Emerging markets

Divergent economic outcomes and risks ahead

A further rise in inflation, waning of global demand for goods, and a prolonged dip in tourism may negatively impact emerging markets this year.

The economic performance of emerging market economies since the onset of the pandemic has varied considerably. Goods exporters have generally fared relatively well, while service exporters have struggled amid the lack of tourism. Moreover, vaccination rates and policy choices have added to that variation. Higher rates of vaccination can ward against pandemic-related shocks to domestic demand. They also reduce risks for potential tourists and enable policymakers to impose fewer restrictions on mobility and border controls as their populations are better protected. Although growth in emerging market economies should continue this year and next, risks remain weighted to the downside. Another wave of infections may possibly lead to weaker economic growth, particularly for countries with low shares of fully vaccinated populations. Government balance sheets, meanwhile, have mostly weakened as the pandemic-induced recession reduced revenue and expenditures grew as countries provided support to their populations while their economies stalled. Rising interest rates in the United States can weaken emerging market currencies and exacerbate inflation.

On a more promising note, several emerging market countries have very high rates of vaccination. Countries such as Chile, Malaysia, and Brazil have vaccination rates above 70%, which is consistent with rates seen in advanced economies.1 However, low-income countries had fully vaccinated less than 6% of their populations by February 2022. For lower-middle-income countries, this figure stands just shy of 42%.2 Even countries with high vaccination rates will not necessarily be adequately protected against future strains of the virus. Slow vaccine dissemination and hesitancy among populations remain serious risks to preventing worsening economic outcomes in the face of vaccine-resistant strains of the virus. Should such strains materialize, emerging market economies are likely to suffer disproportionately relatively to their advanced counterparts.

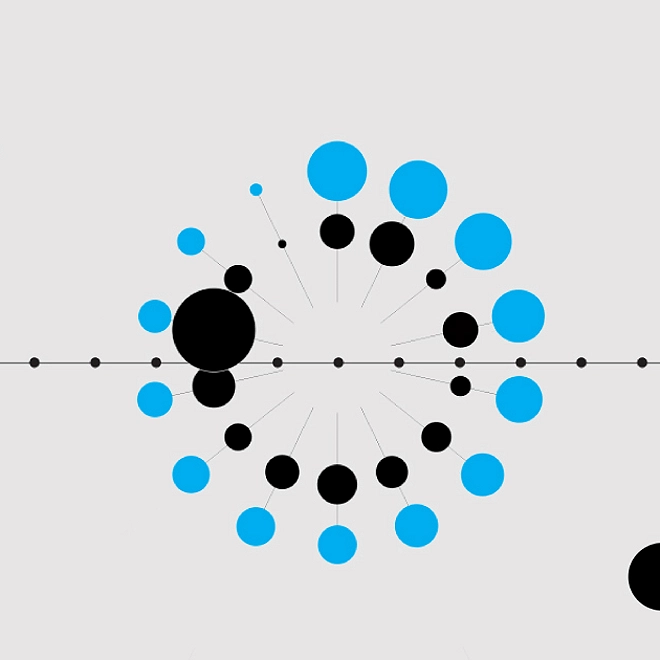

Goods exporters outperform

The global surge in demand for goods and the related commodity price boom have helped many emerging market countries boost their exports (figure 1). In nearly every major emerging market economy, goods exports increased by double-digit percentages over the last two years.3 This is true even after controlling for currency depreciation. High energy prices have favored oil exporters, such as Russia, and improved their terms of trade.4 They also boosted the exports of these countries without raising their import costs, allowing their trade balances to soar. Russia’s trade balance, for instance, increased notably over the last two years, raising its current account balance by more than 5 percentage points of GDP.5 Real GDP for many oil producers, such as Russia and Saudi Arabia, is already above prepandemic levels.6

Energy exporters were not the only countries to see solid trade-related gains. Major nonenergy commodity producers, such as Chile,7 Peru,8 and South Africa,9 posted double-digit percentage increases in their terms of trade. The commodities these countries export, such as base and precious metals, have witnessed significant price increases, helping offset the rising cost of imported energy. As a result, these countries’ trade balances have provided a much-needed support to their economic growth.

Other types of exporters have also fared relatively well. As global demand for in-person services fell amid pandemic-related risks and restrictions on mobility, demand for goods surged. This new spending pattern lifted exports for major goods producers, particularly those involved in technology supply chains. Some of the strongest growth for these types of exports were seen in Vietnam,10 Taiwan,11 and Malaysia.12 Despite a deterioration in the terms of trade in Vietnam and Taiwan, both countries posted sizable increases in their trade balances. Evidently, the rise in the cost of imports was offset by the increase in demand for their exported goods.

Tourism exports to see encouraging, but subdued, improvement in 2022

Service exporters (primarily tourism) have struggled as the pandemic shut borders and diminished demand for travel. Only a few countries managed to keep travel-related expenditures relatively buoyant. Mexico stands out in this group, as its international tourist expenditures were higher at the end of 2021 than they had been two years prior.13 Other central American economies also performed relatively well, thanks to their proximity to the United States and relatively lax restrictions. Even countries such as Turkey14 and Kenya,15 where visitor arrivals were down 20% and 38%, respectively, over two years, performed reasonably well considering the incredible challenges tourist-reliant countries faced as the risks of the pandemic continued.

Most other tourist-reliant economies, particularly those in Southeast Asia, were not nearly as fortunate. By the end of 2021, tourism in Thailand,16 Malaysia,17 and the Philippines,18 was still down more than 90% from two years prior. All three countries rely relatively heavily on tourism and all of them had relatively stringent restrictions in place that made it difficult to enter the country for vacation. Thailand, for instance, did not significantly reduce its border restrictions until November 2021, preventing tourism, one of its most important sectors, from getting anywhere close to prepandemic levels.19 Similar situation prevailed in the other two countries, and as a result, real GDP in all three countries in 2021Q3 was more than 5% below where it had been before the pandemic.20 Although international tourism is expected to improve in 2022, it is unlikely to return to its prepandemic trend.

Uneven inflationary pressures

Emerging market economies, like the rest of the world, have witnessed a surge in inflation, driven primarily by higher commodity prices, supply chain disruptions, labor shortages, and a surge in demand for goods (figure 2). Turkey has experienced some of the worst consumer inflation, with prices rising an average 19.5% per year between December 2019 and December 2021.21 Turkey’s inflation problem, however, has more to do with its currency plummeting more than 90% over the last two years and a highly accommodative central bank. Indeed, Turkey’s central bank has been lowering its policy rate despite alarmingly high inflation.22 Other emerging market central banks have also maintained highly accommodative monetary policy despite high inflation and rapid currency depreciation. Policy rates in Ukraine23 and Pakistan,24 for example, were 4.5 and 3.5 percentage points below where they were two years ago, respectively. Inflation has, meanwhile, been running above a 7% annual average during the last two years.

In Brazil, too, inflation has averaged above 7% over the last few years,25 but its central bank has started to act more aggressively to get it under control. The central bank of Brazil raised its policy rate by 7.25 percentage points over the last year alone.26 Additional interest rate hikes may be necessary to bring inflation back in line with the central bank’s target.

Inflation in Asian emerging markets has been much less pronounced so far. Malaysia,27 Thailand,28 Vietnam,29 and Indonesia30 have all seen consumer inflation average less than 2% over the last two years. Their central banks have succeeded in keeping interest rates relatively low without experiencing runaway inflation. However, accommodative monetary policy in many emerging markets is likely to come to an end soon. As Asian countries reopen their economies more fully, inflationary pressures are likely to build. Plus, high energy, food, and commodity costs will likely add to cost pressures.

Financial conditions will tighten this year

As mentioned earlier, the ability of emerging market central banks to keep monetary policy loose is likely coming to an end this year. Central banks of developed economies, including the US Federal Reserve, are embarking on tighter monetary policy. Historically, such a policy change in the United States causes capital outflows from emerging market economies, thereby depreciating their currencies. Weaker currencies can add to the pre-existing inflationary pressures as imports become more expensive, and they can make servicing foreign currency debt more expensive. Stronger external positions and a smaller share of debt denominated in dollars should help most emerging market countries to avoid the currency crises seen in the 1980s and 1990s. Central banks of emerging market economies will have to choose between raising interest rates in line with the Fed or suffer the consequences of high inflation and a weak exchange rate.

Higher interest rates come at an inconvenient time for emerging markets. Most of these countries are running fiscal deficits. The handful of exceptions are mostly limited to oil producers such as Saudi Arabia31 and Russia.32 Other countries have seen their government finances deteriorate and their debt burdens rise. This also comes at a time when global growth is expected to slow and pandemic flare-ups could re-emerge. Oxford Economics estimates that gross government debt to GDP ratios in Morocco, Hungary, South Africa, Colombia, Malaysia, Thailand, and the Philippines are above 50% and grew by double digits between 2019 and 2021 (figure 3).33 Of those countries, only Malaysia and Thailand are expected to see their debt to GDP ratios come down by 2023. Brazil and Egypt posted slightly smaller increases to their government debt ratios but currently both countries have debt levels in excess of 80% of GDP.34

Throughout the pandemic, the G20 implemented debt-relief programs to support low-income countries.35 However, most of these initiatives do not include the middle-income countries discussed in this paper. Should financial conditions for these countries worsen, debt restructuring may become necessary. Such restructurings often require extended periods of time to work through, which further delays the country’s economic growth and ability to finance crucial investments that can raise productivity and living standards.

As the global economy attempts to renormalize after the pandemic-induced recession, emerging market economies are expected to face a bumpy road ahead. The International Monetary Fund anticipates growth in emerging markets will slow by roughly 2 percentage points this year.36 Tighter financial conditions in the United States and other advanced economies will pressure their own finances and currencies, which could exacerbate inflation and make servicing debt more challenging. As global demand wanes this year and next, goods exporters may find it difficult to maintain their growth trajectories. Furthermore, tourist-dependent economies will need the pandemic to recede further so visitors can feel more confident about traveling again.

Risks in the outlook for emerging markets are weighted to the downside. A faster-than-expected tightening from the United States could make financing and inflation conditions in emerging markets even worse than currently anticipated. A deterioration in China’s property sector and economic outlook, meanwhile, could create additional headwinds for commodity exporters. On the upside, faster progress on the development and dissemination of vaccines that can provide protection against future variants and to broader populations could accelerate the return to normal for tourist-dependent economies.

Most emerging markets would benefit from several policy changes to mitigate the negative aspects of the outlook. Stronger fiscal balances today will help restrain debt accumulation, which can allow policymakers to offer more support should conditions deteriorate. Extending debt maturities and fixing currency mismatches when possible will reduce the costs of rolling over debt in the coming years. Finally, improving the global coordination needed to ensure the populations in emerging markets have ample access to the health care tools necessary to end the pandemic would raise economic growth.

Deloitte Global Economist Network

The Deloitte Global Economist Network is a diverse group of economists that produce relevant, interesting, and thought-provoking content for external and internal audiences. The Network's industry and economics expertise allows us to bring sophisticated analysis to complex industry-based questions. Publications range from in-depth reports and thought leadership examining critical issues to executive briefs aimed at keeping Deloitte’s top management and partners abreast of topical issues.