The value‑seeking consumer is reshaping auto demand

As affordability tightens and brand loyalty wavers, consumers appear to be rewriting the rules of value in the US automotive industry

The automotive industry is evolving at an unprecedented pace, thanks to a set of converging drivers, from the emergence of software-defined vehicles and artificial intelligence–enabled connected technologies to shifting regulatory policies and global trade uncertainty. In the middle of this transformation sits an increasingly cost-conscious consumer and their perception that vehicles are becoming increasingly less affordable. In fact, recent results from Deloitte’s ConsumerSignals survey suggest nearly two-thirds of US consumers (62%) believe new vehicles are unaffordable.1

The growing concern over affordability prompted many consumers to pull vehicle purchases forward during the first half of the year to get ahead of potential price increases resulting from trade uncertainty.2 The market was further bolstered by strong battery electric vehicle sales before Sept. 30, 2025, when federal purchase incentives ended.3 To avoid exaggerating affordability perceptions and losing market share, manufacturers also absorbed roughly US$12 billion of tariff-related cost increases.4 As a result, the hit to operating profitability is estimated to be significant, exceeding US$30 billion by the end of the year.5 Industry analysts believe this is unsustainable and expect 2026 model year offerings to come with higher sticker prices.6

Against this backdrop, shifting consumer expectations and tightening affordability are likely redefining what “value” means in the automotive marketplace, possibly setting the stage for a new era driven by the value-seeking consumer.

Enter the value-seeking consumer

Four in 10 surveyed US consumers, including many young families with six‑figure incomes, belong to a powerful new consumer segment called the “value seeker.”7 These consumers appear to be looking for an array of options to satisfy their mobility needs—they may choose to buy a smaller, more affordable new vehicle, opt for a used vehicle, or simply hold on to their current vehicle for longer. Some consumers, including 44% of those belonging to the 18 to 34 age group, even wonder whether they need to own a vehicle at all, considering the growing availability of mobility-as-a-service (MaaS) solutions.8

Overall, surveyed consumers prioritize product quality (58%), price (53%), and vehicle performance (51%) when making a purchase decision.9 Beyond product-related factors, 4 in 10 respondents also consider the quality of their current ownership experience. Consumers may scrutinize the price tag, but they also expect a brand experience that justifies the financial outlay. In short, they seek value that’s not defined by price alone.

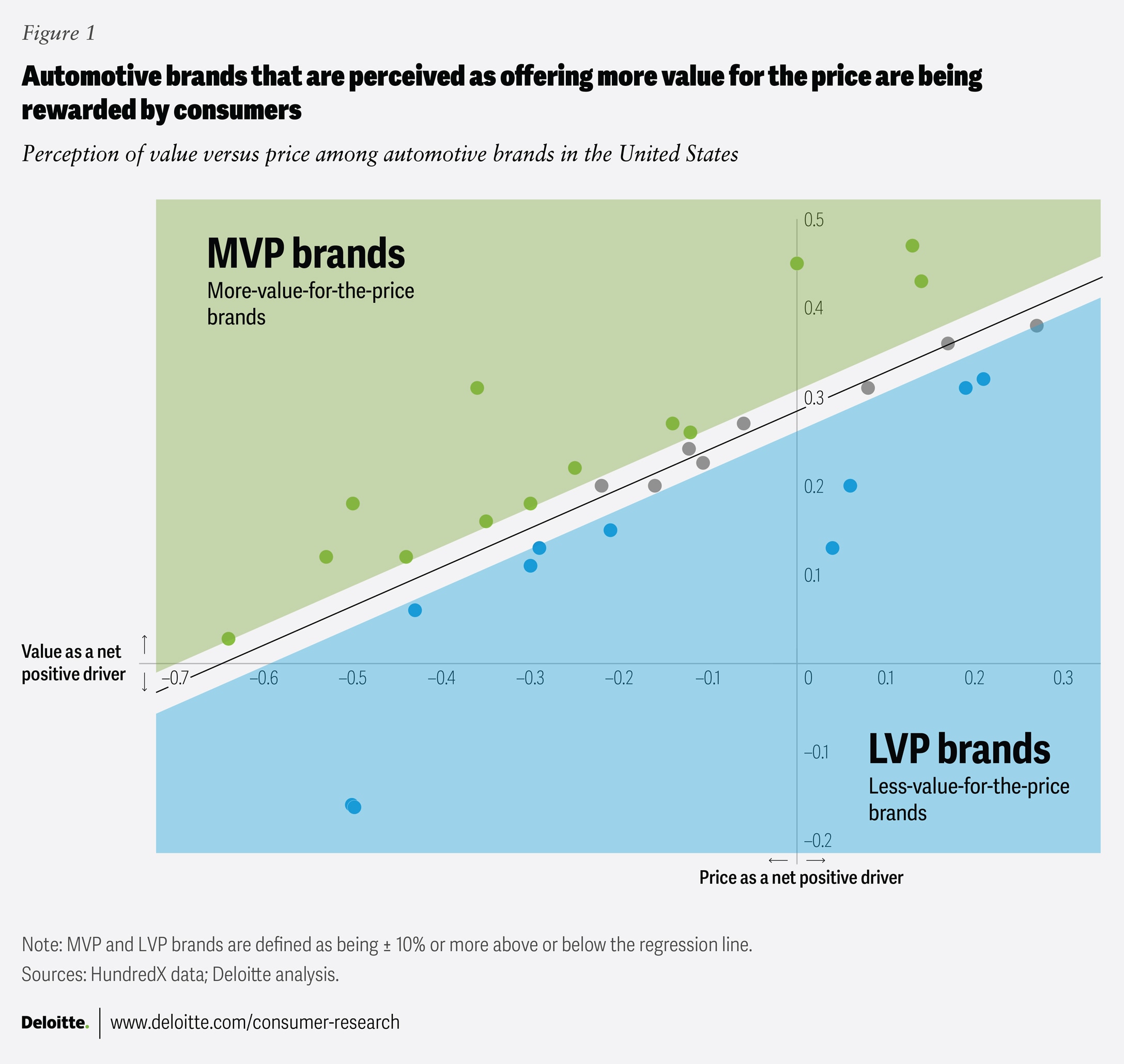

In turn, these consumers seem to be rewarding vehicle brands that stand out as providing “more value for the price” (MVP).10 As a group, these brands not only score higher on the primary drivers of brand choice, including product reliability and performance, but also on key non-price drivers of customer experience and loyalty, including trust (figure 1). This applies to both mass-market and premium brands as value-seeking behavior transcends household income segments. As a result, MVP brands are capturing an increasing share of the new vehicle market, while LVP brands are declining.11 Clearly, being an MVP brand can be a significant advantage in a fiercely competitive market where sales are expected to remain well below the last peak of 17.5 million units in 2016.12

Further, in an environment where loyalty can be fragile, brands can no longer assume that existing customers will automatically return. Deloitte’s 2025 Global Automotive Consumer Study found that more than half of US respondents (54%) plan to switch brands for their next vehicle.13 With brand loyalty in flux, purchase decisions could hinge on whether companies deliver tangible and consistent value in both product and experience at each step of the customer journey. Winning loyalty in this context will likely require brands to anchor offerings on these fundamentals while communicating a clear value proposition.

Affordability versus customer expectations

The average transaction price for a new vehicle in September 2025 was US$50,080, breaking through the US$50,000 threshold for the first time.14 A typical monthly payment now exceeds US$750.15 However, 75% of US new vehicle intenders expect to pay less than US$600 per month for their next vehicle, which appears to signal unrealistic expectations in a market defined by higher prices and extended finance terms.16

In fact, the relentless rise in new vehicle prices pushed the share of new car buyers taking on monthly payments of US$1,000 or more to a near all-time high of 19.1% in the third quarter of 2025.17 At the same time, some consumers are attempting to compensate by extending their finance terms, as 22.4% of new vehicle loans are now 84 months or longer.18 Meanwhile, 0% annual percentage rate promotions have nearly disappeared, accounting for just 0.9% of new loans, the lowest in more than two decades.19 Taken together, it appears that a significant number of households are trading future financial flexibility to satisfy their mobility needs today, underscoring the lasting impact of affordability erosion in the market.

Where have all the entry-level cars gone?

Over the last 15 years, many automakers have been laser-focused on minimizing their exposure to less profitable models in their lineup. In some cases, they discontinued models altogether, resulting in sales of small and compact cars dropping from 2.5 million units in 2010 to 1.7 million units expected this year. Over the same time, sales of small and compact SUVs exploded from 1.5 million units to 5.4 million units. In fact, sales of light trucks, which are generally more expensive, are expected to reach 13.1 million units this year, compared with only 2.7 million passenger cars.20 While it is hard to argue with companies trying to maximize profitability, it has left a significant gap at the bottom of many brand ladders, making it difficult for some value-seekers to climb aboard.

At the same time, overall market growth is expected to remain relatively flat. GlobalData forecasts 2025 US light vehicle sales at 15.8 million units, down 0.8% from roughly 16 million units in 2024. In 2030, sales are only expected to reach around 16.3 million units, implying a compound annual growth rate of just 0.3% from 2024 levels.21 With the market barely expanding over the next five years, automakers are not competing for new growth but for slices of a largely fixed pie, intensifying the fight for share in an era where the bond of brand loyalty cannot be taken for granted.

As some manufacturers retreat from smaller, more affordable segments, cost-conscious buyers may look to the used vehicle market to maximize the value of their next vehicle purchase.

The used vehicle sweet spot

Value seekers are 2.4 times more likely to buy used vehicles, and recent market trends seem to confirm why.22 The average transaction price for a three‑year‑old used vehicle was US$31,216 in the second quarter of 2025, just US$409 shy of the all-time high of US$31,625 in the second quarter of 2022.23 By August, the average used‑vehicle price across all ages was US$25,393, a modest decline from July.24 Persistently high used-vehicle prices mean consumers may be weighing more carefully whether new or pre-owned purchases deliver real value. Depressed new vehicle sales during the COVID-19 pandemic have limited the number of vehicles entering the secondary market, putting continued pressure on used vehicle prices.25

Despite pricing pressure, the monthly payment gap remains a strong pull. In the second quarter of 2025, used‑vehicle buyers paid an average of US$559 per month, compared with US$756 for new vehicles.26 For value seekers, that US$200 monthly difference can be decisive, underscoring the importance of transparent certification, warranties, and reconditioning standards, as they enable consumers to see used vehicles not as a compromise, but as a confident, value‑driven choice.

Holding onto vehicles longer

The average age of a light vehicle in the United States rose to 12.8 years in 2025, up two months from the prior year.27 Consumers are holding on to cars longer, perhaps delaying their purchase decisions until they feel confident that value has returned to the marketplace.

Longer ownership cycles likely boost demand for aftermarket service and maintenance, highlighting the importance of transparent, trust‑based service that reassures customers they are getting maximum value from their aging assets.

Even new technologies designed to draw consumers into new vehicles may have unintended consequences for demand down the road. Increasingly popular over-the-air software updates can keep the mobility experience “fresh,” with enhanced performance and connected services, potentially prompting owners to keep their vehicle for longer.

Winning the value-seeking consumer

The rise of the value seeker is not likely a temporary response to inflation. It appears to be a durable mindset that cuts across income levels. Winning in this environment may require brands to compete not just on price but also on perceived fairness, transparency, and trust.

What automotive leaders can do

- Play the whole game: People are keeping their vehicles longer, creating opportunities to enhance the customer’s experience further into the ownership life cycle.

- Embrace flexible mobility solutions: Value seekers are also signaling a willingness to trade vehicle ownership for increased optionality. Used vehicle leasing and subscriptions are becoming important tools to increase access to affordable mobility solutions.

- Make “trust” a strategic profit driver: Proactively highlight the pricing logic of sales and service events and clearly explain ownership costs, turning transparency and predictability into engines of repeat business.

As affordability pressures reshape consumer behavior, value is being redefined not just by price, but also by flexibility, fairness, and trust. The value-seeking consumer is accelerating the industry’s shift from one-time transactions to multi-life asset models, keeping vehicles attainable while sustaining profitability. Brands that embed transparency and predictability into every stage of the customer relationship will convert short-term affordability concerns into long-term loyalty. In a stagnant market, those that treat trust as a profit driver and mobility as a lifetime journey will earn a “more-value-for-the-price” reputation—and with it, an advantage in market share and repeat customers.