TMT Outlooks 2023: Changes in store for sports, media, and entertainment

With an ever-fragmenting audience, leagues and streamers explore new ways to engage fans and monetize content.

Chris Arkenberg

David Jarvis

Brooke Auxier

Michael Steinhart

Streaming entertainment seems to be growing every day,1 and with it, a sometimes-confusing array of options for sports fans who want to catch their favorite teams in action.2 At the same time, social video and user-generated content (UGC) are supplanting traditional video entertainment for highly coveted younger consumers.3

The sports and media and entertainment industries are both faced with the challenge of engaging more deeply with fans—especially those in the Generation Z cohort—and creating experiences that keep consumers coming back for more.

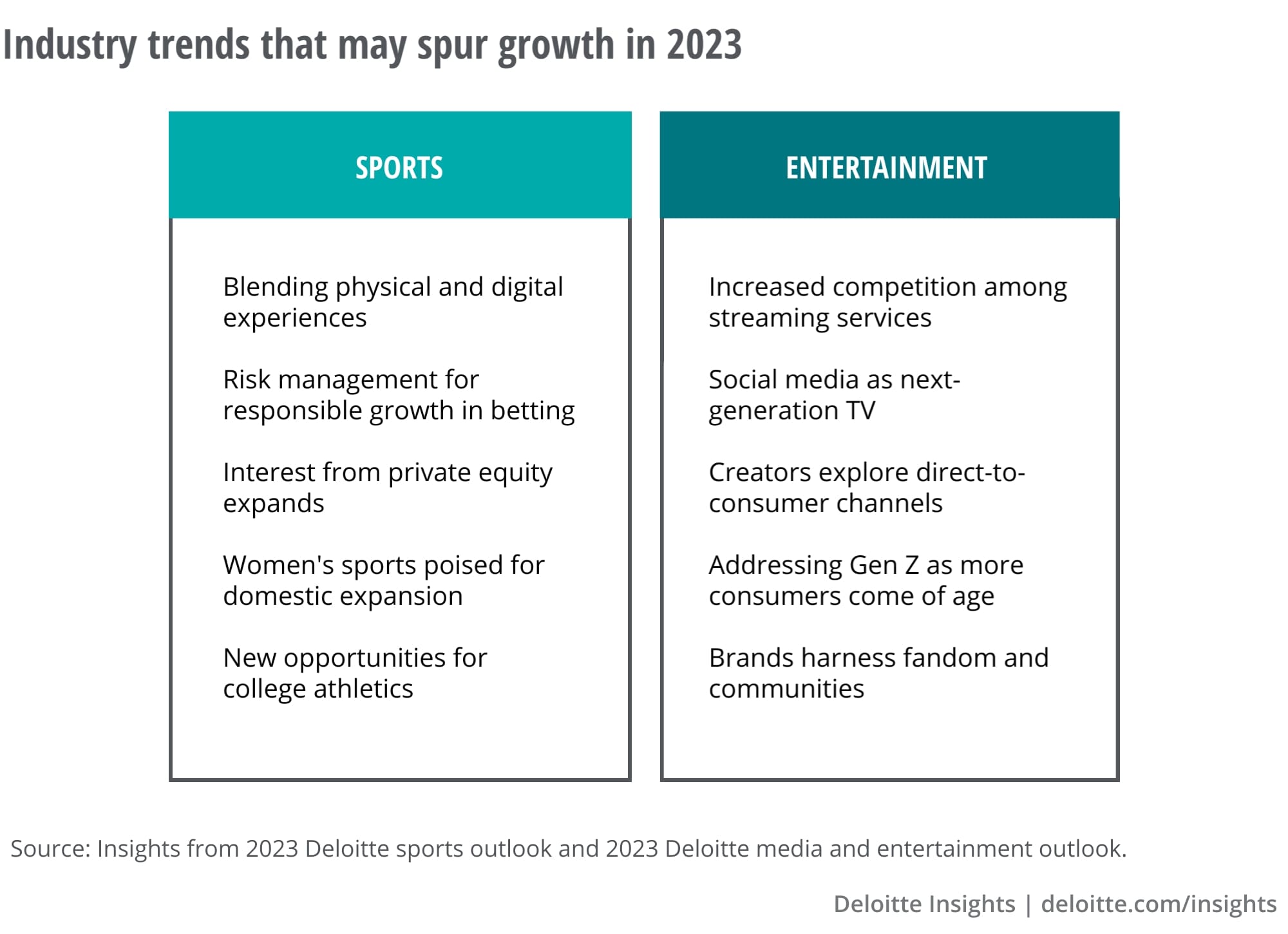

To explore these considerations in detail, Deloitte’s industry leaders recently discussed their perspectives and outlooks for the sports and media and entertainment industries in 2023. Each outlook focuses on important trends and sets out questions for decision-makers to consider when planning for the short and longer terms.

Testing new consumption models

The year 2023 will likely bring sports organizations and athletes ample opportunities to engage deeply with fans through high-profile international events taking place throughout the year, and new offerings from increasingly influential streaming providers.4

While sports leagues are pursuing both linear and streaming options for their events, streaming video on-demand (SVOD) providers are struggling to find the right mix of price point, exclusivity, and ad minutes to counter the high cost of content. Their goal: a balance that delivers truly premium service to the highest-paying customers while subsidizing “lower-tier” subscription rates with advertisements.5

Sports teams, leagues, and organizations are also leveraging blockchain technology to drive pride of ownership in team- and athlete-related nonfungible tokens (NFTs) and fan tokens; many leagues are partnering with digital asset providers to market virtual collectibles and immersive fantasy experiences.6

Catching some Zs

Another challenge shared by the entertainment and sports industries is how to capture and hold the attention of Gen Z audience. This cohort seems to find UGC and video games more immersive and enjoyable as compared to older audiences, saying they feel “most connected to a community” when engaging with these media vs. watching TV and listening to music.7

The sports world wagers that gambling services will increase engagement, marketing these services heavily toward younger audiences.8 This trend may lead to tighter restrictions on advertising and higher age limits for some forms of betting, as companies attempt to avoid negative associations with problem gambling.9

One way to keep track of Gen Z’s shifting attention is to focus on the cohort’s passion for social justice and proclivity for social entertainment—including social streaming services, UGC services, messaging services, and multiplayer games. The exchanges in these media are interactive, trend-driven, and prone to virality.10 Studying the data around these trends in real or near-real time may help companies ride and even engineer cultural waves.11

Questions to consider

Deloitte’s outlooks encourage leaders in the sports and media and entertainment industries to consider important questions such as:

- How can sports organizations leverage social video and improve interoperability across engagement platforms?

- When media rights are in play, what is the best mix of broadcast and streaming channels that leagues and organizations can use to grow reach and engagement?

- Can brands, studios, and content creators harness the collective enthusiasm of fans at each stage of development, production, and promotion of media and entertainment properties?

- What tools may brands use to better understand Gen Z consumers (and those generations that follow them) and their preferences?

- What makes streaming video compelling within the broader landscape of media and entertainment? How can streamers reduce churn and encourage loyalty, especially among younger generations?

- How will social gamers and digital consumers, with their preference for virtual experiences, influence the evolution of media and entertainment?

Continuous growth and transformation are forcing the sports and entertainment industries to take a more sophisticated approach to audience engagement and revenue generation. By developing a strong vision that spans streaming video, social media, and gaming, companies have an opportunity to shape the next evolutionary stage of these industries.