Brazil economic outlook, February 2026

Brazil enters 2026 with a muted outlook, characterized by slowing growth and ongoing pressure on government finances

The Brazilian economy slowed throughout last year, with year-ago real economic growth going from 4% in the first quarter to just 1.8% in the third quarter.1 The economy barely grew at all between the second and third quarters, rising just 0.1%. Real gross fixed capital formation slowed, and consumer spending barely budged. Meanwhile, government spending and the external sector were the main growth drivers.

Although growth has likely improved since then, economic activity is expected to remain relatively subdued. Inflation-adjusted interest rates will likely remain elevated, restraining capital-intensive industries and consumer spending on durables. The precarity of government finances will limit government support. Meanwhile, maintaining strong export growth could be challenging in the current geopolitical environment.

Stronger growth in the last quarter, but risks remain

Economic activity seems to have improved in the last quarter of 2025: The economic activity index was 1.3% higher than a year earlier in November,2 up from 0.6% in September. Agricultural output continues to post solid gains, and although it is likely to remain strong this year,3 its growth rate is expected to be more subdued after record harvests in 2025.

Industrial output continued to decline on a year-ago basis in November,4 with high interest rates likely affecting manufacturers. Manufacturing wholesales were down 8.8% from a year earlier in the same month. Similarly, real consumer spending on autos and parts—another interest rate–sensitive sector—declined on a year-ago basis.5

However, consumer spending is holding up relatively well overall. Services activity rebounded strongly in November, up 2.1% from a year earlier.6 In addition, real retail sales growth rebounded to 2.3% in November on a year-ago basis7—the highest rate since April 2025.

The relative strength of the Brazilian consumer should be unsurprising. After all, the unemployment rate fell to 5.3% in December—the lowest rate since at least 2012.8 Real wages have also accelerated, rising 5% on a year-ago basis—the strongest growth rate since June 2024. Moreover, the employment rate is near an all-time high, and employment grew by 1.2% on a year-ago basis in November.9

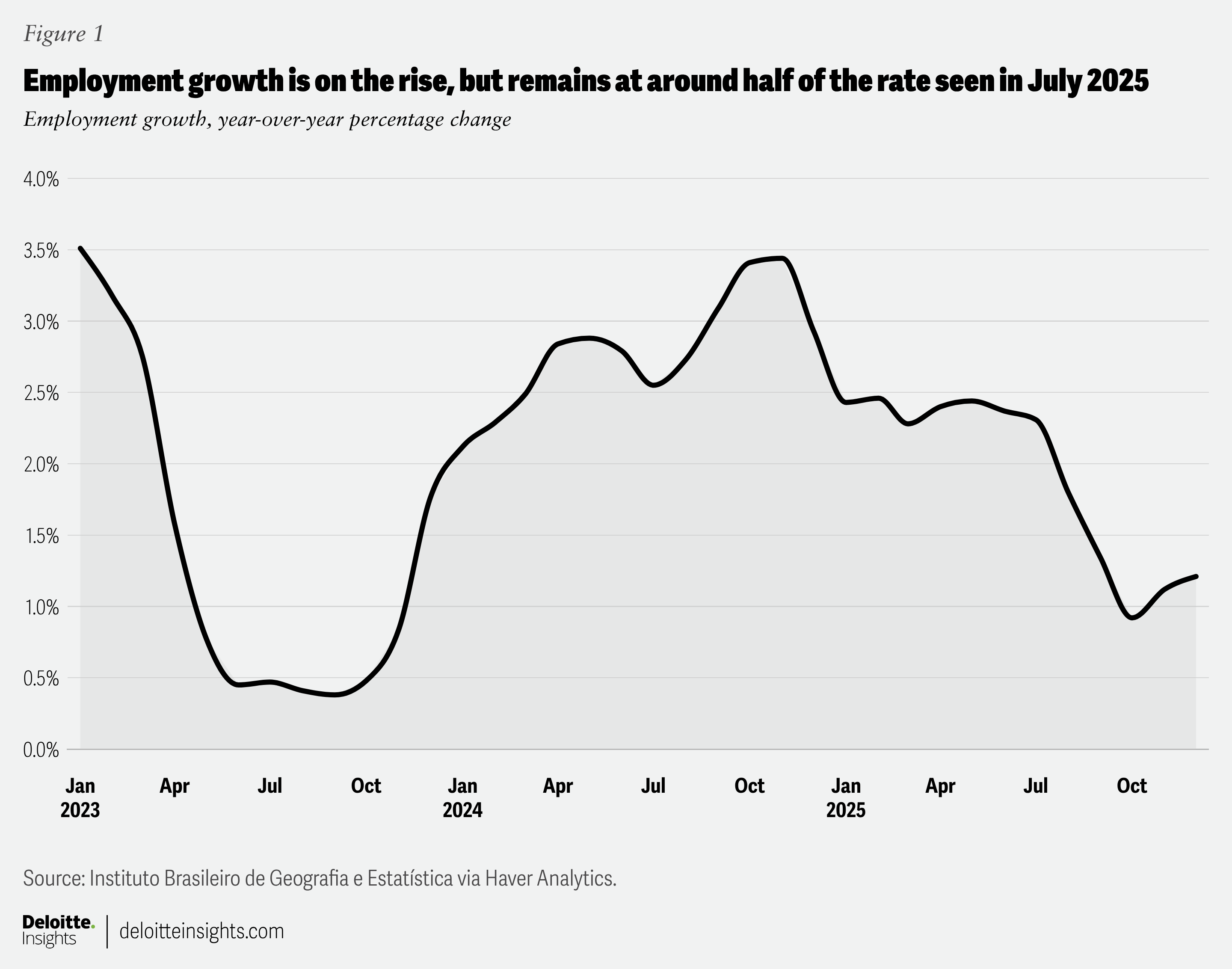

But despite this good news around employment growth, cracks are beginning to emerge: For one, the pace of year-ago job growth in December was half of the July numbers (figure 1). On a month-to-month basis, employment fell for three consecutive months before rising again in November and December. Although private sector employment continues to grow at a relatively healthy pace, public sector employment is growing faster—rising 3.9% from a year earlier in December. However, public sector support for the labor market is unlikely to be sustained if the government is to stabilize its debt.

Government finances remain shaky

The Brazilian government aims to return its primary balance, which excludes interest payments, to a surplus of 0.25% of gross domestic product in 2026.10 As in past years, this excludes many spending categories that can be exempted. In the first three quarters of 2025, the primary deficit excluding those exemptions amounted to a little over 1% of GDP.11 2026 being an election year12 makes it even less likely that a primary surplus will be achieved.

With a perennial primary deficit, general government debt is expected to rise from 87.3% of GDP in 2024 to 95% in 2026—a very high debt burden for an emerging-market economy. For example, comparable 2024 debt ratios for Chile and Peru were less than half of Brazil’s.13

The government has struggled to find new sources of revenue. For example, the Brazilian Congress voted down a proposal to increase taxes on financial transactions in 2025.14 Moreover, Brazil’s tax-to-GDP ratio is the highest in Latin America and the Caribbean.15 One recent exception was a bill the government pushed through at the end of 2025 that is supposed to provide a 10% cut to federal tax incentives, which could generate additional revenue.16

Getting to a primary balance surplus will be crucial to get interest rates down and support economic growth. Long-term interest rates remain very high in Brazil. For example, the average 10-year government bond yield in 2025 was the highest since 2008. Global bond investors have recently shown that they are more cautious when highly indebted countries attempt to widen their deficits.17 A sudden deterioration in the budget could lead to higher long-term rates even as the central bank begins to cut its policy rate.

Inflation comes within range

After more than a year of inflation running above the central bank’s target, it finally slipped just below the 4.5% upper bound of the target range. Year-ago inflation was 4.4% in January, thanks in part to rapidly falling food inflation. Core inflation has also come down, sliding from 5.3% in June to 4.2% in January.18

Inflationary pressure is relatively benign. For example, producer prices declined 3.4% from a year earlier in November.19 In addition, consumer expectations for inflation over the next 12 months dropped to their lowest reading since April 2021.20 Moreover, import prices were up just 1.5% from a year earlier in January.21 Unless the real significantly weakens, imported inflation should remain subdued.

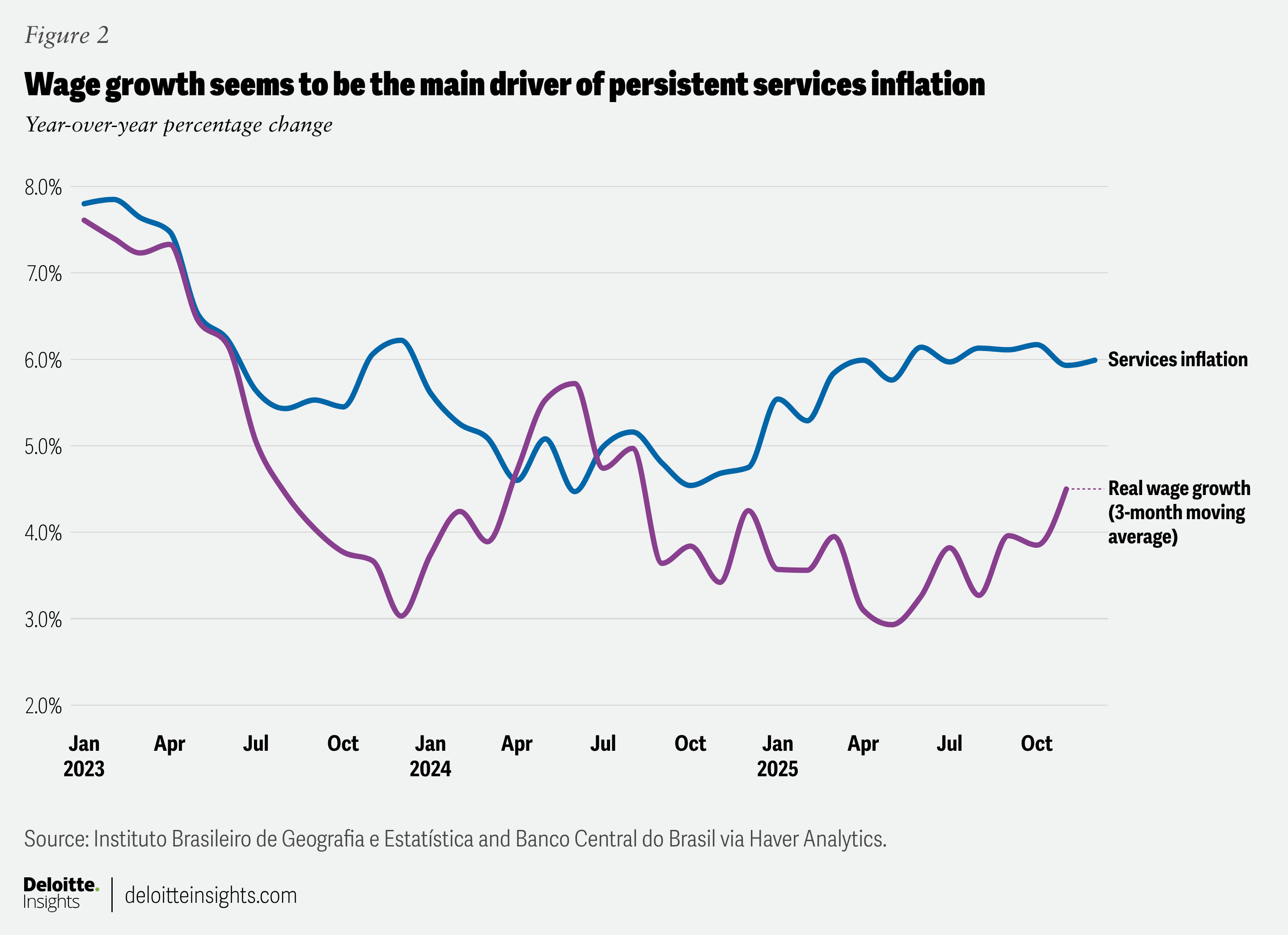

The main challenge to keeping inflation down will be the labor market. Real wage growth in November was the highest in more than a year. This may help explain why services inflation has been so persistently strong (figure 2). Services prices rose 6% from a year earlier in December, roughly in line with where services inflation has been for the past six months.22

Overall, the Banco Central do Brasil is expected to begin cutting interest rates soon. With the policy rate standing at 15% since June 202523 and headline inflation moving lower, the real interest rate is very high and climbing. This alone should allow for rate cuts, as doing so would merely preserve the real rate that prevailed last year. However, cuts are likely to be slow. Wage growth remains strong, and fiscal policy is still loose—both of which risk pushing inflation back above the central bank’s target range.

Export growth fueled by agricultural and intermediate goods

Brazilian export volumes continued to trend upward in the last quarter of 2025, with merchandise exports rising by roughly 17% year over year.24 This growth was largely driven by agricultural products and industrial supplies, which rose by approximately 20% and 15%, respectively. In contrast, durable consumption exports fell by 11%, including a 13% decrease in passenger motor vehicles.25

Unsurprisingly, export volumes to the United States and China continue to diverge: Last-quarter exports to the United States fell by 24%, while exports to China rose by 36% year over year. While diversifying trade dependencies remains a key priority for Brazil, its reliance on China persists.

Any underlying trade tensions have not deterred Brazilian imports of US goods, which rose by 10% in the last quarter of 2025 compared with a year earlier. Brazil continues to rely on the United States for high-value manufactured goods, such as machinery and aerospace parts, in addition to petroleum products.

The European Union finally inked a trade agreement with Mercosur (the “Southern Common Market,” a group that includes Argentina, Brazil, Paraguay, and Uruguay) at the start of this year.26 However, the European Parliament has referred the agreement to the EU Court of Justice to ensure compatibility with existing treaties, which could delay its ratification by up to two years.

As of this writing, the agreement is expected to be applied provisionally in March and to remain in effect until the EU Court of Justice makes its decision. Assuming the provisional agreement moves forward, bilateral trade between Mercosur and the European Union will likely increase significantly in the coming months and years.

The benefits to Brazil’s agricultural sector are clear: One assessment reports that beef exports to the European Union could rise by nearly 80%. In contrast, the benefits for Brazil’s manufacturing sector are less clear. While machinery exports could increase by more than 15%, output and employment in the sector could each contract by more than 5%.27

A similar, though more muted, effect is expected to play out in the automotive sector. The dynamic in which sectors could experience rising trade at the expense of output and employment is typical of trade liberalization. Less-efficient domestic firms are being displaced by foreign competitors, while production is consolidated among more competitive domestic firms.

President Lula’s administration has emphasized the need to strengthen the competitiveness of Brazilian industry and reverse premature deindustrialization through the development of productivity-enhancing technologies. While foreign, high-value machinery will likely contribute to productivity gains, reliance on imported capital goods appears somewhat at odds with objectives such as mechanizing family farming with domestically produced machinery.28

With the global market still uncertain amid US tariffs and ongoing delays to the EU trade agreement, Brazil will likely need to support growth through other avenues. However, consumer spending is likely poised for slower growth as the labor market begins to cool and elevated interest rates limit spending. Government finances are likely to remain relatively lax ahead of the next election, but government spending will eventually need to be pared back to prevent longer-term interest rates from climbing. Monetary easing will also be limited until inflation and wage growth are better aligned.