2026 investment management outlook

Seizing opportunity with new sources of growth and the elusive search for scale

Eric Fox

Jeffrey A. Levi

Tania Lynn Taylor

Roland Waz

Julia Cloud

Doug Dannemiller

Is active management being rebuilt, repackaged, or both?

How quickly is regulatory change accelerating the reinvention of investment management?

What skills will define success in the next era of the investment management industry?

As AI matures, can investment firms scale it without losing control?

The investment management industry enters 2026 with a paradox: Profit growth remains elusive, yet the opportunities for differentiation have rarely been greater. Many investors continue to migrate to low‑cost vehicles, alternatives (private markets specifically) are capturing the next leg of growth, and some leaders are scaling artificial intelligence from isolated experiments to enterprise platforms. At the same time, technology spend, compliance obligations, and distribution complexity are pushing some firms to rethink operating models, talent, and product architectures.

Explore our analysis below on these themes and some important choices available for investment management teams through the remainder of this year and into the next.

ETFs surge, hedge funds pivot, and private capital repositions as industry lines blur and product models evolve

The investment management industry is at an inflection point. Continued cost pressures and the commoditization of long-only actively managed funds are running headlong into the rapidly accelerating development of artificial intelligence as an enabler of either competitive or cost advantage and a more open regulatory environment. These forces are blurring the lines between not only active and passive management, but also those dividing public and private markets. As a result, the emergence of active exchange-traded funds (ETFs), hybrid products, and industry convergence suggests a fundamental shift is underway in the structure of the industry itself.

For many traditional investment firms, the evolution of active portfolio management product structures continues to accelerate. Actively managed mutual funds are experiencing steady net outflows, as investors increasingly gravitate toward more cost-effective investment options, particularly ETFs. Although passive mutual funds are still attracting net inflows, the momentum has slowed. In contrast, the ETF market continues to show robust and consistent growth. While passive ETFs still account for the majority of inflows, active ETFs are playing a more prominent role. Their share of total ETF net inflows in the United States rose—from just 1% in 2014 to 26% in 2024—highlighting a growing preference for investment vehicles that combine professional active management with the structural benefits of ETFs.1 Over the past year, the number of US active ETFs rose by 468 in 2024, bringing the total to 1,600 funds.2 In comparison, passive ETFs increased by 52, while active mutual funds fell by 171 and passive mutual funds declined by five.3 And assets under management (AUM) for active ETFs have grown significantly—rising by 68%, from $502 billion to $843 billion.4 A similar trend appears in Europe. Net flows into active undertakings for collective investment in transferable securities (UCITS) ETFs have risen meaningfully, climbing from 2.1% of total UCITS ETF flows in 2020 to 6.1% in 2024,5 while active UCITS ETF AUM rose by 80% from €27.2 billion in 2023 to €49 billion in 2024.6

This substantial growth of active ETFs likely signals more than a passing interest; it may reflect a structural realignment in the market as many asset managers and investors alike adapt to a new era of investment preferences and innovation. At the same time, active ETFs will likely also cushion some of the margin pressures brought about by the still-healthy demand for passive products. Introducing ETF share classes for existing mutual funds may be one innovation that could slow the outflow of assets from active mutual funds. While the tax-efficient nature of ETFs would likely appeal to many mutual fund shareholders, the distinct back-office requirements for ETFs compared to mutual funds means fund managers would need to invest in operational upgrades.7

Meanwhile, private capital fundraising has experienced a steady decline over the past three years. Following a peak in 2021, the total capital raised by 2024 had decreased by approximately one-third.8 The number of new fund launches declined even more sharply—by nearly two-thirds—suggesting increased caution among both general partners and limited partners amid ongoing market uncertainty.9 At the same time, returns have fallen well below historical averages, contributing to subdued investor sentiment and a slowdown in asset growth.10 Tariff uncertainty has been a considerable source of market friction, as many companies weigh import substitution strategies and reassess supply chain configurations.11 If this uncertainty diminishes over the next 12 to 18 months, the resulting clarity on trade costs and pricing is likely to enhance valuation confidence. Greater transparency in valuations should, in turn, help accelerate deal activity, support the normalization of investor distributions, and ultimately create a more conducive environment for fundraising. Private capital also stands to benefit from ongoing policy discussions in the United Kingdom and United States that aim to permit alternative investments within defined contribution (DC) plans.12 For example, the Department of Labor recently rescinded its 2021 guidance, which had discouraged the inclusion of alternative investments in 401(k) plans.13 In addition, the increasing availability of alternative funds tailored to retail investors is likely to provide further momentum to private market growth. The Deloitte Center for Financial Services recently predicted that alternative funds, including those targeted to retail investors, could grow by more than 50% CAGR to as much as $4.1 trillion by the end of the decade.14 Taken together, the private market segment is likely to benefit if even one of these developments occurs: tariff stability, broader DC plan access, or deeper retail participation.

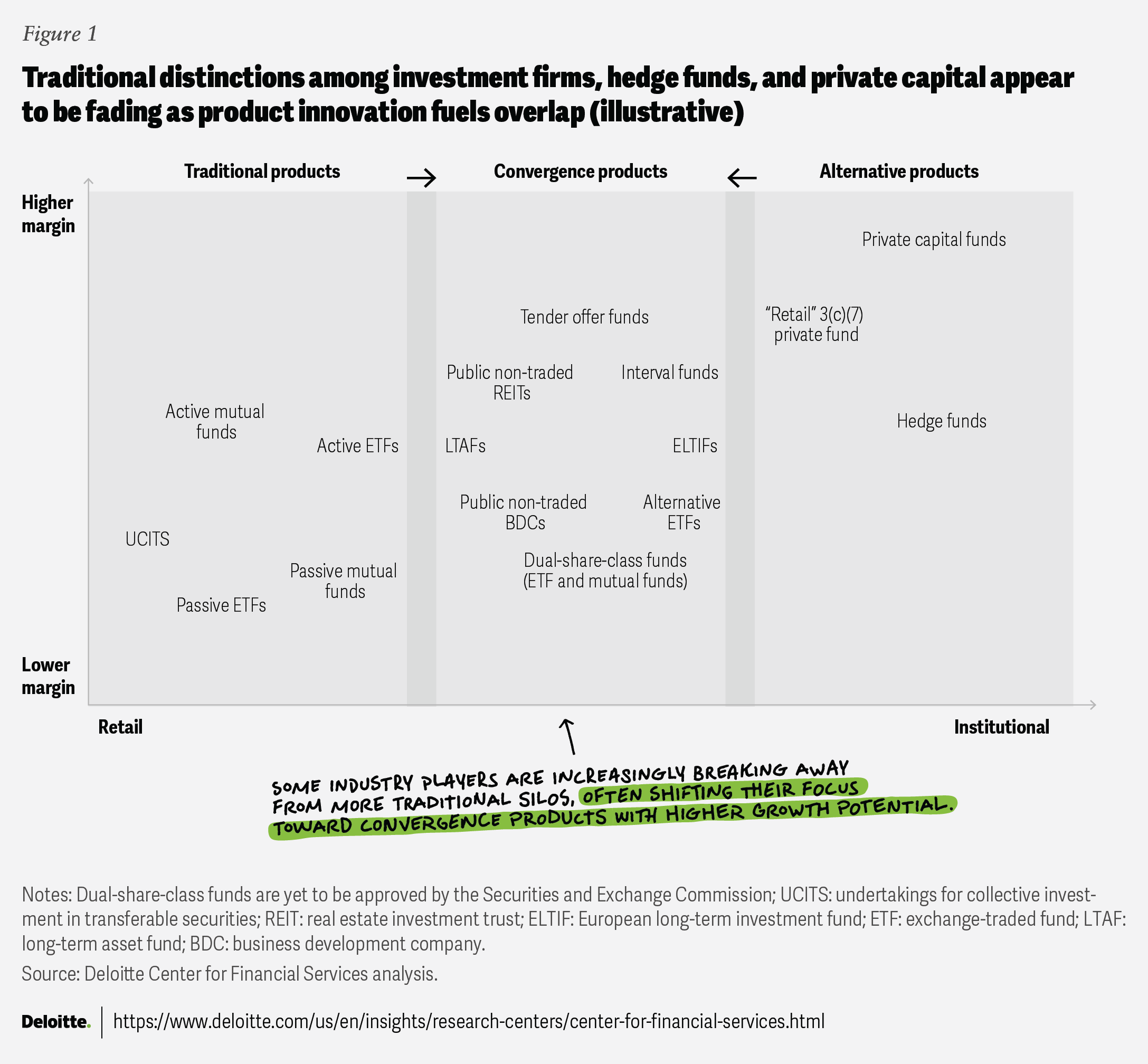

After several years of net outflows, hedge funds are starting to recover, with steady inflows signaling renewed investor confidence.15 Current conditions remain favorable for sustained momentum, supported by heightened market uncertainty from shifting monetary policies and the accompanying rise in volatility—an environment that has historically favored active and opportunistic strategies. In response to changing investor demands and the pursuit of differentiated return streams, several large hedge funds are expanding into private credit, aiming to capture growing opportunities in the space while diversifying their business models.16 As this trend accelerates, the distinctions between product packaging across hedge funds, private equity, and other alternative segments are increasingly blurring, which could signal a broader evolution in the structure of the investment management industry itself (figure 1).

Table of contents

- ETFs surge, hedge funds pivot, and private capital repositions as industry lines blur and product models evolve

- Greater investor access to private markets and new product innovations will likely be fueled by regulatory reforms

- Product mastery and digital fluency define a new talent playbook

- Firms are scaling AI from isolated experiments to enterprisewide platforms

- Looking forward

Greater investor access to private markets and new product innovations will likely be fueled by regulatory reforms

These demand and performance trends are combining with an evolving regulatory environment to create new opportunities for investment management firms. For one, the low ratio of public to private companies today has many industry stakeholders making the case for expanding investor access to private market investments.17 With regulatory support and technological advancements, the industry is likely ripe for product innovations that could give investors the opportunity to allocate their capital across a more comprehensive portfolio of investments.

In 2026, the expansion of partnerships across industries will likely play an increasingly important role for new investment opportunities. Some life insurers have sought to increase their exposure to private markets investments (specifically debt-oriented) to diversify their portfolios and improve investment returns, while some alternative investment managers are looking to gain access to permanent capital to fuel product development and innovation, improve business economics, and drive an advantaged competitive positioning in the investment management industry. Combined with a growth in popularity of public-private hybrid products, these strategies are creating heightened interest in strategic partnerships like that of Legal & General Group Plc and Blackstone Inc.18 The deal allows Legal & General’s clients to access Blackstone’s credit origination platform, while committing up to 10% of its new annuities flows to Blackstone funds.19 This partnership follows in the footsteps of several other recent deals, such as KKR and Global Atlantic, and Blue Owl Capital and Kuvare.20

M&A is emerging as a strategic response for firms looking to offset growing operational and market pressures

Given ongoing cost pressures and market and product innovations, firms are increasingly looking to both scale up and add new capabilities. The number of M&A deals in which investment management and wealth management firms were the targets surged in 2025.21 Deal volume in the first half of 2025 jumped 46% over the same period in 2024, marking the most active first half in more than a decade.22 Much like in 2023, a substantial portion of these transactions targeted wealth management and investment advisory firms. The continued expansion of alternative investment offerings helps underscore the vital role wealth management firms can play in helping high-net-worth individuals and retail investors make informed investment decisions. Additionally, with trillions of dollars set to shift between generations over the coming decades, many investment firms are taking notice and positioning themselves accordingly.23 About 25% of M&A deals in the first half of 2025 involved targets with estate, retirement, or financial planning capabilities—up from 20% in 2024 and 18% in 2023—signaling a rise in demand for firms with expertise to guide clients through this intergenerational transfer.24 Many deals are fueling product expansion and enhancing distribution reach to help support growth and profitability strategies. Given the strategic nature of these deals, integration capabilities—not just scale—will likely emerge as a key driver for success. The integration of public and private market products will likely fuel continued strong M&A activity through 2026.

Many investment managers are welcoming the recent decrease in regulatory intensity in the United States.25 The SEC’s decision to no longer limit closed-end funds holding more than 15% of assets in private funds may be of particular interest to firms looking to launch new products.26 With this staff position no longer in place, fund managers have a clearer path to offering retail investors access to private investment through closed-end product wrappers referred to as semi-liquid funds.27 In fact, even before this guidance from the SEC was released, more than half of executives at buy-side firms indicated that private market fundraising will occur through these types of vehicles over the next two years.28

As investment managers consider offering private funds through a closed-end structure to retail investors, ensuring an appropriate level of disclosures is paramount. According to the updated accounting and disclosure information from the SEC, the fund’s liquidity terms must be disclosed “clearly and prominently,” and fees and costs (including those of the underlying private funds) should describe any performance-related fees that may be paid even if the closed-end fund has a negative return.29 Also of note to private fund managers, the US Department of Labor rescinded a previously held position that private equity investments were not consistent with the responsibilities of fiduciaries of 401(k) plans.30 With these actions from the SEC and Department of Labor, we anticipate that collective investment trusts (CITs), as well as registered interval funds through which private funds can be packaged for investment at the individual level, may be the preferred vehicles for offering alternative investments within 401(k)s.

As regulators move to ease restrictions and further clarify policy positions, more investment managers may become willing to increase investment in novel technologies to offer new products to serve new markets. Digital assets represent a promising frontier for new products, although investment managers often continue looking for regulatory clarity around them.31 The passage of the GENIUS Act that set regulatory guidelines for stablecoins in the United States provided clarity.32 The Act states that payment stablecoins are not securities or commodities and therefore, stablecoin issuers do not need to register as an investment company with the SEC.33 With this increasing regulatory clarity around an important part of the digital asset network, investment management firms are more likely to introduce tokenized funds, which can increase liquidity through fractionalization of shares and enablement of round-the-clock trading.34 Since the GENIUS Act became law, several US investment managers have created tokenized money market funds.35 In Australia, the central bank has chosen 24 use cases—19 of which utilize real money—for tokenized settlements involving a diverse set of asset classes, including private equity and carbon credits, with results due in the first quarter of 2026.36 We expect to see tokenization of additional fund types over the next year, and anticipate healthy growth in tokenized funds that invest in private assets as investors in these fund types stand to benefit from the additional liquidity afforded by tokenization.

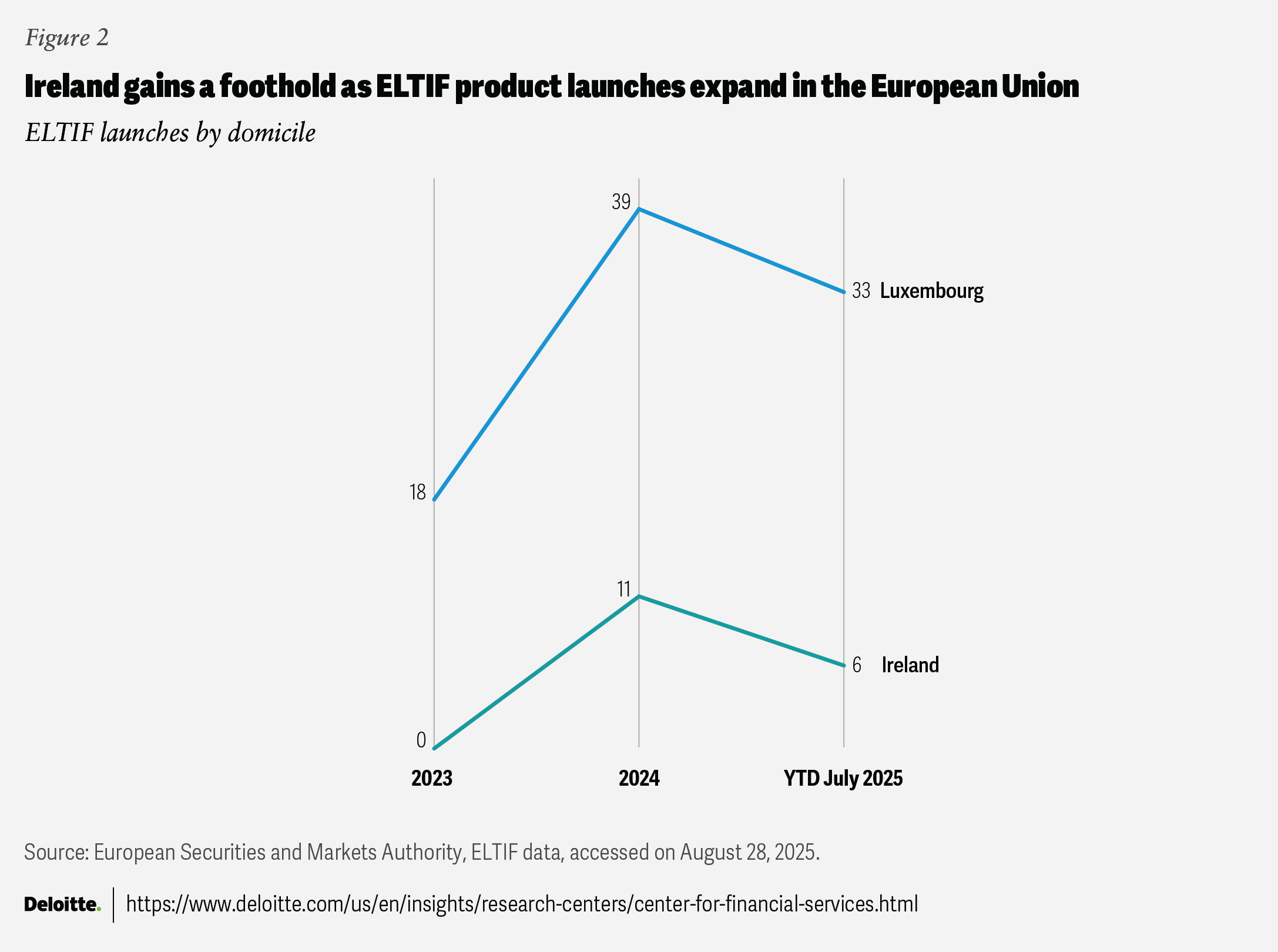

We see similar (but not the same) movement in the European Union, where some policymakers are formalizing a strategy through the formation of the Savings and Investment Union (SIU), which aims to increase the investment returns of its citizens and also grow the capital available to businesses.37 Based on the most recent data, EU citizens allocate more than 31% of their financial portfolios, about €11.6 trillion in aggregate, to assets such as bank deposits that offer little to no return.38 The SIU’s agenda for the fourth quarter of 2025 includes looking at ways to improve cross-border fund offerings and reduce operational barriers faced by investment managers, as well as reviewing the European Venture Capital Fund Regulation in the third quarter of 2026 to better promote equity investments.39 The European Securities and Markets Authority (ESMA) has already taken some steps to address cross-border and operational challenges as they relate to alternative investments through the reformulation of the European Long-Term Investment Fund product wrapper, known as ELTIF 2.0.40 This revision helped ease the marketability of alternative investments to retail clients, and so far, this approach appears to have been well received. As of July 2025, 40 of the 51 ELTIF launches are registered to be marketed to retail clients, compared to 18 of the 32 launches during the same period prior.41 While Luxembourg remains the domicile of choice for most investment managers’ funds, the Central Bank of Ireland is helping position the country for future growth (figure 2). One aspect that may be particularity advantageous to fund managers is that in Ireland, there is a provision to fast-track fund approval in 24 hours, while the review time in Luxembourg could take six months.42 While Luxembourg will likely remain fund managers’ domicile of choice, the actions of the Central Bank of Ireland could have a positive impact on fund domiciliation growth over the next 18 months.

Throughout 2026, we anticipate the industry to be more focused than ever on the fund structure chosen for fund launches. Even in a regulatory environment seen as more conducive to growing capital flows, product structure matters. For example, one of the world’s largest ETFs by AUM is asking its shareholders to change its structure from a UIT ETF to an open-end ETF, which would provide better operational flexibility according to the fund’s sponsor.43 Whether in the United States or the European Union, investment managers should carefully evaluate all product structures, factoring in investor type, asset class, market dynamics, and distribution strategies for long-term growth.

Product mastery and digital fluency define a new talent playbook

To help meet the evolving demands of not only modern portfolio strategies and client engagement but also a rapidly advancing technology environment, some firms are rethinking their approach to talent and organizational culture. While demand for most traditional industry expertise remained flat, skills such as digital fluency, cross-disciplinary thinking, and product innovation—alongside commercially critical capabilities like process optimization and capital raising—appear to be gaining momentum. Firms are increasingly elevating technology-centric and interdisciplinary roles—spanning data science, artificial intelligence, liberal arts-informed communication, and specialized product expertise—reflecting a broader reassessment of which capabilities will likely define success in the years ahead.

Product specialization, fundraising, and process optimization—human skills can drive the industry forward

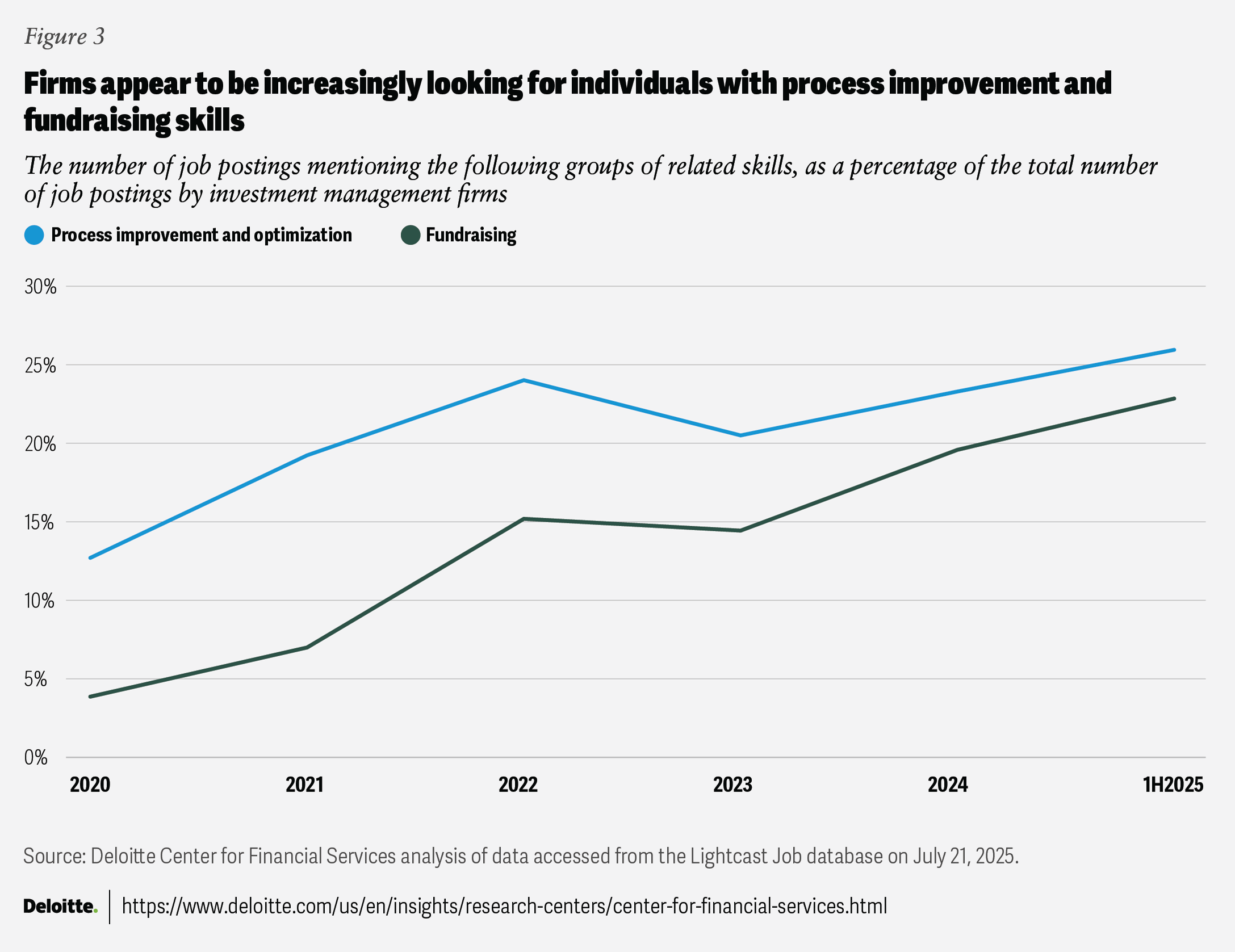

Some firms are sharpening their talent acquisition focus on product specialization, fundraising, and process optimization—areas often critical to commercial competitiveness as market pressures intensify.

With product offerings increasingly weighted toward ETFs and interval funds, demand is rising for specialists who can combine technical expertise with strong fundraising capabilities.44 Some sales and distribution teams, in particular, are prioritizing cross-functional talent able to both educate clients on ETF trading and translate investment strategies into product sales.45 A surge in private market activity may similarly drive demand for expertise in origination, product development and management, institutional sales, and operations.

At the same time, while most traditional skills have shown little change in hiring trends, demand for process optimization and fundraising expertise has increased markedly. Intensifying competition, along with mounting pressure on both margins and fundraising, is prompting some firms to recruit professionals with these capabilities to help sustain their edge. In the first half of 2025, skills related to fundraising or process optimization were cited in roughly one out of every four US investment management job postings (figure 3). Looking ahead, firms that aim to drive long-term growth and enhance returns will likely need to continually reevaluate and evolve their talent models in response to shifting market conditions and investor demands.

Rethinking technology talent: A rise of AI translators

In the United States, some investment firms are also seeking talent with AI expertise, signaling a change in industry priorities. Job postings that referenced artificial intelligence rose by almost 25% from 2022 to the first half of 2025 alone.46 While the absolute numbers may appear modest, the growth is considerable: AI is now featured in 2.4% of all US job postings by industry firms, up from 0.7% in 2022.47 Within a broader surge, references to specific technologies can highlight how quickly the field is evolving. A recent Deloitte survey found that 43% of financial services firms with high generative AI expertise gave access to over 40% of their workforce—compared to just 19% of firms with lower expertise doing the same.48 This may signify that organizations with more employees adopting the technology tend to achieve greater success.

Indeed, mentions of generative AI grew from a single posting in 2022 to 288 by mid-2025; similar growth has occurred in mentions of large language models and even the once-obscure skill of prompt engineering.49 In fact, the demand for AI and prompt engineering talent is leading to the integration of liberal arts graduates into investment teams, reflecting recognition that critical thinking and creativity can be powerful complements to technical expertise.50

The arrival of generative AI in 2022 has led to transformation both in hiring and training: 66% of C-suite and board member respondents to a cross-industry Deloitte survey say that their organizations are leveraging AI to boost productivity and efficiency.51 AI is helping redefine the role of professionals, often shifting focus from manual data processing to delivering strategic insights. AI tools are often seen as accelerators, with human oversight remaining essential.52 Firms are increasingly seeking professionals with strong digital fluency—those able to translate AI outputs and convert them into actionable insights. Meanwhile, autonomous AI agents and protocols for multi-agent collaboration are emerging in some cases.53

“The utilization of AI, especially agentic AI, isn’t just another digital transformation; it’s a whole new playbook where people aren’t simply updating their skills, they’re learning how to collaborate with AI agents as co-workers.”

Firms are scaling AI from isolated experiments to enterprisewide platforms

The reason for this talent acquisition shift is clear: Early indications suggest that some firms deploying AI are beginning to see promise from their AI deployments; as noted below, many are increasing their budget allocations in response. Unlike other technology upgrades that were often for either cost savings or marketplace advantage, AI has shown that it can help firms achieve both. Indeed, some investment management firms have moved from AI exploration to execution, delivering more concrete ROI in specific domains in the past 18 to 24 months.54 For example, some investment managers have successfully implemented gen AI throughout client communications and distribution processes, using it to write investment commentaries, generate sales leads, and capture client insights.55 Morgan Stanley’s financial advisers are rapidly adopting AI (98% penetration) and using the tools to help bring in new customers and assets at an accelerated rate.56 The AI-based tools can help advisers connect the right internal materials to each client, based on their unique needs, and document key points and action steps for each client interaction.

AI is also supporting some of the most intellectually demanding aspects of investment management. Schroders’ virtual investment committee agent was designed to analyze sector dynamics, evaluate business model implications, and assess potential risk factors to support investment decision-making.57 This effort could largely disrupt the heart of active investment management. Portfolio strategy and execution are at the core of the industry, and overseeing AI models in this space can present a major intellectual challenge. Meeting that challenge may require a rare blend of technical skill and investment insight.

Private equity (PE) firms also offer a compelling example of the accelerating tactical adoption of AI. Overall adoption of AI in the PE due diligence process is accelerating rapidly, with 64% of PE firms reporting that they are using AI to streamline the due diligence process.58 This development can help reduce costs and enhance market outcomes. Beyond efficiency, AI is increasingly being leveraged to identify prospective portfolio companies and support early relationship initiation. These capabilities often stem from a blend of learned success factors, advanced search functions, and sophisticated pattern recognition. This collaboration between human judgment and machine intelligence can help firms model traits of a strong portfolio company with greater precision. While AI can provide valuable insights to help guide investment decisions, the ultimate authority remains with firm leadership.

Projects like these can tackle cross-organizational processes, and leading approaches typically have C-suite sponsorship. While AI may be taking center stage, it is equally important to recognize that modernizing core systems is important for AI to function effectively and deliver real value.

A word on agentic AI

A recent Deloitte survey indicates that 26% of respondents reported that their organizations were already exploring autonomous agent development to a large or very large extent.59 The art of the possible for agentic AI is both broad in scope and deep in complexity. For context, AI agents are software systems that can complete complex tasks and meet objectives with little or no human intervention. They are called “agents” because they have the agency to act independently, planning and executing actions to execute assigned tasks consistently and reliably by acquiring and processing multimodal data, using various tools to complete tasks, and coordinating with other AI agents—all while remembering what they’ve done in the past and learning from their experience.

Let’s assume for a moment that a retail firm has advanced agentic AI capability with access to both operational and client interaction data. Agentic AI could screen interactions for common questions, creating behavior-driven segmentation, and then analyze portfolios looking for areas of improvement, such as raising dividend yield, improving diversification, and improving risk-adjusted return. Based on these findings, AI could then alert representatives with possible investment recommendations in language that appeals to the segment of the investor after checking that the recommendations are in compliance with proper documentation and prospectus delivery built into the process. This process is an example of strategic AI implementation that can potentially contribute to cross-organizational effectiveness and efficiencies.

AI graduates from sandbox testing to proving its worth

Use cases such as these are beneficial and will likely continue to be pursued because they can provide clear positive ROI.60 Some important metrics for tracking AI ROI may include time saved per workflow, incremental revenue or assets generated through AI-assisted distribution, reduction in operational errors, uptime and availability of AI platforms, and the ratio of models deployed in production versus those remaining in sandbox environments. However, the sum of tactical implementation benefits is less than the whole. Moving forward, AI funding is becoming a growing priority for many financial services firms; many have boosted their AI project budgets, noting its strategic significance.61 This funding will likely be deployed differently, with enterprise infrastructure and unified AI principles taking priority over discrete, task-based solutions that often excited firms in the early days of AI exploration.62

That said, many firm leaders should move beyond asking, “Can AI add efficiencies to a given task, process, or operating model?” Instead, the questions are: What are the priority projects? What are the risks of deploying AI? Which tasks should be performed internally versus outsourcing them to a service provider more cost-effectively? And as solutions expand, what is the governance model for AI-enhanced processes?

Without strategic frameworks, guidance, and governance, these projects can multiply into an unwieldy collection of mismatched policies, undocumented assumptions, operating procedures, and data management choices.

Despite increases in job postings citing the need for AI expertise, our analysis of investment management job postings also shows that current governance mentions remain generic and not AI-specific.63 While the SEC recently withdrew an AI rule it proposed in 2023, the regulator continues to prioritize enforcement against AI-related misconduct.64 This helps underscore a need for companies to establish robust AI governance frameworks—ideally led by a chief AI officer or equivalent—to proactively manage compliance with existing rules and have a human in the loop.

Imagine being the chief compliance officer, and you are asked for the firm’s AI data privacy and IP protection policy. The answer may not be straightforward; it can depend on when and where each AI use case was introduced, with numerous departments likely having implemented their own ad hoc solutions to achieve a short-term solution. At this point, while some tactical AI solutions may deliver satisfactory results, the overall approach is often fragmented, making a unified strategic framework important for both risk management and long-term planning.

To get the most from AI over time, leading organizations could turn to general, generative, and agentic AI managed by a central team with enterprisewide authority. To be more effective, such central teams should prioritize governance artifacts that help ensure both control and trust in AI adoption—for example, maintaining a model inventory, conducting model risk assessments, establishing clear data lineage, vetting vendors rigorously, defining human-in-the-loop thresholds, ensuring audit trails, and preparing incident response protocols

Looking forward

Investment management firms, regardless of size, strategy or competitive differentiation, should consider how they can simultaneously pursue both growth and scale, using the following potential action steps as a guide through 2026:

- Choose wrappers deliberately. Refresh your ETF roadmap (including active), decide where interval funds or ELTIF 2.0 can extend reach, and determine whether tokenization enhances liquidity or distribution economics.

- Transform the workforce, not just with more data scientists but also with translators, educators, and platform specialists who can convert insights into outcomes and demystify ETFs and semi-liquid alternatives for intermediaries and clients.

- Cement an AI operating model that scales safely by creating a center of excellence with real authority, federated data with shared contracts, agentic workflows with humans in the loop, and instrumentation that surfaces quality, cost, and risk.

A final prompt for leadership teams: In a year when consolidation accelerates and policy clarity expands the product canvas, the gap between bold, well‑governed execution and incrementalism will likely widen. Leaders who move now can potentially convert 2026’s complexity into compound advantage.