2026 global insurance outlook

Changing customer expectations, broker consolidation, and the importance of modernization could reshape the insurance landscape

What happens when the hard market ends—but the pressure doesn’t?

Is life insurance growth losing steam—or just shifting shape?

What will set group insurers apart in a slowing market?

Can insurers scale artificial intelligence without fixing the foundations first?

What will it take to build an insurance workforce that thrives with AI?

What happens when policyholders expect more than a payout?

Are insurers ready to navigate the tax shake-up under the One Big Beautiful Bill Act?

Heading into 2026, there is little doubt insurers are entering an era of considerable uncertainty—from economic and geopolitical volatility to the increasing frequency and severity of catastrophic events. At the same time, clearly defined boundaries are blurring, distributors are consolidating and refashioning, and the technology landscape continues to alter business models. Layered onto this are rapidly evolving customer expectations, redefining what value, convenience, and trust mean in the context of insurance.

It seems clear to most stakeholders that business as usual for insurers may not suffice going forward. A new reality is unfolding, and carriers may need to rethink how they operate, engage, and grow to be ready to take it on.

The emphasis on technology modernization has shifted to executing real AI use cases at scale, strengthening data foundations, and aligning architecture and security to support these ambitions. However, embedding digital tools and capabilities effectively requires insurers to enable their workforce to thrive in increasingly digital, data-rich environments.

The accelerated pace and breadth of complexity and uncertainty don’t appear to be a passing phase. Insurers that understand this and act decisively to reconsider their current business models, products, tools, and stakeholder interactions could be well positioned in the market.

P&C insurers turn to advanced technology, agile capital models, and alternative revenue streams

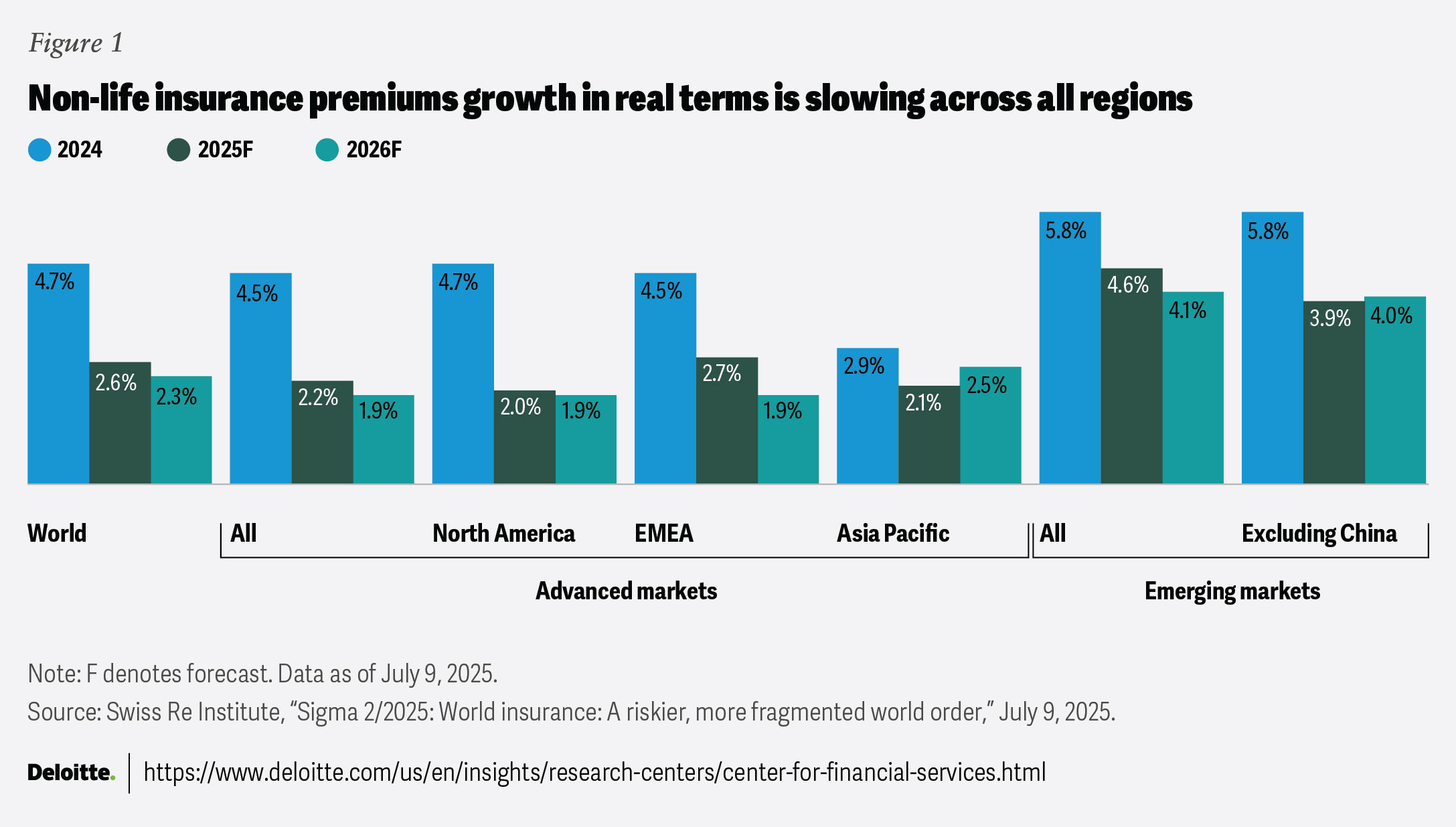

The property and casualty (P&C) insurance segment seems to be moving beyond a prolonged hard cycle into a period of margin pressure and slower premium growth (figure 1). Globally, premium growth is expected to decline through 2026, driven largely by heightened competition, diminishing rate momentum, and emerging cost pressures such as potential tariffs and reserve adjustments.1 Emerging markets are also expected to experience a dip in 2025 and 2026 from an economic slowdown in China, which accounts for half of all emerging market premiums.2

Advanced markets in Europe, including France, Germany, and the United Kingdom, are expected to see strong growth in return on equity, up from 9.1% in 2024 to 11.6% in 2025, due to reduced cost pressures.3

Table of contents

- P&C insurers eye tech, agile capital, and alternative revenues

- L&A carriers ally strategically to fight slow growth

- Group insurers target unique offerings and digital engagement

- AI success: quality data, modernization, and security

- Human-AI: key to digital transformation

- Improve CX with partners, the right channel, and empathy

- OBBBA: tax advantages and uncertainties

- The time is now to walk the talk

Margins are likely to deteriorate in both personal and commercial lines due to ongoing trade policy uncertainty, persistent supply chain disruptions, and labor shortages—factors that are likely to drive up goods prices and wage inflation. In the United States, underwriting performance was the strongest in over a decade in 2024;4 however, the combined ratio is expected to worsen from 97.2% in 2024 to 98.5% and 99% in 2025 and 2026, respectively.5

Tariffs cause ripple effects on insurance lines

Auto and homeowners insurance providers face rising claims costs due to the increased price of imported repair parts and construction materials like lumber, ultimately pushing up premiums and eroding underwriting margins.6

Businesses can either absorb higher import costs or pass them on to customers, squeezing margins and increasing the likelihood of invoice payment delays or nonpayment, especially in export‑oriented sectors.

Demand for trade credit insurance is rising sharply as firms look to protect cash flow, yet insurers face capacity constraints due to weakening buyer credit strength and increased claims exposure.7

Tariffs are also expected to indirectly drive claims costs and risk complexity in commercial insurance portfolios. Marine and aviation insurers, especially those underwriting cargo and logistics exposures, must navigate the growing risks tied to rerouted shipping lanes, port congestion, and geopolitical volatility.8

Investment yields in the United States are expected to rise slightly, from 3.9% in 2024 to 4% and 4.2% in 2025 and 2026, respectively.9 However, if the Federal Reserve continues to reduce interest rates, following its first 25-basis-point cut in September 2025,10 the differential between existing portfolio yields and new-money rates will narrow, slowing further gains in investment income.

P&C insurers are also expected to face headwinds from several forces beyond economic and market movements.

Weather-related losses, a globally pervasive challenge, continue to affect both personal and commercial lines. From floods in Germany11 to wildfires in the United States,12 Canada,13 and Australia,14 the frequency and severity of natural catastrophes continue to escalate. Consequently, these events are making it more expensive for primary firms to transfer their risk. Tightening reinsurance terms and increased risk retention are driving up loss ratios, adding to a US$183 billion global protection gap.15

Moreover, legal risks are rising globally, with third-party litigation funding expanding beyond the United States to the United Kingdom, Australia, Canada, and parts of Asia.16 Social inflation—driven by expanded definitions of liability, rising jury awards, and legal activism—is pushing up claims severity in casualty and liability lines. Some jurisdictions are responding with tort reforms and transparency mandates to alleviate pressure on insurers.17

Carriers are also grappling with structural pressures. Broker consolidation is pressuring carrier negotiating power,18 large corporates are increasingly self-insuring through captives,19 and alternative risk players are entering the market.20 To stay competitive, carriers will likely need more agile capital models that integrate retained risk with third-party reinsurance to manage volatility, while also leveraging collaborative financing vehicles like cat bonds, sidecars, and other insurance-linked securities.21 These structures enable insurers to transfer a portion of risk to capital markets, which can enhance capital flexibility, broaden their capital base, and strengthen resilience against large-scale losses.

There are also emerging tailwinds P&C insurers can take advantage of.

Advancements from generative AI to geospatial analytics, such as drones for roof inspections, satellite imagery for catastrophe triage, and Internet of Things sensors for real-time monitoring, are enabling insurers to predict and minimize losses across business lines.22 Regulators are supportive, as insurers are emphasizing data-driven and science-based approaches to improve risk awareness.23 Globally, insurers and government bodies are also taking a more proactive approach to managing risks.24

Moreover, as the potential to provide alternative services matures and expands, monetizing these offerings can represent a growing proportion of insurer revenues, as Deloitte research projects that fee-based revenue is estimated to grow to US$49.5 billion by 2030.25

Many L&A carriers secure strategic alliances to fight slowing growth

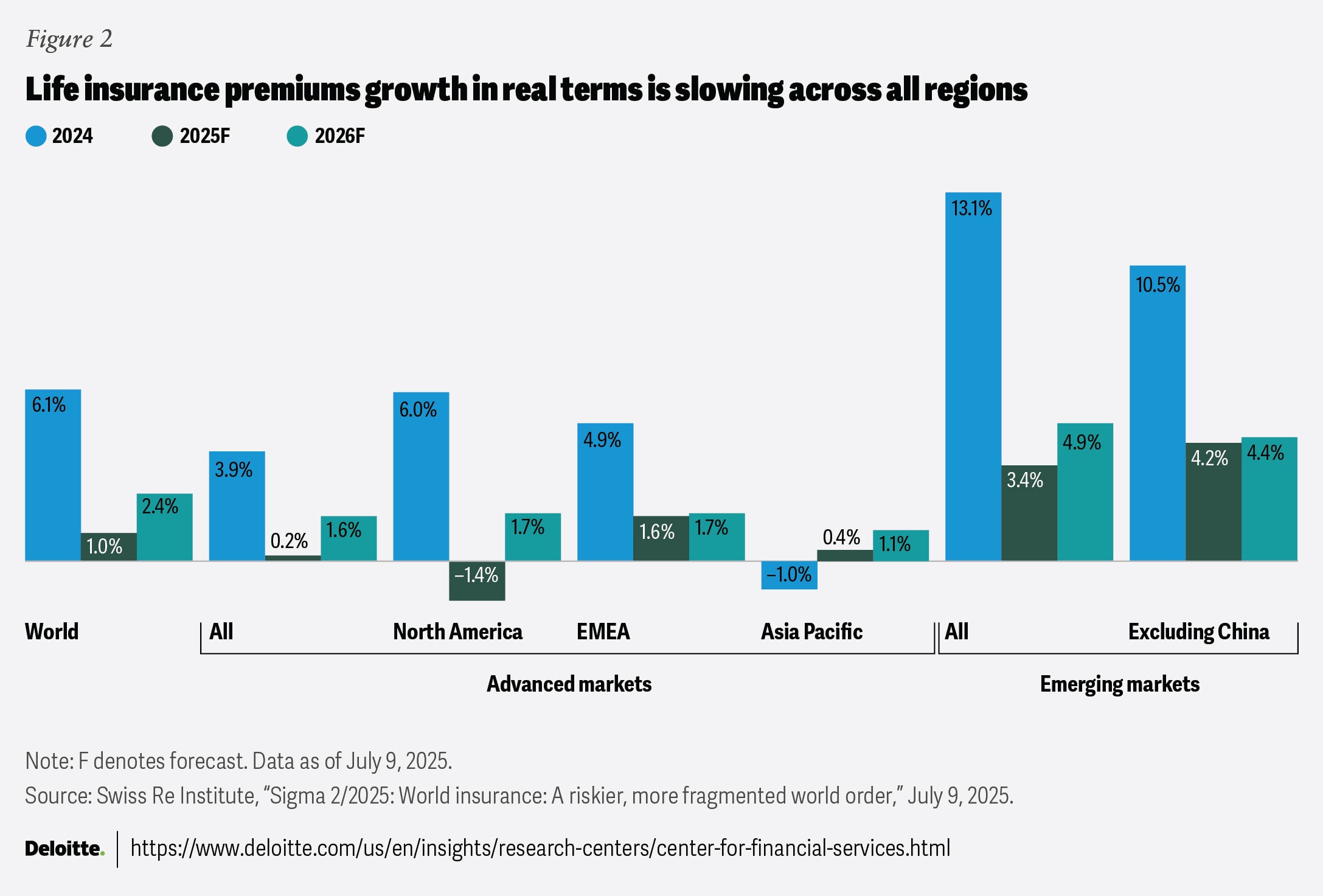

Global life insurance growth is forecast to decline, as US policy uncertainty may fuel caution among consumers,26 causing them to delay or reduce their life insurance coverage. Growth in advanced markets is expected to be more muted than in emerging markets, where insurers continue to benefit from low levels of penetration amid expanding middle markets (figure 2).27

While life premium growth is expected to slow, annuities continue to gain momentum. Sales in the United States grew by 12% in 2024, reaching US$432.4 billion, with quarterly totals holding above US$100 billion for seven straight quarters through 2Q2025.28 As monetary policy loosens, fixed-rate annuity sales are expected to slow, and the focus will likely shift to indexed annuities.29 In Europe, unit-linked sales are surging, particularly in Italy and France, and are expected to broaden to other advanced markets like the United States.30

Carriers’ convergence with private equity continues to alter the L&A landscape

Carriers’ investments in private credit are expanding worldwide despite increasing concerns about a lack of liquidity and minimal regulatory oversight.31 Insurers’ managed assets expanded by 25% to US$4.5 trillion in 2024, with private placements now accounting for 21.1% of total insurance assets under management, up from 20% at the end of 2023.32

A Goldman Sachs survey in March 2025 indicated that 61% of chief financial officers and chief investment officers surveyed globally expect private credit to provide the highest total return over the next year.33 This expectation means 64% of respondents in the Americas and 69% in the Asia-Pacific region plan to increase their allocations to private credit over the next 12 months.34

As carriers allocate a growing share of their portfolios to alternative asset classes, they may increasingly converge with alternative asset managers to leverage private equity (PE) investment expertise. Industry convergence is showing up in various arrangements, from outright PE acquisitions of life and annuity entities to collaborative partnerships and minority stake investments.

Several large investment firms like Apollo35 and Brookfield36 continue to be drawn to life insurers for new sources of capital they can invest.

In June 2025, Lincoln Financial and Bain Capital formed a partnership to help the insurer accelerate its portfolio transformation and capital allocation priorities while leveraging the asset managers’ platform across asset classes.37 Also in pursuit of more advanced investment expertise, on April 8, 2025, Guardian Life and Janus Henderson announced a strategic partnership under which Janus Henderson will become Guardian’s investment-grade public fixed-income asset manager.38

To further boost capital efficiency, several life insurers are turning to reinsurance sidecars to move blocks of business to offshore locations that have fewer demands for capital reserves to offload policy liabilities.39 These vehicles allow outside investors to share in profits and risks, freeing up capital for insurers to underwrite new business.

Reserves ceded to sidecars nearly tripled between 2021 and 2023 (latest available data), reaching nearly US$55 billion.40 Three additional sidecars were announced and launched in 2024. One of the most notable was Allianz SE backed by Voya Financial and Antares Capital.41

These alternative investments are typically less liquid and transparent than public corporate bonds and loans, which can lead to insurance regulators working actively to address this opacity.

The National Association of Insurance Commissioners, for example, is developing guiding principles to update risk-based capital formulas to help enhance the precision and transparency of risk-based capital calculations related to asset risk.42

Increased scrutiny is also arising in other jurisdictions.43 For example, the Bermuda Monetary Authority issued a paper in December 2023 regarding the supervision and regulation of PE insurers, and the International Monetary Fund issued a white paper on PE investments in the life insurance industry.44 As the regulatory scrutiny of PE investments in insurance companies grows, investors should not only focus on the current regulatory landscape but also anticipate how it may evolve going forward.

Another outcome of the convergence between private equity and the insurance industry is that the private equity companies are beginning to model life insurance as a tax-efficient wealth management tool.45

Alliances and partnerships may also broaden opportunities to fuel revenue

Carriers could form networks of partners to provide fee-based services that can complement or expand their traditional product and service portfolios. For example, they can develop partnerships with home care and other wellness providers. In 2024, Genworth diversified its revenue stream through a partnership with a homecare startup to build a network of services to redefine and simplify the way older adults can navigate housing, services, and care.46

Moreover, third-party administrators, traditionally used by life insurers for cost reduction, are evolving into strategic partners that can help support broader business agility and growth initiatives. Third-party administrators are often capable of introducing new products and channels and leveraging advanced technologies to support insurers in reaching broader markets. This new model positions third-party administrators as an integral extension of a carrier, capable of providing support for strategic product launches and ongoing administration.

In developing countries, where the protection gaps are often widest, building alliances could help increase life insurance sales, making it more accessible, affordable, and relevant. For example, in underserved regions with high mobile phone penetration, such as sub-Saharan Africa and South Asia, mobile technology can potentially support life insurance companies to partner with telecommunication operators to offer micro life insurance products.47

Distribution consolidation pushes strategy change

Over the past few years, much of the growth in independent distribution, which accounts for more than half of retail life insurance sales and a substantial amount of annuity business, has been through mergers and acquisitions.48 This consolidation is now complicating traditional distribution strategies for insurers.49

For one, it could increase intermediary bargaining power in contract negotiations, potentially affecting premiums and commissions. It also blurs the lines between what were once distinct market sectors—such as brokerage general agents, marketing organizations, producer groups, and financial planning firms—and is changing the way carriers work with each of them.50

As the distribution transformation continues, carriers will likely try to stand out through differentiated strategies such as offering proprietary products exclusive to firms within each group, addressing bottlenecks in sales and services, and more effectively utilizing customer data to personalize products to clients’ needs.51

Unique offerings and digital engagement can boost group insurance

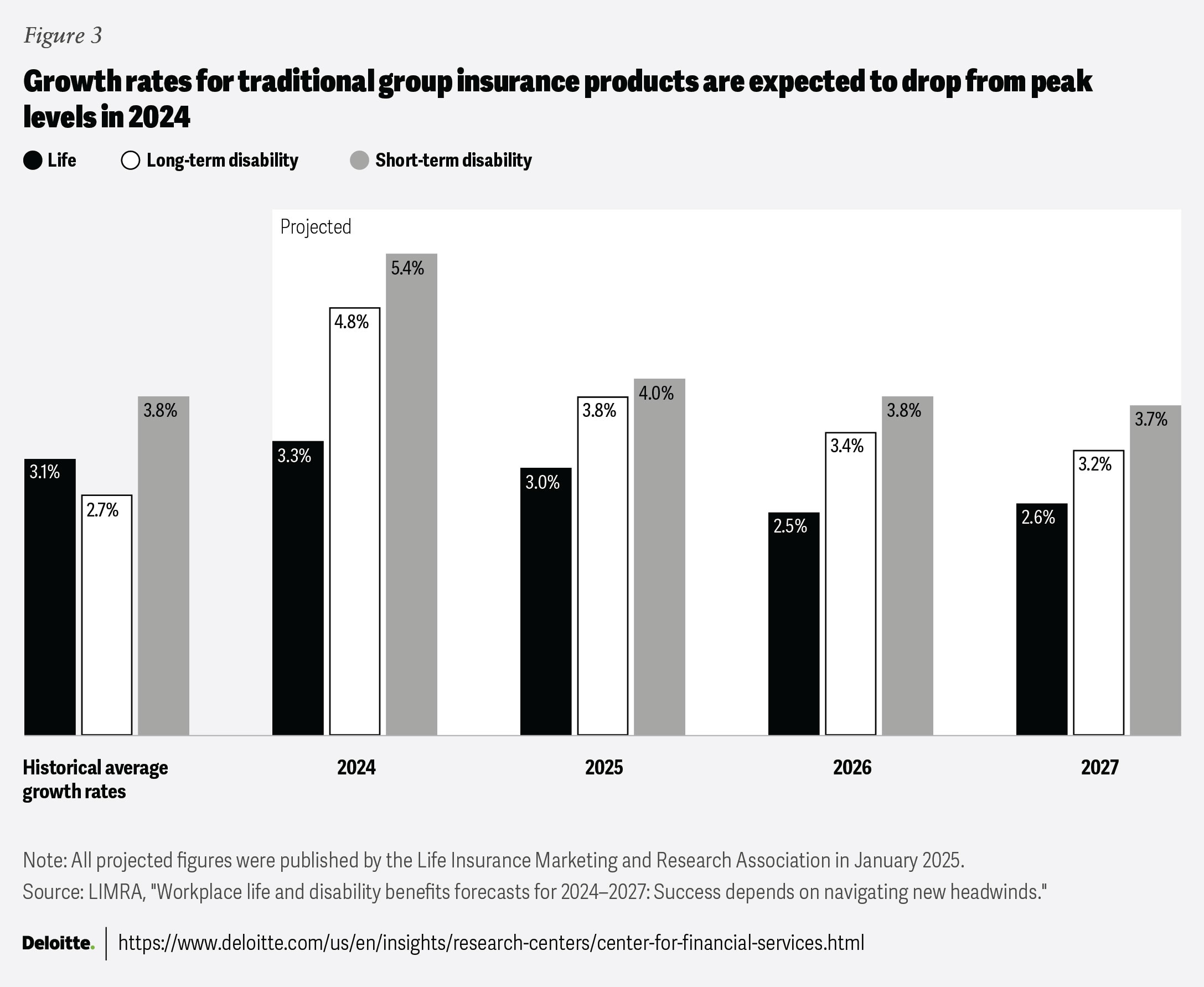

After peaking in 2024, group insurance segment growth is expected to slow over the next few years (figure 3).52

Several factors influencing the segment’s growth include employment and wage trends, which are expected to tighten,53 as well as rising health care costs54 that could begin to pressure participation in traditional employee benefit programs.

Despite these external challenges, growth opportunities exist in the sector, driven by increasing demand for more ancillary employee benefits. Many insurers are positioning themselves to capitalize on this trend by offering innovative products tailored to specific industries, demographics, or other segments such as small businesses and gig workers.

In fact, the workforce now comprises five generations, making it important for carriers to offer products that cater to various employee needs. By expanding their product portfolios to include more tailored solutions like wellness products and services, elder care, in-office daycare options, and even support for adoptions, insurers can attract a broader customer base and enhance their value proposition to both employers and brokers. Moreover, in response to increasing demand for lifetime income options due to the decline of traditional pension plans, a growing number of group insurers are offering in-plan annuities.55

Insurers can likely use innovative product expansion to differentiate and elevate their value to intermediaries to improve market penetration. Independent brokers currently generate 83% of business in the workplace benefits industry, but their role seems to be evolving from salespeople to consultants as the benefits landscape grows ever more complex.56 In addition to their traditional role of helping employers select benefit products and carriers, they can increasingly select digital technologies that increase value and ease for stakeholders.

To further stand out to intermediaries, group insurers can go beyond holistic and targeted offerings and prioritize seamless digital connectivity and technology solutions that can be easily integrated into employer platforms. In fact, a recent survey by the Life Insurance Marketing and Research Association found that 40% of employers were willing to change insurers if their carrier was unable to connect products to their benefits technology platform.57

Digital capabilities and integration tools like application programming interfaces (APIs) are driving some insurers to retire or update legacy technology that may affect their ability to provide modern experiences.58 A forward-thinking API strategy could help group insurers deliver personalized experiences and improve operational efficiency, potentially attracting a broader range of brokers and the employers they represent.

Developing a strategy for employee leave management may be another point of differentiation for group insurers, particularly for entities that operate in multiple states or with remote workforces. The varying dynamics, culture, and regulations across regions can make this expertise highly valuable to brokers when evaluating group insurance carriers, particularly regarding the Family and Medical Leave Act and the Americans with Disabilities Act Amendments Act, which can become costly if managed poorly.59

As in the P&C and individual L&A segments, the evolving and consolidating distribution landscape is putting increasing pressure on agent commissions and profit-sharing agreements with carriers. Sixty percent of carriers said they are concerned about cost stacking, as an increasing number of group insurance market participants seek a share of compensation.60

AI success largely depends on data quality, system modernization, and robust security

While AI pilots filled last year’s headlines, many insurers have now accelerated their AI agendas. Despite a varied pace of adoption and implementation, most insurance leaders are now focused on practical AI use cases, with clear return on investment and manageable risk.

Fraud detection is one such area. For example, Zurich deployed AI technologies to spot claims fraud, including the use of machine learning to detect anomalies in filed claims.61 Deloitte estimates that by deploying AI-driven, real-time fraud analytics, P&C insurers could save up to US$160 billion by 2032.62

Agentic AI is another area of emphasis. AIG launched a gen AI-powered underwriting assistant with Anthropic and Palantir, which ingests and prioritizes every new excess and surplus submission, allowing review of additional policies without adding new staff.63 In Europe, some insurers like Allianz and AXA are working to unlock agentic capabilities in areas like claims,64 however many remain cautious on experimental AI projects, doubling down on data modernization and cloud migration.65

Many insurers are also investing in AI for customer engagement, including call centers and virtual assistants. In Asia, a number of leading carriers have already gone live with gen AI-driven customer service bots and claims triage systems for “safe” use cases not under strict regulatory scrutiny.66

In several Asian markets like Singapore and Hong Kong, regulators seem to be encouraging AI experimentation through grants, sandboxes, and acceleration programs. Singapore’s Monetary Authority launched funding initiatives to promote AI adoption,67 while Hong Kong’s Insurance Authority introduced programs to support AI pilots.68

Brazil’s Open Insurance framework lets customers share data across insurers, enabling personalized offerings and increased competition.69 This environment helps create new distribution channels and fosters collaboration with insurtechs, driving insurers to develop more API-based integrations for connecting with a wider range of potential digital partners. A supportive regulatory environment can help insurers overcome legacy constraints and experiment with modern technology solutions.

Fix the plumbing for the shiny new technology to work

The insurance industry is buzzing with AI activity, but realizing its value remains a work in progress, as many insurers struggle with fragmented, messy data sprawl and outdated systems. To truly “industrialize” AI in insurance and embed it into the very DNA of business processes, insurers should incorporate foundational data readiness and robust technology architecture.

Perfect data hygiene may not be essential for every AI project; however, proper standardization and control can be critical to avoid conflicting results and maintain trust. Insurers should prioritize data quality, integration, and master data management for a unified customer view and real-time data processing.

Alongside data strategies, legacy system modernization continues to be a top focus area for insurers, with many pursuing multi-year cloud-based transformations. Some executives, increasingly hesitant to commit to massive multi-year system replacements, are pondering whether AI-driven models might soon render those very systems obsolete.70 This mindset reflects a shift in insurers’ tech strategy, where executives try to strike a balance between current needs and future AI-driven models.

As enterprise architecture decisions grow more complex, insurers should carefully select technology partners and solutions, including those offering integrated AI services. Success may largely depend on creating adaptable architectures that align with business goals and keeping pace with industry evolution.

Architecture choices are not limited to software systems, but hardware too. Notably, some life insurers are tapping the high-performance computing of graphics processing units for complex actuarial modeling. Insurers are discovering that the same NVIDIA graphics processing unit chips powering AI can also massively parallelize actuarial calculations.71 Interestingly, this push often comes from the actuaries themselves, catching information technology executives off guard.72

Balancing innovation with cyber risk and trust

Ironically, the same drivers energizing the industry, including cloud infrastructure, API connectivity, IoT devices, and AI, also widen the attack surface.

High-profile breaches and ransomware attacks continue to make headlines, underscoring that trust is as important as tech in insurance. Recent incidents involving compromised customer information and resulting legal actions highlight the real-world consequences of lapses.73 Most insurers are acutely aware of the importance of their role as data stewards, not only for regulatory compliance but also for maintaining confidence.

As insurers operate in an increasingly global and interconnected world, they should focus on reinforcing trust by protecting data and vetting third-party providers. Building resilient cyber defenses and fostering a culture of security can be essential to safeguarding customer information and industry reputation.

Adopting AI is not enough; human-AI collaboration could be key to successful digital transformation

In today’s evolving environment, success may not hinge solely on the speed of AI adoption but on how effectively insurers embed digital tools into the workflow and transform workforce capabilities to cultivate a sustained human advantage.

This requires more than automating tasks. It typically demands a strategic re-evaluation of the workforce, grounded in a modern, purpose-driven employee value proposition.74 Upskilling is not enough. Instead, insurers should ask: “How do we design work experiences where humans and AI collaborate more meaningfully? And how do we share the value created through this collaboration?”

To answer these questions, it is important for insurers to preserve legacy knowledge, recruit next-generation talent, reskill the mid-career workforce, and embrace the evolving role of innovation hubs. This transformation will typically require insurers to rethink not only how work gets done but also who does the work, how it is enabled, and how to prepare for what comes next.75

Technology meets talent friction

Modernizing the insurance workforce generally requires updating skills and structuring. Veteran employees are steadily leaving the workforce, and recruiting is not keeping pace with these exits.76 Insurers globally struggle to attract and retain talent.77 For example, in Japan, once-stable university-to-career pipelines are now experiencing record rejection rates for insurance job offers.78

Even when new talent is recruited, many are not familiar with the evolving demands of insurance roles. While the industry is becoming more digital and customer-centric, it still requires deep technical knowledge and a strong grasp of complex regulatory frameworks.79

This is particularly the case when new graduates enter the workforce with advanced degrees in AI, machine learning, and programming languages,80 seeking to contribute to transformative initiatives. However, as many insurers are still limited to pilot programs or proofs of concept, they may divert this talent to traditional workstreams, resulting in early disengagement.81

Perhaps the most complex challenge lies with the mid-career professionals, many of whom are deeply embedded in legacy systems82 and will now need to become AI-literate.83

Unlike developers and data scientists, business users may not need to understand the technical workings behind gen AI, but insurers must equip them to effectively use these tools, interpret AI-generated insights, and apply them to real-world decision-making.84

From skill gaps to strategic workforce models

According to Deloitte’s Human Capital research, while 90% of insurance executives surveyed agree on the urgency of reinventing the employee value proposition to reflect human-machine collaboration, only 25% of respondents have taken tangible action to elevate human skills.85 Closing this gap will likely require new models of workforce strategy.86

In today’s fast-paced, budget-constrained environment, no organization can afford to develop every skill internally. Insurers should consider adopting a broad, agile framework. This often means making bold choices like building new skills through experiential projects, hiring specialized talent like behavioral scientists, borrowing capabilities through partnerships and gig networks, automating repetitive tasks to free up human capacity, and redesigning workflows to better integrate human talent with AI.87

By enabling talent to step into more meaningful, judgment-intensive roles, insurers can not only improve internal efficiency but also deliver more compassionate, trust-based services to their customers.

Insurers can enhance customer experience with collaborations, the right channel, and empathy

A critical factor shaping the insurer of the future is a focus on the customer. Insurance customer experience should not be considered a peripheral metric, as it drives both retention and growth.88

Today’s policyholders, especially in the P&C segment, want speed and hyper-personalized solutions, delivered seamlessly across digital and human touchpoints.89 According to J.D. Power’s 2024 US Claims Digital Experience Study, overall customer satisfaction with the auto and home insurance digital claims experience improved, driven largely by enhancements in the range of services offered on mobile apps and websites and the visual appeal of those digital platforms.90

In contrast, the life insurance segment prioritizes values such as trust, transparency, and long-term personalized guidance.91 The J.D. Power survey revealed that 51% of life insurance customers surveyed, on average, gave a top two-box rating (combines the two highest survey response options) for overall trust, though this fell to as low as 33% among individual carriers.92 Policyholders often seek reassurance through human interaction when making complex financial decisions involving family security, estate planning, or retirement income.93

Although they appear to be making improvements, many P&C and L&A insurers continue to fall short of consumer expectations due to limited product customization and disjointed service models.94

At the same time, underinsured segments, evolving societal needs, and disruptive technologies are opening up the possibilities for insurers to enter entirely new markets and models.

These dynamics are compelling many insurers to go beyond incremental fixes and reconsider how and for whom value is delivered. This effort likely requires close examination of products, redefining customer segments, and redesigning the end-to-end journey.

Collaborate to innovate

Technologies like gen AI are delivering broad process and technological transformations, reducing the traditionally long cycle times for launching new insurance products.95

Many insurers are also forming partnerships to use continuous feedback loops and behavioral analytics to create hyper-personalized product offerings and improve customer service. Zurich Financial Services in Australia, in alliance with the University of Technology Sydney, is implementing AI tools designed to reduce life insurance application processing time for customers with mental health disclosures from 22 days to less than a day. Beyond underwriting, the tool’s findings could also be key in exploring preventative health and wellness offerings.96

In commercial lines, some insurers are collaborating with technology partners to cocreate hybrid products, integrate protection with prevention through real-time underwriting, continuous portfolio assessment, and IoT-enabled sensor monitoring. One large insurer is partnering with Ember Defense to install ember-resistant vents and sprinkler systems in homes located in high-risk wildfire zones, which is expected to result in a 63% reduction in fire-related losses.97 Similarly, collaborations with firms like Alphabet’s Bellwether (weather AI) and startups using satellite data for wildfire prediction have enabled advanced risk mitigation capabilities.98

Omni-channel to the right channel

While distribution options continue to evolve, the rising volume and complexity of customer interactions with insurers, coupled with the high cost of managing multiple service channels, make omni-channel strategies very important for the industry.99 The absence of right channeling capabilities and processes, along with low service channel integration, are two commonly observed factors that can hinder firms from delivering a connected experience to users. Right channeling is a rules-based strategy that helps steer customers to the most effective service channel—digital, human, or hybrid—based on their intent, behavior, and risk profile, thereby ensuring consistent experiences across touchpoints.

To improve client experience, many insurers need better data and more connected teams. This shift can drive satisfaction, reduce service costs, and help deliver well-timed, relevant offers. For instance, insurers can align callers and contact types to the most preferred resolution channels, including self-service bots (voice and chat), messaging platforms, and live voice support. This could enhance customer experience, reduce service costs by pushing lower-priority contacts to low-cost channels, and reduce waiting time by providing more avenues to complete inquiries.100

Empathy meets efficiency

Insurance is essentially about managing uncertainty and protecting people during some of their most vulnerable moments—a death in the family, a home destroyed by wildfire, or a serious medical diagnosis. In such scenarios, customers aren’t just seeking a transaction; they are seeking empathy, clarity, and assurance. As insurers adopt more automation, the human touch remains a critical differentiator of trust, especially in emotionally complex or high-stakes interactions.

The human-machine collaborative model is augmenting advisors by equipping them with real-time quoting tools, AI-driven product suggestions, and dynamic policy review capabilities.101 This shift can enable them to strengthen customer relationships, deliver more personalized advice, and drive meaningful cross-sell opportunities.

For example, Cigna has linked frontline compensation to customer experience metrics such as net promoter score, digital engagement, and service responsiveness with the goal of aligning incentives with customer expectations and reinforcing a culture of service excellence.102

The One Big Beautiful Bill Act offers tax advantages as well as uncertainties to insurers

Insurers are also adapting to tax changes under the new administration. With the passage of the One Big Beautiful Bill Act (the Act) in July 2025, corporations will continue to be subject to a 21% corporate tax rate, alongside immediate tax benefits for qualifying capital expenditures and domestic research and experimentation spending.103

Changes made by the Act to the global intangible low-taxed income regime increased the effective tax rate, but those were offset by generally taxpayer-favorable changes to the foreign tax credit rules that could reduce the impact for some. The base erosion and anti-abuse tax (BEAT) rate will be 10.5%, lower than the Senate’s initially proposed 14%, but the BEAT rules will continue to pose capital challenges for inbound insurers.

While the bill provides some clarity for insurers in the United States, there are still some uncertainties. Proposed Section 899 (Enforcement of Remedies Against Unfair Foreign Taxes) was removed from the final draft of the legislation after the United States reached a joint understanding with G7 countries regarding the application of the Organisation for Economic Co-operation and Development’s Pillar Two global minimum tax rules to US companies. This joint understanding calls for a side-by-side system that would exclude US-parented groups from the undertaxed profits rule and the income inclusion rule for both their domestic and foreign profits. However, the implementation timelines and other details remain unclear, including the availability of relief for US subsidiaries of foreign-parented multinationals.

In the interim, insurers should continue to develop the data collection processes needed for tax modeling, compliance, and reporting related to Pillar Two, with the first information returns due by June 30, 2026. In addition, the Bermuda corporate income tax and the US corporate alternative minimum tax will add complexity and compliance challenges for insurers that are—or may be—subject to these taxes. BEAT will also continue to be an area of monitoring.

The time is now to walk the talk

The insurance industry’s evolution hasn’t been a blink-and-you-miss-it moment, but a series of measures that have slowly, steadily, and decisively changed things. However, emerging and increasingly complex risks, disruptive technology, changing customer expectations, and blurring boundaries are igniting unprecedented shifts. As the landscape becomes more complicated and uncertain, it is important for insurers to consider greater investment in the right partnerships, people, and innovative tools. Moving into 2026, insurers could:

- Invest in modernization and ensure good quality of data: Embrace AI, strengthen data foundations, and modernize core systems to enhance efficiency, improve customer experience, and mitigate risks. This could require a transformation of the workforce, fostering a culture of innovation and adaptability.

- Transform the workforce: Attract, retain, and upskill the workforce to meet the demands of a digital-first environment. This includes bridging the skills gap between legacy and emerging capabilities.

- Forge strategic partnerships: Collaborate with technology providers, reinsurers, and other stakeholders to access new capabilities, share risk, and develop and deploy innovative products and services more effectively and efficiently.

- Prioritize customer-centricity: Meet evolving customer expectations for speed, convenience, and personalized experiences with a holistic approach, which should involve integrating digital and human touchpoints to deliver seamless and empathetic service.

- Shift to proactive risk management: Leverage data-driven insights, invest in predictive modeling, and work with stakeholders to implement preventative measures to mitigate losses.

The future of insurance is here, and carriers will need to decide how to most effectively transform business models, infrastructure, and talent to remain profitable.