Getting ahead of the curve

Reviving the relevance of the credit card business

The credit card market, while still profitable, is facing significant headwinds. Learn how issuers can revisit their value propositions and rework their approaches to meet changing customer needs and expectations.

Key messages

- Credit cards are still a highly profitable business, even though many issuers have relied too much on rewards to attract and retain customers. The future, however, looks less bright: More payment choices, along with changing consumer preferences, are threatening the long-term viability of the credit card business model.

- Millennial and Gen Z consumers may pose the biggest challenges to the credit card market. Younger consumers typically prefer to use debit cards over credit cards, especially when choosing a default payment method for digital payments.

- To revive their relevance, credit card issuers should revisit their value proposition and find ways to offer more personalization and a frictionless payment experience. They could also explore ways to create value beyond credit cards and deeply integrate themselves into consumers’ day-to-day lives.

- Revisiting the value proposition and designing integrated experiences will likely require card issuers to reorganize around customer behaviors, not products.

Credit card economics: Time for a reset?

AT first glance, the credit card market looks healthy. In 2018, the average return on assets (ROA) for credit card issuers was 3.8 percent, more than twice the average ROA of US banks (figure 1).1

Credit cards make up a sizable chunk of payment volumes—nearly US$4 trillion in 2018 in the United States alone.2 They are also used widely for a variety of digital payments, the fastest growing payments area. This growth of credit cards has come at the expense of cash-based transactions. For instance, the share of cash transactions declined from 31 percent in 2016 to 26 percent in 2018, while credit cards accounted for 23 percent in 2018, up from 18 percent in 2016.3

But there could be challenges ahead. While the customer value proposition—convenience, the ability to purchase high-ticket items, and earn generous rewards—has largely been the same over the last decade, industry profitability has been declining. The average ROA dropped from 5.4 percent in 2011 to 3.8 percent in 2018 (figure 1).

More troubling, this decline has come despite favorable interest rates on credit card products and benign credit quality in recent years. Average interest rates on credit card plans rose from 12.8 percent in 2011 to 16.8 percent (on accounts assessed interest) by the end of 2018, while charge-off rates (seasonally adjusted) declined to 3.6 percent in 2018 (compared with 4.6 percent at the end of 2011).5

While regulations, such as the CARD Act in 2009, may have played a role in the decline in profitability, a major contributing factor is the excessive reliance on rewards to attract and retain customers. In 2018, consumers made at least half of their credit card purchases with rewards cards,6 which is why costs associated with rewards have shot up significantly. According to the Consumer Financial Protection Bureau (CFPB), the average issuer rewards expense per rewards card increased from US$139 in 2015 to US$167 in 2018 (figure 2). This is the case even with an increase in rewards being funded directly by the merchant. The increase in rewards expense has been driven, in part, by the increased popularity of high-cost rewards cards and significant sign-on bonuses among affluent cardholders, according to the CFPB. As a result, issuers have reduced the number of rewards cards they issue, with the share of rewards cards now down to 60 percent of all new cards issued.7

But the reality is that consumers have now become accustomed to generous rewards. According to a recent Deloitte Center for Financial Services survey (see sidebar, “About the study and methodology”), nearly three-quarters of consumers surveyed (who prefer credit cards over other instruments) say that rewards, discounts, and other offers are the most important reason for using credit cards. This finding is consistent with other studies as well.8

In addition, one-quarter of consumers surveyed are willing to switch their credit card provider over the next two years to obtain better rewards elsewhere.10 In particular, younger consumers—34 percent of Gen Z and millennials—are even more likely to switch. This highlights how strong an influence rewards have on consumers’ choice and use of credit cards. Clearly, credit card issuers cannot completely eliminate rewards, but they have to become smarter about them or find other value-added offerings to boost loyalty.

Title

subtitle

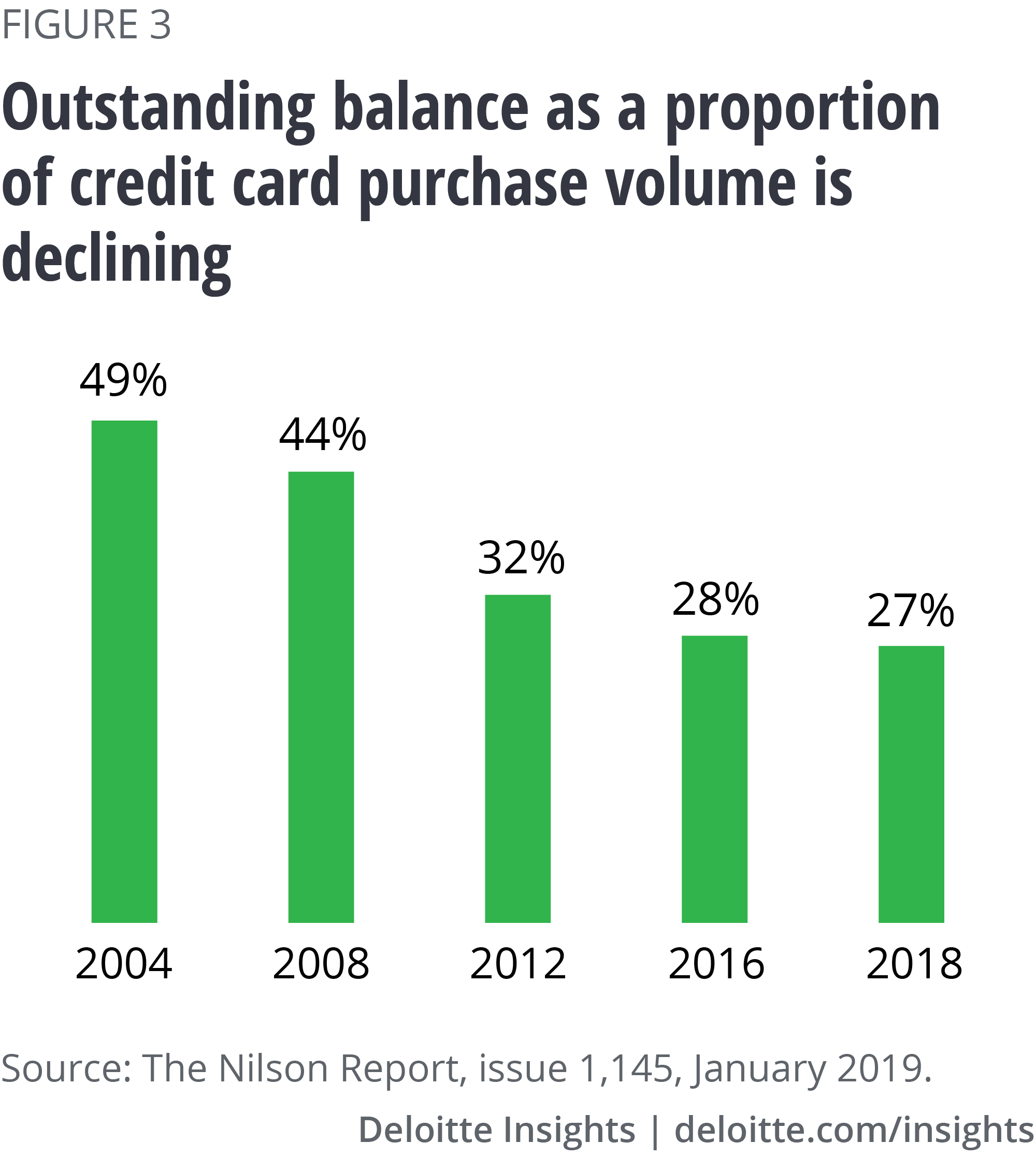

Consumer behavior has also changed regarding credit. According to The Nilson Report, outstanding credit as a proportion of total credit card spending has been steadily declining over the past 15 years (figure 3).11 Clearly, if consumers use credit less and less, it will negatively impact the interest income component of credit card revenues.

Cumulatively, these factors clearly show that multiple challenges loom for the credit card business: the growth of digital payments, changing consumer behaviors, the threat from big techs and nontraditional players, and the rise of faster payments. In this report, we analyze findings from our consumer survey to shed light on the magnitude of these challenges and offer recommendations for how credit card issuers could revive their relevance and profitability going forward.

About the study and methodology

The Deloitte US consumers credit card payments survey was fielded in August 2019, querying 2,520 respondents in the United States who have at least one credit card and one debit card. We set minimum quotas for age and targeted an equal gender representation and an income distribution around a median annual income of US$75,000.

The survey explored consumers’ payments needs and payments behavior overall, especially related to their primary credit card. We also inquired about their interest in new services and experiences.

The survey data reported is unweighted. Note that the interpretations may be limited to the sample of credit and debit cardholders we included in the study.

The payments landscape: Understanding the challenges

Digital payments and the slow death of plastic

Digital payments—for transactions on the web or via mobile apps—have been growing at an impressive rate. In fact, in 2019, the value of digital transactions globally reached US$4.1 trillion; this is expected to grow by a compounded annual growth rate of around 13 percent until 2023.12

We found that nearly four out of five surveyed respondents have used a digital payments app, such as Apple Pay mobile payment solution,13 PayPal, or Venmo, at least once last year. This is not surprising given that 78 percent of consumers globally have shopped from their mobile phones in the last six months, according to a recent PayPal study.14

These digital solutions are pushing card issuers to the background, where they risk losing the interface with customers. Since customer experience is still important in a digital context, issuers not only lose branding opportunity, but also experience mounting hurdles in shaping customer behavior. This challenge is compounded when app providers use peer-to-peer (P2P) channels, such as Venmo, to launch their own branded card products and incentivize users to switch payment instruments, accordingly.

To maintain their current foothold, card issuers should work to become and remain the default payment method—the underlying payment instrument consumers use most in their apps. Once this is saved within the payment app, consumers are unlikely to update it.15 Consumers’ use of default payments should increase as more connected devices, such as digital voice assistants and smart refrigerators, become commonplace. For more on default payments and why they’re important, refer to our report, "Default" payment methods: The digital marketplace reset you didn’t see coming!

Interestingly, the default payment method varies greatly across digital payments solutions. For instance, 41 percent of Apple Pay users in our survey used credit cards the most, compared with only 28 percent of PayPal users (figure 4).

On the other hand, P2P payments apps are mostly linked to bank accounts. What could this mean for credit card issuers? As P2P apps expand into other types of transactions, consumers may carry their default choice in P2P payments to other transaction types. In this scenario, the competition from debit cards and bank transfers for credit card issuers will most likely intensify.

Consumers’ growing preference for debit cards

Another trend that may hinder credit cards’ future prospects is the growing use of debit cards, especially among younger consumers. Confirming findings from other studies,16 we found that 52 percent of Gen Z and 41 percent of millennials in our survey would prefer to use debit cards most. Of course, the fact that individuals under the age of 21 face limitations in obtaining a credit card under the CARD Act’s eligibility requirement is a significant factor in Gen Z’s debit card usage.17 However, as Gen Z goes through different life stages and their financial needs change, their payment preferences could also evolve.

Furthermore, younger consumers are also taking on less credit card debt compared with their predecessors. According to a Federal Reserve study, the youngest consumer generation in 2016 (millennials) held US$1,800 in median credit card debt, compared with the US$2,500 in debt held by the youngest generation (Gen X) in 2004 (or US$3,400, adjusted for inflation).18

Younger consumers seem more likely to prefer debit cards for digital payments than older consumers are. For instance, 42 percent of millennials who use Apple Pay in our survey use debit cards, compared with only 23 percent of Gen X survey respondents (figure 5). The pattern is similar for Google Pay, with 41 percent of millennial users of Google Pay in our survey preferring debit cards compared with 29 percent of baby boomers (age 55 years or above). With younger consumers’ use of digital payments only expected to grow—44 percent of Gen Z and millennial consumers expect to use their phone for most of their payments in the future—the need to revisit the credit card value proposition for the younger segments has possibly never been greater.

On the supply side, the debit card market is growing and expanding its reach. To lure credit card customers, fintechs such as Zero, Venmo, and N26 are collaborating with small banks19 to offer debit cards with attractive rewards similar to those of credit cards.20 In our survey, nearly two-thirds of consumers said they would likely switch to debit cards if they offered the types of rewards credit cards offer.

Competition from alternative credit financing

Issuers have continuously innovated the credit component of the credit card product over the years. These innovations include instant underwriting, using advanced quantitative models to set credit limits and interest rates, and enabling easy balance transfers.

These innovations have, no doubt, added value for consumers. But more recently, this value has been under attack from online lenders and point of sale (PoS) credit solution providers. These competitors are using the same tools (data, analytics and modeling, and sophisticated microsegmentation) to attract credit card users. They also offer comparatively easier underwriting standards and easier credit terms compared with traditional credit cards.

Online lenders, such as SoFi and Prosper, for example, have reshaped the unsecured personal loan business. They are now a major competitor to the credit card business and pose a direct threat to issuers’ interest income. As of Q2 2019, personal loans in the United States amounted to US$148.4 billion,21 a staggering cumulative growth of over 130 percent since 2014. And fintech lenders’ share of total personal loan origination rose to more than 39 percent by 2018, compared with less than 1 percent in 2010.22

Although it is hard to say how much of online lenders’ asset growth is from credit card consolidation—obtaining more attractively priced loans to pay off credit card debt—it is the second most cited reason why consumers apply for a personal loan.23 And online lenders feature consolidation prominently in their advertising messages to attract new borrowers.

Additionally, new alternative options to credit card financing are emerging. PoS financing solutions, such as those offered by Affirm to Walmart customers,24 allow retailers to offer fixed-term installment loans to consumers to finance their purchases at the physical point of sale or on the digital checkout windows. In addition, buy-now-pay-later (BNPL) options, which often include interest-free periods,25 are aimed at customers choosing PoS loans over credit cards.

The growth of these products should not be underestimated, as recent trends in other countries suggest. In Australia, for instance, these products are considered some of the biggest drivers in the overall credit card debt decline.26 In fact, 30 percent of Australian consumers have a BNPL account,27 and nearly half of BNPL users have stopped using credit cards for their transactions altogether.28

Faster payments

Account-to-account-based faster payments is another trend that poses a risk to credit cards’ relevance. While the United States lags behind other countries’ faster payments capabilities, progress is underway: The Clearing House (TCH)’s Real-Time Payments (RTP) solution debuted in 2017. By now, nearly a dozen banks, holding about 50 percent of US deposit balances, are enabled for real-time payments in the United States through TCH.29 Further, the US Federal Reserve is planning to launch FedNow in 2023,30 another step toward modernizing the US payments landscape.

Though faster payments may take a few years to enter the mainstream for consumer payments, credit card issuers would be remiss not to recognize the threat to their business. Faster payments solutions could eventually displace credit cards from the act of paying, which would result in credit card issuers losing interchange fees.31 The threat to credit card payments could get acute if merchants, aiming to save on interchange fees and get access to funds instantly, also decide to incentivize customers to use faster payments solutions.

How credit card issuers can elevate their game

Major card issuers are realizing the magnitude of these challenges and are beginning to respond. For instance, credit card issuers have started offering installment loans as an additional financing choice for their customers.32 This is a win-win for both customers and card issuers. While issuers can still benefit from fixed interest income, customers and issuers could benefit from more transparency and predictability in the entire payments life cycle. Potentially, this PoS solution could go beyond the physical card itself and be incorporated into digital wallets and QR codes.

But card issuers can do more to elevate their game. Issuers should view the challenges as a chance to redesign the credit card value proposition and their role in consumers’ lives for the digital era.

Revisit the credit card value proposition

Give consumers more personalization and flexibility. Though consumers have an array of credit card options to choose from, the rewards choices/product features are preset, such as in an airline miles card or a cashback card. Consumers, however, are looking for flexibility in choosing their product features: Sixty-nine percent of surveyed respondents said they would find a credit card that offered personalized features appealing. Similar to tiered cable subscription options, credit card issuers should provide customers with the flexibility to choose the credit features they want, and structure their pricing accordingly.

When survey respondents were asked to choose their top five rewards categories, traditional offerings such as gas, restaurants, groceries, airline tickets, and hotels topped the list. However, younger customers showed more interest in customizable rewards, such as clothing and apparel (chosen by 41 percent of Gen Z customers versus 23 percent of Gen Xers) or music streaming (chosen by 21 percent of Gen Z customers versus 3 percent of boomers). Card issuers should account for these generational preferences when they design their rewards programs.

Our survey findings suggest that customers would also find value in flexible reward structures, which are more like currency, enabling easier redemption across product categories, and that could be used outside issuers’ offerings (figure 6). For instance, customers may want an option to redeem reward points from an airline miles program for a hotel stay or restaurant discounts. American Express (Amex) has made a move in making its rewards more like currency. In 2018, Amex partnered with PayPal to enable its customers to use Amex membership rewards for their purchases on PayPal.33

Get the basics in customer experience right. Sometimes the most basic elements can create lasting impressions. Our analysis reveals that the same appears to hold true with issue resolution (figure 6). Customers across age demographics consider same-day resolution of issues and complaints an important service from their credit card provider. Card companies should aim to reduce their response time in line with customers’ increasingly discerning expectations.

Excite customers with instant gratification. Consumer expectations for (near) instant gratification has implications for the payments industry. While incumbents, i.e., the established credit card issuers, are keeping pace with some of these expectations (for example, by issuing contactless credit cards), nontraditional players are gaining the first-mover advantage with others, such as daily crediting of reward points (figure 6). The recently launched Apple Card credit card, for example, posts rewards to customers’ accounts on a daily basis. Apple Card customers can use these rewards to pay for transactions as soon as the next day.34

Integrate into consumers’ day-to-day lives

Consumers are increasingly looking for quick and hassle-free shopping experiences. Nearly half of surveyed respondents rank ease of use among their top three most important attributes when thinking about how they’d want to pay in the future. With digital payments taking root in consumers’ lives, credit card issuers should explore ways to expand their business models beyond payments and credit products.

Taking cues from platforms in countries such as China, credit card issuers could consider aggregating consumers’ shopping experiences in a financial superstore app. They could create a platform that enables customers to: (a) access financial products, such as personal loans or a car loans, from different banks or other financial institutions; (b) conduct other purchases, such as buying train or movie tickets, booking flights, paying utility bills; (c) manage personal finances, including budgeting; and even (d) request and receive financial advice.

There seems to be a latent appetite for platform services among consumers. More than half of survey respondents said they would be interested in using this kind of financial superstore app. Notably, younger surveyed customers are more interested in using this app compared with older customers (figure 7). We found similar evidence in another Deloitte survey geared toward retail banking, in which one-third of US retail bank customers surveyed said they would be interested in a platform service if their primary bank offered it.35 Again, younger surveyed consumers showed a significantly stronger preference for this concept.

The financial superstore app could allow credit card issuers to reclaim the driver’s seat in creating a desirable customer experience. More than 75 percent of consumers in our survey consider banks and credit card companies to be the best positioned to offer a financial superstore app, compared with other nonfinancial competitors, such as technology companies or social media platforms. The reason is likely the high degree of trust consumers put in their bank. Seventy-two percent of consumers trust or strongly trust their bank.36

Bolster security across all customer touchpoints

When looking at the demand for financial superstore apps or the mass personalization of credit cards, the future of consumer payments appears promising. Converting these opportunities into profitable business growth would require new capabilities, however. These could include managing internal and external customer data, using superior analytics to draw intelligent insights from that data, and connecting with ecosystem players to offer true convenience at the tip of consumers’ fingertips.

All of these capabilities underscore the importance of stronger security defenses and privacy controls, as threat actors are becoming more sophisticated in their attacks. Of the consumers surveyed, 77 percent chose security (keeping payment information safe) as one of the most important things they will look for when choosing how they’d want to pay in the future. As such, card issuers should step up their defenses and build or acquire capabilities to bolster security to meet customers’ evolving expectations. Doing so could also manage increasing risks to card issuer organizations.

Strengthen customer-centricity and revamp the operating model

Customer insights are central to enhancing the relevance of credit cards in the new digital age. But customer data is often fragmented and owned disparately across organizational silos. As such, most credit card issuers lack a single view of customers and data that would help manage relationships and create products. Therefore, redesigning and delivering a new credit card value proposition would likely require organizations to fundamentally change how data across the customer journey is collected, analyzed, and integrated companywide and with ecosystem partners.

Furthermore, organizations should shift to keep up with constantly evolving customer demands. Currently, many organizations are product-focused. This means product launches often require the work of duplicate functions, which slows down decision-making and isn’t agile enough to meet customer expectations. Cognizant of this mismatch, organizational leaders are now rethinking the way they’ve aligned their organizations in the past—around products—to plan for the desired customer experience in the future.

So, what would be required to become a payments organization of the future? Deloitte’s Future of Work, defined as “a result of many forces of change affecting three deeply connected dimensions of an organization: work (the what), the workforce (the who), and the workplace (the where),”38 could suggest pathways to modernize organizations and operating models. Payment leaders should consider these questions:

- Which payments products will best meet future customer expectations? A financial superstore app? Integrated payments via a digital storefront? What work will be required to develop these capabilities?

- What skills will be needed from the workforce to deliver the desired customer experience? Does the work require institutional knowledge and full-time employees to handle? Or can a gig worker or an on-demand expert complete the work more efficiently and accurately?

- What should the workplace look like? Can the work be completed virtually? Or would the team need to work together in the same location?

Working through these questions would likely require many organizations to redesign and reimagine their operating models. Currently, issuers’ primary focus on products has resulted in unwieldy and duplicate functions, such as risk and compliance, with little regard to where work gets completed, who does it, and what skills will be required in the future. But when looking at what issuers should be doing to add value, technology and marketing should be working hand in hand. Consider technology’s role in product development, as well as marketing’s role in influencing the final product design and capabilities. Both functions require harnessing the power of data to inform product development and design. And both should account for changing customer preferences and use those insights to determine what the organization will deliver in the future. This is why finding ways to work more collaboratively across functions is becoming so critical.

As issuers focus on how technology can bolster product development, many organizations are investing in improving tech fluency across their organizations. This can enable technology leaders to work in lockstep with the product development leads they often pair with on delivery.

Shifting the op model requires functions to play nicely—and differently—together. To deliver a seamless product, leaders should focus on integrating governance and decision-making, and getting people in place who can “speak” the language of the other functions. Developing a cohesive governance structure can also be essential; it can drive productive interactions among core business functions to ensure the design, build, and launch activities follow the customer-first mindset. But first, card issuers should challenge the status quo by creating infrastructure and operating norms that put customers at the core of their businesses (figure 8).

Reevaluating operating models will likely result in tough decisions involving breaking and rebuilding strategy, leadership, talent, rewards, and organizational design. For instance, when Citibank reorganized its US consumer business in August 2018 to enhance the group’s customer-centricity, it broke the silos between its credit card and other consumer banking products. In its place, Citibank brought these divisions together under a common leadership.39

Recentering functions around clients requires active senior leader sponsorship, given the far-reaching organizational and cost implications. Achieving true customer-centricity would also require a fundamental culture shift for issuers, where leaders are held accountable for results and employees are rewarded for exceeding customer expectations. At Capital One, executive leaders invest time to understand customer feedback firsthand by listening to customer calls in the call center and reading their emails.40 Leaders ask employees to own their customer’s experience and reward them for behaviors that reinforce their customer-first culture. Setting the right structure, incentivizing employees for aiming at outstanding customer experiences, and hiring and promoting talent that can drive the customer-first culture will likely remain increasingly critical as issuers aim to stay relevant to their customers via outstanding customer service in a commoditized business.

Finally, in a future where experience is key, it is unlikely that any institution will be successful on its own. To survive and thrive, issuers need to manage the data and ecosystem in which they operate, both critical undercurrents of any payments organization. Data can help product teams better understand customer preferences—for example, which payment functionalities are most used—and can help inform critical features driving customer selection, such as loyalty program offerings. To develop the right ecosystem, organizations are increasingly pairing with enabling technologies to develop the seamless and innovative customer experience consumers seek. While issuers can often build or upgrade their processes and infrastructure, sometimes they will need to buy capabilities or select strategic partners. Forming smart partnerships with leaders who share the same overall goals can help both organizations succeed.

Playing offense to stay on top

As we have outlined throughout this piece, credit card issuers are still enjoying profitability levels more than double the US banks’ average ROA, but credit card profitability has been declining.41 While issuers are scrutinizing excessive rewards programs, reducing or devaluing rewards would likely alienate consumers, limiting issuer options. Other factors—such as digital payment alternatives and consumers’ preference for ease, convenience, and increased choices—are likely to challenge the relevance and profitability of credit cards further in the future. These challenges are only expected to grow in severity, increasing the need for change.

Credit card issuers should act now while in a position of strength to revive profitability and relevance and remain “top of wallet.” Issuers should embrace the challenge and play on offense by elevating their roles in customers’ day-to-day lives, increasing their existing value proposition, and investing in transforming business models that can power the experiences their payments customers desire.

Deloitte Payments Services

Deloitte’s Payments team serves clients across the entire payments ecosystem—issuing banks, acquiring banks, card networks and associations, acquiring processor/service providers, merchants, fintechs, and payment platforms. With professionals across consulting, tax, risk and financial advisory, and audit, Deloitte’s Payments group provides end-to-end capabilities that can enable companies to offer a wide range of alternative delivery channels and enhance customer experience.