Semi-liquid funds: A US$4 trillion opportunity for traditional and alternative investment managers

To help capture this developing opportunity with retail investors, firms will likely have to focus on effective distribution, operations, and brand trust

Who says retail investors need millions to tap into private markets?

Semi-liquid funds are helping retail investors gain access to alternative asset classes, offering diversification and higher return potential while maintaining a degree of liquidity that can suit retail needs.

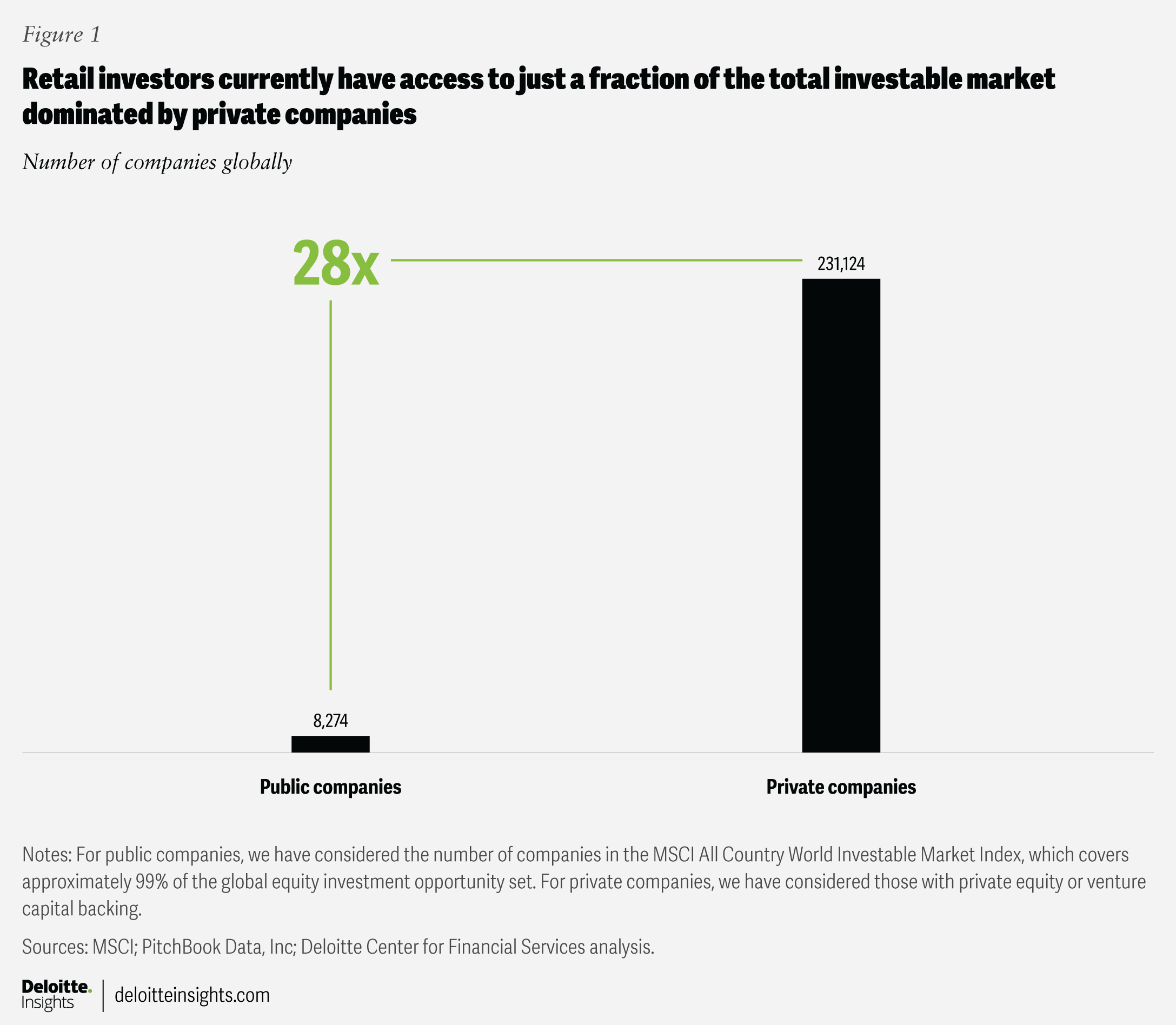

Retail investors have historically been restricted to investing in publicly available equity and fixed income securities. Additionally, the breadth of publicly available investments is shrinking as more companies opt to remain private.1 And even if companies do decide to go public, they typically tend to do so at a later stage, providing fewer opportunities for retail investors to benefit. The median age of companies at initial public offering has increased from six years in 1980 to 14 years in 2024.2 The decreasing number of public market securities provides investors with fewer opportunities to diversify across the wide range and complexity of the overall economy. Private companies, on the other hand, vastly outnumber public ones, offering a broader array of investment opportunities and different risk-return profiles. The number of global private equity- and venture capital-backed private companies is 28 times higher than the number of companies in the MSCI All Country World Investable Market Index, a comprehensive public market index (figure 1).3 Fortunately, retail investors have an opportunity to gain exposure to the growth of private companies through semi-liquid funds. A renewed focus on these funds can help make it more convenient for retail investors to tap into key asset classes such as private equity and private credit.

A revitalization of semi-liquid funds could be a win for both traditional and alternative investment firms. For traditional investment firms, these funds can bring a more diverse product lineup and higher margins. These funds typically charge a 1% to 2% management fee on the net asset value, and some funds may even add a 10% to 20% incentive fee—much higher than the 5 to 150 basis points expense ratios that traditional firms charge for mutual funds and exchange-traded fund products.4 For alternative investment firms, semi-liquid funds can offer new avenues of generating revenue in a challenging fundraising environment, where capital raised by private funds has declined every year since peaking in 2021.5

However, to effectively navigate the evolving retail alternatives market, investment firms will likely have to adapt their operating models. An updated operating model, designed to facilitate semi-liquid fund structures, has the potential to increase accessibility, enhance profit margins, and position early movers as leading providers of diversified solutions for the retail sector.

What is a semi-liquid fund?

Fund structures with certain characteristics are being collectively referred to in the market as semi-liquid funds or evergreen funds, although there is no single regulatory definition. In the United States, the funds are registered with the Securities and Exchange Commission (SEC) and may take the form of public non-traded real estate investment trusts (NT REITs), public non-traded business development companies (NT BDCs), tender offer funds, interval funds, or control stakes. It is even possible to launch continuation funds structured as one of these semi-liquid fund structures.6 Within the European Union, semi-liquid funds are primarily offered as European long-term investment funds (ELTIFs), while in the United Kingdom, these funds are structured as long-term asset funds (LTAFs).

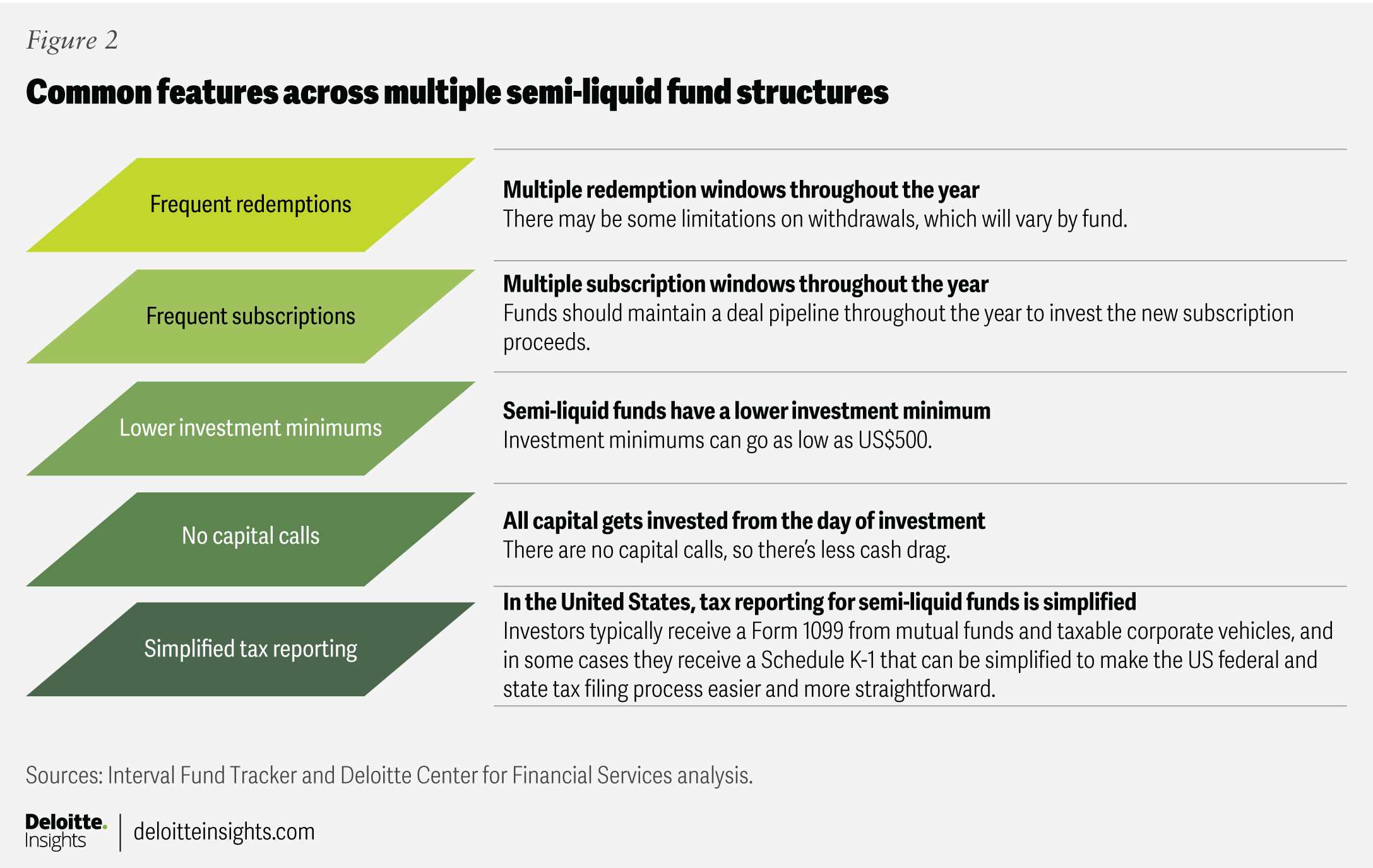

These fund types share similarities such as low investment minimums, frequent redemption and subscription windows, absence of drawdown structures, and simplified tax reporting (figure 2). Despite these commonalities, each structure possesses unique attributes that render it more suitable for specific asset classes. Interval funds, which have to offer periodic liquidity, often invest in credit because regular interest payments help meet the liquidity needs of redemption windows. By the end of 2024, interval funds had allocated 63% of their portfolios to credit assets.7 Conversely, tender offer funds—where redemptions are subject to board approval and not as schedule-bound as interval funds—can afford to invest in more illiquid assets such as private equity, which can take an extended time for realization. By the close of 2024, tender offer funds had allocated approximately 56% of their investments to private equity.8 As firms consider entering the evergreen funds space, strategic decisions on factors such as asset class expertise, distribution approaches, and target investors can help inform the composition of the target product lineup.

How big is the market for semi-liquid funds?

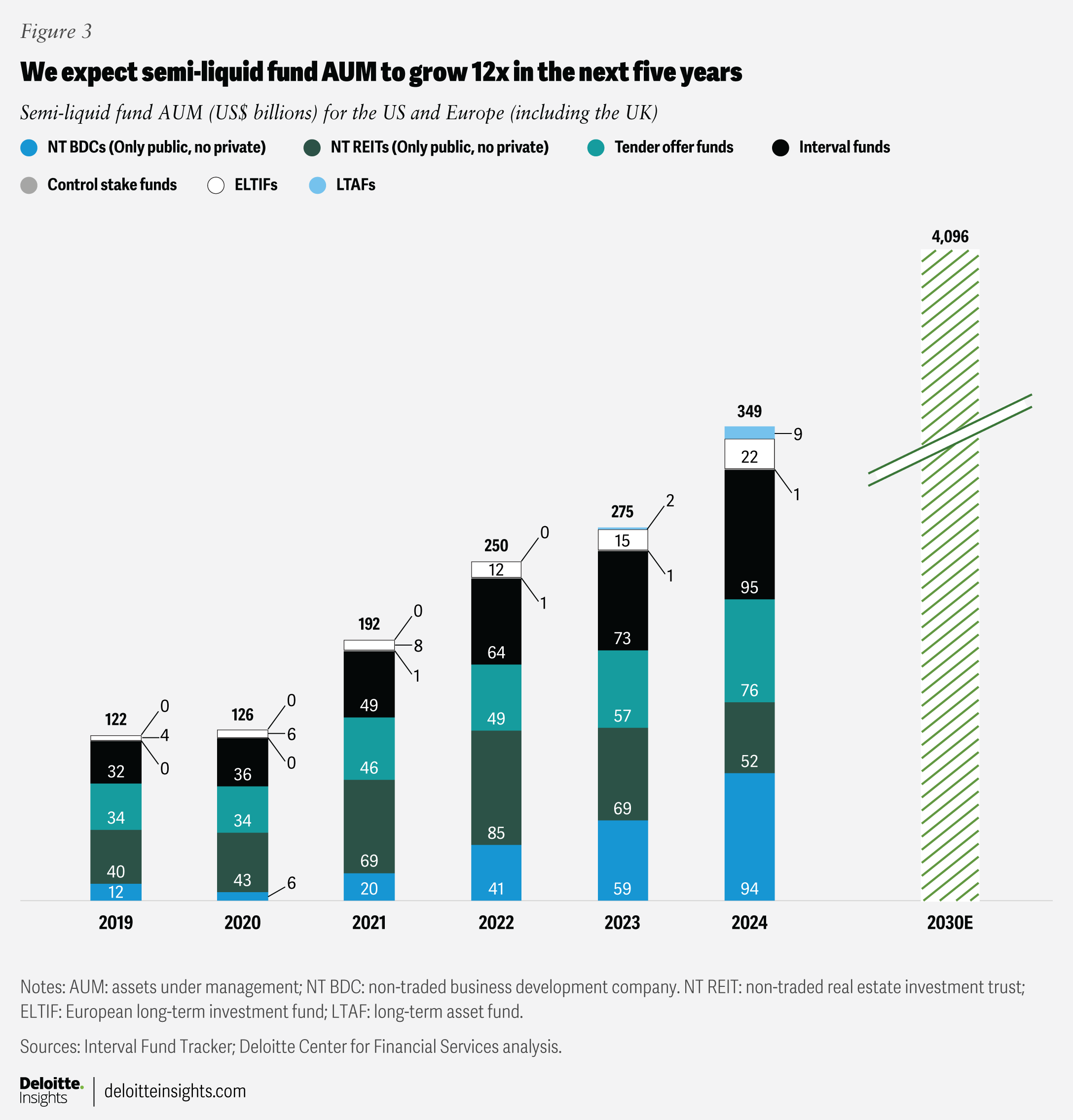

The number of semi-liquid funds has almost doubled from 238 in 2020 to 455 in 2024, while their assets under management (AUM) has almost tripled from US$126 billion to US$349 billion over the same period.9 This segment is expected to continue the growth momentum and reach US$4.1 trillion in AUM by 2030 (figure 3; see “AUM growth projection methodology” for details on how this projection was arrived at).10 It is estimated that retail investors will likely contribute more than 40% of this total AUM.11 This expectation for rapid expansion is driven by increasing investor demand, enhanced distributions, favorable regulatory developments, the relatively low AUM base, and the introduction of new structures such as ELTIF 2.0 and LTAFs. Although certain structures may experience faster growth than others, they are all influenced by the same underlying drivers, making it difficult at this stage to forecast growth at the individual structure level.

AUM growth projection methodology

The projected US$4.1 trillion AUM growth for semi-liquid funds is based on anticipated contributions from three key investor segments: retail investors, high-net-worth individuals (HNWIs), and institutional investors. Demand from these investors and regulatory tailwinds are expected to fuel this exponential growth.

Retail and HNWI contributions: Projections for retail and HNWI investors are calculated using an estimated cumulative investment in semi-liquid funds by adults with investable assets exceeding US$100,000 across the United States, the United Kingdom, and Europe from 2025 to 2030. Specifically:

- Retail investors—defined as individuals with investable assets between US$100,000 and US$1 million—are estimated to invest US$1,000 annually in semi-liquid funds.12

- HNWIs—those with investable assets over US$1 million—are estimated to contribute US$2,000 annually.13

For the purposes of this analysis, the term retail investors refers specifically to mid-tier individuals with investable assets between US$100,000 and US$1 million. This group, which partially overlaps with the upper end of traditional retail investors and includes some accredited investors, possesses sufficient capital to engage in alternative investments. However, they often lack direct access to such opportunities, which are typically available to HNWIs. Investors with less than US$100,000 in investable assets are excluded from this model due to their limited capacity to participate in semi-liquid vehicles.

Institutional contributions: Institutional investor participation is modeled as a function of their total assets allocated to alternative investments in the United States, the United Kingdom, and Europe, with projections aligned to anticipated asset allocation trends through 2030. In particular:

- We estimate that institutions will allocate between 1% and 25% of their total portfolios to alternative investments, reflecting current trends, planned increases in alternative exposures, and regulatory posture.

- Of the alternative investment allocation, we estimate 10% to be invested through semi-liquid fund structures, which can be considered a conservative estimate given the growing appeal of such vehicles.

To estimate the asset base of institutional investors, we relied on national financial accounts (books of accounts) from the United States, the European Union, and the United Kingdom.14 These sources provide comprehensive data on institutional asset holdings and serve as the foundational input for calculating their potential exposure to semi-liquid funds.

What are the common drivers of growth for semi-liquid funds?

Semi-liquid funds provide retail investors with a differentiated way to access alternative assets, offering unique risk-return profiles, diversification benefits, periodic liquidity, and simplified administration. Additional factors such as reduced cash drag and lower reinvestment risk can further incentivize eligible investors to allocate capital to semi-liquid funds. Evolving regulatory frameworks have the potential to broaden the definition of eligible investors, while advancements in technology can enhance the overall investment experience by streamlining processes for all investors. Here’s a look at each of these factors in more detail.

Performance achieved with reduced cash drag compared to traditional private equity funds: Unlike traditional private equity funds, semi-liquid funds deploy fund contributions right away, eliminating the need for investors to hold capital in cash or Treasuries for several years. As a result, investors can achieve returns with a lower internal rate of return (IRR) compared to drawdown structures. A semi-liquid private equity fund may triple the initial investment with an IRR of 12% net of fees, while a typical private equity drawdown fund may require a net IRR of 18%.15

Breaking free from a cycle of reinvestment: Semi-liquid alternative funds often do not have a fixed end date, unlike legacy alternative investment products such as private equity and private credit funds. This characteristic of semi-liquid funds can alleviate investor concerns about the need to seek new investment opportunities repeatedly as each fund matures. Additionally, semi-liquid structures lessen the operational burden on investment firms to continuously raise capital for successive funds. The process of raising new capital can be both costly and administratively time-consuming, and may also damage an investment manager’s reputation if fundraising efforts fall short of previous ones. The cost savings from avoiding continual fundraising may also improve margins.

Evolving regulatory stance toward semi-liquid alternative funds: Regulators appear to have been striving to make alternative investments more accessible to retail investors. The SEC has relaxed the definition of accredited investors to include individuals with professional knowledge, experience, or certification, regardless of their income or net wealth.16 Additionally, numerous amendments are currently at various stages of implementation, aiming to further expand the definition of accredited investors.17 One such amendment includes allowing individuals to qualify as accredited investors by passing an exam established by the SEC. In Europe, the ELTIF 2.0 regime has facilitated greater access to alternative assets for retail investors. The new regulations have removed the previous €10,000 minimum initial investment requirement and the 10% cap on aggregate ELTIF investments for retail investors with financial portfolios below €500,000.18 Regulators and policymakers in both the United States and the United Kingdom have engaged in deliberations to permit alternative investments within defined contribution plans (such as 401(k) plans in the United States).19 Semi-liquid funds could likely benefit from these developments if they come to fruition.

Efficiency gains due to tokenization: The adoption of technologies such as tokenization for private assets is expected to increase, which can improve liquidity and simplify fund administration.20 Semi-liquid funds can be tokenized, and the tokens can be traded on the secondary markets to improve liquidity between redemption periods. Furthermore, tokenization facilitates fractional ownership of semi-liquid funds, offering investors greater flexibility in their transactions. Tokens can be updated, transferred, or redeemed through smart contracts, and can also streamline administrative tasks such as bookkeeping and settlement. Additionally, tokenization supports the simplification of know your customer and anti-money laundering compliance for semi-liquid funds using reusable decentralized identity management solutions.21 Some examples of such solutions include those offered by zkMe, cheqd, and Privado ID.22 While tokenization streamlines fund operations and investor onboarding, it does not eliminate the need to satisfy existing regulatory and compliance obligations. It represents an operational evolution—not a regulatory exemption.

Although several factors support the growth of semi-liquid funds, it is important to approach them cautiously—not because the structures are new, but because historical data exists mostly at lower AUMs, and their behavior at scale remains largely untested. Firms without a detailed strategy to expand in this area may encounter operational difficulties.

What risks and considerations should firms address when expanding semi-liquid fund offerings?

Without careful planning, rapid expansion can dilute brand equity, expose liquidity vulnerabilities during periods of elevated redemptions, and undermine trust through inconsistent valuations. Operational strain from outdated technology and a weak deal pipeline can further impair execution and long-term performance. Here are some of the risks, considerations, and mitigation strategies for firms planning to expand into semi-liquid funds.

Investor awareness and trust: A survey of retail investors indicates that limited awareness and trust are significant challenges to investing in alternative assets.23 Investment firms have an opportunity to establish a robust brand presence within the semi-liquid fund segment, as these innovative structures appear to be gaining traction. Leveraging an established and trusted brand to enter this new market can be an effective strategy. About 47% of survey respondents indicated that financial backing from large firms will positively influence trust.24 Furthermore, investor education initiatives can contribute to cultivating trust, raising investor awareness, and increasing brand recognition. Investment advisors often play a crucial role in assisting firms to comprehend customer requirements and develop superior products. Collaborations with investment advisors can be essential for elevating brand awareness and driving sales growth.

Liquidity management: Semi-liquid funds can face asset–liability mismatches due to short- to medium-term redemption windows and medium- to long-term assets. It’s important to handle liquidity events systematically to help avoid liquidity issues. This can be done by controlling redemptions and managing liquidity. To keep things balanced, managers often use a combination of tools. For example, they might control redemptions by adding notice periods, setting redemption limits, or applying early withdrawal penalties. Some funds use lockups or gates to slow outflows, or stagger payouts so that investors receive returns gradually as the underlying assets produce cash. On the flip side, managing the fund’s liquidity proactively can be just as important. This could mean holding back a portion of capital in liquid reserves, using new investor inflows to meet redemptions, or making sure the types of assets in the portfolio match the fund’s redemption schedule. Some funds also establish credit lines or invest across different vintages to create more flexibility. Liquidity management is often about building enough resilience into the structure so that investors can access their capital without putting the fund under unnecessary pressure.

Frequent valuations: Unlike drawdown funds, which typically perform portfolio valuations every quarter when the financial statements are available, many semi-liquid funds offer more frequent subscriptions and redemptions. Consequently, these funds will likely have to perform valuations more often, as net asset value is the basis for these transactions. Valuation considerations can hold even greater importance for traditional investment firms since expertise in the valuation of private assets often does not exist within these firms. According to the 2024 Deloitte Fair Valuation Pricing Survey, about 63% of firms use external experts in some capacity to value private equity assets, and 52% do so for private credit assets.25 Alternative data can help firms arrive at holistic valuations even when quarterly financials are not available. Investment firms can also use AI to accelerate the portfolio valuation process. The firm’s revenue is also tied to the net asset value, and hence, the independence of the valuation process can help enhance investor trust. External third-party valuations or assurance services may be useful tools to address this conflict of interest. Furthermore, different firms holding the same portfolio company can value the company quite differently due to limited regulation.26 As such, being conservative and maintaining audit trails will likely be important.

Management of rising administrative complexity: Engaging with retail investors can necessitate additional operational overhead, especially for alternative investment management firms. Retail investors typically expect frequent communication, thorough disclosures, seamless transactions, data privacy, and various support services. Firms may have to reevaluate their custodian arrangements, transfer agency relationships, and risk management frameworks. Firms may use blocker corporations in semi-liquid fund structures to help manage tax obligations and streamline compliance across diverse investor types, enabling more scalable and transparent operations. Alternative investment firms will likely have to develop a comprehensive strategy to manage the increased administrative costs associated with accommodating a larger number of investors with smaller investment sizes.

Efficient investment sourcing: Semi-liquid funds accept subscriptions at periodic intervals. To help deploy incoming capital promptly and avoid cash drag, it’s important to manage sourcing effectively and maintain an optimal deal pipeline. This will also likely help ensure the fund remains aligned with the stated fund strategy in a cost-effective manner. Strategies such as investing in limited partner-led secondaries involve putting capital into multiple companies, which can lead to over-diversification and hinder the fund’s focus on its investment objective. By contrast, direct investments, coinvestments, and general partner-led secondaries may allow firms to achieve concentrated exposure and maintain alignment with their fund objectives. These investment options are typically less costly compared to investing in private capital funds, which can add another layer of fees. Additionally, strategic alliances with other financial institutions can support firms in sustaining steady and diversified deal flows.27

Semi-liquid funds are likely to go mainstream

Semi-liquid funds can help bridge the gap between retail investors’ demand for enhanced liquidity and easier access and their desire for exposure to diverse asset classes with higher return potential. Advancements in technology adoption, favorable changes in regulatory policies, and increased ease of operation are also expected to help drive the growth of semi-liquid funds over the coming years. Many of these investment structures can provide retail investors with access to alternative investment options without the limitations of traditional vehicles such as mutual funds and exchange-traded funds. Semi-liquid funds have the potential to become a preferred vehicle for democratizing alternative assets, catering to retail investors who may seek exposure to private asset classes. Firms that establish effective guardrails for managing potential risks and build a brand in this evolving space will likely be better positioned to attract investor interest, growing AUM in a high-margin asset class at scale.