How AI is revolutionizing restaurants

A Deloitte survey sheds light on the state of AI readiness and adoption across the industry

Evert Gruyaert

Stephanie Perrone Goldstein

Ed Lee

Maggie Rauch

Introduction

The worldwide AI market is expected to grow to over US$631 billion by 2028 from US$235 billion in 2024.1 How much of that growth is likely to occur in the restaurant industry? It could be a healthy amount, based on the findings of Deloitte’s State of AI in Restaurants Survey of 375 restaurant executives across brands and operators located in 11 countries (see methodology).

Findings from the survey indicate that the industry is embracing AI, changing the way work is performed and restaurant experience is delivered, with great potential to do more in the very near future. We set out to understand AI aspirations, expectations, usage, and readiness by restaurant type, entity profile, and geography. Some of the key takeaways across these groups are:

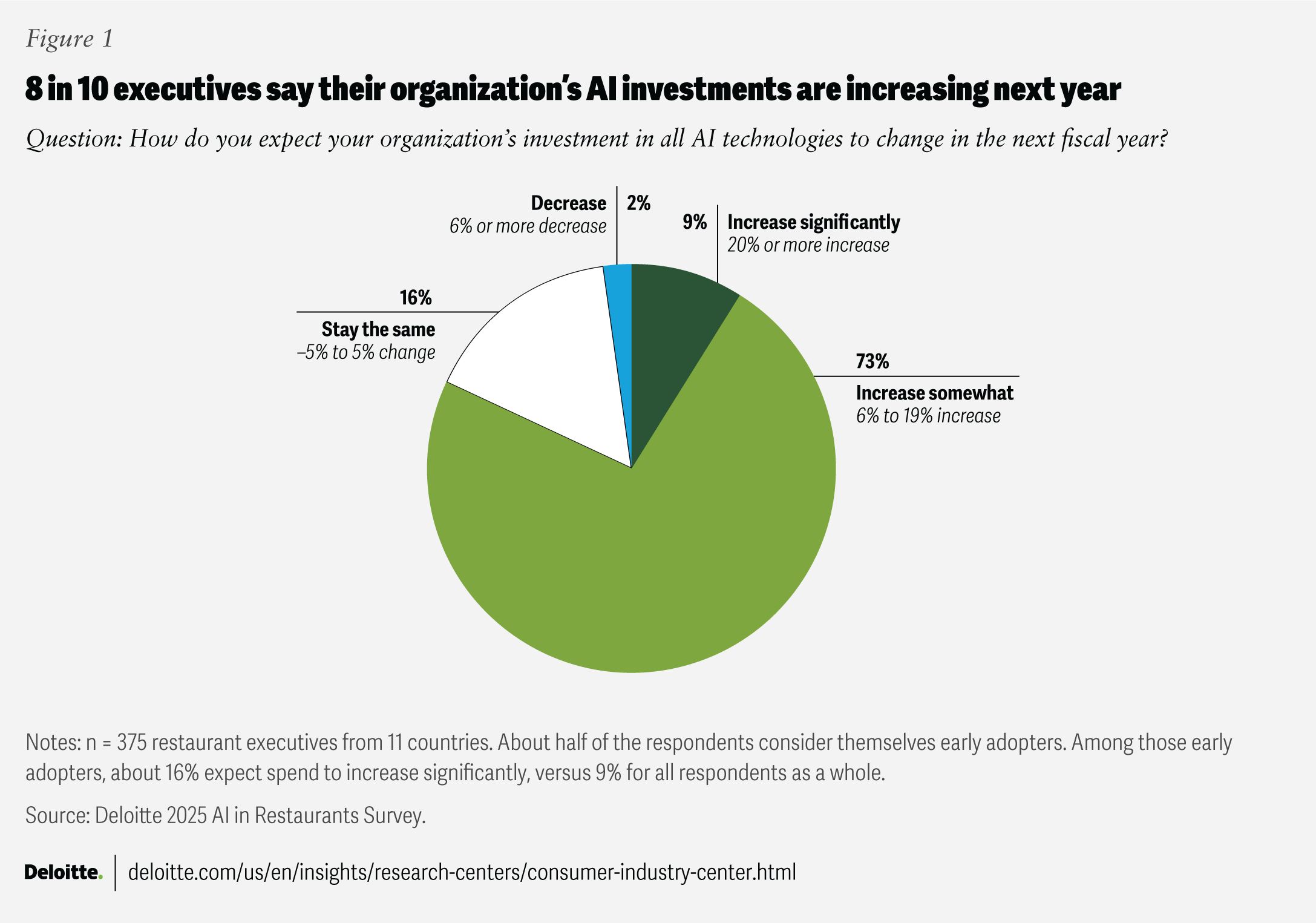

- Expectations for AI expenditure and benefits are high. Eight in 10 restaurant executives surveyed say their investments in AI technologies will increase in the next fiscal year, with expected benefits such as enhanced customer experience, smoother restaurant operations, and more impactful loyalty programs.

- Restaurants are already seeing results. AI use cases such as customer experience and inventory management, which have seen high adoption rates among respondents, are generating economic value.

- Adoption is expected to come in waves. While restaurant companies have invested in areas with potential for high return on investment where proven technologies exist, they are also exploring emerging applications.

- Identifying the right use cases and managing risks are top challenges. Other obstacles to AI deployment among respondents include a lack of technical talent and skills, concerns about compliance with regulations, and a lack of governance.

- Most feel underprepared for AI adoption. Across all brands, most respondents say their organizations lack readiness when it comes to strategy, operations, technology infrastructure, and other enablers; Asia stands out as the most prepared region.

We also uncovered interesting nuances in how AI perspectives differ across restaurant executives when we analyzed them by respondent cohort—operators, brand representatives, quick service restaurants, casual brands, and across different global regions. As restaurant companies around the globe work to ensure that their organizations are ready for AI adoption, they should be able to draw inspiration from leaders in this space. In addition to reporting the findings of our survey, we capture some of the leading practices being put in place today to help increase the probability that AI investments will generate value in the future.

Expectations for AI spend and benefits are high

AI has captured the interest and imagination of business leaders worldwide, and restaurant executives are no exception. In our survey, the respondents indicate plans for AI adoption, along with hopes for what such investments will help them achieve.

When asked how they expect their organization’s investment in AI technologies to change in the next fiscal year, 73% of those surveyed say they are likely to increase somewhat, while another 9% predict it will increase significantly (figure 1). Only 2% forecast a decrease.

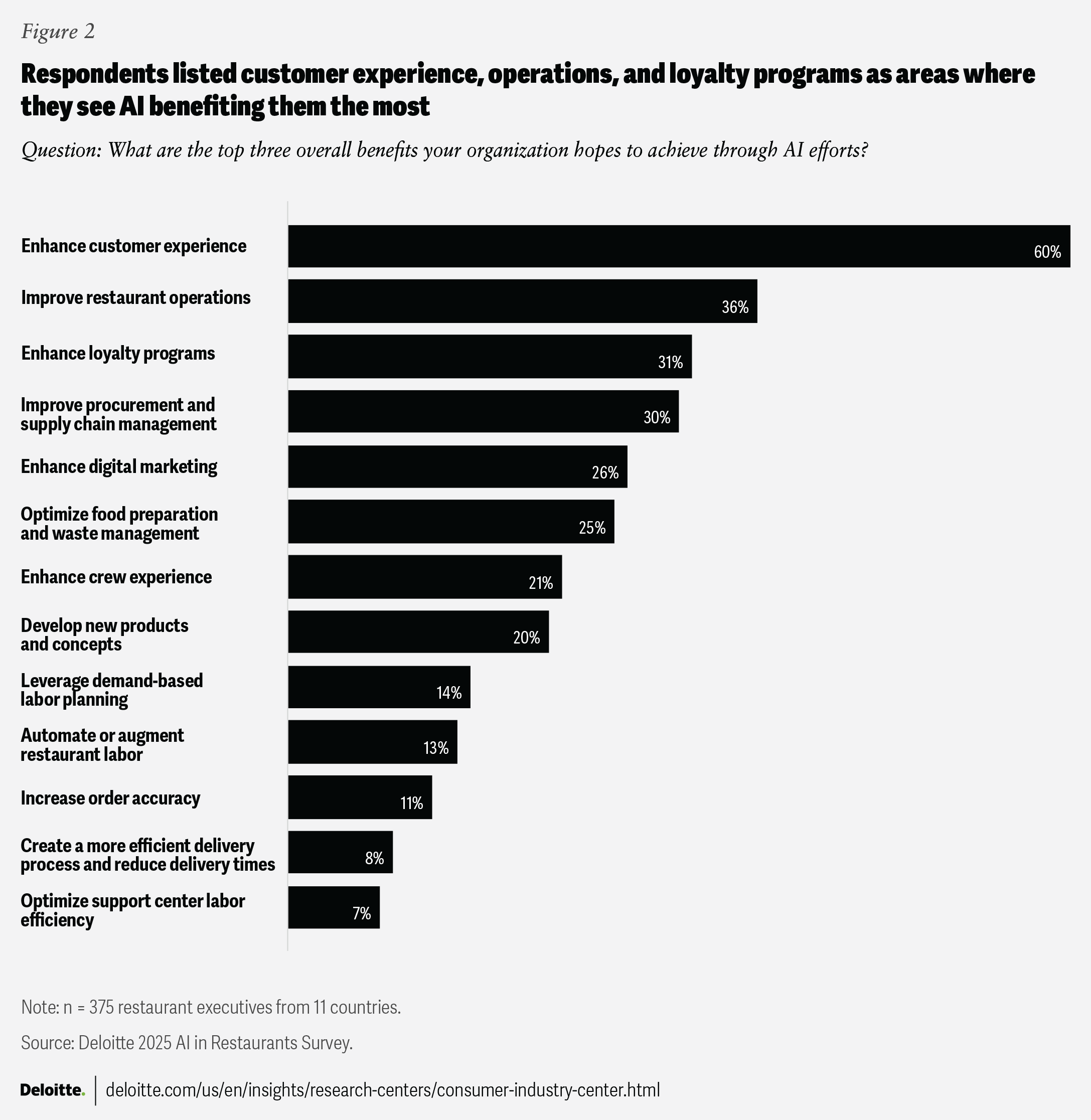

Restaurant executives expect those investments to yield numerous benefits in the future. When asked to pick their top three, enhanced customer experience emerged as the clear leader, listed by 6 in 10 respondents (figure 2). Thirty-six percent expect AI to improve their restaurant operations, loyalty programs, and procurement and supply chain management. A smaller but significant cohort (at least 2 in 10) believes AI will strengthen their digital marketing efforts, optimize food prep and waste management, enhance crew experiences, and help them develop new products and concepts.

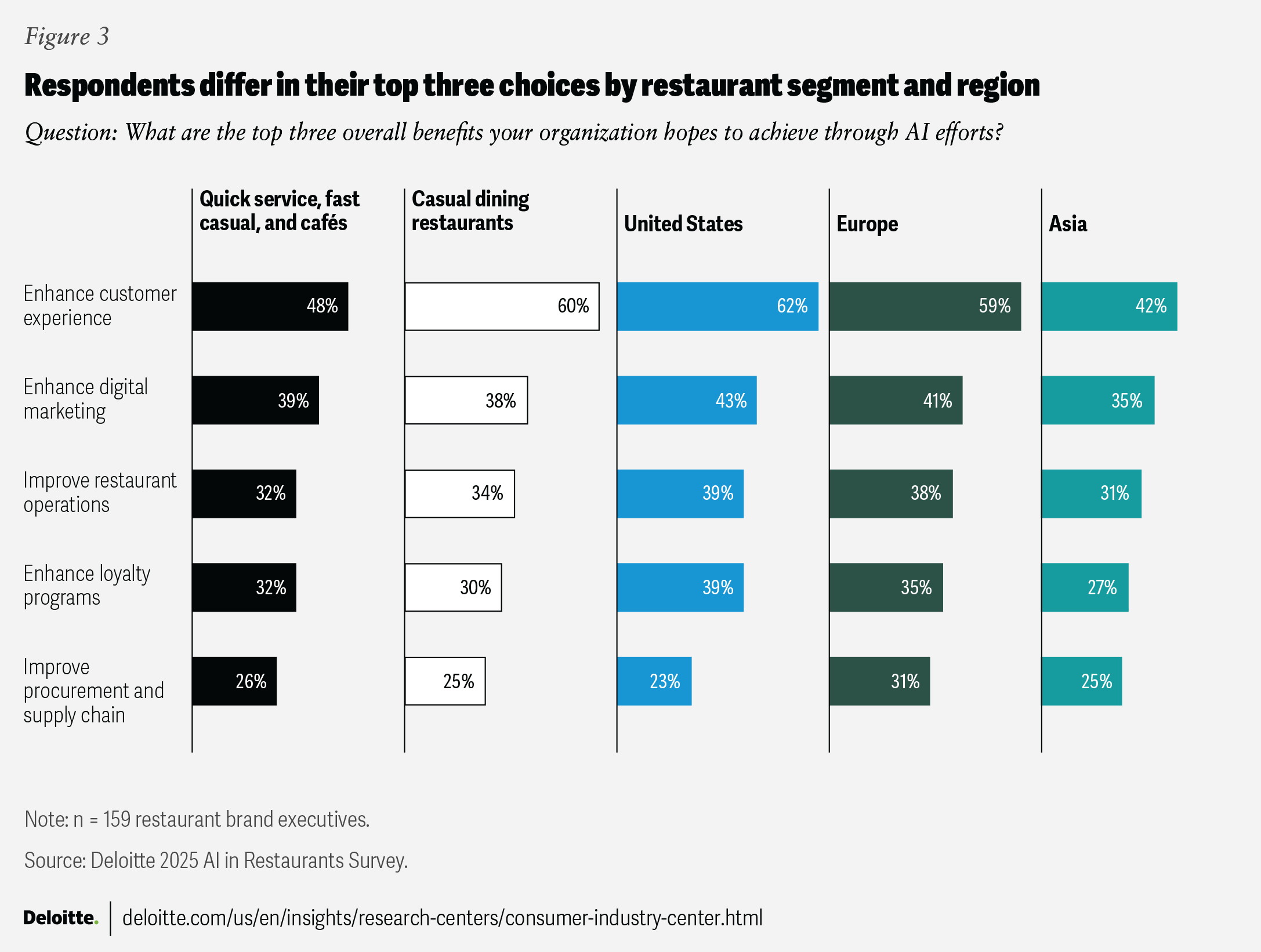

Significant differences by restaurant type and region, however, show up in benefits expectations. This likely ties to the nuanced business challenges they face, and related AI investments they are planning. For example, the respondents from casual dining restaurants hope to achieve a significantly greater benefit in enhancing customer experience, compared to those in the quick service, fast casual, and café segments (60% versus 48%). Additionally, casual dining brands prioritized benefits from improved procurement and supply chain, and optimizing food prep and waste management made their top five, unlike their counterparts. Regionally, respondents in the United States and Europe are more optimistic than their counterparts in Asia about AI enabling a more positive customer experience (figure 3). Notably, respondents from Asia were the only group to rank automation and augmentation of restaurant labor in their top five.

Adoption is expected to come in waves

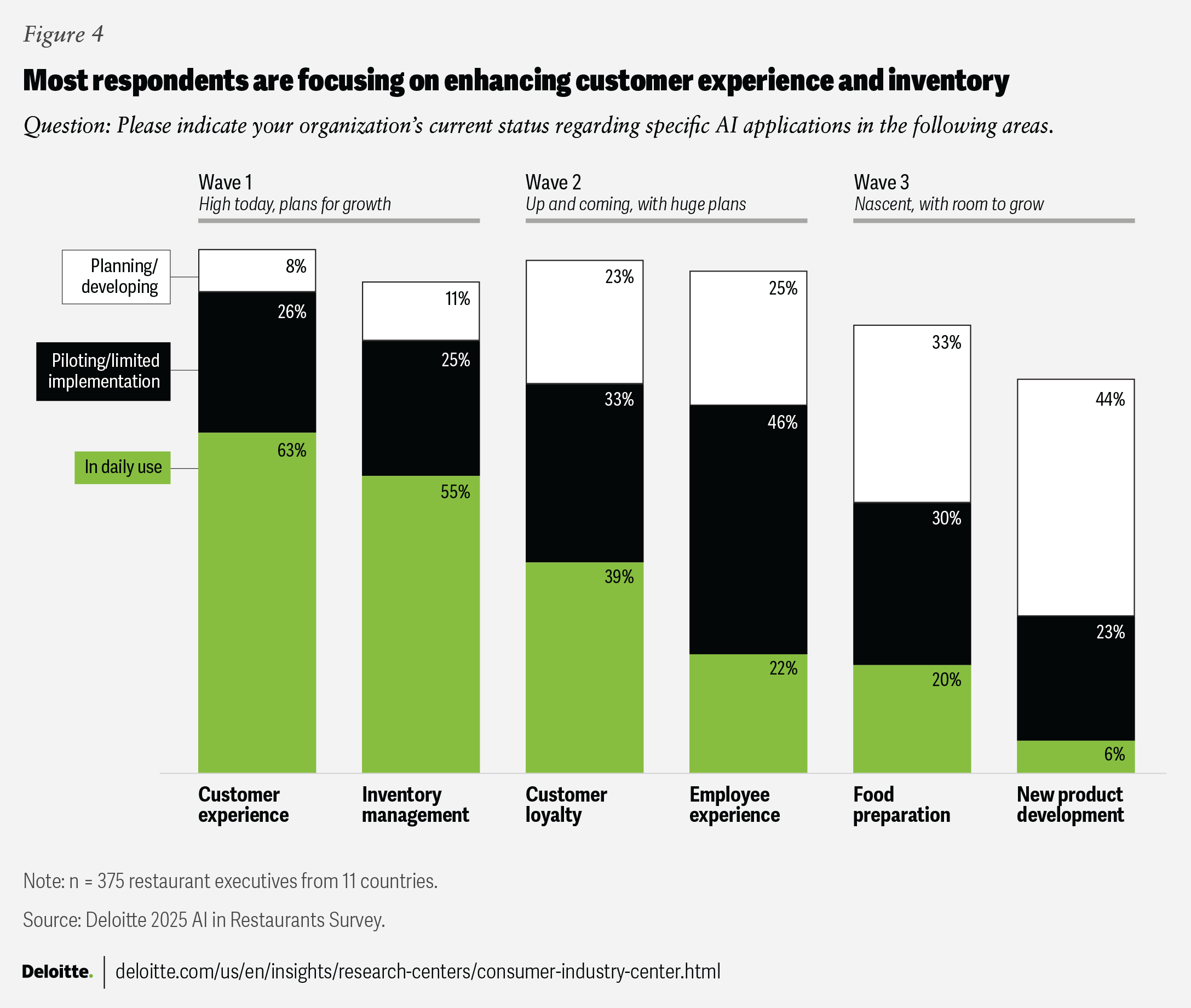

Most respondents have already integrated AI into their day-to-day in various capacities (figure 4). It may not be surprising that customer experience is leading the way, given the expected benefits reported earlier and the prevalence of readily available customer experience AI capabilities (for example, in-app or in-kiosk recommendation engines). Sixty-three percent report daily use of AI in enhancing customer experience, and another 26% say they are engaged in pilots or other forms of limited implementation (figure 4). One of the more emerging examples is the use of voice AI in drive-thrus to automate the order-taking process.

Fifty-five percent of the respondents surveyed report they are using AI in inventory management on a daily basis; another 25% say they are testing out such applications. While forecasting is a common use case here, other AI-enabled use cases include Internet of Things sensors that enable automated data collection for real-time inventory tracking, and the use of predictive analytics to help minimize waste and optimize disposal processes.

While customer experience and inventory management represent the first wave of AI adoption in restaurants, our survey indicates that two other waves are gaining traction.

The second wave is focused on using AI to boost customer loyalty and enhance employee experience. Implementation hovers near 70% for these two opportunity areas (including daily use and pilots), but plans in the works for both applications indicate those numbers could soon rise. In fact, if their current plans come to fruition, the use of AI in customer loyalty and employee experience could eventually surpass that in inventory management.

Following behind is the third wave, which includes leveraging AI in food preparation and new product development, respectively. Both applications are being used or tested in these areas by less than 50% of our respondents today, but they also boast the highest readings when it comes to planning and development. Some of the more promising pilots in these areas include real-time detection of food defects and contamination using computer vision, and flavor compound analysis enabled by machine learning algorithms.

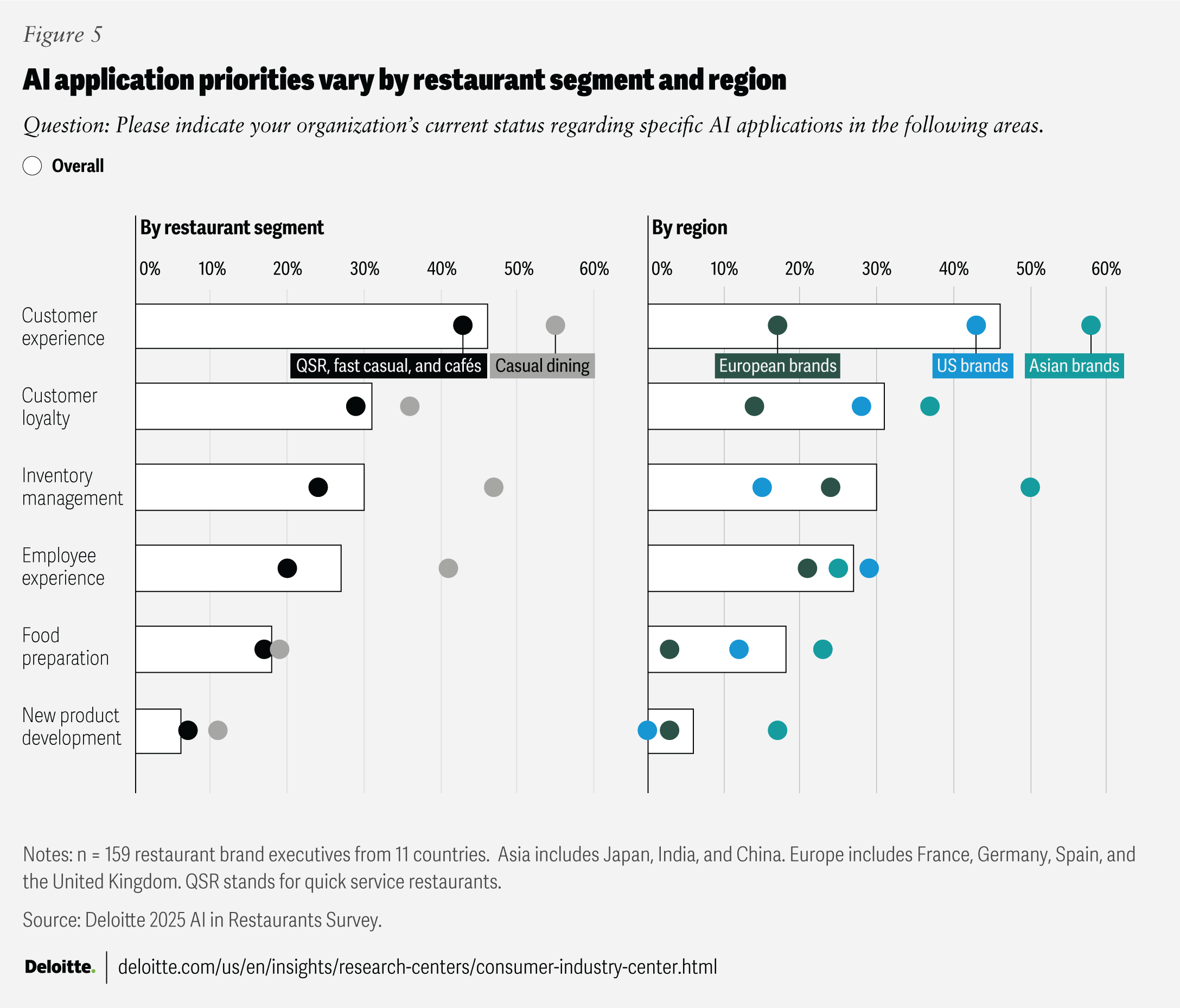

When we analyzed our respondents by restaurant segment and region, we found some are ahead of others when it comes to deploying AI. Casual dining is the most aggressive adopter of AI across most AI applications, but is the most noticeable in inventory management and employee experience (figure 5). This is likely due to the typically more complex menus, larger and more varied teams, and the increased focus on customer experience that most casual dining brands rely on to operate effectively. And the same can be said for restaurants in Asia relative to those in the United States and Europe (figure 5).

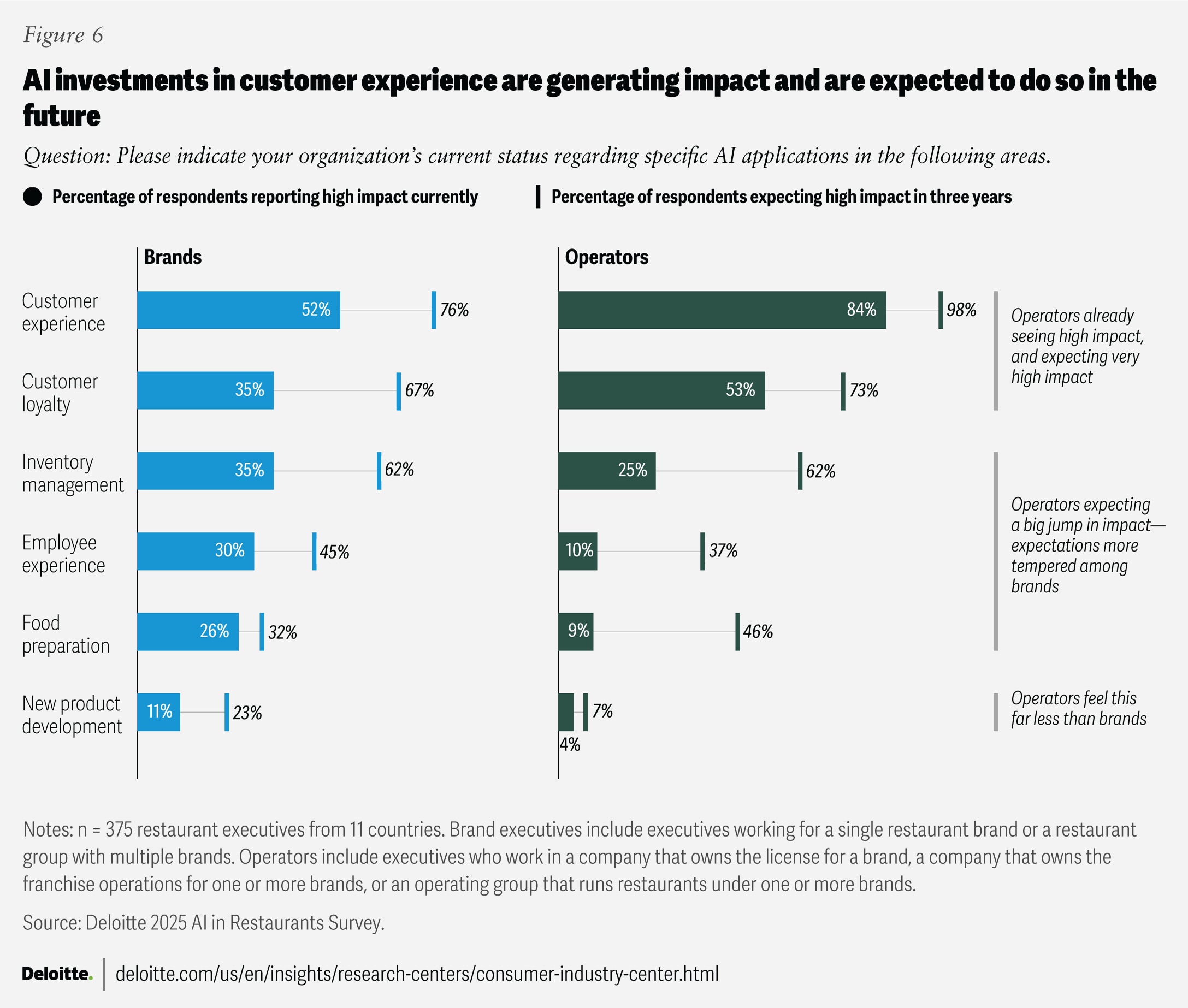

Both brand owners and operators report that their AI investment in customer experience is generating a high impact that they expect to grow higher still (figure 6). Operators say they’re realizing more tangible economic value from customer loyalty investments, while brands are more likely to see impact in inventory management, employee experience, and food preparation.

A deeper look at specific technologies

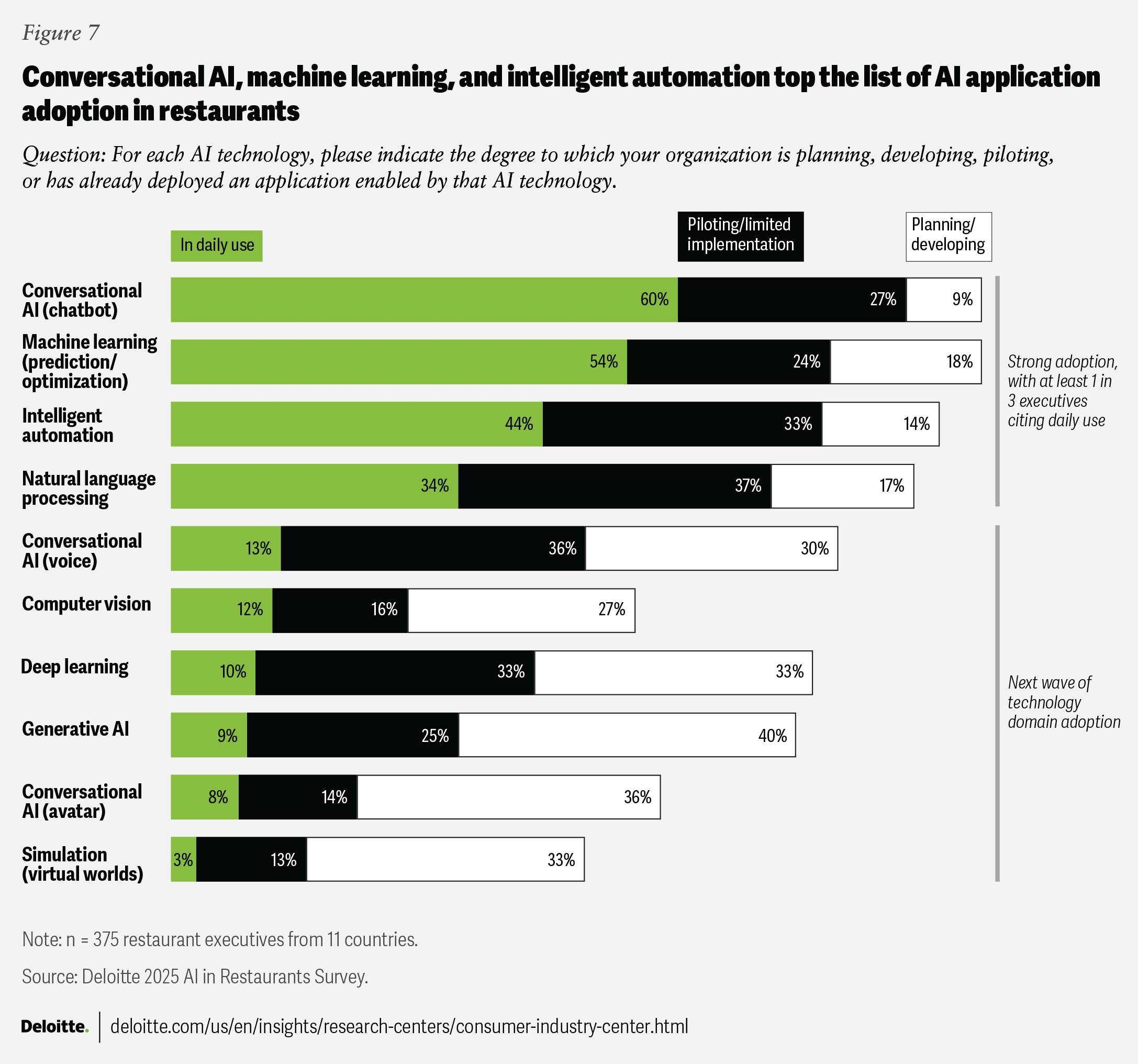

What are the actual AI capabilities that are powering the industry’s solutions? Chatbots top the list among respondents, with restaurants using them as interactive interfaces for guests to place orders and make reservations, as well as to help employees resolve customer service issues, among other tasks. Sixty percent of our respondents say they are using them daily, while 27% say such solutions are in the pilot stage (figure 7). Machine learning is being used by slightly over half of the respondents (54%), while intelligent automation and natural language processing make the top four list. This makes sense given these are common AI capabilities that power prevalent use case areas in customer experience and inventory management, among others.

From there, the responses flip more into experimental mode. More respondents indicate they are testing technologies such as conversational voice AI, computer vision, and deep learning than they are using them on a daily basis. In the market, voice AI appears to be a focus of heavy experimentation in kiosks and drive-thrus, while computer vision can be used for order accuracy by detecting anomalies.

Despite its potential and the buzz around it, generative AI is only being used daily by 9% of those surveyed, and more respondents said they are in the planning stages than those currently using it. Avatars and virtual worlds show similarly low levels of adoption thus far, but relatively higher levels of planning and development. This is likely due to the phased adoption most organizations are taking to minimize risk, as well as the identification of high-value use cases to deploy against.

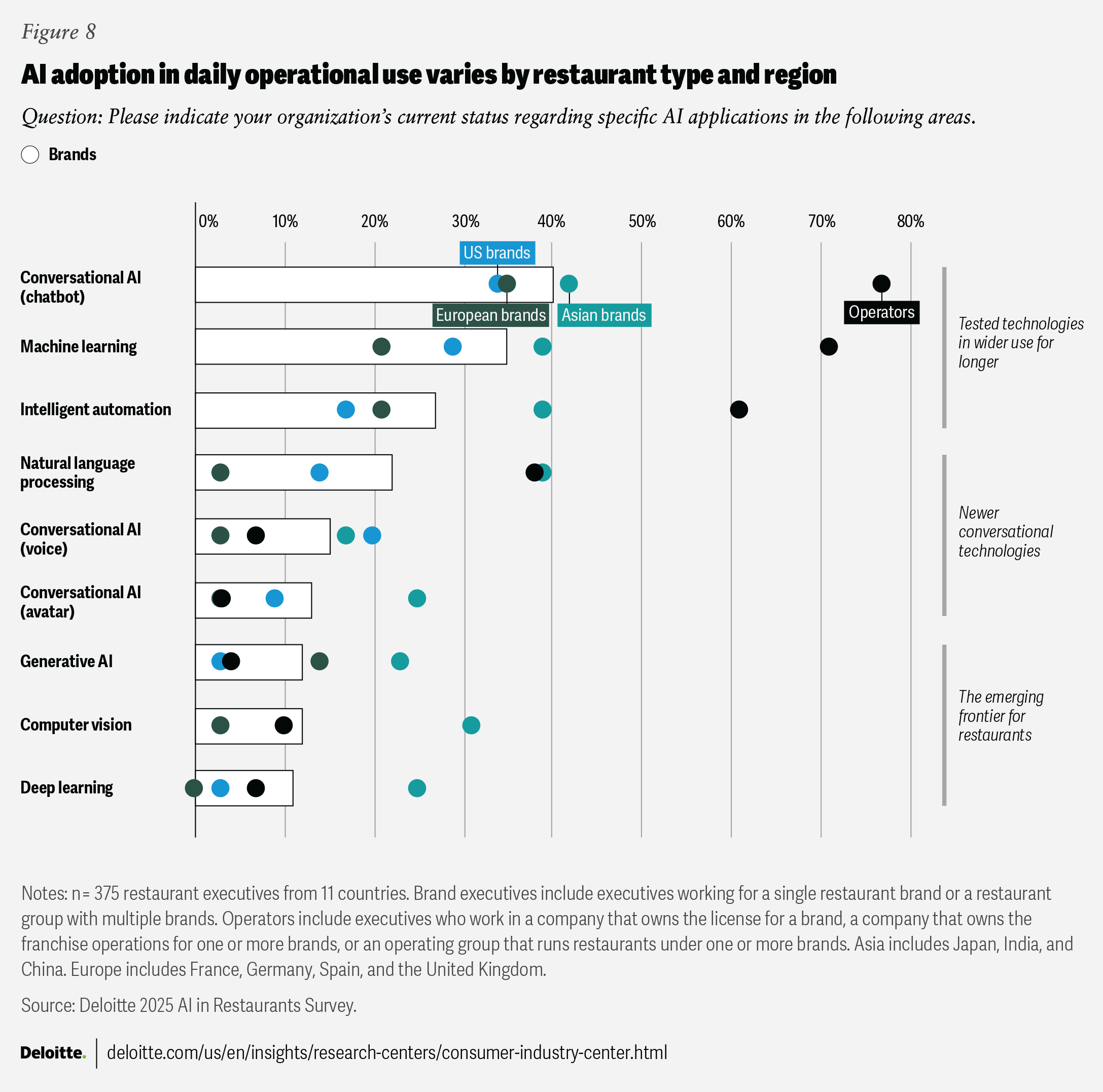

When we break down the answers by company type and region, we find some notable differences (figure 8). Given that brands are generally developing technology to be adopted by operators, the latter group leading in its usage across the board may not be surprising. Among regions, Asian restaurants exhibit higher adoption rates in almost all capabilities. By comparison, restaurants in the United States are relative laggards when it comes to technologies such as intelligent automation, but are ahead in conversational voice AI. Europe doesn’t lead in any technology, but is close to on par in the use of chatbots.

Lacking in readiness

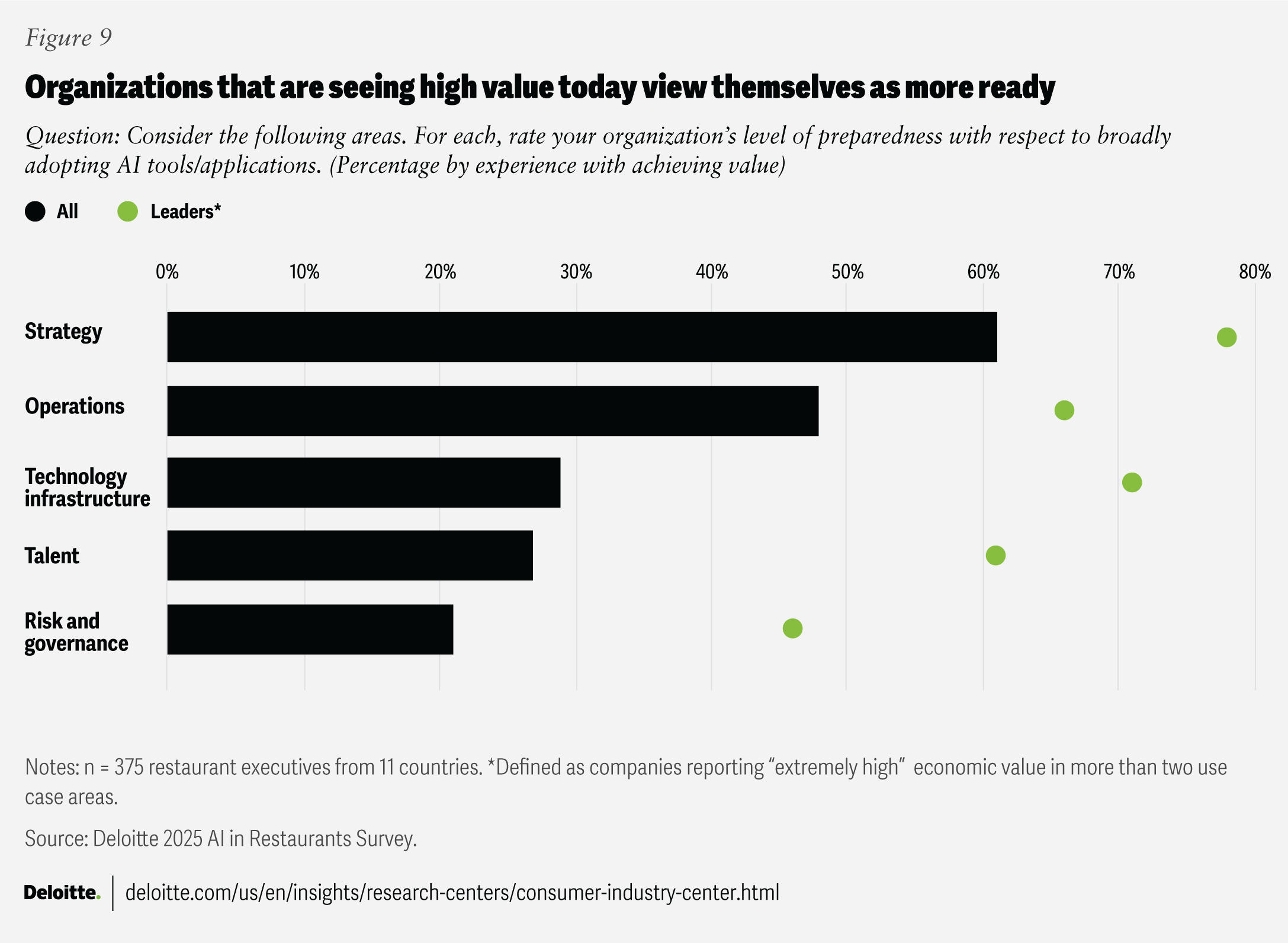

As their plans unfold for future AI deployments, some restaurant executives say their organizations may not have foundational elements in place to scale. In our survey analysis, we identified significant gaps in AI readiness (figure 9). Only about 20% of the respondents across all segments and geographies believe they have the risk and governance in place to shepherd AI investments to fruition. Meanwhile, less than 30% say their organizations are prepared from a technology infrastructure and talent standpoint. Strategy is the only area where most respondents agree their companies are adequately prepared, although almost 40% say they don’t feel they have a strong strategy in place.

Perhaps unsurprisingly, we found a direct correlation between companies seeing high economic value from existing AI investments and their expected readiness for future applications. Only in risk and governance do most respondents not feel prepared.

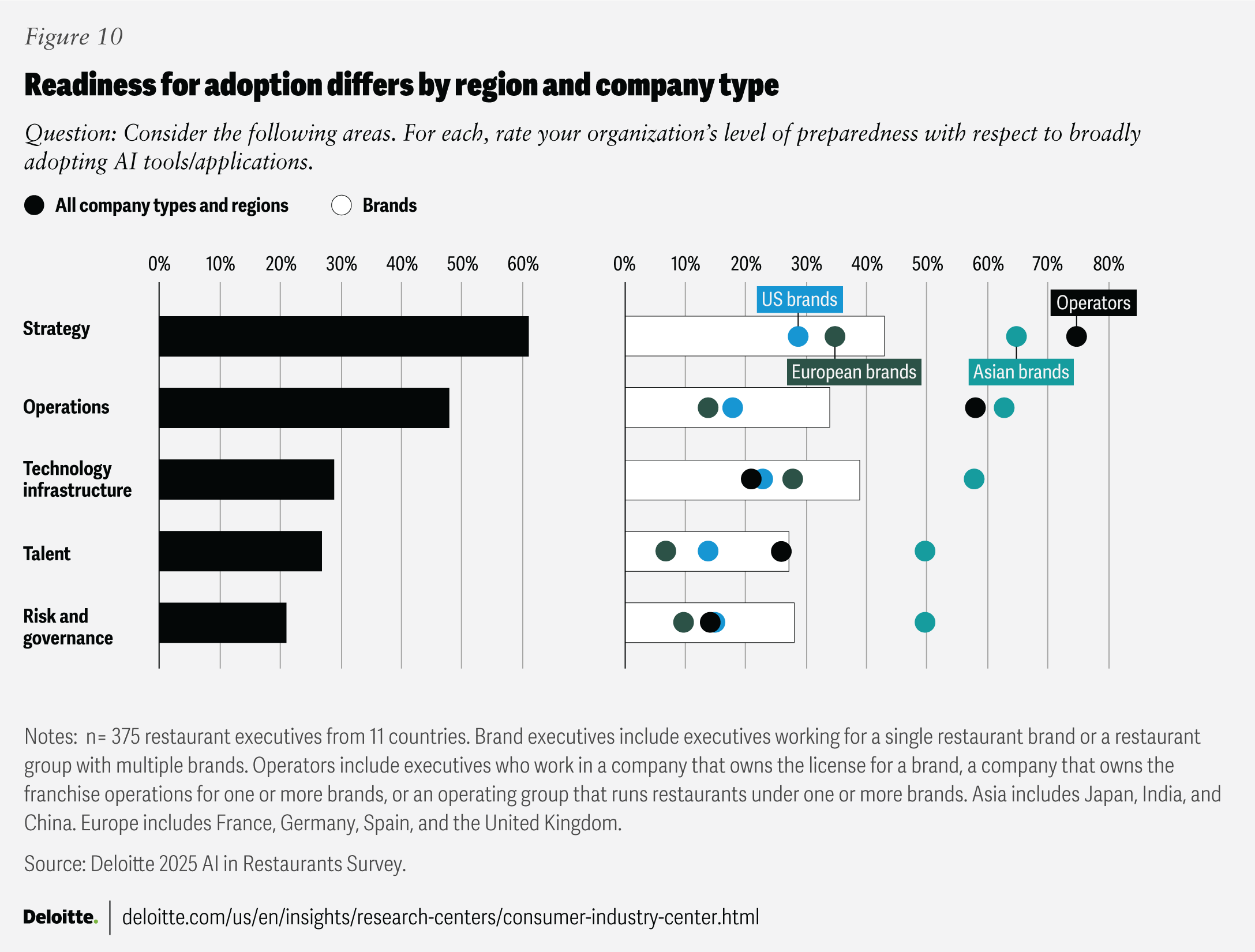

When it comes to differences between brands and operators, our survey shows more variances (figure 10). The latter group reports being more prepared across strategy and operations, which may be because the benefits are more readily apparent than they are for the technology organization. Brands, meanwhile, have the edge in technology infrastructure readiness. Both groups report relatively low levels of confidence in readiness in terms of talent, and risk and governance. Across regions, we see again that Asian companies have a higher professed readiness across all dimensions.

Multiple challenges to overcome

Across the commercial spectrum, companies that have adopted AI at some level have reported challenges in certain critical assets, such as data management, integration with existing tools and processes, and cultural and organizational resistance.

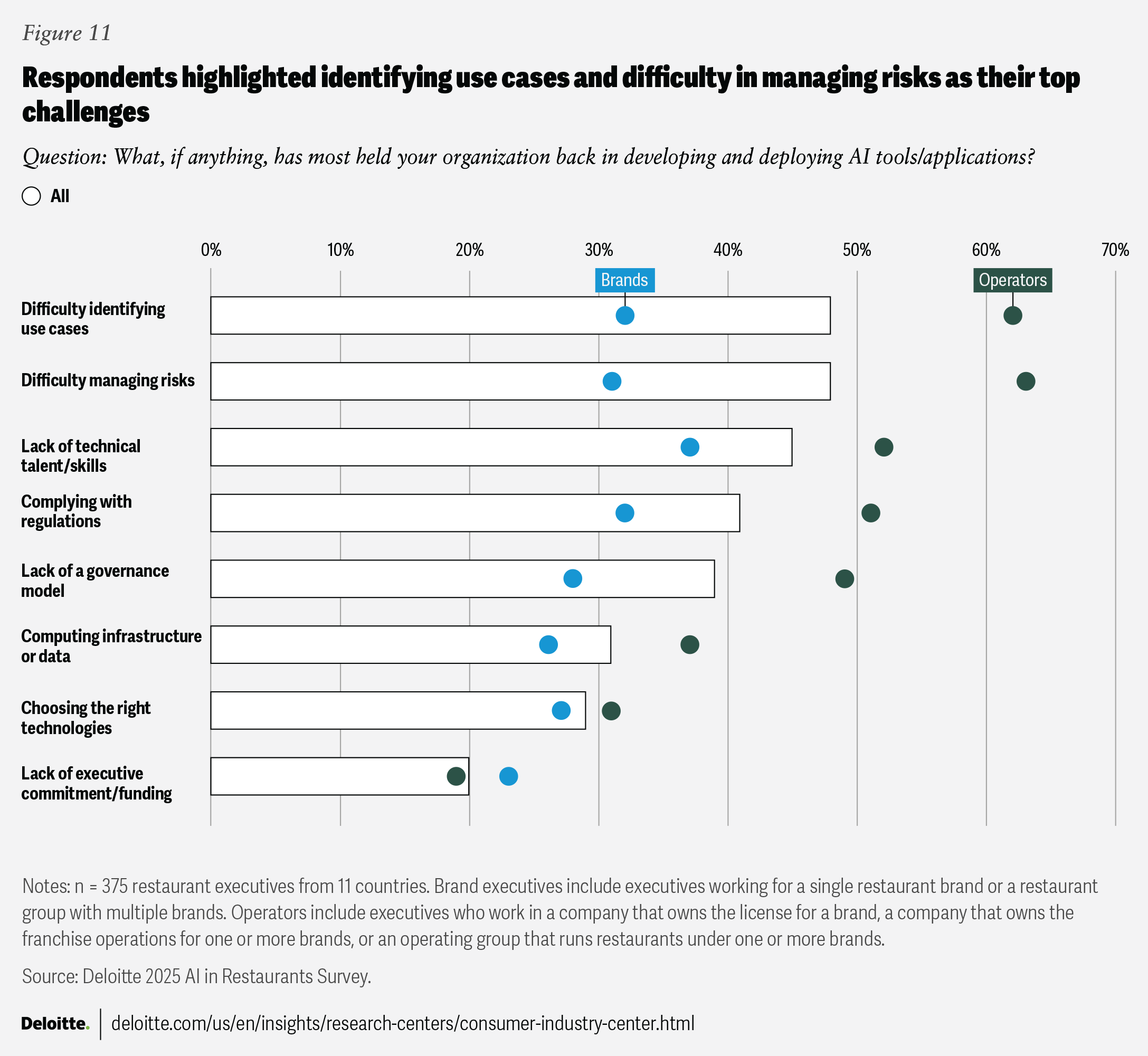

Building on that theme, we asked the survey respondents to cite the top challenges they are experiencing in putting AI to use in their restaurants. One of the biggest constraints the executives cite in implementing AI is the difficulty in identifying use cases. It’s not for a shortage of ideas—it’s a question of finding the right uses that can be scalable and help drive value for the business.

Survey respondents are also worried about managing the risks around AI technologies, with operators highlighting it as their No. 1 concern (figure 11). Other challenges aren’t as pressing but are still highly ranked—including lack of technical talent and skills, complying with regulations, and lack of a governance model, especially among operators. Brands stand out for their concern about technical talent and skills gaps.

What doesn’t worry the executives is just as noteworthy. Our findings indicate that companies aren’t being held back by lack of executive commitment, choosing the right technologies, or computing infrastructure or data. This suggests that they have moved past getting leadership buy-in for AI investments and have now moved into more practical considerations, such as picking the right applications and finding the people to support them.

Addressing key risks

As AI has proliferated, one of the chief worries companies and consumers have about its deployment is the misuse of intellectual property and customer data. These potential vulnerabilities top the list of risks the respondents see related to AI tools and applications (figure 12).

Yet, the relatively low numbers—no risk garners more than 20% of the responses—may have to do with how confident the executives feel about their risk-mitigation strategies. Those who are already achieving high economic benefits seem to understand the importance of an integrated approach to risk management. In fact, most leaders (54%) report adopting integrated risk management versus 43% of the rest of the pack.

About half of the respondents (48%) do not include vendor evaluation in their risk processes, with leaders just barely ahead of the pack on this practice.

Underscoring this point is the fact that lack of confidence in results is the lowest-ranked risk among the executives surveyed. AI has often been perceived as a black box, but the findings suggest companies are becoming more confident, as they understand how the results are being generated.

Leading practices worth emulating

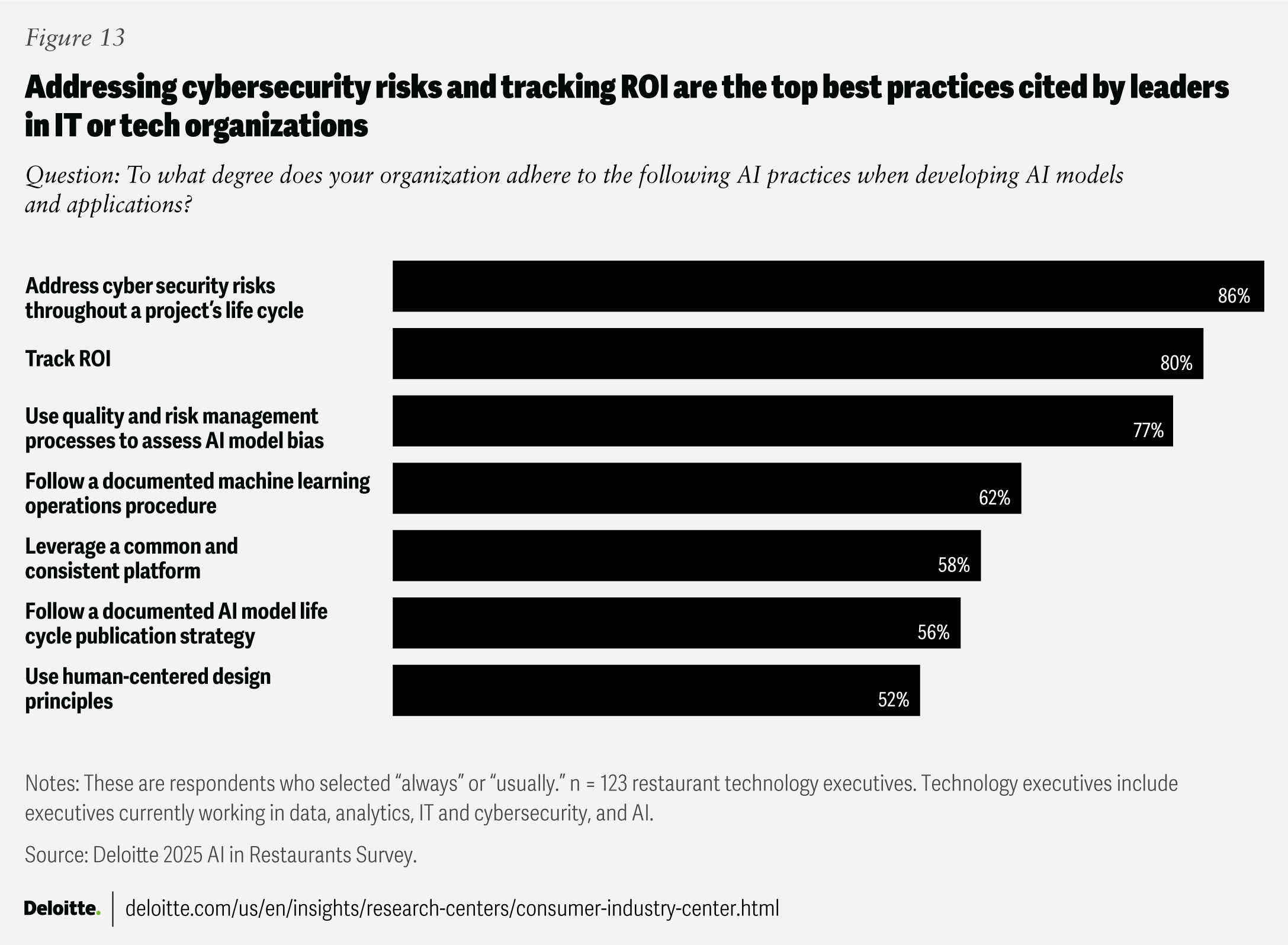

Finally, we asked all survey participants to identify the leading practices they are adopting as they increasingly turn to AI technology solutions. The responses from leaders in IT departments are worth highlighting (figure 13).

Addressing cybersecurity, tracking ROI, and assessing bias in AI models using quality and risk management processes are all cited by at least two-thirds of the 123 IT executives surveyed. These are all fundamental to AI deployment, as companies need to protect their data and ensure a requisite payoff from AI investments. But other practices they list—including using human-centered design principles—appear to be emerging in the AI playbook. We will keep an eye on these practices in future surveys to track broader use.

Investing with confidence

The promise of AI to reshape organizations does not appear to be future tense for the global restaurant industry. AI solutions have not just arrived. They are delivering.

But our survey findings indicate much work is left to be done to ensure these investments continue to deliver value to the business and don’t open restaurants to new risks. As leaders across the industry build the foundational elements and guardrails that will support AI technology implementation, they should find the right expertise to help inform their decisions and support their efforts. Our findings underscore the importance of leadership confidence in advancing the AI agenda and the role that requisite talent and capabilities play in preserving it.

Methodology

Deloitte’s State of AI in Restaurants Survey was conducted in the fourth quarter of 2024, reaching 375 restaurant leaders across 11 countries. More than half (57%) represented the quick service restaurant segment; other segments covered included fast casual (36%), casual dining (35%), café/coffee (14%), fine dining (9%), ghost kitchens (4%), and pop-ups (1%). More than a third of those surveyed came from organizations with 2,000 or more locations, and 93% employed 1,000 or more workers. Among organization types, those owning franchise operations for at least one brand accounted for almost half of the respondent base (48%), while about a fifth each hailed from restaurant groups with multiple brands or single restaurant brands. Respondents mainly worked in data, analytics, and AI, or in IT and cybersecurity capacities. For the purposes of this study, we defined “operators” as those whose organization owns franchise operations for one or more brands, owns a license for a brand in the market, or is from an operating group with restaurants under one or more brands.