Chipping in to boost production: US and Europe move toward greater self-sufficiency and resilient supply chains

As governments and companies bring semiconductor manufacturing closer to home, they should recognize that no country or region can do everything on its own.

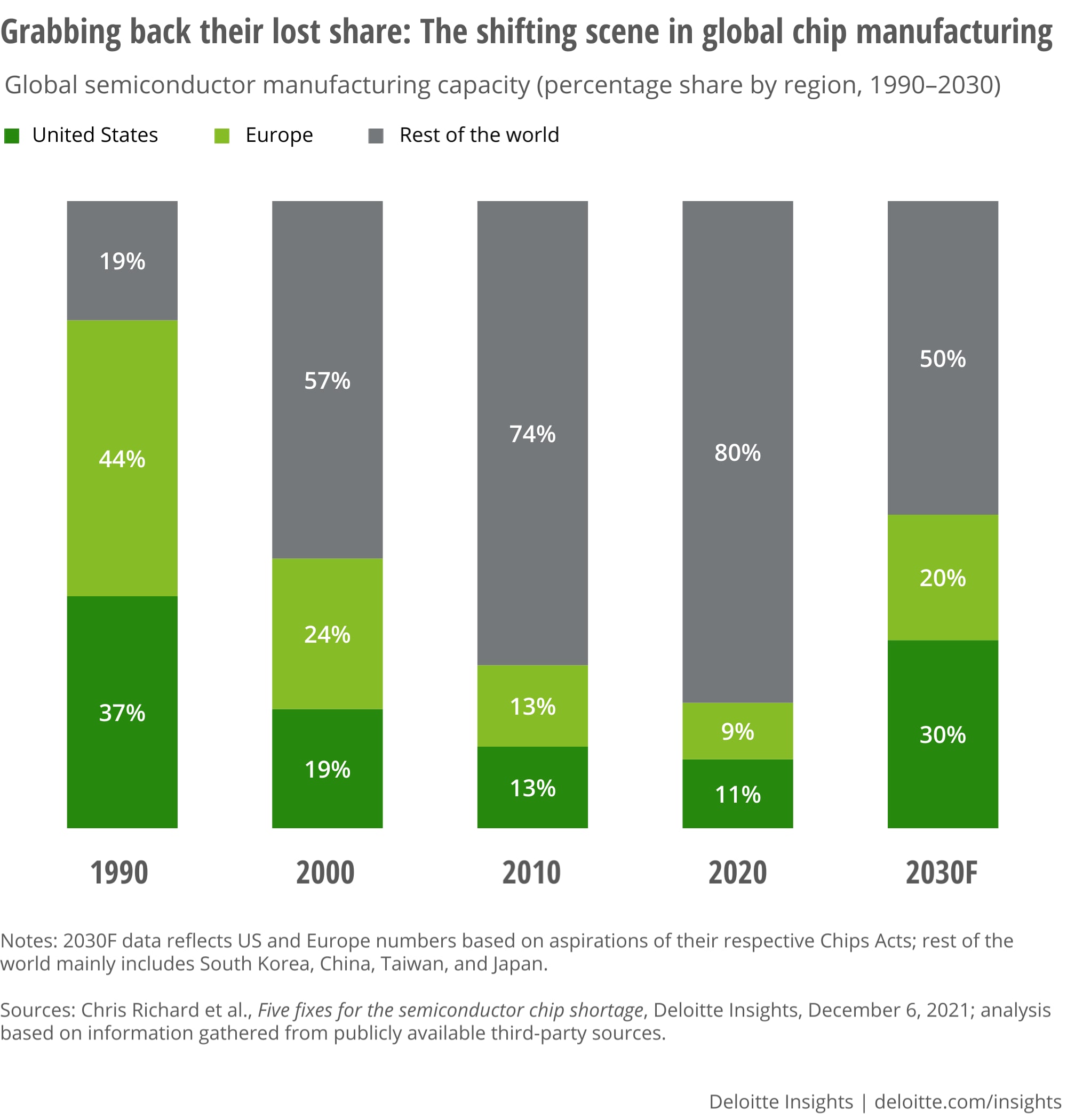

Semiconductor manufacturing is a highly complex process that involves various types of chips, wafer sizes, process technologies, materials, equipment, and design tools.1 Moreover, the manufacturing footprint is spread unevenly across the globe. Currently, more than 80% of semiconductor-manufacturing capacity is predominantly in Asia.2 But it wasn’t always that way (see chart), and now the United States and Europe appear to want to get some of that lost share back.

As shortages began manifesting in 2020, policymakers in the United States and Europe recognized that the high concentration of chip manufacturing in Asia served to harm their competitive advantage and created massive supply chain vulnerabilities.3 Throw in pandemics, natural disasters, or potential military conflicts, and a bad situation had the potential to reach crisis levels.

Some governments and semi companies in the United States and Europe have taken—and are taking—steps to make their domestic capacity more self-sufficient—allocating over US$100 billion combined in incentive packages to boost semiconductor-manufacturing capabilities while acknowledging that absolute self-sufficiency may be unattainable.4 Already, several large chipmakers have announced US$10–25 billion in spending (per fab) in the United States and Europe, including moving a part of their current production operations away from China. They are focusing on upskilling and strengthening their semi talent pool as well.5

Even with these ongoing efforts, headwinds are gathering in the form of rising interest rates, high inflation, lower consumer confidence, and tech-led stock market retreats in 2023.6 The Russia-Ukraine conflict continues to disrupt supply chains, access to important raw materials, and energy prices worldwide. Perhaps most importantly, the United States (along with the Netherlands and Japan) continues to tighten rules around the export of advanced semiconductor technologies to China.7

In Deloitte’s 2023 global semiconductor industry outlook, we noted that the landscape is uncertain and volatile, but also that the current downturn may be a pause that refreshes, allowing the industry to make collective progress on sustainability, talent, digital transformation, and realignment of manufacturing resources.

Considerations for companies across the US and European semiconductor and electronics manufacturing ecosystem

- Finding the right supply chain and manufacturing balance: At a high level, decision-makers in almost all countries and regions should consider rethinking their manufacturing footprint, based on continually evolving trade restrictions. They should identify what parts of the supply chain absolutely must be domestic (onshoring); what parts could be in geographies very close to the home country (nearshoring); and what in countries that are considered friends and allies (friendshoring). Offshoring will likely remain part of the mix, however, as the global semi supply chain is so distributed that every country or region will likely always have to rely on someone else, even if they are less friendly or unfriendly. Finding that optimal mix can be challenging, could change over time, and has multiple political choices embedded in it.

- Moving assembly and testing (AT) closer: So far, much of the focus has been on the need to bring home actual chip-making plants, which are indeed big, important, and expensive. But once made (front-end), chips need to undergo back-end AT, which is an equally essential part of the process. Leaving almost all AT in Asia could do little to mitigate supply chain risk, and US and European decision-makers should invest in this less-glamorous but still critical part of the semi supply chain.

- Ecosystems and alliances: As part of the efforts to bolster manufacturing capabilities, semi companies may foster strategic partnerships and alliances—taking a consortium-based approach to build capabilities for the future, partnering with other chip companies (coopetition), governments, financial players such as private equity firms, construction contractors, equipment companies, and providers of raw materials such as substrates and process gases, among others.

- Workforce and skills: Companies should prioritize talent and workforce development and attract talent from allied countries and regions by crafting favorable immigration policies. Importantly, companies and governments should work closely to augment core STEM education programs that build required skills and talent among students who may join the workforce years in the future.

- Modernized manufacturing: Rather than default to cloning existing facilities in new locations, semi manufacturers may take this opportunity to push the envelope to improve yield and reduce operating costs. They should consider using artificial intelligence and cloud to improve performance and transparency, connecting manufacturing and enterprise systems and data, and focusing more on sustainability.

Semiconductor fabs and their related ecosystems have lifespans measured in decades. The decisions made in 2023 can shape the world of 2030 and beyond for the chip industry and all those who rely on it. Which is everyone.