Financial services firms can untap global growth by democratizing financial advice

Personalized financial advice shouldn’t just be for the wealthy anymore—and it doesn’t have to be. Why advising the mass market could be a win-win financial inclusion opportunity.

Krissy Davis

Sean Collins

Katerina Tzouganatos

Samia Hazuria

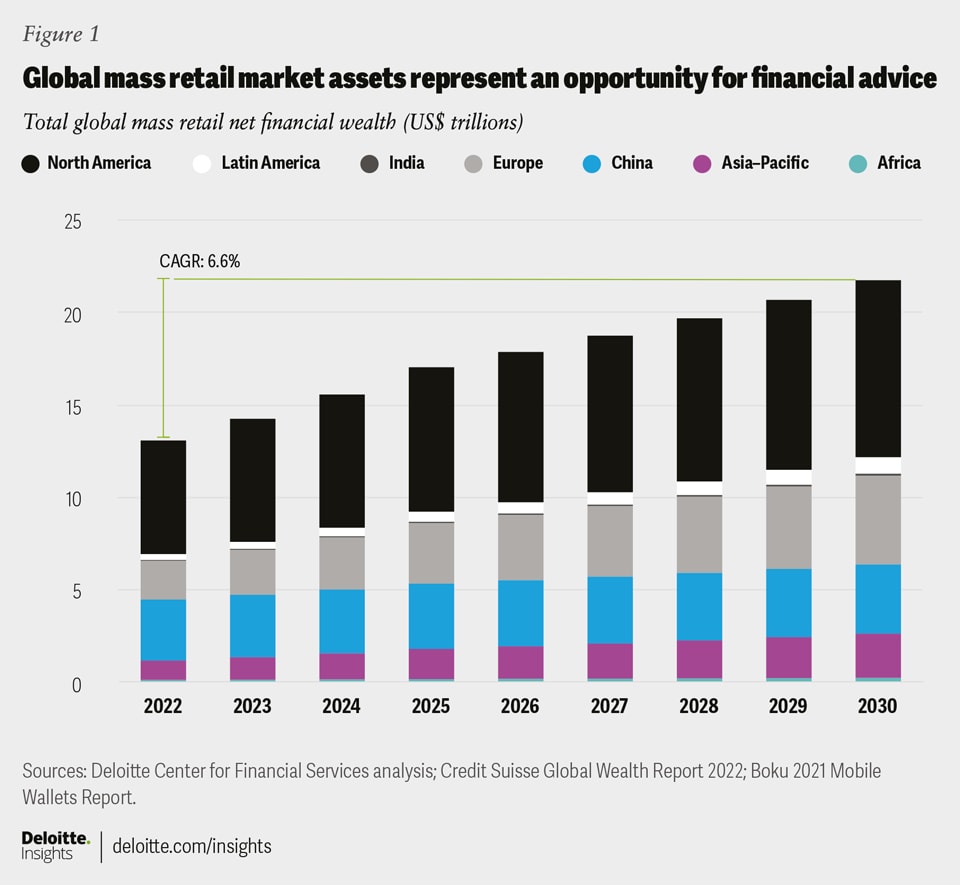

Two growing trends—the demand for holistic financial advice among mass-market investors and adoption of mobile wallet platforms—are converging, spurring hope for a true democratization of financial advice. Deloitte estimates net financial wealth held by the mass retail population segment globally to almost double, to US$22 trillion by 2030.1 Wealth and asset managers can achieve greater financial inclusion by serving less affluent clients. And now, serving the mass market could provide financial services firms with significant economic opportunities.

The unprecedented disruption in society over the last few years has led to many changes in financial services; greater attention to financial well-being is one.2 Today, most financial services industry leaders recognize that their organizations can help support this new dynamic by developing financial inclusion strategies within their organizations.3 These strategies have benefited companies and workforces alike, and there may be good cause to broaden the strategies themselves for even greater dividends.4 One possible path is to fully democratize financial advice by servicing individuals at the lower end of the wealth spectrum, i.e., the mass retail segment, which the Deloitte Center for Financial Services defines as the bottom 60% in wealth of each global region’s adult population.

The professional advice gap in the mass retail segment is a huge market-making opportunity

At present, the Deloitte Center for Financial Services estimates this segment to hold around US$14 trillion in assets.5 While some of these assets may already be held in interest-bearing accounts, our research suggests that the majority is not professionally managed. In the United States, almost three in five (59%) consumers seek financial advice but aren’t sure how to get it.6 In fact, over 40% of people turn to digital sources, including social media, blogs/vlogs, and podcasts, for financial advice.7 The top reason respondents reported for not seeking out a registered financial advisor was that people didn’t think they had enough money to invest.8 The large percentage of people already turning to digital sources for financial advice could mean there may be a huge untapped opportunity for financial advice in the global mass retail population segment.

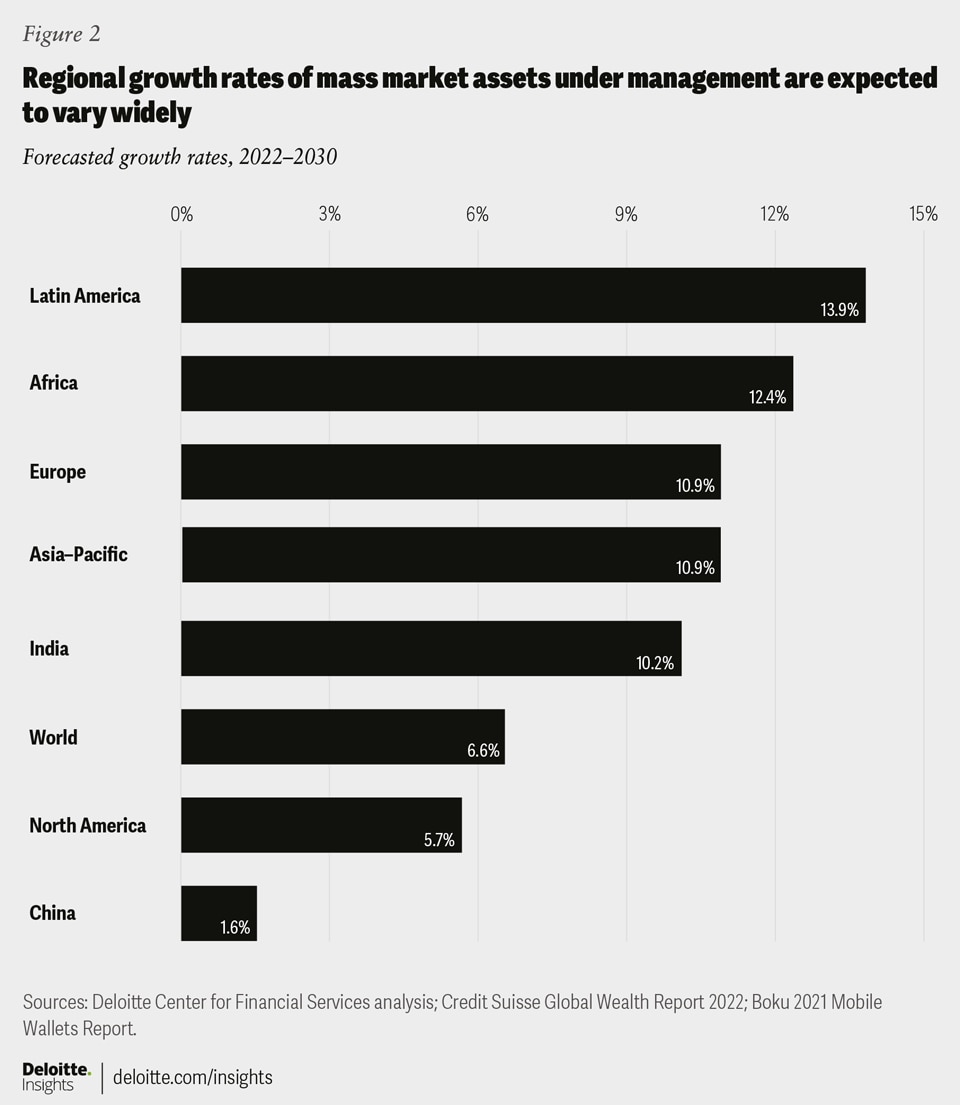

We estimate the opportunity for assets in this market to cross the US$20 trillion-mark by 2030, growing globally at an annual rate of 6.6% (figure 1).9 While Latin America could witness the fastest regional growth (13.9% CAGR; figure 2), it is only projected to represent about 4% of the market by end of the decade. The largest share of global assets is in North America, where growth is forecast to be around 6% per annum. We expect Europe’s mobile wallet platform adoption to surpass that of China’s within the next few years, which would make Europe the second largest opportunity for the mass retail segment, behind only North America, by 2030.

Serving mass market clients is becoming more affordable

Given the sizeable assets held by the mass retail segment, providing financial advice to this market could be an attractive opportunity for the financial services industry. However, getting the economics right has been challenging. Historically, many financial advice providers have shied away from the mass retail segment in part because of high customer acquisition costs and much lower investable asset levels.10 These challenging market dynamics have contributed to a high client to advisor ratio in order to profitably serve this segment, which in turn, has often limited the ability to personalize advice.11 It typically costs a traditional advisor almost US$3,000 per client to acquire a new client. Of this, around 80% is the ‘time cost’ of a human advisor.12

Financial services leaders may want to reexamine whether these previous assumptions are still valid today. Robo-advisory—delivering automated advice with minimal human intervention needed—could be a cost-effective and scalable solution to provide advice to clients who have smaller portfolios.

In the past, financial organizations that deployed robo-advisers found it difficult to target potential clients outside of those in the high net wealth segment because providing holistic financial advice in a direct-to-consumer model was very expensive.13 Also, it could take as long as a decade for financial services firms using robo-advisers to recoup their customer acquisition costs.14 But the technology driving robo-advisers has evolved considerably since robo-advisory first appeared when the advice was mainly limited to suggesting potential exchange-traded funds for investment based on the answers to online questionnaires.15

Robo-advisers are shifting from algorithm-based portfolio adjustments that use predefined sets of rules to fully automated investments fueled by self-learning artificial intelligence algorithms and automatic asset shifts.16 AI-powered robo-advisers can provide end-to-end, real-time, personalized investment solutions (e.g., portfolio selection, automatic rebalancing, and tax loss harvesting) based on a client's investment goals and risk profile to deliver recommendations in an interactive, conversational format with lower incremental client servicing costs than human advisers.

Regardless the amount of human interaction, financial services firms should continue to prioritize addressing regulatory requirements, such as those surrounding fiduciary duty. In the United States, the SEC offers guidance for robo-advisers surrounding the presentation of disclosures, ongoing client suitability of advice, and effective internal compliance programs.17 As more client services are driven through robo-advisory platforms, corresponding increases in client protection should follow. Apart from adhering to regulatory requirements such as conducting an annual review of the written policies and procedures enacted to prevent violations of the Investment Advisers Act of 1940, robo-advisers should also consider instituting procedures surrounding aspects that pertain to their operating model. For example, robo-advisers should consider policies and procedures for testing and monitoring the algorithmic code, as well as adequate oversight of any third party which may have been involved in the development of the code.18

Aside from the technological advancements that are helping pave the way for more comprehensive automated financial advice at a lower cost, it may also be more cost-effective to reach new clients than previously believed. One way financial advisory firms can minimize customer acquisitions costs could be by capitalizing on these potential clients who are already familiar and participating in the growing mobile wallet market. Rather than building a platform from the ground up, there may be opportunities to form partnerships with established mobile wallet platforms to tap into an existing user base. The partnership could involve an all-in-one type of platform where the mobile wallet and robo-advisory accounts share the same platform, or the user could be directed through the mobile wallet to open a robo-advisory account on a robo-specific platform.

Robo-advice for all

According to a recent survey, 75% of millennial respondents were open to using a robo-advisor to manage investments.19 This may be ascribed to limited investment knowledge or the desire to actively manage a portfolio. On the other hand, only 43% of baby boomers surveyed said they were interested in using robo-adviser platforms, perhaps because they either lack trust in financial advice algorithms, or they prefer a more hands-on approach to choosing their investments.20

But robo-advisers can only truly be inclusive if they serve people of all ages. Older clients may prefer hybrid robo-adviser platforms. These combine automated advice and human financial advisors, who are available via phone or video. While slightly more expensive than purely automated advice, virtual access to a human advisor can help alleviate trust-related concerns and build credibility over time.

With an almost US$22 trillion in estimated investable assets by 2030, the global mass retail market may be too great of an opportunity to pass over for much longer. Should financial services institutions succeed in making financial advice more accessible, people who may have previously turned to social media for advice could seek out the industry’s vast knowledge and expertise. Ultimately, financial services players can play a large role in making society more equitable, profitably.