2026 Manufacturing Industry Outlook

Renewed strategic focus and targeted technology investments could be essential to maintaining a competitive edge in 2026

Steve Shepley

Kate Hardin

John Morehouse

Kruttika Dwivedi

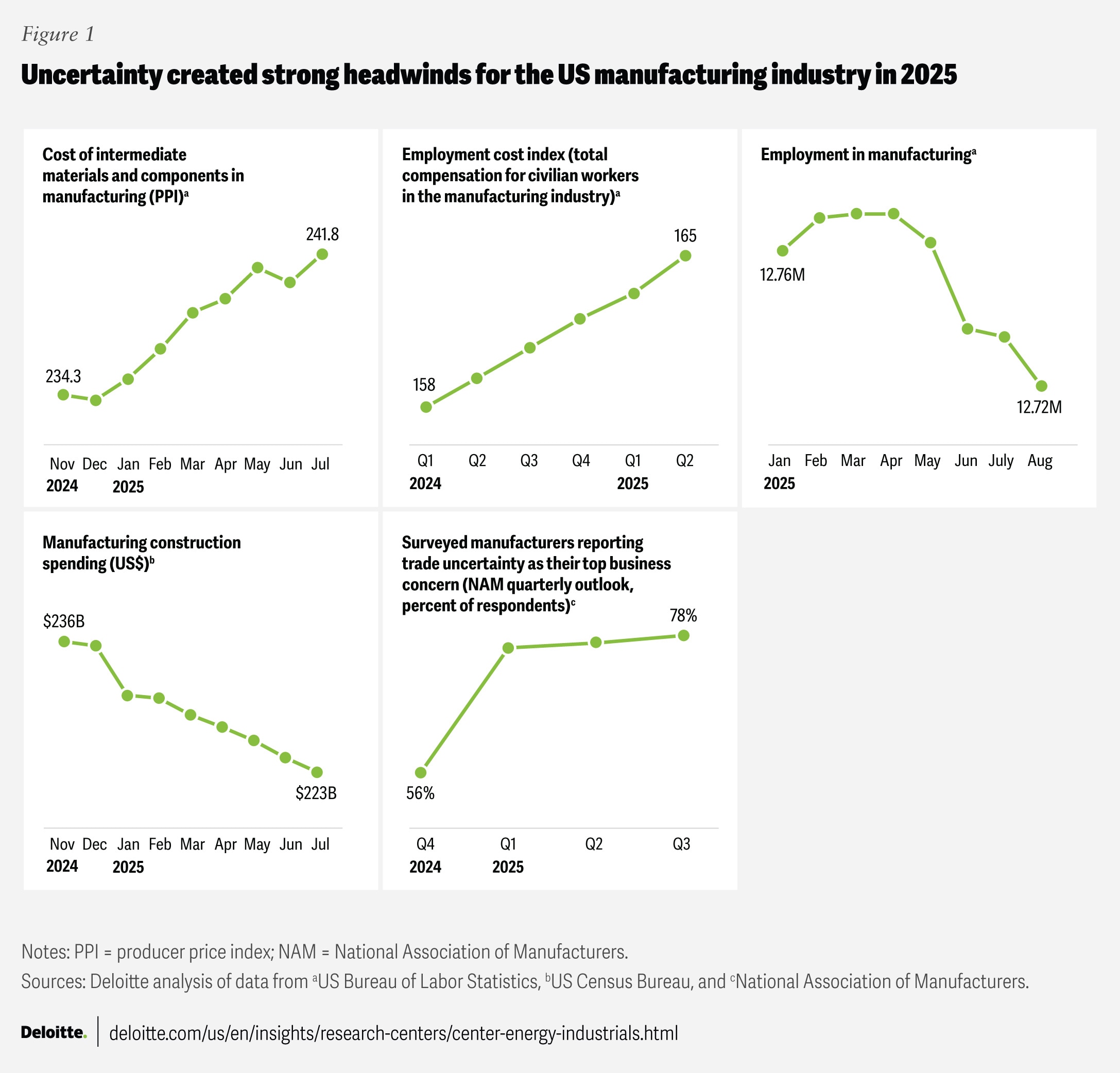

In 2025, the US manufacturing industry faced a challenging economic environment. The Institute for Supply Management’s manufacturing purchasing managers’ index remained below 50 for much of the year, signaling contraction in the sector.1 Costs rose, employment fell,2 and manufacturing construction spending—an indicator of investment in new or expanded facilities3—steadily declined (figure 1). These challenges were due in large part to trade policy uncertainty and tariffs.4 More than three-quarters of manufacturers5 responding to the National Association of Manufacturers 2025 quarterly outlook surveys consistently cited trade uncertainty as their top concern (figure 1).

Despite these challenges, there are opportunities for US manufacturers on the horizon in 2026. The passage of a major tax and spending bill, commonly called the One Big Beautiful Bill Act, includes several tax provisions that could lower costs and encourage manufacturing investment.6 The announcement of additional revised US trade deals, such as those struck with the United Kingdom and Vietnam, could help reduce uncertainty,7 while interest rate cuts8 might help reignite demand for manufactured goods. Despite the potential for these developments, manufacturers should prepare for multiple economic scenarios: continuation of current market conditions, possible contraction, or renewed growth.9

Table of contents

To help industry leaders gain agility, build resilience, and uncover new opportunities in the year ahead, Deloitte’s 2026 Manufacturing Industry Outlook explores the following trends:

- Smart manufacturing and operations: Continued investment in technology, including agentic AI, can boost competitiveness and agility

- Supply chain: New digital tools can offer transformative solutions for managing global supply chain complexity

- Manufacturing investment: New incentives, the data center boom, and continued demand for semiconductors could drive investment and growth

- Aftermarket services: Agentic aftermarket services could transform the customer experience

- Talent: An adaptive workforce planning framework could help address uncertainty and increasing skill requirements

1. Smart manufacturing and operations: Continued investment in technology, including agentic AI, can boost competitiveness and agility

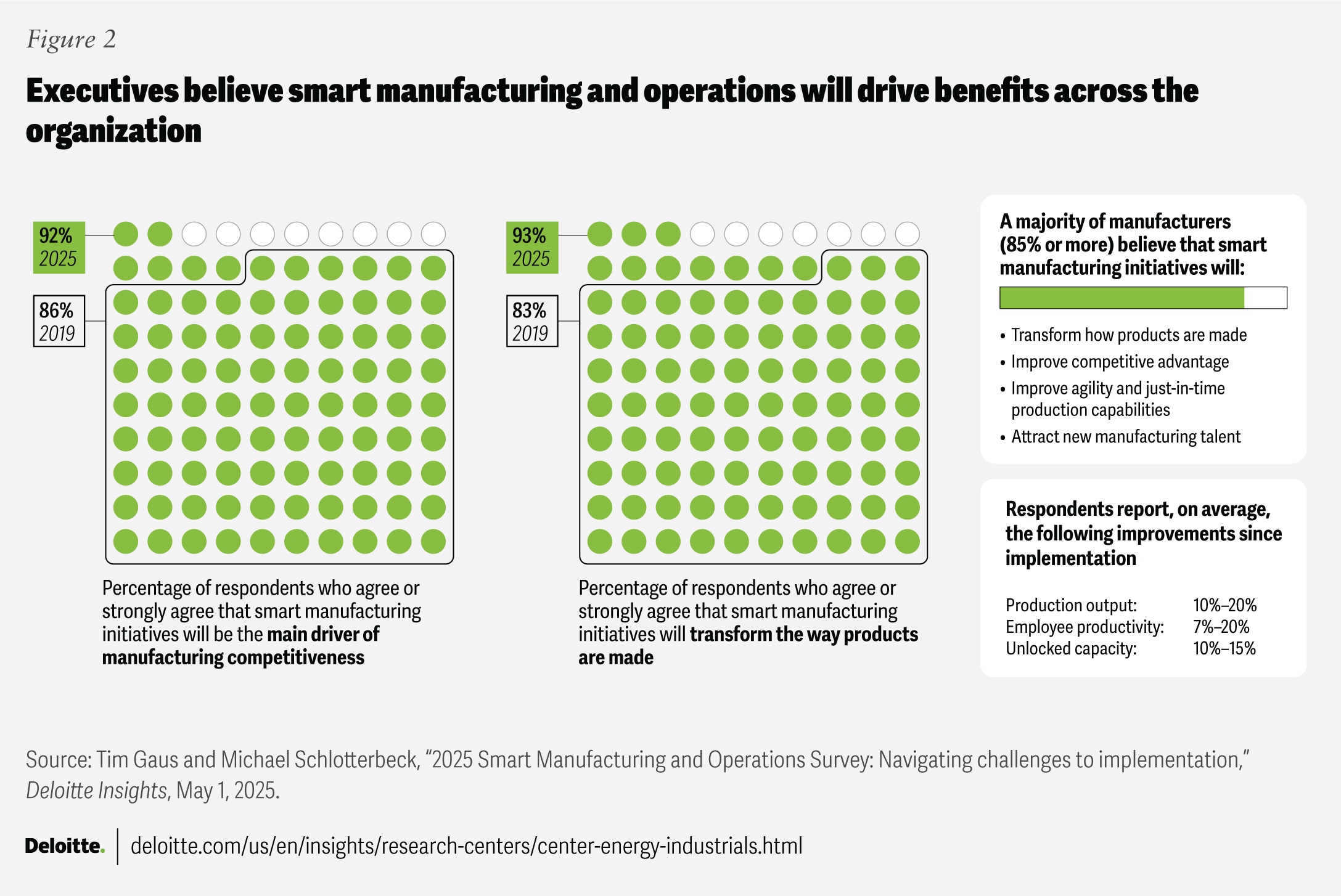

Investment in smart manufacturing is likely to continue in 2026 as manufacturers seek to improve competitiveness, agility, and resilience in the face of uncertainty and complexity. A 2025 Deloitte survey of 600 manufacturing executives found that the majority (80%) plan to invest 20% or more of their improvement budgets in smart manufacturing initiatives, with a focus on foundational tools and technologies. These include automation hardware, data analytics, sensors, and cloud computing.10 According to the survey results, they largely view smart manufacturing as the primary driver of competitiveness over the next three years, thanks to benefits such as improved production output, increased employee productivity, and unlocked capacity (figure 2).11

Through its ability to reason, plan, and take autonomous action, agentic artificial intelligence is also poised to elevate smart manufacturing and operations. Industry adoption12 is likely to grow considerably in the next few years.13 Agentic AI can help add substantial value from the back office to production to the front office by helping manufacturers:14

- Identify and engage alternative suppliers in response to supply chain disruptions

- Capture institutional knowledge from retiring employees and make jobs more attractive to younger generations

- Maximize production uptime with autonomously generated shift handover reports and work instructions

- Improve customer experience by simplifying and accelerating equipment repair

Agentic AI also lays the foundation for physical AI—robots with more autonomy—which could attract additional investment from manufacturers in 2026. Among respondents to a survey conducted by the Manufacturing Leadership Council in early 2025, nearly one-quarter (22%) of manufacturers plan to use physical AI in just two years—a more than twofold increase from today (9%).15 Examples include robotic dogs and humanoid robots that can traverse unstructured environments—like a production floor—and accomplish tasks such as transporting, sorting, and installing specific parts.16

To prepare for a future with agentic AI, manufacturers should consider key factors such as cost, talent, data, technology, governance, and workflow transformation that will be required at scale.17 This approach could be essential to moving from agentic AI pilots to full-scale implementation—a trend that is likely to accelerate in the year to come.18

2. Supply chain: New digital tools can offer transformative solutions for managing global supply chain complexity

The shifting trade and tariffs landscape has resulted in uncertainty and increased costs for US manufacturers in 2025, and companies have responded with a variety of strategies, from front-loading inventory to reevaluating the structure of their supply chains (figure 3).19 Despite these efforts, 78% of manufacturers responding to the National Association of Manufacturers’ “2025 third quarter manufacturers’ outlook survey” reported that trade uncertainty remains their top concern, and they expect input costs to increase by an average of 5.4% over the next year.20

However, the future could bring greater trade certainty. The United States has brokered tariff agreements with the United Kingdom, Vietnam, Japan, Indonesia, the Philippines, South Korea, and the European Union, and additional deals could follow.21 The renegotiation of the United States–Mexico–Canada Agreement has also kicked off,22 which could potentially establish stable tariff rates for two of US manufacturing’s largest import partners.23 Nevertheless, sourcing challenges are likely to persist amid ongoing supply chain volatility and as negotiations continue to play out.

To mitigate these potential challenges, manufacturers can continue to invest in digital technologies. A majority of 285 global trade professionals surveyed by the Thomson Reuters Institute in March 2025 indicated that their companies are already using technology to evaluate trade routes, identify risk, find potential cost savings, and perform scenario modeling.24 Agentic AI offers a new level of capability, providing enhanced visibility and agility by autonomously sensing and mitigating supply chain risk while optimizing costs.25 For instance, AI agents can:

- Monitor potential sources of disruption and risk due to trade policies, tariffs, or weather events, with visibility into Tier 1 and Tier 2 suppliers (and beyond)

- Alert appropriate personnel when an issue is detected

- Quantify the potential financial and operational impacts, including the “should-cost”26 value of affected materials and estimated shipment delays

- Recommend alternative suppliers that balance risk and cost

- Initiate mitigation steps, including contract negotiations, with human approval

Given the likelihood that supply chain complexity will continue to increase, targeted investments in digital tools, including agentic AI, could be essential for manufacturers to maintain a competitive edge in 2026 and beyond.

3. Manufacturing investment: New incentives, the data center boom, and continued demand for semiconductors could drive investment and growth

Respondents to a survey of over 500 manufacturers conducted by the Reshoring Initiative in early 2025 indicated that several factors—including some influenced by US policy—could encourage further reshoring to the United States.27 These include a larger pool of highly skilled US workers, a weaker dollar, lower corporate tax rates, regulatory reform, and 15% additional tariffs applied to all imports from all countries.28 The survey results suggest that if trade policies provide greater certainty—even if they may lead to higher input costs—they could support more investment in US manufacturing.

Recent policy changes seek to further investment incentives. The One Big Beautiful Bill Act, for example, retained the corporate tax rate (21%) set by the 2017 Tax Cuts and Jobs Act and made permanent other tax-saving provisions, such as full expensing for new equipment and immediate expensing of domestic research and development.29 The Trump administration also released America’s AI Action Plan, a policy roadmap for US AI leadership, which could help accelerate the data center surge and the demand for related manufactured components, while also promoting deregulation and streamlined permitting for new semiconductor manufacturing facilities.30

Data center growth is already creating substantial demand and driving significant investment, and this is expected to continue in 2026. For instance, startups focused on small modular reactors attracted US$3.9 billion in funding in 2024—a tenfold increase from 2023.31 Several large original equipment manufacturers have reported multi-year agreements to produce key components—such as transformers, switchgear, power management equipment, and power generation systems—and some are sold out for multiple years.32 Various manufacturers have also announced plans to expand US production to meet the growing demand for these components.33

Semiconductor manufacturing investment is also likely to continue to grow. As of July 2025, companies have announced more than US$500 billion in private sector commitments to revitalize the US chipmaking ecosystem, setting the stage for a projected tripling of domestic capacity by 2032.34 These projects are expected to create more than 500,000 jobs in the United States.35 The One Big Beautiful Bill Act also increased the advanced manufacturing investment credit from 25% to 35%, which could strengthen the incentives for investment in US semiconductor manufacturing.36

Manufacturing companies that can harness these growth opportunities in 2026 may be better positioned for the future, especially if economic uncertainty continues.

4. Aftermarket services: Agentic aftermarket services could transform the customer experience

Aftermarket services can be an important revenue source and profit driver for industrial manufacturers, delivering margins that are more than two times higher than equipment sales alone.37 They can also create predictable, less cyclical revenue streams and strategic differentiation, which could be essential for remaining competitive during economic uncertainty. New tools such as agentic AI are also poised to help manufacturers take their aftermarket services to the next level.

A key goal for aftermarket services is to move toward proactive planning, ensuring the right expertise, parts, and tools are available at the point of service when required. This can reduce response times and help customers minimize downtime. Agentic AI can help advance this goal by taking autonomous action on data across multiple internal and external systems,38 such as dealer inventories, service schedules, customer platforms, and manufacturing execution systems. For instance, with a human in the loop for final approvals, an agentic aftermarket system could:

- Detect component wear on farm machinery based on usage patterns, then autonomously order parts, reallocate inventory, schedule service, manage part delivery, and optimize part manufacturing quantities based on real-time demand and equipment utilization

- Dynamically adjust service-level agreements based on equipment usage and risk patterns. For example, AI agents could autonomously upgrade a heavily used bulldozer in a construction fleet to priority servicing.

- Evaluate telemetry data on industrial machinery, detect misuse, validate claims, and even approve or reject warranty submissions

To begin preparing for the agentic aftermarket in 2026, companies can:

- Identify aftermarket personas by breaking down the steps of their aftermarket services to identify where AI agents might be deployed, what their roles could be, and how they can best partner with humans to augment their capabilities while managing risk

- Take a data-backed approach that begins with identifying the key resources required at scale to successfully transition from pilots to fully deployed solutions39

5. Talent: An adaptive workforce planning framework could help address uncertainty and increasing skill requirements

The competition for skilled labor remains intense, especially as manufacturers invest in advanced digital tools and smart manufacturing facilities. For instance, the top concern for more than a third of the 600 manufacturing executives in a 2025 Deloitte survey was “equipping workers with the skills and knowledge they need to maximize the potential of smart manufacturing and operations.”40 The skill sets that companies require may also shift if they adjust their product portfolios to maximize profitability in response to fluctuating tariff costs. And if the trend toward reshoring accelerates—even if companies leverage existing US capacity—the supply of skilled workers could become increasingly strained. Shifting immigration policies may further impact the labor pool, since immigrant workers filled nearly one in four US manufacturing production jobs in 2024.41

The potential for ongoing economic uncertainty in 2026 could compound these challenges. Demand volatility and modifications to new facility construction timelines can cause unpredictable and rapid changes in manufacturing labor needs. However, the long lead times required to hire and train new workers can make it difficult to effectively respond to these swings. Following a “build, buy, or borrow” framework for workforce planning could help manufacturers remain agile while continuing to build and strengthen their workforce for the future, even if it potentially means higher upfront costs. This concept involves:

- Build: Investing in the talent that is most important to the core of the business, including their wages, skills, and employee experience. Nonwage investments are becoming increasingly important, including potential support for childcare, transportation, and housing.42 Leveraging technology to make jobs more flexible, supportive of employee growth, and technologically appealing can also make them more attractive to current and potential employees.43

- Buy: Recruiting external personnel with critical expertise that may take longer or cost more to develop internally.

- Borrow: Hiring temporary workers or third parties to help meet fluctuating demand for roles that have less impact on the core of the business.

Manufacturers could also leverage technology to enhance their talent sourcing, screening, and training processes, including a shift to granular, skills-based workforce modeling and planning. For instance, agentic AI could be used to capture workers’ tacit knowledge and generate standard operating procedures, thereby accelerating onboarding and training.44

Companies that can remain focused on the long-term goal of creating a world-class workforce, while also managing potential uncertainty and volatility in 2026, may gain a substantial advantage over their competitors.

Harnessing technology and strategy for growth in 2026

US manufacturers should prioritize a renewed strategic focus and targeted technology investments in the year ahead to maintain a competitive edge, continue to drive innovation, and achieve sustainable growth regardless of economic conditions. As operations and global supply chains grow increasingly complex, manufacturers can leverage advanced technologies to optimize costs, enhance decision-making, improve customer experience, and create new solutions to longstanding challenges. The AI-fueled data center boom, investments in semiconductor manufacturing, and supportive policies could present new growth opportunities. However, maintaining a focus on developing a skilled workforce while also prioritizing agility could be essential to supporting growth in the coming year and beyond.

Future in focus: Humans to remain at the center of AI-enabled manufacturing

The US manufacturing industry will continue to make its human workforce a top priority over the next few years, even as AI helps reshape the workplace. Artificial Intelligence can accelerate training, knowledge-sharing, and remote collaboration, helping companies address longstanding talent challenges. However, skills that are uniquely human—such as creativity, collaboration, critical thinking, adaptability, and emotional intelligence—will remain essential.45 In fact, skilled, hands-on jobs could offer additional security and purpose to employees, and more than 81% of task hours in manufacturing are expected to remain human-driven.46 By fostering a culture of learning and leveraging AI to augment—not replace—human talent, manufacturers can tackle talent gaps and drive superior performance in an evolving industry landscape.