Unleashing value from digital transformation: Paths and pitfalls

Our analysis of 10 years of financial disclosures from more than 4,000 global organizations reveals where digital transformation actions can increase enterprise value—and, just as importantly, where they can erode it.

Digital transformation is on everyone’s agenda. But the hardest part of any transformation is not deciding whether to embark on it; it’s understanding whether you’re seeing distinctive returns on your investment. Organizations often struggle to determine which actions drive the most impact and which investments yield the most enterprise value.

We examined which actions can increase the odds of transformation success, and we identified the actions that drive value: those that, when combined, can create outsized returns on tech investments and those that, when done in isolation, can destroy it. According to our analysis, the right combination of digital transformation actions can unlock as much as US$1.25 trillion in additional market capitalization across all Fortune 500 companies. But the wrong combinations can erode market value, putting more than US$1.5 trillion at risk. The takeaway: Getting digital transformation right takes more than just ambition and bold investments.

The power of being intentional in both words and actions

We applied data science to a decade of public shareholder filings, investor relations statements, and financial data. This covered more than three million pages of financial disclosures for 4,651 US and global firms listed on the New York Stock Exchange. The goal was to assess what impact, if any, digital transformation initiatives have on enterprise value, as determined by market capitalization.

We analyzed these financial disclosures to ascertain how companies talked about their digital transformation actions—namely, how they spoke to (1) implementing a digital strategy; (2) their discrete, strategically aligned technology investments; and (3) their efforts to prepare their people and processes for digital transformation. Since these investor communications are governed by SEC regulations, they serve as a proxy for digital transformation intentions and the actions taken by the enterprise.

We applied natural language processing to scan the documents for keywords related to these actions.1 We then used a series of financial models2 to look for correlations3 between how the companies explained their digital transformation plans to investors and other stakeholders, and what valuations were assigned to the companies.

The findings

We found that the link between strategy and action is the determining factor in a company’s ability to derive the most value from its digital transformation. Research shows these actions can increase enterprise value if executed with intent, yet not all actions are created equal.

Clarifying the actions

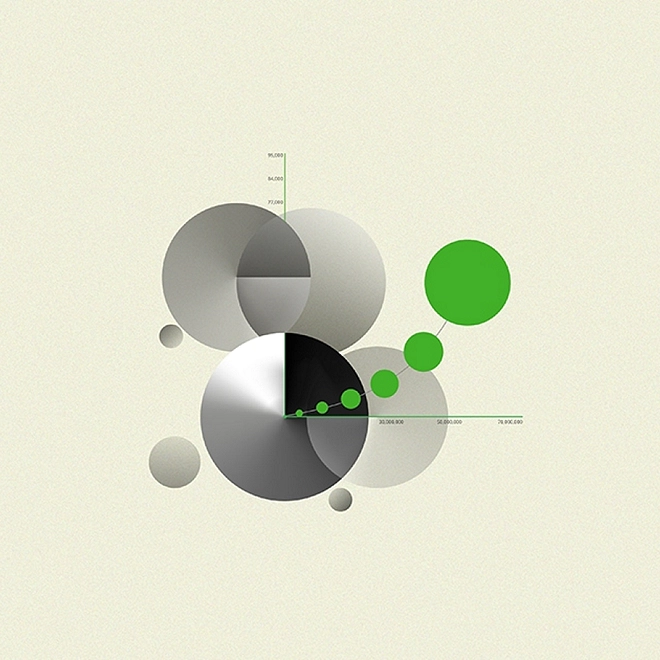

Our research began with a frequency analysis of terms commonly used to set strategies, enable technologies, and mobilize the enterprise for digital change. Once this data set was formed, we then pivoted to the relationships between select groups. These relationships were analyzed via clustering terms into various actions (figure 1).

These are the focal points most often discussed with our clients undergoing digital transformation and comprise a useful frame to understand how enterprises drive their efforts. In practical terms, they are defined as:

- Digital strategy: The strategic possibilities created by digital transformation. Examples of digital strategy terms include new digital capabilities, new markets, and new products—essentially, terms that describe efforts to enable a larger strategy, sometimes spanning multiple business units.

- Tech aligned to strategy: The technologies that come with digital transformation. When we say, “aligned to strategy,” we mean these technologies are being harnessed to achieve some discrete goal and bring the strategy to life.

- Digital change: The organization’s ability to adapt to and adopt new processes, resources, and ways of working. It refers to the more qualitative, human characteristics necessary for a transformation, encapsulating a multitude of talent domains.

How the individual actions drive value

Each of these actions was correlated to market capitalization. We examined the impacts of each individually and in various combinations to understand which combinations could yield the greatest value—and which could yield the least. Several distinct patterns emerged:

Digital strategy

When a company articulated its digital strategy in its financial disclosures, we observed a significant positive impact on valuation. This is where many organizations start their digital transformation value journey, though only 44% have a high maturity related to this action.4 We hypothesize that the market understands the impact of “digital” on all companies regardless of industry and gives management credit for taking action to modernize the business in support of a broader strategy. Perhaps evidence of action, no matter how general, demonstrates an organization’s prioritization of digital goals.

Technology aligned to strategy

When we found evidence of technology aligned to strategy in companies’ financial disclosures, the valuation impact was two times higher than that of digital strategy. We believe the higher valuation is due to the specificity of technologies mentioned (figure 1). This likely gives stakeholders a more tangible sense of strategies employed, and a way to keep closer tabs on where the enterprise is placing its capital bets—which, for many, can be massive. Many of these technologies are also viewed as emerging or leading-edge and can reflect a forward-looking approach to improved performance.

Digital change

Despite the positive news around the previous two actions, our research uncovered a cautionary tale for digital change. When analyzing disclosures that articulated change programs in general terms or without reference to specific digital actions, we found that market capitalization eroded. When observed on its own, digital change was nearly three times less impactful than digital strategy and put existing market cap at risk of erosion.

We believe this occurs for two reasons. First, change for change’s sake, without purpose or any ties to a broader strategy, is insufficient. It lacks the specificity to mobilize stakeholders and rally them around shared interests. Second, many stakeholders understand that change can yield a high degree of uncertainty. Without a specific plan, stakeholders discount management’s ability to move the organization forward. Confidence is lost, momentum is impaired, and leadership could be viewed as chasing the latest management fad.

Consider Agile adoption over the years. Solving for a scaled Agile organization and achieving enterprise agility5 is certainly complex. It involves upskilling talent, building the right product teams, and instilling a new organizational mindset. But it goes well beyond that. To realize the value of Agile—the products enabled, the velocity expected, and the customer experience impacted—it all has to tie back to the enterprise strategy. If an Agile enterprise is built without these in mind, the enterprise is simply adopting a management trend and not taking full advantage of Agile as a solution. Our research suggests this is a path to value destruction.

Individual actions: The upshot

According to our analysis, if you can only do one thing, focus your efforts on technologies aligned to strategy because it drives superior market value. And the more specific you can be with stakeholders, the more you’re rewarded in the market. There’s power in being vocal about your actions with investors and other stakeholders. Think about investor relations as a possibly overlooked tool in your arsenal—a way to signal your confidence in the plans you have made and the actions you intend to take, and to demonstrate how strongly digital transformation figures into the enterprise’s plans.

How combined actions shape value

After we analyzed each of the actions individually, we looked for combinations that could unlock (or destroy) even more value. The results are compelling: Specific combinations of actions can yield up to a 5% increase in market capitalization, while other combinations can lead to significant value erosion risks of as much as 9%.

Transformers rejoice: Value is there if you execute with intention

The most positive combination is the digital trifecta: the presence of an articulated digital strategy, where specific technology investments are aligned and set, and the organization is mobilized and ready to manage the change. This equates to a value impact 1.2 times that of digital strategy applied individually, and nearly 3.5 times that of change capability on its own.

While it would be easy to dismiss the trifecta catalyst as conventional wisdom, the evidence shows otherwise.6 Only 34% of Fortune 500 companies we analyzed showed signs of being strategic about their technology investments in their financial disclosures. It’s possible that the remainder are making important investments but have lost the plot line, are reluctant to disclose “too much” to competitors, or don’t know how best to convey the impact of those investments.

Transformers beware: Where you have the will, make sure you have the way

Our analysis revealed that change capability is the wild card: Its presence can make or break value for the enterprise. On its own, it’s a value eroder. As part of the trifecta, it’s a value catalyst. But when it’s entirely absent, we observed the worst outcome of all.

We found evidence that the combination of digital strategy and technology-aligned investments without change capability results in a significant erosion of enterprise value. The losses are 10 times greater than those seen with the other value destroyer: digital change on its own. In fact, it’s the most negative combination, posing a 9% value erosion risk that could cost Fortune 500 firms US$1.5 trillion in value.7

But how can that be? How can the same actions that create an outsized return also destroy value? Digital transformations require buy-in at the onset, commitment to sustain, and organizational incentives to match. If you lack the capability to adopt and use those technologies or to bring the organization along on the change, you’ve wasted significant time, attention, and capital. Digital transformation, in this instance, becomes a distraction for management and top talent. Stakeholders are savvy enough to understand how hard transformational change can be and, as a result, significantly discount the value of the enterprise.

To combat the risks, how and when the organization directs its change capability can be a difference-maker. While it has a negative relationship to market cap on its own, when combined with one or two of the other actions, it’s an essential value catalyst. It turns the most negative scenario into the most positive one.

What impact do individual technologies have on market cap?

While our analysis suggests that discrete technology investments aligned to strategy can drive twice the competitive market capitalization than simply having a digital strategy, certain technologies are quicker to yield value than others.

Cloud was first out of the gate to spark digital transformation. It’s also a natural fit for our analysis, as it serves a forcing function from the strategy to the operating model changes that come in adoption. AI and cyber increase value, though over longer horizons. As adoption accelerates, we expect the same value impacts. Cloud is the leading indicator that foundational tech will drive returns if wielded intentionally.

How do high performing enterprises fare?

Deloitte has researched the impact of digital transformation using other value measures and found similarly positive results. Our Exponential Enterprise index of 500 large-cap US enterprises shows that the “leaders” (Exponential Enterprises), with both a high capacity for change and an ability to win had, on average, 176% higher forward price to earnings than the lowest performers in their industry.8

We ran our financial model on this subgroup of highest-performing organizations9 and found that, on average, Exponential Enterprises garner 12.5 times the market cap increases than other organizations. However, while they see higher highs for actions that increase market cap than other organizations, they also are at greater risk of suffering from lower lows—and shouldn’t take their privileged position for granted.

How these findings differ by industry and organizational size, and other considerations

Our findings were largely consistent across all industries we studied—consumer; energy, resources, and industrials; financial services; government and public services; life sciences and health care; and technology, media, and telecommunications—and for organizations of all sizes, with a few variations:

- Large-cap organizations (US$10 billion or more) benefited more from technology aligned to strategy than smaller organizations.

- Small- to mid-cap organizations (less than US$10 billion) benefited more from digital strategy than larger organizations.

- Financial services doesn’t see a positive impact on market cap related to a digital strategy until other factors are added. Instead, for financial services firms that discussed digital strategy on its own in their financial disclosures, we saw a correlation with a loss in market cap. In addition, the combination of digital strategy and technology aligned to strategy is a highly positive scenario for financial services firms, especially compared with other industries.

- Energy, resources, and industrials doesn’t see positive impacts on market cap from technology aligned to strategy until other factors are added. It’s also the only industry cluster for which we saw statistical significance for a combination that wasn’t significant for any other industry: tech aligned to strategy enabled by a change capability. For organizations in this industry, this new combination showed a highly positive correlation to market cap.

- Tech aligned to strategy holds its significance when compared with companies that experienced M&A activity.10

- Dividend-paying companies,11 compared with nondividend payers, saw minimal correlation for the individual factors and combinations, likely given the fact that the payment of dividends itself is highly correlated with increased market cap.

- MIT Culture Index high-scoring innovation companies saw a positive market cap correlation, suggesting that being a highly innovative company could have a positive impact on market cap.12

Capitalizing on it all

Our research shows that the power of digital strategy, brought to life by specific technology investments, and underpinned by change capabilities, can meaningfully shift a company’s valuation (figure 2).

This is easier said than done, as unlocking each takes significant time, effort, and expertise. So for the companies that aren’t leading in this today, what can executives do to capitalize? Our research findings point to four actions:

- Be deliberate. When we analyzed approximately three million pages of financial disclosures, we didn’t look simply at the coexistence of digital strategy, technology aligned to strategy, and change capability. Rather, we examined both the coexistence and the proximity of those factors, and it’s the proximity of the factors that shows which companies are linking these concepts most deliberately. Proximity also made the difference in distinguishing companies that tend to outperform their peers in market valuation. Put simply, as you take deliberate action to advance your digital strategy, as you make the choice to invest in certain technologies, and as you evolve your organization’s change capability, make certain that you understand how those three factors are mutually enabling and reinforcing.13 Absent that alignment, your investments may not deliver the returns they could be producing.

- Communicate with purpose. Our analysis is rooted not only in what these statements say companies are doing, but also in how companies communicate with the market about their choices. Undoubtedly, the vast majority of organizations today are making some form of technology investment to improve how they operate and how they go to market, though nearly two-thirds are unable to link their technology investments to their strategy. Nor are they able to talk about the relationship between the two. Words without action can erode value. Actions without words also limit value potential. Take stock of where you’re investing, craft a thoughtful narrative, and communicate accordingly.

- Get close to the technology so you can get specific. Digital strategy is valuable, but technology aligned to strategy is twice as valuable. With the latter, companies that see added benefit are getting very specific about the technology investments they make, and they’re demonstrating how those technology investments further their enterprise strategy. It‘s not enough for executives to approve and fund technology; they also need to have a fundamental understanding of the technology. Be sure to invest the time—and invest in the relationships—necessary to get close to the technology: what it is, how it works, how it’s architected, and why it matters. And be certain that this understanding carries through into strategy discussions.

- Prepare, prepare, prepare. Any approach to digital transformation is suboptimal if it isn’t underpinned by change capabilities. And there’s only so much a company can do to fast-track. Change capability means bringing the right skill sets and culture, as well as agility. Unlocking all of this takes time, and the benefit goes to those who start earlier. Start now.

Succeeding with digital transformation requires assembling the right pieces in a multivariate puzzle. We examined multiple approaches here, but as we step back and think about the main insight from our analysis, it’s ultimately that intentionality matters.

Digital transformation is a continuous effort14 that extends well beyond one single technology, platform, or skill set. It’s the fabric for enterprise survival in the face of continuous disruption. Getting it right means crafting a strategy that places purposeful digital bets. Getting it right means allocating your capital to new technology that can power your strategic initiatives. Getting it right means mobilizing your organization and adopting a change mindset with no defined horizon (or a horizon that could go well beyond your tenure). And getting it right means explaining to stakeholders that your digital transformation actions are intentionally aimed at increasing the odds of your organization’s ongoing success.

About the research

For our data science analysis, we examined 10 years15 of business and financial data16 from 10-K filings with the US Securities and Exchange Commission covering US and global17 companies listed on the New York Stock Exchange as of April 2022, which totaled 4,651 organizations.18

We removed high- and low-market-cap outliers19 that could skew results, which left more than three million pages across 18,039 filings.20 Our method and data set were inspired by research that our coauthor Tim Bottke conducted for his book, Digital Transformation Payday.21

We chose to use these particular documents because information listed in financial findings is governed by regulatory requirements: You can’t say something in a 10-K statement if you’re not doing it. Thus, it enables us to begin to correlate action and outcomes. Specifically, we applied natural language processing to scan the documents and look at how those organizations talk about their digital strategy, existing or planned technology investments aligned to their strategy, and preparedness for people and process transformation (change capability) within investor communications, management discussions, and analysis sections of their public filings.22 These mentions—and, more specifically, the way these topics were mentioned—help give us a sense of the real-world actions that organizations are taking with respect to digital and tech investments.

Then, using a financial model,23 we looked for correlations between these three factors and the companies’ market capitalization, which helps us look beyond the direct value of technology investments (for example, did this technology yield operational savings from increased efficiency?) to their organizationwide impact.

While we acknowledge that there are some limitations to this approach—namely, that some organizations may be taking some of these actions but not highlighting them in their filings—we did find that those organizations that specified their actions in this area showed correlations with value. We hypothesize that this may be due in part to confidence: Those who are most confident in their digital actions are more apt to celebrate their impact.

A look at our US$1.25 trillion value calculation and more

Our research found organizations with digital transformations that combined digital strategy, the technology aligned to strategy, and a strong change capability have the most to gain. How much? There’s no easy answer, but we ran the numbers to help guide organizations on what ultimately needs to be a very individual value journey based on what’s possible, what’s probable, and their potential.

The maximum path to value: What’s possible?

Overall, organizations that brought together all three digital transformation actions saw as much as a 5% competitive market cap lift relative to others that didn’t take these combined actions. This is not a 5% topline return for digital transformation, but rather the relative difference—versus peers—that can be gained from the trifecta combination of these three actions when comparing group A (those in this winning scenario) versus group B (all others).

To make that more tangible, we can look at an example. If group A is all Fortune 500 companies today, their total market cap is US$37 trillion. An approximate +5% differential in market cap across all 500 companies is as much as US$1.89 trillion that they could gain compared to others. When we account for organizations that may already be getting it right,24 we see a value potential of US$1.25 trillion available to this group versus others.

A realistic value path: What’s probable?

Realistically, what’s optimal isn’t always what’s probable or what the typical organization might expect to achieve. Therefore, we dug deeper to look at what might be probable for the average organization (figure 3).25

Our analysis found that even if organizations set their sights low and do the minimum working toward this scenario, they could expect an approximate +0.4% average market cap lift versus peers. If all Fortune 500 companies even minimally improved relative to their peers, that approximate +0.4% lift would be, on average, US$147.8 billion. And when those that are already starting to get it right are factored in,26 it’s a US$97.5 billion value potential.

The impact that action can have: What’s the potential?

Finally, to understand how mimicking the actions of a high-performing organization might impact that value potential, we ran another simulation27 and found a probable 1% average increase versus peers. Again, if we look at the Fortune 500 companies today, their total market cap is US$37 trillion. An approximate +1% increase in market cap across all 500 companies is as much as US$370 billion. However, 34% of companies already have tech aligned to strategy. For the remaining companies, we can see a value potential of US$244 billion available relative to others.

How engaged C-suites can make an impact on tech value

- The 2022 Digital Frontier study found that 31 out of 100 organizations with “tech-savvy boards” saw, on average, 8% better year-over-year stock performance than those with non-tech-savvy boards. However, fewer than half of boards provide enough tech stewardship.

- Our CEO’s role in digital transformation research frames five levels of the digital journey. CEOs can use them to assess their organization’s digital ambition and organizational readiness, and lead from the top guided by three simple truths.

- Our CFO Signals shows that 52% of IT expenses go to maintaining day-to-day operations. Only 22% is focused on creating new business capabilities.

- The upcoming Deloitte 2023 Global Technology Leadership Study found that 65% of C-suite executives say their top challenge for valuing technology investments is quantifying the soft benefits and that technology leaders drive digital transformation in 89% of the organizations.

Monitor Deloitte

Deloitte’s Strategy practice helps the most influential organizations around the world generate measurable outcomes by making winning choices on their most significant strategic issues. We build long-term relationships with senior executives and work together to create effective strategies that cover a broad spectrum of issues. From defining corporate and business unit strategy to identifying new growth opportunities, and more, we use cutting-edge approaches embedded with deep industry knowledge to develop and execute integrated, tailored strategies to meet the future with confidence.