Shifting trade flows in Europe: How geopolitical dynamics are shaping new alliances

The Deloitte geoeconomic dynamics index reveals how Europe’s trade partnerships could adapt to new geopolitical realities

Geopolitical tension is no longer background noise for global businesses—it is directly reshaping investment flows, supply chains, and trade patterns. For European companies, this interplay between economic and political factors means adapting to a new reality where alignment, resilience, and strategic positioning are essential. To gain a deeper understanding of how Europe’s international relationships are evolving, this article leverages data from the 2025 Deloitte geoeconomic dynamics index on trade and geopolitical alignment. The index, developed by Deloitte’s economic research team, draws on the analysis of more than 59 million data points across multiple indicators to identify the evolution of international relationships (see methodology).

Data on global geopolitical cohesion reveals a sustained decline over the past 15 years. Rising global fragmentation, growing supply chain risks, and intensifying strategic competition around the globe expose the vulnerabilities of the European trade structure built on interdependence and consensus. Analysis of historical data on Europe’s economic and geopolitical relationships shows how trade and geopolitical alignment move in tandem for the region. Beyond purely economic considerations, our findings show that geopolitics plays a crucial role in shaping Europe’s trade relationships. As global geopolitical cohesion deteriorates, Europe’s economic model—anchored in openness and multilateralism as a means of securing prosperity and international influence—comes under pressure.

Looking ahead, Europe’s future trade partners can, therefore, not be exclusively defined by their economic potential, but also by their geopolitical risk profile. Building on the global trends in recent years, Deloitte economic research estimated projections for Europe’s most important trading partners in 2035, highlighting alliances that will be determined both by their shared economic interests and geopolitical proximity.

For companies operating in or trading with Europe, these changes are no longer theoretical—they are already reshaping their day-to-day decisions. Shifting trade policies now influence where firms source materials, how they manage risk, and which markets remain viable. Geopolitical alignment, regulatory divergence and supply chain resilience have moved from background concerns to boardroom priorities. Businesses seeking to stay competitive must understand Europe’s evolving trade dynamics as a strategic necessity.

Global geopolitical cohesion is deteriorating

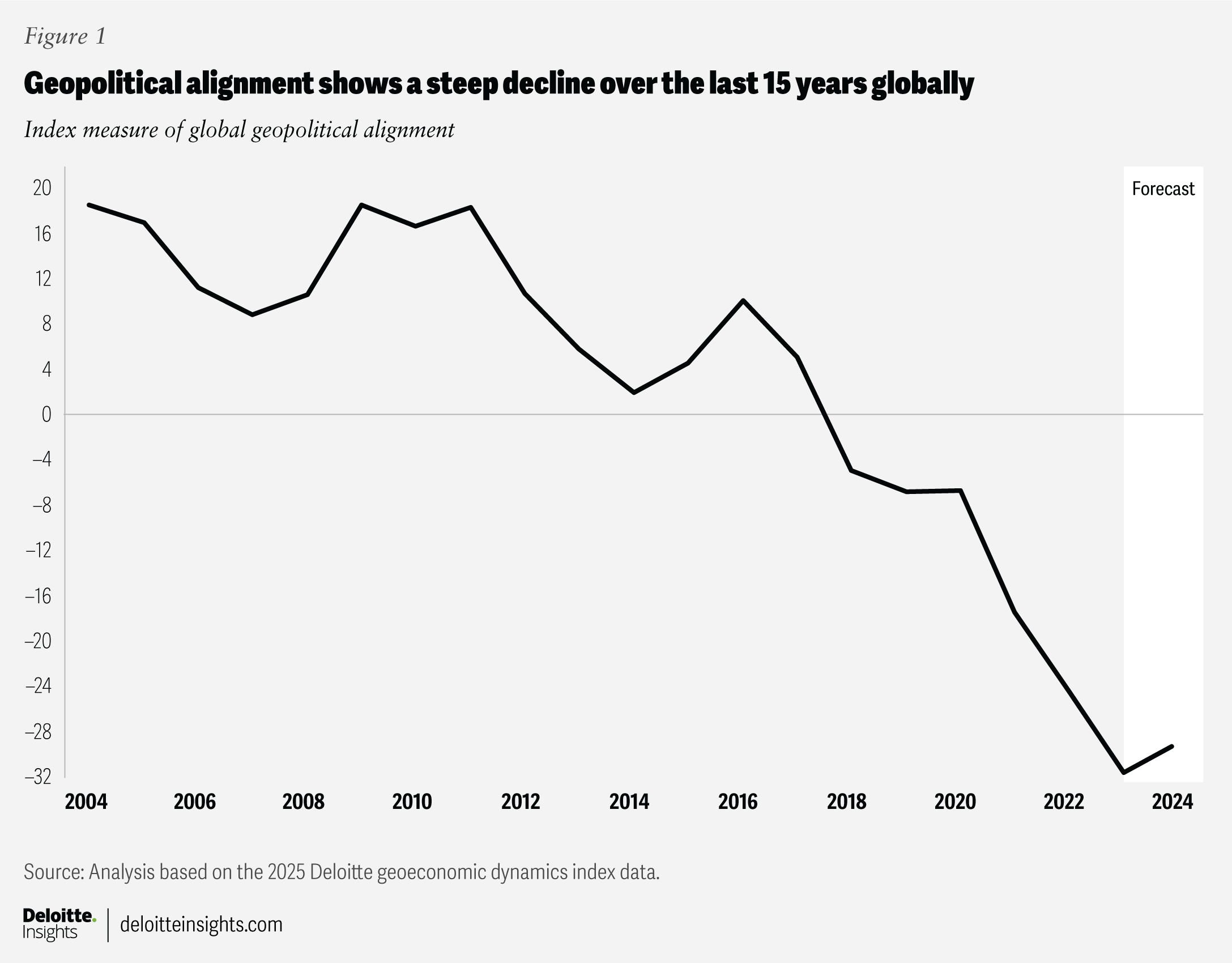

A key finding from the index shows a distinct and sustained decline in geopolitical alignment globally. Since 2011, the geopolitics element of the index—measured by the United Nations voting similarity between countries, sanctions, and military conflict intensity—has declined to record lows (figure 1). Although there was a brief uptick between 2014 and 2016, the downward trend in geopolitical alignment has since intensified, especially over the past four years. This period has been marked by escalating conflicts in Ukraine and the Middle East, alongside a sharp rise in global sanctions—further accelerating the fragmentation of the global economic order. Recent fragmentation between economies shows up clearly in some of the underlying inputs of the index. For example, the number of country pairs with sanctions in force has increased by 9% since 2020, reaching 2,065 in 2024. Over the same period, the alignment in UN voting has declined by 4%.

For Europe, trade and geopolitics go hand in hand

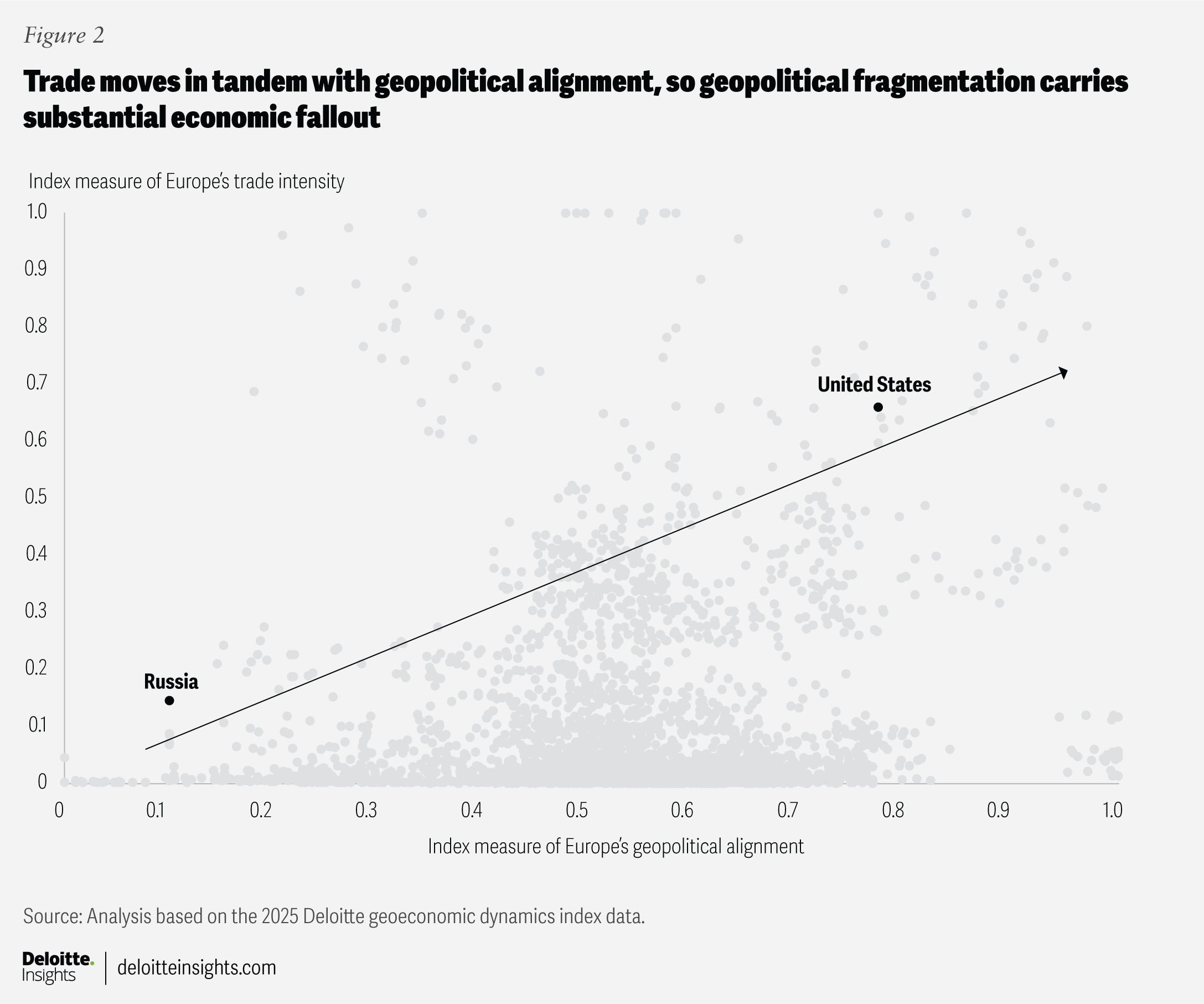

The loss of geopolitical cohesion has a profound impact on international trade, especially in open economies such as Europe. We measure this relationship by comparing, on a country-pair level, trade intensity—a measure of how much two economies trade with each other relative to their gross domestic product—with their geopolitical alignment. For Europe, analysis of the historical data shows that a 1% drop in geopolitical alignment is associated with a corresponding 1% decline in trade intensity (figure 2).

A prominent example: As relations with Russia worsened after it invaded Ukraine, Europe's trade with the country fell sharply. The drop reflects a broader trend: when political ties unravel, economic connections often follow.

Between 2020 and 2024, Europe strengthened its alignment with the United States, and a significant rise in transatlantic trade mirrored this. Trade between the European Union and the United States grew by nearly 40% during that period, while foreign direct investment flows also increased markedly over the period until 2024.

Yet the story is not one of simple decoupling, where geopolitics alone dictates the way. Trade with countries such as Saudi Arabia and the United Arab Emirates has increased based on the mere realities of commodity dependencies. Geopolitics does shape the direction of travel here, but it is not the only determinant.

Europe’s future trade partners

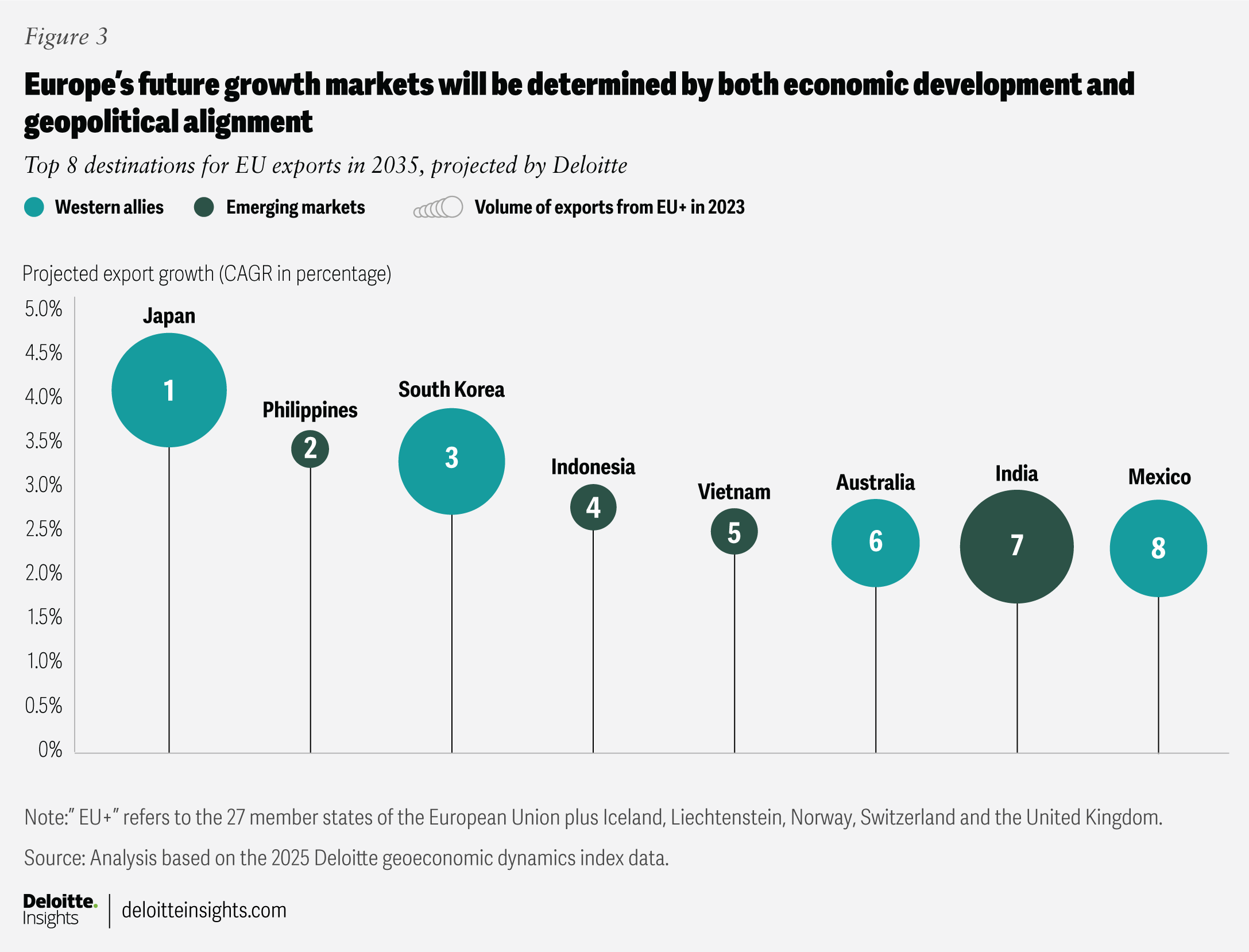

Looking ahead, Europe’s future trade flows will, therefore, be shaped by market potential as well as geopolitical dynamics. We can use the trends of the recent years identified by the index as inputs for our trade model to calculate projections for the most important export growth markets for Europe in ten years (figure 3). The model outcomes reinforce the already visible first indications that Europe’s trade partnerships could be shifting away from purely economically driven countries to more selective and geopolitical alliances.

Countries such as Japan and South Korea illustrate this trend clearly. Once viewed as stable but secondary partners, they could now emerge as core drivers of Europe’s export growth. Our forecast projects annual export growth from Europe to Japan of 4.1% and to South Korea of 3.3%, driven not just by market expansion but also by more substantial geopolitical alignment, evidenced through deepening trade ties, recent defense agreements, and rising foreign direct investment.

In parallel, Europe is eyeing opportunities in emerging Asian economies, including India, Indonesia, Vietnam, and the Philippines. While these countries have not yet fully aligned with any geopolitical bloc, their strong economic momentum makes them attractive prospects. However, as historic experiences have shown, the absence or breakdown of political alignment can swiftly undermine economic partnerships. From a policy side, ensuring long-term trade stability with these markets to match the projections will require Europe to actively foster closer geopolitical ties that can serve as a foundation for deeper economic integration.

Conversely, Europe’s trade relationships with countries with declining alignment—such as Belarus, China, Iran, and Russia—are projected to deteriorate further. As global economic relations become increasingly shaped by strategic alliances, Europe’s trade shifts reflect not just where growth is possible but where it is politically sustainable. The challenge lies in cultivating this next generation of trade relationships in a way that balances opportunity, resilience, and alignment.

Case study

Japan: A rising partner in Europe’s trade realignment

Japan, long seen as a dependable yet secondary trade partner for Europe, is deepening its partnership with the European Union on multiple levels, growing into a “quiet alliance.” This shift reflects Japan’s economic resilience, a growing political alignment, and shared strategic values between the two regions.

Since the EU-Japan Economic Partnership Agreement came into effect in 2019, trade relations have deepened. In the past four years, this momentum has accelerated, supported by closer diplomatic ties, rising foreign direct investment, and joint efforts in areas such as digital innovation, green technology, and defense. As geopolitical alignment becomes as critical as market size in Europe’s trade calculus, Japan’s role has been reshaped —not just as a commercial partner, but as a strategic ally.

Our projections suggest that exports to Japan could grow by over 4% annually through 2035. In many ways, Japan illustrates how previously underleveraged relationships can take on new relevance as Europe’s economic relationships are evolving.

Building strategic resilience in a fragmented global economy

For companies, these new geopolitical realities should induce a change in strategic thinking. Geopolitical dynamics have become a strategic variable on par with cost, market potential, and proximity. Considerations of political alignment and risk exposure now shape decisions about market entry, sourcing, and supply chains. Understanding the direction and pace of geopolitical change is essential in this context.

As geopolitical shifts accelerate and economic distortions become more frequent, European companies can no longer afford to remain reactive. Staying competitive means more than just reacting to change. Companies should adjust operations to keep pace with shifting conditions, stay ahead of emerging risks and act quickly when opportunities arise. At the same time, companies need to build geoeconomic awareness—the ability to read how politics and economics intersect and understand how they shape investment conditions, regulatory environments, and trade flows. This is no longer a matter for government affairs teams alone. Senior leaders should know where to engage, how to voice their interests, and which platforms—whether trade associations, regional forums or policymaker roundtables—can influence the rules that affect them.

As they look to build long-term strategic resilience, they should consider their company’s position through at least three critical lenses: efficient and resilient supply chains, individual risk exposure, and the potential for opportunity amid disruption.

Efficiency only with resilience: Global supply chains built on cost efficiency alone are showing cracks. Sanctions, trade disputes, and shifting alliances have exposed how brittle “just-in-time” systems can be. Building resilient supply networks that can absorb shocks, adapt quickly, and ensure continuity is the new imperative. This means prioritizing redundancy over razor-thin margins and flexibility over the fastest route. Businesses that once optimized purely for cost are now learning to optimize for durability.

Individualized resilience: Not all sectors face the same risks. The risks facing a carmaker dependent on rare earth minerals from politically unstable regions look vastly different from the risks facing a professional services provider. That’s why companies cannot afford to rely on one-size-fits-all risk models. Instead, they need to look closer at their specific exposures—identifying pressure points in supply chains or assessing how regulatory changes might disrupt operations. These insights then inform practical steps, such as broadening the supplier base, moving production closer to home or reshaping logistics.

Opportunity in disruption: While the current geopolitical world brings disruption, it also creates space to grow. Market realignments, shifting alliances, and the emergence of new trade blocs are opening doors to previously overlooked regions. Companies willing to adapt their business models—to reshore, expand into alternative markets, or deepen relationships with trusted partners—stand to benefit. Success will not come from waiting out the volatility, but from stepping into it with a plan. Those who spot political trends early and act decisively will be well-positioned to lead in the next phase of global trade.

Competing through a strong geoeconomic voice

Competing in today’s geoeconomic environment requires more from European firms than agility—it demands strategic insight, operational foresight, and the ability to influence the broader system in which a company operates. As geopolitics becomes a driving force behind investment flows, trade flows and regulatory landscapes, businesses must move beyond risk mitigation and become more active. This means developing internal capabilities to understand geopolitical trends, engaging in policy dialogue where decisions are being shaped and aligning corporate strategy with the realities of a more fragmented world.

Companies that invest in building this geoeconomic intelligence and voice—whether through dedicated internal teams, industry coalitions or cross-border partnerships—will be better positioned to anticipate disruptions, capture new growth opportunities, and influence outcomes. Ultimately, this is not just about protecting margins. It is about shaping the operating environment and demonstrating leadership in a world where economics, politics, and power are increasingly intertwined.

Methodology

Measuring global shifts

The 2025 Deloitte geoeconomic dynamics index offers a detailed analysis of global trends by assessing 249 countries and territories across 35 indicators in five key areas: financial integration, geopolitical alignment, trade ties, cultural relationships, and geographic proximity.

These indicators include data on foreign direct investment, debt and equity positions, trade volumes, sanctions, military alliances, UN voting patterns, and conflict-related deaths, among others.

Its bottom-up approach sets the index apart, mapping country-pair relationships to provide a high-resolution view of bilateral and regional dynamics. This method allows results from more than 59 million data points to be aggregated, enabling the identification of meta trends, as well as detailed national, regional, and global insights. The strength of connections is weighted by the average GDP of country pairs—meaning changes between larger economies have a greater effect on the overall results. For details on methodology, data sources, and calculations, see the appendix in the downloadable report.

Read the 2025 Deloitte geoeconomic dynamics index.