‘Tis the season for smarter sourcing: How AI is helping some retailers rethink holiday buying strategies

This holiday season, retail buyers may be relying on AI to help navigate headwinds

Brian McCarthy

Lupine Skelly

Sangharsh Shinde

The holiday shopping season might seem far off, but shifts in global trade policy, along with consumer price sensitivity, appear to be reshaping retail’s holiday playbook behind the scenes. Deloitte’s 2025 Retail Holiday Buyer Survey (see methodology) revealed that many buyers are navigating uncertainty when procuring holiday goods. Seventy-eight percent of respondents are concerned about securing adequate inventory, while 76% are worried about possible issues with the reliability of suppliers amid geopolitical tensions.

And it’s not just potential supply chain changes that seem to be on the minds of retail buyers. Sixty-four percent of surveyed respondents said consumers have pulled back spending in their category in the six-month period prior to the survey (versus 49% in 2024),1 and 76% expect consumers to only make discretionary purchases around promotional periods, putting additional pressure on planning.

Despite these challenges, retail buyers appear to be somewhat optimistic, with three-quarters expecting consumer sentiment to improve as the holiday season approaches. In addition, the average year-over-year holiday sales growth is expected to increase by 4.5%, according to those surveyed. So, what is behind the optimism? We found three strategies that surveyed buyers are implementing to help navigate today’s environment.

First, when it comes to stocking up on inventory, retail buyers reported they are front-loading their orders. Respondents said they placed more than half of all their holiday orders by the end of May, nearly two months ahead of last year’s timeline when compared to the 2024 version of the survey. Seven in 10 noted they increased inventory levels in key categories before the announcement of potential trade policy changes. Meanwhile, some of the survey respondents reported their organizations are reassessing existing commitments: Approximately 1 in 5 retail buyers (20%) have paused shipments of certain orders until there is more trade certainty, and nearly as many (18%) have canceled orders deemed unprofitable.

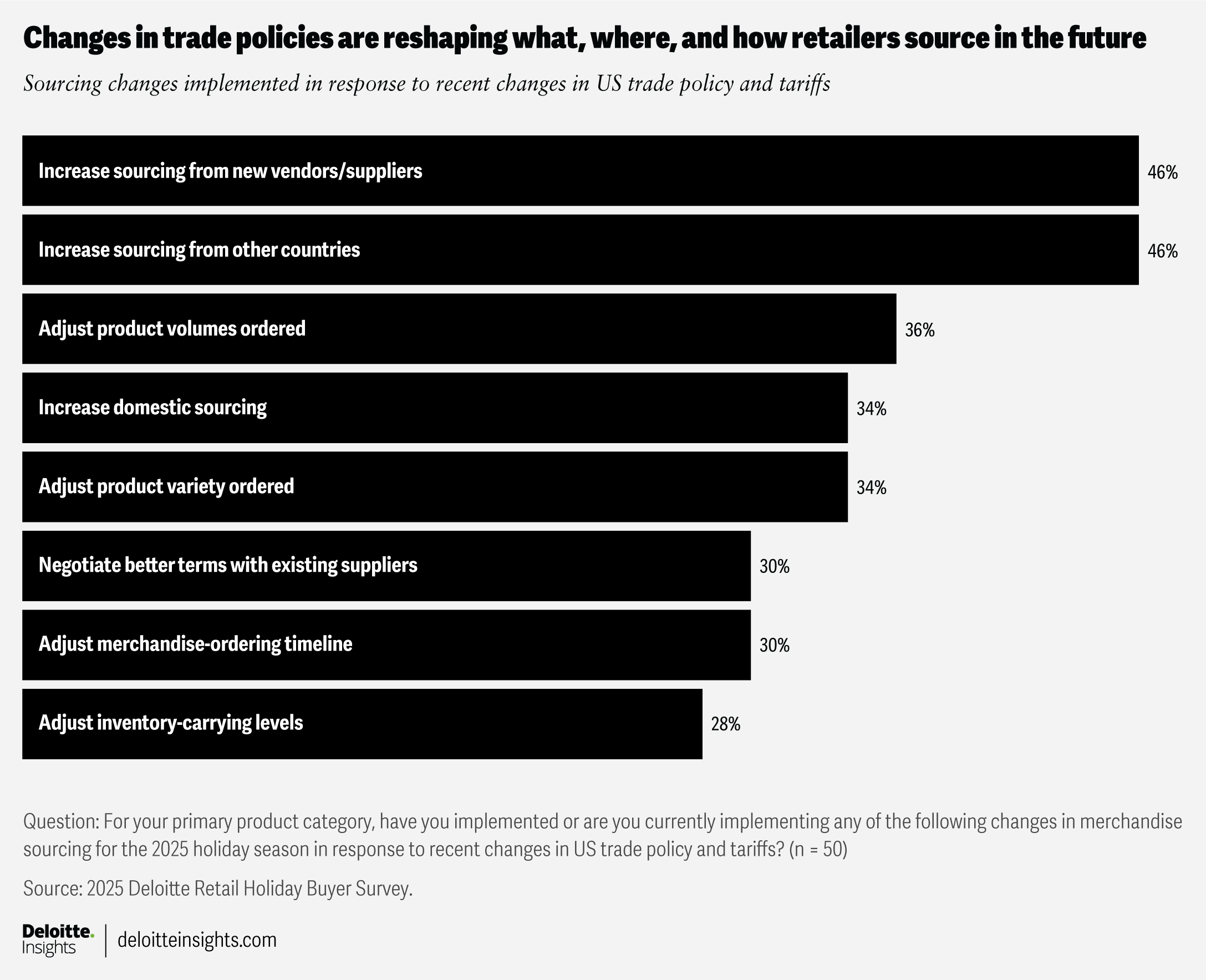

Second, they’re not just buying earlier—they’re also buying from different places. Nearly 50% of surveyed retail buyers said they plan to increase sourcing from new vendors, with an average of 35% of holiday orders moving to new suppliers or countries. It’s a reshuffling of the global supply chain that is reportedly reshaping what, where, and how the survey respondents source in the future (figure 1).

Third, artificial intelligence is playing a larger role. Supply chain reshuffling may be giving retailers COVID-19 pandemic déjà vu—but this time, they have new tools that can help forecast in a changing environment. Newer forms of AI and advanced analytics, barely on the radar for retail buyers in 2020, may be helping to build resilience for the 2025 holiday rush. Approximately 78% of surveyed retail buyers leverage AI-enabled tools to enhance buying activities, while 74% specifically utilize AI to address challenges stemming from trade policy–related changes. Respondents who are using AI report improvements in several areas:

- Supply chain management (46%): AI-driven analytics meant to provide deeper insights into supply chain dynamics could help retailers to predict potential disruptions and optimize logistics.

- Pricing optimization (46%): Advanced algorithms designed to analyze market trends and consumer behavior could help set competitive prices dynamically.

- Product assortment optimization (44%): AI solutions could help streamline inventory management, helping the right products to be available at the right time.

- Demand forecasting (28%): Predictive models could help retailers anticipate customer demand, reducing overstock and stockouts.

In other words, surveyed retail buyers aren’t leaving the holidays to chance. Between shifting trade winds and tighter consumer wallets, the majority of retail buyers appear to be looking to leverage AI-powered agility. This year, smarter buying may not just be nice to have—it could be a must-have strategy, potentially turning uncertainty into opportunity and ensuring shelves remain stocked to welcome the holiday rush.

Methodology

The 2025 Deloitte Retail Holiday Buyer Survey was conducted online by an independent research company from May 20 to June 4, 2025. The survey polled 50 retail industry buyers, 68% of whom were from retailers with annual revenues of US$15 billion or more, while 96% were from retailers with annual revenues of at least US$5 billion. The respondents included buyers, senior buyers, and buying or merchandising managers with a medium or high level of involvement in buying and merchandising for the coming holiday season. The respondents were involved in one of the following categories: clothing and accessories, electronics and accessories, seasonal merchandise and gifts, sporting goods, and beauty.

Note that the reported average expected sales growth is a weighted average based on survey responses. Each response option was assigned a representative midpoint, and responses were weighted by the number of selections per category to reflect overall sentiment.