Quantum computing over the next five years: Scenario planning for strategic resilience

Explore insights from four possible quantum computing futures to help you navigate uncertainty and seize opportunity

Imagine this: You’re a leader of a cutting-edge investment management firm. You’ve invested in intelligent reasoning models, anomaly detection, and high-performance private AI data centers. Yesterday, you had the best tech for market analysis; but, today, a new class of technology has arrived that can analyze multivariate relationships, drive dramatic portfolio optimization, and better simulate nature. Is your organization ready to compete and capitalize?

This is the disruptive potential of quantum computing. Quantum hardware and algorithms could drive profound business innovation. For chemical and pharmaceutical companies, this can mean groundbreaking therapeutics and industrial catalysts. For aerospace, automotive, and industrial manufacturing, new physical materials could transform performance, reliability, sustainability, and more.

Quantum computing is evolving rapidly. Quantum hardware could be what unlocks commercial opportunities, business agility and resilience, intellectual property gains, and venture capital. One technical inflection point is when gate-based technologies can perform accurate calculations with anywhere from 200 to 1,000 reliable logical qubits —the particles that make quantum computing hardware work—from approximately 50 today1 (see glossary for full list of terms). This milestone would achieve the accuracy, reliability, and production scalability necessary for enterprise quantum computing.

Recent chip advancements, networking breakthroughs,2 and error correction3 reflect steady progress. Quantum computing vendors are projecting tangible business benefits by 2030 and accelerating their expected timelines to commercial scale over the next five to seven years.4

Despite advancements, many enterprises are taking a wait-and-see approach, perhaps given other technology priorities, quantum’s complexity, and uncertainty about breakthrough timelines. Given the variability in technical forecasts, some may even doubt scalable quantum computing needs to be in their top 10 priorities, perpetuating delayed action.5 With exponential technologies, however, businesses often don’t “see” them until they hit the hockey-stick curve. When machine learning exploded, a decade ago, hiring data scientists and accessing hardware were nearly impossible. A decade later, some enterprises are reimaging computing infrastructure for AI to scale, but others still appear to be playing catch-up.

Commercial quantum computing strategies will likely take significant time to execute (think years instead of months) and require complex development of talent and technology operating models over multiple investment cycles. Leaders ignoring the necessary preparation—whether defining a strategic road map or hiring sufficiently expert and capable talent—may already be behind. The exact inflection point of scalable quantum computing should not be the trigger for action. Whether commercial quantum computing arrives in three to five years or 10 to 15, the time to pursue a strategic road map is now.

This research employs foresight scenario methods to help leaders prepare their strategy by analyzing plausible quantum computing futures and identifying decisions to consider making today that could be relevant and beneficial no matter which scenario is realized.

Foreseeing four potential quantum computing futures

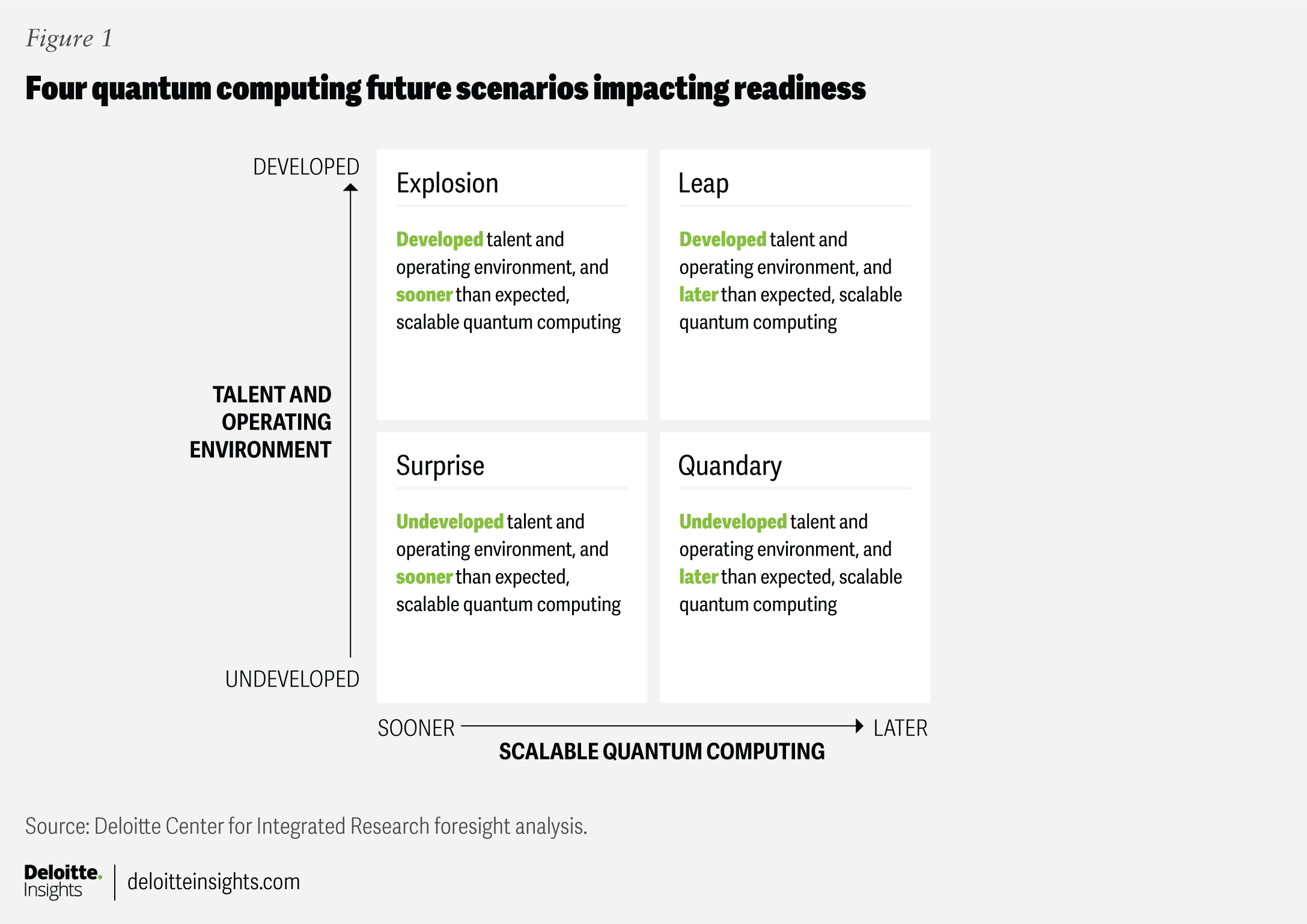

Deloitte’s scenario analysis explores four plausible quantum computing futures that could arrive in the next five years, leading into 2030. The scenarios evolve from the intersection of two highly impactful and highly uncertain drivers of the quantum computing future (see methodology).

1. Uncertainty No. 1 (x-axis): Quantum talent and operating environment: Will an organization’s workforce and operating environment, including ease and access to resources, be ready to take advantage of quantum computing advances (undeveloped versus developed)?

2. Uncertainty No. 2 (y-axis): Scalable quantum computing: Will quantum computing capabilities (hardware and algorithms) be commercially scalable and production-ready sooner or later than anticipated, leading into 2030 (sooner versus later)?

When considered together, four plausible future scenarios emerge (figure 1).

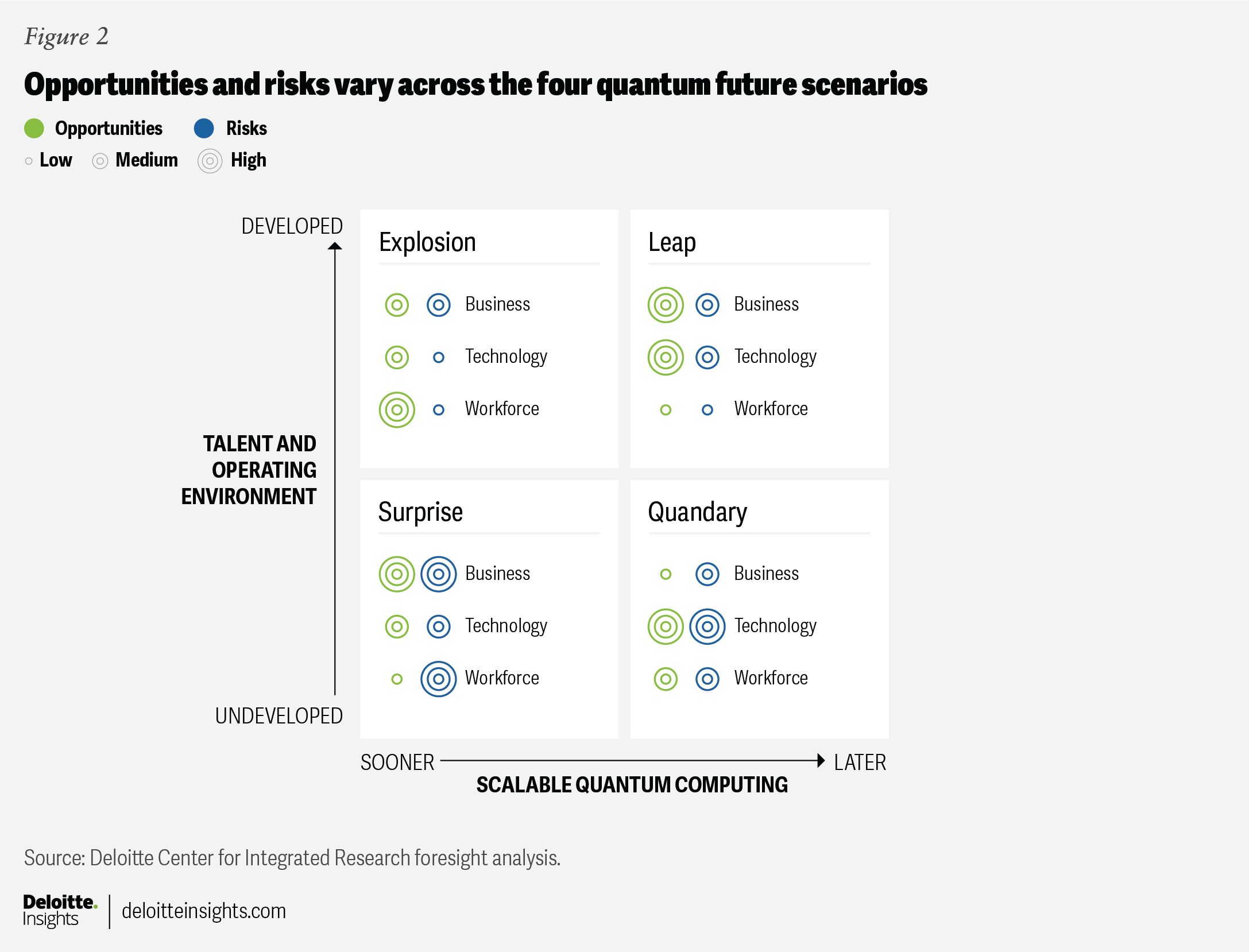

We analyzed the business, technology, and workforce opportunities and risks aligned with these four distinct scenarios (figure 2), with each scenario bringing different levels of impact or exposure to organizations.

Surprise

Scalable quantum computing has arrived sooner than expected, while the enterprise talent and operating environment have remained undeveloped.

Early movers (those that invested in 2025 or sooner) have gained significant business advantages, helped shape the tech ecosystem to their needs, and have been first in line for talent resources. Those who failed to act have faced significant competitive disadvantages and have been playing catch-up. While cloud-accessible quantum models may be available, organizations that have not established relationships with third parties may struggle to access talent and computing capacity from busy vendors that have prioritized existing clients.

Quandary

The talent and operating ecosystems are undeveloped, and commercially scalable quantum computing has taken longer than expected to materialize.

Organizations that acted previously have gained experience and cultivated relationships within the tech ecosystem to codevelop targeted solutions with established partners. Those that waited to act have locked themselves out of these ecosystems, resulting in longer production cycles and increased competition.

Explosion

The talent and operating ecosystems are developed, and commercially scalable quantum computing has arrived sooner than expected.

Organizations that invested previously can tap into a more developed talent ecosystem to pursue relevant proofs of concept (POCs) and can scale them in the market. Early POC learnings provided strategic guidance to scale and commercialize. Those who failed to act have missed out on these insights and have struggled to fully leverage available talent for effective implementation.

Leap

The talent and operating ecosystems have grown and developed, while commercially scalable quantum computing has taken longer than expected to arrive.

Organizations that acted early have leveraged their established innovation teams and insights from a consolidated ecosystem to drive business advantage, while those that failed to act early have been unprepared in terms of workforce readiness and have struggled to navigate a complex ecosystem.

Leaders can make better decisions today by planning for the opportunities and risks that they could face across all these possible futures, which we’ll explore in greater detail with corresponding actions to consider.

Scenario 1: Surprise

An undeveloped talent and operating environment, combined with sooner-than-expected, scalable quantum computing, leads to talent wars.

It’s 2028, and experts almost can’t believe the announcement: Quantum computing is commercially scalable, years ahead of when most analysts anticipated. The breakthrough has turned quantum computing into one of the most critical topics on the C-suite agenda, leading into 2030, with the undeveloped quantum talent market front and center.

At business conferences and on earnings calls, executives are promoting their visions for quantum computing across everything from optimizing supply chains and investment strategies to supporting the development of radical breakthroughs in medicine, materials, and other technical fields. Already, several early quantum innovators have filed patents on new battery technologies that appear to be gaining traction with high-tech, automotive, and manufacturing organizations, opening up new, high-value revenue streams. The rest of the business community is anxious to catch up.

Until now, tech budgets have been focused on initiatives like AI, edge networks, and high-performance computing that had seemed more promising and near-term. While cloud and broader AI infrastructure investments have provided the technical on-ramps necessary for quantum hardware, specialized internal quantum-as-a-service talent is still needed. Organizations have struggled to comprehend the new quantum tech stack, especially at the application, data, and middleware layers.

Despite initial hopes that internal technical talent can be quickly upskilled to shift from classical to quantum computers, the timelines and retraining costs are substantial. External hiring has been equally tricky. Academic support from universities has been limited, given reduced funding and a lack of international scientific cooperation.

Organizations find themselves locked in competition for just a few thousand highly trained, high-cost experts in the global market.

The organizations that acted early with a quantum computing strategy seem to have been somewhat insulated from these larger market risks and may be better prepared for the opportunities.

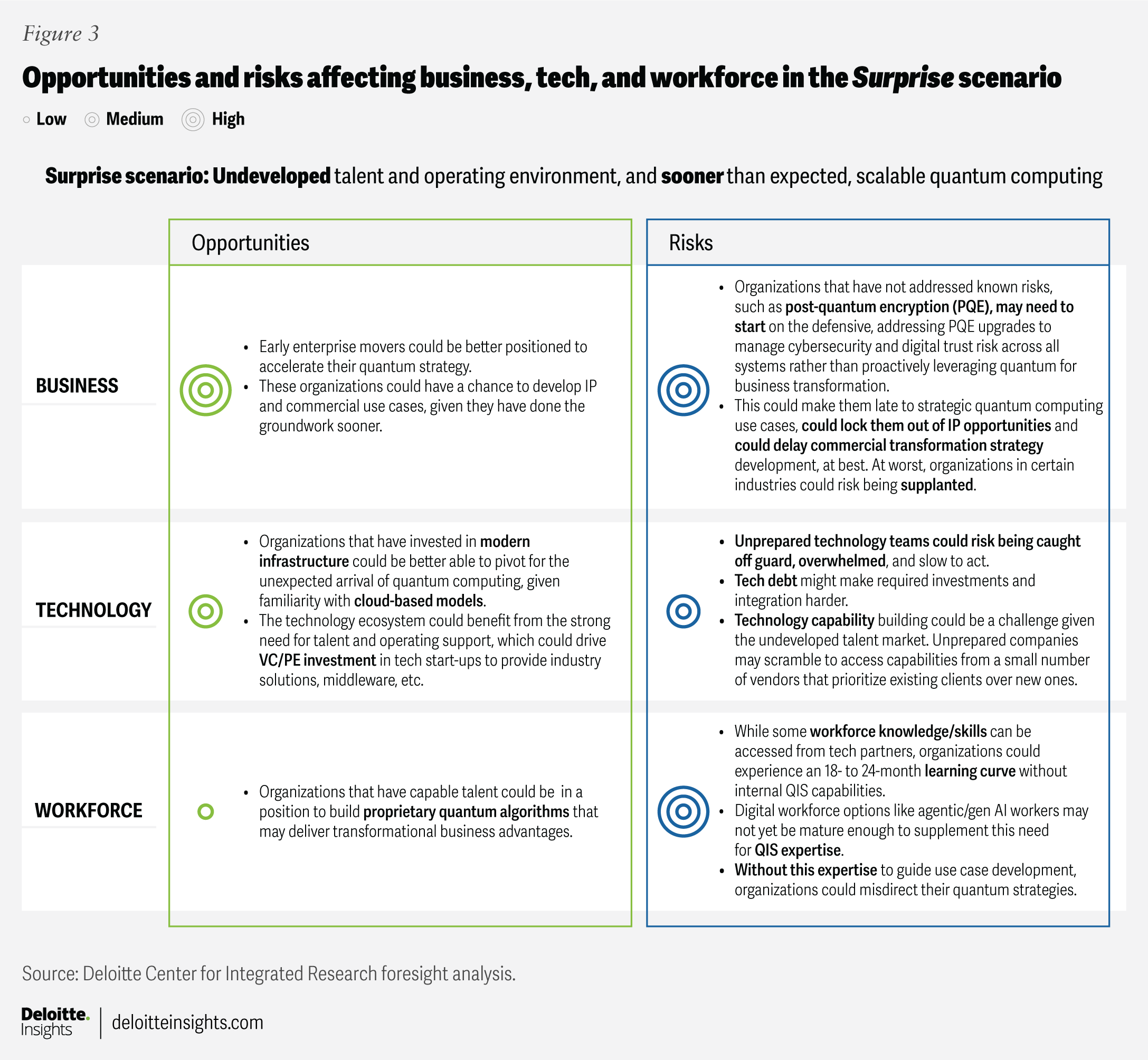

Impacts: Emerging opportunities and risks

A few businesses that focused on quantum computing experiments before 2025 in fields like life sciences, banking, tech, and energy are expected to be better positioned to identify and build transformative use cases.

Others face a steep learning curve and may be focused on managing the likely more immediate threats of post-quantum cryptography (PQC) and the new encryption solutions that would be required (figure 3).

Signals: What makes this scenario plausible?

Recent market forecasts, attention, and investment suggest scalable quantum computing may arrive sooner than later, while gaps in organizational skills that are left unaddressed may be challenging to overcome.

- The supply gap between quantum job postings and available talent is already significant. Analysts estimate that 250,000 quantum computing jobs will be needed by 2030.6 An April 2025 report shows a 12-month global increase in quantum job postings of only 4.4% and a month-over-month global decrease in postings of 13.9%.7

- Various technical breakthroughs—from multiple companies across the ecosystem—suggest the hardware ecosystem may be maturing rapidly. In the last several months, there have been groundbreaking technological innovations in quantum computing: Amazon announced its quantum computing chip, which utilizes cat qubits and transmons to simplify error correction;8 Microsoft announced their development of a quantum chip with a breakthrough innovation known as a topoconductor, which has shortened the time needed to achieve reliable qubits at scale from decades to years;9 US and Swedish researchers announced the coldest ever superconducting qubit, which makes the hardware more reliable;10 PsiQuantum plans to have a commercially useful quantum computer available by 2027;11 and Google is aiming to release their commercial quantum computer within five years,12 among others. And, recently, Lockheed Martin used IBM’s quantum-centric supercomputing framework to successfully simulate molecular systems as an alternative to classical methods with a 52-qubit quantum computer, demonstrating tangible value gains available on today’s infrastructure that would scale by more than 20 times on 1,000 qubits.13

- Intellectual property continues to grow. An original analysis of academic research papers published over the last decade (2015 to 2025) shows that the share of technical papers being published on quantum computing is increasing 4% to 5% annually since 2019.14 Additionally, companies have filed over 1,100 quantum patents in the last five years.15 Rafal Janik, chief operating officer at Xanadu, notes that, in the next three to five years, among chemistry, materials, pharmaceuticals, and energy companies, “There will be some really big winners that have already captured IP and partnerships in order to get access to those (quantum) devices.”16

- Those investing in quantum increasingly believe they’re seeing returns on investment now. A Deloitte study of nearly 400 US business and tech leaders conducted in 2024 found that a quarter (25%) of respondents reported investing in quantum computing in the prior 12 months, a 3x increase from 2023. Of those investing in 2024, 76% believed they were gaining value to a large or very large extent.17

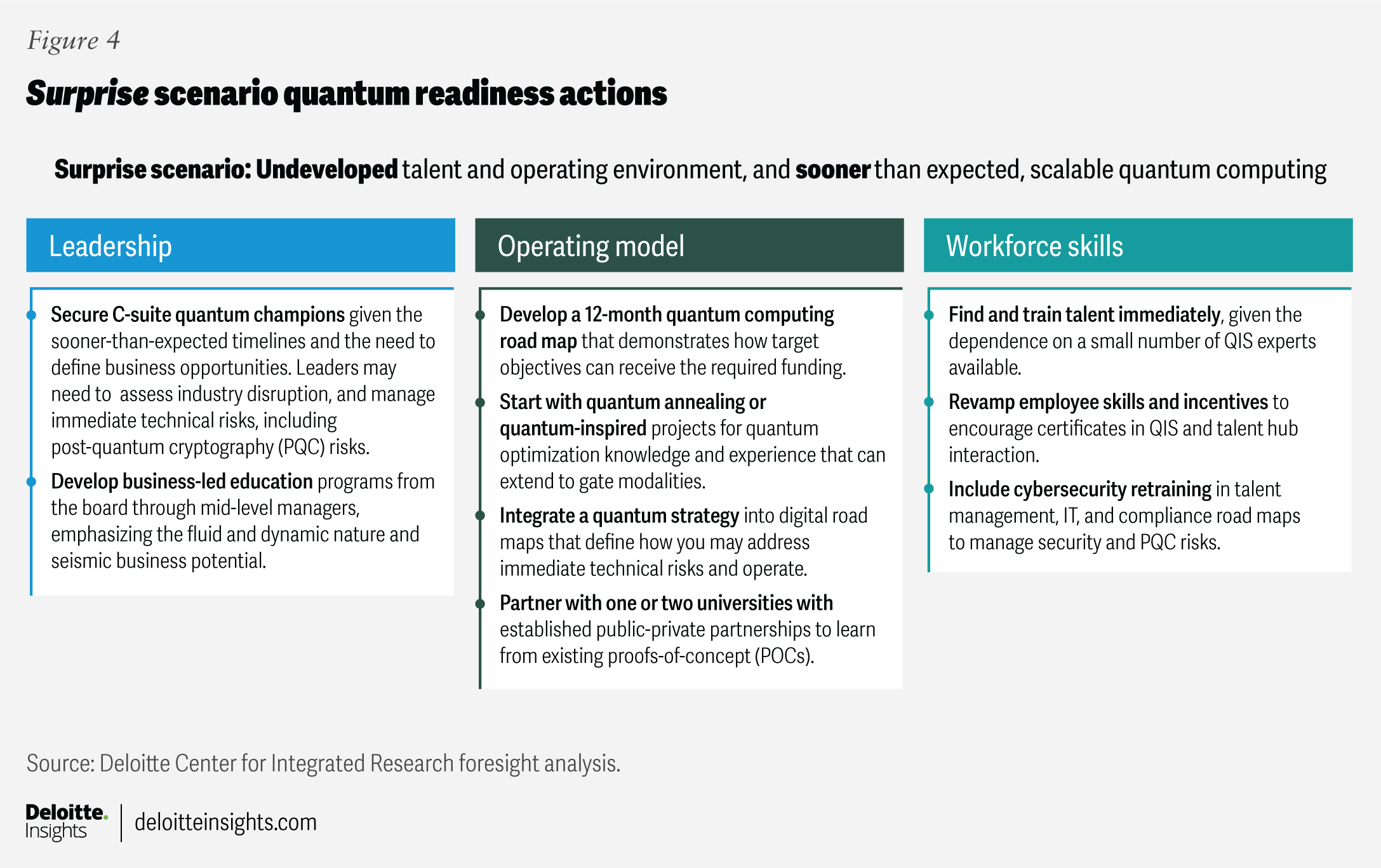

Actions: What organizations can do today to help prepare for this scenario

In this scenario, organizations might position themselves for future success by building a road map today that includes triggers that would signal when it’s time to act and where to focus first. The plan should clearly define responsibilities at senior leadership levels and involve training and educating not only leaders but also the broader organization on what quantum computing can and cannot do to manage risks and define the right strategy for bringing in talent and partners.

Additionally, new incentive structures addressing risk management, given the immediate encryption risks and innovation opportunities, would likely be needed, as well as tech talent experienced in running managed services programs (figure 4).

Scenario 2: Quandary

An undeveloped talent and operating environment, combined with later-than-expected scalable quantum computing, leads to slow progress.

Quantum progress has been continuous, but slow. Organizations continue to learn about the transformative potential that quantum computers can deliver, but innovation budgets are limited, and enterprise leaders are focused on other technologies, mainly AI. Given underinvestment from venture firms that made bets on AI and classical computing, quantum computing hasn’t passed the technical threshold to meet commercial needs by 2030.

While it always has felt like there’s a light at the end of the tunnel with new scientific breakthroughs, the tunnel keeps getting longer in unexpected ways. Organizations’ investments move elsewhere, timelines extend, and business investment continues to shift. Only a few public universities and government institutions persist in investing at meaningful levels.

Stagnant talent operating in an academic environment has led to fewer vendors and options for organizations to experiment. Although most organizations have invested in AI talent, these teams have lacked any practical exposure to and experience with quantum algorithms and systems. Those that have continued to experiment in quantum computing have cornered the market on limited available talent.

While AI has driven revenue growth, shortsighted tech planning has left many organizations vulnerable when quantum utility does arrive, post 2030. Businesses have lost a decade of knowledge and infrastructure development. For example, when a seismic breakthrough in quantum molecular simulation occurs in pharma, leaders across all industries scramble to assemble boards and react. Chief information and technical officers must jump back into the quantum fray (or enter the quantum computing arena for the first time).

Most company leaders have written off quantum computing, except for a few stalwarts that continue to gain incremental, short-term advantages, such as enhanced classical computing capabilities, while they wait for scalable quantum computing to arrive (while filing patents to protect IP in the future). Some of these companies are also benefiting from experiments with quantum-inspired approaches, developing, for example, new optimization techniques that are generating enhanced performance relative to classical computers. By continuing to invest in maintaining their institutional knowledge from ongoing experimentation, they have secured a talent advantage and sustained a vision through C-suite role changes and commitment to multiyear quantum innovation agendas.

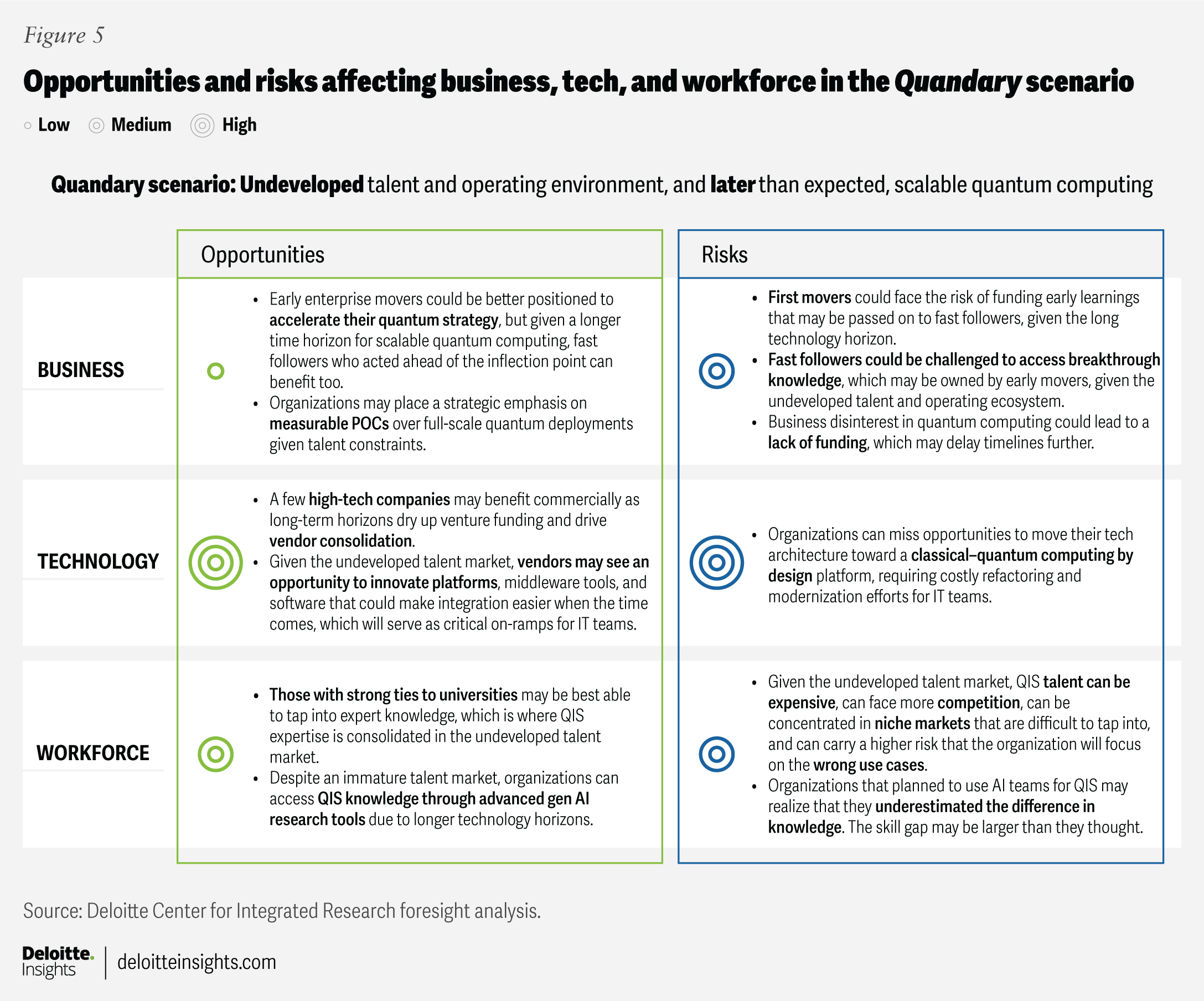

Impacts: Emerging opportunities and risks

While this may seem like a familiar future market scenario—quantum technical breakthroughs and the talent market taking a long time to evolve—many organizations that are making decisions based on this assumed future may have failed to fully think through the long-term implications on their businesses. Their assumption may be that if the market takes a decade to mature, the organization doesn’t need to act today because the opportunities and risks are also far off and can be addressed closer to a technical inflection point.

However, if the market experiences a “quantum winter” and technical progress takes longer than expected, that might not mean that they can and should delay investment for another decade. What’s worked in the past won’t necessarily work in this moment, given the pace of technological change and the sheer complexity it will require to get quantum infrastructure and talent scaled to the organization. Implementation of quantum computing will likely be significantly complex, taking longer to manage the risks, seize the opportunities, and compete relative to those who are investing in the quantum ecosystem now.

In the quantum quandary future (figure 5), we envision leading companies would concentrate expert quantum knowledge in the business, and it would be the responsibility of this small group to educate the broader organization.

Signals: What makes this scenario plausible?

Evidence today indicates that quantum jobs are growing,18 but will the talent ecosystem develop quickly enough?

- A meaningful skills gap already exists and could expand over time. Key skills for quantum computing professionals include quantum algorithm design and development, information processing, and quantum computing error correction. However, a recent survey found only 12% of respondents had formal training in these areas, revealing a significant supply-demand gap.19 Given the skilled talent needed to build quantum capability, Marco Paini, vice president of financial services and EMEA at Rigetti Computing, agrees, and says, “An enterprise would struggle to build a proper quantum computing organization from scratch in less than a year.”20 This suggests that ramping up quantum capabilities will remain a long-term challenge.

Furthermore, recent evidence suggests that quantum global job growth may be slowing, as enterprises operate in an environment of economic uncertainty, AI prioritization, and reduced research funding. The Quantum Technology Workforce Monitoring Report found that global quantum technology job postings fell 17.6% from February to March, with a 3.7% decline in new roles over the trailing 12 months.21

- Financial market performance in quantum computing reflects the emerging industry’s complexity, characterized by both long-term gains and short-term volatility. Annual and three-year gains have been steady among leading pure play quantum stocks, where annualized increases peaked at 2600%.22 However, at several points in 2025, when commercial quantum computing timelines were called into question, stock prices plummeted.23

- Quantum investments are competing across a robust emerging tech agenda, potentially limiting progress. In 2024, quantum venture investments reached just US$2 billion.24 In contrast, AI venture investments in 2024 totaled approximately US$132 billion.25

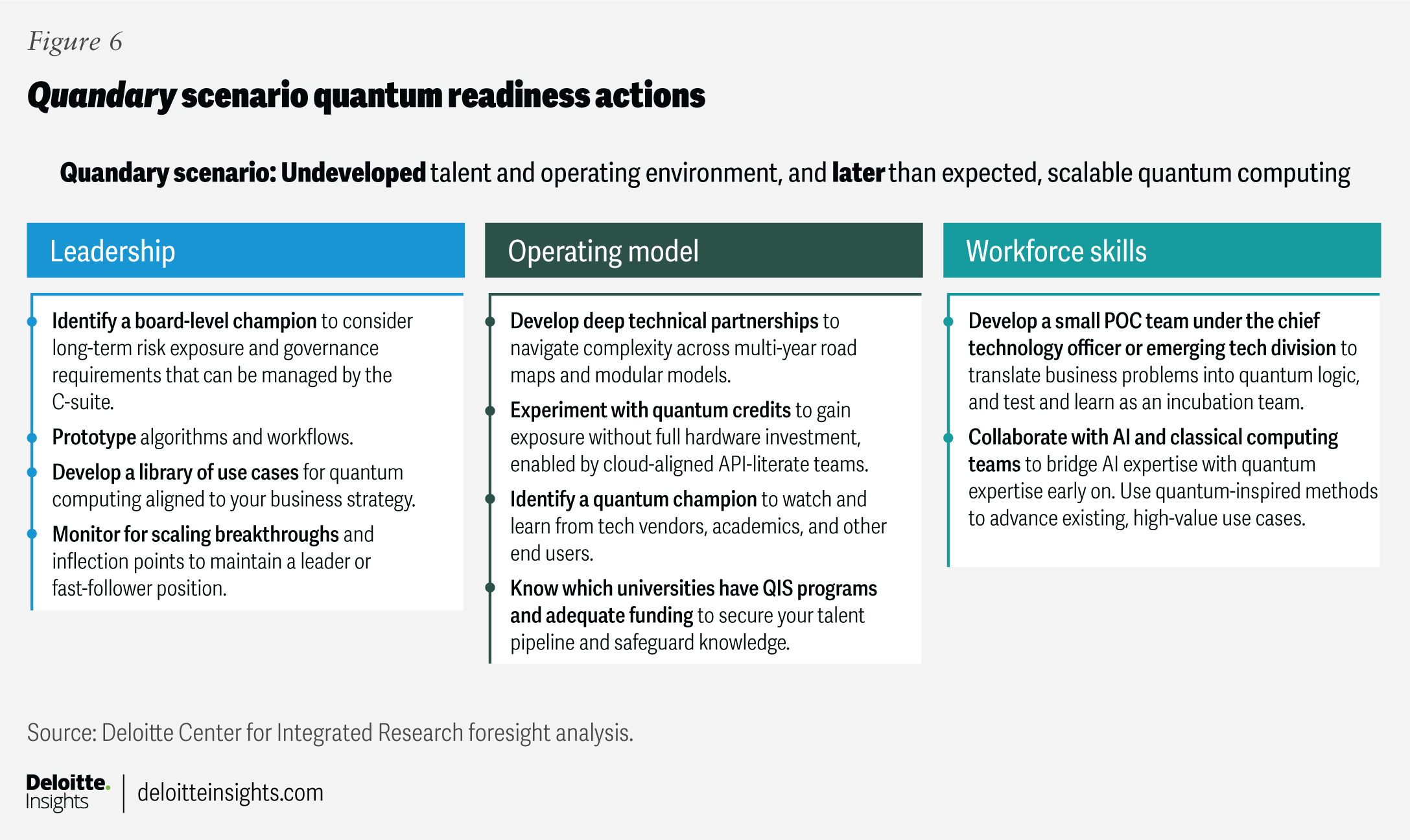

Actions: What organizations can do today to help prepare for this scenario

Longer timelines for developing quantum computing talent and operating capabilities provide more commercial flexibility in this world, but steps may still be needed to continue growing capabilities while the technology advances, even if it takes time (figure 6). Considering the long production cycles, organizations should start with small-scale POCs now to understand business applications and risks. These POCs could serve as an early preparation to extract value and build understanding when quantum computing matures.

Scenario 3: Explosion

Both scalable quantum computing and the talent pool develop sooner than expected.

Despite prior skepticism, quantum advantage—when quantum computers surpass classical computers—has arrived and unlocked new processing potential and ROI. Technical progress has accelerated, in part, due to talent development and operating advancements. The groundwork has been laid for an explosion in quantum technical and human capabilities across industries, leading into 2030.

Organizations have scrambled to adapt their business and relative competitive position. C-suites have called emergency board meetings to discuss what quantum computing means for their business, and CTOs have been tasked to produce solutions quickly, leading to a misdirected focus for some. Market enthusiasm, innovation pressure, and overall hype have pushed organizations to act before they can thoroughly evaluate this new, complex technology. Many senior leaders have said they are reminded of the AI rush (and some the dot-com boom) and worry that, to beat competitors to market, they’ll make the wrong bets.

Tech providers have quickly pivoted, standardizing the tech stack across vendors, speeding implementation time, and putting pressure on end users. Venture financing has flooded the market, and now many quantum-as-a-service offerings are available, given an abundance of talent.

The labor market has been able to pivot STEM talent into business training courses focused on fundamentals like the laws of nature and quantum use case development. One critical innovation has been the user interface and networking that enables quantum applications to come online with limited expert knowledge. Much of this has been possible due to robust public and private partnerships with universities.

A lack of cohesive strategy and focus has been the biggest challenge to ROI for slow movers. Those with the most success seem to have been the companies that developed executive leadership committees and centers of excellence early and prior to the logical qubit milestone to set their strategic vision and guide execution.

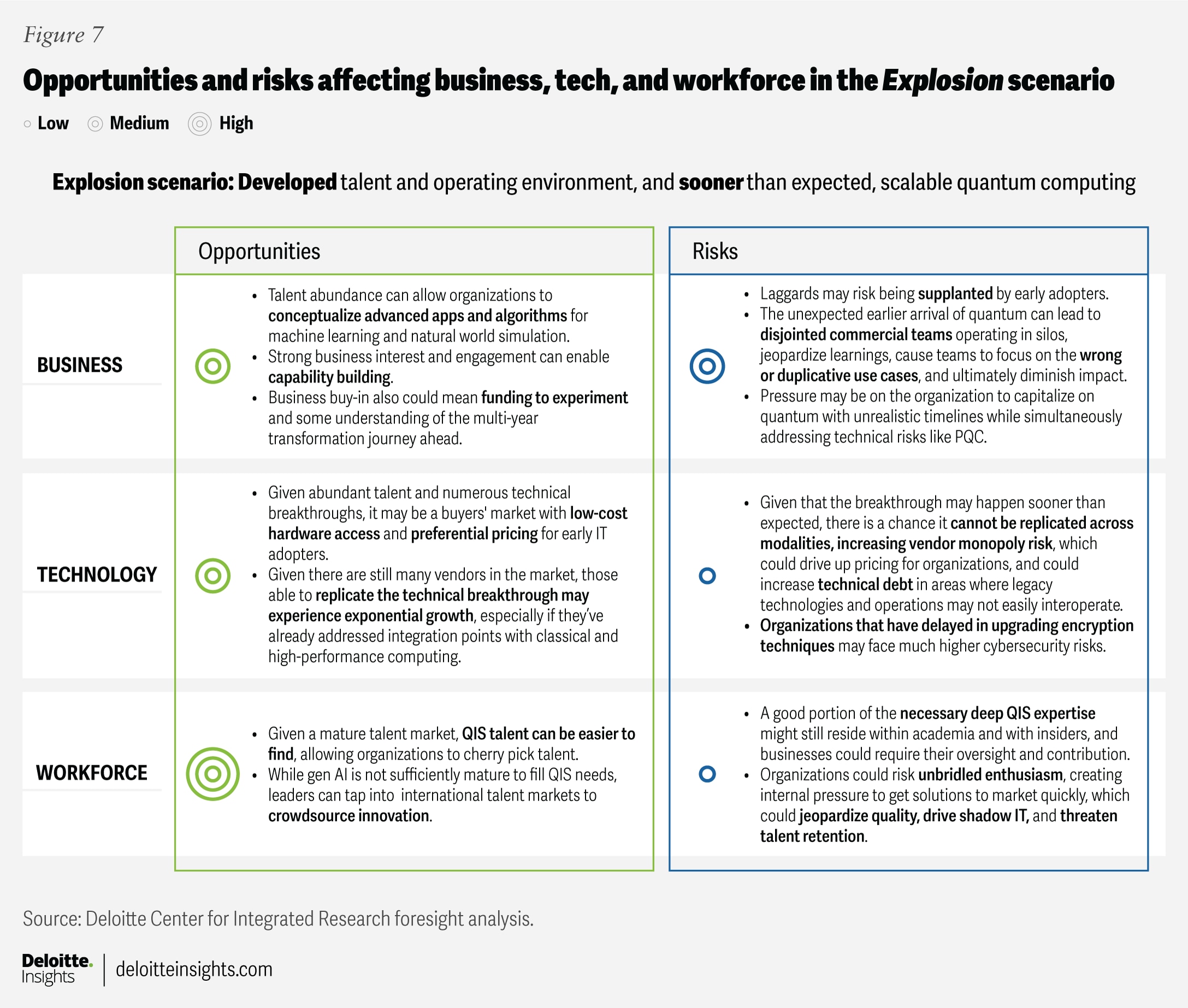

Impacts: Emerging opportunities and risks

Organizations that have not had significant exposure to and experience with POCs and road maps could struggle to take advantage of the quantum opportunity. Those companies that have completed POCs with prior investments may have a quantum business advantage, and more influence to define priorities and guide innovation priorities across the vendor and operating ecosystem.

Strategic prioritization of use cases to pursue will likely remain an important factor in creating the industry advantage that an organization is seeking. While strong integrations with classical computing and business tools can make it easier for organizations to move quickly, adoption is still fragmented, with an organization’s legacy technology and lack of experience possibly slowing its progress.

Since the barriers to entry are comparatively lower, the market could witness an influx of new vendors, algorithms, and use cases, which can reduce the cost for end users. Organizations may have the opportunity to tap into a more developed talent ecosystem to scale relevant POCs and propel innovation in the market—potentially leading to new discoveries (figure 7).

Signals: What makes this scenario plausible

Talent hubs and faster-than-expected hardware advancements could point to an explosion scenario where quantum computing could be ready within the next five years.

- Overall investment in quantum computing is growing. It is estimated that the quantum computing market could grow nearly 35% annually from 2024 to 2032.26 Yuval Boger, chief commercial officer at QuEra Computing, explained that organizations are buying quantum computers “because they believe that in two or three years, they will be valuable.”27

- Market data shows progress may be faster than businesses realize. In a recent survey by QuEra Computing, over half of the 920 global respondents (51%) stated that they believe quantum technology is making faster progress than they expected. Further, 33% of the respondents believe their organization will likely be caught off guard by rapid progress.28 Yuval Boger put it this way: “Quantum computing could be used for simulations; it could be used for optimization. It could be used for machine learning, and I would bet that nine out of 10 industries would have a need for improvements in simulation, optimization, and/or machine learning.”29

- Quantum talent hubs are emerging as an emblem of a developing talent market across the United States and globally. In the United States, these include IBM's hub in Chicago30 and contenders in Albuquerque, New Mexico; Pittsburgh, Pennsylvania; Madison, Wisconsin; Austin, Texas; Minneapolis, Minnesota; Rochester, New York; and Raleigh, North Carolina31—not to mention those around the world in the United Kingdom, China, Canada, and Australia.32

These hubs are expected to support talent development, especially through relationships with local universities. For example, the University of Chicago Professional Education program offers an eight-week online course in quantum science, networking, and communications. While not a full replacement for the depth of skills needed, this program, developed by the Pritzker School of Molecular Engineering and the Chicago Quantum Exchange, provides hands-on experience with quantum technologies and direct interaction with leading researchers. The program signals that those with up to 10 years of experience in physics, computer science, engineering, or mathematics could be good candidates for longer-term upskilling initiatives.33

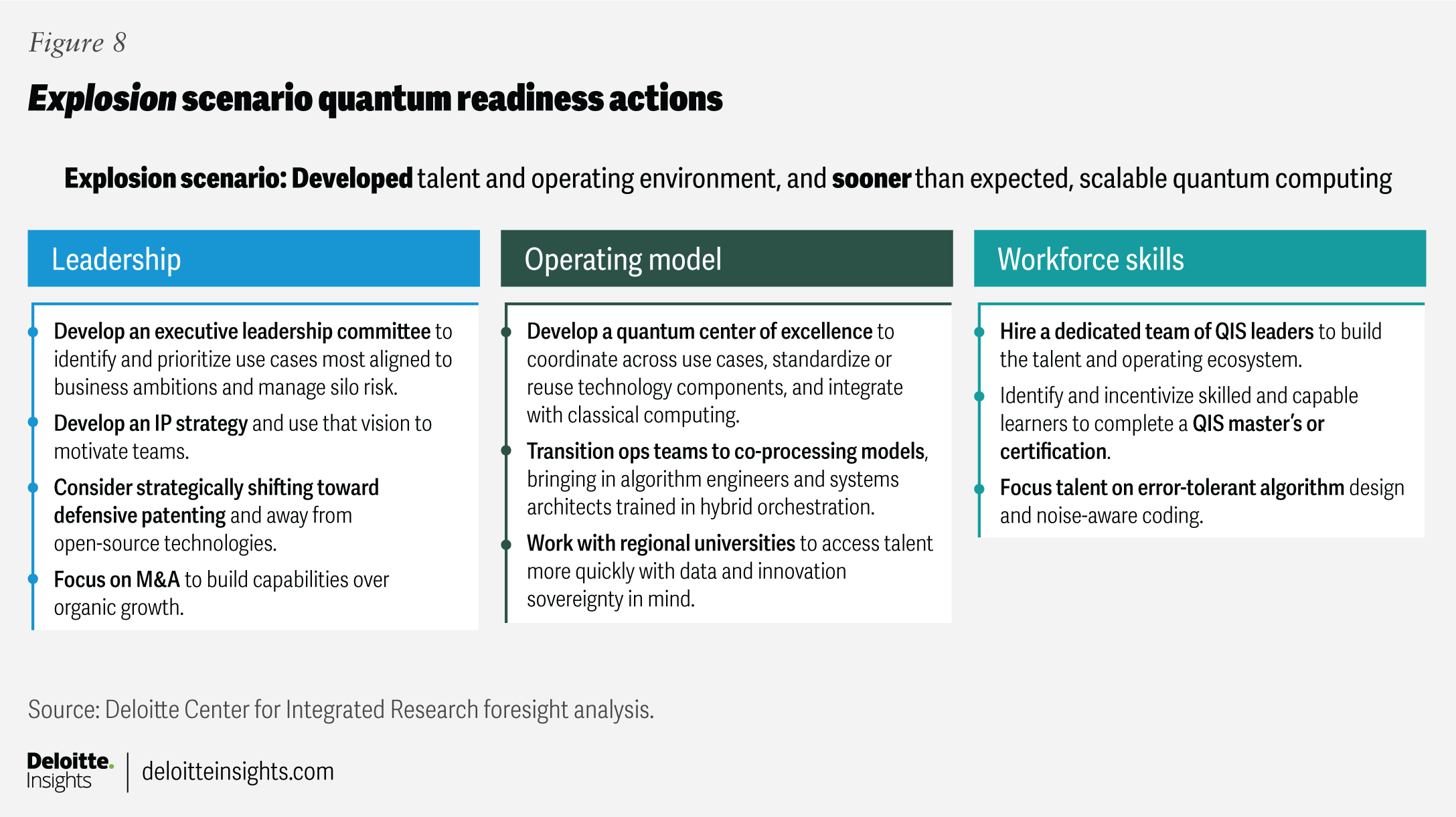

Actions: What organizations can do today to help prepare for this scenario

Strategies to get up to speed and access available talent more quickly are important for organizations to capitalize on a sooner-than-expected quantum computing timeline (figure 8).

Scenario 4: Leap

A developed talent and operating environment, combined with a later than expected scalable quantum computing, has the technology “all dressed up with nowhere to go.”

Despite quantum computing’s slow advancement—the technical community has not advanced to technically scalable quantum computing leading into 2030—the overall AI tech boom has driven growth in STEM skills, including a pipeline of quantum information sciences talent. Humans, in general, have a greater understanding of quantum computing’s potential to advance our collective understanding of the natural world, resulting in an ongoing willingness to invest and a profound growth in experiments despite technical hurdles limiting scalability. Quantum computing has captured the imagination of everyday people and placed pressure on business leaders to create and experiment.

Given slow technical progress, the number of vendors with funding has diminished over time, and the market has consolidated, leaving just a few promising larger providers. Knowledge has consolidated within universities and large tech vendors, given a general lack of innovation through global cooperation.

Companies that invested in quantum computing early appear to be realizing incremental and secondary advantages and benefitting from established relationships with vendors for faster contracting and expanded capacity. If these early movers continue to act consistently to maintain knowledge and ecosystem relationships, they’ll likely be well-positioned when scalable quantum computing arrives.

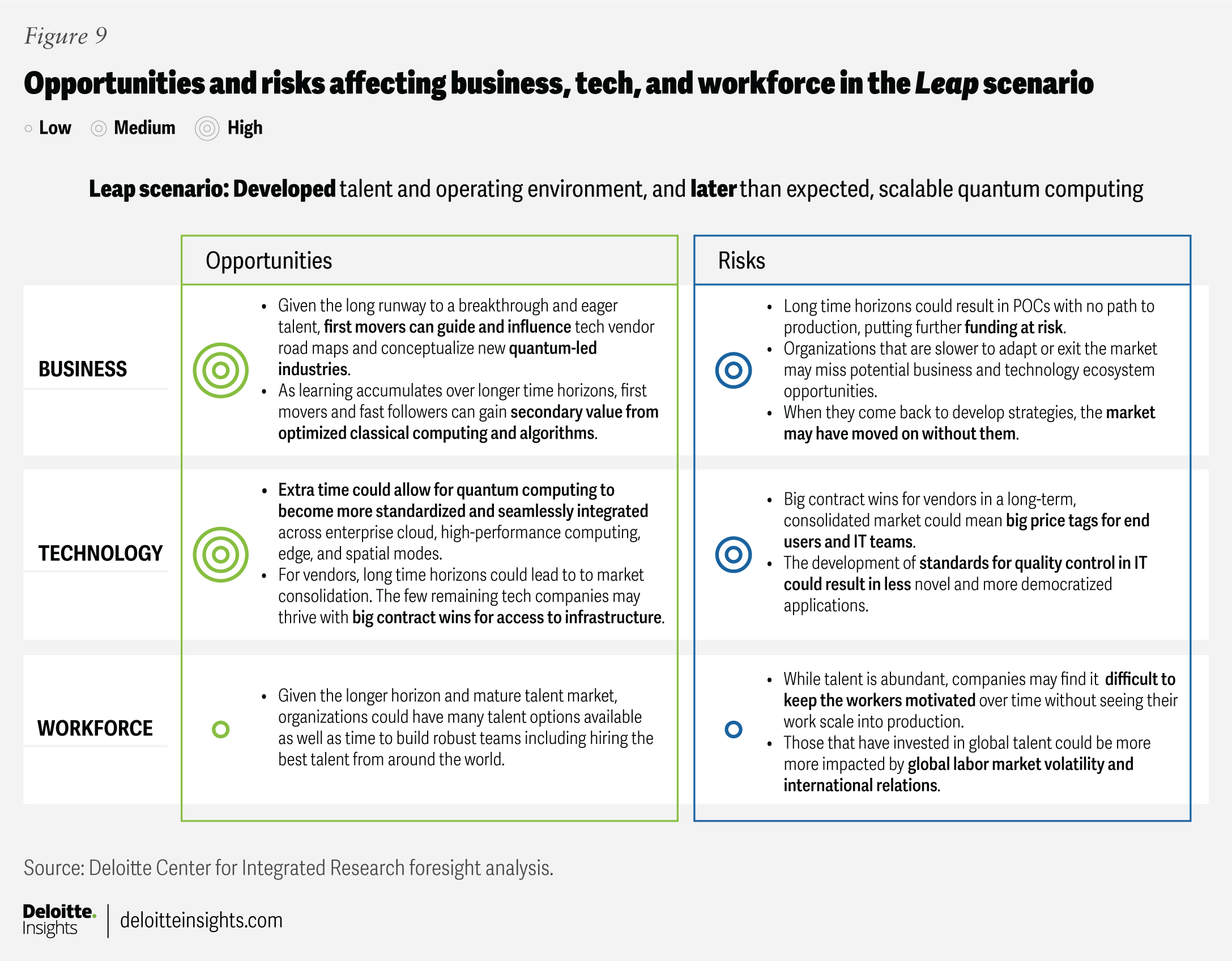

Impact: What opportunities and risks potentially affect business, tech, and workforce

This scenario allows leaders to conceptualize new industries that don’t yet exist today, experiment with a strong talent pool, and manage the risks associated with a technology ecosystem that's likely contracting and consolidating as the technology matures. Importantly, a workforce that has grown faster than technology could need to remain motivated to solve the hardest problems without placing pressure on organizations to scale too soon. However, this scenario could benefit the entire technology function.

Highly skilled technology talent might become cheaper given demand constraints, allowing organizations to build up their technology function ahead of the need. The spillover effects from this talent in cutting-edge math, physics, and quantum mechanics could benefit other areas of technology innovation in the short term. Organizations could enhance their ability relative to competitors and move closer to the speed of technology innovation over time (figure 9).

Signals: What makes this scenario plausible?

As we’ve experienced with other technology waves, it’s possible quantum computing makes slow, quiet progress in technical circles without gaining much attention until the “moment” that it can routinely run a broad collection of commercially relevant tasks and use cases. At the same time, there’s evidence showing that the talent market could be maturing quietly to become ready for that moment.

- Technologists are working to make quantum hardware easier to use and accessible by improving technology features and functions. As quantum computing capabilities advance, there is a movement toward increased democratization through standards, abstraction layers, and education that allow for greater usability and less demand for specialized knowledge. For example, in 2024, researchers from MIT created the “quantum control machine,” an instruction set making it easier for programmers to implement quantum algorithms.34

- Visual learning approaches help talent better understand and engage with the technology. A method to train novice students called quantum picturalism (QPic) is showing promising results. When using diagram-based instruction to teach high school students with no prior advanced math background key quantum concepts, 82% of these students in a recent study passed a quantum post-training exam related to basic quantum concepts and principles.35

- Quantum investment, an important driver to achieve commercially scalable quantum computing, has been unpredictable. For example, in 2023—the year when generative AI captured widespread attention—investments in quantum dropped by approximately 50%—from US$2.2 billion in 2022 to US$1.2 billion. This decline can be partly attributable to a shift of investments toward gen AI.36

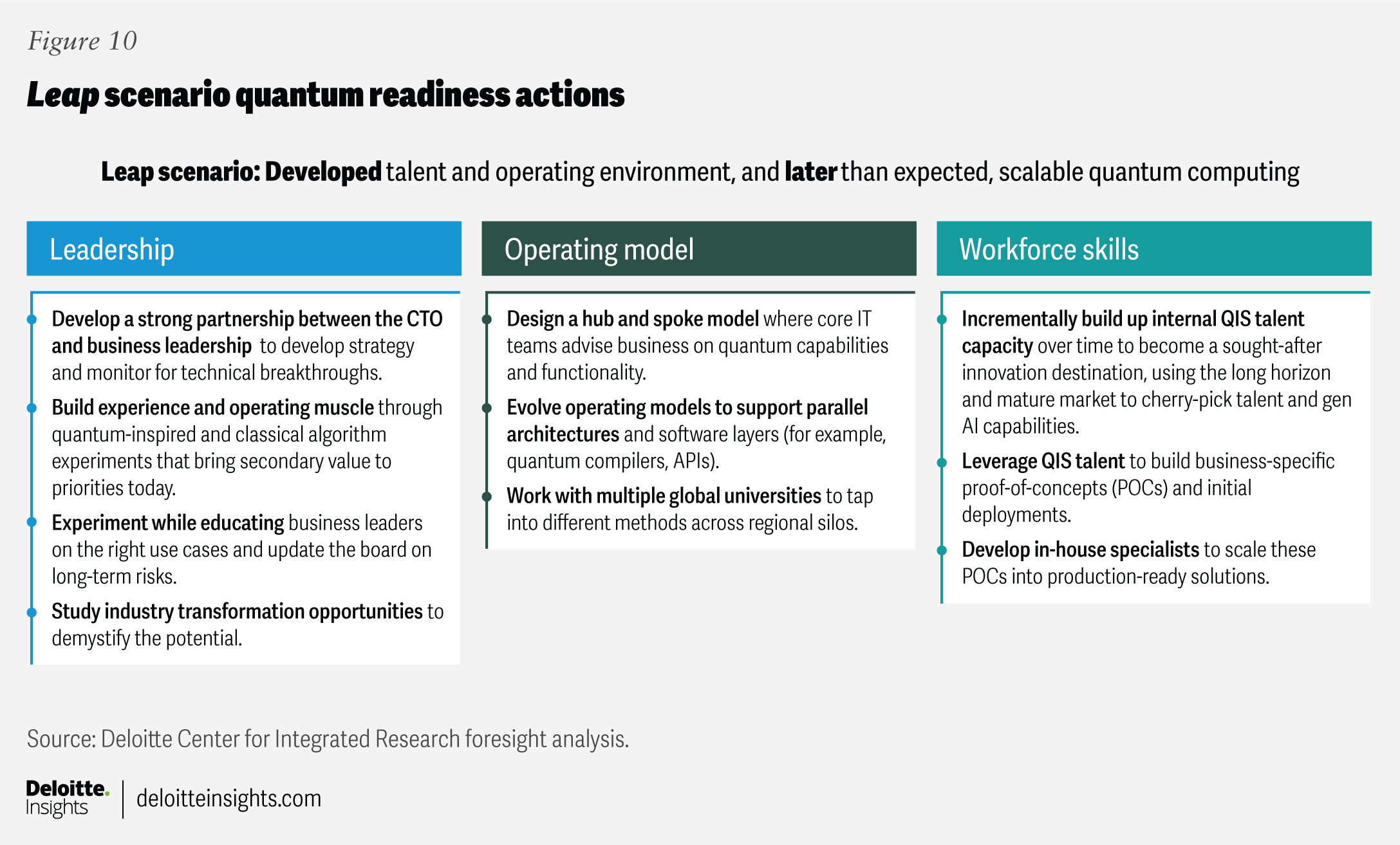

Actions: What organizations can do today to help prepare for this scenario

Consider strengthening the partnership between the CTO and the business to build new operating modes by creating interoperable architectures that will be more ready for future integrations and incrementally building talent capabilities today.

Organizations should leverage the developed talent market and consider starting to build small innovation teams that can focus on POCs aligned with their specific business challenges. Adopting a quantum-inspired approach now could help mitigate future risks and lay the groundwork for necessary learning and preparation. Without these early learnings, organizations may struggle to realize the commercial and technological benefits of quantum computing once it matures, especially given its longer production cycles and technological complexities (figure 10).

Moves to consider for multiple potential futures

The science behind quantum computing is significantly different than classical computing—and more complex. Developing the infrastructure to operate scalable quantum computing in an organization will take time. For organizations with business models that could be disrupted by quantum computing’s transformative potential, getting started might be the most important decision to make today and will likely shorten the distance to catch up as the logical qubit threshold is reached.

Capitalizing on the quantum computing opportunity and remaining competitive when it arrives could benefit from significant preparation behind the scenes. Idalia Friedson, former chief strategy officer at Strangeworks and current cofounder at Sygaldry Technologies, thinks of it like a light switch: “A lot of people think there’ll be a moment when quantum just turns on once the hardware is ready. But it’s not that simple. Like flipping a light switch, it only works if the wiring behind the scenes is already in place. You need the right infrastructure aligned to the right problems. The more that companies can lay that groundwork now, the faster we’ll get to broad adoption.”37

For these organizations in the early planning stages, a number of moves should be prioritized. Even in scenarios we examined outside of this paper where quantum advantage never arrives, organizations executing these baseline activities would likely still benefit from the knowledge, relationships, and infrastructure from these practical investments.

Leadership: The time to act is now given quantum computing’s truly transformative potential

Consider identifying an executive sponsor who recognizes quantum computing’s potential for the organization and is committed to championing the technology over time to seize opportunities and educate the board and C-suite on potential risks from inaction. The CTO and their team can then be charged with developing a road map in support of the organization’s strategy. Leverage scenario modeling while monitoring ongoing technology advancements to be alert to new technical achievements signaling that scalable commercialization may be imminent. Rather than monitoring for and trying to predict the technical inflection point that you think warrants action for the current investment cycle, recognize that the runway needed for organizational change when dealing with exponential technologies like quantum is likewise significant, and waiting for that breakthrough to occur could mean you’re already too late.

Operating model: Start with a road map to establish your position in the tech ecosystem

Develop a quantum road map that capitalizes on capabilities of today and plans for the potentials of tomorrow. Explore opportunities such as quantum annealing or quantum-inspired projects to develop in-house talent and experience. Begin developing or continue to advance relationships with quantum computing ecosystems including well-known public and private partnerships to establish your place in the ecosystem. Monitor the ongoing development of quantum-as-a-service models with an eye on niche players outside of your existing tech ecosystem. Alert organizations can be better prepared for a quantum breakthrough (whenever it occurs) by deepening relationships with existing technology vendors proficient in both cloud and quantum computing to build the onramps (or at least relationships) needed for future quantum-as-a-service models. More integrated short- and long-term thinking about technology infrastructure and architecture can benefit organizations regardless of the time horizon.

Workforce skills: Educate and cross-pollinate

Think about the information-processing skills your organization needs to participate in the quantum computing ecosystem. Beyond skills in physics, mathematics, computer science, and domain-specific expertise, what many emerging technologies like AI, cloud, edge, and quantum computing have in common is that they’re pushing forward the information-processing paradigm. In the short term, there may be opportunities to cross-train AI scientists on quantum mechanics. In the longer term, monitor the development of quantum information science programs that are developing at select universities, making non-PhD talent more accessible. While quantum computing requires expert knowledge today, broader investment in building expertise and exposure to quantum information science through talent management within a foundation could help organizations to test and learn through quantum-inspired thinking, algorithms, and methods. Organizations can even explore classical computing approaches to achieve value now while preparing for future groundbreaking opportunities. For example, a better understanding of heuristics algorithms used in quantum models can optimize traditional AI models operating on classical computers. Bringing your quantum workforce—whether that’s a hire tasked with bringing or developing expertise in quantum information sciences or a future vendor—closer to these issues now can enable more cross-pollination for the future.

Organizations today have a choice: Begin “behind the scenes” preparation for a quantum computing future or continue to wait. If quantum computing reaches utility scale as expected, the organizations that chose to be proactive and remained close to the technology are likely to have a competitive advantage while those that stayed on the sidelines might have to scramble to compete. What choice will your organization make?

Methodology

Deloitte employed several foresight analysis methods for this research to identify market signals, trends, and forces of critical importance and uncertainty shaping the quantum future.

- Trends and emerging issues analysis was used, including analysis of Deloitte survey and proprietary data sets to contextualize the marketplace. This included quantum computing investment trend data analysis from Deloitte’s tech value research and proprietary data from MKT Media stats on news intensity, academic research, and patent trends.

- Horizon scanning helped to identify trends, weak signals, and unexpected issues with regard to quantum computing development and potential adoption that provide insights into emerging changes.

- A STEEPV analysis enabled the authors to explore the issue from multiple angles related to broader macro market forces (societal, technological, economic, environmental, political, and value-based) to expand the perspective and contextualize the prioritization of drivers and uncertainty factors.

- Expert interviews with business and technology leaders knowledgeable in quantum information sciences and the market contributed valuable insights. Deloitte conducted these 20 interviews from February to April 2025.

These methods informed the scenario analysis, whereby Deloitte identified the highest impact and highest uncertainty drivers to inform two axes of uncertainty, forming the basis for the four scenarios, opportunity versus risk analysis, and critical actions for each scenario.

- Uncertainty No. 1 (x-axis): Quantum talent and operating environment (undeveloped vs. developed): Today, engaging with quantum computers and algorithms requires expert knowledge in quantum information science (QIS)—a combination of quantum engineering, advanced math, and physics. These highly specialized skills require deeply specialized education, sometimes PhDs, to navigate successfully. In other words, QIS is a new discipline, and learning it is akin to learning data science from scratch. The transition is not as “simple” as shifting programmers to a new coding language. While exposure to basic concepts through early education and master programs can provide deeper familiarity with principles, organizational transformation requires deeper retraining of existing employees, establishing new modes of thinking and problem-solving, and forging new paths to access quantum talent and partnerships. Continued national and academic innovation is dependent on government funding and continued international partnership and collaboration.

In recent years, as technology opportunities like AI have accelerated, organizations have relied on internal and external talent ecosystems to plug internal skill technology gaps and address wider operating needs via partners and automation. And while these ecosystems may emerge for quantum computing, it is not clear that there would be sufficient talent—as well as clear standards and integration models—to make this a viable solution. Talent needs and the operating environment may vary in the future based on how knowledge diffuses across business leaders and as user interfaces evolve (or don’t) to make capabilities more accessible to nonexperts. While there have been impressive advancements in generative AI models with expert knowledge, these tools are unlikely to fill the gap in the near or even long term, relative to the expertise and experience in software and hardware implementation that will be needed to implement quantum solutions. - Uncertainty No. 2 (y-axis): Scalable quantum computing (sooner vs. later): Recently, considerable commercial advancements toward fault-tolerant quantum computing have been claimed. At the same time, many production scaling questions remain that could push technology timelines out beyond the next five years. This axis represents the extent to which commercial quantum gate technologies become production-ready sooner or later than expected. While there are likely to be applications that work with a few hundred logical qubits, the scope and scale of information processes needed for a modern organization to reach scalable applications opens in the realm of 1,000 logical qubits. This axis reflects that technical threshold being achieved either sooner or later than expected.

This advancement is driven by multiple underlying forces.

- The speed of quantum algorithmic improvements (to lower the hardware requirements)38 and hardware maturation in logical qubits relative to use case utility39

- The variability of funding across the tech ecosystem

- The dynamics with other tech innovation progress (AI, high-performance computing, spatial, etc.) as future paradigms are defined

- The extent of vendor consolidation or expansion across quantum computing modalities (superconducting, trapped ion, photonic, etc.)

- The broader geopolitical environment impacting public and private partnerships and investment

While the axes of uncertainty method is recognized among foresight analysts as potentially limiting world-building to only two dimensions (and therefore missing other large uncertainties, outlier factors, taboo topics, or unexpected phenomenon), this method provides a high degree of focus that aids organizational decision-making. To address these methodological concerns, the research team tested several different uncertainties before narrowing down to these two likely variables.

Additionally, for further rigor, Deloitte ran a scenario model through its proprietary AI scenario automation tool and further augmented findings based on AI-driven recommendations, validated by the research to complete the foresight, insight, and action analysis. While unexpected and unplanned changes can always happen, organizations are well served when they plan for likely future possibilities and build in the ability to pivot as the broader macro environment changes.

Glossary

- Gate-based modalities (or universal quantum computing):40 Gate-based modalities in quantum computing are computational approaches that perform calculations by sequentially applying quantum gates to qubits, manipulating their quantum states before measurement. Gate-based modalities include superconducting, trapped ion, photonic, and other methods. They differ from quantum computing modalities like quantum annealing, which specialize in solving optimization problems using the change in physical systems.

- Logical qubit:41 A logical qubit refers to a group of physical qubits combined using quantum error-correction codes to encode and protect quantum information from errors such as decoherence and gate faults. This structure enables fault-tolerant quantum computation, making logical qubits a foundational element of scalable, reliable quantum computers.

- High-performance computing (HPC) centers:42 HPC enhances data centers by leveraging multiple interconnected servers and supercomputers, enabling rapid processing of extensive datasets. HPC provides significant improvements in performance, scalability, and long-term cost-effectiveness. HPC deployments are particularly suitable for scenarios characterized by high server utilization and substantial power demands but typically lower availability requirements. Such systems rely on specialized hardware, advanced cooling solutions, and prioritize high-density server arrangements far beyond the computational capabilities of traditional data centers.

- Cat qubits:43 Cat qubits are superconducting qubits characterized by an asymmetric trade-off between bit-flip and phase-flip error rates. Unlike typical superconducting qubits, which suffer from high levels of both bit-flip and phase-flip errors, cat qubits significantly reduce bit-flip errors exponentially, at the expense of a linear increase in phase-flip errors. This substantial improvement in bit-flip error rates is generally considered valuable enough to outweigh the modest increase in phase-flip error rates.

- Superconducting qubits:44 Superconducting qubits are circuits made of superconducting materials that exhibit zero electrical resistance at extremely low temperatures.

- Quantum inspired:45 By integrating mathematical frameworks and insights drawn from quantum physics, researchers can develop enhanced classical algorithms that exploit quantum mechanical principles without relying on actual quantum hardware. These quantum-inspired algorithms operate effectively on conventional computing platforms, such as GPUs, while still delivering substantial performance improvements, especially in optimization and machine learning applications.

- Quantum annealing:46 Quantum annealing is a modality of quantum computing carried out via quantum annealers. In annealing, the optimal solution for a problem is found among different solutions by taking advantage of certain properties of quantum physics such as quantum tunneling, entanglement, and superposition. Similar to the adiabatic process in thermodynamics, in quantum annealing, temperature is replaced by energy and the lowest energy state, the global minimum, is found via annealing. This enables user to solve optimization problems that take too long for traditional computers to solve.

- Fault-tolerant quantum computer:47 Fault-tolerant quantum computing (FTQC) will indicate that quantum computers can execute computations with logical error rates reduced to arbitrarily low levels. Achieving FTQC demonstrates that:

a. The threshold for error correction has been surpassed

b. Quantum information is sufficiently protected from environmental disturbances

c. Errors are effectively confined locally, preventing their propagation across the system - Qubit:48 Quantum computers rely on qubits to conduct calculations. A physical qubit is a basic unit of quantum information implemented in a physical quantum system, such as a superconducting circuit, trapped ion, or photon. It uses two distinct quantum states, 0 and 1, to encode information, though it can exist in a superposition of both. Unlike logical qubits, physical qubits do not include any error correction and are directly realized in hardware.