How board and C-suite collaboration can build organizational resilience

A Deloitte Global survey shows that boards and C-suite executives are working together in new ways to navigate volatility and keep growth on the agenda

Anna Marks

Prof. Dr. Arno Probst

Benjamin Finzi

Karen Edelman

Foreword

Businesses operating globally have experienced a number of unprecedented developments and disruptions in the past decade, including geopolitical shifts, advances in artificial intelligence and quantum computing, the impact of conflicts, trade relations, supply chain challenges, extreme weather events, and a global pandemic. Now, the convergence of these developments has determined that uncertainty has become the new norm.

As business leaders, we should ensure that, amid this complexity, organizations are positioned not only to survive but also to thrive. An active focus on organizational resilience has never been more important. This report on resilience and growth, brought to you by the Deloitte Global Boardroom Program in collaboration with the Deloitte Global CEO Program, is based on a survey of nearly 750 board members and C-suite executives, along with thoughtful conversations with over a dozen board chairs, directors, and CEOs worldwide, who have generously shared their experiences and insights into the challenges facing leading organizations today. We plan to dive deeper, in a future article, into the perspective of CEOs, and on how they are focusing on resilience and their relationship with the board.

We’d like to thank all the participants for their time and contributions. In this report, we share their aggregated perspectives. What we heard loud and clear is that neither the board nor the C-suite can go it alone. One could argue that this new normal may require a new model of board and C-suite challenge and support through enhanced collaboration. Together, we can work to build a new kind of resilience—one that is not solely defensive in nature but also acts as an engine for resilient growth, seizing opportunities as they emerge.

As we close out 2025, we hope the insights from this report can help to catalyze meaningful conversations between your board and executive teams, helping your organization navigate and thrive amid the short- and long-term challenges and opportunities we all face.

Anna Marks

Chair

Deloitte Global Board of Directors

Prof. Dr. Arno Probst

Deloitte Global Boardroom Program leader

Deloitte Global

Benjamin Finzi

Deloitte Global CEO Program leader

Deloitte Global

Across global markets, organizations continue to face challenges stemming from uncertainty, rapid change, and an array of risks. At the same time, there is potential for tremendous opportunity, including the use of technology to access new markets, products and services, and to augment the workforce of the future. A recent Deloitte analysis1 shows that many Fortune 500 organizations have added new C-suite roles, such as chief legal officer, chief transformation officer, and chief communications officer, to help ensure that the C-suite has the right skills and capabilities to capture opportunities and effectively manage challenges and risks.

In this environment, it is perhaps no surprise that CEO tenure has reached its lowest point since Russell Reynolds began tracking it in 2018—a shift the firm attributes to “evolving role demands.”2 The takeaway from these trends? Many CEOs—and their top management teams—may be seeking a different kind of engagement model with their boards, one that is more reflective of effective partnering and could offer challenge and support in equal measure.

Traditionally, board oversight has been narrowly defined; at times, boards were, perhaps, regarded as a process step, and their interaction with the C-suite was often limited to scheduled meetings and formal reporting. Today, however, the complexity and speed of change demand a more engaged, fluid, and collaborative approach—one where boards and executives act as thought partners, communicate more frequently, and jointly focus on key agenda topics to drive organizational resilience for the longer term.

Table of contents

In June 2025, the Deloitte Global Boardroom Program and the Deloitte Global CEO Program teamed up to explore how boards and C-suites are rethinking the ways they work together to bolster long-term organizational resilience. Our research includes a cross-industry survey of 739 leaders, 76% of whom are board directors and 24% of whom are C-suite executives, from 59 countries (see methodology), along with in-depth interviews with 15 directors and executives. Among the main findings:

- Strategic risk oversight and scenario planning are where respondents say board oversight can help boost resilience the most (71% of all respondents).

- Most respondents say their boards have stepped up their level of activity and involvement, particularly around strategy development and scenario planning (73% overall; 76% board and 63% C-suite).

- Both C-suite and board respondents point to having open, transparent communication between the board and C-suite as the No. 1 leadership factor impacting their organization’s level of resilience (66% overall; 69% board and 57% C-suite).

Overall, the research suggests there’s a strong tie between achieving board and C-suite alignment and building organizational resilience. In our conversations with leading board chairs and executives, we heard that an increased emphasis on fostering a trusted working relationship—between boards and the C-suite, and between the chair and CEO—is fundamental to helping achieve that alignment.

From economic volatility to technological advancement: Tracking the shift in board and C-suite priorities

Building resilience today can require organizations to respond to near-term opportunities, challenges, and risk-related priorities while also maintaining focus on longer-term goals and growth opportunities. When it comes to risks, however, the survey shows that boards and C-suite respondents are juggling multiple priorities simultaneously.

The survey asked respondents to identify their top immediate (2025) and longer-term priorities (2026 and beyond). What is interesting is the shift in priorities depending on the time horizon being considered.

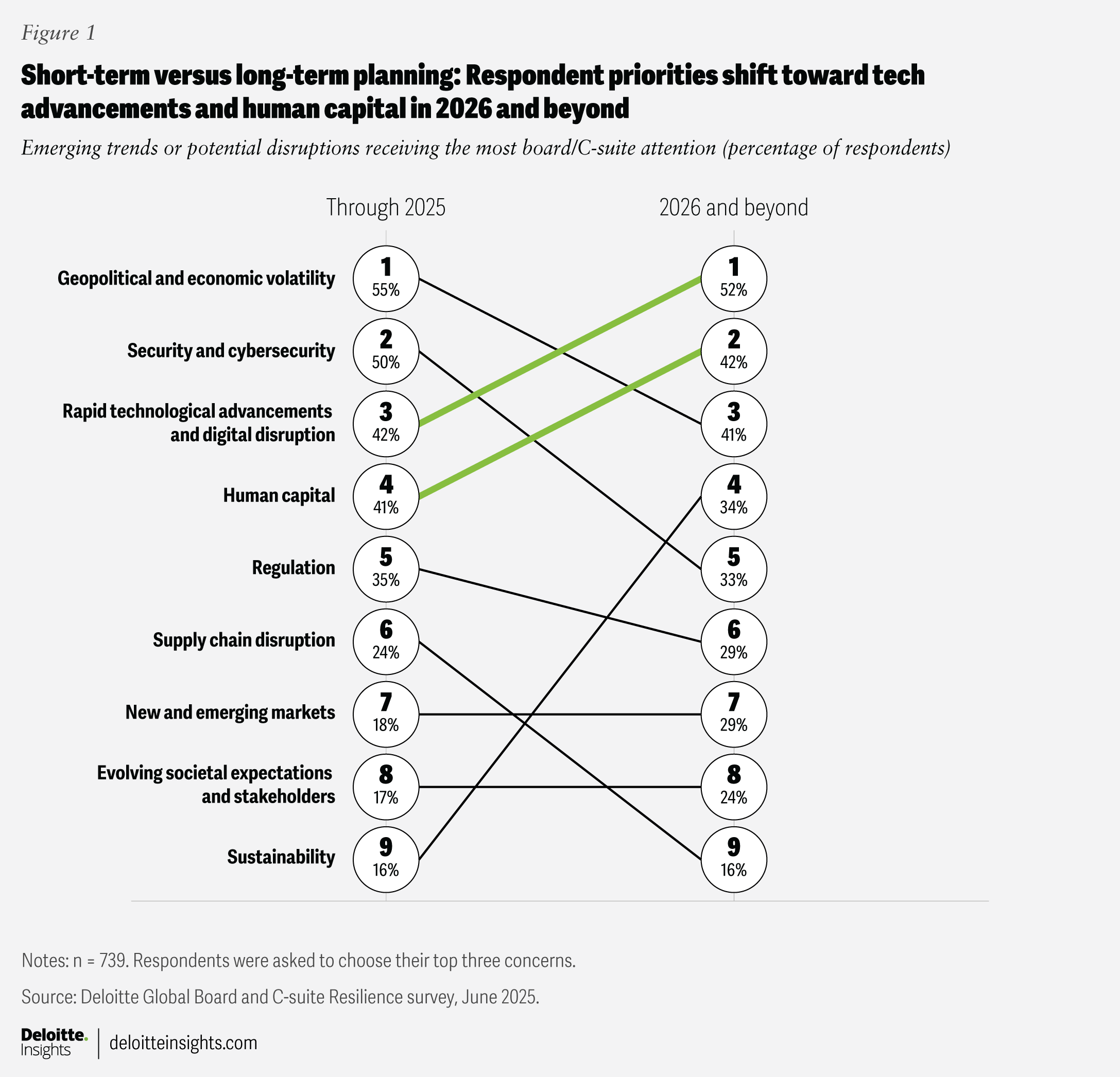

In the short term, through 2025, survey respondents say they’re focused most on geopolitical and economic volatility (55%), security and cybersecurity (50%), and rapid technological advancements and digital disruption (42%). And although human capital ranks fourth, at 41%, it’s a top near-term concern for a sizable number of respondents as well (figure 1).

Other recent Deloitte research reveals a similarly expansive and complex risk landscape. In the Spring 2025 Fortune/Deloitte CEO Survey, 3 respondents said their biggest challenges were economic, political, and geopolitical uncertainty. It can be difficult for leaders to think about the long term right now because “the level of uncertainty today is absolutely unprecedented,” says Anjali Bansal, founder of India-based venture capital platform Avaana Capital Advisors LLP and independent director on the boards of Maruti Suzuki India Ltd., Nestle India Ltd., Piramal Enterprises Ltd., and Tata Power Co. Ltd. “Leadership now requires the ability to move fluidly across parallel realities, synthesizing complexity into decisive action,” Bansal adds. “We are living in a multiverse.”

There is a risk, therefore, that the need to focus on short-term disruptions may distract executives and boards from focusing on the future. Leaders we spoke with cautioned against falling into this trap. “If you become too defensive, given the geopolitical environment, it’s really going to constrain longer-term growth because you’re not making the investments today that you should be making for the future,” explains Gordon Nixon, chair of Canadian telecom company BCE Inc., and independent director on the boards of BlackRock Inc. and George Weston Ltd.

Looking beyond 2025, the ranking of board and C-suite priorities shifts noticeably. Rapid technological advancements and digital disruptions rise, becoming the top concern over the longer horizon (jumping from 42% to 52%). Human capital moves up to second place (from 41% to 42%), followed by geopolitical and economic volatility, which drops from the top short-term concern in 2025 to third place in the longer-term view (from 55% to 41%). Meanwhile, security and cybersecurity, though still a top-five concern, declines in priority over the longer horizon (from 50% to 33%), suggesting respondent organizations are placing greater emphasis on cyber risks in the near term than in their longer-term planning.

This shift in concerns may reflect several factors. Boards and C-suites are generally focusing on growth, acknowledging that talent and technology have significant potential to drive long-term, resilient business value. They also likely recognize the need to continue to monitor the changing geopolitical environment.

When we asked respondents to evaluate whether their organizations possess enough financial, technological, and human capital resources to build long-term resilience, most believe they are well-resourced across these dimensions. Confidence, however, varied: Respondents are most confident in their organizations’ financial resources (82% agree or strongly agree), but less so in having robust enough human capital (64%) and technological resources (63%). This may reflect an awareness of the resource demands that these longer-term priorities often require.

Many of our interviewees point out that complexity and uncertainty can also yield opportunity—and that it is critical to stay focused on emerging opportunities. “When I think of resilience in a corporate setting, [it’s about] surviving the uncertainties and the constant body blows that corporations have to endure. But it’s also finding a way to thrive and take advantage of the opportunities that come from the uncertainties,” says Sheila Murray, independent chair of Canadian mining company Teck Resources Limited, independent director of BCE Inc., and independent trustee of Granite REIT.

They also say a key part of the board’s role is to help management balance short-term priorities while keeping an eye on longer-term goals and opportunities. “When management is very preoccupied with near-term risk mitigation, boards can make sure that questions on innovation and growth remain on the agenda,” says Seow Kee Gan, chairman of Singapore LNG Corporation and Singapore Business Federation's Center for the Future of Trade and Investment (CFOTI). “Risk management, building resilience, and innovation and growth are not mutually exclusive. Innovation is part of building resilience: Resilient companies are constantly innovating. That’s how they stay resilient.”

But it’s asking a lot of C-suite leaders to balance short-term priorities with longer-term opportunities at the same time, explains Joe Hurd, independent director of Trustpilot Group Plc, Hays Plc, and Lloyd’s of London Ltd. “I liken it to parallel parking during rush hour. You’ve got to look in the rearview mirror to make sure you don’t hit the car behind you. But you’re constantly looking out the windshield and the side window to make sure you’re not about to get broadsided. It takes a very special and adept CEO and management team to hold two conflicting views in mind at the same time.” Boards should continue to work with management to help ensure that this appropriate balance is struck and maintained.

Boards lean in on risk, strategy, and scenario planning

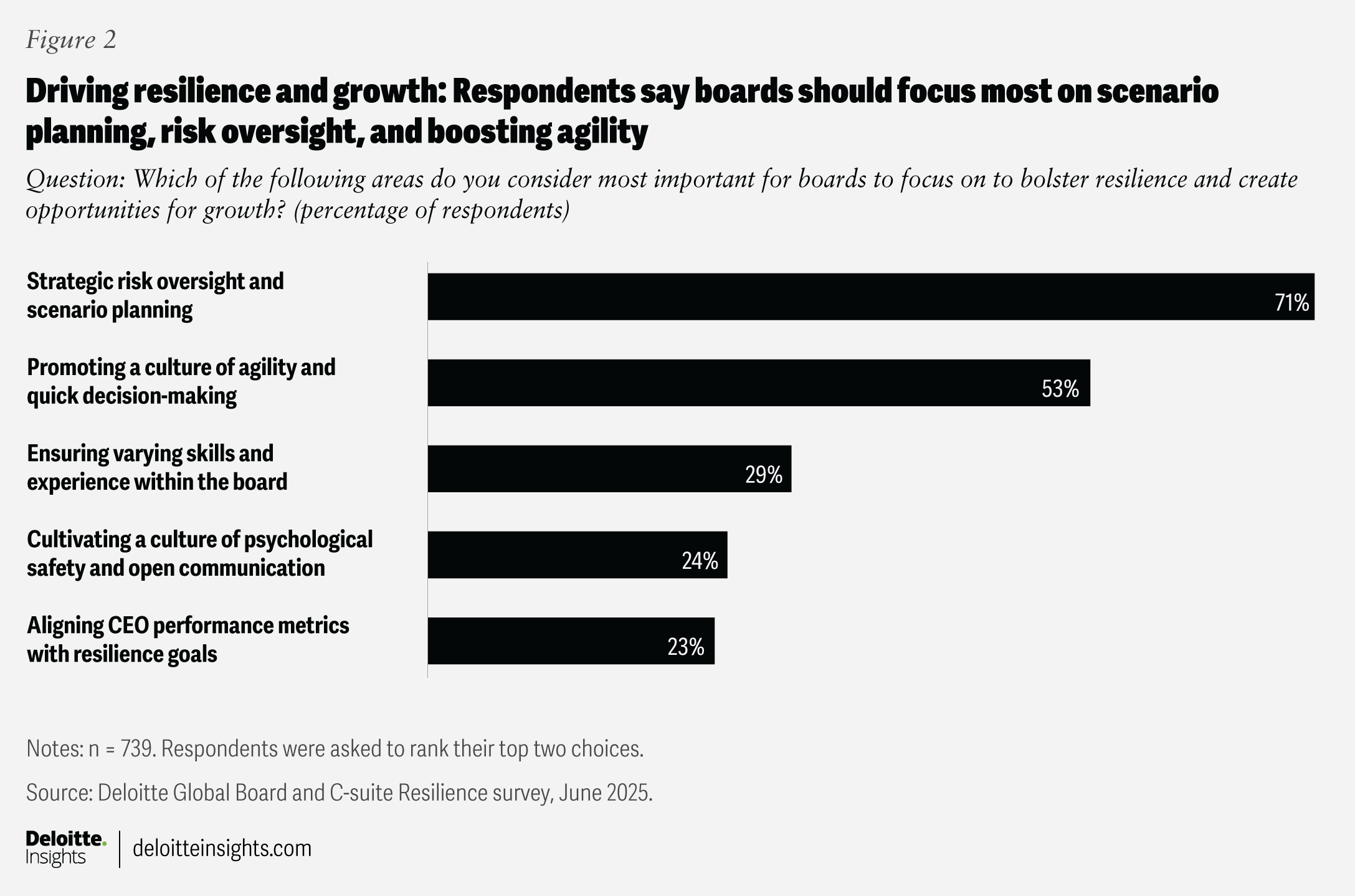

Our survey shows that boards are actively focusing on several dimensions to help build resilience, particularly on risk management and scenario planning. Most respondents (86%) say their boards have increased activity to monitor risk, oversee growth strategies, and bolster longer-term resilience, with 39% saying they’ve increased their efforts on those fronts significantly. So far, their focus areas have been strategic risk oversight and scenario planning (71%) and promoting a culture of agility and quick decision-making (53%) (figure 2).

Respondents, therefore, rank other activities as lower in priority, including ensuring varying skills and experience within the board (29%), cultivating a culture of psychological safety and open communication (24%), and aligning CEO performance metrics with resilience goals (23%). This could indicate that, because board agendas are often so packed right now, it may be difficult to spend enough time across the spectrum of activities needed to drive resilient growth. It also suggests that chairs and boards may want to explore the breadth of their focus and activities to help ensure that important aspects are not overlooked or de-prioritized too extensively.

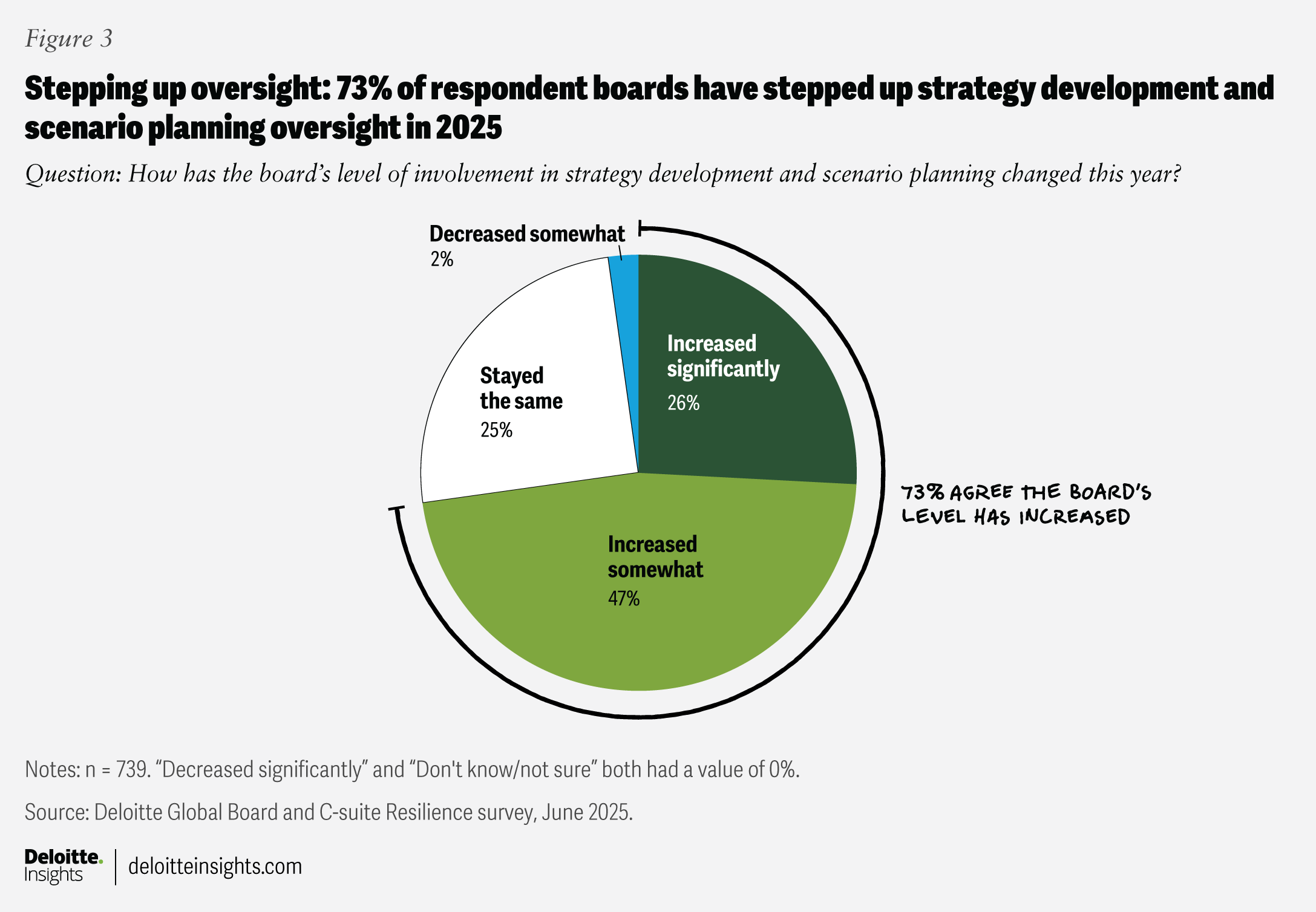

Encouragingly, the survey shows progress in respondent boards’ efforts to collaborate more with the C-suite on strategy development and scenario planning—two operational focus areas that, according to leaders we spoke with, are among the most important for building resilience. Nearly three-quarters of respondents (73%) say they’ve been spending more time on both this year, although only 26% say they’ve “significantly” increased the time devoted to these activities (figure 3).

“I think it’s important to do scenario planning and figure out what you would do so that you are prepared with a playbook if particular scenarios were to materialize,” says Robert Herz, independent director, Morgan Stanley and Workiva Inc.

Roy Dunbar, independent director of McKesson Corp., Duke Energy Corp., Johnson Controls International Plc, and SiteOne Landscape Supply, says: “In these times, what you want is to go deeper and ask more challenging questions around, ‘What are the threats? What are the opportunities? Where is growth going to come from?’ Management and the board should leave that discussion with real clarity of what the agenda will be for operations, for optimizing the portfolio. … That level of clarity really helps the best companies take action and move forward.”

How can boards add value to these discussions without being overly prescriptive and risk stepping on management’s toes? Gordon Nixon offers his view on where to draw the line: “Today’s boards are much more engaged, given the expectation in terms of oversight from a governance perspective. But at the same time, [they need to] get that balance right and not stand in the way of what management should be doing. Boards don’t run companies; management runs companies. Boards oversee management.”

Board and C-suite leaders see open communication as critical to fostering resilience

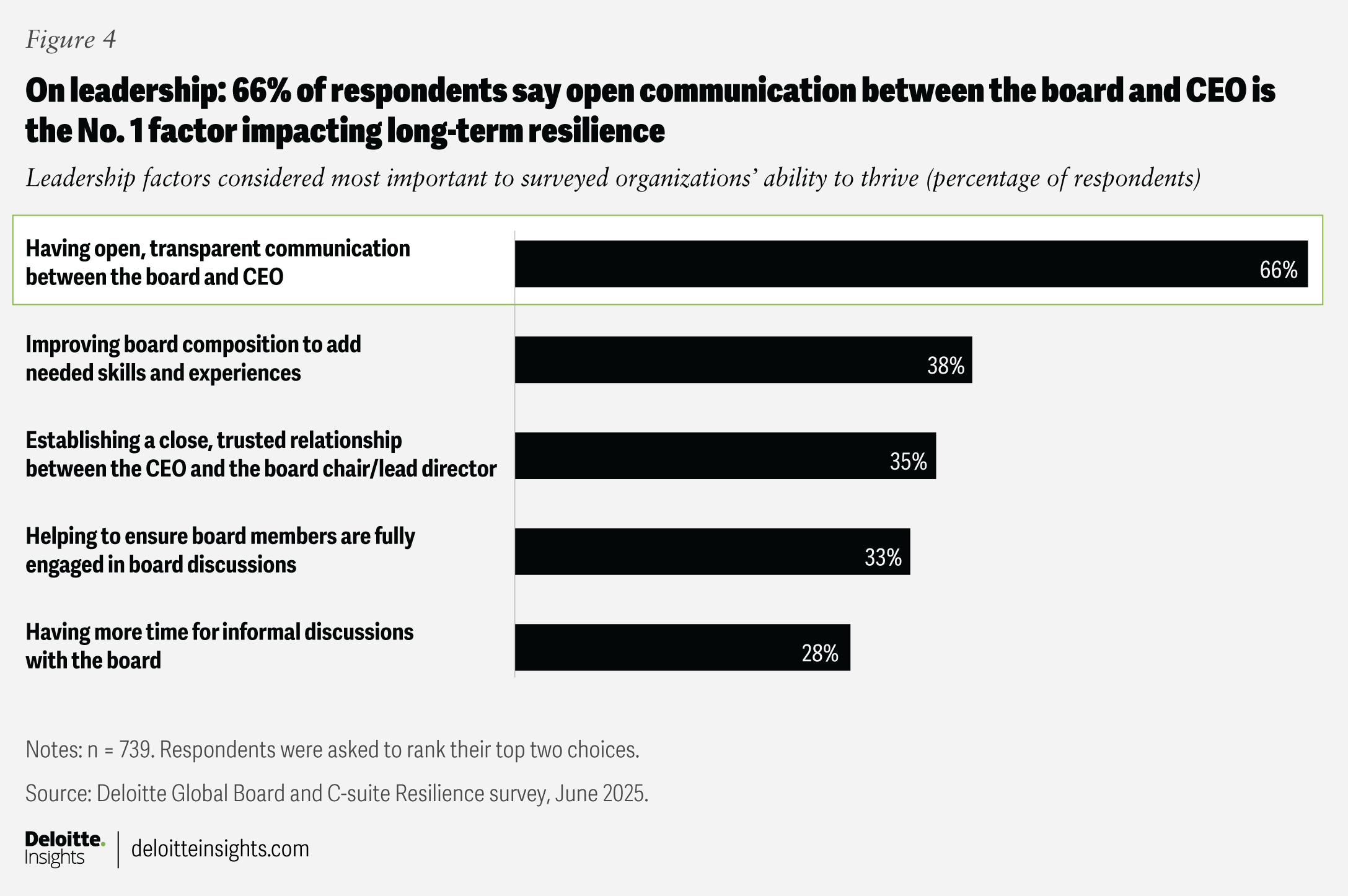

When we asked respondents which two leadership factors are most valuable in helping leaders build organizational resilience, most board and C-suite respondents agreed that open, transparent communication between the board and CEO is, by far, the most important leadership factor in helping their organizations thrive in the future (figure 4).

This finding is echoed by Scott Beaumont, former president of Google Asia Pacific Pte. Ltd., who describes how important it is for CEOs to have a trusted team around them—including the board chair: “Within the enterprise, the CEO ultimately is alone. It’s very important for the CEO to have a group of people that they can connect with for different problems. Some to give you a dose of resilience, some a boost to confidence, some to provide reassurance or a nudge towards the right path—the board chair is perfectly positioned for this role.”

Beyond open communication, more than one-third of respondents point to having a trusted relationship between the CEO and the board chair or lead director (35%) and ensuring that every board member is fully engaged (33%) as top leadership factors influencing their organization’s ability to thrive.

Robert Herz says: “There’s no substitute for honest, free-form discussion about the environment. What issues should we be focusing on? Should we be meeting more often? Should you change your processes? Just discuss it in a full board meeting so people can get their heads around it.”

Having more time for informal discussions with the board was cited by 28% of respondents as one of their top two resilience-building leadership factors. Some boards are adding more of these discussions to stay updated between board meetings: “In one of my companies, between board meetings, we have eight touchpoint calls. Some of those calls are only 30 minutes, but it’s amazing how much we accomplish,” Roy Dunbar says. “When we turn up for a board meeting, there is very little surprise. Those sorts of very tight collaborations and alignment make opportunities for a company. If suddenly a roadblock occurs in one place, or a new opportunity opens in another, being able to get the board on a call [on short notice] and … make a decision really quickly, that level of agility is a critical feature of resilience.”

Moreover, 38% of respondents say that a top factor enabling their organizations’ resilience is ensuring that the board has the right skills and experiences in place. Yet, when asked earlier about which focus areas are most critical to bolstering resilience and growth (figure 2), only 29% of respondents ranked ‘ensuring varying skills and experience within the board’ as a top factor. Therefore, it’s important that business leaders do not lose sight of this factor.

Chairs are pivotal to enhancing collaboration and board effectiveness

Chairs and lead directors play a key role in helping boost engagement and board effectiveness. One way they’re doing this is through more stringent agenda-setting—actively encouraging and listening to board members’ views on topics for board discussion before finalizing the agenda. “In all three of my companies, the chair plays a more active role, being the traffic cop and being that buffer between board and management. You can bring everything to the chair, and they decide what gets escalated to management or not,” Joe Hurd says. “And when newer board members sometimes are a little more difficult to rein in because they haven’t yet figured out the signal-to-noise filter in what to escalate, the chair is quite helpful in setting the direction.”

Chairs are also central to helping build a more collaborative relationship between the board and C-suite. “The job of the board chair is to try and encourage healthy discussion, healthy relationships, and to ensure that the relationships between management and the board are robust, the level of communication is good,” Sheila Murray explains.

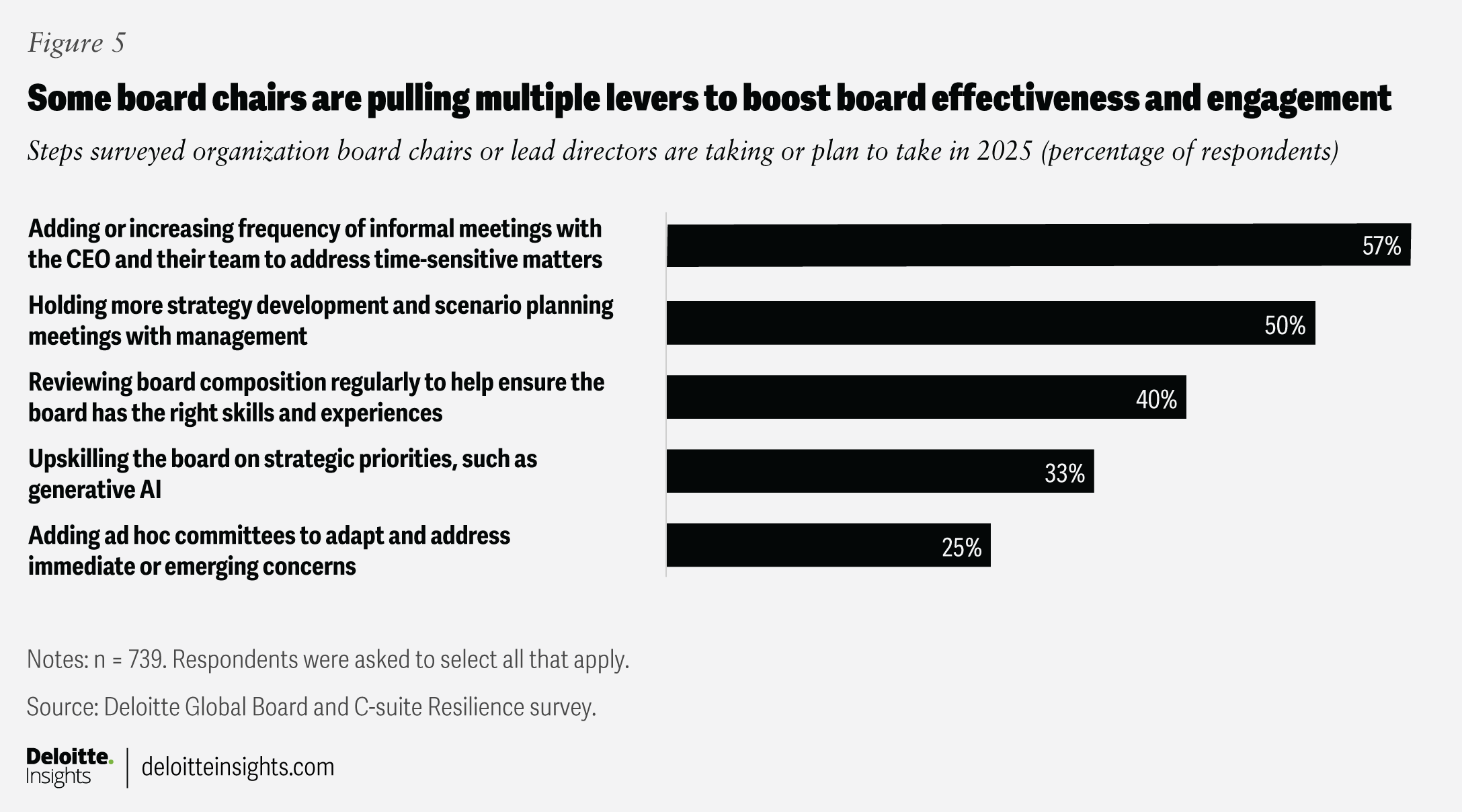

Among leading practices chairs and lead directors are adopting to boost effectiveness, the Deloitte Global survey shows that most respondents (57%) say their board chairs are adding or increasing the frequency of informal meetings with the CEO, and 50% say their chairs are holding more strategy development and scenario planning meetings with management (figure 5). Fewer respondents say their chairs are focusing on upskilling the board on strategic priorities (33%) or adding ad hoc committees to adapt and address near-term concerns (25%)—two levers that could be pulled to help ensure boards are responsive and adept enough to provide robust governance and support to top management.

Do boards need to shore up capabilities to provide the right support and guidance?

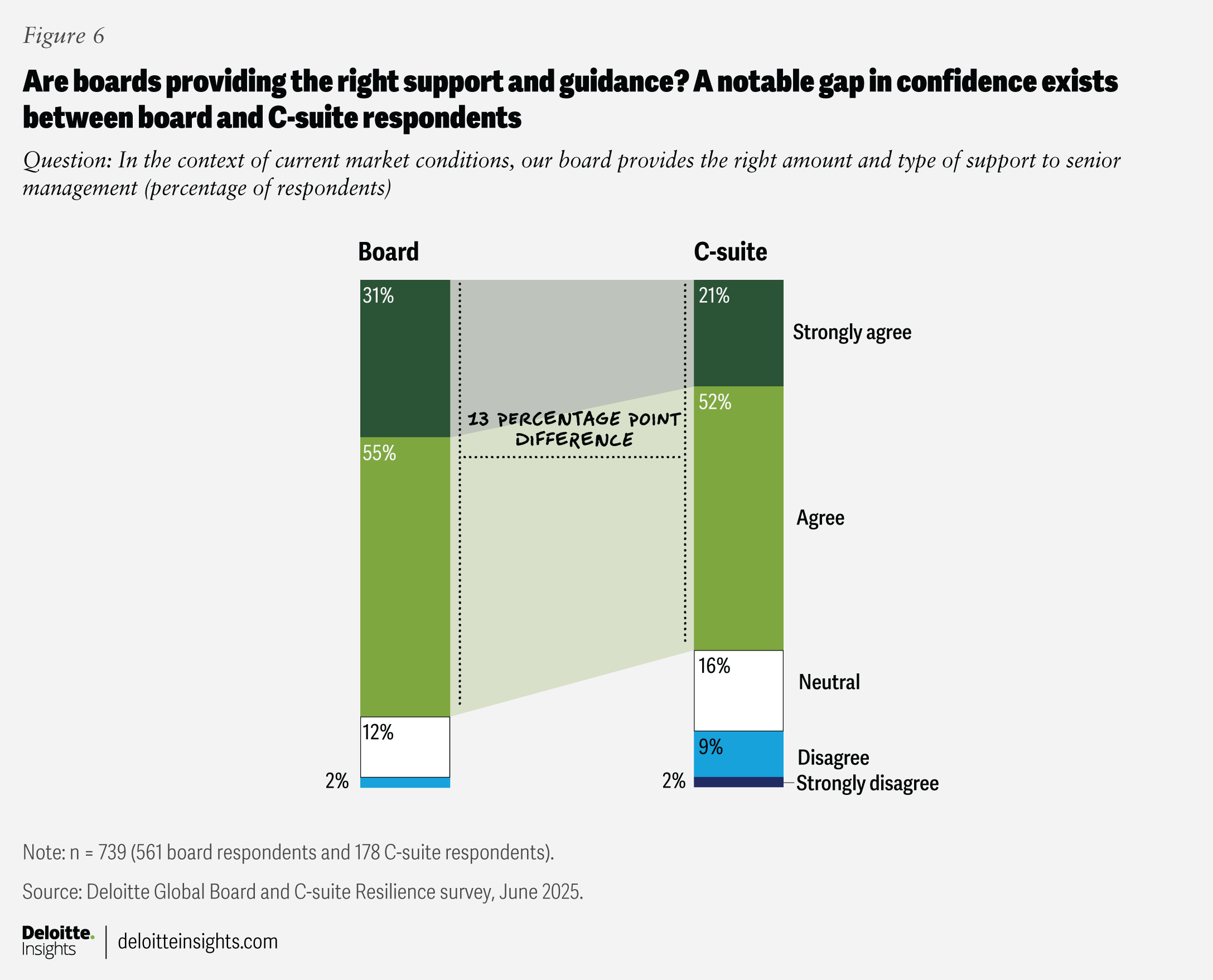

The C-suite, too, may be seeing the need for boards to strengthen their support. Our survey uncovered a few notable gaps between C-suite and board responses on board support and effectiveness. Most board respondents (86%) agree or strongly agree that, in the context of current market conditions, they’re providing the right amount and type of support to senior management (figure 6). And while most C-suite respondents (73%) also agree or strongly agree they’re receiving the right level of support, there was a 13–percentage-point gap between board and C-suite sentiment—and a 10–percentage-point gap among respondents who chose “strongly agree.” By intentionally exploring the level and style of their engagement on an ongoing basis, boards and management teams can help ensure their discussions are effective and impactful.

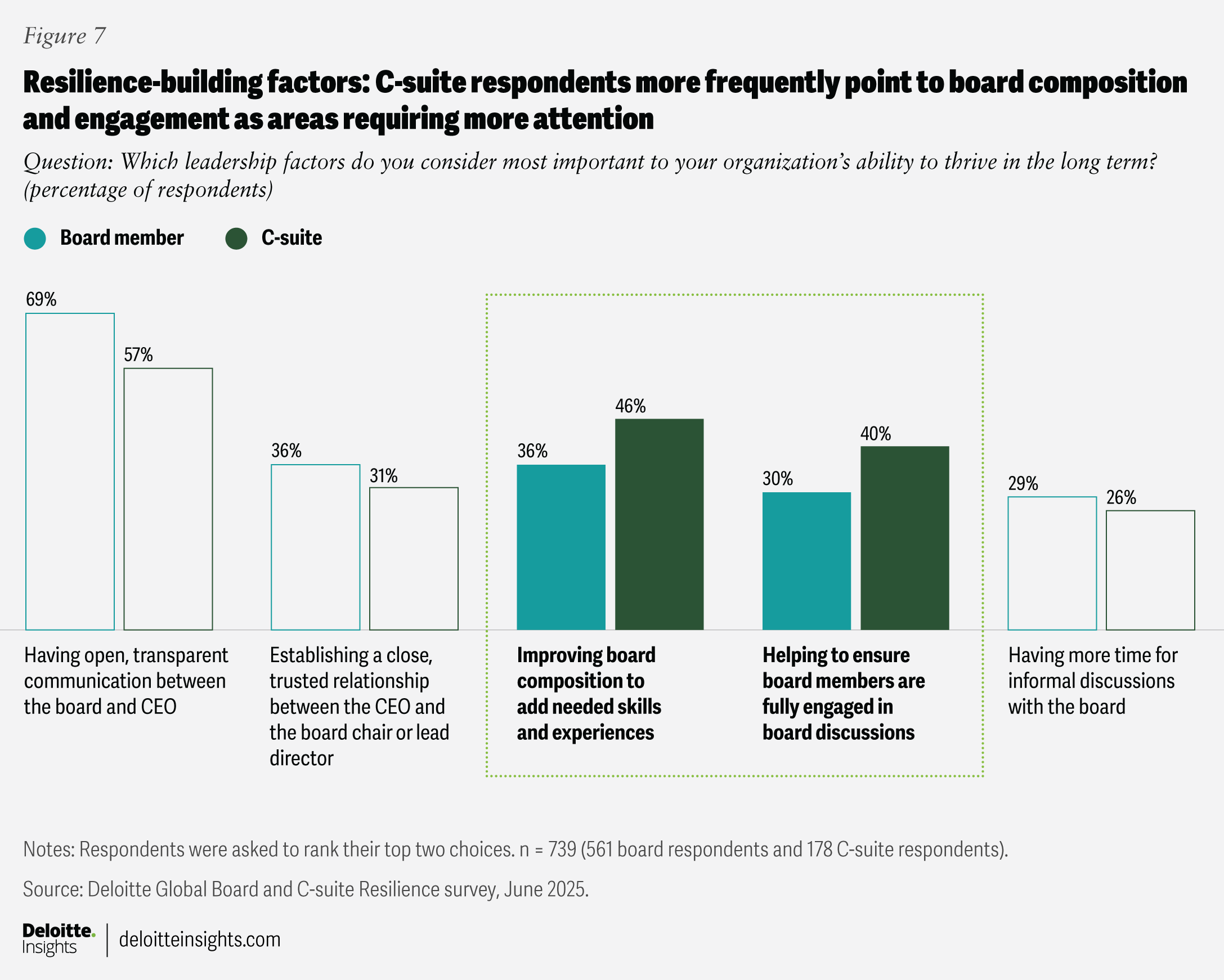

Specifically, a breakdown of board and C-suite responses to the question on leadership factors shows gaps in confidence around board composition and engagement. Nearly half (46%) of C-suite respondents rank improving board composition to add needed skills and experiences as a top concern, compared with 36% of board respondents. Similarly, C-suite respondents were 10 percentage points more likely than board respondents to rank “helping to ensure board members are fully engaged in board discussions” as a top concern (40% and 30%, respectively) (figure 7).

The survey highlights why it’s important to review the board’s skills and experiences regularly to find potential gaps—and then recruit new members or provide training opportunities to help fill them. Roy Dunbar connects the idea of building board capabilities with the ongoing process of bringing in new talent: “This notion of refreshment is really important. You want a span of longevity on the board, because in that, the new folk are coming in all the time.” In the current environment, it may be prudent for chairs to review the current cadence of board refreshment and adjust if necessary.

Another key factor is whether each board director is actively engaged. In her role as chair, Sheila Murray believes it’s her responsibility to ensure every board member is pulling their weight: “We all get paid a lot of money to fulfill this role, and the responsibilities are big. We have to take the job seriously. If somebody’s coming to meetings and not participating, that’s on me. I’ve got to try to bring out the best in them. If they’re not able to participate in a meaningful way, well, then, eventually, we make the hard decision.” Each board member, however, is ultimately responsible for their own level of involvement and engagement. If a chair senses a board member’s commitment levels dipping, they can help rectify the situation by having honest conversations with that director to explore the reasons or underlying drivers.

Boards and management can cocreate a more resilient tomorrow

Overall, the Deloitte Global Boardroom research shows that a new model of collaboration is beginning to take hold among some leading boards. Traditional, rigid boundaries are starting to give way to a more flexible and synergistic relationship. Many of the board interviewees are leading the way, serving as thought partners to their management teams. The survey, while showing progress, also highlights some divergences and areas where boards and C-suites—led by chairs and CEOs—can proactively explore ways to ensure they work together most effectively.

Keeping the big picture in mind—and taking that step back from the stresses of today—can help organizations survive and thrive. “When you get into these periods of uncertainty and rapid changes, sometimes there’s a tendency for management to hunker down and retreat into bunkers, so that when this blows over, we are all still alive. But this is where boards need to point out that there’s life after that. And if you don’t prepare and start to do all those things, you may survive in your bunker. But when you come out, you don’t really have a business,” Seow Kee Gan says.

Despite current challenges, Anjali Bansal is optimistic that leaders, and their organizations, will find the right path forward: “The level of uncertainty is at an all-time high, and it’s very, very hard to plan. And yet, we are the wonderful human species; we’re tremendously resilient. We keep innovating. So, every day you wake up to some new challenge, but you also wake up to some new innovation.”

Five focus areas to help foster alignment

Based on this research and our ongoing conversations with business leaders, a key foundation of organizational resilience is the relationship between the board and the C-suite. To help their organizations thrive while acknowledging the complexities and a changing global environment, boards and C-suite executives should continue to evolve the way they work and engage with each other. Here are five key focus areas boards can explore to help foster alignment and build more collaborative and productive working relationships with the C-suite:

- Board composition should be evaluated regularly to help ensure the board is up to the task. Collectively, does your board have what it takes to partner with the C-suite on planning and strategy? If not, boards can explore building a skills, capabilities, and attributes matrix, mapping board members to it, and assessing its sufficiency. They can also look at upskilling and education opportunities, review the cadence of board refreshment, and add ad hoc committees to address pressing, near-term topics.

- Reflect on the dynamics between the board and C-suite. Does the current relationship enable the appropriate level of support and challenge? Engagement and transparency between the chair and the CEO are particularly important at this moment. Board chairs and CEOs we interviewed say they’re frequently in touch—they talk daily, when needed.

- Chairs and CEOs can collaborate on agenda setting to devote ample time to deeper discussions. Are board meetings packed with presentations or pre-fixed agenda items? In prior Deloitte research, directors have told us they prefer board discussions to start where the pre-reads end.4 To have enough time to delve deeper and have open dialogue, the chair and CEO can work together to be more intentional about planning board meetings well in advance. This can help ensure meetings move away from a show-and-tell model, dive deeper into the right areas, and leverage committee work where appropriate.

- Transparent conversations require safe spaces to have them. Does everyone in the C-suite—not just the CEO—feel comfortable bringing up challenges and seeking candid feedback? Open, honest communication on sensitive topics and thorny risk challenges requires a high level of trust. Executives should feel the board has their back and is there to support them, especially when they’re asked tough questions.

- Being a board director may require more time and engagement now. Having a diverse set of skills and experiences only works if everyone uses them. Is every board member putting in enough time and energy needed to govern effectively? While it’s up to each board member to ensure they can fully engage, it’s the board chair’s responsibility to help provide the time, space, and input needed to enable that engagement.

By thoughtfully evolving board and C-suite collaboration, leaders can better position their organizations to respond to uncertainty and pursue long-term growth. When boards and executives embrace new ways of working together, they can unlock the agility and innovation organizations need to thrive in a rapidly changing world.

Methodology

In June and July 2025, the Deloitte Global Boardroom Program, in collaboration with the Deloitte Global CEO program, surveyed 739 board members and C-suite executives in 59 countries. Among the respondents, 76% (561) serve as board directors, and 20% serve as board chairs. Among the 24% of respondents (178) from the C-suite, 6% are chief financial officers, 4% are CEOs, and the remaining 14% hold other C-suite positions, including chief operating officer, chief information officer, chief human resources officer, and chief marketing officer. Responses are distributed across the Americas (45%), EMEA (Europe, the Middle East, and Africa) (38%), and Asia Pacific (16%). Primary industries represented include financial services (29%); energy and industrials (20%); consumer (17%); life sciences and health care (9%); and technology, media, and telecommunications (8%). Most organizations surveyed (85%) are for-profit enterprises: 46% are privately owned and 39% are publicly traded. Among the rest, 10% are not-for-profit organizations, and 5% are government- or state-owned. Surveyed organizations vary in size, with annual revenues ranging from less than US$500 million to more than US$100 billion reported in their last fiscal year.

The views and opinions expressed by interview subjects are solely their own and do not necessarily reflect the views and opinions of Deloitte or any other individuals or organizations. These interviews provide general information only and are not intended to constitute advice or services of any kind. No individual or organization shall be responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on the views or opinions expressed in these interviews.