2025 Deloitte Holiday Retail Survey

Deloitte’s 40th Holiday Retail Survey finds shoppers navigating economic uncertainty by turning to deals, digital conveniences, and seasonal experiences to keep spirits bright

Natalie Martini

Lupine Skelly

Brian McCarthy

Kusum Raimalani

Stephen Rogers

2025 marks the 40th year of the Deloitte Holiday Retail Survey, and the retail transformation over that time has been remarkable. Holiday shopping has shifted from crowded malls and print circulars to a world of omnichannel convenience, digital discovery, and artificial intelligence-powered tools. Yet one constant remains: The holidays are when consumer behavior reflects both the realities of the economy and the desire to celebrate.

This year, the season is unfolding against a backdrop of economic uncertainty. Three-quarters of surveyed shoppers (77%) expect higher prices on holiday goods, and over half (57%) expect the economy to weaken in the next six months—the most negative outlook since we started tracking economic sentiment in 1997. Many shoppers across all income groups remain highly attuned to value, with promotions and deals shaping when and where they spend. But it’s not just about price. As noted in our recent report, “The value-seeking consumer,” surveyed shoppers also report seeking quality, trust, and meaningful experiences from the brands they choose. Retailers that can provide high value at both low and high price points this holiday season may be best positioned to attract value seekers.

Younger generations, particularly Generation Z, appear to be reshaping how holiday shopping happens. Not only are they more likely to seek deals (95%), but they’re also turning to influencers and social media (74%) and AI (43%) for inspiration and product discovery, and are using digital tools to find the best prices. This season, they’re planning to spend 34% less than last year, which means it will likely be important to provide shopping experiences that are entertaining, authentic, and seamlessly integrated into the platforms where they already spend time.

For retailers, this holiday season isn’t just about offering deals; it’s about meeting shoppers where they are—digitally, socially, and emotionally. Winners will likely be those who stand out by providing value, offering seamless technology to reduce friction, and delivering experiences that feel worth the spend. Forty years on, holiday shopping keeps evolving, but the magic of connection and celebration never fades.

Read on for key takeaways and what they mean for retailers.

Spirits bright, wallets tight

Amid economic uncertainty, surveyed consumers plan to pull back spending this holiday season. On average, shoppers expect to spend US$1,595, down 10% from 2024. Seventy-seven percent of respondents expect higher prices on holiday items, while 57% anticipate a weaker economy next year. Despite these headwinds, the spirit of celebration endures: surveyed consumers plan to focus on value and trim seasonal extras to preserve holiday traditions.

What this means for retailers

With consumers looking to stretch every dollar, retailers that can offer a range of price options—including private-label counterparts to premium products—stand to gain this shopping season. In addition to financial strain, 58% of surveyed shoppers also consider holiday shopping to be stressful. Retailers can help ease this stress with curated gift ideas, wish lists, and tools that simplify the holiday experience.

Deals still drive the sleigh

Seven in 10 shoppers across all income groups are engaging in value-seeking behaviors, with women (78%) more likely than men (58%) to do so. Consumers are making frugal trade-offs and seeking creative ways to save money, such as shopping at affordable retailers over preferred ones, redeeming loyalty points, and making handmade gifts instead of buying them.

What this means for retailers

Retailers should consider going beyond discounts and find more ways to deliver value through quality, convenience, and emotional connection. The brands that can offer value beyond the price tag—providing more value than expected for the price—will likely entice shoppers to spend more. In a holiday season where loyalty is up for grabs, retailers that can personalize the entire experience will likely stand to gain.

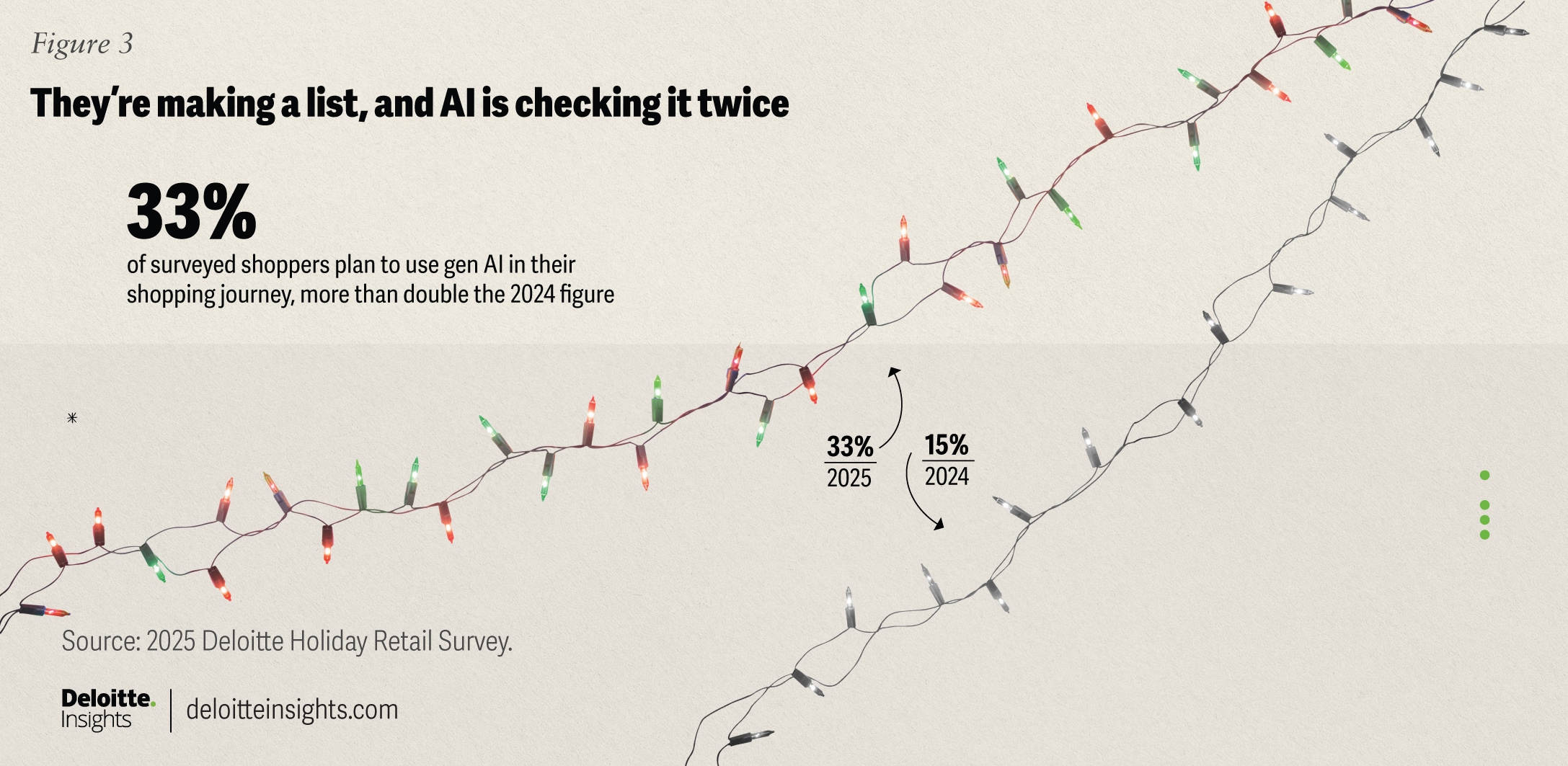

Shoppers are making a list and AI is checking it twice

Thirty-three percent of respondents plan to use generative AI in their shopping journey—more than double the 2024 figure. This figure is likely to keep growing, as 26% of those surveyed indicated that they trust gen AI more than they did six months ago. Younger generations are leading the charge, using gen AI for finding the best deals, summarizing product reviews, and generating shopping lists.

What this means for retailers

Consumer adoption of gen AI shows that expectations are shifting toward personalization and efficiency. Shoppers now expect instant recommendations tailored to their preferences, budgets, and recipients, raising the bar for retailers’ digital experiences. To meet holiday shoppers’ expectations, retailers could consider embedding AI-powered gift finders, style assistants, or deal copilots directly into their sites or apps.

2025 Deloitte Black Friday-Cyber Monday survey trends

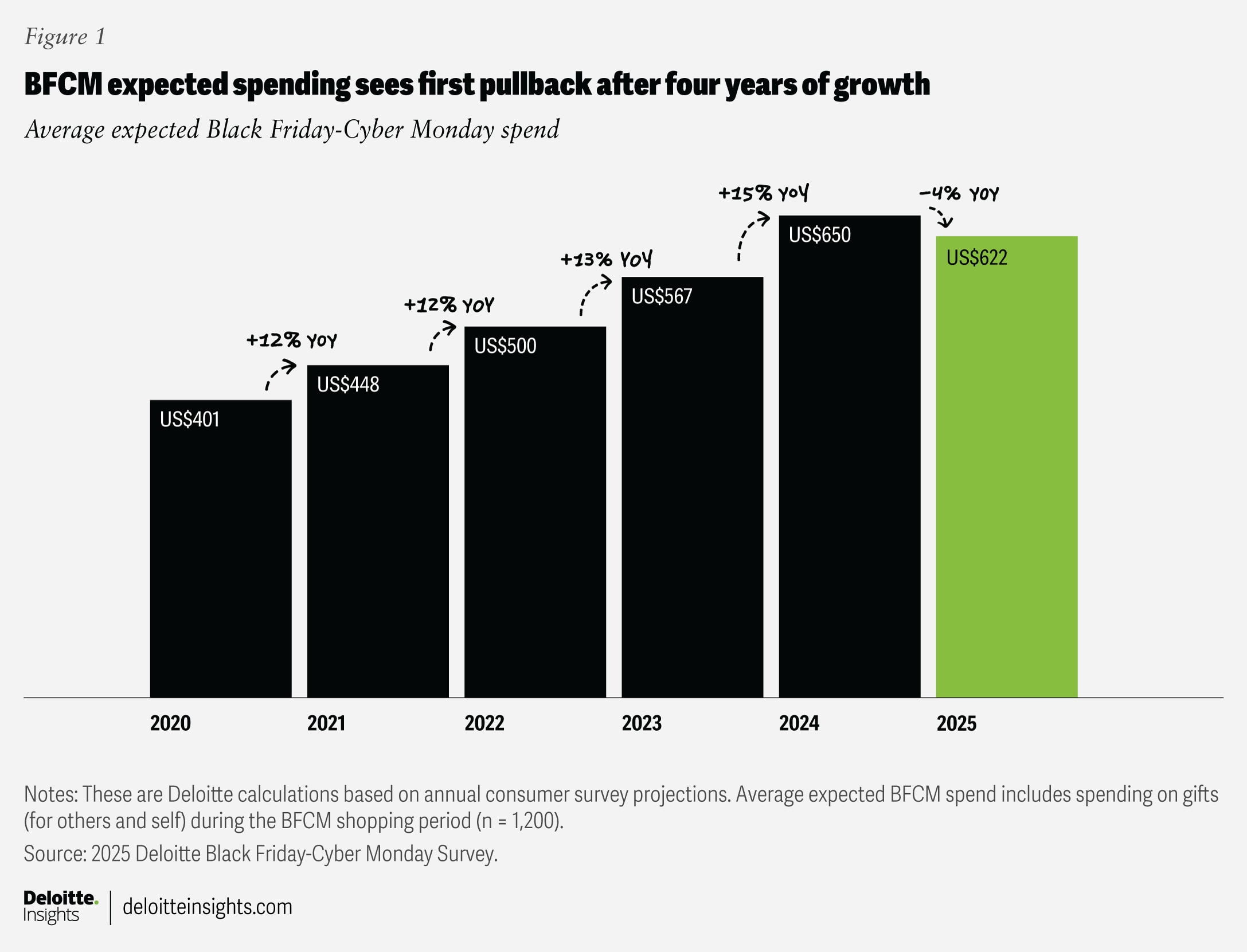

As deal-seeking consumers continue to rely on promotions to stretch their holiday budgets, 82% of surveyed consumers plan to shop during Black Friday-Cyber Monday (BFCM) this year, versus 79% in 2024. On average, shoppers plan to spend $622, down 4% year over year.