Unlocking value: Ways gen AI can transform sales and marketing in investment management

With some generative AI applications addressing macro trends in sales and marketing functions and promising much more, firms should be strategic with their priorities

Snehal Waghulde

Kira Mikulecky

Doug Dannemiller

Jana Borer

Over the past several years, some investment management firms have attempted to improve their sales and marketing capabilities, realigning organizational structures and investing in scalable technologies to help fuel growth. Despite these efforts, some still trail their financial services counterparts.

Meanwhile, some clients have become more sophisticated, taking control of the sales process, demanding more from managers, and concentrating their attention on select relationships. As client needs and preferences become more complex, firms are also facing heightened competition, declining margins, and slower forecasted growth with operating profit as a percentage of net revenue decreasing from 38% to 30% between 2021 and 2023.1 As a result, sales and marketing leaders have likely had to adopt more scalable ways of marketing and selling by enhancing their capabilities to better align with emerging client engagement preferences and a growing need to boost their productivity.

To help achieve these goals, investment managers are using multiple tactics, from diversifying the types of funds they offer to providing hyper-personalized experiences to investors.2 Many sales and marketing professionals appear to recognize that technology, and more recently, generative AI, can be pivotal in addressing these challenges. One of the top priorities for the distribution functions in these organizations is increasing productivity, and gen AI can play an important role here.

Table of Contents

- Why using AI in sales and marketing can make a difference for investment managers

- AI makes macro moves to meet sales and marketing megatrends

- Beyond productivity: Distribution use cases multiply

- Level up with AI: Action items to consider for sales and marketing teams looking to up their AI game

- Staying ahead of the curve

Why using AI in sales and marketing can make a difference for investment managers

Some companies aiming to differentiate themselves are turning to AI to help meet client needs and drive productivity. Gen AI, in particular, is already changing how work, innovation, and teamwork are approached.

The widespread adoption of AI in sales and marketing departments underscores the benefits and transformative potential that AI can offer. Deloitte’s 2024 fourth quarter report on the State of Generative AI in the Enterprise predicts that among emerging gen AI technologies, agentic AI is expected to shape the future of sales and marketing for companies, with 52% of surveyed directors and C-suite executives highlighting it as the gen AI technology of most interest to their organization.3

Sales teams are using new gen AI technologies to gain better client insights, leading to improved sales leads.4 Through automated segmentation, marketers can deliver enhanced customer experiences to a variety of client types, increasing customer loyalty and retention rates.5 The wide array of applications can make gen AI a strategic choice for companies deciding where to allocate time and resources.

AI makes macro moves to meet sales and marketing megatrends

Shifting toward controlled autonomous AI-powered roles

The dawn of agentic AI and human-supervised autonomous AI agents is boosting AI adoption, reducing time spent on minor tasks, and empowering employees to engage in more strategic work.6 For instance, customer relationship management (CRM) platforms can organize, schedule, and summarize meetings, as well as draft follow-up communications. Controlled autonomous agents can research discussion points, explore exposure to various entities, or even verify account credentials to ensure proper compliance.7

Inbound leads routed to controlled autonomous sales agents with clear guardrails can allow the agents to craft tailored messages at scale, leveraging CRM systems and increasing the chances of lead engagement.8 Controlled autonomous agents can also be deployed to proactively and continuously monitor customer patterns and buying trends, while predictive modeling can be used to predict cross-selling and upselling opportunities and position other products.

Impact of gen AI across the end-to-end client journey

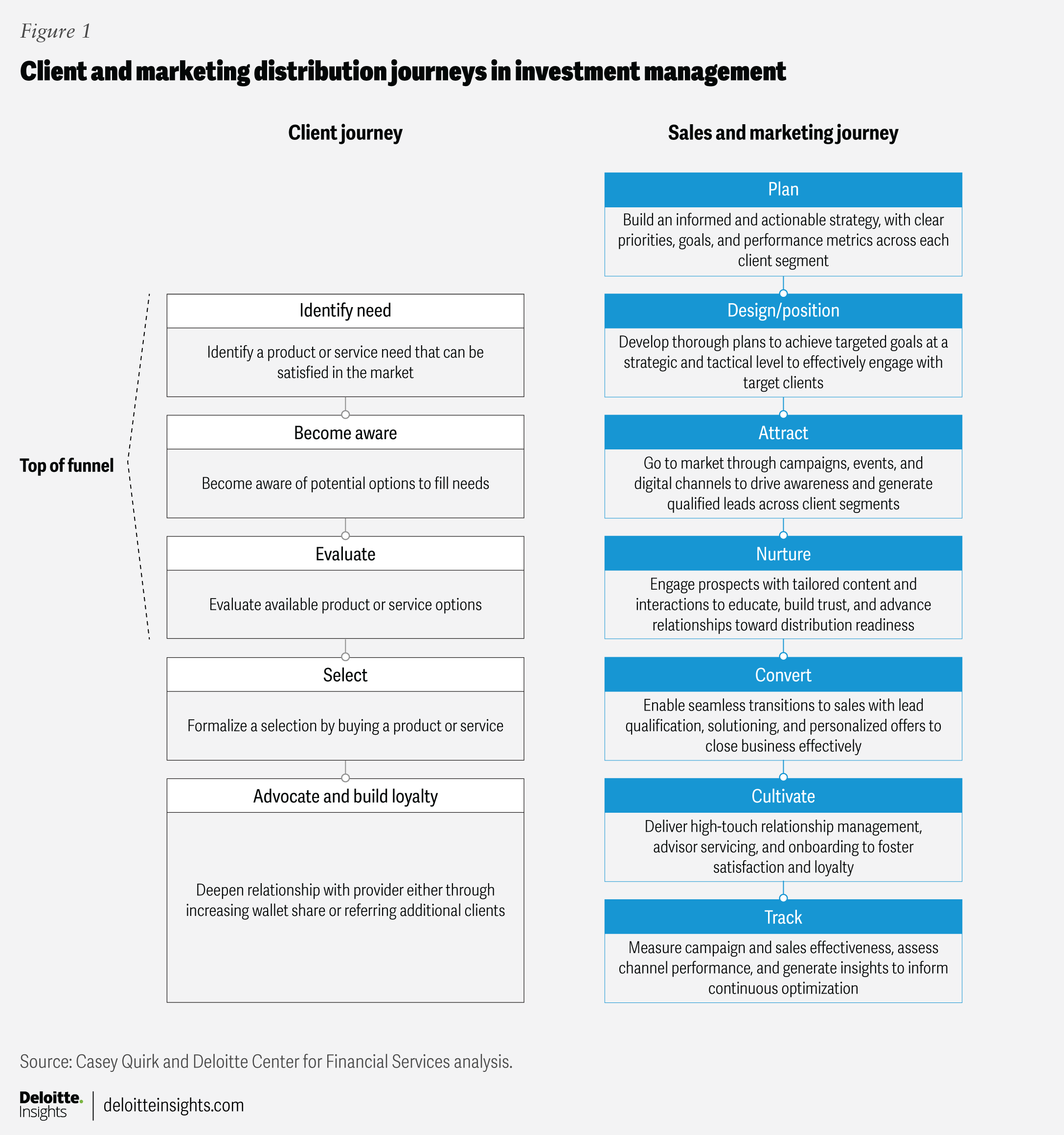

Sales and marketing teams in investment management firms can consider deploying AI applications across the entire sales and marketing life cycle, from building awareness to generating and nurturing leads, to retaining clients given its potential benefits and the role it can play across the client journey (figure 1).

Agentic AI tools can help sales and marketing teams enhance efficiencies and strengthen overall enablement. With these tools, sales teams can draft communications, generate client interaction summaries, and consolidate collaterals for client conversations.9

But that could just be scratching the surface as far as potential is concerned. AI agents can offer more. Imagine an investment manager having an AI agent that can aid them through all stages of the sales life cycle. An investment manager could prompt the assistant to generate leads from internal sources with a specific profile, ask for product recommendations relevant to that profile, and even request a summary of market trends for different geographies and regulatory environments. These assistants could serve as guides through sales phases, providing investment managers with prioritized action items, things to know, or suggested leading practices for the sales phase, product information, and client profiles.

Cutting through the noise: Curating relevant content to help build awareness and entice clients

Many investors and prospective clients are inundated with large amounts of manager content, thought leadership, and reporting through multiple channels. Some investment managers who use this content to build awareness and differentiate themselves in a crowded market are exploring AI use cases to quickly generate relevant content, automate its dissemination across channels, and where possible, personalize by client.

Effective marketing in the early stages of distribution can be essential for investment managers aiming to attract new investors, making this a critical point for client conversion. With many investors expecting personalization right from the early stages, some marketing teams are exploring tools to generate creative images, conduct translations (which could reduce time by up to 80%), and even draft investment commentaries or components of fact sheets.10

Implementing gen AI for customer awareness exercises can not only result in a more engaged and informed client base, but can also help marketing teams to spend less time on lower-value activities and instead focus on developing new content, delivering more campaigns, and customizing content to a given channel or client segment.

Tailored touchpoints: Meeting investors where they are with personalized engagements

As some investors may expect detailed discussions around their specific needs, sales and marketing professionals should anticipate and adopt their preferred interaction style, product preferences, and solution needs, and personalize their engagement approach accordingly. Some sales and marketing organizations are deploying gen AI solutions focused on optimizing territory planning, determining engagement cadence and preferences, and enabling a more personalized experience, which can lead to a more efficient conversion process.

Managers can use machine learning and gen AI-powered predictive analysis to rank leads based on their likelihood to convert. These technologies have helped enable investment managers to analyze multiple factors such as behavioral, demographic, and engagement data to produce real-time scores.11 This can help sales teams target leads with greater precision, resulting in higher conversion rates.12 A large financial services firm was able to improve its target conversion from 3% to 5% using AI-enabled segmentation and personalization.13

Investment management firms can also use AI to help draft request for proposal (RFP) responses in a more timely and efficient manner. RFP efforts can require digging into company documents and large data sets from different sources, which can make keeping up with demand at scale challenging. Teams can save time and cost by using large language models to draft RFP responses and create customized proposal presentations. In fact, survey data shows that RFP automation is a top gen AI application for 80% of surveyed institutional distribution leaders.14

From data to dialogue: Building and strengthening client relationships with gen AI-powered onboarding and servicing

Client-facing teams at investment management firms can leverage gen AI during negotiations, using AI tools to analyze current market conditions and future trends to help gain real-time insights, relevant information, recommendations, and support for decision-making. Gen AI can streamline the customer onboarding process by automating various tasks, such as data collection, verification, compliance checks, and documentation. Some managers are using gen AI to help roll out a more streamlined onboarding experience for their clients, with agentic AI managing the obstacles along the journey. A faster, less manual-driven and disjointed onboarding process can help enhance the client experience, while investment managers can benefit by reallocating freed-up hours to value-added activities and client conversions. Reduced pain points in the process can help build trust, and positively shape the client’s overall perception.15

After a client is onboarded, their demands and expectations around meeting their needs and engagement preferences likely remain. This is another area where gen AI can have an impact. Relationship managers and client service professionals can, for example, use AI to generate customized reports and deploy chatbots and related automation tools to answer client queries and respond to emails.

Staying ahead: Anticipating needs and offering holistic solutions to help deepen client relationships

As clients across both the institutional and retail intermediary channels consolidate manager relationships, some sales and marketing teams are responding by bringing more tailored content, value-added tools and services, access to specialists and leaders, and other offerings to help fulfill clients’ needs. While revenue potential at this stage in the client life cycle can be high, only a few firms appear to be deploying gen AI. One use case at this stage of the journey is identifying at-risk clients and predicting the next best product that might create cross-selling or upselling opportunities.

Deepening existing client relationships is important in a world with increasing competition and slowing organic growth. The ability to anticipate client needs and proactively bring solutions to the clients before they know they need them can help differentiate and set apart leading investment managers.

Beyond productivity: Distribution use cases multiply

Investment management firms are investing in and deploying AI and generative AI technologies within the distribution function primarily to boost productivity. This is often achieved through proofs-of-concept (POCs) to demonstrate the technology’s effectiveness, and by leveraging external vendors to help expedite the deployment of these POCs and the surrounding data and risk management infrastructures.

Some common objectives of these AI and gen AI technology initiatives and POCs being deployed include:

- Improving productivity and efficiency of the sales or marketing organization

- Enhancing customer experience, engagement, and personalization of communication

- Supporting growth and client retention efforts

Some investment management firms are achieving efficiency and enhancing personalized client communications using gen AI (see “How some investment management firms are using gen AI for distribution efforts”).

How some investment management firms are using gen AI for distribution efforts

- Invesco has used gen AI to reduce the time taken to write investment commentaries for custom model portfolios from three to four weeks to less than a day.16

- WisdomTree is using AI across sales operations to generate leads, conduct predictive analysis, and provide personalized fund recommendations to advisors.17

- PIMCO has deployed a tool to help client teams access information faster and more accurately.18

- At Fidelity, associates are using gen AI to shave off days and generate customer-facing Q&A sections in minutes.19

- Financial advisors at Morgan Stanley are using their AI tool to capture client insights, generate personalized recommendations, and outline next steps.20

As more use cases mature and more firms adopt them, gen AI could become the norm for client engagement in investment management, which could set higher standards for customer expectations and industry competitiveness.

Mind, but don’t succumb to adoption challenges

Although many investment managers have begun exploring or piloting AI solutions to gain scale and differentiate themselves in the market, enterprisewide investment appears to be measured. Caution may stem not only from the changing regulatory environment and concerns over data security and infrastructure requirements, but also from the relative novelty of generative AI technologies.

Regulations continue to evolve to keep pace with the rapidly changing AI landscape and technology improvements, which can create uncertainty for organizations.21 While some regions focus on a vertical approach by targeting specific AI applications, some follow a horizontal approach, covering multiple sectors.22

At the same time, cybersecurity remains a top concern for some investment management firms, with each incident costing the financial services industry an average of US$5.5 million so far in 2025.23 To help avoid these additional costs and maintain client trust, some investment managers may be more wary of adopting new AI solutions, especially when it comes to embedding them into the client experience.

To help reduce security risk and use gen AI solutions effectively, firms should source high-quality data, use modern data cloud infrastructure, and adopt robust data governance principles. However, these foundational requirements are often not in place at many firms exploring AI’s potential, although they may be among their top tech development priorities. That said, given AI’s ability to help improve efficiency, innovate products and processes, acquire new clients, and service existing clients, organizations are likely motivated to overcome such challenges to AI adoption.

Level up with AI: Action items to consider for sales and marketing teams looking to up their AI game

As investment management firms set out on their AI empowerment journey, several lessons can be learned from early adopters who are harvesting returns on their investments. Leaders should consider a focused, integrated approach that aligns with both strategic objectives and organizational readiness. Some firms are:

- Focusing on practical, high-impact use cases that are congruent with business priorities, incremental to the enterprise value, and feasible to implement

- Taking a long-term view on return on investment while also investing in early experimentations

- Embedding sales and marketing into their firmwide AI apparatus, to help guide and oversee the strategy, implementation, and change management in an integrated manner

- Enabling flexibility and openness to change to help align with the fluid AI and regulatory environment

By taking this integrated approach, investment managers can move beyond isolated pilots and build the capabilities, culture, and confidence needed for enterprise-wide AI adoption.

Prioritizing gen AI use cases

The rapid pace at which AI technologies are evolving can make it challenging for organizations to chart a course for effective scaling. Firms that begin implementation on too many use cases without adequate consideration and prioritization of risks, tangible returns, regulatory suitability, and ease of implementation may not achieve optimal results.24 While small pilots remain valuable for testing feasibility, greater success often comes from reimagining and transforming entire end-to-end processes, rather than narrowly applying AI to isolated use cases. Leading practices often call for firms to pilot thoughtfully, after which they can move to scaling end-to-end solutions to achieve practical gains.

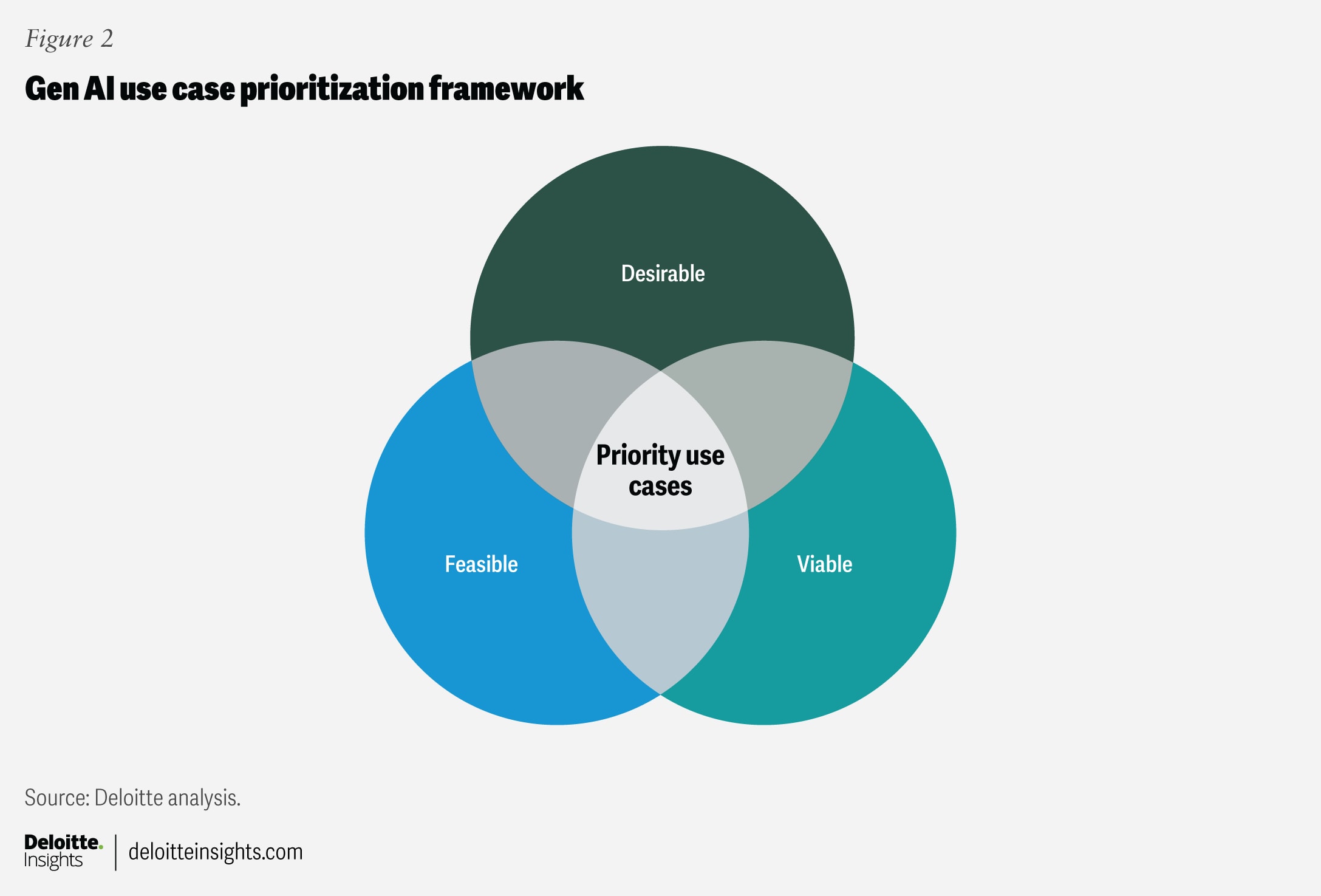

When considering different use cases, firms should consider three dimensions (figure 2).

Use case prioritization should lie at the intersection of:

- Desirability, that is ensuring that the use cases meet the needs of clients and internal stakeholders, and are aligned with the strategic priorities of not only sales and marketing functions, but also the firm overall

- Viability, that is understanding the value these use cases bring to the organization, including factors like the level of business impact, return on investment, time to realize the benefits, level of risk present, and so on

- Feasibility, that is building a solution that is fit-for-purpose in the near term by ensuring that the technology exists to enable implementation, and understanding the complexity, data requirements, and whether the business can support the delivery

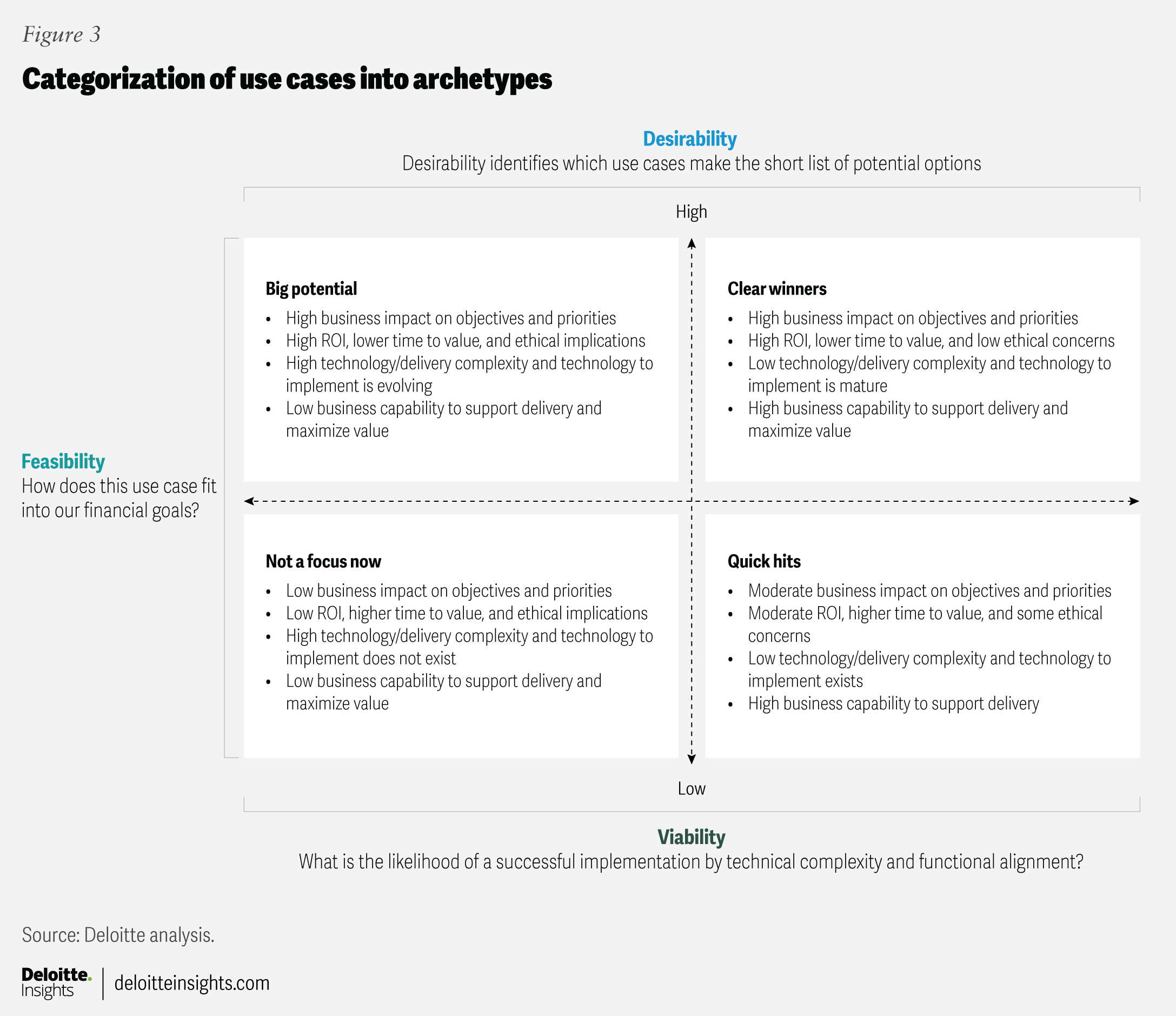

Assessing each case against the three-dimensional framework can help lead to a clearer distinction across four archetypes (figure 3) and consequently, can help separate the highest priority use cases from others.

Embedding sales and marketing into a firmwide AI apparatus

Changes driven by the evolution and rapid adoption of gen AI technologies could call for an upgrade to governance, processes, mechanisms, and operational controls. While sales and marketing teams are business users in the apparatus, it is important for them to take an active part in the firm’s AI design. As part of this, leaders should consider:

- Ensuring that the enterprisewide AI strategy helps enable sales and marketing functions to achieve their strategic objectives and facilitate scaling and delivery of a differentiated client experience, taking into account factors like goal development, intake, project support, management and measurement of value (ROI), talents and risk, and governance considerations.

- Having sales and marketing executives represent functional interests in AI governance bodies to help champion the AI adoption cause for their teams. Integrating the sales and marketing voice within the governing body can not only help create rapport internally, but also ensure that clients’ voices and needs are considered when delivering a differentiated offering.

- Centralizing the testing of AI before taking the technology to the broader organization. Client communication will be equally important in the face of significant governance and regulatory headwinds.

- Driving adaptability, and tailoring tech and AI solutions to help fit current and future sales and marketing needs. Some sales and marketing organizations work with outdated databases, spreadsheets, and isolated data repositories. It is important to focus on what is most critical and what to prioritize in the sales and marketing technology stack to help ensure it can and is supporting the needs of the business.

Broader considerations

For AI projects with a broader scope, investment management leaders could introduce a companywide risk management program to help identify new and existing risks and potential governance and control mechanisms for each, as a starting point.25 Risk assessments will likely require constant revisiting to account for the continuing unknowns of AI technology. Some of these risks can be managed by providing AI models with accurate and impartial data. Deciding what customer and prospect data to feed into models for micro-segmentation and custom pitches can help with risk management, influencing both the success and risk profile of the strategy. Human supervision will likely be an important component in managing this balance. Moreover, there is little clarity on what kind of domestic or international regulations could more broadly govern AI, and who would be responsible for implementing and governing such rules.26 A robust governance approach will likely be important to successfully scale gen AI usage. As gen AI can alter how processes might look and function, firms should invest in training and support to help employees build confidence and fluency in working with these tools.

Staying ahead of the curve

The ability of investment management firms’ sales and marketing teams to address client needs at scale will likely be shaped by the continued evolution and integration of gen AI technologies. Agentic AI, in particular, could play a pivotal role in transforming how firms engage with clients, optimize operations, and drive growth. As technology matures, investment managers should work to stay ahead of the curve by continuously exploring and adopting innovative AI solutions to help maintain a competitive edge in the market, with sales and marketing leaders contributing to help set a vision of how their firm’s future could look.