Reimagining claims: Soft skills are the differentiator

Critical skills shortage widens, but new approaches to skills development could offer insurers a bridge to close the gap

Kedar Kamalapurkar

Namrata Sharma

Michelle Canaan

Sabyasachi Satapathy

A claim can be a pivotal moment of truth, shaping how customers experience the value of their policy and the support provided by their insurer. But that moment is under intense pressure as the US insurance industry is facing rising claims severity and complexity, and a shrinking pool of talent. As experienced professionals retire, the sector loses not just headcount but decades of institutional knowledge and field judgment—capabilities that can be difficult to replicate.1

Our discussions with chief claims officers of leading property and casualty (P&C) insurers revealed an average attrition rate of 20%, with each claims professional’s exit reportedly resulting in the loss of nearly six years of experience.2 Many insurers are turning to technological innovations like generative and agentic artificial intelligence to help bridge this gap.3 AI can enable more effective decision-making, but cannot replace the human elements critical to claims work: showing empathy at some of the worst moments for an insured, interpreting ambiguity in coverage, and handling difficult customer or vendor conversations. The real differentiator often lies in the soft skills that shape key moments in the claims journey: first notice of loss, investigation, negotiation, and settlement.4 Yet, these capabilities have steadily eroded, and many adjusters struggle to develop or retain them.5

As AI enablement becomes the norm, insurers should ask, “How do we maximize the impact of the human touch in claims management while capitalizing on the insights technology can deliver?” This question isn’t new—Deloitte’s 2021 research called on insurers to enhance the capabilities of claims professionals. The difference now is that the capability gap has widened, and skills development has not kept pace.6

Closing this gap may require a shift to experiential, immersive training, such as interactive simulations and real-time coaching that reflects the complexity and emotional nuance of modern claims. This approach helps adjusters focus more on building capabilities such as empathy, sound judgment, and effective communication.

Claims professionals should be positioned at the center of the claims function, acting as a strategic differentiator. Success should not solely depend on technological advancements, but on how well insurers can embed those tools into the flow of work, attract and retain talent, and cultivate the human skills that define every claims interaction.

From routine inspections to managing complex claims

While advanced technology continues to roll out across claims operations, the traditional role of claims adjusters—once primarily centered on field inspections and processing—is changing. AI-driven tools like computer vision, machine learning, and image recognition can handle high-frequency, low-complexity tasks. These include capturing damage photos, processing visual data, segmenting damage types, estimating repair costs, drafting initial assessments, and even flagging anomalies with speed.7

This could reshape the role of the adjuster—from predominantly task executor to strategic decision-maker and empathetic anchor—focusing on cases involving potential litigation, policy interpretation, or disaster-related, emotionally sensitive customer interactions, where human judgment, empathy, and adaptability are indispensable.

“You can get enamored with the bright shiny object, but it is still ultimately this individual that we’ve hired, trained, and cultivated that has to deliver, and so if those tools aren’t built and then executed on with complete synergy with your claims staff, you’re going to create outcomes you’re not going to be happy with.”

However, advanced technologies can introduce new risks, including the potential for algorithmic bias or inaccurate denials. For example, a completely AI-driven claims system might disproportionately flag claims from certain zip codes as high-risk based on historical data, unintentionally reflecting demographic biases. Human oversight is important to help ensure accuracy, fairness, and contextual understanding, safeguarding against such errors that a purely automated system might miss.8 For this, it is essential that human reviewers remain independent thinkers and actively question and validate system outputs rather than simply defer to them.

As one CCO from a leading P&C insurer notes, “You can get enamored with the bright shiny object, but it is still ultimately this individual that we’ve hired, trained, and cultivated that has to deliver, and so if those tools aren’t built and then executed on with complete synergy with your claims staff, you’re going to create outcomes you’re not going to be happy with.”

In a human-machine collaborative workforce model, the adjuster of the future is likely no longer a task executor; they become a human connection point to help ensure that technology enhances both speed to conclusion and trust.

Skill development has struggled to keep pace

Claims professionals’ expanded responsibilities can demand a blend of technical fluency, critical thinking, empathy, and judgment, but existing skill development models are often inadequate for the demographic profile and capabilities of today’s workforce.

Our discussions with CCOs suggest that onboarding a new adjuster at their companies typically costs between US$8,000 and US$10,000 in the first year.9 However, most of that investment goes toward training on core insurance tenets, processes, compliance, and systems, leaving little room for the more nuanced, high-impact skills that adjusters should develop on the job.10 For example, an adjuster trained only during initial onboarding may know how to estimate damage from a claim using standardized tools. Yet they may lack the skills to objectively and empathetically explain the valuation process, leading to dissatisfaction even when the assessment is accurate.

Virtual learning formats, while convenient, have also struggled to develop the behavioral and cognitive skills often required for success in today’s claims environment.11 For example, a webinar on de-escalation techniques may provide theoretical knowledge, but it often fails to simulate the emotional intensity of a live conversation with a distressed policyholder, which can leave adjusters underprepared to demonstrate empathy, active listening, and critical thinking in high-stress situations.12

This challenge can be amplified by changing workforce dynamics. Digitally native graduates entering the insurance workforce often struggle to interpret industry and regulatory nuances.13 For example, new hires may be proficient with digital tools but may struggle to accurately interpret coverage exclusions or apply state-specific claims handling regulations. These gaps can become especially problematic in bodily injury claims, where errors can drive compliance risk, inflate indemnity costs, and increase the risk of litigation.

At the same time, while experienced professionals can bring deep technical knowledge, such as settlement negotiation honed through years of practice, they may hesitate to trust AI-generated analysis, collaborate in developing gen AI capabilities, or manage case files through cloud-based systems in a remote setting.14

Yet the effectiveness of AI generally depends on the human talent that supervises and interprets its outputs. One leading global insurer underscores this balance by relying on trained investigators—many with law enforcement backgrounds—to help detect fraud and manage complex claims. Pairing technology with their real-world experience can amplify judgment and decision-making.

Although many in the industry recognize the need for this shift, skills development strategies haven’t kept pace. Deloitte’s 2025 Global Human Capital Trends research highlights that while 90% of insurance executives agree on the urgency of reinventing the employee value proposition to reflect human-machine collaboration, only 25% have taken any tangible action to elevate human skills.15

The failure to modernize training can impact performance, employee engagement, retention, loss costs, and loss adjustment expenses. Our discussions with CCOs suggest productivity among new hires has dropped by about 15%, and error rates have climbed as adjusters struggle to keep pace with rising case complexity without the behavioral and analytical tools now essential to the role.16 Insurers with high turnover among experienced adjusters reported seeing operational costs rise by approximately 12%, while those relying more heavily on underprepared talent report up to 20% higher indemnity payouts.17

Claims adjuster skills: What’s in and what’s out

Insurers should move decisively to rethink not only what skills are needed but also how they’re developed, deployed, and sustained.

“The insurance industry needs to reevaluate its view on the skills needed for the future and reset on how we scout for talent. There is a need to identify talent with adaptability, critical thinking, and common sense.”

We spoke with P&C insurance CCOs and identified several issues, including difficulty in appealing to early-career professionals due to unfamiliarity with the role, limited intern pipelines with programs too small to scale, a mismatch between legacy skill development and real-world claims complexity, and challenges in integrating tech-enabled processes effectively.

As one claims leader of a leading P&C insurer puts it: “The insurance industry needs to reevaluate its view on the skills needed for the future and reset on how we scout for talent. There is a need to identify talent with adaptability, critical thinking, and common sense.”

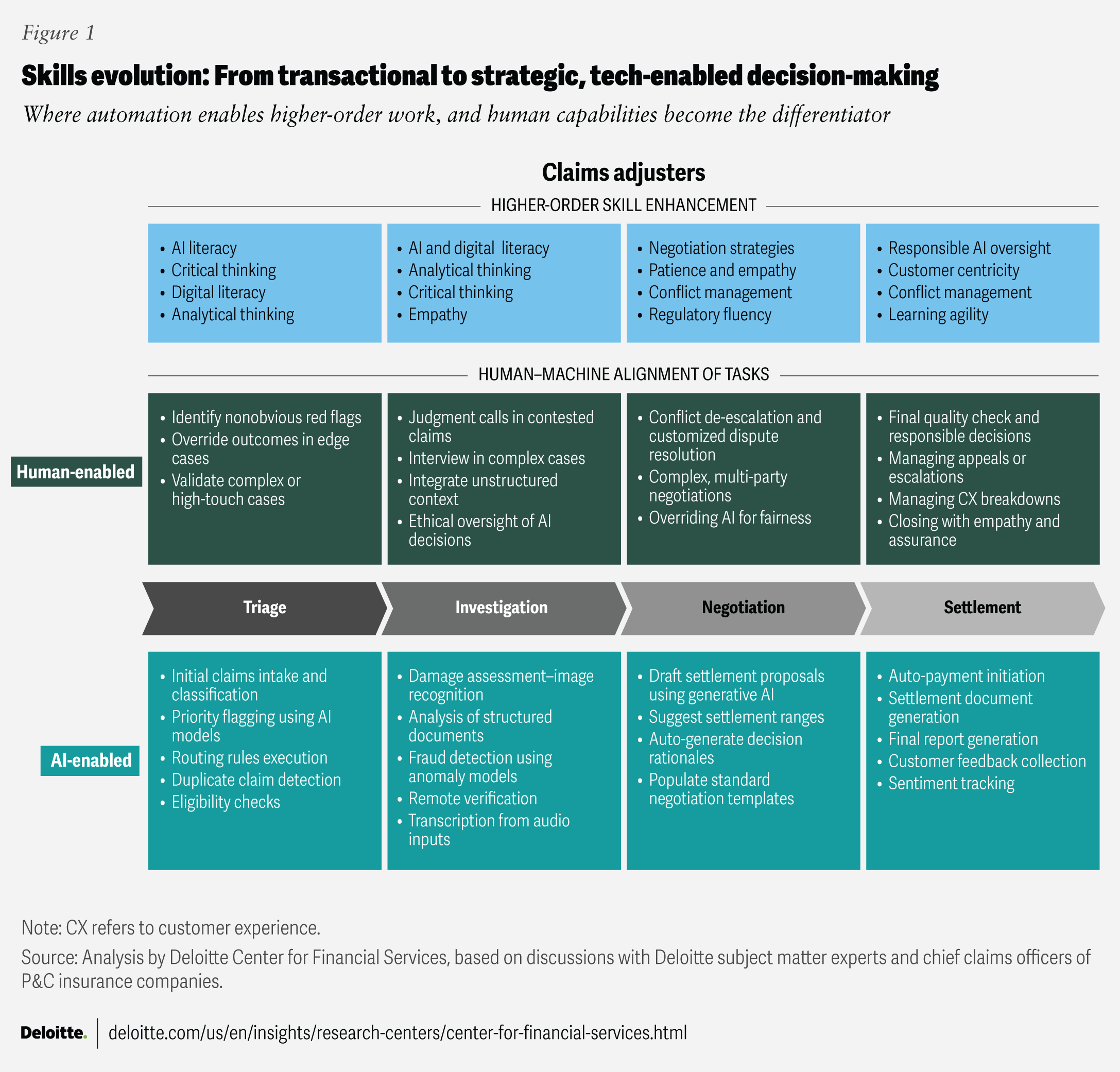

Insurers can begin by deconstructing roles into core functional components and mapping the skills required at each stage. It will likely be essential to understand where automation adds value and where human judgment remains irreplaceable. Figure 1 illustrates the division between AI-enabled tasks and human judgment across the claims life cycle, from triage to settlement. As AI takes on more routine, rule-based tasks, claims adjusters should evolve their skill sets to focus on higher-order, judgment-based work.

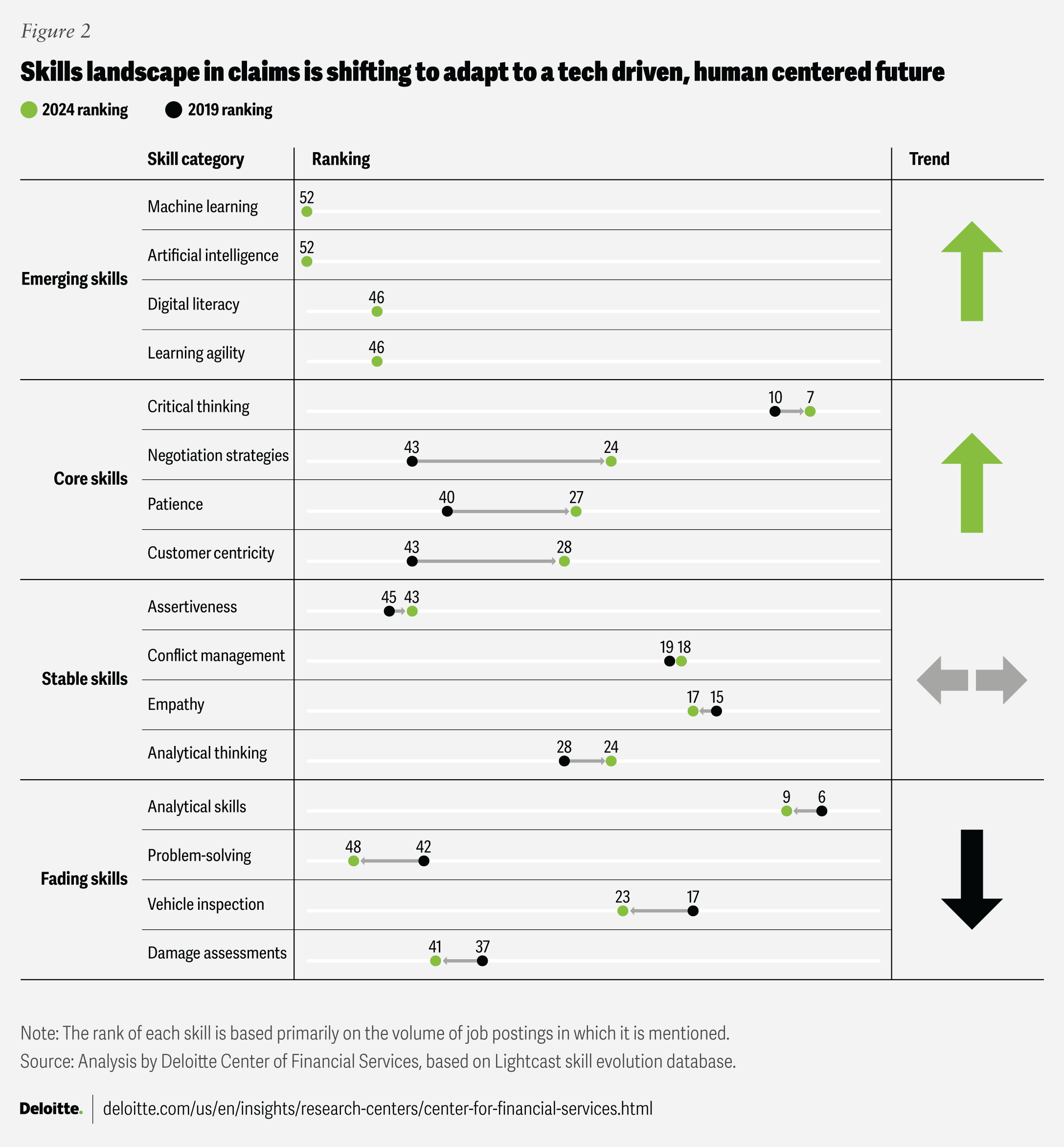

Mapping these skills to the Lightcast database, a global labor market intelligence platform, helped us track an evolution of in-demand capabilities for claims management roles (figure 2). The analysis examined frequency trends across job postings from 2019 to 2024 and identified rising and falling skill clusters (see methodology). This skills-based approach helps provide clarity on which capabilities will likely need to be developed and enhanced. It can also help insurers tailor training based on experience—a critical consideration in today’s multigenerational and skills-diverse claims teams.

The findings help highlight what appears to be a clear shift toward judgment-based, digital-fluent, and human-centric skills.

There appears to be a rise in core skills such as critical thinking, negotiation strategies, patience, and customer centricity. These high-impact human capabilities, often central to the modern claims roles, can help underscore the industry’s growing reliance on contextual judgment and long-term relationship management as claims become more complex.

Foundational abilities such as empathy, conflict management, assertiveness, and analytical thinking appear to remain relatively stable, which could suggest their continued importance as a baseline for effective claims handling, even if they no longer serve as key differentiators for the role.

A notable shift is the apparent decline in skills such as problem-solving, vehicle inspection, damage assessments, and analytical skills. While still relevant, their reduced presence in job postings could suggest that these capabilities may no longer be central to success in today’s tech-enabled claims environment.

This shift is likely linked to a rise in newly prioritized skills, previously unranked but gaining traction due to digital transformation. An emerging demand for machine learning, artificial intelligence, digital literacy, and learning agility reflects a growing need for professionals who can navigate AI-powered workflows, interpret digital outputs, and continuously adapt to evolving technologies and platforms.

Supporting this broader shift, the World Economic Forum’s projections for 2030 identify curiosity and lifelong learning, resilience, flexibility, and agility as core future skills, while once sought-after capabilities, like programming, are declining.18

The future of learning: Immersive, just-in-time, and personalized

Skills enhancement can be key to enabling claims professionals to deliver an exceptional customer experience. As skills evolve, traditional classroom- or presentation-driven learning models may no longer suffice.

According to Deloitte’s 2025 Gen Z and Millennial Survey, nearly 85% of respondents value soft skills as essential, while only 60% rank AI skills as highly important. This reinforces the importance of a balanced development model that can build both digital fluency and human connection.19

Leading insurers looking to develop their internal talent may use AI and behavioral detection as educational aids. Many are moving toward experiential learning models, including augmented reality and virtual reality simulations, AI co-pilot role-playing, in-the-flow coaching, and immersive assessments.20 For instance, a leading global insurer uses analytics to assess skill gaps and tailor learning journeys, incorporating AI co-pilot simulations for real-time claims assessment or customer interaction scenarios.21

This type of immersive simulation-based training could help entry-level professionals focus on building foundational claims knowledge, communication skills, and digital tool usage.

Many mid-career adjusters can benefit from continued development in behavioral skills needed for negotiation and critical thinking. In addition, as AI tools become increasingly embedded in claims workflows, equipping this cohort with targeted training on AI literacy could be equally important to support their ongoing professional development and long-term adaptability. One national insurer, for example, deploys 360° immersive videos, stimulating accident scenarios to train adjusters in empathetic communication and complex damage assessment.22 Early indicators suggest these methods may improve engagement and skill retention, aligning with how many in today’s workforce often prefer to learn.23

To ensure that the most experienced personnel—likely steeped in more traditional skill sets—are not left behind in a digital-first operating model, insurers should help them upskill in advanced analytics, fraud detection, and AI oversight.

Technology matters, but the last-mile delivery can be the difference

Insurance adjusters play a critical role at the front line of the insurance value chain, engaging with customers during emotionally and financially vulnerable moments. A shortage in this workforce is more than a labor market statistic; it likely represents a fundamental challenge to the industry’s ability to deliver timely, accurate, and empathetic service, which could lead to diminished trust in insurance.

Addressing this critical shortage should involve a proactive approach to skills enablement. Insurers that develop innovative skill development approaches, such as immersive, AI co-pilot simulations and personalized training, may not only attract and retain better talent but also elevate their claims outcomes.

Technology may become a game changer in the claims process; however, the real differentiator lies in people who embody the skill sets necessary to leverage digital tools with judgment, empathy, and contextual understanding. As the insurance industry continues to digitize, the ability to cultivate human skills alongside technology could define who thrives and who falls behind in an essential customer-facing part of the insurance value chain. The future likely belongs to insurers who understand that unlocking the value of AI should begin with unlocking the potential of their people.

Methodology

To help insurers assess which capabilities will likely need to be developed and enhanced for claims professionals, the Deloitte Center for Financial Services and Deloitte Consulting conducted interviews with 17 chief claims officers from leading P&C insurers. We first identified tasks within the claims life cycle that could be enabled by AI. Next, we outlined the higher-order tasks claims adjusters would perform, and determined the specific skills generally required to carry them out. We then mapped these skills to the Lightcast database, which aggregates labor market information from job postings, to track how demand for these specific skills evolved over time. Each skill was ranked primarily based on the volume of job postings in which it is mentioned. Finally, we analyzed changes in skill rankings from 2019 to 2024 to identify emerging, growing, or declining skills within the claims management domain.