Gifts beat gigabits: Some mobile users rank rewards over network upgrades

Some consumers in developed markets struggle to perceive improvements in network performance. Telecom companies should consider more creative offerings to increase market share.

Deloitte predicts that in 2026, mobile operator reward schemes may matter to mainstream consumers in developed markets as much as, or even more than, network performance. Over the remainder of the decade, as network upgrades continue, non-network benefits may become increasingly critical to attract users or suppress churn: A slice of margherita pizza may hold more allure than a slice of stand-alone 5G (the more complete version of the 5G standard).1 The former is tangible, and the latter often beyond the understanding of mainstream consumers.

This trend toward rewards appears to reflect the growing maturity of mobile networks in developed markets. Demand, particularly from the perspectives of network speed and latency (the speed at which a network responds), is largely satiated. Coverage is typically imperfect—there are not spots (no coverage) and overly busy hot spots (too many users relative to available capacity)—but comparing coverage between network operators is often too challenging a chore for consumers who may lack the tools, understanding, and patience to contrast thoroughly.

As a result, network upgrades that are marketed for their higher downlink or uplink speeds, or improved latency, may have diminishing impact on loyalty to a network, as many users can neither perceive nor value such upgrades. Similarly, while important, users may struggle to comprehend the benefit to them of sunsetting 2G and 3G networks and reallocating spectrum to 4G and 5G.

The shift from network upgrades to rewards-based differentiation

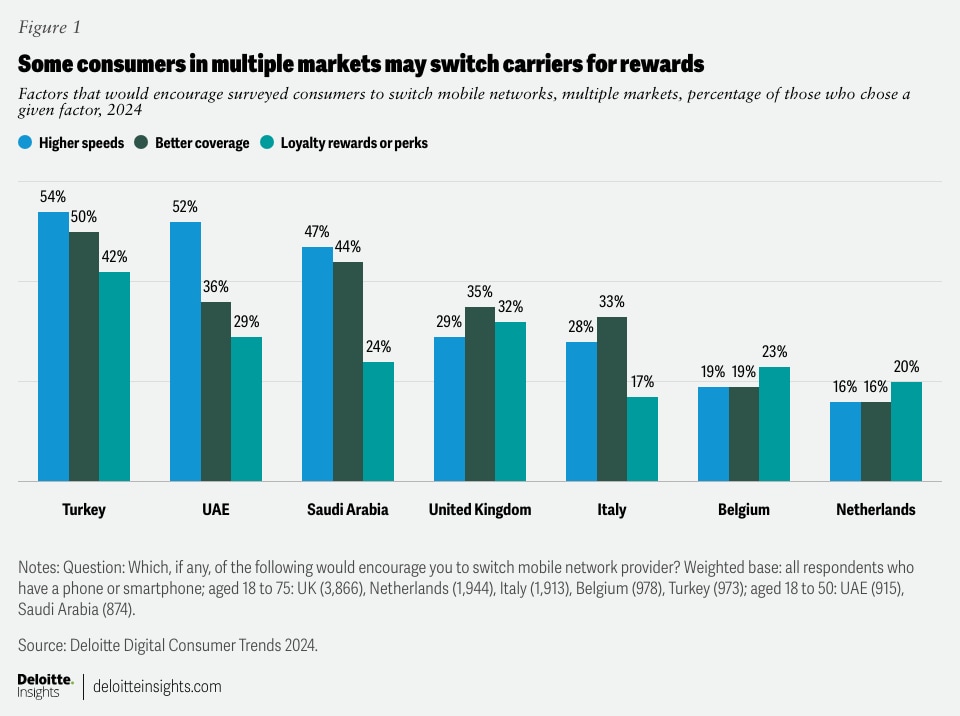

Deloitte’s view is that each market is likely to be at different points in the journey to rewards-based differentiation (figure 1). But most are likely heading in the same direction. As of 2024, rewards were reportedly the No. 1 factor that could cause churn in the Netherlands and Belgium, and No. 2 in the United Kingdom (note that pricing was excluded as a factor, as would typically be the leading claimed factor). In other markets, however, higher speeds or better coverage were more important.2 Over the medium term (through 2030), Deloitte predicts that non-network differentiation via offerings such as rewards is likely to become increasingly important.

At some point, network upgrades may exceed need, and all carriers in a market may offer what users perceive as roughly equivalent network performance. This is a contrast to the historical situation that had prevailed from the late 1970s in which almost every generational upgrade was meaningful and evident.3 For example, in the early 2010s, the 4G upgrade delivered an instantly notable performance improvement relative to any 3G network.4 The technology unlocked what consumers equated to “Wi-Fi like” speeds and latency (response times) when out and about, and applications like search or navigation that faltered on 3G could thrive on 4G.5

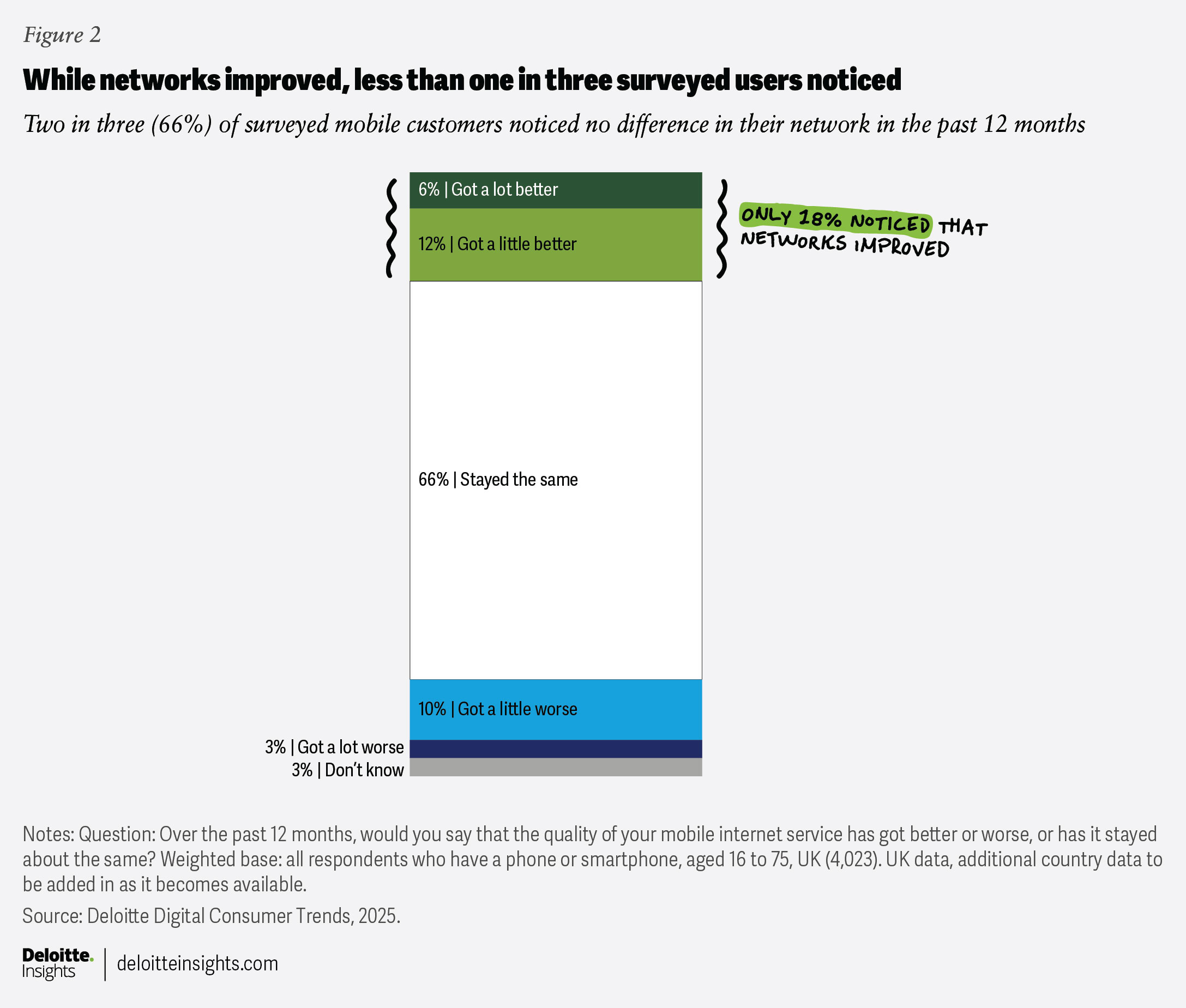

As of late 2025, however, there are few if any mainstream applications that only work on a 5G network.6 As such there may be far less motivation to switch to another network with a claimed superior 5G network than was the case with 4G. Some year-over-year improvements may be imperceptible. For example, latency on UK mobile networks over the 2024 to 2025 period showed a 0.7 millisecond improvement (decline) to 18.2 milliseconds.7 (A millisecond is one thousandth of a second.) A 0.7 millisecond variation is not discernible by a human; even elite athletes react in about 140 milliseconds.8 Further, almost no mainstream application is likely to benefit from it (latency of 150 milliseconds on a voice call is barely noticeable).9 Real-time applications such as Voice over IP, for example, need 100 millisecond latency; in the United Kingdom, the slowest-performing network technology, 3G, had 42.3 millisecond average latency in 2025.10 Deloitte UK’s research from that year found that two-thirds of surveyed mobile customers in the United Kingdom noticed no difference in their network over the prior year (figure 2).

Additionally, some consumers may struggle to compare mobile networks in their market, and this may blunt the impact of marketing campaigns urging consumers to switch to a better-performing network.

Most users’ network usage is unique, with differing travel patterns and different preferred applications. Coverage maps exist for mobile coverage, but they do not reflect intensity of demand in each location at each point in time.11 A user could compare two networks side by side by maintaining two SIMs, but this would likely be too tedious a task for most users.

Peak personal connectivity may nearly be here

It has taken more than four decades to satiate demand, but the transformation of consumer connectivity may be nearing completion.12

While a prediction should never say never, there is a reasonable probability that no further new fundamentally revolutionary devices that connect to a mobile network will emerge in the medium term (the next five years, through 2030). Similarly, there may not be any transformative applications running over these networks—a mainstream migration to a metaverse could be possible, albeit improbable. And finally, the connectivity demands per major application may remain steady or decline.13

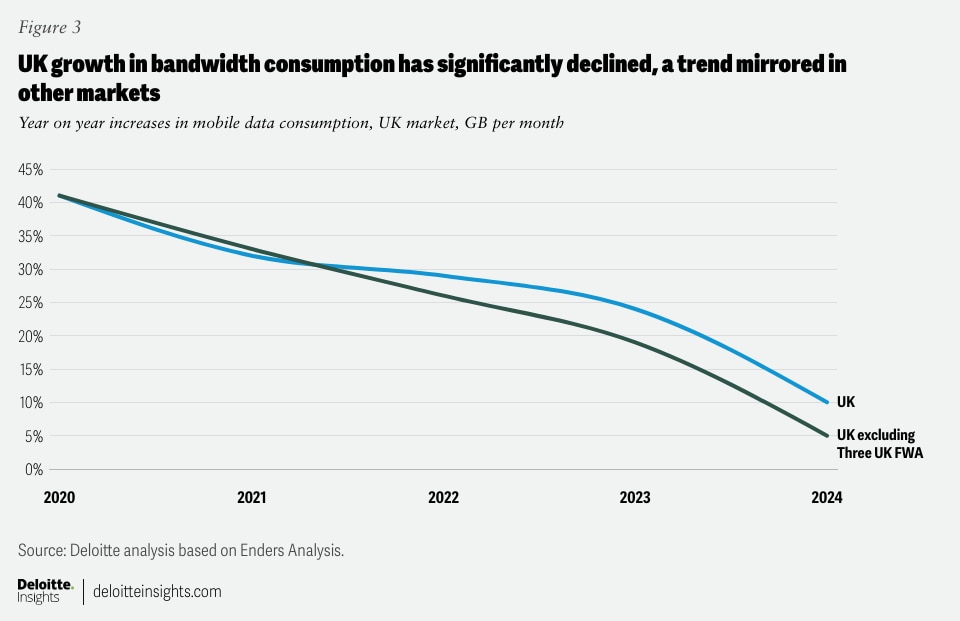

The stability and predictability of usage patterns appear to be signaled by data usage trends. Over the past five years, in many major markets, the rate of growth in gigabytes (GB) per SIM has declined. In 10 developed markets, the rate of growth had fallen to single-digit levels by 2024;14 where growth is at double-digit levels, this is often attributable to a modest growth in cellular mobile connections being used for home broadband, either via a dedicated fixed wireless access (FWA) device or via smartphone tethering. For example, in the United Kingdom, year-over-year increases in mobile data consumption declined to 10% by 2024; however, when excluding the impact of dedicated FWA, growth declined to 5% by 2024 (figure 3).

Differentiation in the advent of 6G

If consumers struggle to perceive the benefits of 5G, then marketing some elements of 6G may be even harder. The general rule of thumb for every new mobile network generation is a 10-fold (or better) improvement in performance.15 This would include capacity, which may be needed in specific places at specific times (such as the largest music festivals or the busiest shopping seasons). It may also reduce the cost per gigabyte (GB) carried, as has been the case with 5G versus 4G.16 But it would also include factors such as higher speeds. The specification for 6G may be finalized in 2026, but there have already been tests of the technology that have demonstrated speeds of 100 gigabits per second (Gbps),17 which is about 20 times faster than 5G’s peak speed of about 5 Gbps (this is the total speed per cell, which would then be shared among users within it).

While 6G may offer higher peak speeds, demand may remain static. A typical high-definition video stream delivered to a smartphone often requires under 5 megabits per second (Mbps) per connection. Over the coming years this may well remain constant, or more likely, decline further, as compression and other factors reduce the average bit rate. If demand remains static, then the return on capital from an extensive network upgrade to 6G may be challenging, unless the primary intent of an upgrade is to reduce operational costs.

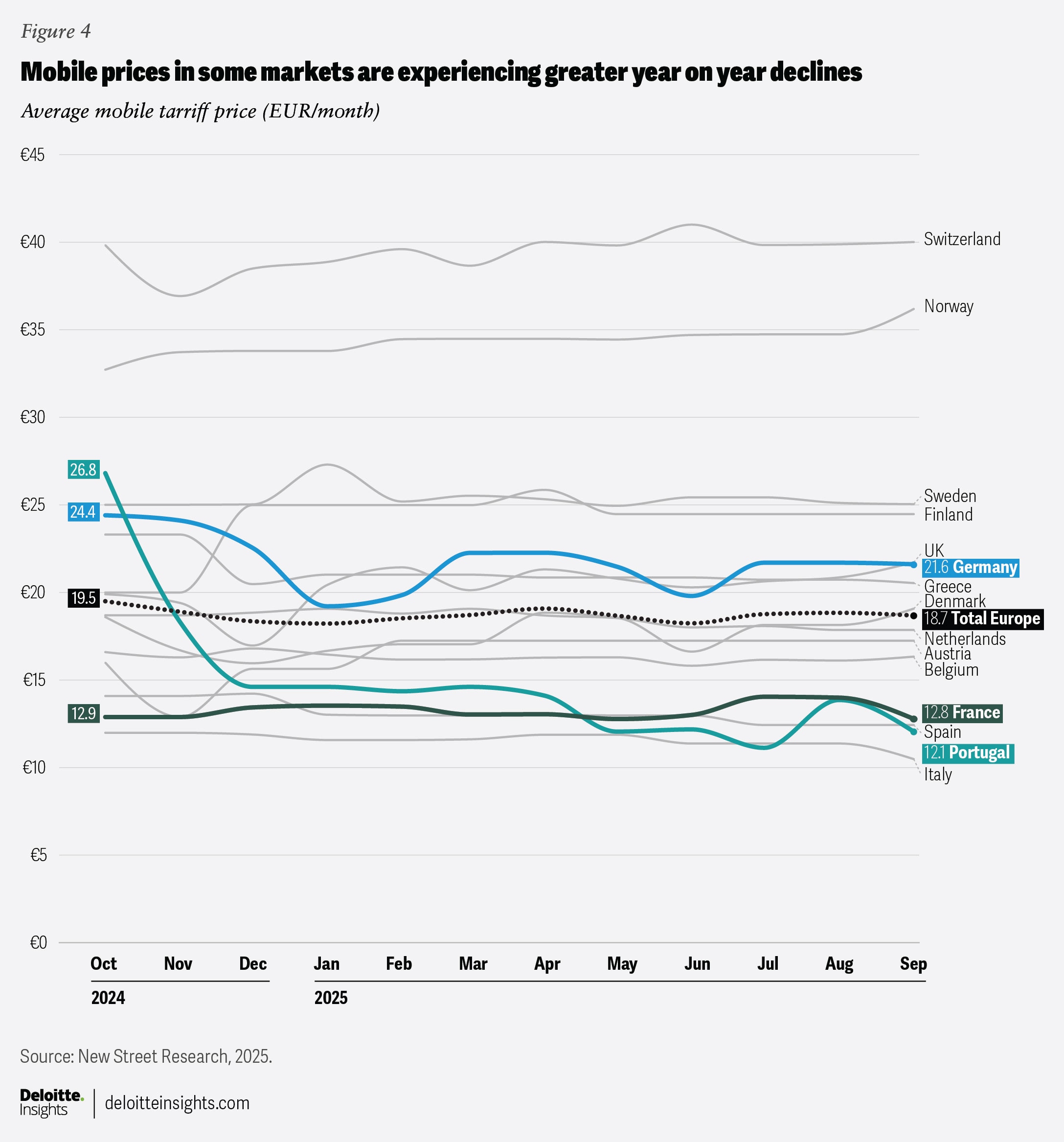

An additional reason for upping the focus on rewards may be to help lessen comparisons that are focused primarily on cost (also known in the industry as a tariff) per a given bundle; for example, 10 GB per month. Between 2024 and 2025, prices for mobile declined by up to 50% in some markets (figure 4).18 If a bundle also includes elements such as complimentary coffee and pizza, this may make like-for-like comparison less probable.

Bottom line: Loyalty rewards may be a promising path forward

Leaders at carriers should consider how their networks are going to be selected in the future and ask if this reflects a major variance to the past. And if so, they should adjust for it. Capital allocation should always matter, and the next decade might look very different for telecom companies. Right now, return on invested capital is 7.3%, but weighted average cost of capital is 6.9%.19 So telecom investment just about breaks even in economic terms. A slowdown in data usage across fixed and mobile may therefore be a blessing, allowing telecom companies to forgo significant spending on network upgrades for propositions that may deliver greater return on capital.

Telecom companies should note that many other industries have embraced rewards as a differentiator as their core offering has matured. The airline industry—which at one point in time regarded supersonic speeds as a value add—appears to have pivoted substantially to rewards as a sales tool. Airline loyalty schemes have been valued at more than US$100 billion, with just three airlines’ schemes being value at more than US$20 billion.20 In the United States, more than 90% of general credit card spending since 2019 has been on a reward credit card.21

As telecom companies invest in non-network benefits, they should market them judiciously. High-budget, above-the-line campaigns are already used by some telecom companies to showcase rewards across screen, print, radio, social media, and billboards. T-Mobile US has celebrated 1 billion total “thank-you” gifts claimed, which included food, movies, gas, and trips.22 Vodafone UK counted 175 million rewards via its VeryMe scheme.23 O2 UK claimed its customers saved £23 million in one year via its Priority scheme.24

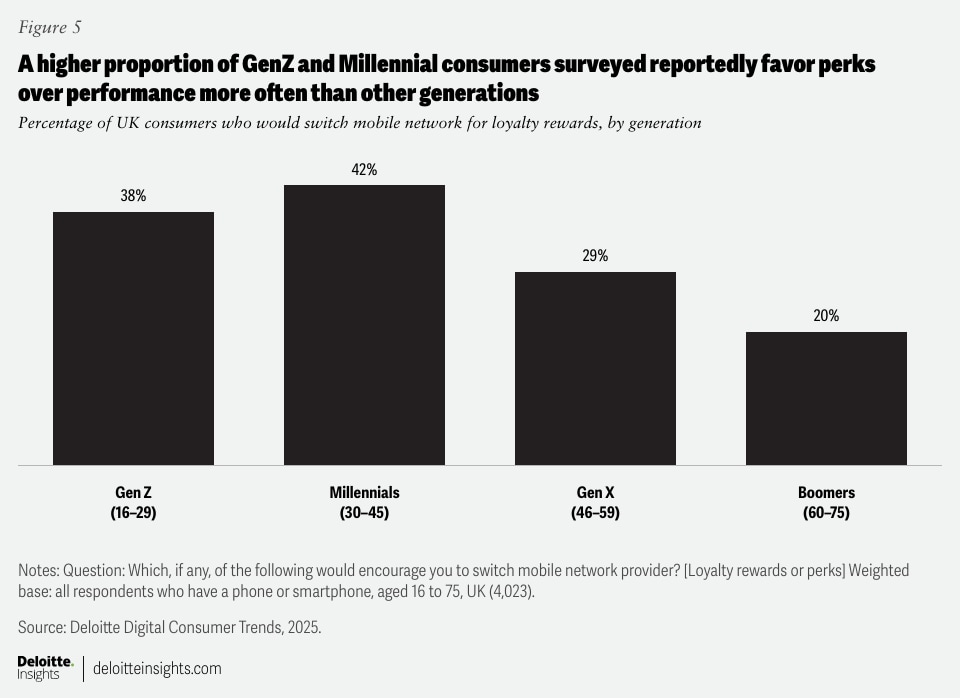

Operators should consider that Generation Z and millennial subscribers may be more amenable to the offer of perks versus network performance. A customer in their mid-20s may be unfamiliar with the sluggishness of 3G (the latest technology in the 2000s) and have mostly used 4G connections and perceived little difference from 5G. A customer in their 40s may have not had to try to browse on a 2G (the latest network in the 1990s) data connection. And so, some groups may be more likely to look for certain differentiators than others. According to Deloitte UK’s research, surveyed Gen Z and millennials have a higher propensity to switch networks based on loyalty rewards than older age groups (figure 5).

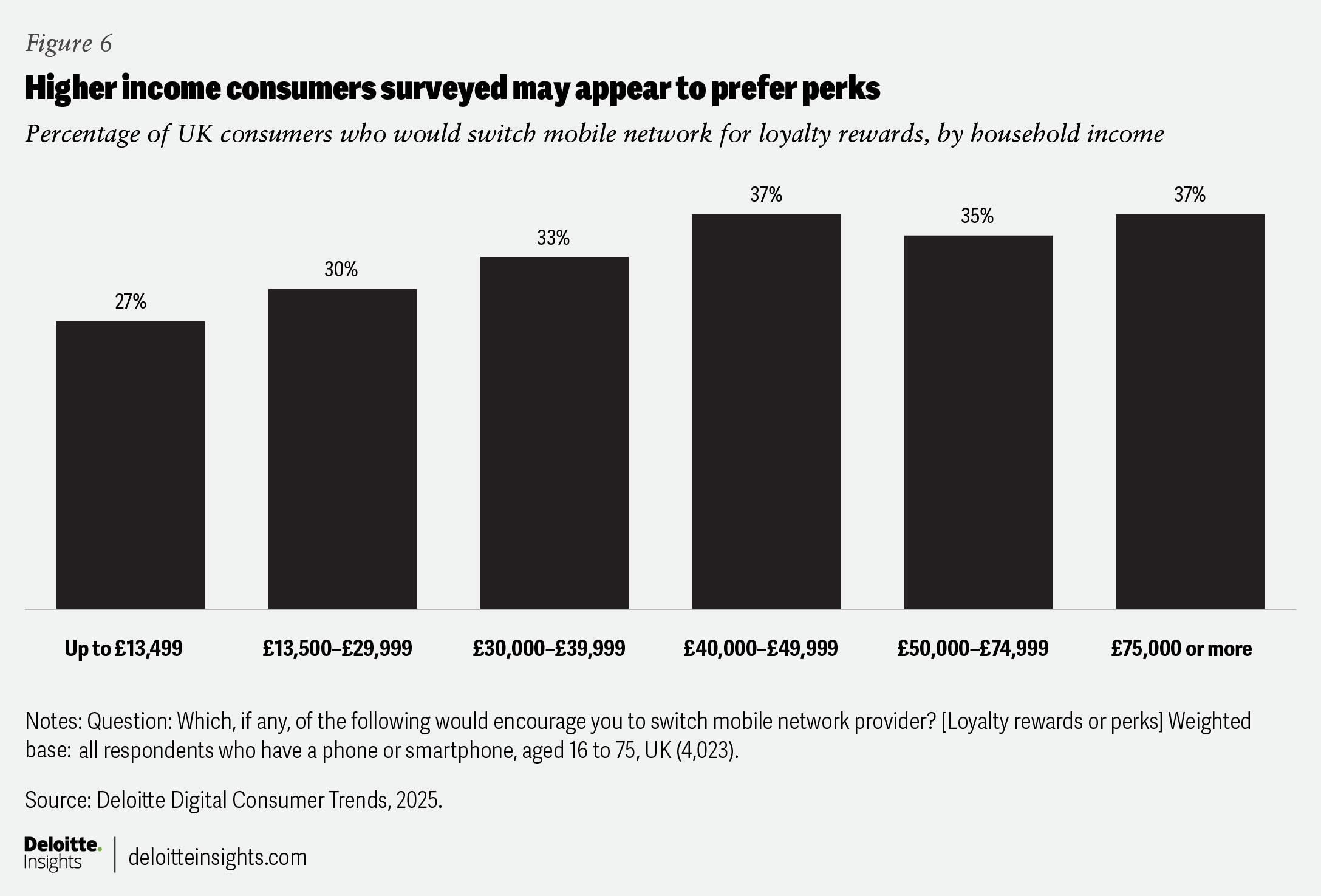

Operators should note that rewards may resonate more with higher-spend subscribers. Subscribers with higher incomes may be more inclined to switch for better offers than those on lower incomes (figure 6). The offer of a “freebie” can create a powerful, even slightly irrational, positive emotional response.25

If major telecom companies pursue similar strategies, one risk may be that rewards become commoditized, just like connectivity. Also, as alternate sectors like banking and utilities build their own schemes, the market can become further saturated.26 Consumers may have a ceiling for the number of free coffees they are willing to consume—and if multiple service providers are providing the same perk, the appeal may get diluted. So creating a unique, differentiated scheme will be important to help attract customers and reduce churn. This means live events, concerts, and sports games may become particularly attractive properties,27 but these perks can have limited reach, benefiting tens of thousands of customers among a base of tens of millions.