Forecasting the rise of push payment scams—the fraud consumers are tricked into authorizing

Deloitte estimates US losses from authorized push payment fraud could surge to nearly $15 billion by 2028. Who’s most vulnerable, and how can banks shore up their defenses?

Satish Lalchand

Val Srinivas

Richa Wadhwani

Brendan Maggiore

In July 2025, the FBI’s Los Angeles field office posted on its social media handle about “phantom hacker scams”—where scammers impersonate tech support, banks, and government agents to create urgency and manipulate victims, especially senior citizens, into transferring money directly into fraudsters’ accounts.1 First flagged by the FBI in 2023, these scams made headlines for their layered deception and causing Americans millions in losses.2 Since then, the playbook hasn’t changed much—it’s just gotten more aggressive.

Phantom hacker scams are just one example of a broader—and fast-growing—type of crime known as authorized push payment fraud, or APP fraud. These incidents have been all too common, and chances are, you or someone you know has already been targeted by similar schemes. Whether it’s a retiree deceived into transferring funds to a tech-support imposter, a millennial lured by a text about a too-good-to-be-true job opportunity, or an investor drawn to the promises of astronomical returns in a fake cryptocurrency, the common thread is that victims are increasingly being manipulated into willingly sending money straight to scammers. In these cases, individuals are tricked—often through social engineering—into authorizing payments themselves, making the transactions almost impossible to reverse once the funds are gone.

These scams are on the upswing, and the losses are expected to balloon. To better understand who is most at risk and how much financial damage authorized push payment fraud could cause in the coming years, the Deloitte Center for Financial Services analyzed fraud data from the Federal Trade Commission’s (FTC) Consumer Sentinel Network. The FTC tracks 48 fraud categories, but we only focused on 20 fraud types that are most vulnerable to APP fraud. By combining this detailed data with other assumptions and scenario-based forecasting, we aimed to identify which types of scams are most likely to drive future losses (see methodology).

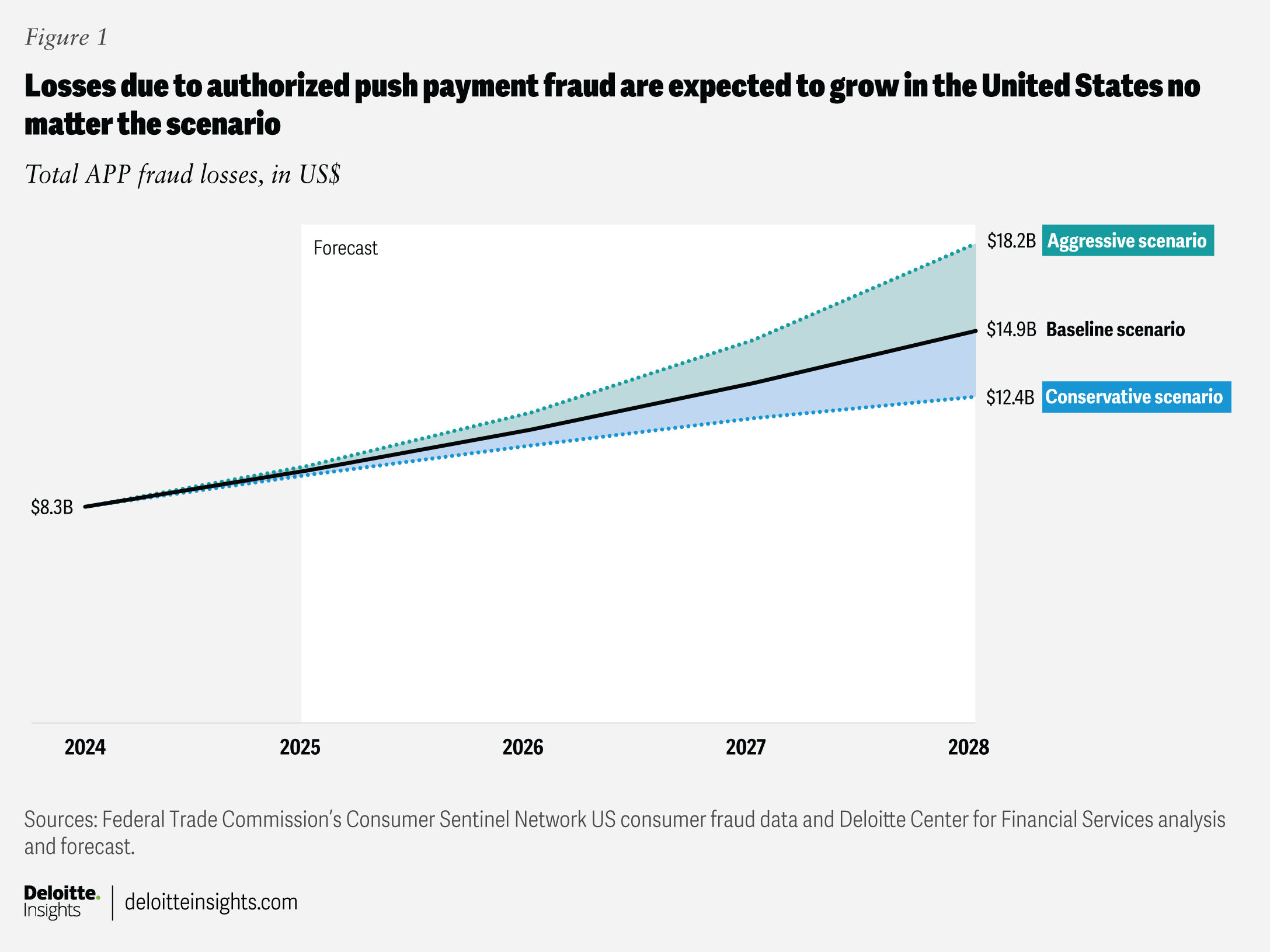

In the baseline scenario, we estimate authorized push payment fraud losses in the United States could increase to $14.9 billion by 2028 from an estimated $8.3 billion in 2024 (figure 1). In an aggressive scenario, where AI-driven APP fraud incidents outpace societal and institutional defenses, APP fraud losses could shoot up to as much as $18.2 billion by 2028. Of all such fraud types, investment scams are expected to account for the bulk of the growth in APP fraud losses, followed by bank and business impersonation and romance imposter scams.

This rapid growth will likely be fueled by the use of generative AI and agentic AI to create highly realistic deepfake content, impersonate people, and execute large-scale, targeted scams.3 As fraudsters gain access to an ever-expanding array of AI tools, social engineering in APP fraud is poised to become even more sophisticated and difficult to detect. Meanwhile, the rise of real-time payment apps in the United States increases the complexity for financial institutions to quickly verify identity and stop fraud before funds are irreversibly transferred.4

Some APP fraud types have impacted consumers’ finances more than others

Even as our analysis shows the total number of APP fraud incidents has been increasing, the true extent may be underestimated on two accounts: First, it is likely that not all such scams are reported to financial institutions or regulatory authorities like the Federal Trade Commission or the FBI; and second, even among the ones that are reported, information on the dollar amount of losses and the victims’ age is not shared in all cases for a number of reasons, including embarrassment. Nevertheless, our analysis reveals some interesting insights.

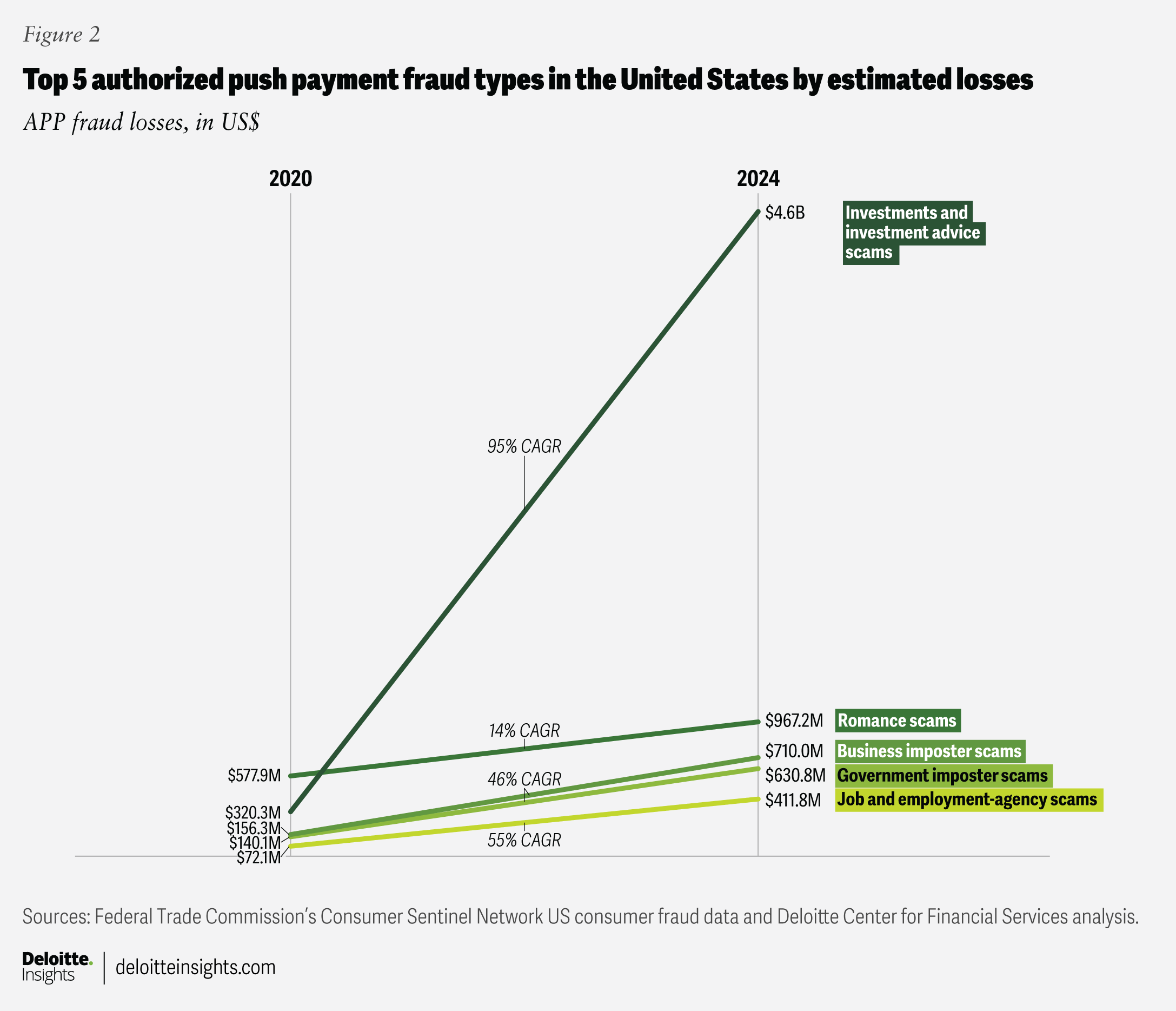

Among all APP fraud types, investment fraud tops the list with $4.6 billion in losses in 2024, by our estimation. This type of APP fraud has surged over 14 times since 2020 (figure 2). One of the most common tactics is known as “pig butchering,” a term that refers to scammers gradually “fattening up” victims by building trust before deceiving (“butchering”) them with fake high-return schemes, often involving cryptocurrency for easy laundering across borders.5

Imposter scams rank just behind investment fraud in terms of total losses. In these schemes, fraudsters pretend to be a romantic partner, bank or business, government agency, friend or family member, or tech support, then create a sense of urgency, and take advantage of victims’ vulnerability. In 2024, we estimate Americans suffered about $2.5 billion in APP fraud losses from imposter scams. Losses from these scams have grown quickly—up from an estimated $960 million in 2020, averaging 27% growth each year. In our analysis, business imposter scams accounted for 360,487 cases, making them the most reported type of APP fraud in 2024, followed by government imposter scams with 212,267 reported cases.

APP fraud has affected consumers of all ages, albeit differently

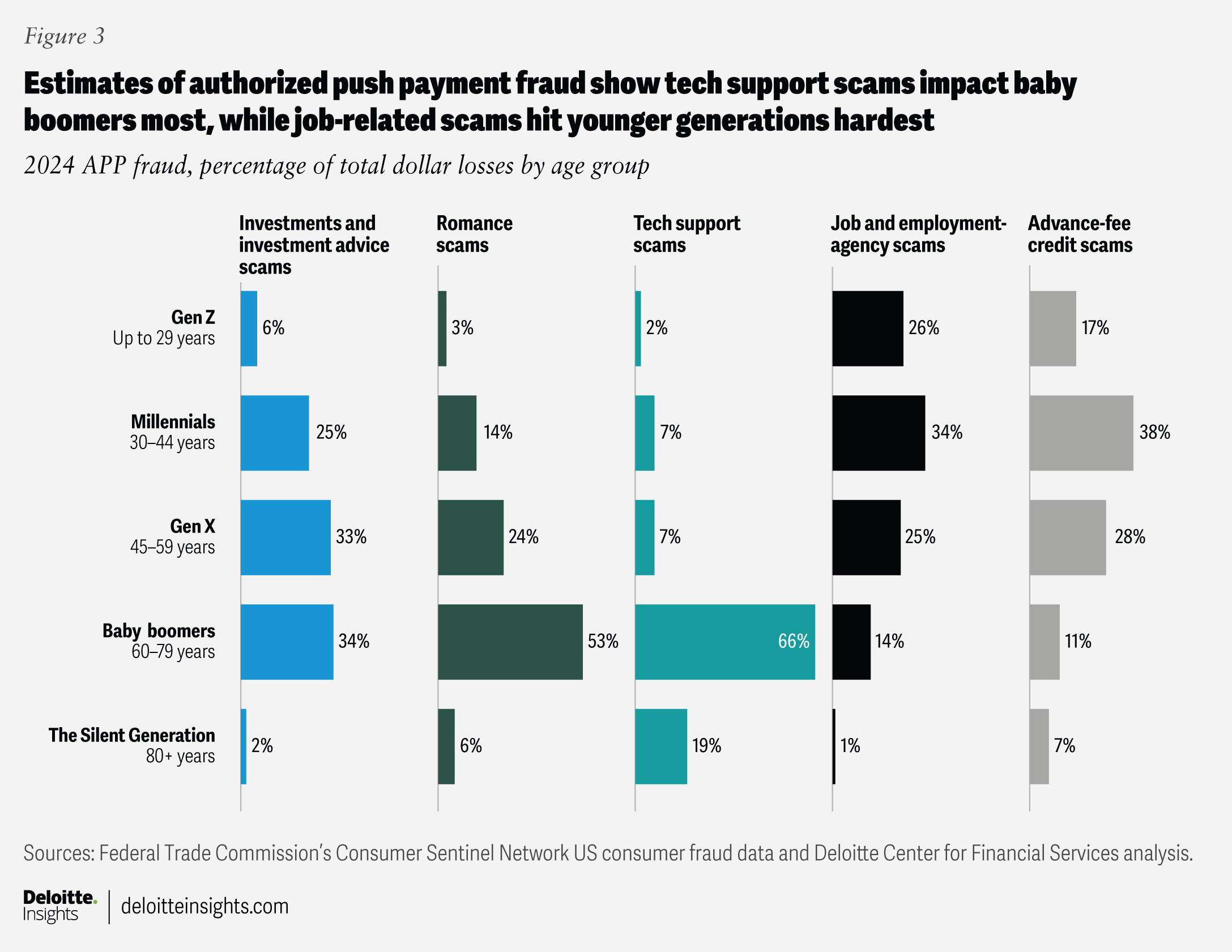

APP fraudsters do not discriminate; they target the young and old alike, although our analysis suggests that older adults are generally easier targets, and are hardest hit by imposter scams. For instance, of the estimated $95 million in APP fraud losses in tech support scams with victim's reported age in 2024, 66% were reported by baby boomers (60 to 79 years) and 19% were reported by the Silent Generation (above 80 years) (figure 3). Older adults are often targeted because they tend to hold more financial assets and may be less familiar with the evolving technologies scammers rely on.6

Younger generations are not spared either, though. As figure 3 indicates, they are disproportionately hit by business and job opportunity scams, online shopping fraud, and advance-fee credit traps where consumers are directed to pay some form of tax or fee prior to obtaining the funds. Many young Americans are digital natives and frequently use digital channels to send and receive money.

Mitigating APP fraud demands a multifaceted, multi-industry defense

Unlike with unauthorized money transfers or credit card fraud, banks in the United States aren’t legally required to reimburse customers for APP fraud, though some may in cases involving investment fraud. Despite this, addressing APP fraud is crucial, as it may hurt customers’ loyalty to their banking or payments institutions. Over half of victims of fraud (both authorized and unauthorized payments) consider switching financial providers, and 30% actually do, according to a 2024 study of 10,000 consumers by PYMNTS Intelligence and Featurespace.7 In response, some US banks are responding with payment verification steps and stronger education efforts to better protect and inform consumers. Additionally, AI agents could transform fraud defense by spotting anomalies, assessing risk in real time, monitoring transactions for anti-money laundering, and making autonomous decisions at speed and scale.

There are also anti-fraud strategies that financial institutions are using in other countries that can be considered. One such example is “confirmation of payee,” an industry-wide name-checking service that banks and financial institutions in the United Kingdom and Australia have implemented.8 This process verifies recipient details before a transfer by matching the account name entered by the payer with the name on file at the recipient’s financial institution.

Another big takeaway is to widen the lens. Combating APP fraud isn’t just a banking or payments issue; it’s a cross-industry challenge. Many of these scams originate through telecom and social media platforms, making them critical players in the fight.9

Strengthening defenses, accountability, and collaboration across these industries can help in creating a unified and effective response. For instance, in Australia, a pilot SMS Sender ID Registry helps telecommunications companies block impersonation by verifying message headers from legitimate businesses.10 Similarly, the Stop Scams UK Unit brings together banks, telcos, tech firms, regulators, law enforcement, and consumer groups to coordinate scam responses, run awareness campaigns, and share fraud intelligence.11

Efforts are also underway in the United States to lay more groundwork. The Aspen Institute’s National Task Force for Fraud and Scam Prevention unites 33 cross-industry players—from federal agencies to banks and payments institutions to tech platforms—to tackle consumer fraud. Meanwhile, the bipartisan TRAPS Act proposed in June 2025 aims to establish a federal task force focused on combating digital payment scams across consumer and commercial contexts.12

Industry reforms could take some time to show impact. Customers also have a responsibility to be vigilant. Nevertheless, banks and payment institutions that help educate, remind, and work proactively with customers in fighting APP fraud could also benefit from greater loyalty and trust.

Methodology

Our estimates of APP fraud are based exclusively on the Federal Trade Commission’s Consumer Sentinel Network data from 2020 to 2024. The data set tracks 48 categories of reported fraud but does not separate APP fraud from other methods.

The Federal Trade Commission data also segmented fraud by age group, both in the number of cases and dollar losses. We reclassified these into five generational cohorts: Gen Z, millennials, Gen X, baby boomers, and the Silent Generation.

Working with Deloitte subject matter specialists, we identified the 20 categories most vulnerable to APP fraud. Each was assigned an APP fraud incidence rate (in percentage). Using these rates, we estimated the share of fraud within each category attributable to APP for every year from 2020 through 2024. It’s important to note not all fraud categories are susceptible to APP fraud—such as pyramid schemes, multi-level marketing, and timeshare sales.

These historical adjustments informed our forecasts. We modeled three scenarios—conservative, baseline, and aggressive—that reflect AI adoption by both fraudsters and financial institutions, shifts in fraud frequency and success, the effectiveness of countermeasures, and consumer awareness. Forecast assumptions were grounded in fraud typology analysis and validated with Deloitte specialists.