Colombia economic outlook 2025

Despite restrictive monetary policy, relatively high inflation, and sectoral divergence, Colombia’s economy continues down a path of sustained—albeit moderate—growth

The Colombian economy is navigating a gradual recovery after the pandemic, marked by resilience in some sectors and persistent challenges in others. Hence, while overall activity levels have improved, momentum remains uneven, with some industries exhibiting strong dynamics while others remaining constrained by structural and regulatory headwinds.

Private consumption and investment are slowly regaining strength, supported by improving business sentiment and a more stable external environment. However, this recovery remains fragile, particularly in areas like construction and housing, where financing conditions and demand remain subdued.

Inflation is showing signs of renewed pressure, after a period of moderation, especially in food prices, which complicates the central bank’s efforts to steer inflation toward its 3% target, prompting a cautious monetary stance. Meanwhile, the labor market is healing, with better employment indicators, although informality and regulatory changes continue to shape its trajectory.

On the fiscal front, the government faces a two-headed challenge—managing spending pressures while trying to implement a comprehensive tax reform. The reform aims to broaden the tax base and increase revenues, but its approval and impact remain uncertain.

Colombia is currently benefiting from a more favorable perception among investors, reflected in the stability of its currency and improvements in foreign investment. The export mix is gradually diversifying—with services and tourism gaining relevance, while sectors like fuels face headwinds.

Looking ahead, the 2026 outlook for Colombia remains cautiously optimistic. Moderate growth is expected, with key sectors like financial services, entertainment, and retail leading the way. However, sustaining this trajectory will depend on policy consistency, investment recovery, and the ability to navigate both domestic and global uncertainties.

At a glance: Colombia’s economic trajectory (2024 to 2025)

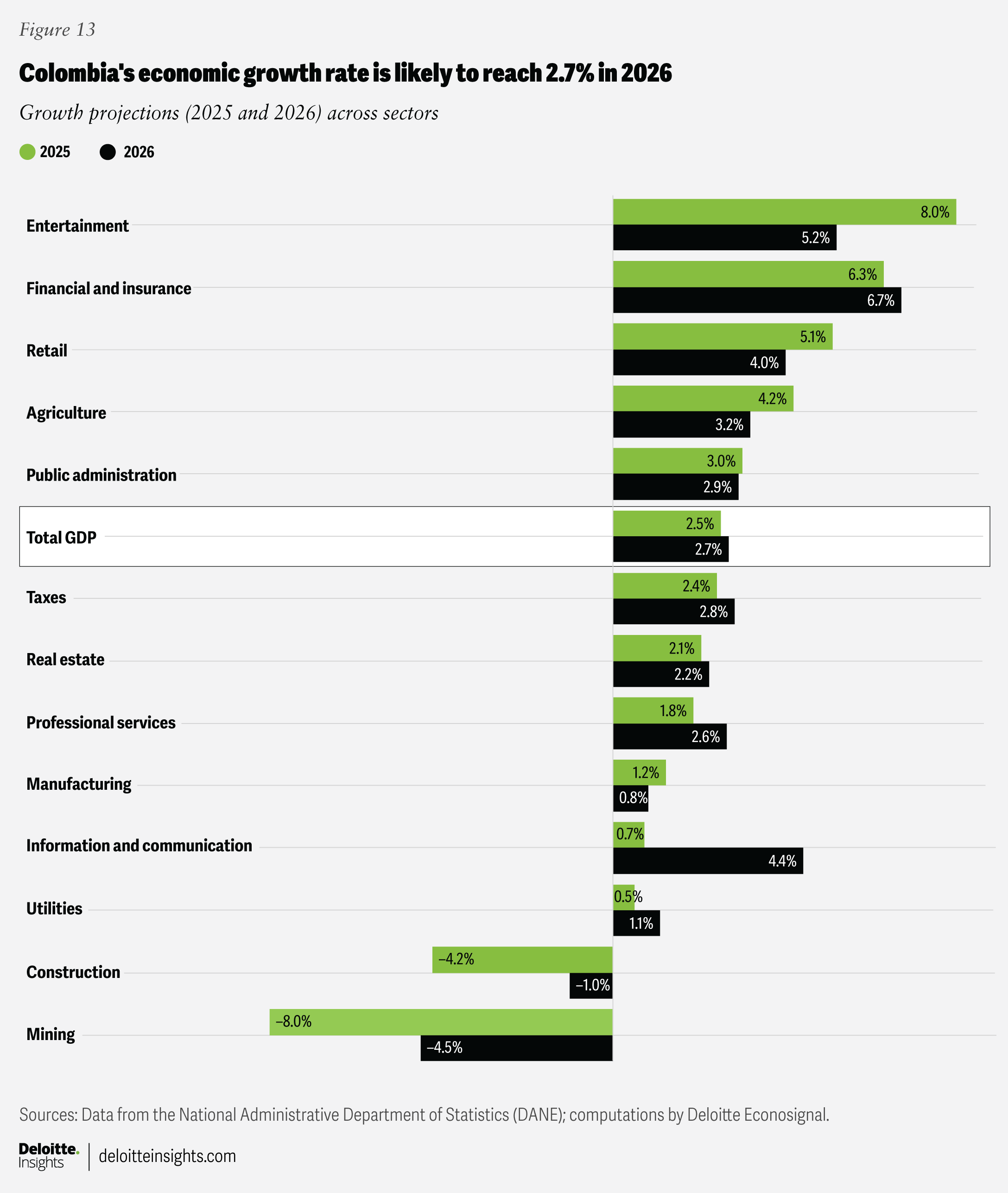

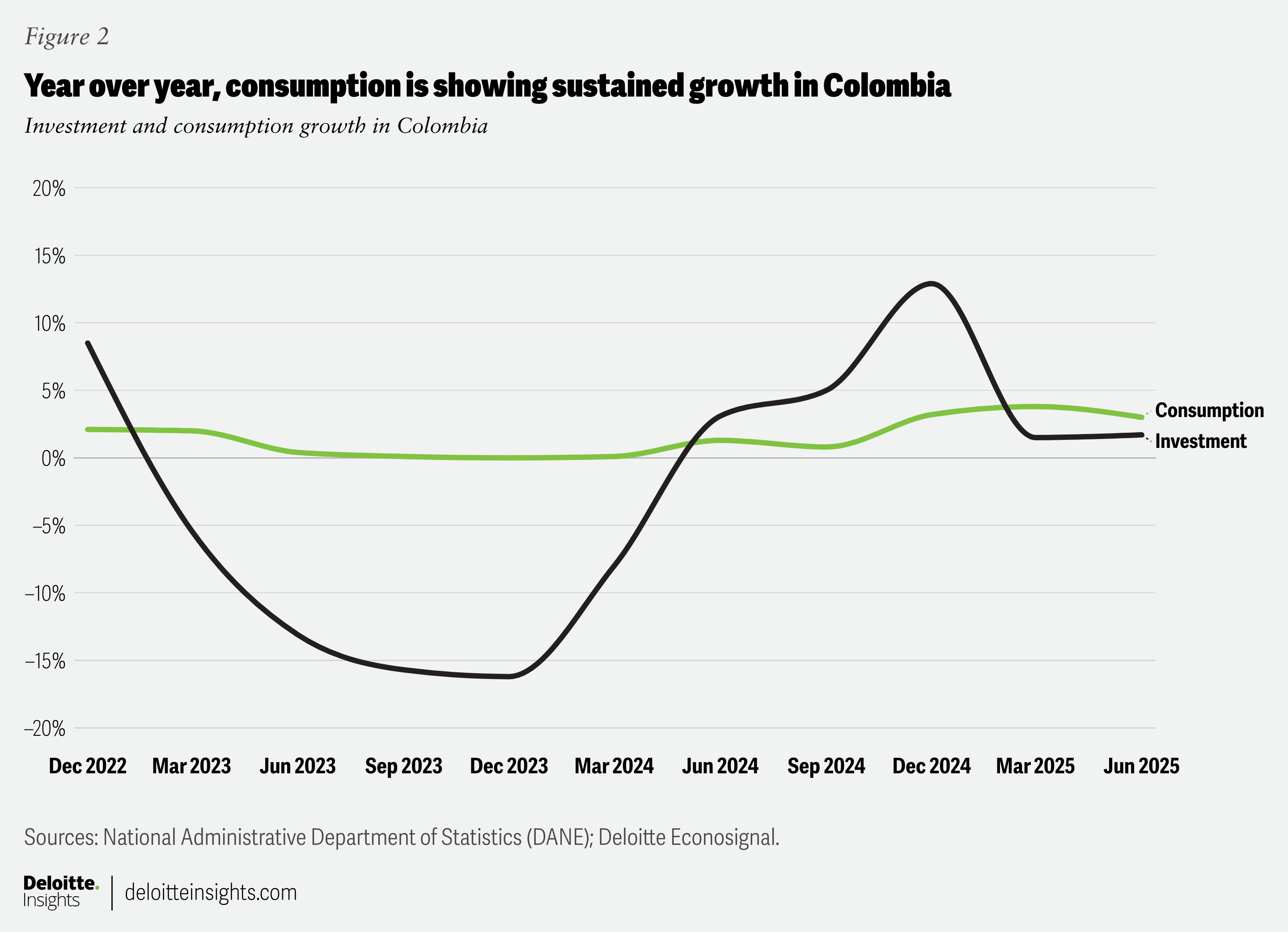

Over 2024 and into the first half of 2025, the Colombian economy has maintained a moderately positive trajectory, supported by both public and private sector activity. Data from the National Administrative Department of Statistics (or, “DANE”) shows an annual growth rate of 2.1% in the second quarter of 2025 (figure 1),1 reinforcing the continuity of the recovery observed since early 2023. While growth remains modest, its persistence signals underlying resilience in the economy, especially amid a complex global economic environment.

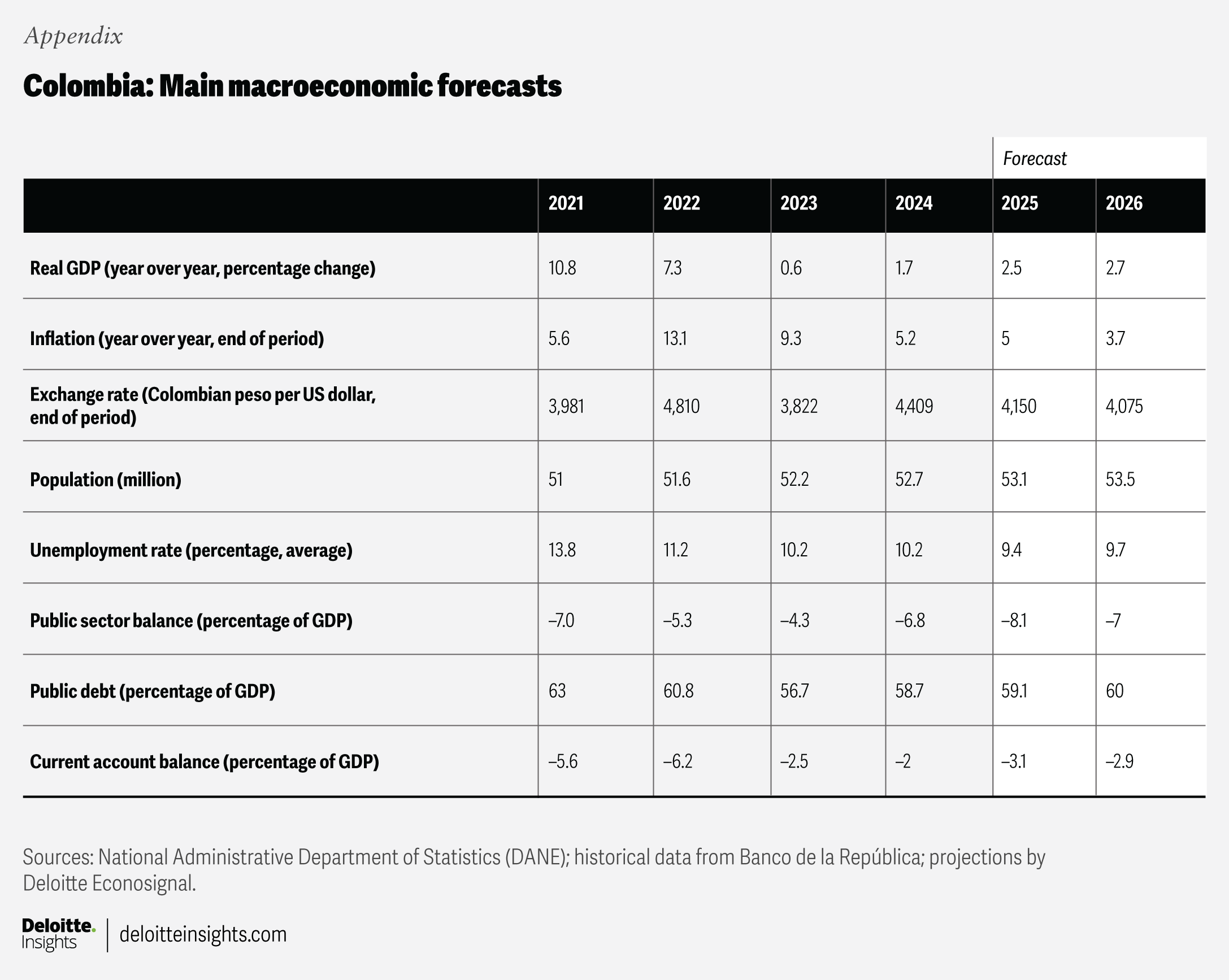

Cumulative gross domestic product for the second quarter of 2025 grew 2.4%, compared with the same period in 2024. Private sector GDP also grew 2.4%, while consumption grew 3.0%. Investment recovered as well, showing an annual growth of 1.7% (figure 2).

For productive sectors, strong annual growth was seen in entertainment (11.3%), agriculture (5.3%), and retail (4.8%).2 On the downside, mining contracted by 7.6%, largely due to changes in domestic regulation, while construction shrank by 3.3%, reflecting a continued lack of investment.

Investment: There’s still room for improvement

Investment dynamics have been mixed over the last five years, recovering 17.2% from the COVID-19 pandemic until 2023—yet remaining 10% below pre-pandemic levels.3 After a contraction phase in 2023, investments began to recover through 2024 and 2025. As of the second quarter of 2025, total investment registered a modest annual growth of 1.7%, reflecting a fragile but ongoing recovery.4

The composition of investment reveals important divergences, however. Machinery and equipment has been the most dynamic component, posting a robust 11.6% annual growth rate, likely driven by improved business sentiment and the normalization of global supply chains.5 In contrast, housing investment remains in negative territory, with a sharp contraction of 10.6%,6 suggesting persistent weakness in the real estate sector, possibly due to high financing costs and low household demand.

Investment in other buildings and structures slightly declined, by 1.2%, indicating stagnation in broader construction activity beyond the residential segment. Overall, while aggregate investment has returned to positive ground, recovery remains uneven across sectors. The strength in capital goods investment is a positive signal for medium-term productivity, but the continued drag from housing and construction warrants close attention.

Inflation: Too steep a target for 2025

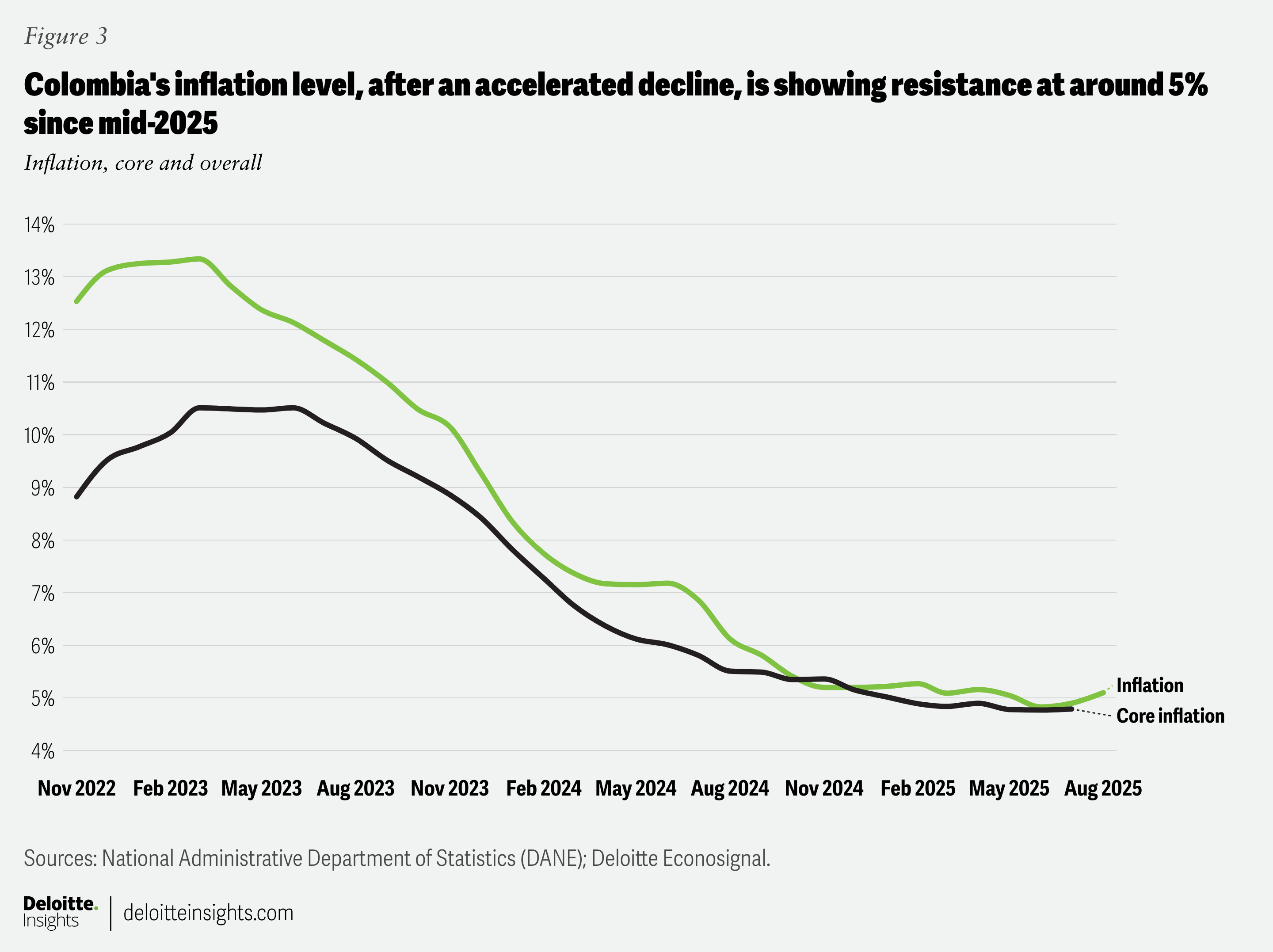

Colombia’s annual inflation rate reached 5.1% in August 2025, up from 4.9% in July and 4.83% in June, reversing the downward trend observed over the previous months (figure 3);7 to compare, the country’s central bank has set a target level of 3% for inflation.

This recent acceleration suggests renewed price pressures, despite earlier signs of stabilization. The largest contributor to headline inflation was the housing and utilities sector, which added 1.5 percentage points in August.8 However, its impact has moderated compared with August 2024, when it contributed nearly 2.79 percentage points. In contrast, the contribution from the food and nonalcoholic beverages sector increased significantly, rising from 0.47 percentage points in August 2024 to 0.86 points in August 2025, reflecting stronger price dynamics.

Core inflation, which excludes food and energy prices, declined from 5.81% in July 2024 to 4.79% in July 2025, indicating a softening of underlying inflationary pressures.9 This trend aligns with easing supply-side constraints and more stable exchange rate conditions.

So, while inflation had been going down, recent data points to a reacceleration driven primarily by food prices.10 The moderation seen in housing inflation is a positive signal, but the uptick in headline inflation warrants close monitoring, particularly considering its implications for monetary policy and household purchasing power.

The labor market shows strong signs of recovery

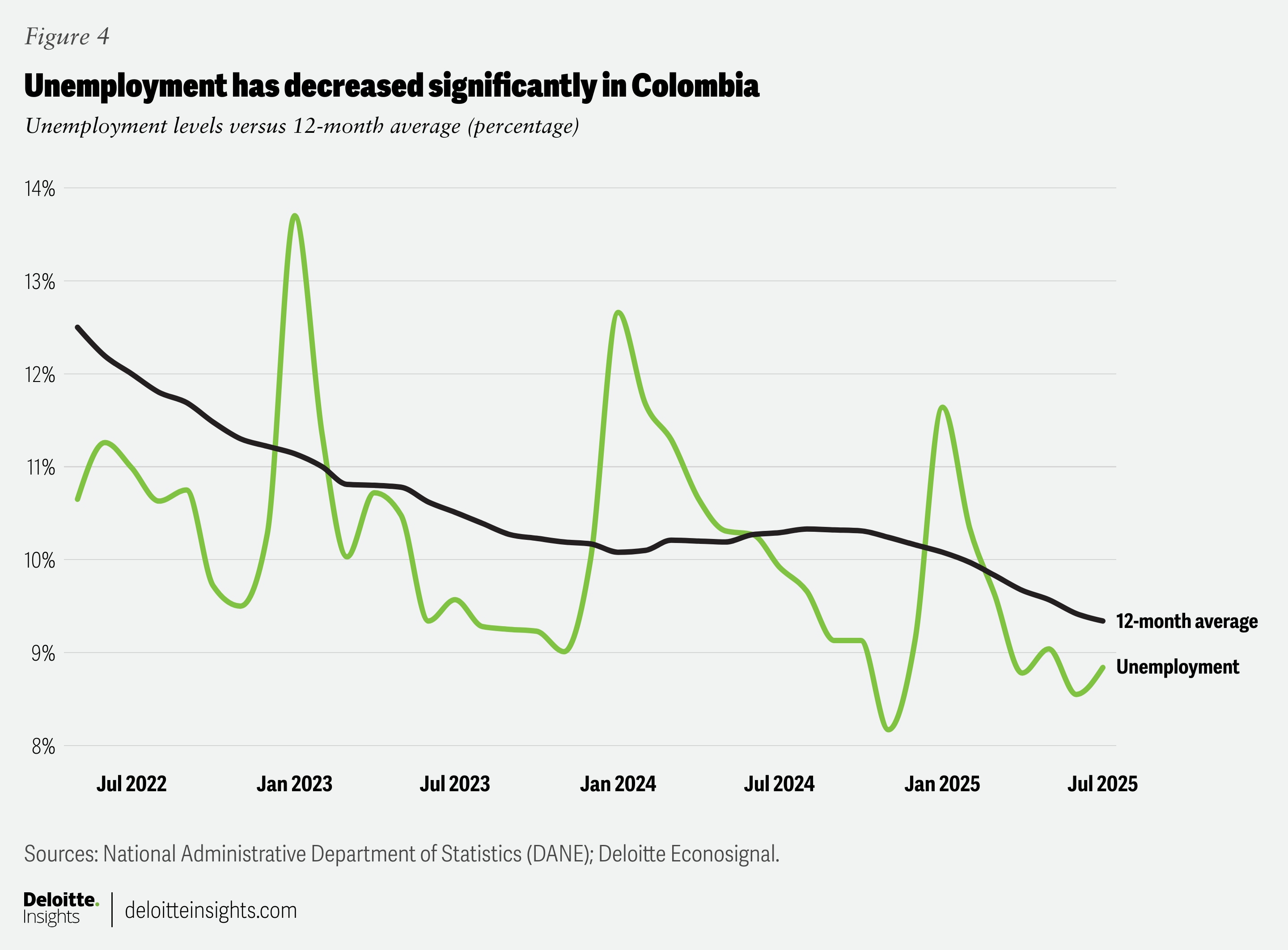

As of July 2025, Colombia’s labor market is showing signs of gradual improvement. The national unemployment rate declined to 8.8% from 9.9% a year earlier, while the 12-month average fell below 9.4%, reflecting a sustained recovery in employment conditions (figure 4).11 Labor force participation also increased slightly, reaching 64.6%, suggesting a modest reactivation in job-seeking behavior.12 Informality remains high, but has edged down to 55% from 55.9% in 2024,13 indicating progress in formal job creation.

However, changes to labor market regulations, which the government enacted in June 2025, could increase labor costs, particularly for small businesses. This change may limit the pace of formal job creation and partially offset the gains observed over the past year.

A new labor force regulation has increased surcharges for overtime, Sundays, and holidays, also adjusting night shifts to start at 7 p.m. (9 p.m. previously) and end at 6 a.m.

Exchange rate: Slight appreciation and stability expected

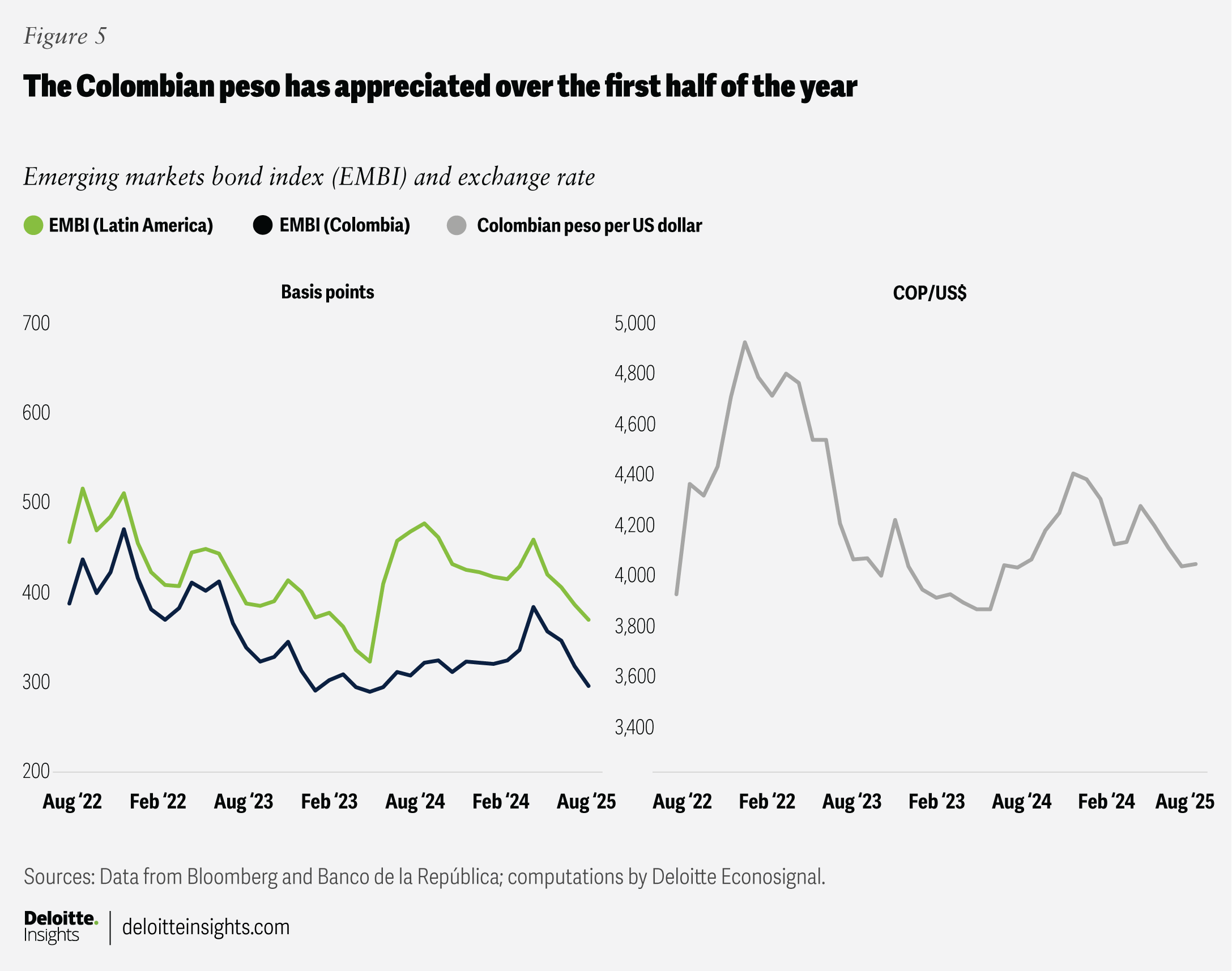

Over the past year, the Colombian peso has gradually appreciated against the US dollar, reflecting a more favorable external positioning for the country. This movement has occurred in parallel with a decline in sovereign risk premiums, seen particularly in the emerging markets bonds index (EMBI) for Colombia, suggesting improved investor confidence amid a more stable macroeconomic environment (figure 5).

The narrowing spread compared to regional EMBI also points to a differentiated perception of Colombia’s fiscal and institutional trajectory.

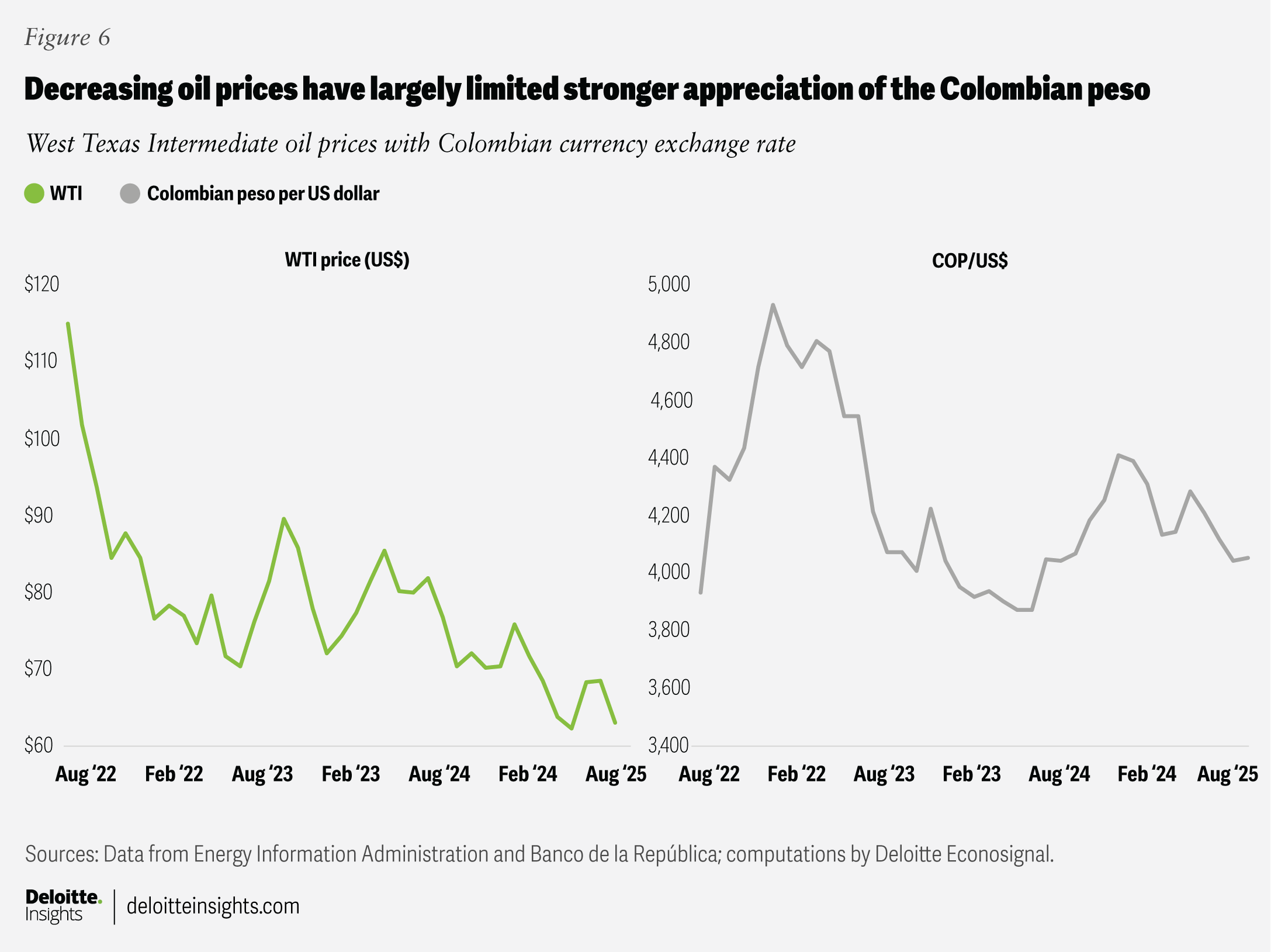

At the same time, oil prices have decreased but remain within a relatively stable range, providing stability to the currency but limiting a more pronounced appreciation (figure 6). While the exchange rate continues to exhibit sensitivity to global commodity cycles and risk sentiment, recent behavior suggests a shift toward lower volatility and greater alignment with economic fundamentals.

Looking ahead, the peso’s trajectory is expected to largely depend on the stability of the external macroeconomic climate—broadly speaking, the environment offers a window of relative stability. A potential easing of US monetary policy and a rebound in global commodity demand could support further strengthening.

Conversely, external shocks and pressures to Colombia’s fiscal accounts remain key downside risks that could shift the balance toward renewed depreciation. Accordingly, the exchange rate is expected to close next year at 4,000 Colombian pesos per US dollar, with levels going as high as 4,200 pesos per dollar over the same period.

Colombia’s fiscal framework projections

According to the Medium-Term Fiscal Framework, published by the Ministry of Finance and Public Credit in mid-2025, a deterioration was observed in most macroeconomic assumptions compared to the ministry’s Financial Plan released earlier in the year.14 In particular, projections for central government revenues and expenditures worsened, implying a potential increase in the fiscal deficit.

The only two assumptions that did not deteriorate were the annual GDP growth rate, set at 2.7%, and year-end inflation, projected at 4.5%. Although economic activity has accelerated during 2025, cumulative growth for the first two quarters stood at 2.4% year on year, while inflation reached 5.1%, suggesting that the ministry’s assumptions in the medium-term framework may have been slightly optimistic. Consequently, the fiscal deficit at year-end could exceed the 7.1% share of GDP projected in the framework, primarily due to lower-than-expected tax revenues.

It is important to note that a deficit of 7.1% does not comply with the fiscal rule. As a result, the government has activated an escape clause embedded in the constitution, temporarily suspending fiscal rule application.

The objective of this suspension is to ensure compliance with fiscal obligations that were at risk due to rigidities in public spending, with the intention of subsequently normalizing the deficit trajectory. However, the implementation of the country’s new pension system, which took effect in July 2025, and changes to the general participation system will increase spending pressures in the future. Without offsetting reductions in other expenditure categories, it will be difficult to return to a moderately low deficit level that does not entail higher debt.

New tax reforms

Colombia’s proposed tax reform, presented by the government in September 2025, aims to raise 26.3 trillion Colombian pesos (1.5% of GDP) in 2026 through the reduction of tax benefits, a broadening of the tax base, and the introduction of new taxes.15 Key measures include the expansion of the wealth tax (up to a maximum rate of 5%, compared with the current 1.5%), an increase in the top personal income tax rate to 41% (currently 39%), and a permanent 15% surcharge (currently up to 10%) on financial institutions.16

The 19% value-added tax (VAT) on online gambling activities, introduced temporarily at the beginning of the year, has been maintained. Preferential VAT treatments on fossil fuels will be eliminated, and taxes on gasoline, diesel, and biofuels will also be gradually increased, which will affect prices. Additionally, taxes on alcohol and tobacco will be redesigned.

The reform is expected to have a negative impact on economic activity, primarily due to the increase in fuel prices. The absence of expenditure cuts remains the main weak link that could hinder its approval in Congress. The deadline for approval was set for October 2025.

Cautious monetary policy

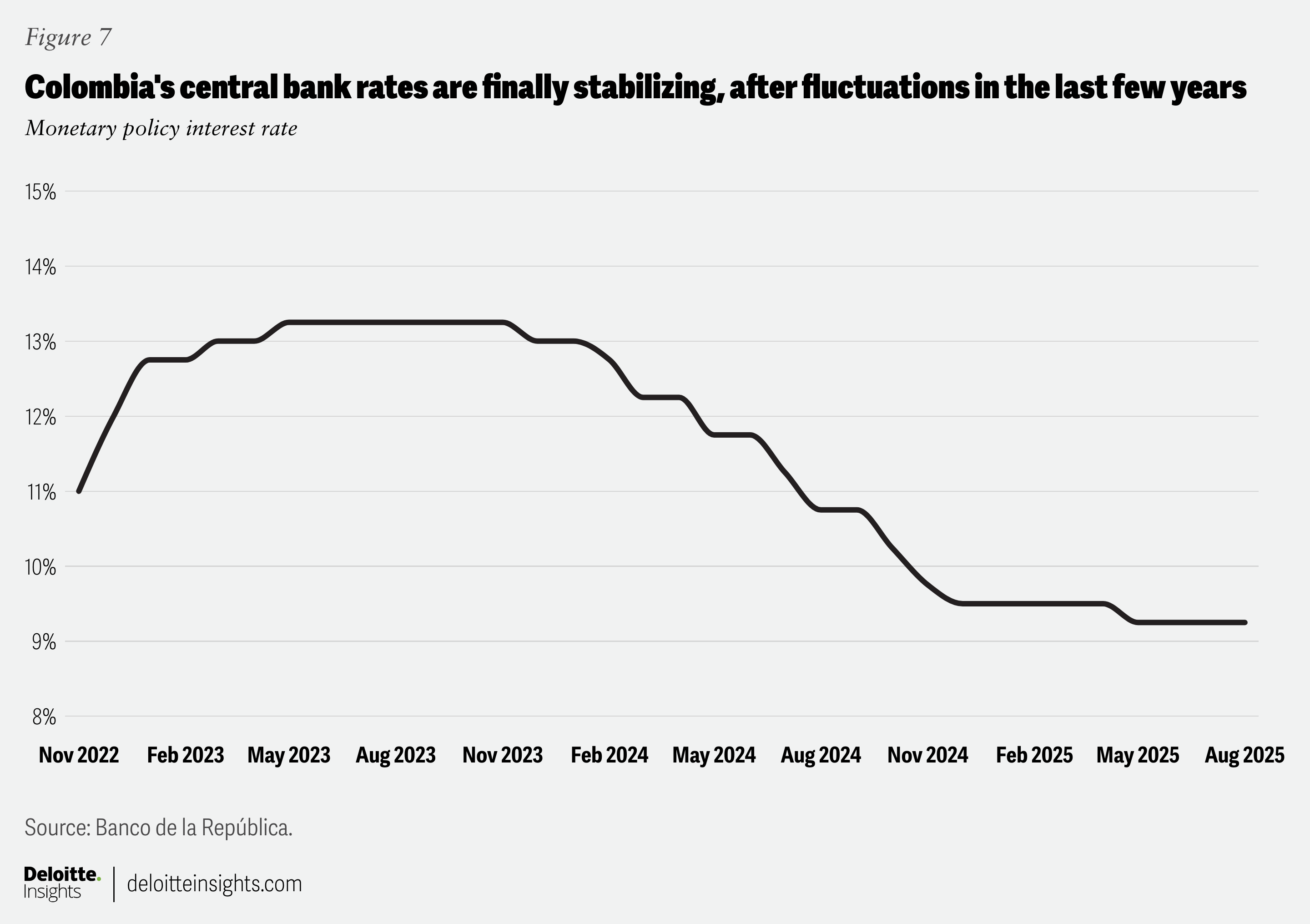

The monetary policy implemented by the Banco de la República this year has been characterized by a restrictive and cautious stance, aimed at bringing inflation down toward its 3% target. Although inflation declined in early 2025, the pace of reduction was slower than expected, and the recent uptick in prices has made it more difficult to meet the target.

At its most recent meeting (July 2025), the central bank’s board of directors decided to maintain the policy interest rate at 9.25%, acknowledging that the effects of monetary policy take time to materialize (figure 7). This decision reflects persistent inflationary pressures, particularly in food, services, and regulated items, as well as strong private consumption and a resilient labor market.

The Colombian economy is facing a challenging external environment, marked by high global uncertainty, domestic fiscal deterioration, and an elevated sovereign risk premium. Hence its restrictive monetary policy seeks to balance inflation reduction with macroeconomic stability. Consequently, it is highly likely that the interest rate will remain unaltered for the rest of the year.

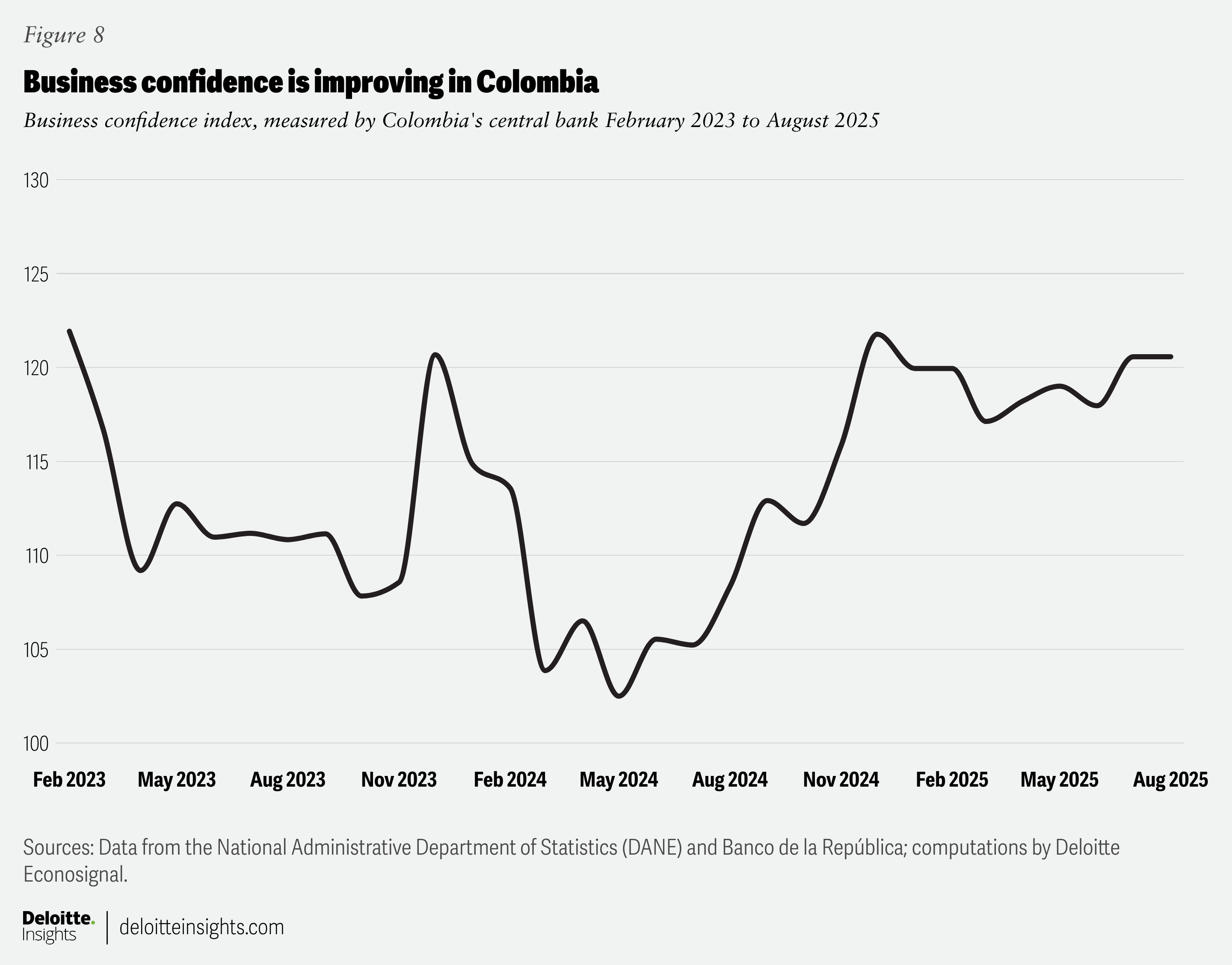

Business confidence: Future trajectory looks promising

The business confidence indicator, calculated by the central bank based on its survey of companies, has shown a positive trend since May 2024.17 This is consistent with the recent improvement observed in investment and suggests that the Colombian economy could maintain solid performance in 2026.

External sector: Foreign direct investments stabilize while tourism and service exports experience considerable growth

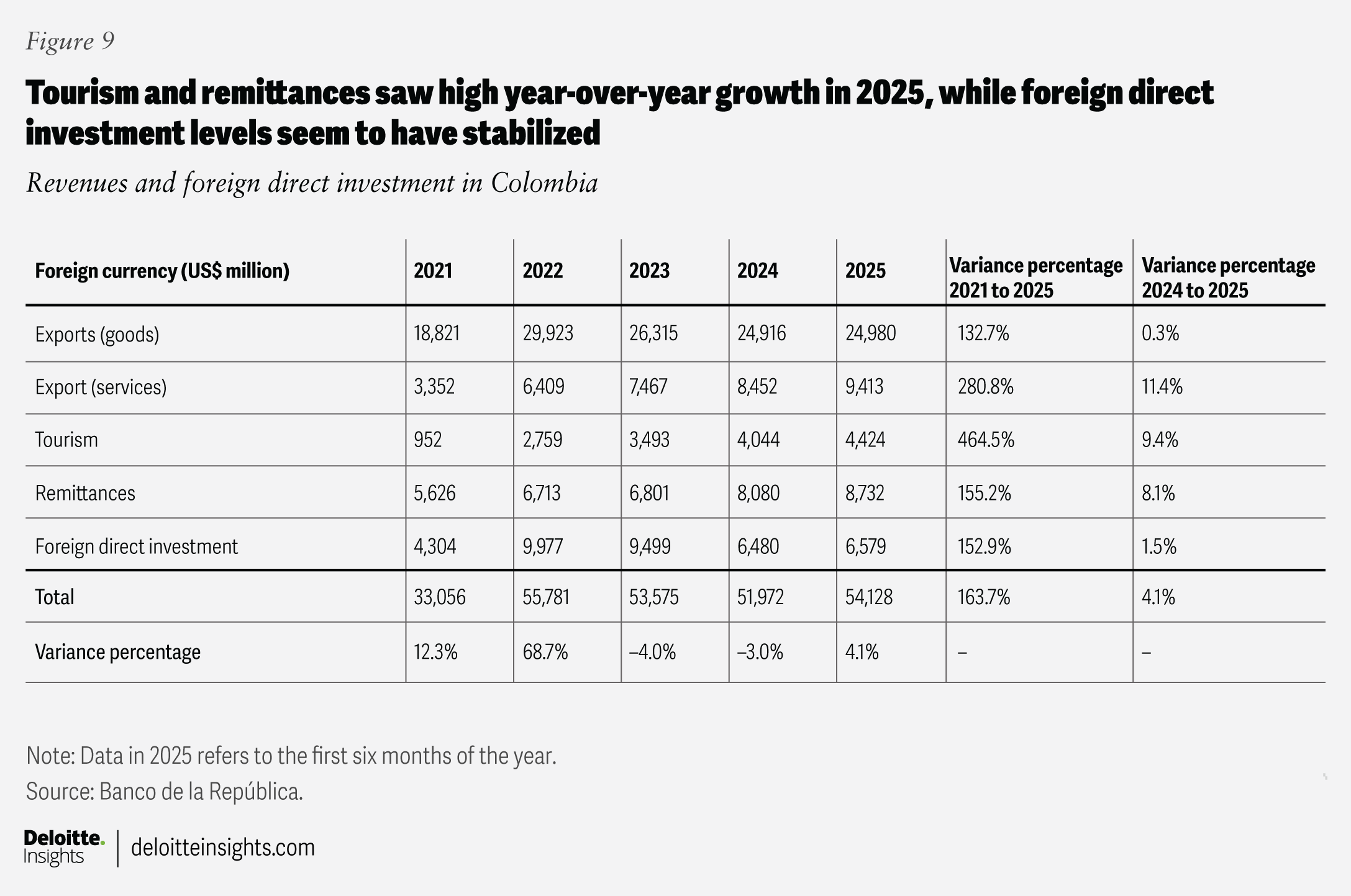

Colombia’s foreign currency inflows are showing signs of stabilization this year, following a period of strong post-pandemic recovery. Total inflows reached US$54.1 billion, reflecting a modest annual growth of 4.1% compared with 2024.18

Goods exports remained steady at nearly US$25 billion, showing minimal growth, while service exports continued their upward trend, rising by 11.4% to US$9.4 billion (figure 9).19 Tourism also contributed positively, with revenues climbing to US$4.4 billion—an increase of 9.4%—underscoring the sector’s resilience and growing international appeal.20

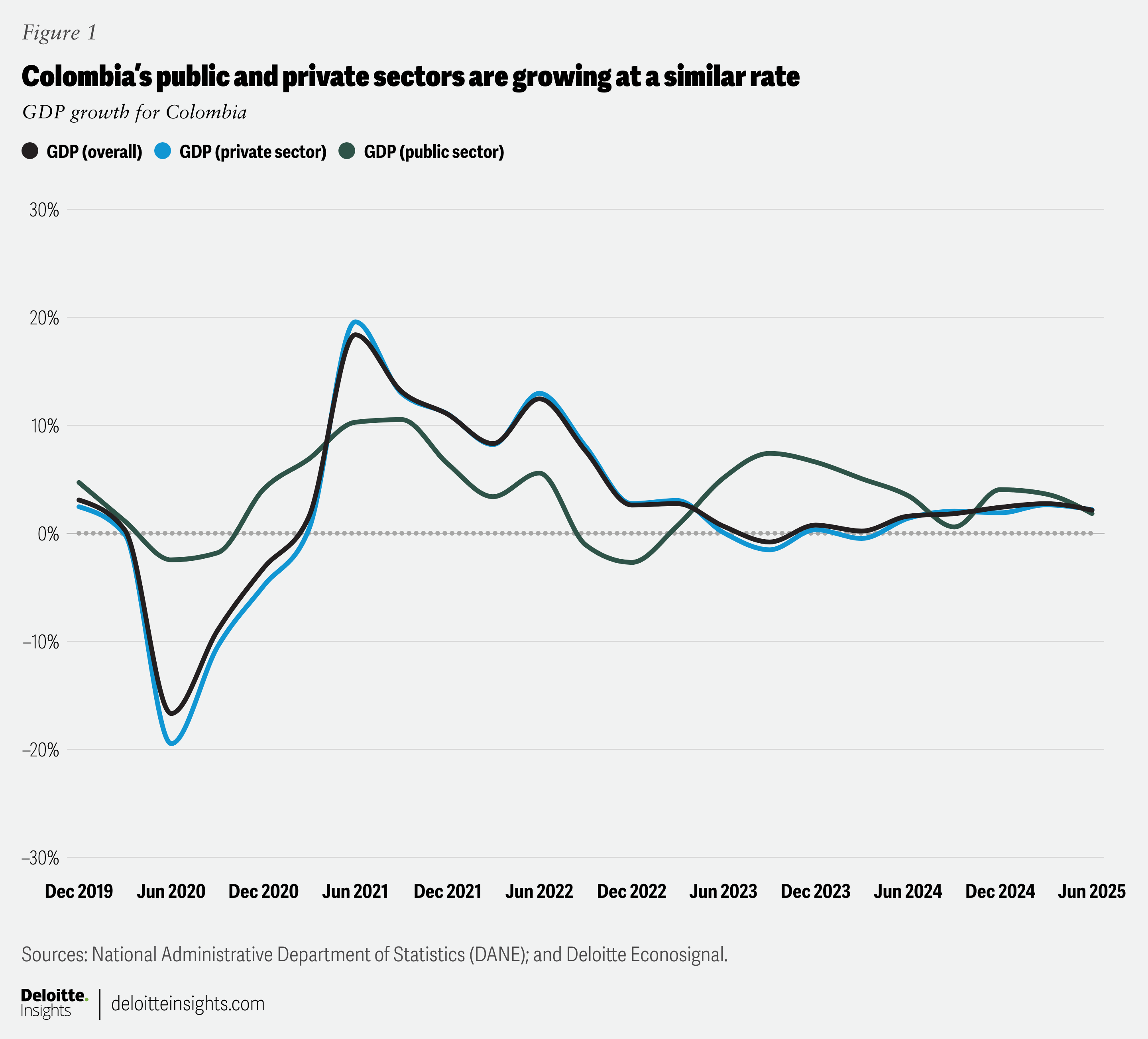

Colombia’s economy is projected to grow by 2.5% in 2025, with the most dynamic sectors being entertainment (8%), financial and insurance services (6.3%), and retail (5.1%).

Remittances saw a healthy rise of 8.1%, reaching US$8.7 billion, reaffirming their role as a stable source of external income.21 However, recent US immigration policy changes and the introduction of a 1% tax on cash remittances may pose challenges to future growth.

Meanwhile, foreign direct investment showed a slight recovery, growing 1.5% to US$6.6 billion, suggesting cautious optimism among international investors.22

Overall, 2025 appears to be marked by moderate growth across most categories, with services and tourism continuing to gain relevance in Colombia’s external income structure.

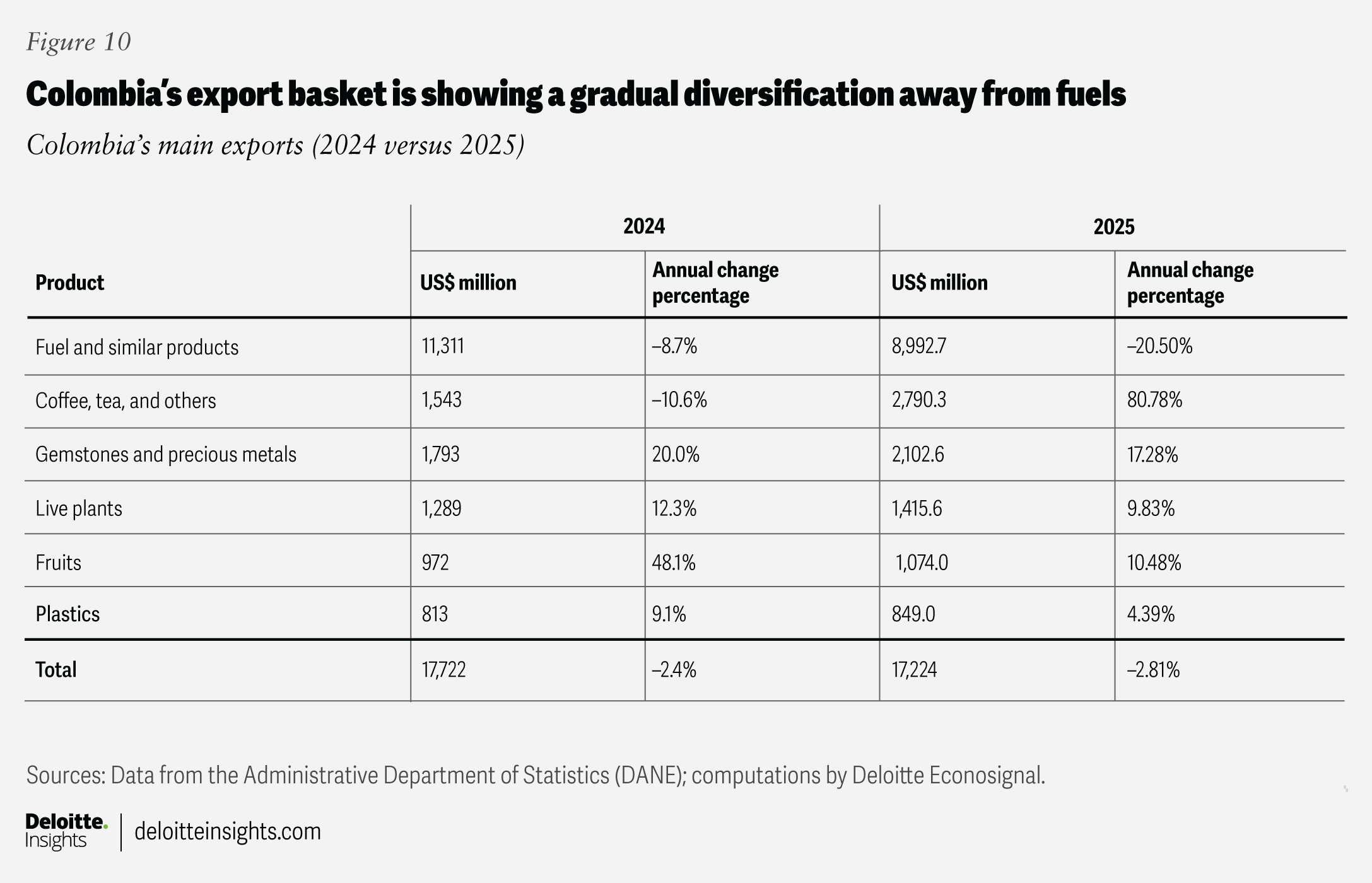

Exports

From January to June 2025, Colombia’s total exports of goods and services increased by 1.6%, compared with the same period in 2024.23 However, fuel exports, which accounted for 37% of total exports (in 2024, oil exports accounted for 47% of total exports), declined by 20.5%, reflecting global price adjustments, lower demand, and a local production decline (figure 10).24

Colombia’s main exports showed mixed performance: While total exports declined slightly by 2.8%, key agricultural products like coffee, tea, and related goods surged by over 80%, reaching US$2.79 billion.25 Gemstones and precious metals also grew steadily, up 17.3%. Fruits and live plants maintained positive momentum, while plastics saw only marginal growth of 4.39%.26

This shift suggests a gradual diversification away from traditional commodities, with stronger prospects for agro-industrial and value-added sectors.

Imports

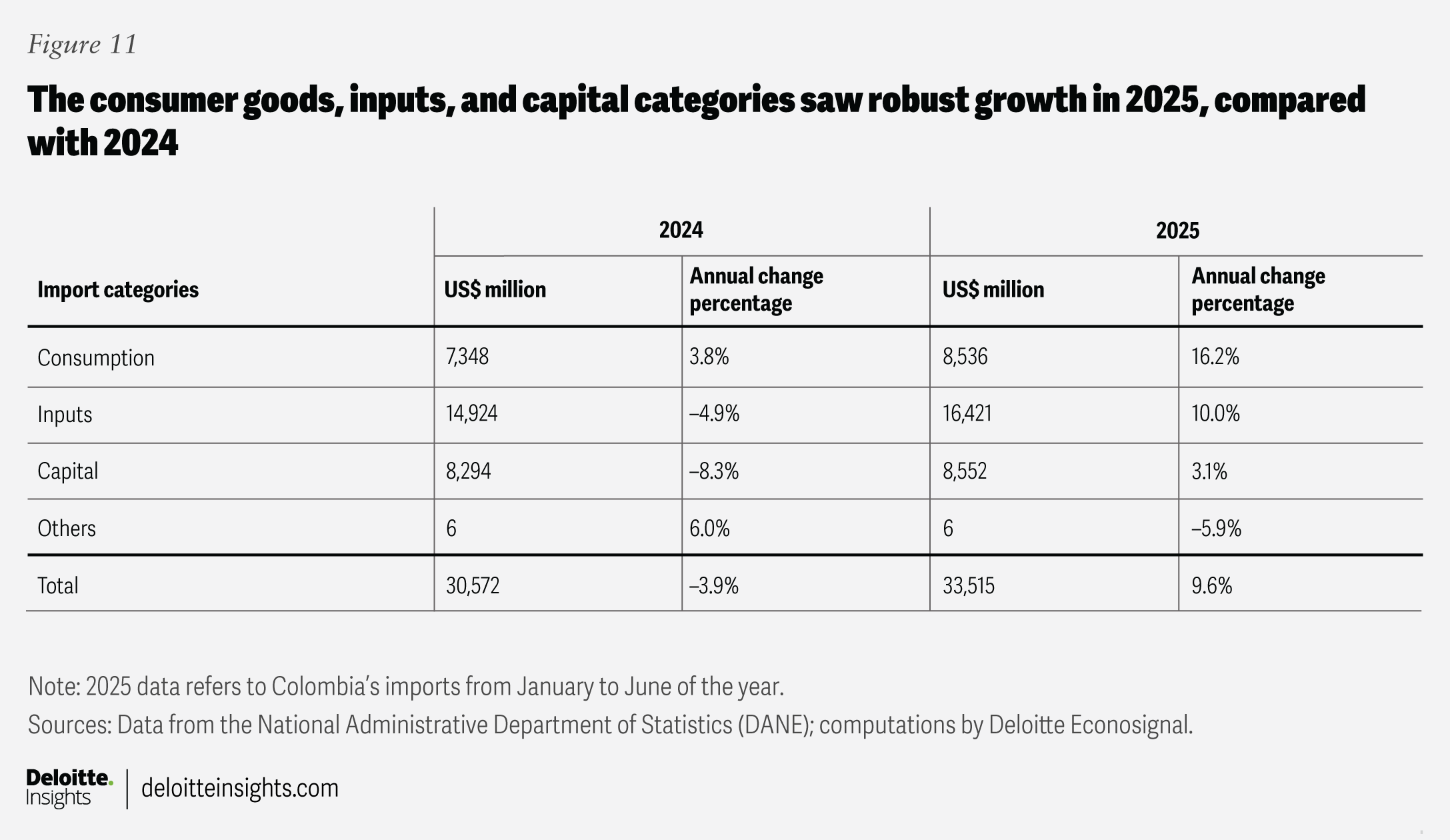

Colombia’s imports from January to June 2025 rebounded, growing 9.6% to reach US$33.5 billion.27 The increase was driven mainly by higher demand for consumer goods, which rose 16.2%, and inputs for production, which grew 10% (figure 11).28 Capital goods also showed a modest recovery of 3.1%, after a decline the previous year. This trend suggests a more active domestic economy.

Sectoral trends

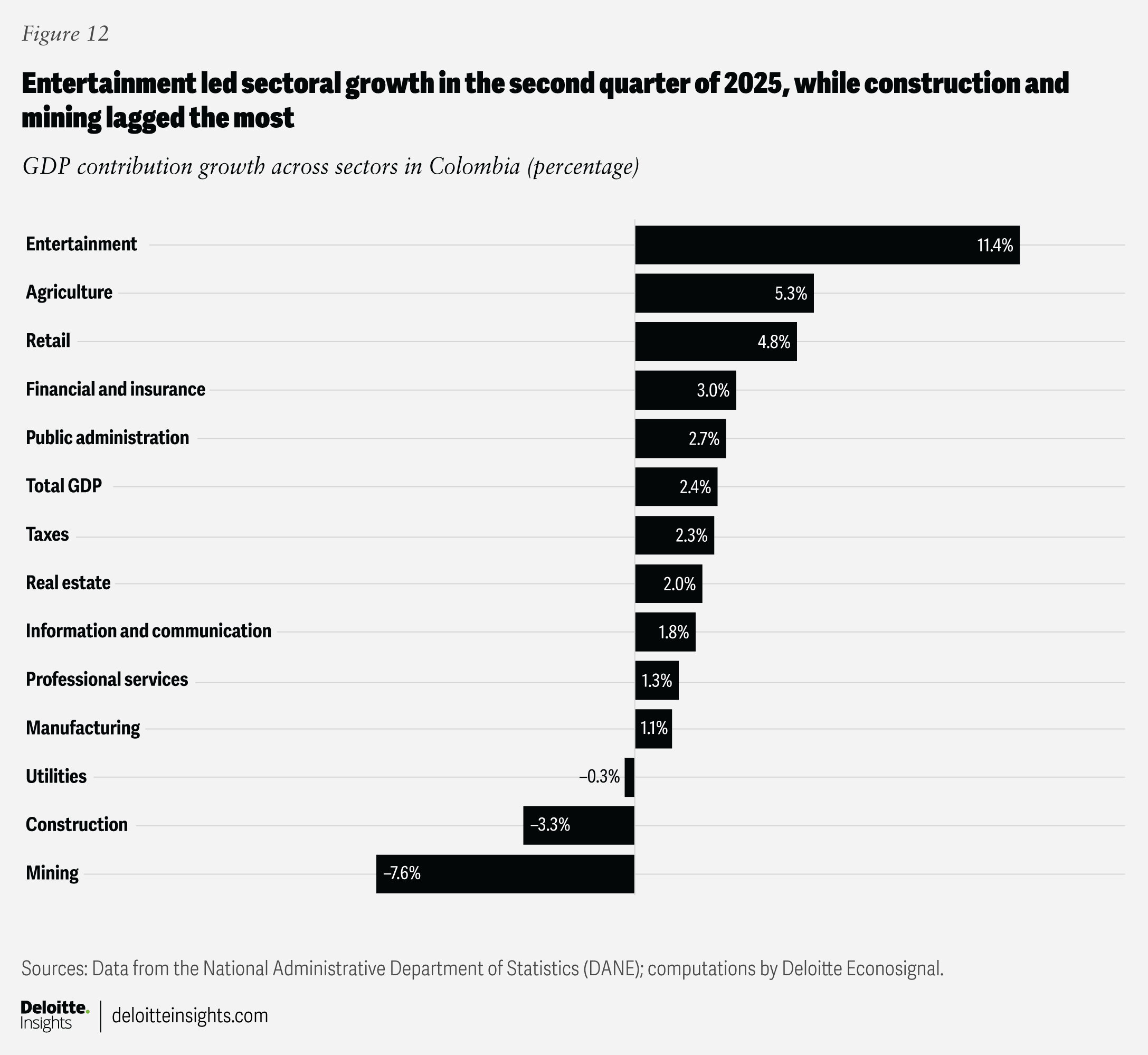

As of the second quarter of 2025, Colombia’s economy grew by 2.4% since the beginning of the year, with notable differences across sectors (figure 12). The strongest performance came from entertainment, which expanded by 11.4%, largely driven by the growth of digital platforms and streaming services.29 Agriculture and retail also posted solid gains of 5.3% and 4.8%, respectively, suggesting resilience in household consumption and food production.30

The financial and insurance sector grew 3%, slightly above the national average, while public administration, real estate, and information and communication showed moderate but steady growth. These sectors contributed to a more balanced expansion, even as traditional engines like manufacturing (1.1%) and professional services (1.3%) lagged.31

On the downside, utilities contracted slightly (0.3%), while construction and mining experienced significant declines of 3.3% and 7.6%, respectively.32 These negative results reflect ongoing challenges in investment and extraction industries, which continue to weigh on broader economic momentum.

Colombia’s economy is projected to grow by 2.5% in 2025, with the most dynamic sectors being entertainment (8%), financial and insurance services (6.3%), and retail (5.1%). These areas are expected to lead the expansion, while sectors like agriculture are projected to grow at a moderate pace (4.2%), compared to the aforementioned, more dynamic sectors.

In 2026, overall growth is expected to remain stable, but with a shift in sectoral momentum. Financial and insurance services are projected to accelerate to 6.7%, becoming the top-performing sector, while entertainment and agriculture will likely slow to 5.2% and 3.2%, respectively (figure 13).