2026 Life Sciences Outlook

Surveyed life sciences executives are optimistic about their own organizations’ financial outlooks, but identify a need for resilience in a complex global landscape

Pete Lyons

Todd Konersmann

Sheryl Jacobson

Nico Kleyn

Kavita Rekhraj

Darshan Gosalia

The life sciences industry may be increasingly borderless, but confidence does not appear to be. According to Deloitte’s 2026 Life Sciences Outlook Survey, more than 75% of responding biopharma and medtech executives are confident in their own organizations’ financial outlooks for the coming year. However, only 41% feel optimistic about the health of the global economy.

The year ahead may reward organizations that are able to harmonize global momentum with local resilience—balancing bold investments in artificial intelligence and emerging technologies with the pragmatic ability to adapt to regulatory and economic change.

To better understand industry priorities and concerns, the Deloitte US Center for Health Solutions, in collaboration with Deloitte Global, conducted its fourth annual Life Sciences Outlook Survey from August to September 2025. The survey included 280 C-suite executives from biopharma and medtech companies across the United States, Europe (France, Germany, Switzerland, and the United Kingdom), and Asia (China and Japan). Insights from the survey were further enriched by in-depth interviews with several industry leaders (see methodology).

Overall, most surveyed industry leaders agree that real transformation in 2026 will involve innovative thinking, agile operating models, and robust external partnerships to help ensure sustained growth.

Market sentiment varies by region and sector

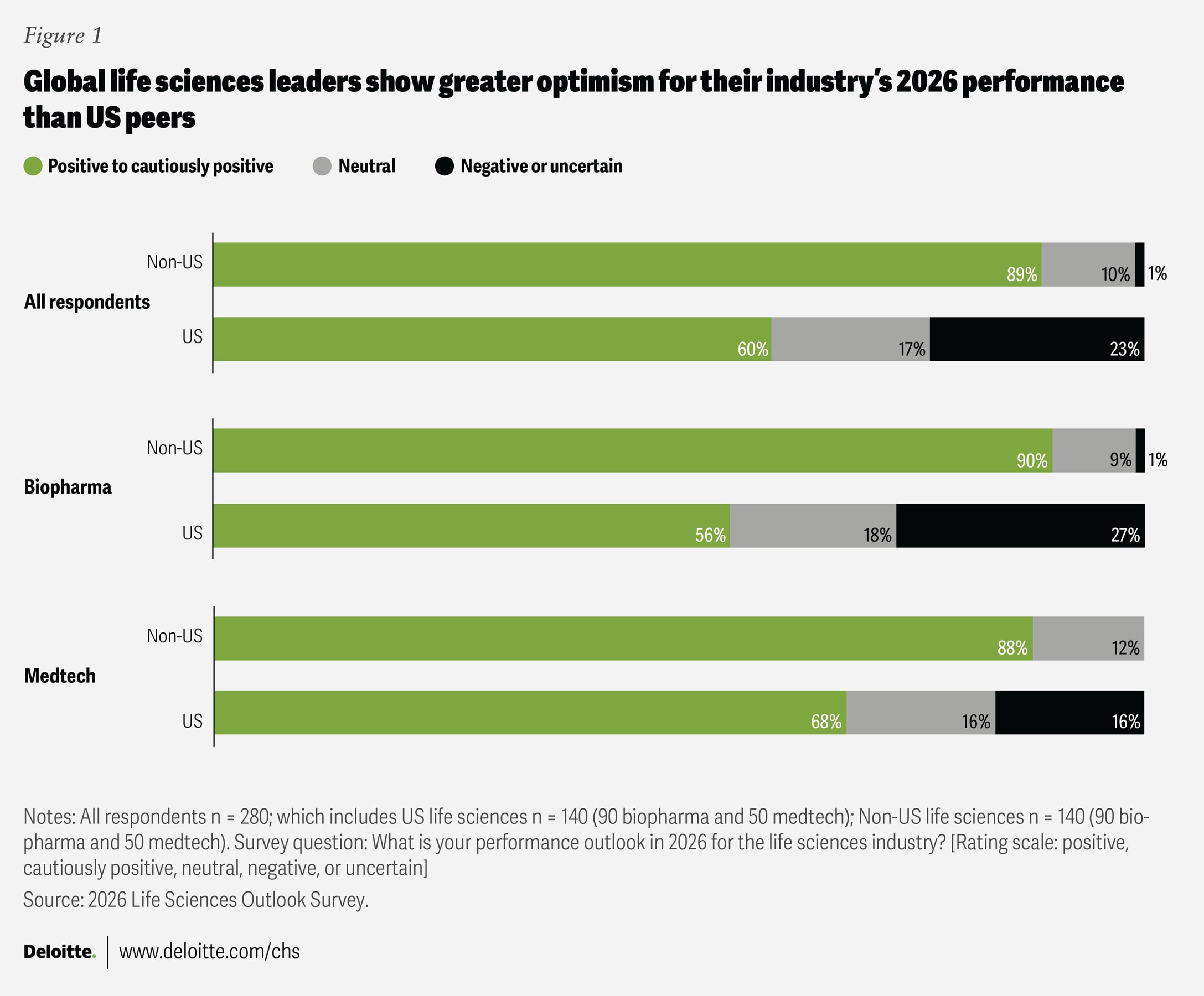

While many surveyed life sciences executives are optimistic about 2026, confidence levels differ across regions and sectors. Ninety percent of biopharma leaders in the surveyed European and Asian countries report “positive” or “cautiously positive” expectations for the coming year; additionally, 83% predict steady or strong revenue growth, and only 2% anticipate a decline. In contrast, optimism is more tempered among US-based biopharma leaders: 56% express a positive or cautiously positive outlook for 2026, while 27% remain negative or uncertain (figure 1). When it comes to growth expectations, 71% of US biopharma respondents anticipate revenue gains, but 18% foresee a decline.

Surveyed medtech executives tend to be more optimistic about the future than their biopharma peers, while anticipating similar revenue growth (81%). There is no statistically significant difference between the growth expectations of medtech executives in the United States (84%) and those in several countries outside the United States (78%), suggesting a broadly consistent outlook across geographies.

While overall optimism is evident among both biopharma and medtech executives for 2026, this positivity is tempered by persistent geopolitical tensions, pricing pressures, and regulatory shifts that complicate growth strategies and operating models. The prevailing US-focused growth strategy appears to be giving way to a more fragmented and complex global landscape.1 Companies are beginning to carefully weigh nuanced decisions about which products to advance, where to launch them, and how to set their prices.2 Some structural characteristics and existing portfolio strategies can serve as an advantage. As one European corporate strategy executive sums up: “[The outlook is] uncertain for sure, but I would say neutral to positive. In these times, if you have a diversified footprint, you can build that agility muscle to react without being completely dependent on one thing.”

“In these times, if you have a diversified footprint, you can build that agility muscle to react without being completely dependent on one thing.”

Another perspective comes from Gabriele Ricci, chief data and technology officer at Takeda Pharmaceuticals, who notes, “Volatility fuels innovation,” reflecting a readiness to embrace and adapt to a dynamic landscape and to drive progress amid ongoing uncertainty. He adds, “We’re all entering a period of purposeful transformation, where discipline and innovation must coexist as the industry matures beyond hype toward measurable productivity from AI and data.”

In response to rapidly shifting dynamics, surveyed executives identified a set of interlinked strategies—from advancing digital transformation and managing regulatory change to optimizing pricing and portfolio management. The following sections highlight the areas executives consider most important for maintaining growth and resilience in 2026.

Trends shaping 2026 strategies

Looking ahead, life sciences leaders cited several trends likely to influence their corporate strategies in 2026. While digital transformation remains a core focus, regulatory changes, pricing pressures, and geopolitical shifts are equally pressing and could affect organizational performance.

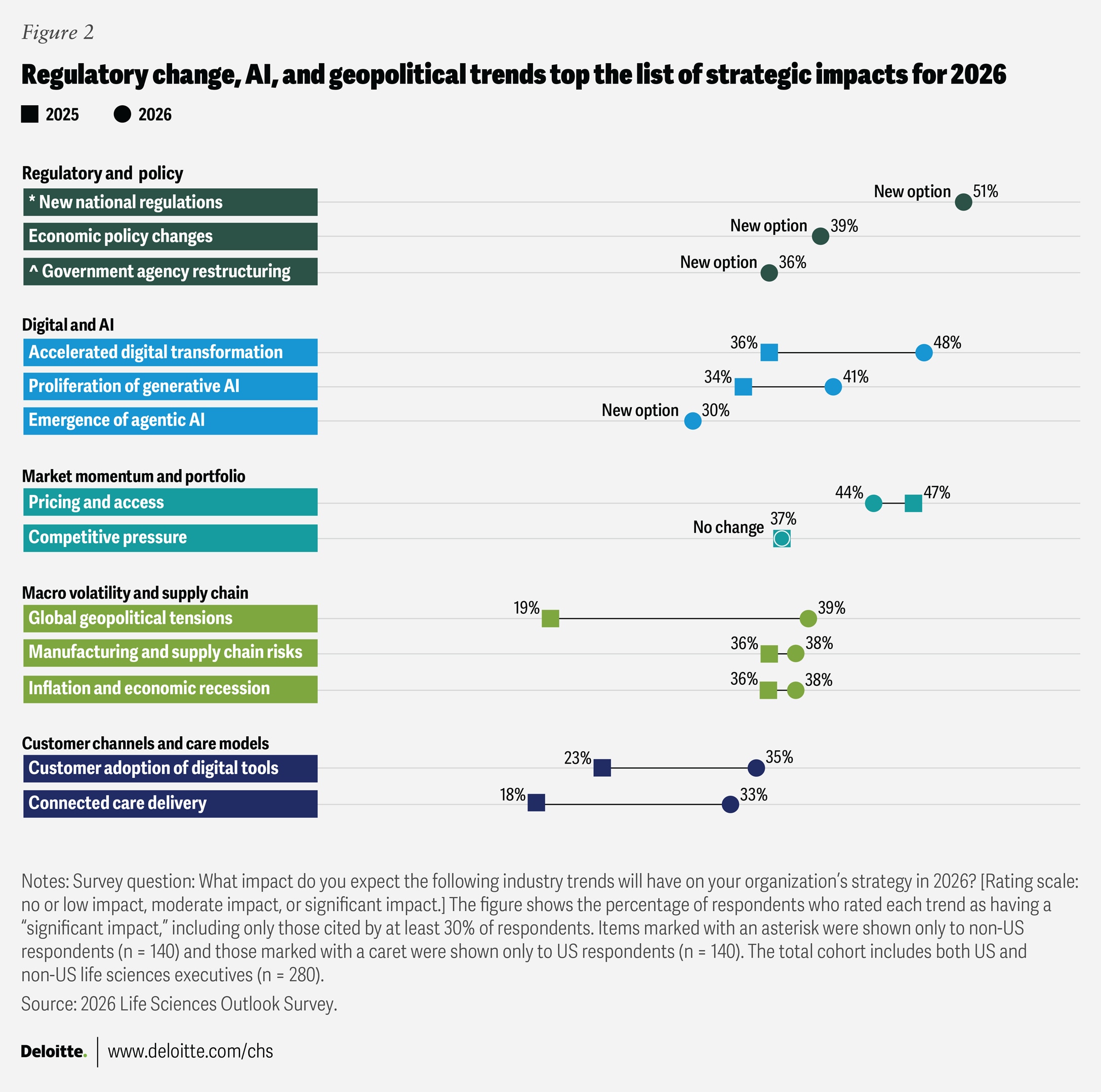

Survey respondents identify several major trends that will most likely influence their organizations’ operational strategies in 2026 (figure 2).

- Growing regulatory and policy influence: Regulation was the most frequently cited trend expected to shape organizational strategy. One in two non-US respondents (51%) pointed to national regulatory changes—such as the EU AI Act, the Corporate Sustainability Reporting Directive, the European Health Data Space, and China’s volume-based procurement program3—that could affect market access, pricing, and reimbursement models. In the United States, 36% of respondents highlighted agency restructuring within the Food and Drug Administration and the Department of Health and Human Services, while 39% cited economic policy changes, including tariffs. These factors might also shape how leaders think about pricing and portfolio management decisions in the year ahead.

- Acceleration of digital transformation and AI: Nearly half of respondents (48%) identified accelerated digital transformation as a trend that is likely to have a substantial impact on their organizations in 2026—a statistically significant increase compared with 2025. The proliferation of generative AI, identified by 41% of respondents as an influential trend, highlights how analytics and automation are increasingly shaping research, manufacturing, and commercial operations. Notably, 30% cited agentic AI—AI systems that can act autonomously to achieve goals, make decisions, and perform tasks—a new survey category this year, signaling growing interest in advanced digital capabilities. Despite these investments, only 22% of life sciences leaders said they have successfully scaled AI, and just 9% reported achieving significant returns on these efforts.

Cybersecurity concerns are also on the rise, with 35% of respondents saying it will affect their strategy. - Persistent pricing, access, and portfolio pressures: Pricing and access to medications, therapies, and medical technologies remain major strategic considerations for 44% of respondents—a slight change from last year’s Life Sciences Outlook. Other key trends expected in 2026 include increased competitive pressure from generics and biosimilars (cited by 37% of respondents), as well as the expiration of blockbuster drugs and impending patent cliffs (mentioned by 26%).

- Heightened geopolitical and economic uncertainty: Concern about geopolitical tensions has risen sharply, with 39% of respondents naming it as a top issue—a jump of 20 percentage points from last year and the largest increase among all tracked trends. Nearly the same share of respondents (38%) identified inflation, broader economic pressures, and supply chain risks as factors likely to shape organizational strategies in 2026.

- Evolving customer models and needs: One-third of respondents (33%) said connected care delivery is a top trend for 2026—a rise of 15 percentage points year over year. Customer adoption of digital tools was cited by 35% of executives, while evolving customer needs and preferences were cited by 32%, highlighting the ongoing shift in care delivery and engagement models. As a supply chain executive from a large US medtech company put it, “There aren’t enough phlebotomists or lab managers. Our customers don’t have enough people capacity. We need to automate things for them and make it cost-effective.”

Investment analyst questions signal market expectations

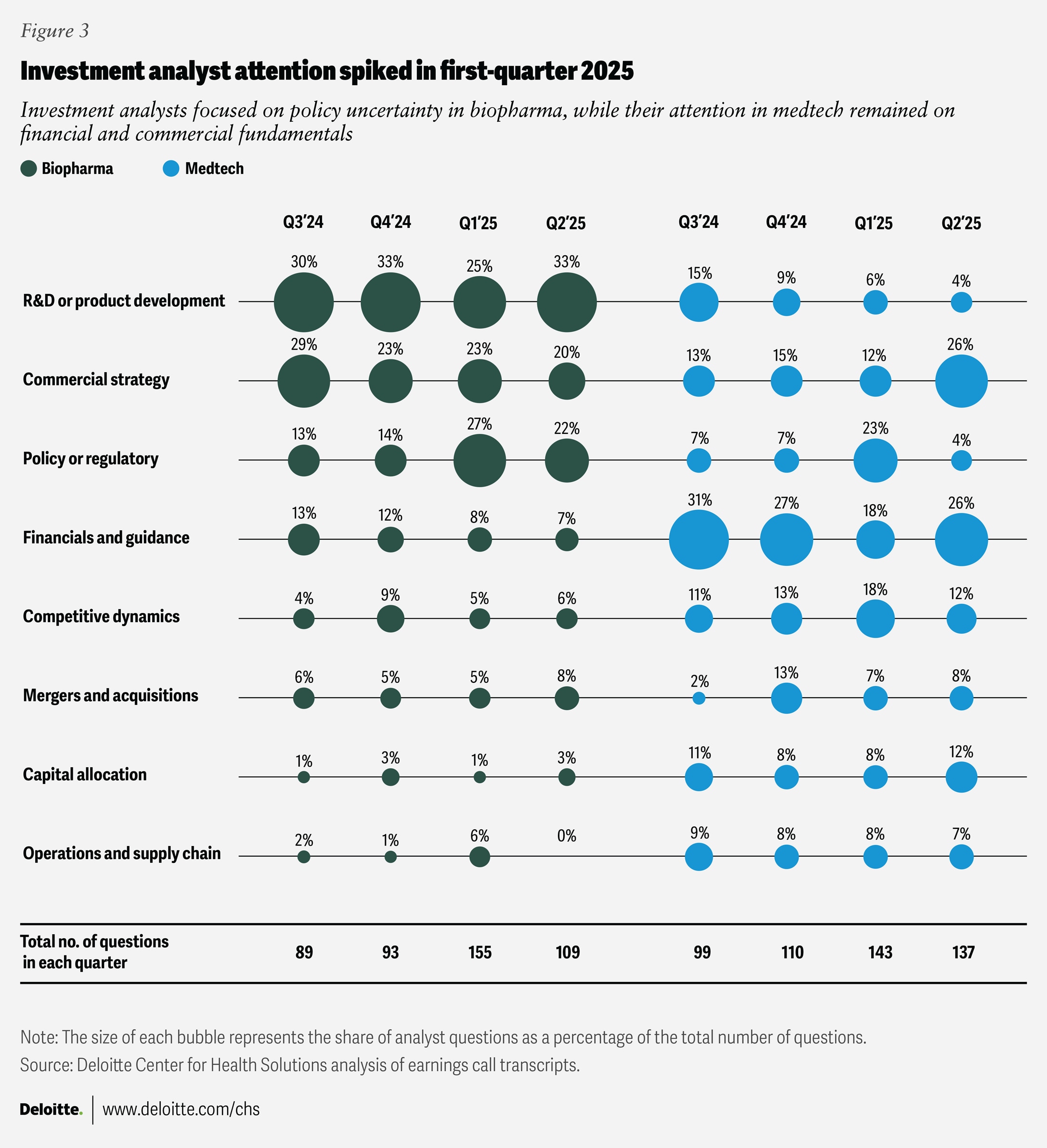

Our analysis of the questions investment analysts posed during earnings calls held between the third quarter of 2024 and the second quarter of 2025 highlights evolving market expectations for life sciences companies.

In the first quarter of 2025, the rise in policy- and regulation-related inquiries reflected investment community concerns about pricing reform, cost discipline, and the potential implications of an evolving regulatory environment for biopharma companies. Alongside this short-term focus, sustained attention to commercial execution and research and development innovation underscores continued investor interest in balancing near-term performance with long-term growth.

In contrast, medtech’s relatively consistent mix of analyst questions on financial guidance and commercial strategy signaled investor confidence in operational execution and margin stability.

Consistent with the trends observed in our survey, the overall direction points to a recalibration of investors’ attention from reacting to policy uncertainty toward resilience, innovation, and disciplined execution as the foundation for long-term value creation. (See methodology for more information on how this analysis was conducted.)

Cost management emerges as a strategic response to trends

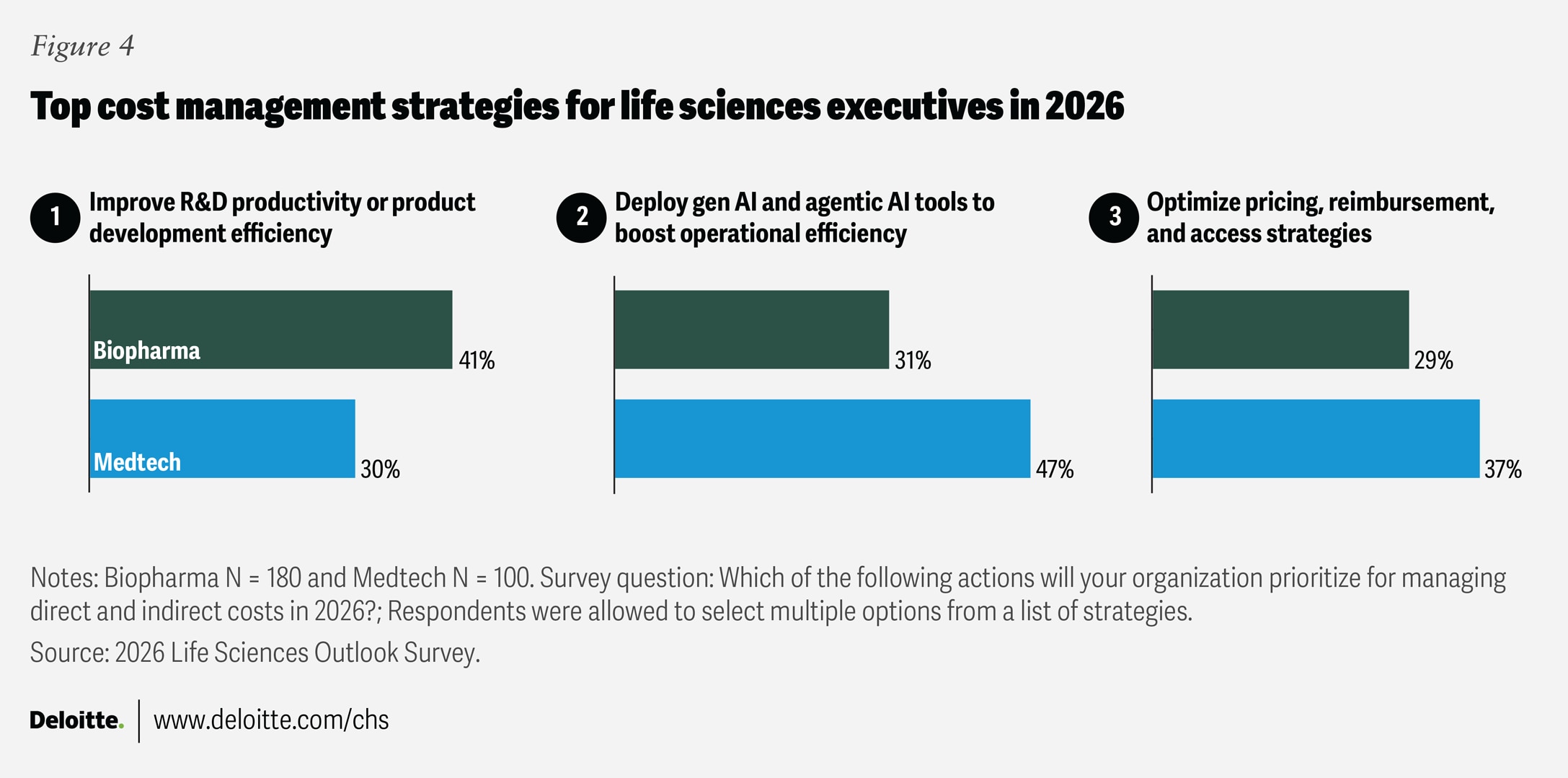

Life sciences leaders expect cost discipline to be a core strategy for responding to market conditions in 2026. Surveyed executives identified three main priorities for managing costs: deploying AI tools, improving productivity, and optimizing pricing and access strategies (figure 4).

Biopharma and medtech leaders generally anticipate that AI will help boost organizational efficiency in 2026, with 78% expecting it to play a central role in driving major change. In fact, 29% of biopharma leaders and 31% of medtech leaders plan to use AI tools or training to help improve workforce productivity.

Achieving AI maturity remains aspirational for most organizations in 2026. While many are actively undertaking major transformations to adapt to AI-driven ways of working, none report having fully completed this journey. The greatest progress has been in integrating AI tools into daily workflows to enhance productivity: 14% of the surveyed executives report full implementation, and another 40% are currently working toward this goal. Surveyed executives from organizations that are further along the AI maturity continuum express greater optimism about the economy, the industry, and their own financial performance.

Among biopharma executives, 41% cited improving R&D productivity as their top priority for managing costs, reflecting persistent industry headwinds and rising costs. As the average cost of bringing a new drug to market now tops $2 billion,4 the emphasis on R&D productivity signals the importance of retooling drug development models and accelerating time to market. Meanwhile, medtech leaders plan to prioritize operational efficiency, with 47% of respondents indicating that AI implementation will be their primary cost-containment strategy in 2026.

When it comes to pricing, access, contracting, and reimbursement, 29% of biopharma leaders and 37% of medtech leaders say these will be key areas of focus for their organizations. This emphasis is most often linked to key external trends such as pricing and access to drugs and devices, ongoing regulatory changes, and manufacturing and supply chain risks. Surveyed executives prioritizing pricing and market access activities are more likely to apply these efforts to their existing product portfolios, alongside new customer engagement and sales enablement models.

Innovation and technology as growth drivers

Life sciences leaders increasingly view innovation—coupled with the intentional scaling of technology—as a pathway to navigating uncertainty and fueling growth in the year ahead. “Companies should focus on what they do best: discovering novel biology and building differentiated assets while remaining flexible in all other areas. As an industry, we need to deliver innovation, that’s the only path to ensure long-term sustainability,” says Karl Gubitz, chief financial officer of argenx.

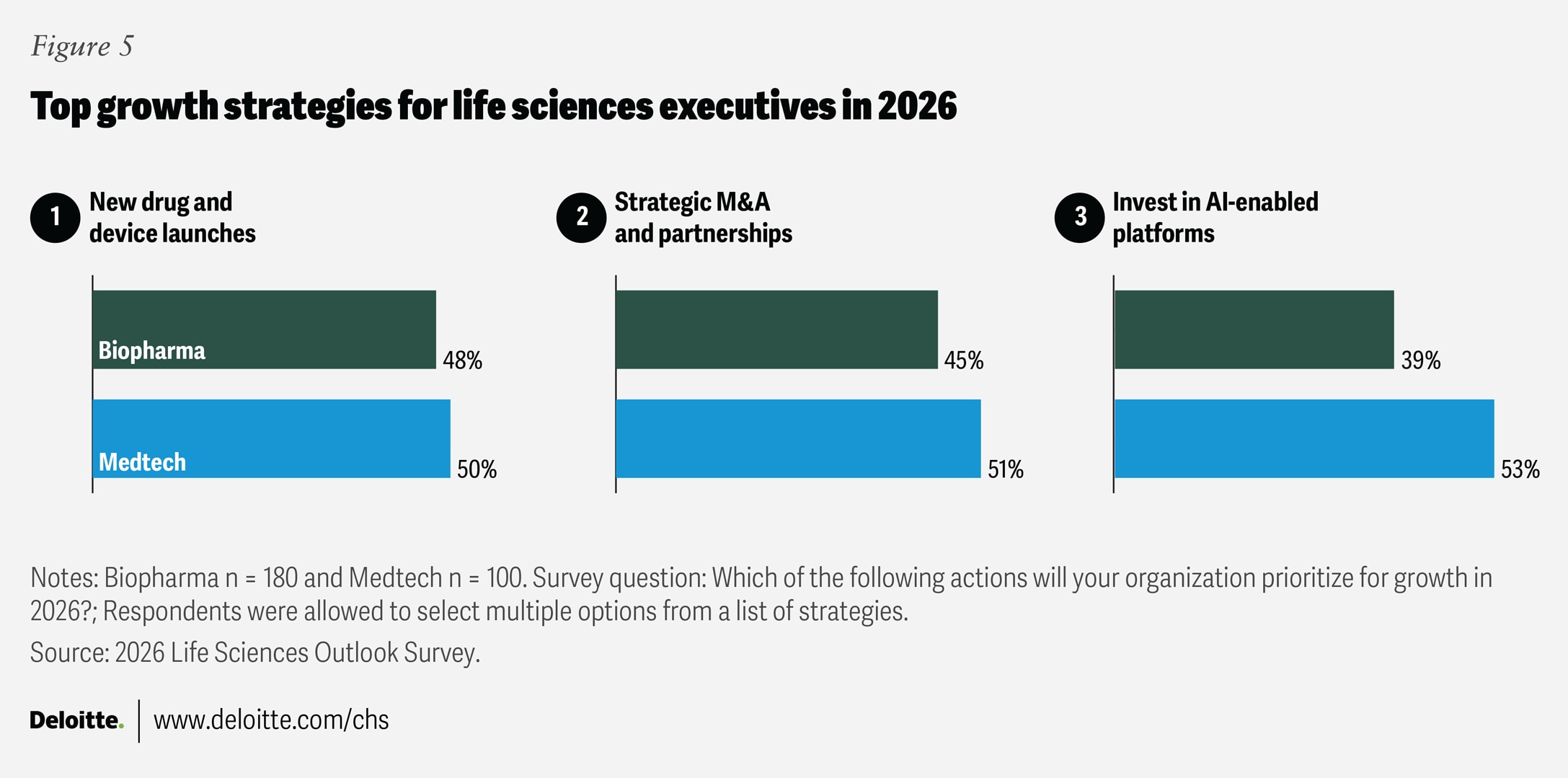

Surveyed executives identify three key actions expected to help drive organizational growth in 2026 (figure 5).

- Organic pipeline replenishment and expansion: About half of biopharma (48%) and medtech (50%) executives intend to focus on launching new therapies and devices or platforms, likely signaling continued confidence in their product pipelines. For biopharma, near-term R&D priorities include expanding portfolios into new therapeutic areas and indications (43%), as well as developing new drug modalities or discovery platforms (40%). Surveyed executives expect that large molecules (64%), cell, gene, and RNA-based therapies (62%), and antibody-drug conjugates (54%) will power revenue growth over the next two to three years. Meanwhile, medtech executives intend to focus on AI and digital solutions in 2026, according to survey results. AI-driven diagnostics (49%) and expansion into adjacent product categories (46%) were cited as their top product development priorities.

- Renewed focus on mergers and acquisitions: After a recent lull, strategic partnerships, mergers and acquisitions are rising on the growth agenda: 45% of surveyed biopharma leaders and 51% of medtech leaders see M&A as a top near-term strategic priority. In biopharma, appetite is returning for pipeline expansion and early-stage assets, with aggregate deal value in the first three quarters of 2025 ($91.9 billion) already exceeding the total for 2024 ($61.7 billion).5 “More deals are getting done in the latter part of 2025 compared to the last few years. That is good for the market overall and for a company like ours, because those of us on a growth trajectory require considerable capital,” notes Shankar Musunuri, chairman, CEO, and co-founder of Ocugen. In medtech, M&A activity rebounded in 2024 and 2025, with some firms pursuing high-growth small and mid-cap companies, particularly in diagnostics, cardiovascular, and orthopedics.6

“AI is already out of the box, and the speed at which innovation is moving will only accelerate.”

- AI as a growth engine: AI appears to be evolving from a productivity tool into a growth catalyst for life sciences organizations. Leaders tend to recognize that future competitiveness is likely to depend on how effectively they harness AI to fundamentally reimagine how their organizations work, make decisions, and deliver value—a view shared by nearly 80% of surveyed executives. Respondents see investments in AI-enabled platforms as a key growth driver for 2026, particularly among medtech executives (53%, compared with 39% in biopharma), as organizations move from pilot projects to redesigning processes and embedding AI across all aspects of operations.7 In medtech, AI-driven diagnostics is expected to be a top product development priority for 2026, while health IT and AI-enhanced workflow solutions are seen as immediate revenue drivers by 82% of executives. “AI is already out of the box, and the speed at which innovation is moving will only accelerate. The complexity will be—will regulators, governing bodies, and even healthcare systems be able to catch up?” says William Phillips, chief commercial officer of Terumo Neuro.

“Agility and resilience matter, but our true purpose lies in uniting discovery with patient care.”

What’s next: Building resilience and value in life sciences

As 2026 approaches, life sciences organizations may find themselves at a crossroads—balancing global economic caution with strong growth expectations, driven by science, digital transformation, and AI-fueled innovation. However, optimism alone isn’t enough. Regulatory shifts, persistent pricing pressures, and geopolitical uncertainty could test the industry’s ability to adapt. Our research suggests that leaders who are well prepared for the future are those who scale AI strategically, redesign how work is done, and align investments with the most defensible sources of value. These organizations aren’t simply reacting to disruption—they are aiming to define new standards for agility and resilience, setting themselves apart in an increasingly competitive market.

“Agility and resilience matter, but our true purpose lies in uniting discovery with patient care,” says Simone Thomsen, president and general manager of Eli Lilly Japan. Her perspective reflects a broader focus for the industry (and a refrain in many of our interviews): Sustaining progress will involve not only operational adaptability but also a steadfast focus on purpose, ensuring that innovation ultimately delivers meaningful outcomes for patients.

Methodology

The study consisted of three components: 1) survey of 280 life sciences executives; 2) interviews with nine industry executives; and 3) analysis of investment analysts’ questions asked during earnings calls.

Survey

The Deloitte US Center for Health Solutions and Deloitte Global surveyed 180 biopharma and 100 medtech C-suite executives (280 respondents in total) from pharmaceutical, biotechnology, biosimilar, and medical device manufacturing companies. In this study, the biopharma segment is defined as organizations focused on developing and commercializing drug and biologic therapies, while medtech refers to companies that design and manufacture medical devices and diagnostic equipment. Respondents represented companies headquartered in the United States, Europe (France, Germany, Switzerland, and the United Kingdom), and Asia (China and Japan). The survey was fielded from August to September 2025.

In-depth interviews

The Deloitte US Center for Health Solutions, together with Deloitte Global, interviewed nine life sciences executives across various functional areas including R&D, supply chain and manufacturing, commercial, corporate strategy, and digital, from September to November 2025. We gathered their perspectives on market trends shaping the industry, its impact on their business, actions they plan to take in response to these trends, and their concerns and hopes.

Quarterly earnings call transcripts

The Deloitte US Center for Health Solutions analyzed 935 analyst questions from third-quarter 2024 to second-quarter 2025 earnings-call transcripts of the top 10 biopharma and top 10 medtech companies by global 2024 revenue. The questions—asked by analysts from 41 unique investment firms—were reviewed and coded into eight themes to capture where investor and analyst focus concentrated each quarter. The themes were:

- R&D and product development: Clinical trial readouts, regulatory filings, and label changes

- Commercial strategy and market access: Product launches, adoption trends, pricing and reimbursement, and gross-to-net dynamics

- Policy and regulatory environment: Inflation Reduction Act, Most Favored Nation model, 340B Drug Pricing Program, payer and pharmacy benefit manager reforms, Food and Drug Administration and Department of Health and Human Services developments, EU Medical Device Regulation and In Vitro Diagnostic Regulation implementation, and other policies

- Capital allocation: Portfolio reshaping, business development and licensing activity, and M&A posture

- Operations and supply chain: Manufacturing capacity, quality management, supply resilience, and logistics

- Competitive dynamics: Market-share shifts, class competition, and new entrants

- Financial performance and guidance: Revenue, margins, capital expenditures, free cash flow, and forward guidance

- M&A: Acquisitions, divestitures, strategic partnerships, and post-deal integration