2023 Digital media trends: Immersed and connected

Younger generations are weaving TV, gaming, and UGC into a tapestry of entertainment, community, and meaning.

Kevin Westcott

Chris Arkenberg

Jana Arbanas

Brooke Auxier

Jeff Loucks

Kevin Downs

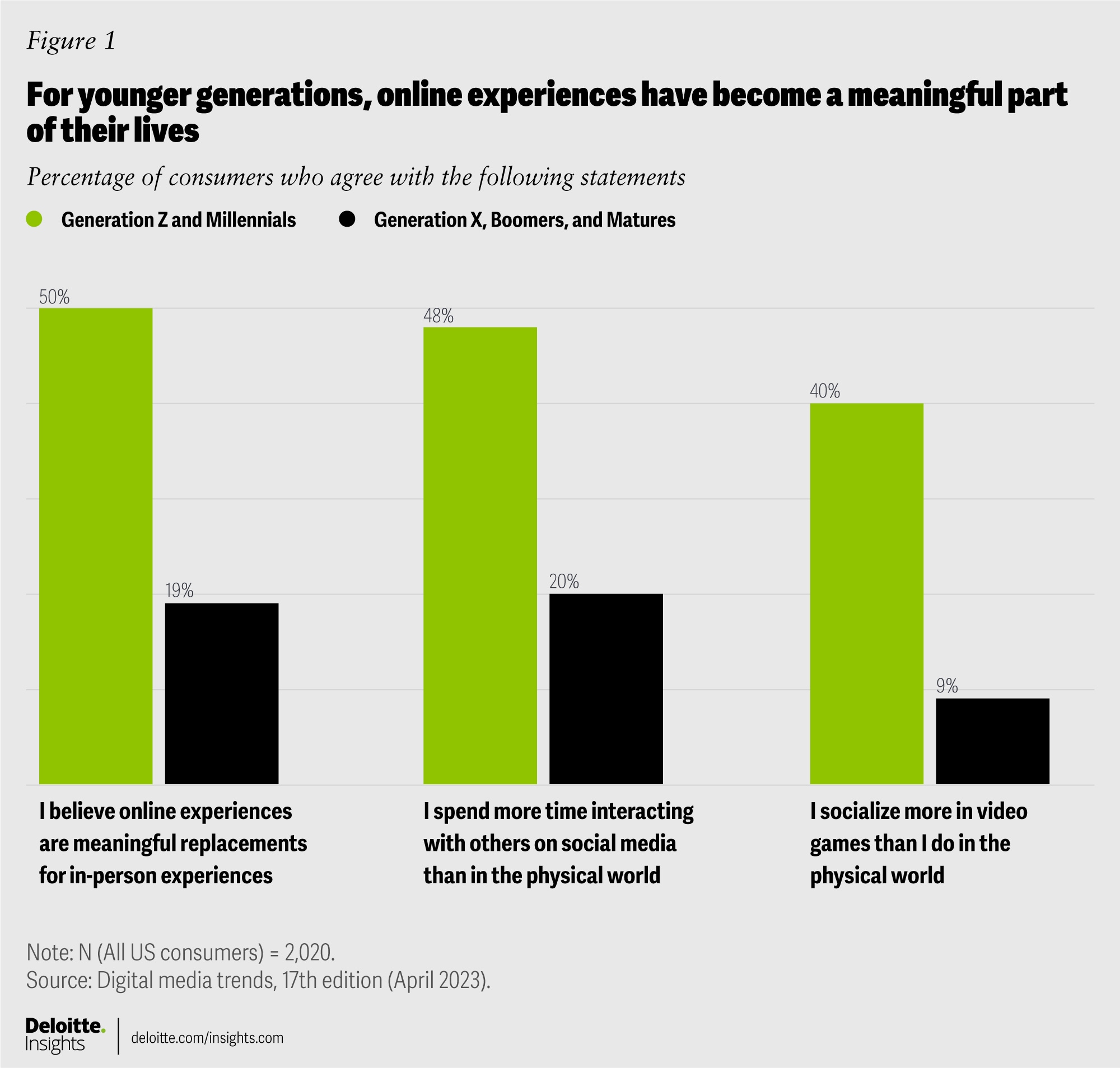

Digital media can transport us to new places, allow us to forge bonds with people from across the world, and help us feel part of something larger than ourselves. We can tap into creators, trusted advisors, communities, and experiences from wherever we are with just a click or a swipe. For many, these digital “places” are a very real part of their lives that can support their social and emotional needs. Around one-third of people in the US consider online experiences to be meaningful replacements for in-person experiences–but half of all Gen Zs and Millennials feel this way (figure 1).

In this year’s Digital Media Trends, the changes roiling the media and entertainment industry continue to be driven by the blended realities of younger generations. Almost half of Gen Zs and Millennials in the US say they spend more time socializing with others in social media than in the physical world, and 40% admit to socializing more in video games than in the physical world.

So, what might draw people in all generations to different types of digital entertainment experiences—from watching TV shows and movies, or scrolling through videos in user-generated content (UGC) streams, to playing video games? What kinds of value are they finding in these experiences?

TV shows and movies have their own immersive qualities and communities,1 but they increasingly live beside—and even within—social media and gaming. Video games and UGC can deliver a blend of experiences and a diversity of content, from competition and collaboration and grand adventures to music and shopping and seemingly endless personalized content that can whirl up into viral moments. This variety can increase engagement and utility, and the ability to interact and share with others builds greater connections and stickiness.

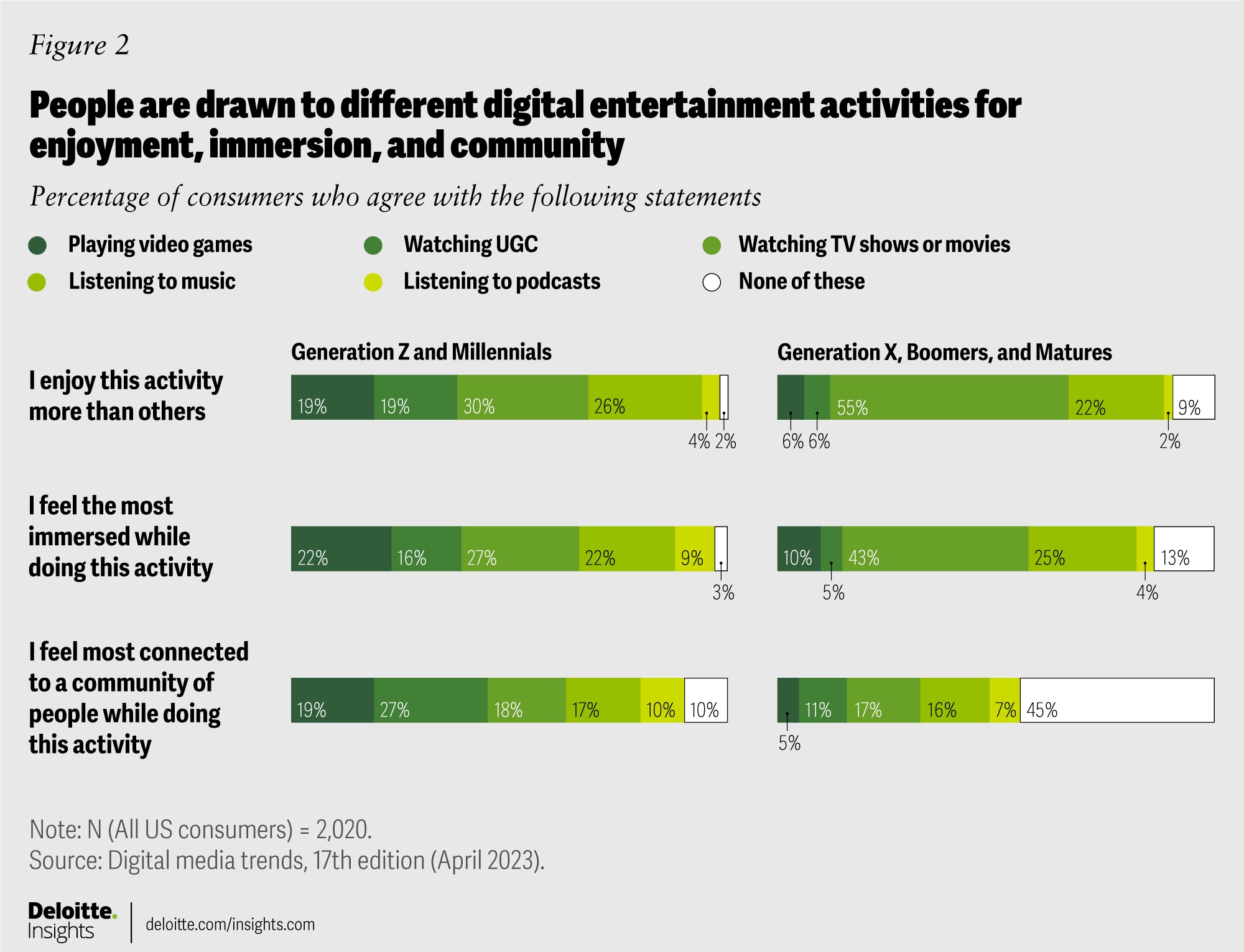

In general, younger generations like Gen Zs and Millennials play video games and watch UGC to be entertained but also for social connection and a sense of immersion—that feeling of being deeply engaged and even transported into the screen (figure 2). In contrast, Gen X and older generations are likely to feel most immersed while watching TV shows and movies and are less likely to feel a sense of community from any of these options. Notably, music is consistently valued for all generations and often moves across TV, film, UGC services, and even gaming.

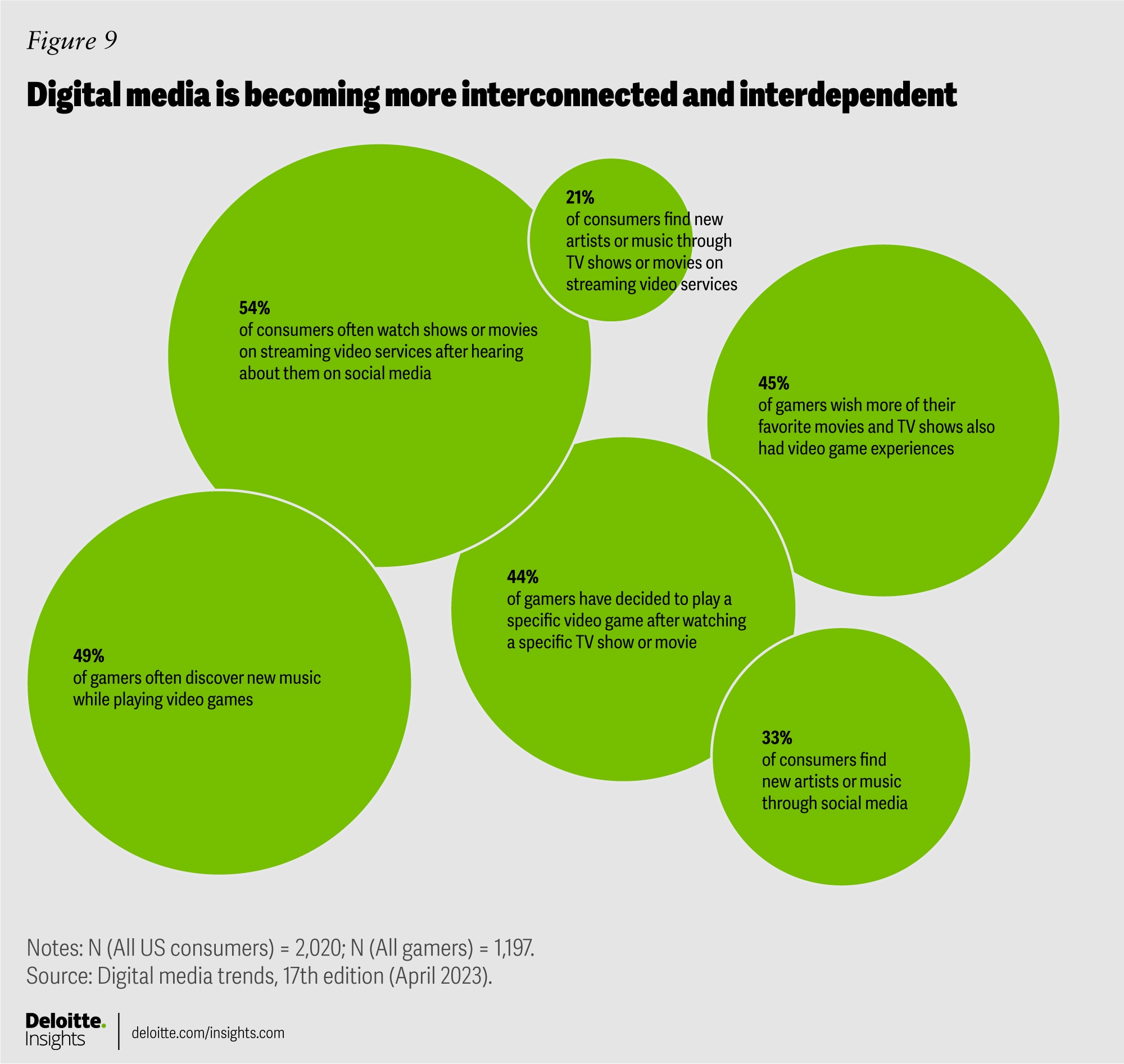

Rather than existing in silos, streaming video, social media, music, and gaming are weaving together into a more interconnected and interdependent tapestry. What stands out most is that younger generations may give their digital entertainment time more evenly to TV and movies, video games, music, and UGC. How can media and entertainment companies better understand these changes? And how can they consider leveraging those insights to reach and engage people across media, deliver more value and enjoyment, and establish deeper relationships amidst so much competition and change?

The value of streaming video may be under pressure

If digital media behaviors are evolving, streaming video providers may face more challenges. Subscription growth has slowed, and more consumers are opting for cheaper ad-supported tiers that can lower subscription revenues.2 Watching TV shows or movies at home remains dominant for the Gen X-and-older set, but across generations there are mounting frustrations. Nearly half of consumers say they pay too much for the SVOD (streaming video on demand) services they use and about a third intend to reduce the number they subscribe to.

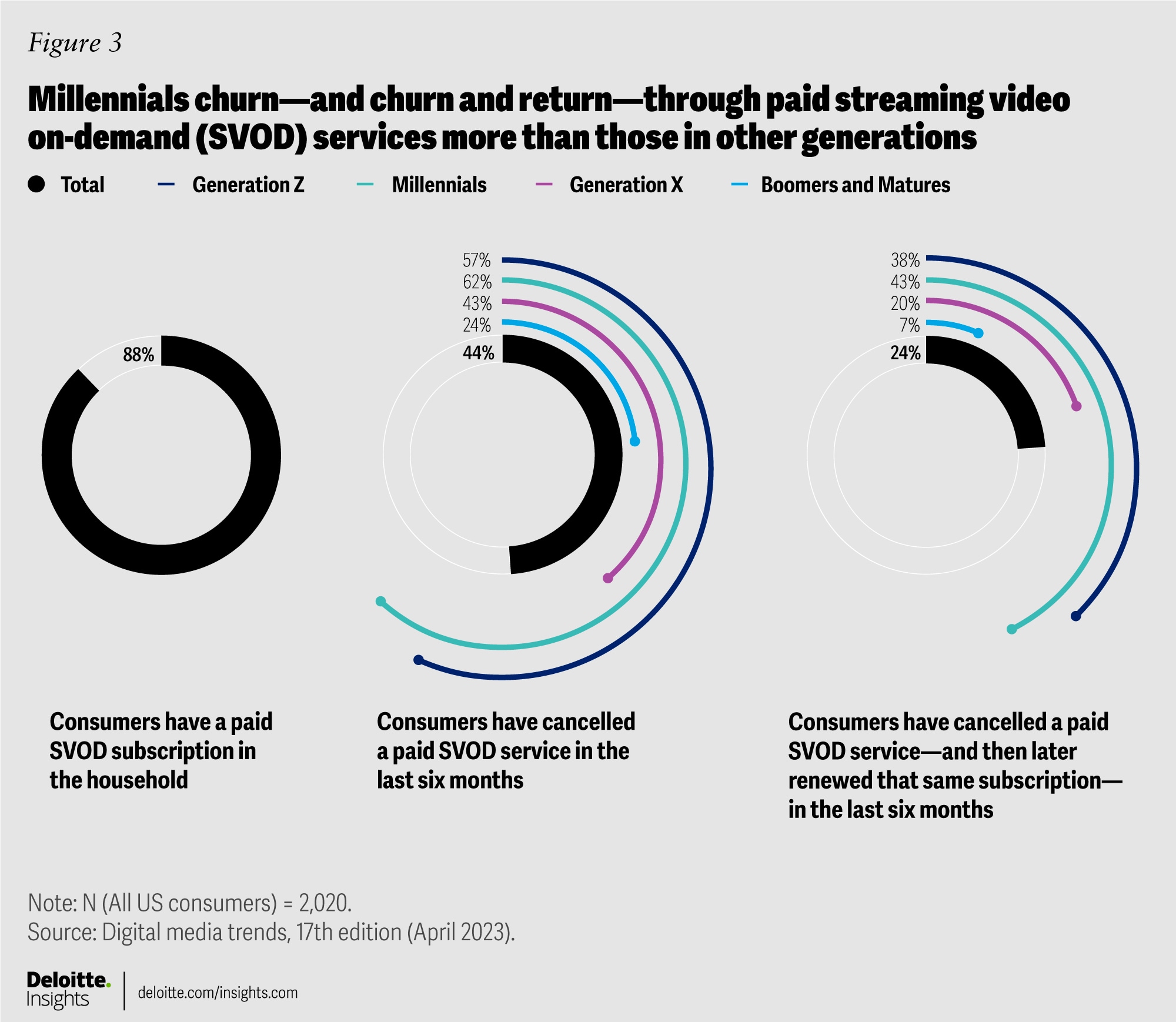

Indeed, churn (when a subscriber cancels their subscription) persists (figure 3). Overall subscriber churn for paid SVOD services over a six-month period is 44% according to our survey. For Gen Z and Millennial consumers, those numbers jump to 57% and 62%, respectively. Similarly, around a quarter of consumers have “churned and returned,” cancelling a paid SVOD subscription only to renew that same subscription within a 6-month period. Again, these figures jump by double digits for Gen Zs and Millennials, who often subscribe to watch specific shows and movies and then cancel when they’re done—only to resubscribe to watch a new season or film.

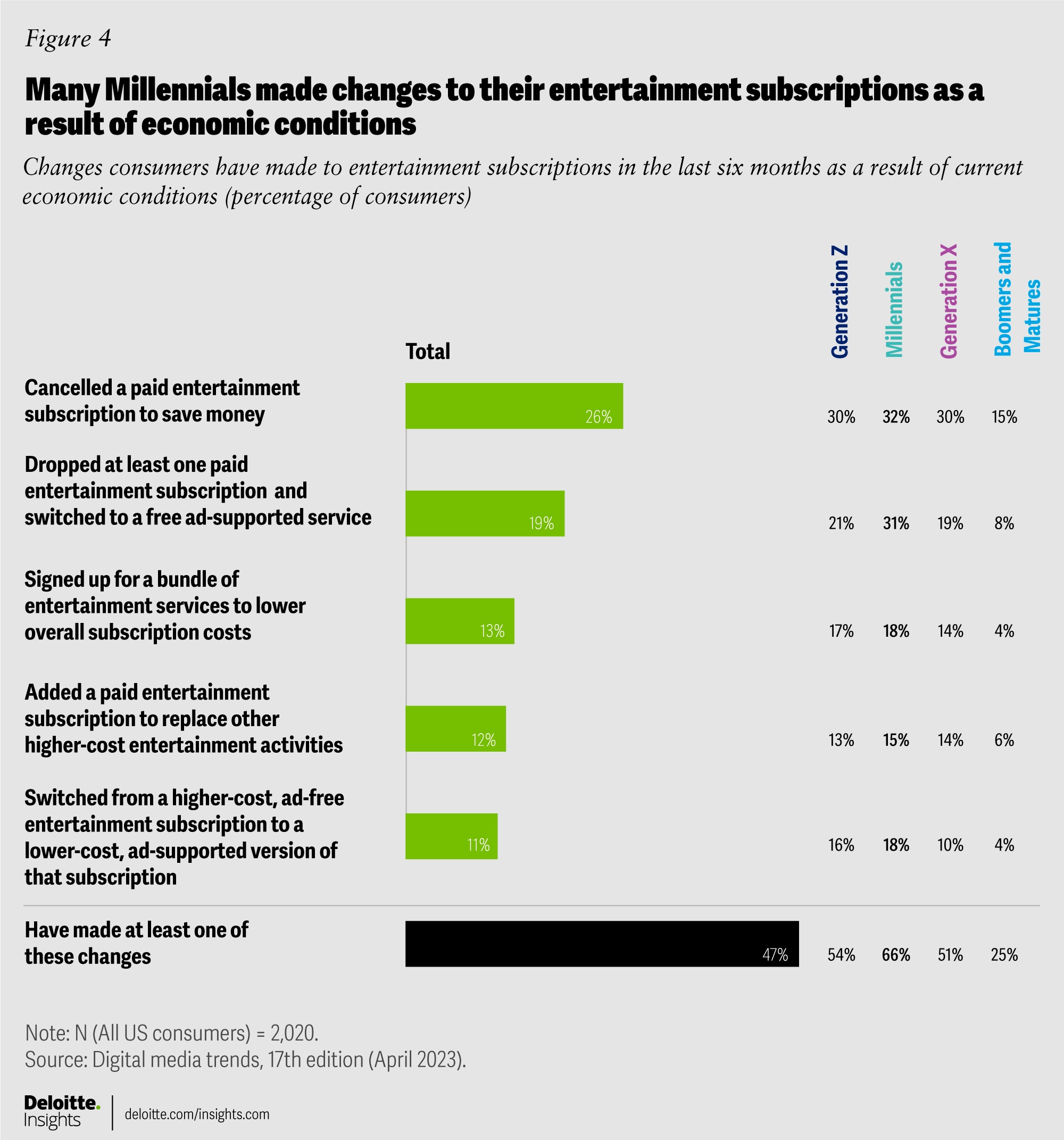

US consumers have been frustrated by chasing content across multiple subscriptions and losing content to cancellations or expiring rights, but economic pressures seem to be growing as well.3 Around half of consumers (47%) say they have made a change to their entertainment subscriptions because of current economic conditions—like cancelling a service to save money, switching to a free ad-supported version of a service, or bundling services. Around 60% of households are now using a free, ad-supported streaming video service, and roughly 4 in 10 say they watch more ad-supported streaming video than they did a year ago, whether paid or free. In Deloitte’s 2023 Global TMT Predictions, it’s estimated that by the end of 2023 nearly two thirds of consumers in developed countries will have at least one subscription to an ad-supported video service.4 Subsidizing prices with ads could help acquire and retain more cost-sensitive subscribers, but it changes the economics of streaming video: If subscription prices drop, revenues depend more on successful advertising.

Millennials—the canary in the SVOD coalmine?

Millennials drove the adoption of SVOD but may now illustrate the impacts of subscription fatigue and cost-sensitivity. The oldest among them turn 40 this year, and many may now have children, mortgages, and other financial obligations—including record household debt.5 Millennials spend more than any other generation on paid streaming video services—an average of USD$54 per month. They churn through SVOD services at the highest rates and are more likely to cancel paid gaming and paid music services (figure 4). Streaming media providers might hope that cheaper ad-supported options could retain these cost-conscious consumers, but Millennial behaviors and preferences tend to skew closer to Gen Z’s. Will they put up with subscriptions and traditional advertising? Or will they shift to spending more time and less money on other digital media?

Millennials churn through SVOD services at the highest rates and are more likely to cancel paid gaming and paid music services.

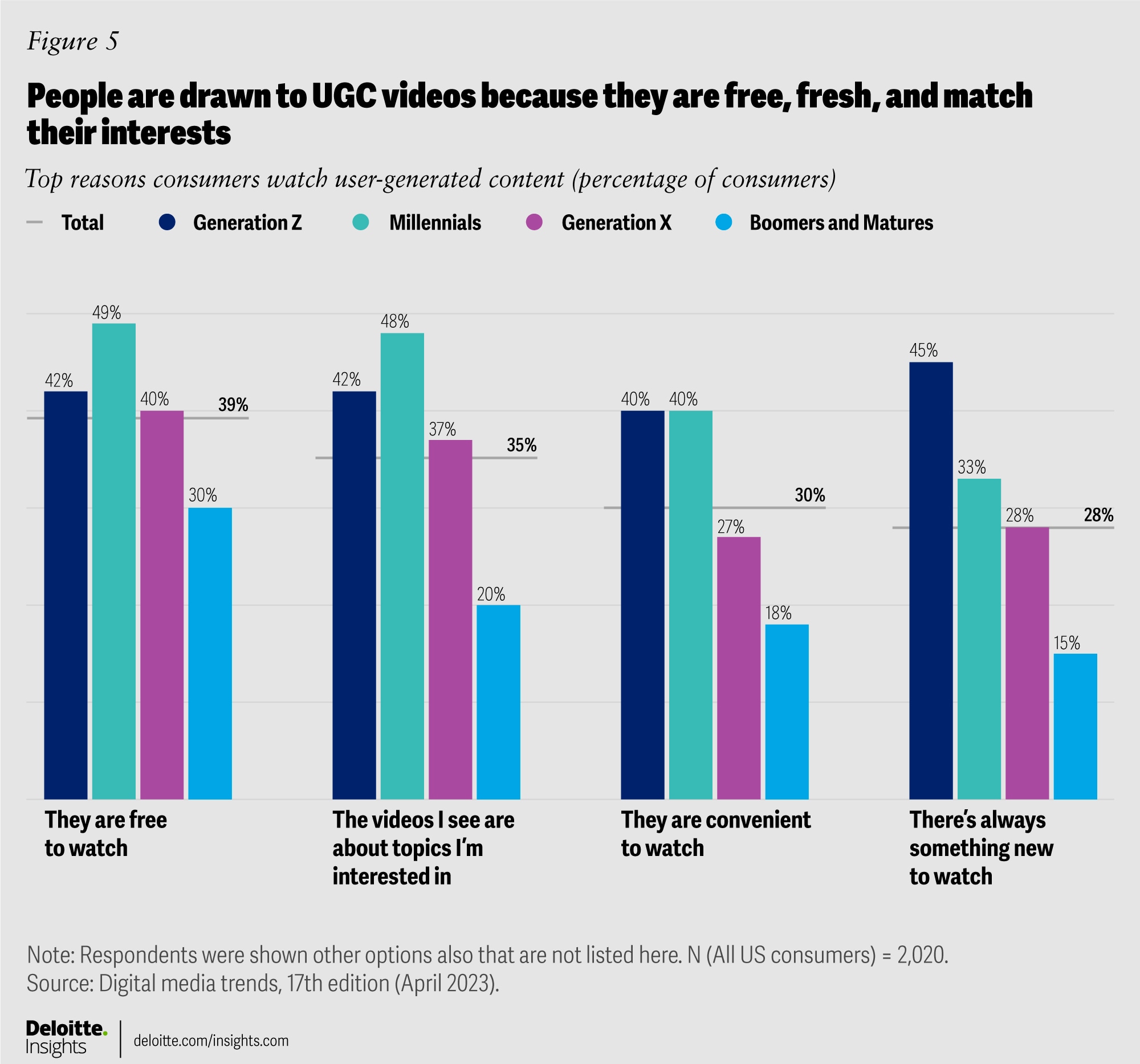

Millennials may be reaching their SVOD limit, but social media services are happy to serve their video needs. Half of Gen Zs and Millennials prefer user-generated video feeds to streaming video services. Across all generations, a majority say they watch user-generated videos—because they’re free to watch, videos they see are about topics they’re interested in, they’re convenient to watch, and there’s always something new (figure 5). Like TV (streaming or otherwise), top social media services now offer a more passive video experience. Unlike TV, they deliver endless streams of shorter, user-generated videos that are personalized, interactive, and social, at no cost.

People are finding different kinds of value in different entertainment options

It’s not that SVOD experiences are in decline and social, user-generated videos are taking over. But watching TV shows and movies at home may not be the dominant, “go-to” activity it once was—especially for younger generations. People have more choices and seem to be dividing their digital entertainment options more evenly based on the kinds of value they offer. For many, digital media is not just entertaining but can also offer utility, foster community, and support emotional needs.

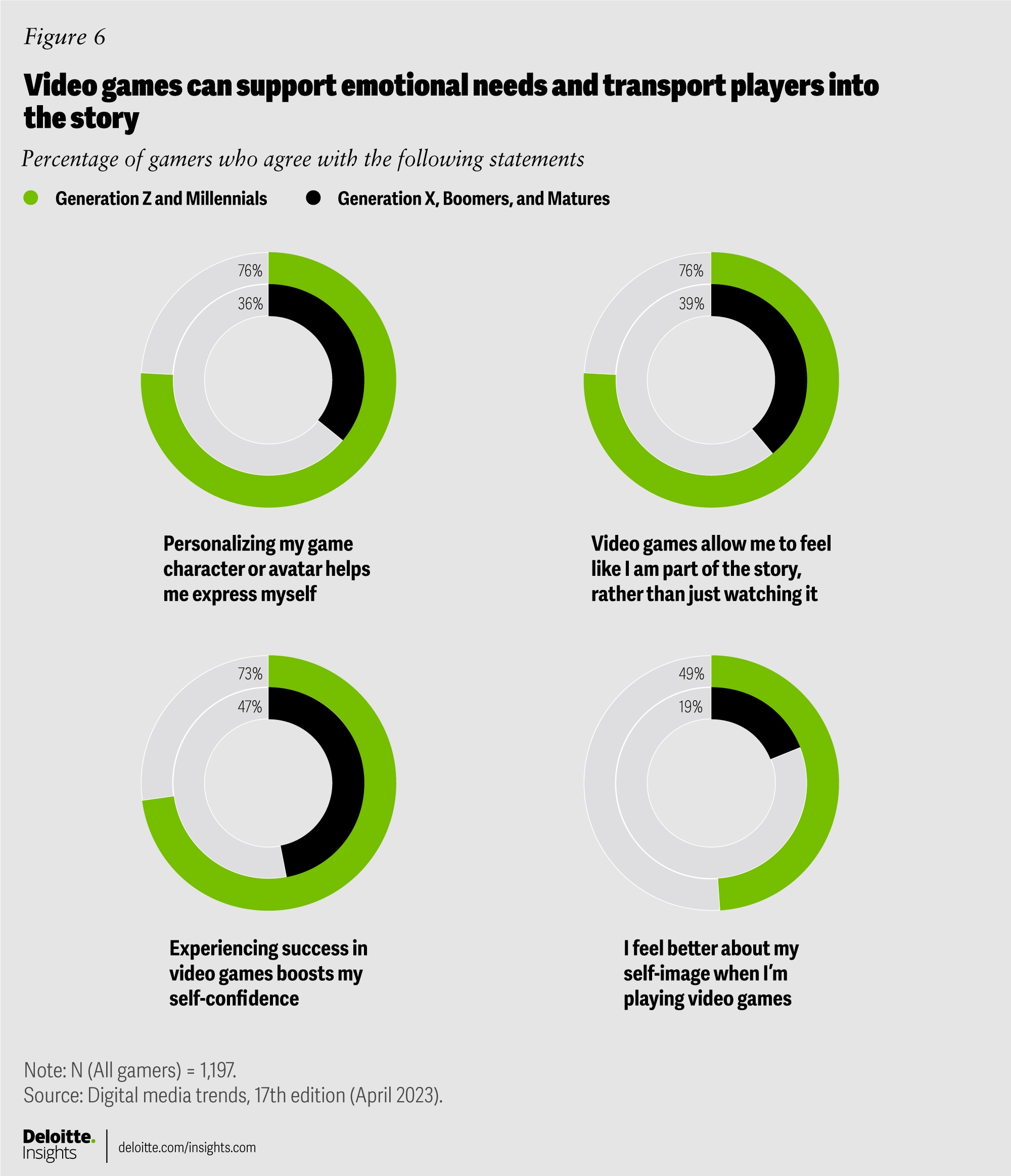

Most gamers, for example, say that succeeding in a video game boosts their self-confidence. About a third of gamers say they feel better about their self-image when they’re playing video games, and many gamers agree that video games allow them to feel like they are part of the story rather than just watching it. They can be their own movie star, the hero of grand adventures, and even take the lead role in the world’s largest entertainment franchises—and many are willing to spend money on virtual enhancements and upgrades to help them succeed or to express themselves with personalized, in-game appearances (figure 6).

About a third of gamers say they feel better about their self-image when they’re playing video games, and many gamers agree that video games allow them to feel like they are part of the story rather than just watching it.

Smartphones have led to a boom in the number of gamers—especially casual gamers who play mostly puzzle and word games for less than five hours per week. In our study, casual gamers are more likely to be females and people in older generations, and the games they play tend to be puzzle and matching games that are typically single player. More committed gamers are playing regularly on gaming consoles or computers, but also smartphones. They tend to play more sports and racing games, competitive multiplayer games, and rich story-driven experiences, and are typically younger and male, though women and girls now account for 38% of them.

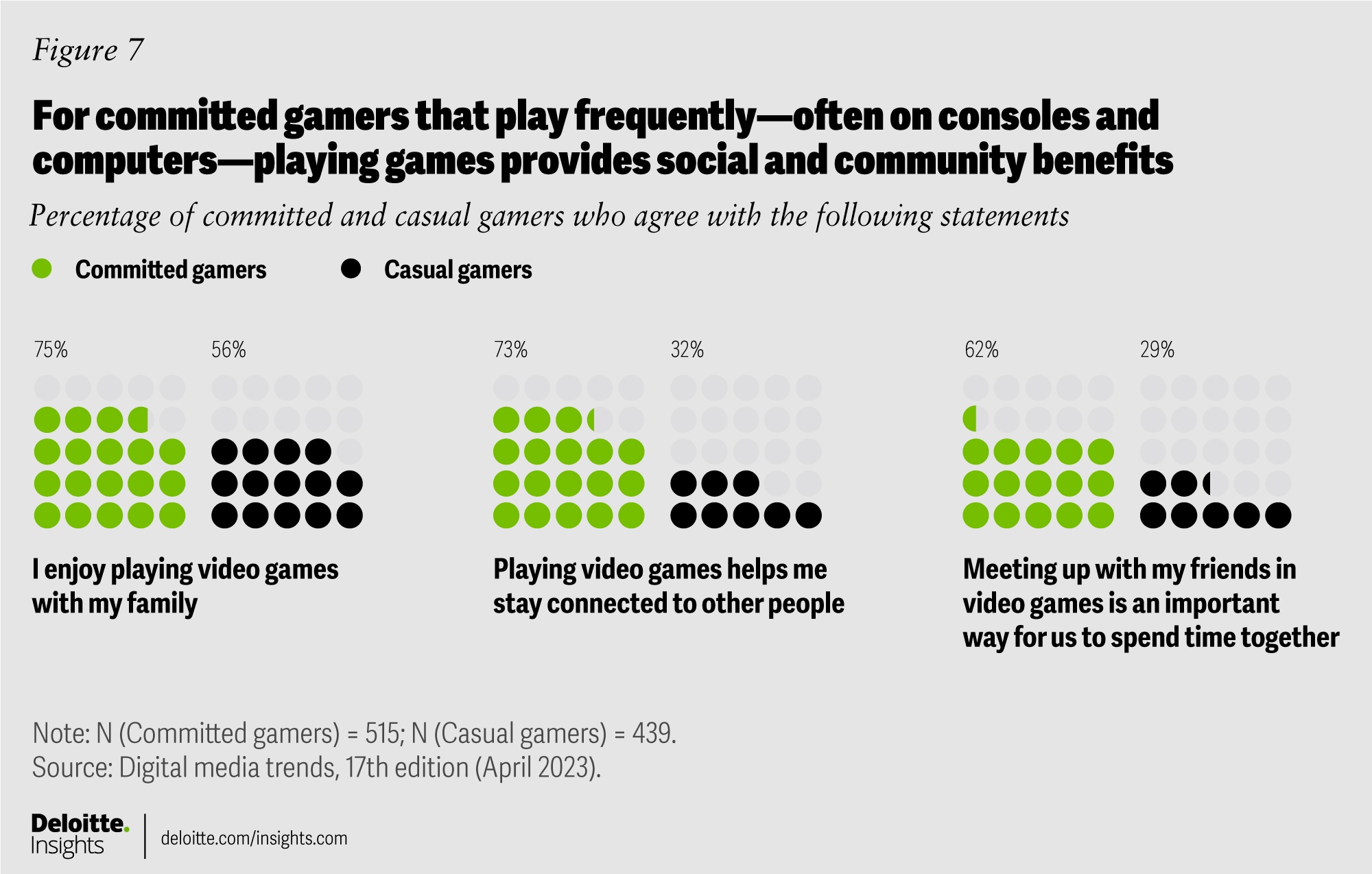

For gaming companies, gaining more committed gamers can be good for revenues and retention. We found that committed gamers are more likely to spend money on video games, attend live non-gaming events inside game worlds, and enjoy social and competitive gaming that can reinforce personalization and customization of game avatars. They enjoy playing games with their families and are far more likely than casual gamers to say that meeting up with their friends in video games is an important way for them to spend time together (figure 7).

While gaming may have typically been seen as a male pursuit, rich story-driven games are more universal: males and females are playing them in nearly equal amounts. Such games can bring people into complex narratives and have recently featured more female leads and stronger female characters, more balanced storylines, and crossovers with popular TV, movie, and literature franchises.6 With more women developing games and helping guide the industry, gaming could further expand its reach.7 Just as movies and TV shows have become more representative of the many kinds of people that enjoy them, and social media has given more people a voice in the global conversation, more games are offering deeper character personalization so players can better see themselves in the leading role.8 By bringing more people into gaming–especially into social multiplayer worlds–the medium is seeing more interest from brands and advertisers.9

User-generated video feeds offer utility, community, and trust

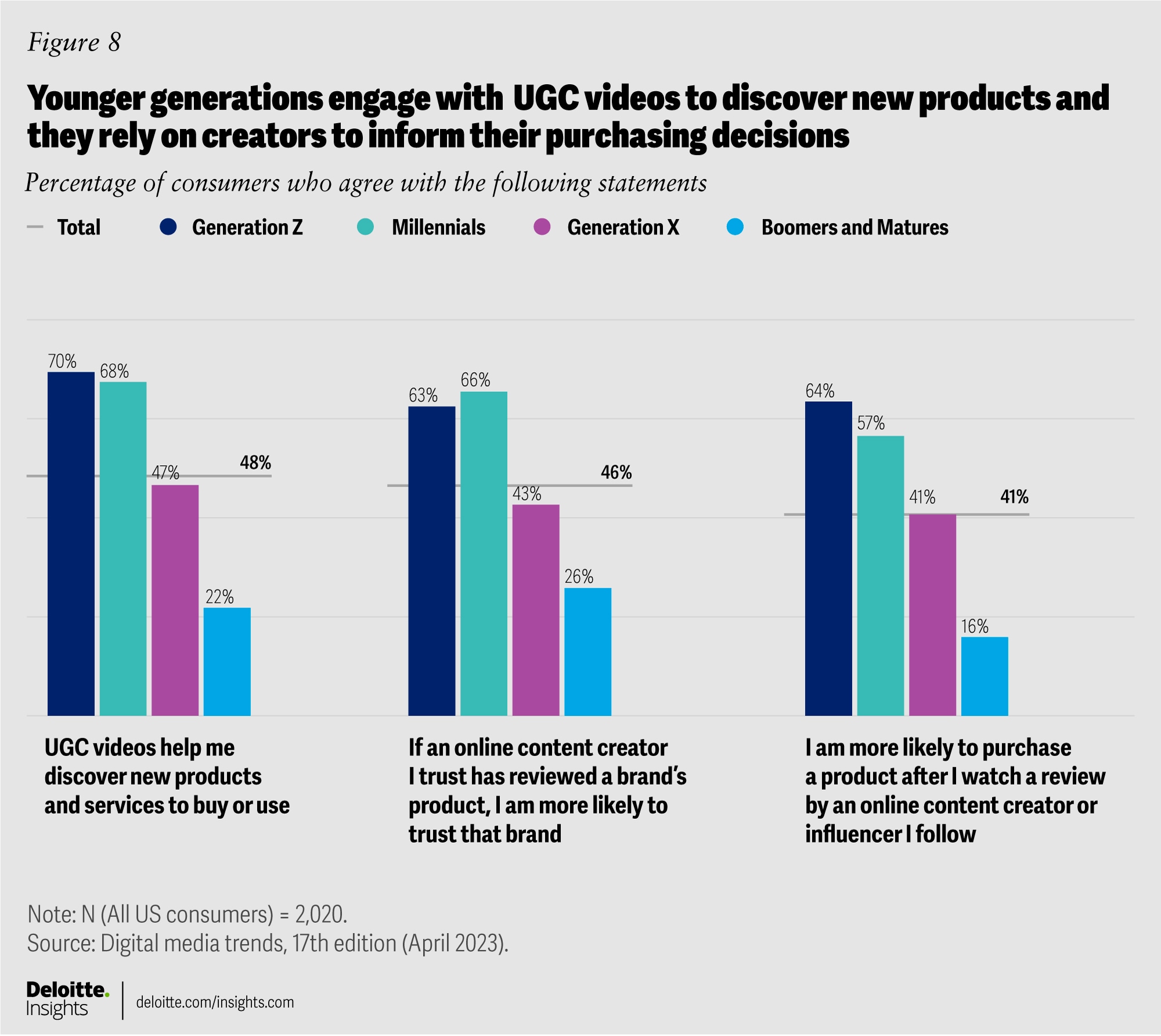

Reaching people through video games may be one important part of the media tapestry. Leveraging social media—and especially social media content creators—is another. For many, the creators that fuel these services are not just entertainers but can become trusted guides and intermediaries. Their followers also rely on them for product recommendations and reviews and trust them for purchasing advice (figure 8). About 50% of consumers say UGC videos help them to discover new products or services to buy, and around 40% say they are more likely to purchase a product after they watch a creator review it. This may be, in part, due to the nature of creator advertising, which can more frequently appear as product reviews or simply using the product within a creator’s niche. Roughly four in 10 consumers agree that it’s hard to determine when user-created videos are “sponsored” or contain an “advertisement.” Essentially, people seem to be opting-in to this form of advertising when it’s coming from a creator they already trust.

Creators and influencers can establish and build trust, grow communities, and drive awareness and excitement for brands, products, and content. Notably, the trust that creators accrue can transfer to the brands they represent. Nearly half of consumers say that if an online creator they trust has reviewed a brand’s product, they are more likely to trust that brand. These sentiments are especially strong for Gen Zs and Millennials, showing the importance of brand-creator partnerships for reaching and building relationships with these youngest Americans so used to connecting online. Around 40% of those in these generations are more influenced by being part of community of followers of a creator or brand than by reviews on a shopping site. These trends may have big implications for the future of advertising.

Designing discovery and buzz

Advertising may face more disruption and innovation ahead, but savvy brands should sharpen the art of social persuasion. Beyond selling and shopping, social media is a nexus for virality and buzz and can be central to stoking interest and driving entertainment behaviors. For example, more than half of all consumers—and nearly three quarters of Gen Zs and Millennials—often watch a TV show or movie on a streaming video service after hearing about it on social media (figure 9). Half of Gen Zs and Millennials also report discovering music through videos on a UGC service, while less than 30% of them discover music on a streaming music service.

Methodology

Digital Media Trends, 17th edition, is conducted by Deloitte’s Technology, Media, and Telecommunications (TMT) practice. The survey provides insight into how people in the US, ages 14 and older, are interacting with media and entertainment offerings—including streaming video, gaming, streaming music, user-generated content, social media, and emerging technologies.

The US survey was fielded by an independent research firm in November 2022 and employed an online methodology among 2,020 US consumers. All data is weighted back to the most recent census data to give a representative view of consumer sentiment and behaviors.

Throughout this report, we reference generations. Our generational definitions are as follows: Gen Z (1997-2009), Millennial (1983-1996), Gen X (1966-1982), Boomers (1947-1965), and Matures (1946 and prior).