From brand steward to growth architect: The bank CMO agenda for the AI age

As AI reshapes customer expectations in the banking industry, marketing can become the engine of growth—and the CMO its driver

Ryan Alderman

Jonathan Valenti

Baylee Simon

Alan Hart

Val Srinivas

Shivalik Srivastav

These are extraordinary times to be a bank chief marketing officer. Internally, they are under unprecedented pressure to show sharper accountability for return on marketing investments. And externally, a panoply of evolving dynamics, notably artificial intelligence’s transformative impact on customer behaviors, is prompting a revaluation of how marketing should be done in the banking industry.

This comes as the chief marketing officer (CMO) role appears to have been diminishing in recent years,1 with several banks reconsidering whether the enterprisewide position is necessary.

Given this context, banks should consider a new marketing charter—not just in tools and tactics, but also in purpose, leadership, and accountability. In an AI-dominant future, CMOs can become architects of intelligent, efficient, and bot-aware ecosystems. As creative visionaries and compelling storytellers, bank CMOs seem uniquely positioned to lead this reinvention. Yet success will likely demand more. They should embrace a more expansive and assertive role as enterprise growth leaders, with accountability beyond traditional brand stewardship, communications, and sponsorships.

Redefining the role of bank CMO as a growth architect

CMOs are uniquely qualified to lead the growth transformation agenda. First, they are the maestros of market sensing, turning market signals such as customer behaviors, competitive dynamics, and technological advances into coherent growth strategies. They also know how to influence demand and create strong competitive positioning via brand narratives. CMOs and other marketing leaders also often excel at orchestrating and synchronizing brand, product, customer experience (CX), media, and distribution initiatives.

But to be a catalyst for growth, doing these things requires CMOs to also exercise strong influence over data, analytics, CX, and marketing technology (martech). By doing so, marketing can become a bank’s forceful catalyst for growth.

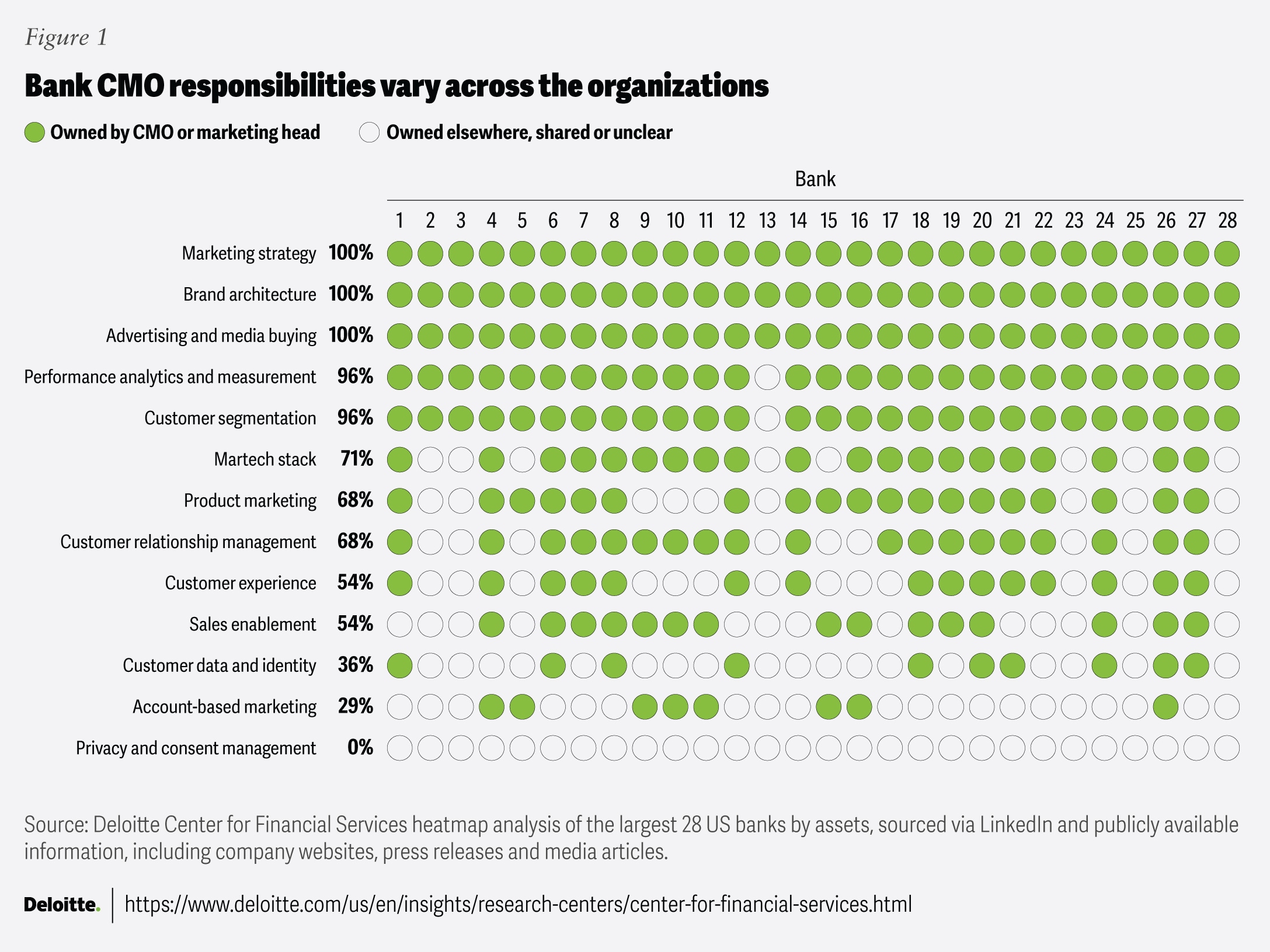

Our analysis of CMOs’ responsibilities2 across the largest 28 US banks by assets revealed uneven patterns in their influence over data, performance analytics, and martech (figure 1). While responsibilities such as branding, advertising, media, and marketing strategy continue to be core, growth remit among some enterprise marketing leaders (defined as revenue lift from stronger customer relationships) is not uniform. Growth can be defined in multiple ways, but for our purpose, we can assume it’s about sustainable revenue and profit lift from stronger, enduring customer relationships. Fewer than half of the CMOs included in our sample have an explicit growth remit, as per our analysis.

Growth is a team sport; unilateral “control” is neither realistic nor desirable. To help drive growth, CMOs should maintain explicit decision rights, platform stewardship, budget authority for experimentation, and access to data, analytical resources, and channels. Without these, their ability to shape market demand, demonstrate causal impact, and accelerate learning is curtailed, and their remit could collapse into just messaging and coordination. With them, the CMO can credibly act as the enterprise’s “chief growth orchestrator.”

These growth levers are often also critical for AI deployment in marketing; as such, marketing leaders with responsibility for data, analytics, CX, and martech should also have functional accountability for how AI is applied on a day-to-day basis. This means that having the technology is not enough; many banks may lack the right data, processes, or talent to use it.

Rethinking the marketing operating model for growth

If CMOs are to embrace a more forceful role in enterprise growth and have more direct influence and a “seat at the table” regarding growth levers, how should banks rethink the scope of the CMOs, and how far should this remit go?

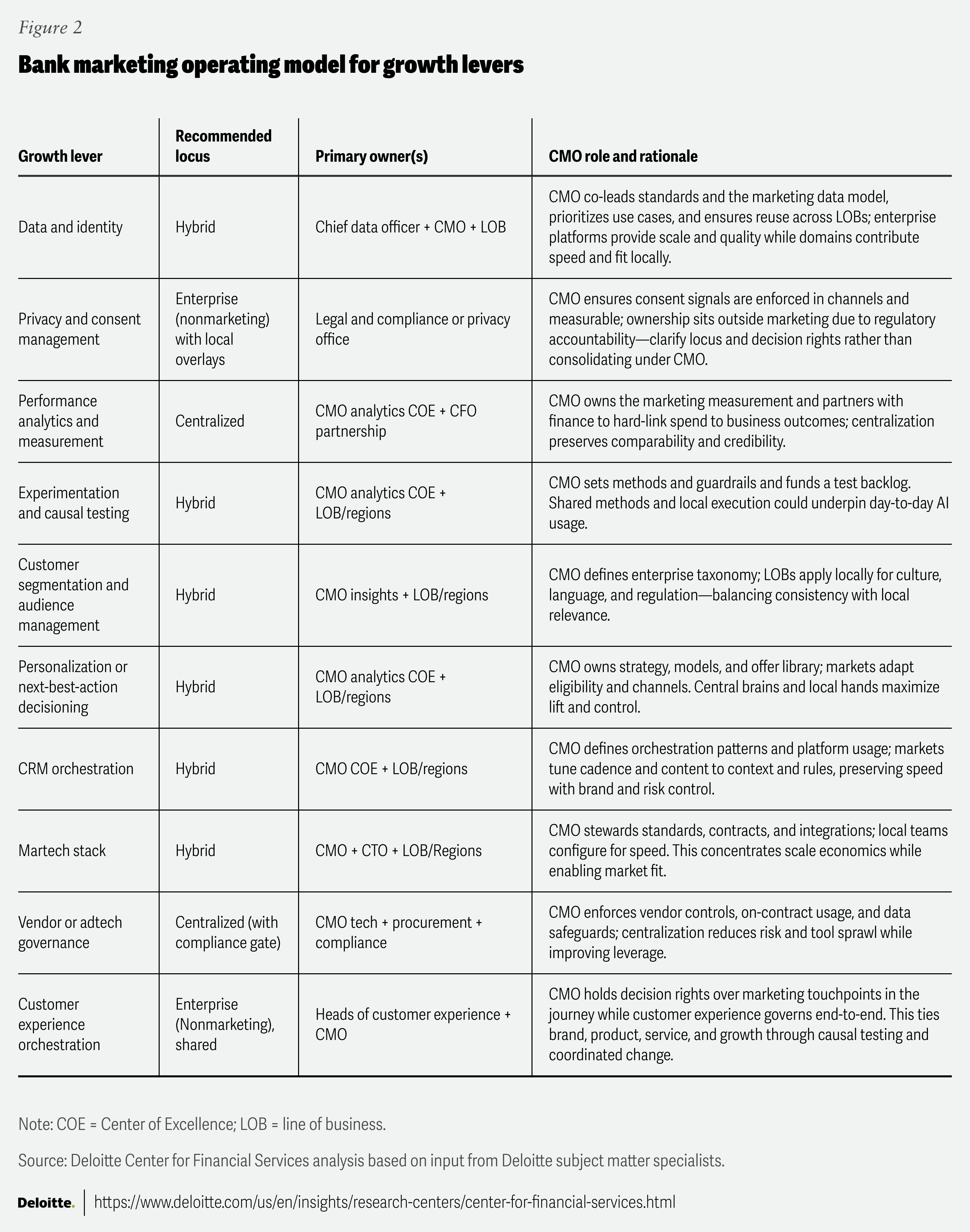

Below, we propose a framework to help decide where the operating locus of marketing activities that drive growth should be located, with the rationale expanded in figure 2. There are three options for consideration.

- Centralized: Here, the CMO’s office is responsible for shared platforms and can enforce more common, consistent standards. This is where risk tends to be a dominant concern and scale economics matter.

- Hybrid: In contrast, a hybrid model can involve ownership of responsibilities being shared between the lines of business (LOBs), regions or segments, and the CMO’s office. Here, agility and proximity to the market/customer and product/service delivery are paramount. In this model, there could be a firmwide hub for standards and platforms, but with execution capabilities embedded in the LOBs or regions.

- Hub and spoke: Here, marketing efforts are centralized in a “hub” for strategic decisions, while “spokes” (such as LOBs, regions, or segments) are empowered for local execution and market adaptation. Depending on scale and diversity of operations, smaller banks may benefit from centralization to help drive direct growth, whereas larger banks with multiple business lines and operating in different jurisdictions may opt for a hub-and-spoke model, which is probably the current state for many. Banks undergoing some form of remediation or a turnaround may temporarily opt for a centralized model to help stabilize customer experience and standards, before returning to a more decentralized, hub-and-spoke approach.

How will agentic AI influence bank marketing?

AI is already having a profound impact on customer behaviors, influencing how they search for information3 and evaluate offers, and their expectations of products and service providers.4 It is also making algorithmic curation the norm, dictating what customers see first. If marketing content is not designed for this reality, the brand may not enter the consideration set. At the same time, AI-generated synthetic noise is inviting some customer skepticism. Consequently, authenticity has become a premium. In an Adobe survey, a third of consumers wanted clarity on how AI is used for recommendations.5

But this is not all. As agentic AI systems become more pervasive, more radical changes in customer behaviors may appear. For instance, digital assistants may replace search engines in comparing and analyzing trade-offs unique to the purchase context. This could make how information is presented to AI agents (rather than reach, impressions, or clicks) become a more decisive role for marketing.

Similarly, how customers evaluate products will also likely change with agentic AI. They may want what-if scenarios tailored to their needs, and agent-to-agent negotiation and information exchange could become commonplace. The use of agentic AI can also extend to the institutional context, for instance, by synthesizing request for proposal responses, comparing term sheets, and highlighting stakeholder trade-offs, such as those from treasury, procurement, or tax departments.

Banks should consider pivoting to generative and agent engine optimization to help stay relevant in a world of large language models, where product and brand recommendations are often more important than brand recall. If banks don’t adapt their marketing to the evolving needs of their customers, they may face the risk of becoming invisible.

Bank CMOs can’t act alone

For bank CMOs to have a more decisive role in driving enterprise growth, holding the keys to data, analytics, CX, and martech is important, but it may not be enough. Real impact requires visible alignment and support across the C-suite, especially from chief financial officers, whose focus on return on investment can sometimes narrow the aperture and result in limiting marketing’s value. Over-emphasizing short-term returns may satisfy financial discipline, but it can risk squeezing out creativity, underfunding innovation, and eroding the brand equity that can help sustain trust—the very foundation of banking.

The role envisioned for CMOs is therefore both expansive and demanding: to serve as strategic leaders, compelling storytellers, agile operators, and disciplined experimenters, while also developing new muscles, most notably, AI fluency. AI presents new opportunities to help redefine the role of the CMO, but realizing this potential requires fostering relationships with the chief executive officer and chief financial officer. This is a way for marketing to stake its position as a catalyst for growth in the banking industry.