Time to reconsider: Tech companies may shift priorities in an uncertain economy

Tech execs may proceed with caution but should not lose sight of future goals.

“First, it was COVID, and the aftereffects of COVID were supply chain problems and labor shortages … Then it was all about the Great Resignation, where everybody thought that they could just leave. And then you have a war. So there are still a lot of geopolitical issues … And then you have a recession looming, and the short-term thoughts and actions around that. And then you have all these companies doing a bunch of layoffs, which makes you ask yourself, ‘Do I need a bunch of layoffs just because everybody else is doing a bunch of layoffs?,’” said the general manager of a Fortune 1000 company.

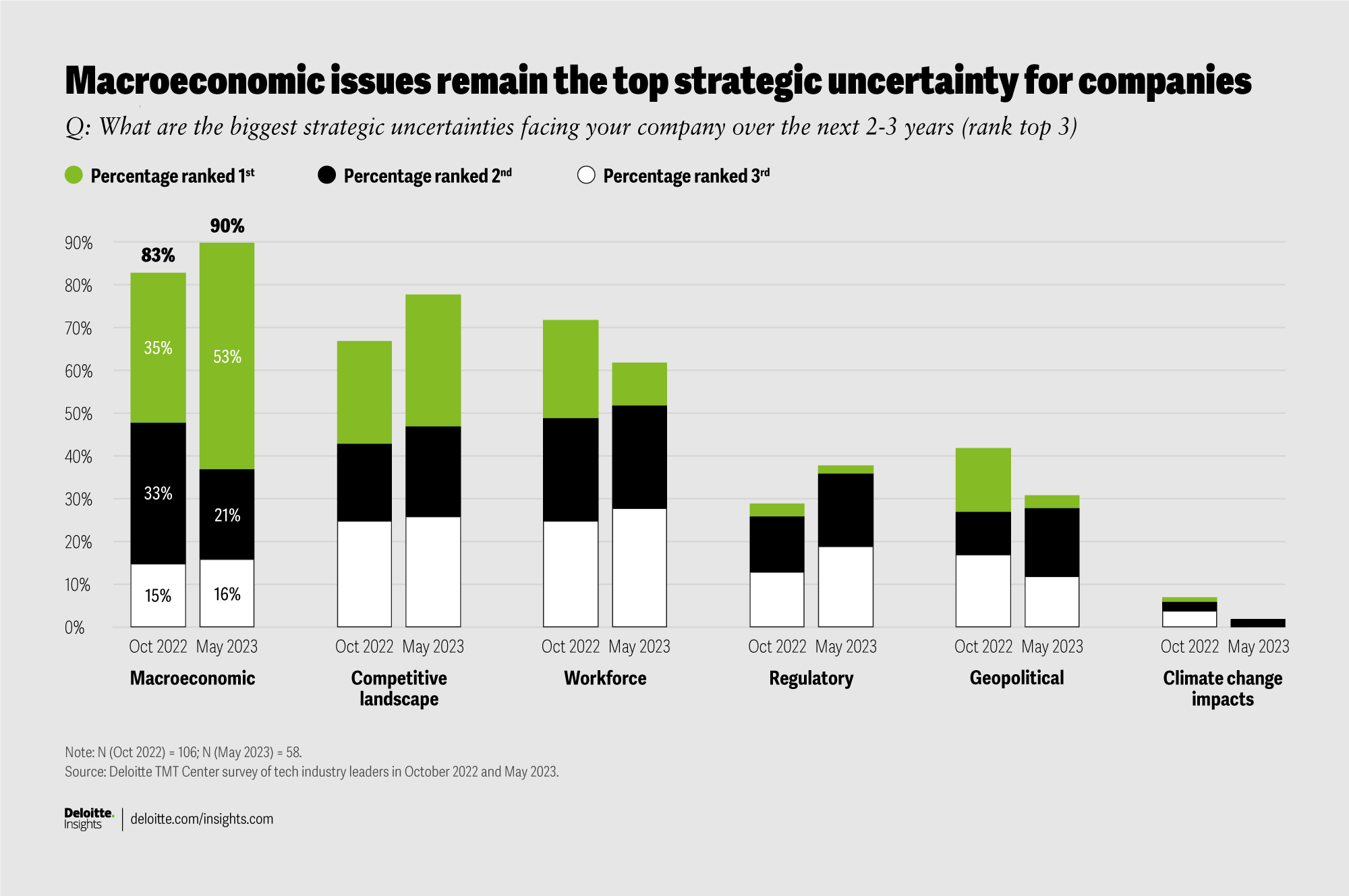

These comments reflect the roller coaster that tech companies have been riding, without a break, for the last few years. Chief among the worries for technology industry leaders today are macroeconomic uncertainties. In Deloitte surveys of tech industry leaders conducted in October 2022 and May 2023, macroeconomic issues ranked as the top strategic uncertainty facing companies over the next two to three years.1 In fact, in May 2023, 47% of leaders surveyed said that economic conditions facing their company today were worse than six months ago. In-depth interviews with 11 C-suite executives added perspective and insight to the data.

On the whole, tech leaders seem to be waiting for more positive market news before they push new investments and riskier moves. They say they are more focused on return on investment, reducing costs, rebalancing their workforces, and leveraging automation technologies. This change in focus has seemingly ushered in a “moment of caution.” How that moment is dealt with today could dictate success or failure in the next wave of growth.

Bracing for … something

Almost three-quarters of the technology industry leaders surveyed said that their company was taking actions to prepare for an economic downturn. One exec said: “You slow down hiring; you slow down marketing; you bounce sales enablement; you try to just close the deals that you’ve got. You maybe delay some of your innovation a little bit to ride it out and to reserve some cash, and to make sure you’re sustainable enough to survive the market downturn. And so, we’ve been making a lot of proactive changes.”

A downturn has been expected for a while, but the specifics and duration aren’t clear. Deloitte’s most recent economic forecast projects a slowdown, but ultimately a soft landing for the US economy—as long as key issues around labor markets, interest rates hikes, and the debt ceiling are addressed properly. Deloitte’s baseline economic scenario expects limited growth, with consumer spending focused on entertainment and travel and business investment focused on IT.2

Some leaders from large technology companies have been very open about their shift in focus toward efficiency, cost-cutting, reducing head count, and improving core products and services.3 Some execs from our cohort, however, see this environment as an opportunity to bet prudently on core competencies

“I would say in the past we've placed a lot of bets, and some of those bets didn't pan out,” said one leader. “That's some of our pullback. We’re getting a bit more conservative, focusing on our core strengths at the moment … The belt is a little bit tighter, and it gives us a chance to retrench, dig in, do what we need to do a little bit better.”

Whither innovation?

Another exec described hesitation to invest in less-proven ideas. “I don't think it is necessarily a pullback, but more of a ‘let's not venture in too quickly.’ Let’s watch the industry and competition closely and not be bleeding-edge and jump ahead unnecessarily.”

This type of short-term conservative thinking—especially the canceling of higher-risk projects—points to the possibility that innovation could suffer. If companies focus too narrowly and don’t pursue a broader innovation portfolio, however, they may miss building a foundation for the next big opportunity. In fact, a third of executives surveyed by Deloitte said that market shifts are primary triggers for transformation efforts.4

Recommendations for technology industry leaders to consider

- Don’t overcorrect. Cutting the least promising innovation projects and focusing on core products and services may represent a wise course, but in the quest to streamline operations and build cash reserves, don’t take too much attention away from expanding the business. Maintain focus on ways to increase existing revenue streams, enter adjacent markets, and perhaps enter new markets so as not to lose competitive advantage.5

- Keep a focus on talent. Before reducing head count, companies should confirm they are utilizing talent optimally. It may be more cost-effective to retrain current talent than relaunch recruitment efforts once the market recovers. Even if layoffs become necessary, organizations should think strategically about the skills they could need to drive the next wave of growth and set the stage for flexible recruitment and retention.

- Ensure that efficiency serves a greater purpose. When looking to improve the efficiency of various systems and processes to drive cost savings, companies should maintain a long-term focus and drive changes that can help enable innovation in the future. Leaders told us that digital transformation efforts are still receiving a great deal of focus and investment. Technology companies are looking to boost efficiency and improve products and services through AI, cloud adoption, and process automation.