The path to AI computing for power companies crosses many platforms

The AI economy may need more power than the current grid can deliver, but AI itself can help the industry meet the demand. Deloitte’s data shows how the power sector is building its tech infrastructure.

Power companies are at an inflection point for infrastructure modernization, due to surging power demand from AI data centers. Paradoxically, these data centers offer the AI computing that power companies need to optimize grid operations and meet this demand reliably and affordably.

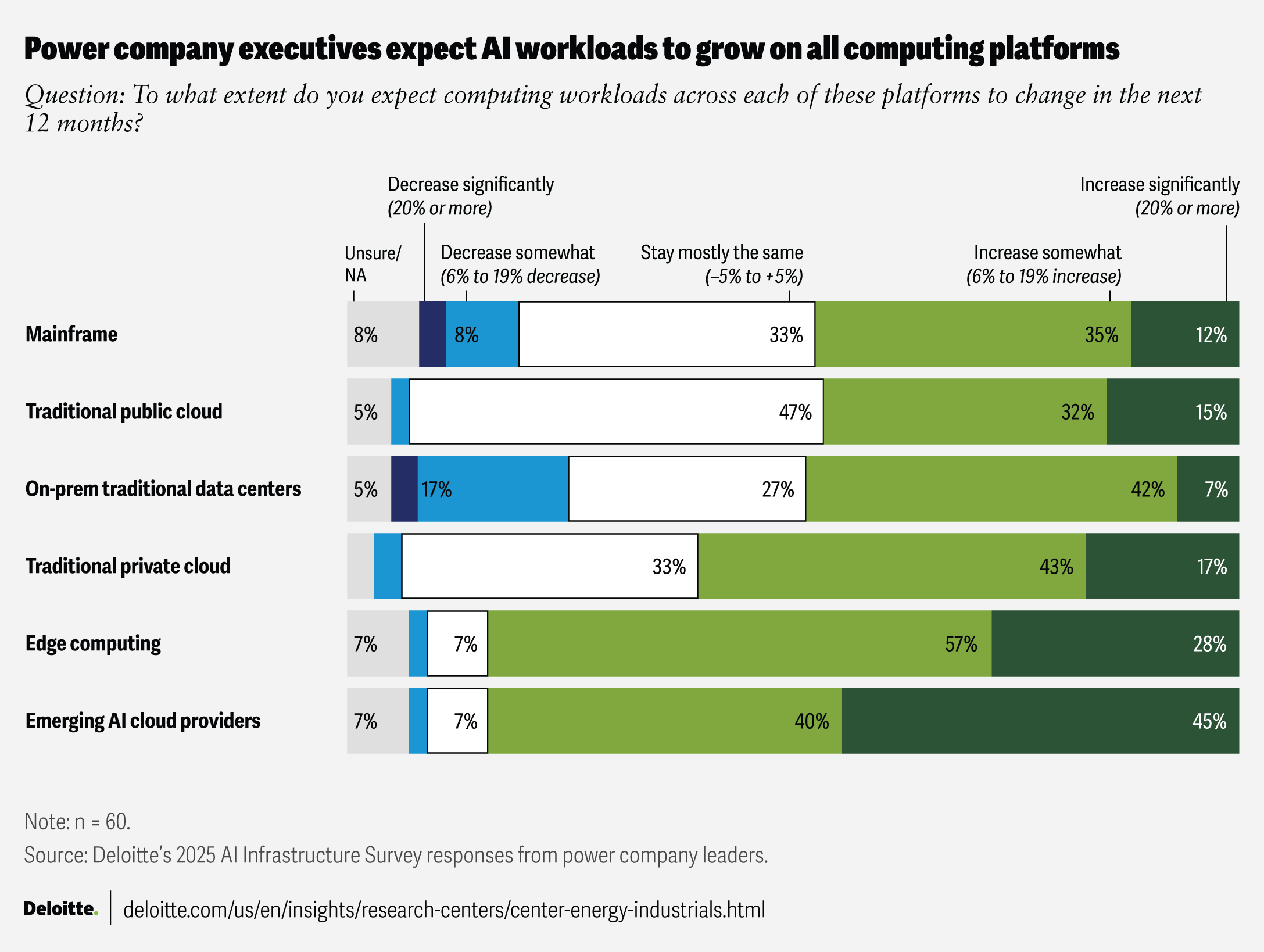

Success will likely hinge on building a balanced portfolio on a strong foundation of data, cost, and security management. According to a Deloitte survey data from 60 power company executives in April 2025, most of these companies are taking a “hybrid” approach to AI computing, investing in a variety of computing platforms to meet the industry’s unique needs.

The greatest growth is taking place in the use of edge computing and emerging AI cloud providers, which power sector leaders expect to grow “significantly” over the next 12 months. Edge computing is one key to autonomously managing distributed energy resources at the grid edge, where balancing dynamic demand and supply will require a fleet of AI agents to make millisecond decisions. Emerging AI cloud providers can offer a secure alternative when on-premises data centers cannot be upgraded for AI purposes. Most regulated utilities have also held on to the data centers they own for the ratemaking advantages, and to comply with data residency and privacy laws.

The more AI workloads scale, the more costly cloud computing becomes because users pay per unit of data processed, or token. As a result, 60% of power companies surveyed by Deloitte plan to start moving AI workloads to alternatives over the next year. Yet, 52% of power company executives also said they won’t consider a move until cloud costs reach more than 1.25 to 1.75 times the cost of an alternative, underscoring the importance of a guaranteed return on investment off the cloud.

Methodology

The Deloitte Research Center for Energy & Industrials conducted a survey in April 2025 to benchmark AI infrastructure development among 120 respondents: 60 from US data center and 60 from US power companies. This study included a focus on how these leaders expect computing demand to change based on AI workloads and decision-making triggers for moving workloads from the cloud. For more results from this research, see Can US infrastructure keep up with the AI economy? and AI workloads are surging. What does that mean for computing?