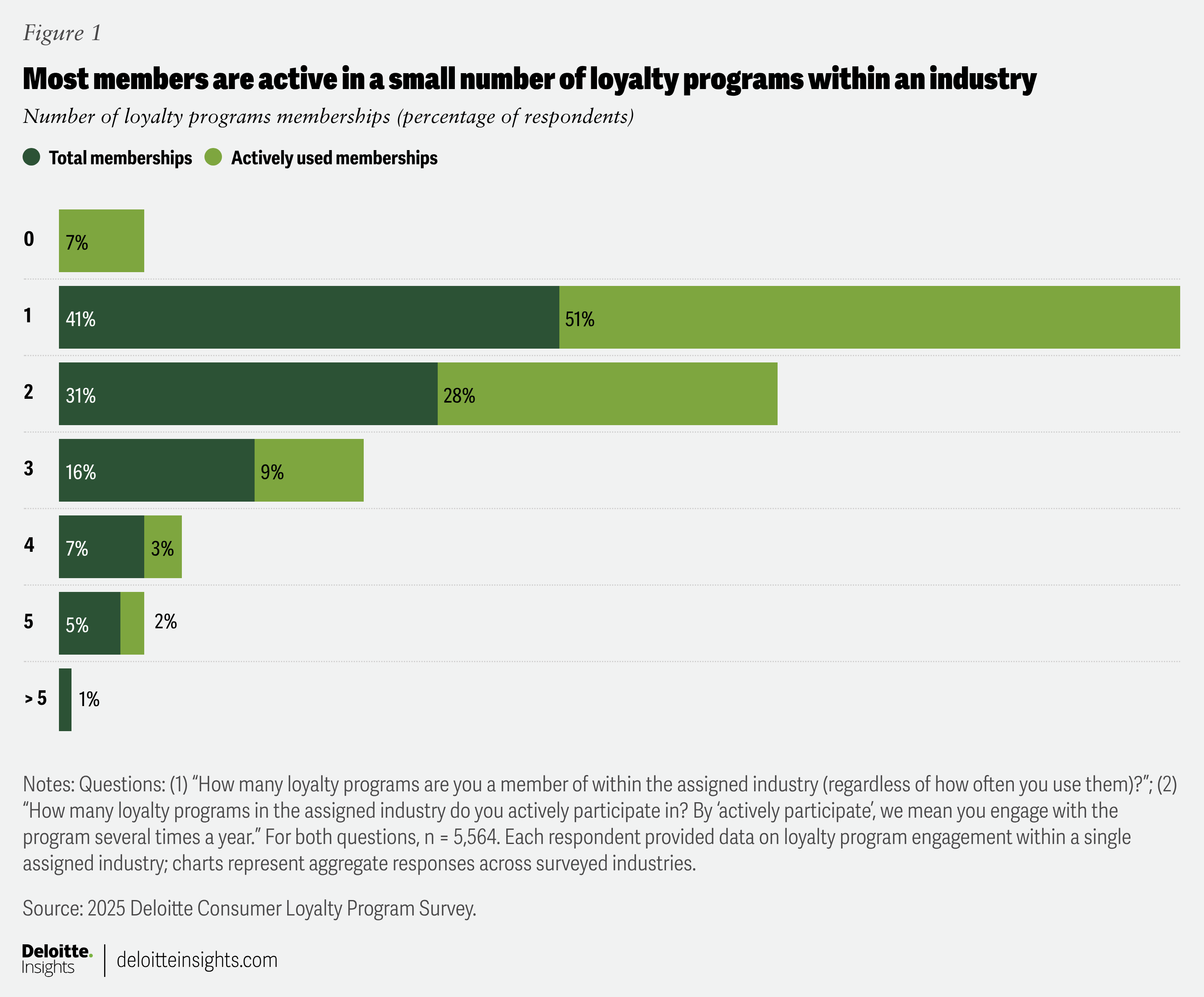

The data also reveals significant untapped potential. Across industries, the average consumer enrolls in eight loyalty programs, yet actively participates in only five. Looking at an industry level, however, this gap is even more pronounced, as over half of respondents (51%) engage with only one program (figure 1). With consumers actively engaging with far fewer programs than those in which they are enrolled, it seems that many loyalty programs fail to deliver sustained relevance and value.

Value is more than points, especially for Generation Z

When consumers were asked what motivates them to join new loyalty programs, they ranked “overall value” as the top driver, followed by attractive ongoing benefits and immediate sign-up incentives.6 This finding underscores that while discounts might draw consumers in, the perceived value of a brand’s loyalty program supersedes the initial sign-up incentive. But value means different things to different people, and brands will need to navigate changing consumer preferences to recalibrate how they offer and communicate value if they want to improve engagement levels.

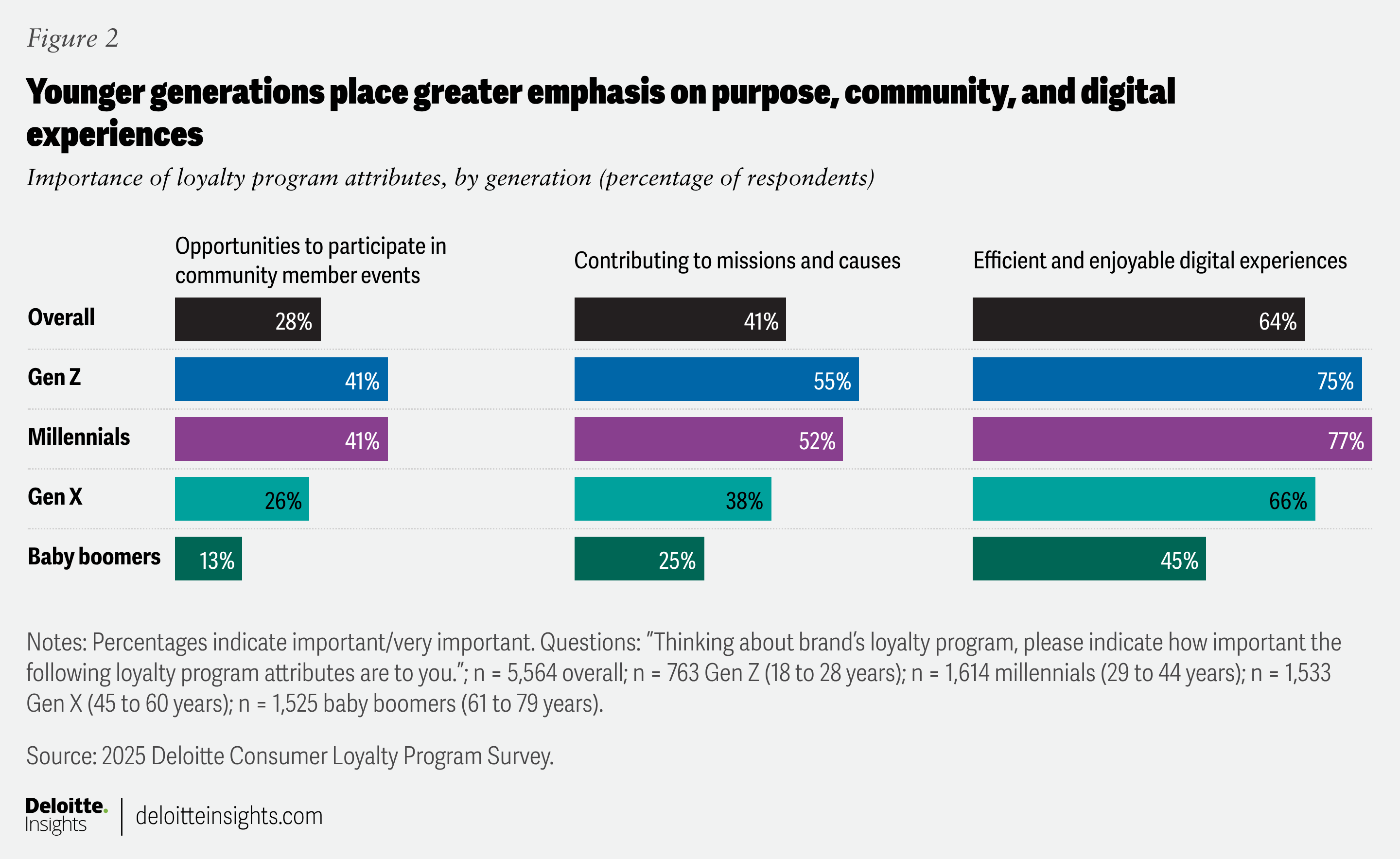

The preferences for loyalty programs are also changing across generations. For example, Gen Z and millennials are placing greater importance on contributing to missions and causes, opportunities to participate in community member events, and efficient and enjoyable digital experiences (figure 2). Customized rewards, accelerated earnings, and digital features like real-time tracking are also far more appealing to younger cohorts.7

Building loyalty for the next era of value

Consumer companies’ goals might need to shift from simply maintaining a program to designing programs that convert enrollment into enduring engagement. Three strategies can help define the path forward.

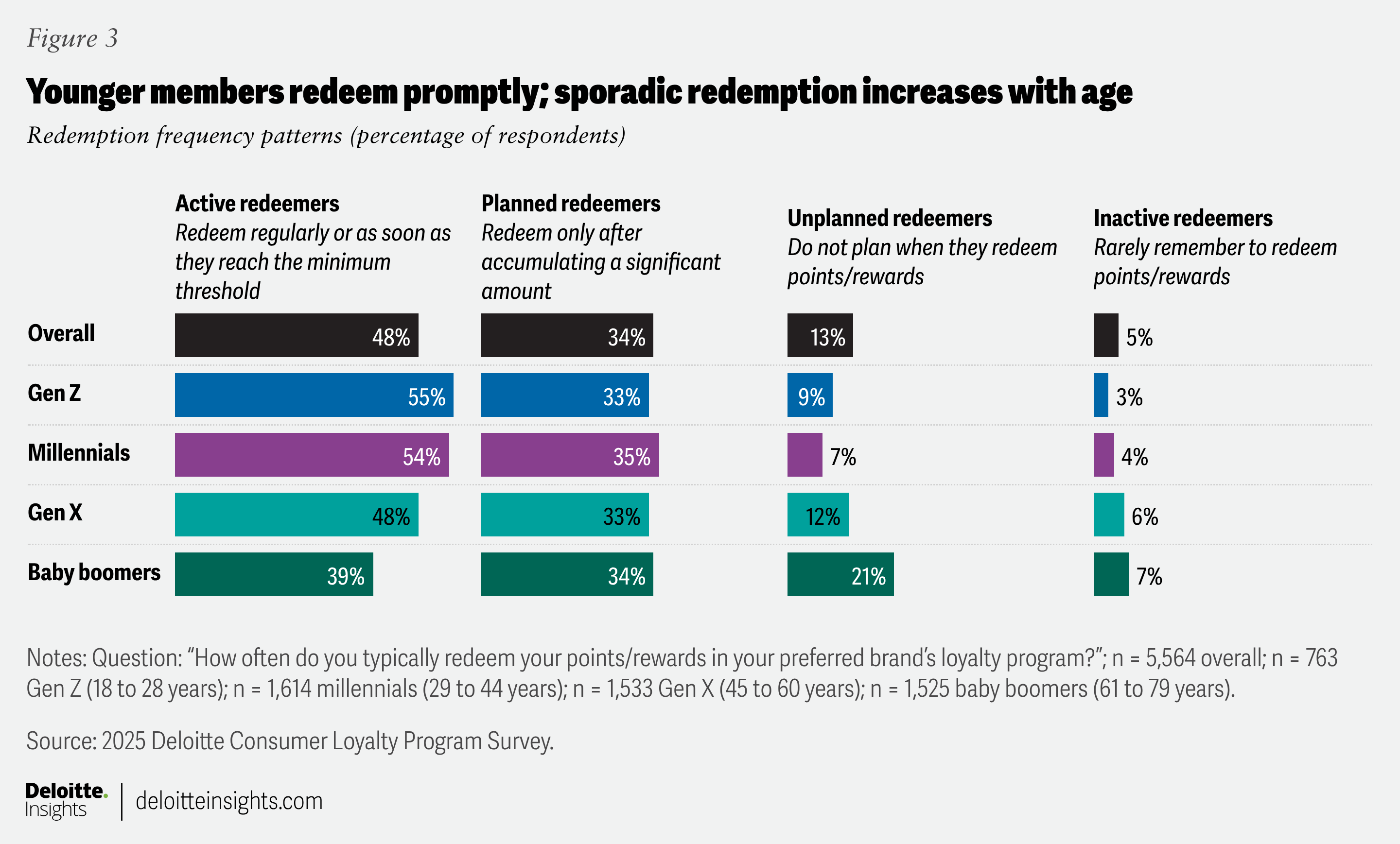

1. Make redemption effortless. While enrollment is widespread, brands have an opportunity to improve engagement levels, especially through user experience. Generational patterns reveal that younger consumers are more likely to redeem rewards promptly, while unplanned redemptions are more common among older generations (figure 3). Yet 40% of all respondents admit to sometimes forgetting to redeem, evidence that this is an area for improvement.8 The decisive lever? Transform redemption into a seamless transaction experience that offers clarity, simplicity, and flexibility, and can directly strengthen the perception of reciprocal value.

2. Personalize with purpose. No two members are alike, and programs that recognize and reward individuality could up the value they’re providing through tailored benefits. Key differentiators could include investing in AI-driven, dynamically personalized journeys while transparently safeguarding data privacy.

Personalization has become a critical differentiator for loyalty programs, especially among younger generations. For example, 89% of Gen Z and 87% of millennials surveyed are willing to share personal information for more tailored offers or experiences, compared to 78% of Gen X and 64% of baby boomers. Similarly, 62% of Gen Z and 64% of millennials say they would opt into hyper-personalized loyalty settings to access better perks and rewards, versus 55% of Gen X and only 33% of boomers. The impact on spend is equally pronounced: More than half of Gen Z (51%) and millennials (53%) say they would spend more at that brand if it offered a personalized experience, while just 38% of Gen X and 19% of boomers say the same.9 These patterns underscore that unlocking the next wave of loyalty lies in making personalization not just available, but meaningful, especially for younger consumers who expect it as the norm.

3. Strengthen engagement with next-generation digital tools. The digital components of loyalty programs are key to strengthening engagement across the omnichannel landscape and can help value-seeking consumers more easily access what they want. In a marketplace crowded with competing programs, next-generation tools make it easier for members to access rewards, recognize savings opportunities, and connect and interact socially.

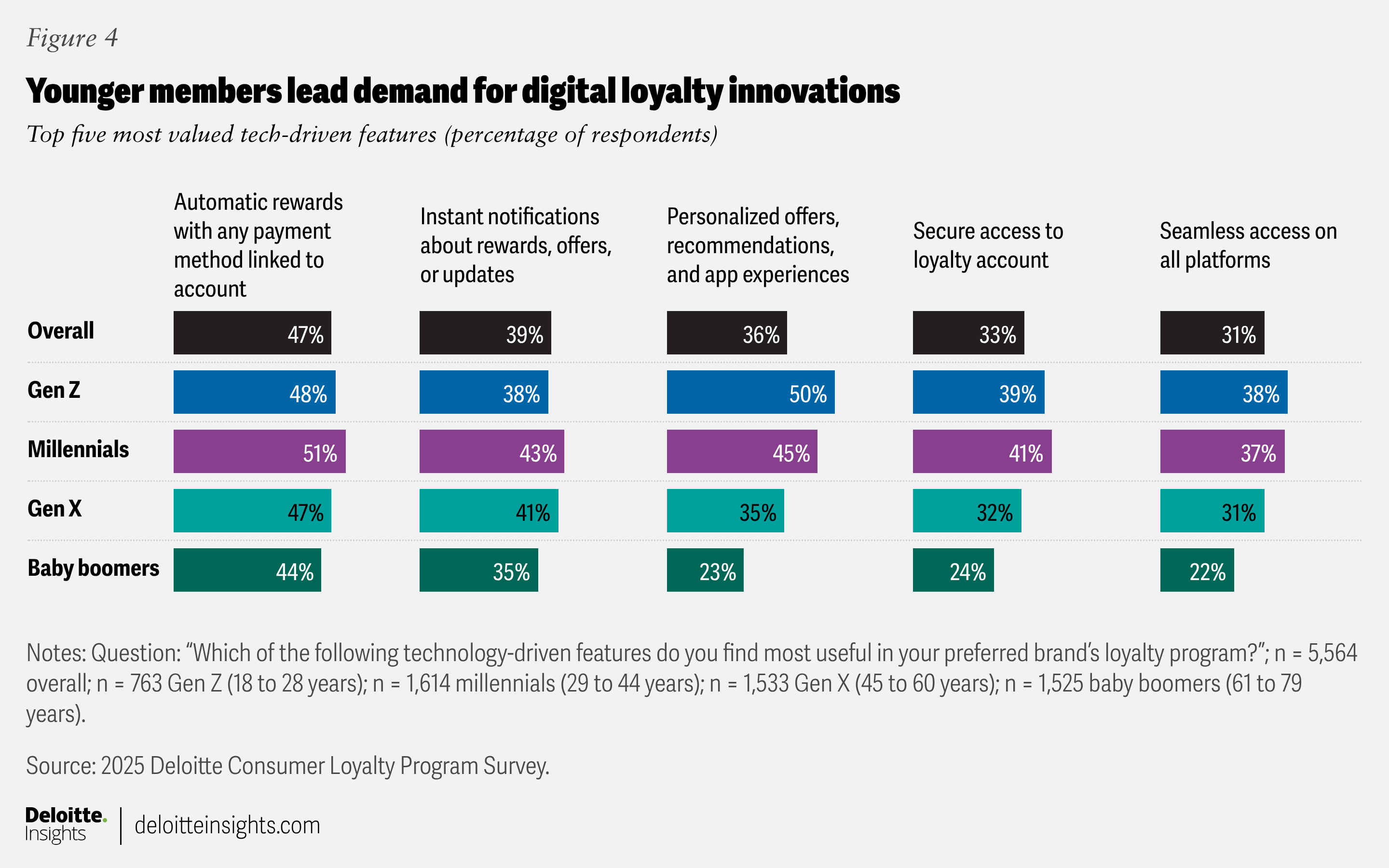

Younger consumers show an especially strong preference for digital enablement. More than 90% of Gen Z and millennial respondents found at least one tech-enabled feature useful, compared with 73% of baby boomers. Their interest is especially pronounced in features like payment integration; instant notifications; and personalized offers, recommendations, and experiences (figure 4). This widening gap suggests that retailers should adapt their digital investments to meet the expectations of emerging customer cohorts while ensuring accessibility for all members. These insights point to a clear opportunity to use digital features to elevate loyalty experiences, improve consistency and remove friction across channels, and simplify value discovery.

The value exchange

Loyalty programs are becoming a defining lever for brands competing for value-seeking consumers who are more discerning about where they spend and what they receive in return. The data shows that while enrollment is high, the real opportunity lies in designing programs that inspire consumers to participate more often and more deeply. When loyalty programs make it easy to redeem rewards, are personalized in meaningful ways, and are supported by intuitive digital features, they drive stronger perceptions of value and measurable behavior change that price cuts alone cannot achieve. In an environment where consumers expect every interaction to feel worthwhile, brands that focus on elevating engagement will likely be best positioned to deliver sustained, differentiated value.

Methodology

The 2025 Deloitte Consumer Loyalty Program Survey collected data from 5,564 US adults (18 years and over) who are loyalty program members. The survey, conducted from September to October 2025, was developed by Deloitte and conducted online by an independent research company. Respondents were assigned to one of seven major consumer-facing industry groups, represented by 14 underlying sectors. Industry quotas were managed at the group level, while sector samples contributed to industry-level results. The sample included airlines (n = 683); hotels (n = 679); restaurants (n = 681, including fast food and coffee shops, and casual dining); grocery, convenience, and drug stores (n = 812, including grocery stores, convenience stores, and pharmacy and drug stores); club stores (n = 675); mass retailers (n = 678); and department stores and specialty retailers (n = 1,356, including department stores, home goods and electronics stores, health, beauty, and wellness stores, apparel and footwear stores, and sports, leisure, and hobby stores).