Is your supply chain trustworthy?

Executives can overestimate customer trust in their organizations’ operations. Here’s how they can close that gap to help build more reliable supply chains and enhance financial performance.

Michael Bondar

James Cascone

Adam Mussomeli

Kate Graeff

Natasha Buckley

Timothy Murphy

A time like no other

As a large European beverage manufacturer, your company likely has not had to navigate turbulence like this before. Energy bills remain high, aluminum cans are in short supply, and fewer cargo vehicle drivers are available due to recent immigration policy changes. Bad weather and regional geopolitical uncertainties are limiting availability and increasing the price of key raw inputs, including the fruit crops you may rely on for your core product offering. Your costs may be increasing, and your products may not be reaching supermarket shelves as quickly as before.

As a result of these factors, some of your customers are starting to lose trust in your ability to deliver the same standard as before. They may have noticed the increase in the price of your beverages, and given the cost-of-living crisis, some may be considering more affordable alternatives. The restaurant chains you’ve been working with are considering partnering with some of your competitors instead of repeatedly having to let their customers know that your products are “temporarily unavailable.”

For leaders of large, complex supply chain networks, the seismic challenges from the COVID-19 pandemic may have eased, but for many, significant challenges remain. Having worked so hard to weather the storms of this decade, an important question remains: How do you continue to earn or rebuild stakeholders’ trust in your supply chain in this uncertain environment? Our analysis points to several critical factors, including investing in technology to better forecast demand and drive visibility, and aligning with customer and employee values.

Volatile, complex challenges—before, during, and likely beyond the COVID-19 pandemic

Many consumers and businesses underestimated the extent to which supply chains could falter during the pandemic until they found themselves scrambling for basic necessities from baby formula to toilet paper. But supply chain tensions were becoming evident even before the pandemic.1 Take, for example, the technology sector: Using more microchips in a growing array of electronic and consumer products in combination with a business mindset focused on distributing cheaper products more quickly and just in time has been a growing trend over the past decade.2 As supply chains become more sophisticated, so can the underlying complexities and vulnerabilities. This means that supply chain performance is likely to remain a critical challenge for executives for the foreseeable future. For example, the Winter 2023 Fortune/Deloitte CEO Survey found that nearly 30% of CEOs prioritized supply chain resilience as one of their top areas to invest in over the next year.3

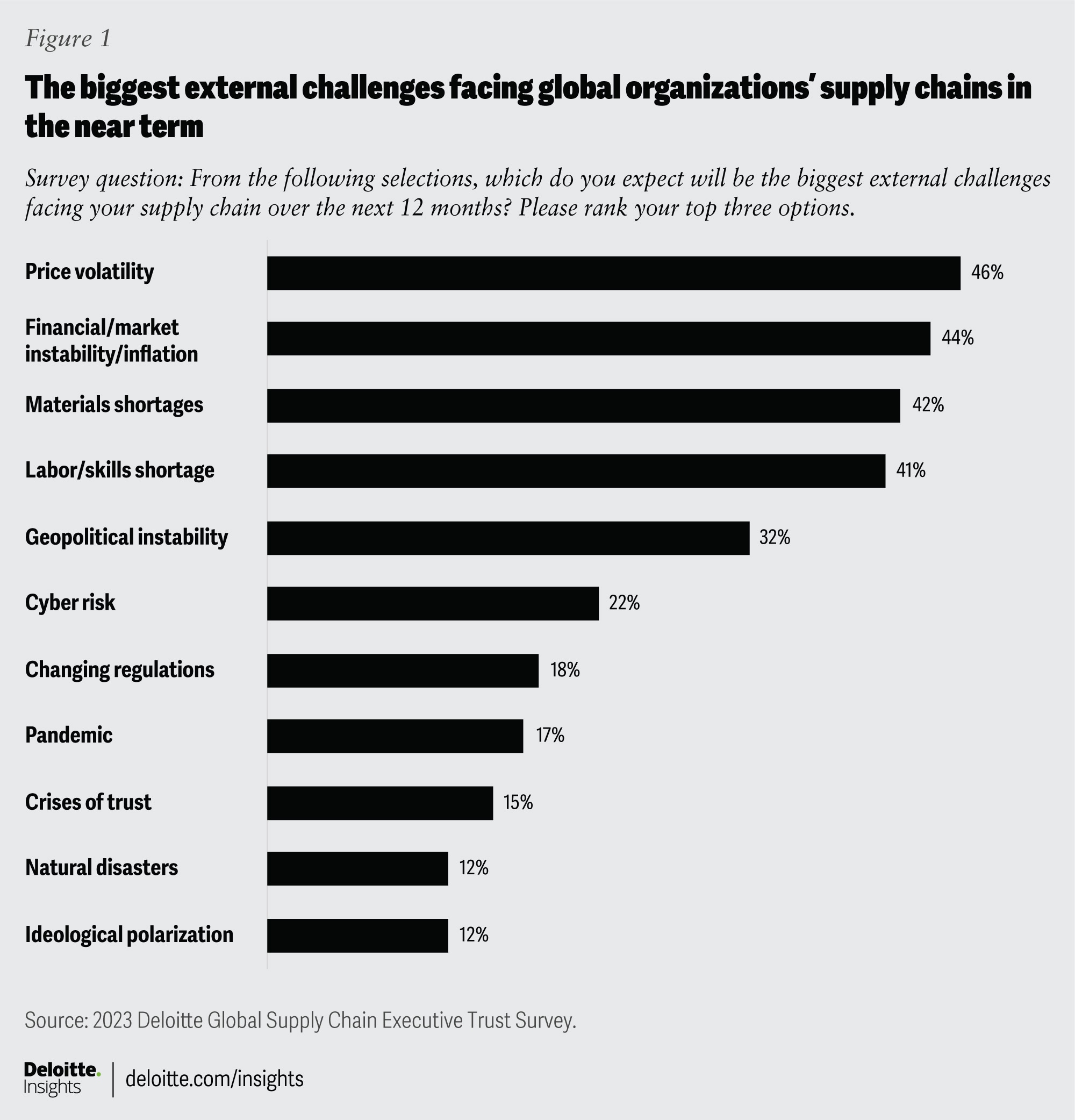

While bottlenecks may have improved, continuous supply chain volatility is expected.4 When we surveyed more than 1,000 executives from large global organizations operating complex supply chains, we found supply chain disruptions are ubiquitous, as 77% acknowledged experiencing an adverse supply chain event in the last 12 months (see the sidebar, “Methodology,” for more information). Further, almost half of global supply chain executives (44%) expect more shocks in the coming 24 months. And this likely understates the true risk. The primary challenges that executives are planning for in the next 12 months include price volatility, inflation, resource shortages (labor and materials), and geopolitical instability (figure 1).

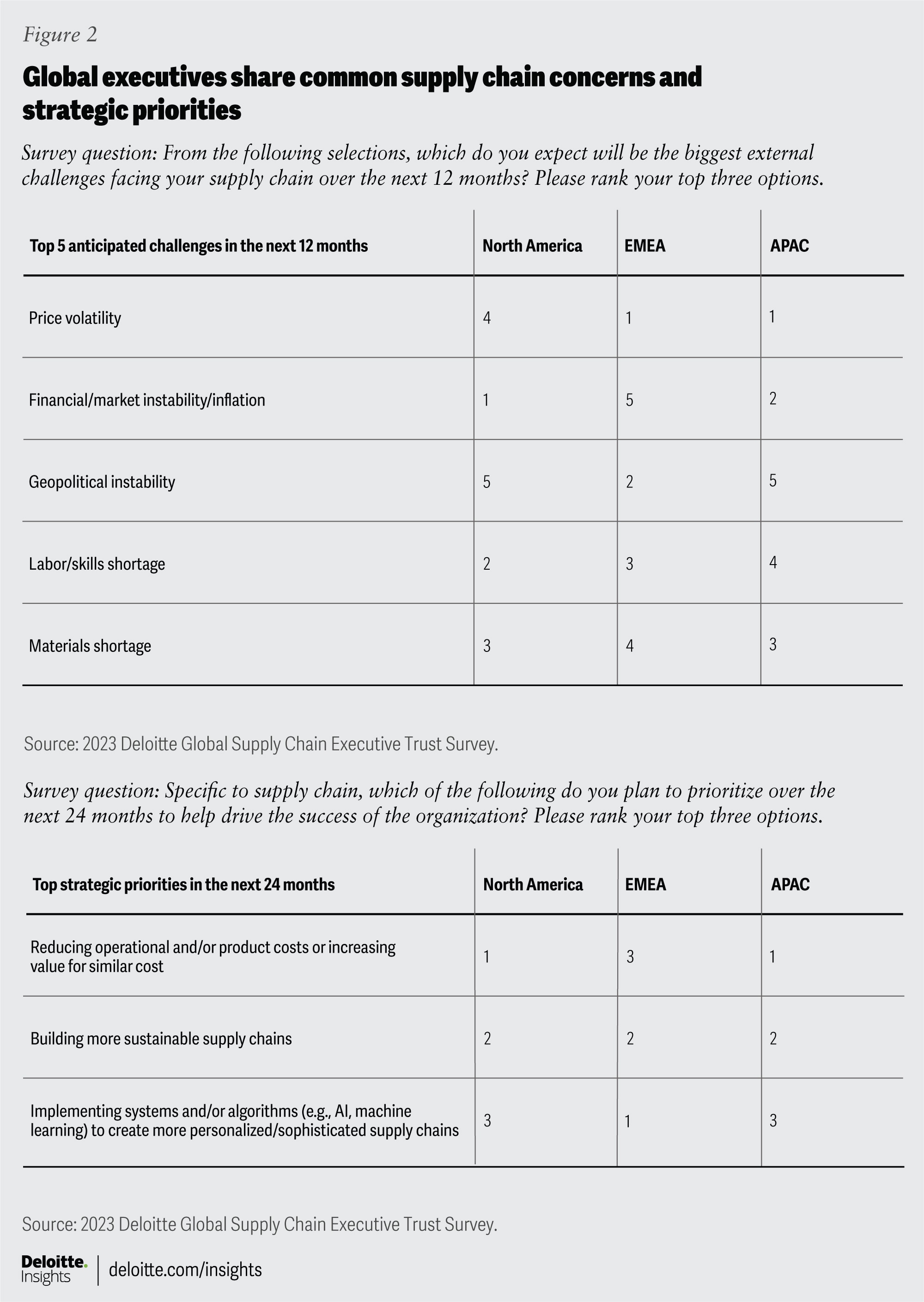

Notably, these findings are relatively consistent for organizations operating supply chains across the North American, European, and Asia Pacific regions. While companies in Europe, Middle East, and Africa (EMEA) are more likely to cite geopolitical instability as a top challenge, price volatility and inflation are top concerns across global regions. Additionally, companies across regions are focused on similar strategies to help improve supply chain performance. Despite media suggestions that suppliers are exchanging efficiency for resilience, reducing operational costs is a primary focus (figure 2).5

Do executives recognize how supply chain challenges impact stakeholder trust?

Trusted relationships are often critical to supply chain performance. In our study, among different enhancements that are adding “significant value” to an organization’s financial performance, the second most cited were enhancements that improved trust with customers. However, while trust is deemed important in boardrooms and in the C-suite, insufficient attention is often being paid to this topic today. A recent poll suggests only 14% of executives have a way to track stakeholder trust across the organization, and 63% of board members admit that they either do not discuss trust or have no fixed cadence to discuss trust.6

At its core, trust is based on the relationship between an organization and its stakeholders. Trust is the outcome of high competence and the right intent, which in turn typically rests on four factors of trust: capability, reliability, humanity, and transparency. These factors are relevant and can be measured across the operating and functional areas of the organization. This includes areas such as customer experience, cybersecurity, culture, and supply chain operations. Organizations can take actions within these operating domains to help earn and maintain trust with their different stakeholders in practical and tangible ways.

C-suite executives should maintain and grow trust in their supply chain to help mitigate operational risk, improve resilience, protect the brand, make strategic decisions, and enable growth. When trust is impaired, the damage usually cascades across the business ecosystem. At its core, customers may not trust they can purchase the brand’s products when they need them most, suppliers may lack confidence in the enterprise’s ability to scale demand, and board members and investors may lose trust in the C-suite’s and organization’s ability to navigate an ever-more-complex environment. Alternatively, when trust is strong between an organization and the stakeholders in its ecosystem, the organization is typically much better positioned to collaborate with customers and vendors, share critical information, and capitalize on market opportunities in a concerted manner.

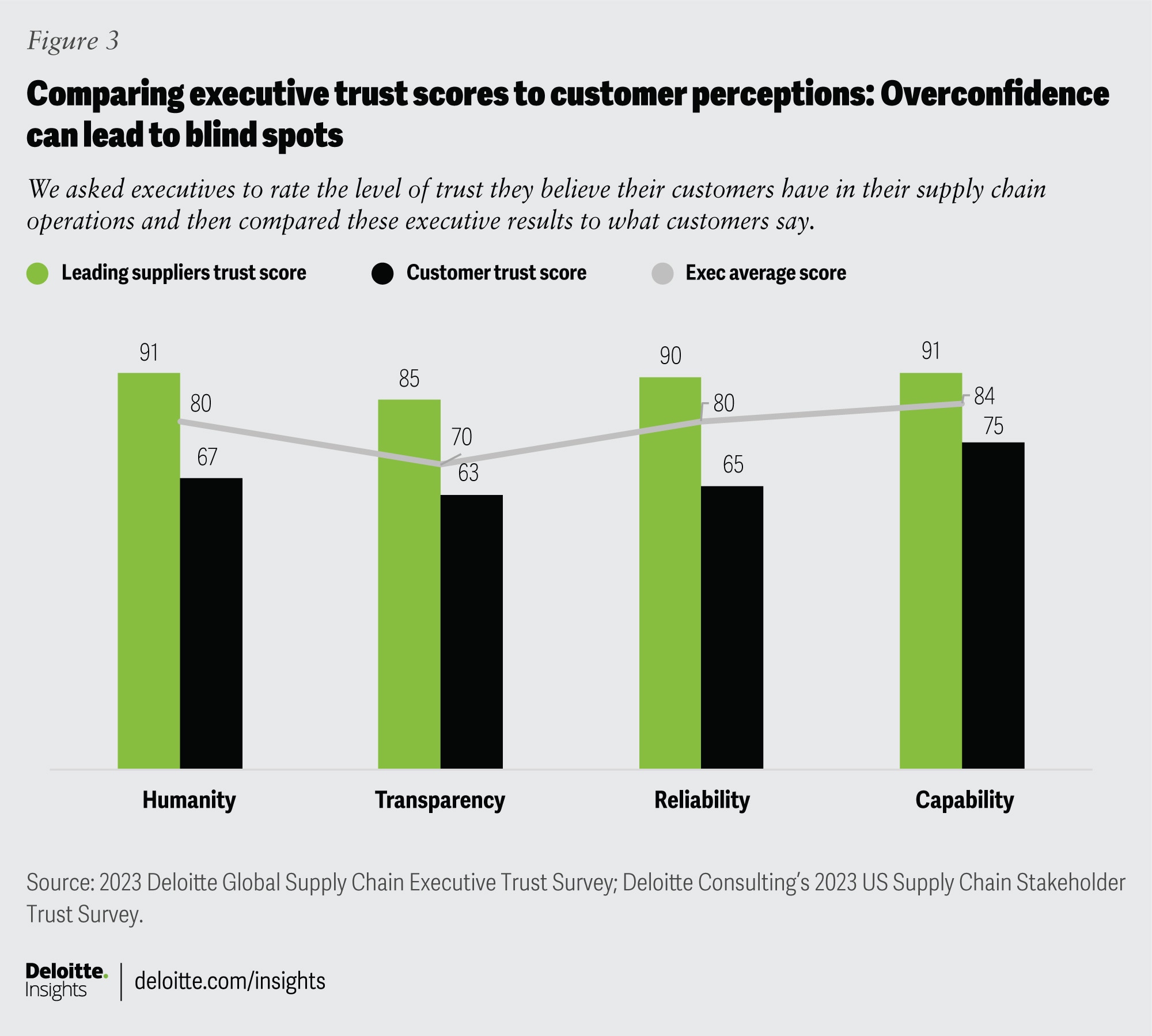

Executives at large multinationals believe their stakeholders trust their supply chain capability and performance, yet a recent Deloitte survey of US stakeholders suggests this confidence is significantly overstated (figure 3). When we asked global executives to assess customer trust across the four factors, they overestimated the trust in their organizations’ supply chains by an average of 20% (see the sidebar, “Measuring trust across four factors,” for more information). Even when customers think of their leading suppliers, they still have lower trust in those suppliers than executives believe. These findings suggest executives have potential trust blind spots in areas that customers care about—areas that may need to be explored and analyzed.

Measuring trust across four factors

We measure trust by assessing how an organization performs across each trust factor (humanity, transparency, capability, and reliability).7 The trust score for a given factor is the difference between those who agree the organization is performing well (agree and strongly agree) and those who perceive it to be underperforming (disagree and strongly disagree). For example, if 80% of customers agree or strongly agree a brand consistently and dependably delivers on its promises (i.e., reliability) and 15% disagree or strongly disagree, then the reliability score for the brand would be 65% (neutral responses are not included).

For this analysis, we asked executives of large multinationals to assess how well they believe their customers view their (the multinational’s) performance across each factor. These scores were compared to an additional supply chain study that asked customers to assess their supply chain partners.

By comparing executive trust perceptions to actual customer perceptions, the gap between assumed performance (in the eyes of executives) and actual performance (in the eyes of customers) can be measured.

Naturally, one may wonder if improving trust truly matters in terms of supplier performance. To better understand this relationship, we conducted a series of linear regressions that measured the relationship between each of the four factors and performance metrics such as organizational revenue growth and supply chain resilience.

Our analysis shows that stakeholder perceptions of reliability and transparency are paramount to organizational performance: These two factors demonstrate a statistically significant relationship with annual revenue growth and an organization’s ability to maintain operational consistency through supply chain shocks.8

For both trust factors, when stakeholder assessments move from lower scores (strongly disagree and disagree) to higher scores (agree and strongly agree), the likelihood that organizations experience growth rates of 15% or more increases 14% for reliability and 25% for transparency.9 Further, there is a similar relationship to resiliency as organizations are approximately 30% more likely to maintain operational consistency throughout supply chain disruptions when moving from lower to higher levels for both trust factors.10

Higher capability scores also correlate with an organization’s ability to maintain operational consistency. These findings are intuitive when considering the organizations that have weathered the pandemic shocks of the past three years and have the necessary agility to drive performance in uncertain environments.11

The humanity with which organizations treat their stakeholders in the supply chain is also an important element of trust. Executives in large organizations and stakeholders agree that treating workers, customers, and other partners fairly and with respect matters. In fact, prior Deloitte Consulting research suggests employees are 2.6 times more motivated at work because of humanity.12 Further, studies surveying Generation Z workers indicate that within the supply chain, actions that prioritize humanity (i.e., caring about employee well-being and environmental, social, and governance [ESG] issues) have a significant impact on trust levels—especially with these younger employees. Gen Z professionals who feel that their leaders demonstrate empathy and kindness are 3.3 times more likely to look forward to coming to work and are less likely to plan to leave their job.13

Actions that enhance stakeholder trust

Given the importance of supply chain trust, how can organizations invest in capabilities and actions that help elevate intent, strengthen competency, and fuel organizational growth and resilience?

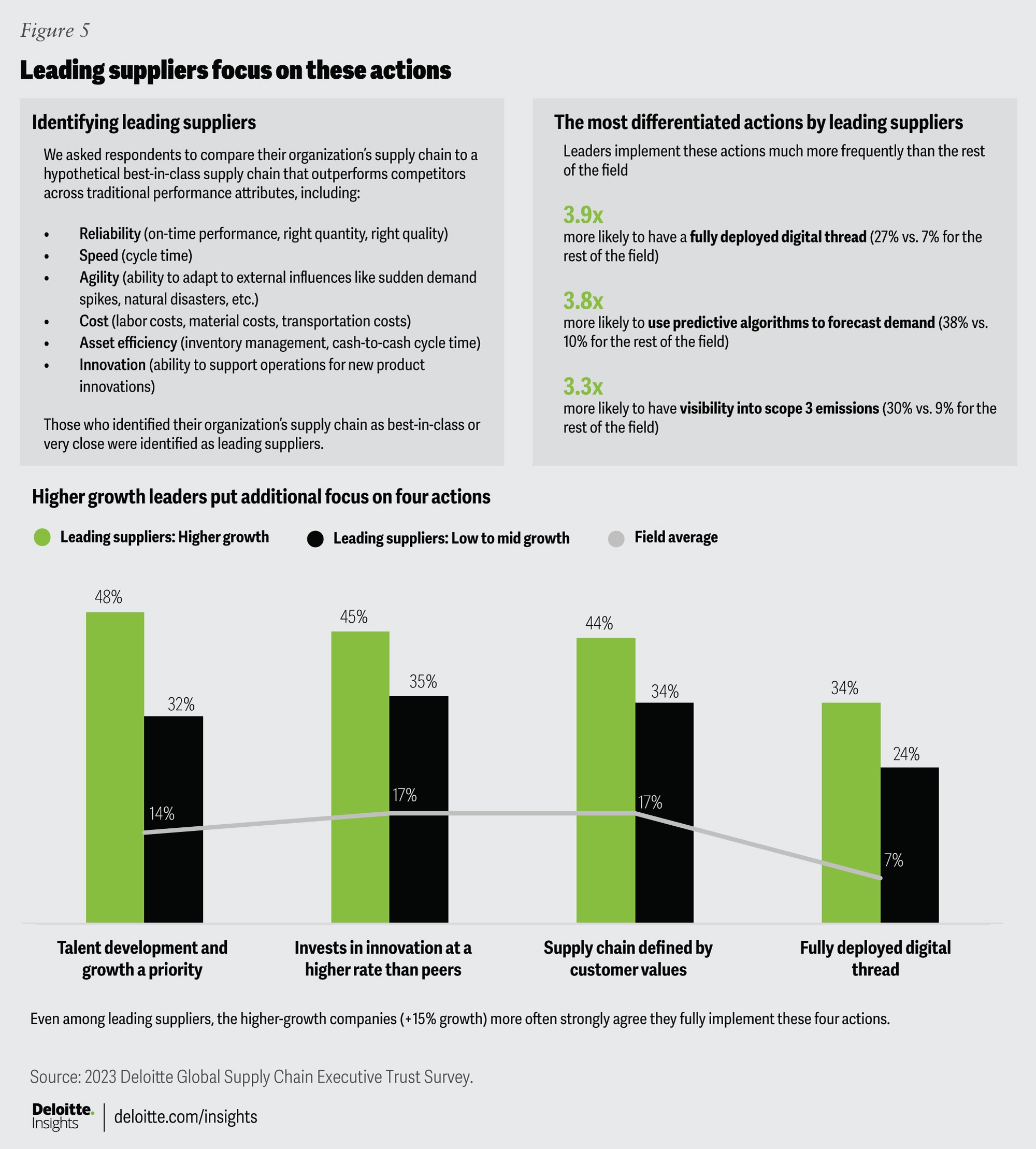

To help answer this question, we turn to the leading supply chain organizations to understand where they are making investments that separate them from the rest of the field. To identify these suppliers, we asked executives to assess their supply chain performance compared with competitors across six attributes: reliability, speed, agility, cost, asset efficiency, and innovation. From these assessments, 8% suggested they are performing at a best in class level and another 33% indicated they are “very close” to best in class. We grouped these two responses to identify the leading suppliers (41%).14

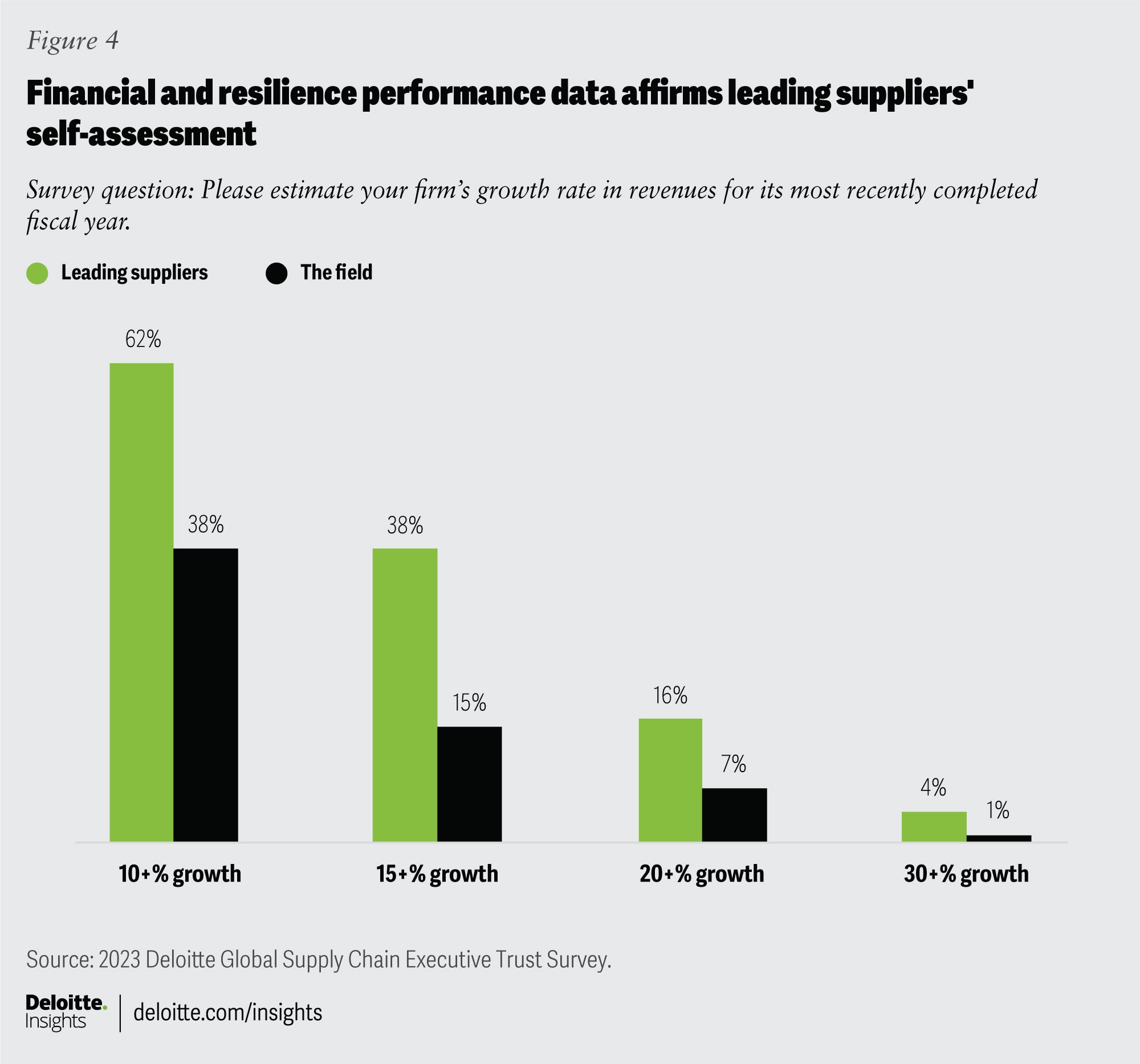

While the assessments are self-reported, these leaders routinely outperform the rest of the field across a variety of performance metrics (figure 4). For instance, they are 2.5 times more likely to have achieved 15% or higher annual revenue growth (38% versus 15% for the rest of the field) in the past year, 2.8 times more likely to be resilient against external shocks or crises (34% versus 12% for the rest of the field), and 2.1 times more likely to maintain operational consistency through most supply chain shocks (34% versus 16% for the rest of the field).15

Interestingly, these leaders systematically prioritize a specific set of actions that help foster reliability through greater technical capabilities, prioritize supply chain visibility to enhance transparency, and elevate humanity to create a competitive differentiator.

Action 1: Invest in technology to foster reliability

Leading suppliers are investing in actions that help create a more reliable—and predictable—supply chain. This is especially true in the realms of technology and intelligence including the application of a digital thread (a single, seamless strand of data that stretches from development to commercialization). Specifically, the leaders are 3.9 times more likely to strongly agree their organization has a fully deployed digital thread compared with the rest of the field (figure 5). One study in 2021 found that more than 67% of companies had only begun to develop their digital thread in the prior two years.16 Therefore, it’s notable that more than a quarter of these leaders (27%) have already achieved this level of supply chain sophistication, while only 7% of the rest of the field have accomplished the same.

Closely related, the leaders are 3.8 times more likely to use advanced predictive algorithms to better forecast demand. Layering more accurate forecasting over the data provided by digital threads can help bolster a supplier’s ability to set expectations and plan for future needs and disruptions. For instance, aerospace manufacturer Boeing developed a digital thread to connect data across the entire product life cycle.17 By embedding sensors across factories, Boeing has a near-real-time view into inventory needs and operational inefficiencies. And to make this process more proactive and forward-looking, Boeing plans to use artificial intelligence (AI) to “mine for additional improvement over time.”

The benefits of this focus on technology are significant as they can help companies build reliability and resilience into their supply chains while requiring less costly investments in physical infrastructure (such as incremental inventory, incremental capacity, or incremental suppliers).18 For example, sensing and analytics tools can provide advance warning of impending issues and thus may mitigate the need to diversify existing supply chains. Technology enables supply chains to become more agile as organizations are better able to sense demand, and predict and adjust for potential issues that threaten inventory, service, compliance, or other critical needs. And more agile supply chains not only help mitigate risk, they can also position organizations to capitalize on new growth opportunities.19

Action 2: Make visibility into sustainability a priority

Transparency is foundational to trust and, by close extension, performance. Perhaps for this reason, we see the leaders putting an additional emphasis on supply chain visibility—particularly in regard to scope or greenhouse gas emissions.20 Scope 3 emissions are indirect emissions produced by customers who use the company’s product or suppliers who contribute to making the product the company sells.21 In comparison with the rest of the field, the leaders are 3.3 times more likely to strongly agree they have visibility into scope 3 emissions (30% versus 9%) (figure 5).

In general, organizations have a relatively difficult time gaining visibility into the emissions of their suppliers, particularly with respect to scope 3 emissions. More than 80% of climate disclosure preparers find scope 3 emissions to either be very difficult or somewhat difficult to disclose.22 However, there are some exciting examples of companies deploying analytics to gain a fuller picture of the carbon footprints created by their supply chains. Take Doconomy, a digital transformation company that focuses on more sustainable solutions. Doconomy’s 2030 Calculator implements AI to help manufacturers and brands calculate the carbon footprint of their products by incorporating “unique emissions factors for each of the product parts, material, packaging, and transportation.”23

Some companies are also experimenting with DNA and AI to analyze supplier materials, such as the cotton used for clothing, to help gain a clearer picture of where in the world the materials originated.24 Use cases like this exemplify how technological investments like those mentioned earlier can also be redeployed to create greater visibility and transparency into more opaque supply chains.

Action 3: Demonstrate humanity to create a competitive differentiator

While reliability and transparency are critical trust factors, humanity is an important factor that can create a competitive advantage in terms of both talent acquisition and customer value.

Deloitte Consulting’s stakeholder research indicates that supply chain employees and their customers, particularly younger generations, care deeply about the intentions and humanity of the organizations operating the supply chains they interact with. This is something that executives may overlook when building a trusted supply chain.25

Interestingly, the faster-growing supply leaders in our research focus more on the human side of the supply chain. When we compare these supply chain leaders (defined as those achieving 15% annual growth or more) with their low- to medium-growth peers, we see they are more likely to make talent development and growth a priority (48% versus 32%) and continually ensure their supply chains are updated and defined by customer values (44% versus 34%), as shown in figure 5.26

Carrefour, a French supermarket chain, rearranged its supply chain to represent the values of Carrefour’s workforce, customers, and communities through its “Act for Food” campaign. To gain a better line of sight into employee ideas, Carrefour created an “Act for Change” platform so workers could share ideas on how it could better serve its communities.27 This prompted Carrefour to rearrange its supply chains to support local farmers and grow food through more sustainable practices. And to both provide transparency and elevate humanity, Carrefour has deployed blockchain technology to clearly show consumers from where their produce originated (such as producer name and transportation means), the quality (such as harvest date), and the organic certification.28

Whether they are improving competence or reexamining and reprioritizing intentions, many of the leading suppliers are taking actions to help cultivate trust and increase performance.

Where to go from here: What leaders can do differently

Many supply chain executives understand the importance of trust but have yet to take proactive measures to manage trust. However, some leading supply chain organizations are taking actions that enhance trust: leveraging digital technology to enable reliability and transparency; focusing on increased visibility, especially with respect to ESG; and elevating humanity as a source of differentiation.

Each of these often require long-term vision and commitment, as well as sufficient funding and anticipation of financial consequences. For example, implementing a fully deployed digital thread can take years rather than months. Further, when evaluating changes to supply chains, there are likely tax implications and opportunities that require attention, including potential impact to existing transfer pricing policies and available incentives that could help fund the investments. Major changes and investments in the supply chain are often akin to moving a large ship: They don’t turn quickly. Given this, it can be critically important to start making supply chain investments today and accelerate the pace of those already made.

In the short term, to nurture the momentum and support needed to help cultivate meaningful trust in the supply chain function, executives can take the following two steps:

- Widen the stakeholder relationship lens. Trust in your supply chain is an asset that you should manage as you would likely manage other critical organizational assets. And while shareholder value and cost optimization should almost always be supply chain priorities, too myopic of a view on these dimensions may inadvertently erode trust—and eventually, the bottom line. Rather, it’s important to nurture trust across the wide array of stakeholders the supply chain ecosystem encompasses. Whether it be customers, employees, vendors, communities, investors, regulators, or others, each can play an important role in building a trusted supply chain.

- Measure trust, intentionally. With so many stakeholders in balance, it’s important to have a pulse on progress and the trade-offs made to help ensure trust is upheld. This means intentionally measuring trust levels over time and ensuring that metrics probe deeply into areas such as digital privacy and protection, supply chain employee experience, conduct and compliance, and visibility across supplier tiers. A clear view of progress can help supply chain leaders determine where additional resources are required and perhaps most importantly, whether trust is truly at the center of the ecosystem.

An intentional focus on trust can help supply chain leaders better understand stakeholders’ needs and prepare their organizations to develop and implement the initiatives that will generate the greatest impact and value over time.

Methodology

Between January and February of 2023, Deloitte Global surveyed 1,037 executives from large global organizations operating complex supply chains. These executives work for a cross-sector of industries and are located across 10 different countries, spanning North America (44% of sample), EMEA (31%), and Asia Pacific (25%). Each respondent either works within or closely with their organization’s supply chain function, and 83% work for organizations that generated more than US$1 billion in annual revenues. Respondents come from the following industries: technology, media, and telecom (26%); consumer (26%); energy, resources, and industrials (20%); life sciences and health care (20%); and financial services (4%).

To better understand how trust and the actions that drive trust can relate to performance, we asked each respondent to assess how well they are establishing trust with their customers, supply chain partners, and workforce across four trust factors: capability (creating quality products, services, or experiences); reliability (consistently and dependably delivering upon promises made); transparency (openly sharing information, motives, and choices in plain language); and humanity (demonstrating empathy and kindness, and treating everyone fairly). We also asked respondents to answer a series of questions regarding the “trusted” actions their supply chain organization took in areas such as strategy and operations, technology, talent and culture, and ESG.

Results of the actions and trust factors were then analyzed through a set of regression models to test the impact of each dimension of trust on a variety of performance metrics, including revenue growth rates, resilience against external shocks (i.e., ability to maintain operational consistency), and maturity as a best-in-class supply chain (i.e., ability to outperform peers across a number of supply chain metrics such as speed, innovation, and reliability).

We tested actions and trust factors against those organizations with leading supply chain operations. We asked respondents to imagine a best-in-class supply chain that outperforms competitors across traditional performance attributes (below) and how close their organization came to having that ideal supply chain in the past year.

- Reliability (on-time performance, right quantity, and right quality)

- Speed (cycle time)

- Agility (ability to adapt to external influences such as sudden demand spikes and natural disasters)

- Cost (labor costs, material costs, transportation costs)

- Asset efficiency (inventory management, cash-to-cash cycle time)

- Innovation (ability to support operations for new product innovations)

From these assessments, 8% suggested they are performing at a best-in-class level, and another 33% indicated they are “very close” to best in class. We grouped these two responses to identify the leading suppliers (41%).

We supplemented this analysis with findings from Deloitte Consulting’s 2023 US Supply Chain Stakeholder Trust survey.