2026 Global Health Care Outlook

Health systems are prioritizing revenue, workforce challenges, and care model transformation as AI’s transformative potential remains on the horizon

Sara Siegel

Minni Särkkä-Hietala

Kavita Rekhraj

Filipe Piteira Ganhão

Despite ongoing challenges, health system leaders across Australia, Canada, Germany, the Netherlands, and the United Kingdom are generally optimistic about their organizations and the sector as a whole, according to Deloitte Global’s 2026 Health Care Outlook Survey. More than 80% of executives surveyed in those countries reported a “positive” or “cautiously positive” outlook for their own organizations, with 1% expressing a negative view. When asked about the health care industry overall, 72% said they were upbeat about the year ahead, again with 1% having a negative view.

By contrast, US health system leaders are notably more cautious, partly due to ongoing uncertainties regarding tariffs, drug pricing, and regulatory changes. The current environment may have contributed to 20% of US respondents expressing a negative industry outlook for 2026 and 33% feeling uncertain—a notable increase from the 3% who expressed uncertainty a year ago.

To capture leaders’ perspectives and plans, Deloitte Global, in collaboration with the Deloitte US Center for Health Solutions, conducted its annual global outlook survey of 180 C-suite executives from large health systems in August and September 2025. Survey respondents were based in Australia, Canada, Germany, the Netherlands, the United Kingdom, and the United States. These nations represent significant portions of the global economy and the health care sector; however, the insights primarily reflect the perspectives of developed health care markets. Anecdotally, developing markets may face similar priorities, though this was not quantitatively verified.

Health system leaders across all six countries agreed that their 2026 strategies will likely be strongly influenced by:

- Financial pressures and transforming care models

- Workforce and productivity challenges

- Cybersecurity risks

While generative artificial intelligence and agentic AI could support progress on these fronts, most health system executives do not expect a major strategic impact from AI in 2026. Currently, about 30% of surveyed health systems report operating gen AI at scale in select areas of their organizations—across both the United States and other surveyed countries—while just 2% have deployed AI across their entire enterprise. This limited use reflects the early stage of adoption, particularly on the clinical side.

Using automation and AI to boost revenue and transform care models

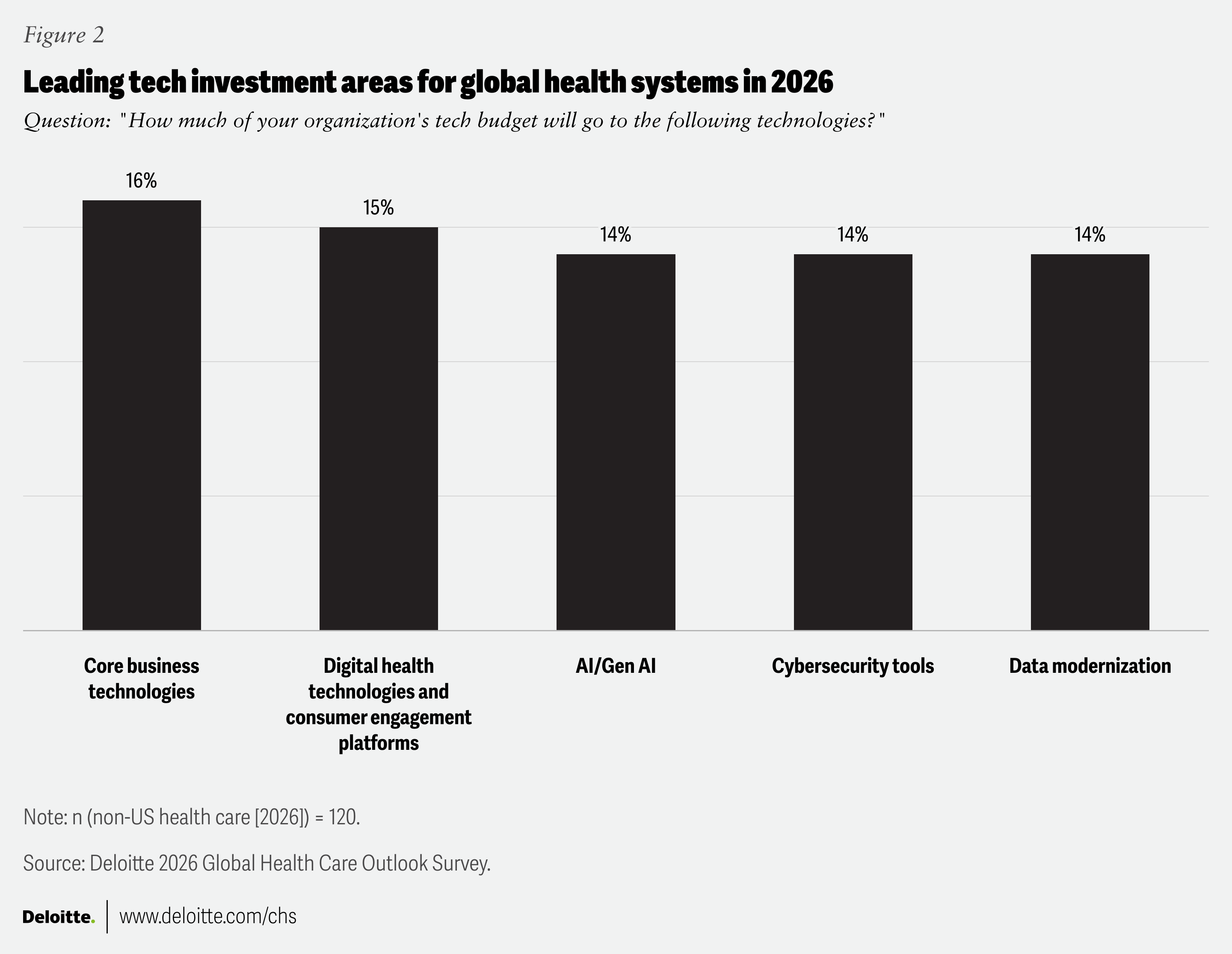

About 70% of non-US health system executives expect operating revenue and margins to increase next year, while over 50% predict that operating costs will be flat or decline slightly. Only 13% of respondents said they expect operating costs to increase “significantly” next year. To boost operating revenue, survey respondents said they intend to invest in core business technologies, expand the use of digital and AI tools and services, and improve workforce engagement and retention.

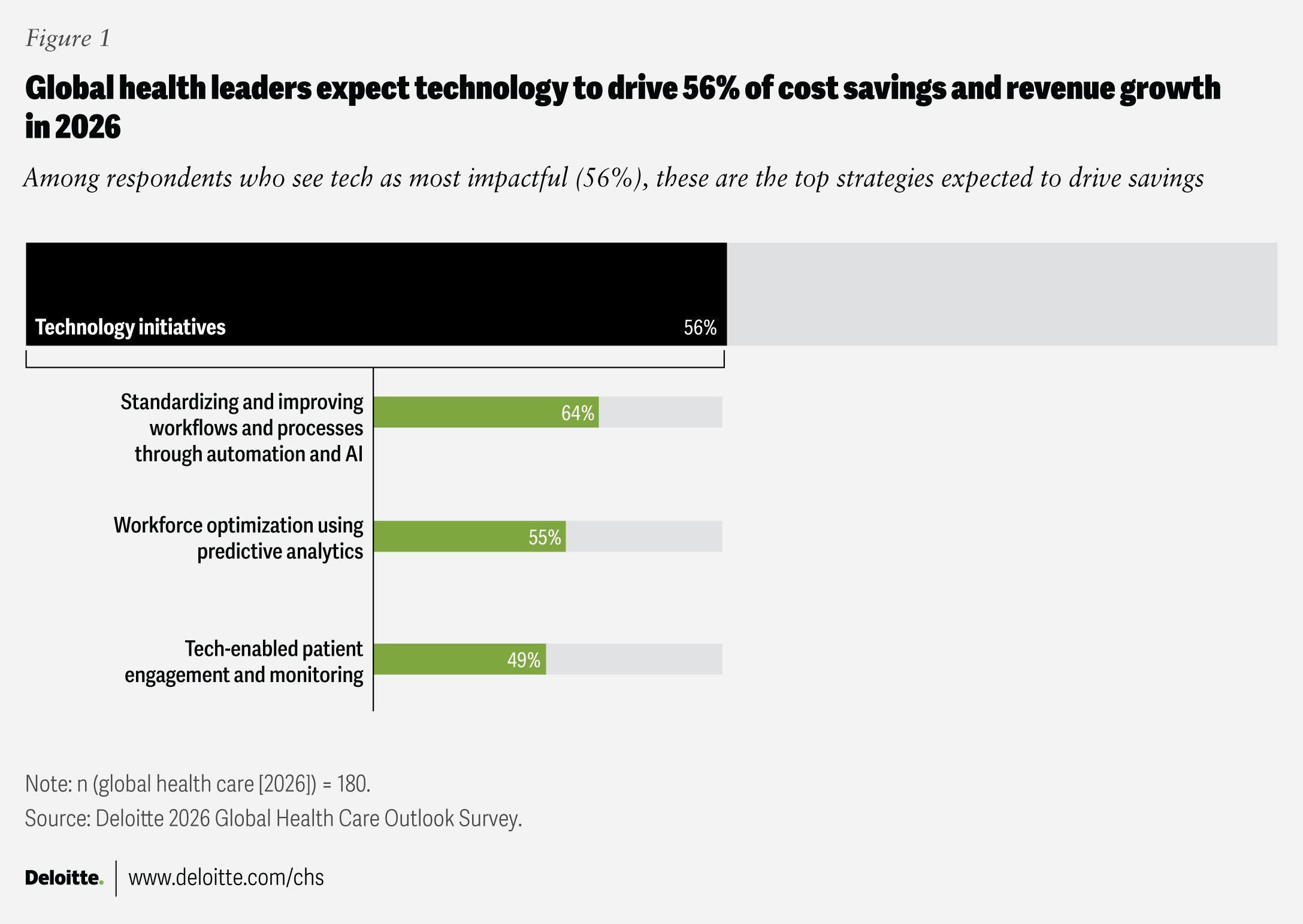

When asked where they expect savings to come from in 2026, 64% of respondents said AI could reduce costs by standardizing and automating workflows. More than half (55%) also see savings potential from the increased use of predictive analytics to optimize the workforce, while 49% expect benefits from tech-enabled patient engagement and remote monitoring. In addition, care model transformation is expected to contribute to revenue growth next year, particularly through expanding outpatient services, increasing digital offerings, and deploying AI agents to follow up with patients. AI can also be used for risk stratification by evaluating health risks based on genetics, environment, and lifestyle, which can lead to more proactive and targeted interventions.

An increased focus on preventive care was cited as a priority by many non-US executives. Nearly half of those respondents (45%) said care model transformation would be a leading trend in 2026, and 38% said their organizations would focus on preventive care and early detection in the year ahead. Specific interventions include regular health checks and disease screening, immunizations, and providing advice and guidance to encourage healthy living. By contrast, only 7% of US health system executives expect preventive care to be a major trend for their organizations in 2026. Most US health systems receive a substantial portion of their revenue through private insurance fee-for-service payments, whereas many health systems around the world are primarily government-funded. The fee-for-service model incentivizes volume over value, emphasizing treatment over prevention.1 In single-payer systems, financial incentives are generally aligned with keeping people healthy and minimizing costly interventions.2

Three strategies to reduce costs, boost revenue, and transform the care model

- Adopt a holistic approach to margin improvement: Health systems should focus collectively on various levers, including strategic growth, revenue improvement, cost reduction, efficient capital deployment, and supply chain management, rather than addressing each area separately.

- Foster a culture of clinical entrepreneurship: As health care organizations address long-standing challenges in care delivery and consumer experience, clinical entrepreneurship is emerging as a powerful catalyst for transformation. Clinicians, with their specialized insights, can help drive both innovation and meaningful change when supported by committed leadership, customized training, and sufficient funding.

- Embrace data-driven, whole-health care: Hospitals were designed to treat individual conditions rather than evaluate patients holistically. The whole-health approach is a key component of Deloitte’s vision for The Future of HealthTM. Outcomes-based whole health aims to improve or sustain an individual’s health, rather than just treating symptoms after they appear. Additionally, health systems should try to shift care to lower-cost settings such as neighborhood clinics, outpatient facilities, and at-home care via remote monitoring and virtual visits. This strategy could help reduce costs and free up hospital beds.

Re-architecting workforce issues to boost productivity and retain staff

Attracting and retaining clinical staff is a challenge for hospitals around the world as populations age and fewer professionals enter the workforce. The World Health Organization projects a shortage of 4.5 million nurses by 2030.3 In the United Kingdom, for example, 40% of general practitioners expect to leave the profession within the next five years.4 The loss of experienced clinicians could have profound implications for patient care, staff morale, and job satisfaction.5

It’s not surprising that health system executives cited workforce challenges as their top concern for 2026, and more than 90% said improving productivity would be a priority. In the year ahead, respondents said they intend to invest in workforce retention and engagement and rely more on AI and other tools to help improve productivity.

Three strategies to optimize and retain clinical and nonclinical workers

- Introduce greater flexibility: An improved employee experience that offers alternative work models, such as hybrid or online training options, could help attract people to the profession and give them an incentive to stay. Allowing clinicians to conduct virtual consultations from home, for example, could help retain valuable talent. Making it possible for nurses and doctors to manage work around family responsibilities might also help improve retention and reduce migration to other sectors where work-life balance might seem more accommodating.

- Consider offshoring: Offshoring IT and administrative tasks has become a common strategy for improving efficiency and relieving some pressure on in-house back-office staff. This often involves shifting services to other countries, with Eastern Europe being a popular choice due to its skilled IT workforce and significantly lower labor costs.6 However, offshoring might have some restrictions. The United Kingdom, for example, does not allow the offshoring of patient-level data.

- Train and upskill staff: According to the World Economic Forum, nearly 40% of today’s job skills may become outdated because of AI and automation.7 Health care workers should look for opportunities to improve their fluency in the use of AI and digital tools. This could help ensure they remain relevant in an increasingly digital health care environment.

Investing in cybersecurity to protect patient data and hospital operations

Health care organizations often handle highly sensitive protected health information, which is vital for patient safety. It is also a valuable target for cybercriminals. Cyberattacks targeting hospitals have become more frequent, sophisticated, and costly, with ransomware and supply chain attacks emerging as major threats to health systems around the world.8 Nearly half of non-US health executives (48%) cited cybersecurity and data privacy as a top concern for 2026. They expect that about 14% of their technology budgets will go toward cyber tools and enhanced cyber processes in 2026. That puts cyber investments on par with funds earmarked for gen AI and digital health or consumer engagement platforms, and well ahead of expected investments in cloud computing. Cybersecurity is expected to be slightly less of a priority for US health systems, where 35% of executives said it was a top concern and anticipate spending about 10% of their technology budgets on it.

Globally, cybercriminals are leveraging AI to help maximize financial gain and disruption, with ransomware attacks on hospitals and health systems increasing worldwide.9 When malware encrypts hospital systems and records, it can disrupt patient care. These disruptions not only increase the risk of medical errors and threaten patient safety but can also result in significant financial damage. Beyond the financial impact, such incidents can harm an organization’s reputation and erode the trust of patients and communities.

The growing threat of cyberattacks has prompted action in regions around the world. The European Commission’s EU Cybersecurity Reserve—a pool of cybersecurity specialists and services ready to respond to large-scale cyber incidents—is set to take effect in 2026.10 In Canada, the Centre for Cyber Security is strengthening health care defenses through training, security drills, and enhanced education.11 In the United States, the HIPAA Security Rule requires hospitals to implement comprehensive safeguards to protect patient data,12 but some states have introduced more rigorous regulations.13

Three strategies to enhance cybersecurity

- Identify and secure vulnerable areas: As more third-party vendors and Internet of Medical Things devices connect to health system networks, leaders must contend with an expanding attack surface. Health systems should focus on locations where personal health data resides—from electronic records to connected devices—and ensure information housed in legacy systems is protected.

- Build a cyber-aware workforce: Train staff to recognize and respond to threats as new digital platforms, AI tools, and connected devices are adopted. By embedding cybersecurity into daily operations and enforcing multi-factor authentication, organizations can help prevent breaches that can be caused by human error.

- Elevate cyber to the leadership level: Assign clear ownership of cybersecurity at the executive or board level, making it a strategic priority rather than solely an IT concern. Leaders who champion cyber resilience can help prevent crises that disrupt care and compromise patient trust.

AI will likely be important in 2026, even if it’s not a top priority for health system leaders

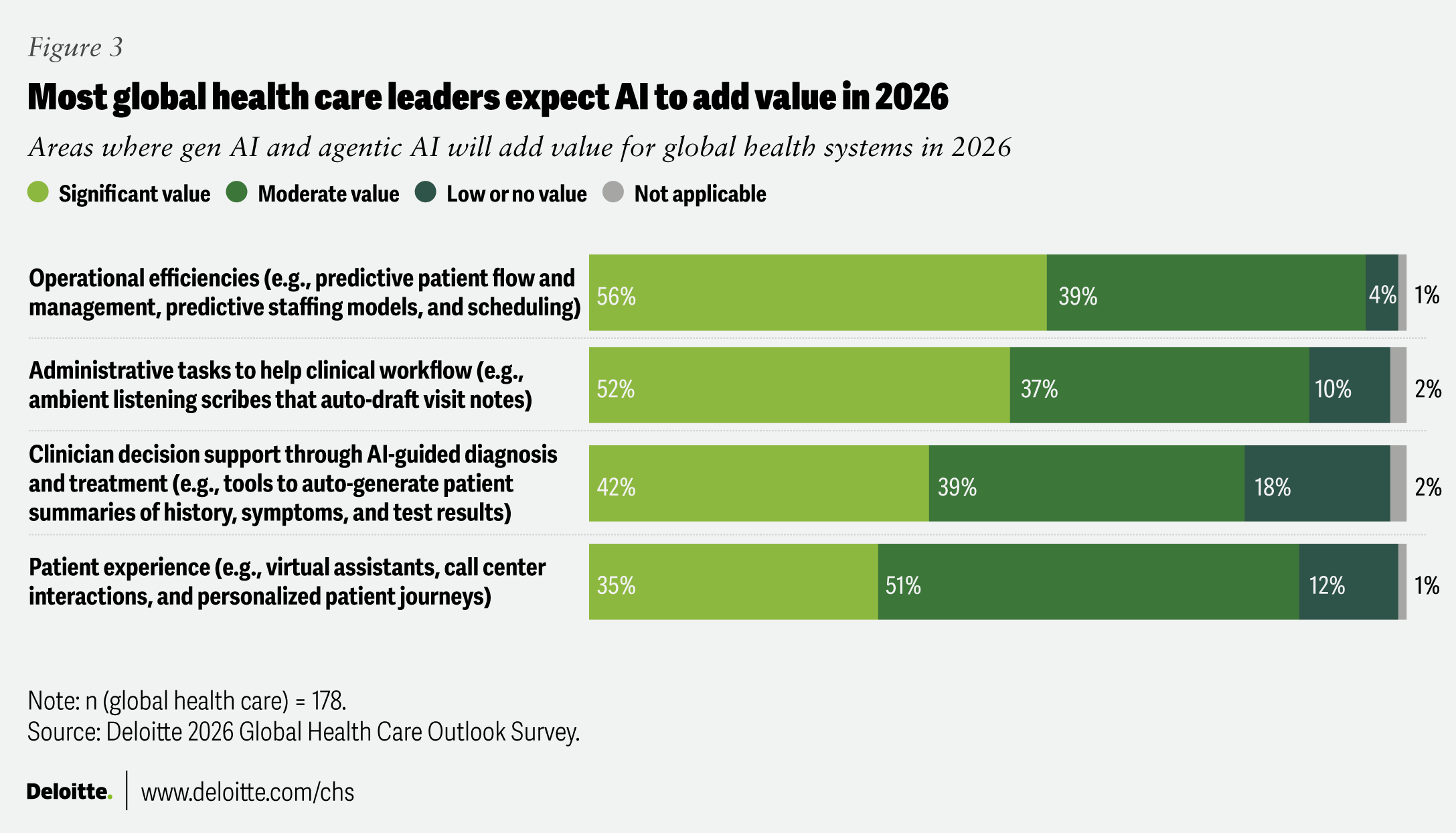

The transformative potential of gen AI and agentic AI is widely recognized among health system leaders. However, just 22% of non-US respondents said AI was likely to be a major focus at their facilities in 2026, compared with 37% of US health system executives. Still, there is broad agreement that AI technology could help improve operational efficiencies, streamline administrative tasks, and provide decision support to clinicians. Globally, the AI in health care market is projected to grow from $39 billion in 2025 to $504 billion by 2032. North America currently dominates in the use of AI in health care, accounting for 49% of the global market share in 2024.14

Regulatory uncertainty around the use of AI in health settings has likely delayed adoption in many regions. The EU AI Act, in effect since August 2024, requires nearly all AI-enabled medical devices, diagnostic algorithms, and decision-support tools to undergo mandatory risk management review.15 Canada’s proposed Artificial Intelligence and Data Act, introduced in 2022, failed to progress in Parliament in early 2025. In the absence of an AI-specific law, provinces and their health systems continue to rely on existing privacy laws to guide AI use. Australia has not yet implemented statutes governing the use of AI but is developing a framework and mandatory guardrails for high-risk applications.16

In addition to some regulatory uncertainty, health systems are under increasing pressure to demonstrate a clear return on investment for their AI initiatives. Slightly more than half of respondents (51%) said they either haven’t measured returns or determined that it is too soon to see results. However, 31% of respondents reported “moderate” financial returns and 3% said the ROI has been “significant.” In the year ahead, surveyed executives expect gen AI and agentic AI to account for 19% of their technology budgets.

Three strategies to maximize value from AI while navigating evolving oversight

- Develop an enterprisewide AI strategy: Establish a clear strategy for AI adoption by defining key challenges and desired outcomes, and by assigning ownership for each use case. This foundation should align with governance structures to ensure that priorities are aligned across clinical, business, and back-office functions.

- Train staff and address their concerns: Some administrative staff might resist AI if they think the technology could threaten their jobs. Help staff understand how AI could help them become more efficient without increasing their workload or taking over their duties. Integrate clinicians and staff into workflow design to encourage adoption as AI automates routine tasks.

- Avoid the pilot trap: Many organizations pursue pilots or proofs of concept but stumble when trying to scale. If a health system has a strong business need, starting with a phase 1 approach might be more effective than launching a pilot. Develop the infrastructure and technical environments required for scaling from the outset.

Health systems are looking to align AI innovation, compliance, and workforce strategies in 2026

As health systems around the world prepare for 2026, executives appear cautiously optimistic, focusing on growth and transformation even as they face persistent challenges with margins, workforce shortages, cybersecurity threats, and regulatory uncertainty. At the same time, care is increasingly shifting from hospitals to the home and community through virtual care, and remote monitoring. Care is also moving from reactive to proactive and preventive. The challenge for health systems is not simply to adopt new technologies, but to align them with sustainable business models, empowered workforces, and whole-health outcomes that deliver lasting value for patients.